Introduction to Strengthening Corporate Governance

- Strengthening Corporate Governance: Is essential in preventing fraud, fostering a culture ethics and integrity, and is accountability to shareholders.

- Strong Internal Controls: Are systems of policies and procedures that ensure an organization’s assets are protected, financial reporting is accurate and reliable, operations are efficient, and compliance with laws and regulations is maintained.

- Code of Ethics: A set of principles and standards that guide the behavior and decision-making of professionals and organizations. It is a formal document that outlines expected conduct, emphasizing honesty, integrity, and fairness to ensure accountability and maintain trust within a profession or company.

- Regulatory Compliance: When an organization adheres to laws, regulations, and standards set by government or industry bodies to avoid negative consequences like fines, lawsuits, or reputational damage.

- This process involves identifying applicable rules, managing risks, implementing controls, and providing ongoing employee training. Benefits include reduced risk, improved efficiency, and enhanced customer and market trust.

- Regulatory Enforcement: The process by which government agencies compel individuals and organizations to comply with laws and regulations within their jurisdiction.

- Agencies have significant discretionary and rule-making authority to develop, monitor, and enforce rules that govern various sectors, including finance, environmental protection, and public health.

- Reputational Damage: The harm to a company’s or it’s standing and credibility in the public eye. It is caused by adverse events, such as a product failure, ethical misconduct, or negative publicity, filing false and misleading financial statements, and can result in significant financial, social, and market share losses.

- Securities Litigation: Lawsuits arising from the purchase and sale of securities like stocks and bonds.

- It involves legal actions against corporations, investment professionals, and other parties for alleged violations of securities laws such as having weak corporate governance and committing securities fraud.

- It is a critical component of the financial market, meant to protect investors and maintain market integrity.

Strengthening Corporate Governance

- Corporate Governance

- Is a critical framework that defines the rules, practices, and processes by which a company is directed and controlled.

- At its core, corporate governance impacts how effectively a company operates and how it maintains accountability to stakeholders.

- With the increasing complexity of business operations and the rise of digital transactions, strong governance has become vital in preventing fraud.

- Implementing Controls

- Your role in establishing a robust corporate governance structure is to ensure transparency and integrity, which are crucial in deterring fraudulent activities.

- When corporate governance is weak, it creates loopholes that fraudsters can exploit.

- By implementing strong governance measures, you not only protect your business from financial losses but also enhance its reputation and trustworthiness.

- Ethical Environment

- Fostering an environment of accountability starts with understanding the value of corporate governance in fraud prevention.

- This involves setting up systems that detect irregularities early and promote ethical behavior.

- By investing in governance, you can create a culture where fraud is less likely to occur, thereby safeguarding your organization’s assets and reputation.

CORPORATE GOVERNANCE CHART

Key Components of Effective Corporate Governance

- Effective Corporate Governance

- Is built on several key components that work together to prevent fraud.

- These components include a strong board of directors, transparent reporting systems, and a comprehensive risk management strategy.

- Each of these elements plays a vital role in creating a governance framework that can withstand potential fraudulent threats.

- Board of Directors

- A competent board is essential for effective governance.

- Your board should consist of members with diverse expertise who can provide oversight and guidance.

- They should be independent and free from conflicts of interest to make unbiased decisions that align with the company’s best interests.

- Transparent Reporting Systems

- Transparency in financial reporting is crucial for fraud prevention.

- Implementing robust reporting systems ensures that financial data is accurate and accessible to stakeholders.

- This transparency helps in identifying discrepancies early and fosters trust among investors and regulators.

- Risk Management Strategy

- A well-defined risk management strategy is vital to anticipate and mitigate potential fraud risks.This proactive approach minimizes the chances of fraud occurring.

- By focusing on these key components, you can build a governance structure that not only prevents fraud but also enhances your company’s operational efficiency and stakeholder confidence.

The Role of Internal Controls in Fraud Prevention

- Internal controls

- Are the policies and procedures you implement to safeguard your organization’s assets, ensure the accuracy of financial reporting, and promote operational efficiency.

- They are a crucial aspect of corporate governance and play a significant role in preventing fraud.

- Robust Internal Controls

- The first step in implementing effective internal controls is to conduct a thorough assessment of your current processes.

- This involves identifying areas where controls are weak or non-existent and developing a plan to address these gaps.

- By proactively strengthening these areas, you reduce the likelihood of fraudulent activities going undetected.

- The Importance of Updating Controls

- Internal controls should not be static; they must evolve with your organization.

- Regularly reviewing and updating these controls to reflect changes in your business environment is essential.

- This adaptability ensures that your organization remains resilient against new types of fraud and continues to protect its assets effectively.

Navigating Securities Litigation and its Implications

- Securities Litigation

- Refers to legal actions taken against a company for violations related to securities laws.

- Securities litigation can have severe implications for your organization, including financial losses, reputational damage, and loss of investor confidence.

- Understanding these implications is crucial for maintaining robust corporate governance.

- Misleading Disclosures

- Securities litigation often arises from allegations of fraud or misrepresentation in a company’s financial disclosures.

- To navigate these challenges, it is vital to maintain transparency and accuracy in all financial communications.

- By ensuring that all information provided to investors is truthful and complete, you can minimize the risk of litigation.

- Litigation Strategy

- In the event of securities litigation, having a well-prepared legal strategy is imperative.

- This involves working closely with legal experts to respond promptly and effectively to any allegations.

- A swift and comprehensive response can mitigate potential damage and demonstrate your commitment to ethical business practices.

Impact of Securities Class Action Lawsuits on Corporations

- Allegations and Effect

- Securities class action lawsuits are collective legal actions taken by investors who claim to have suffered losses due to a company’s fraudulent activities.

- These lawsuits can have a profound impact on your corporation, both financially and reputationally.

- Financial Repercussions

- Financial repercussions are often the most immediate impact of securities class action lawsuits.

- Legal fees, settlement costs, and potential fines can be substantial, diverting resources away from other critical business operations.

- It is essential to allocate resources strategically to manage these financial challenges without compromising your organization’s stability.

- Reputational Damages

- Beyond financial implications, these lawsuits can tarnish your company’s reputation, leading to a loss of trust among investors and the public.

- Rebuilding this trust requires a concerted effort to demonstrate transparency, accountability, and a commitment to ethical practices.

- By taking proactive measures to address the underlying issues that led to the lawsuit, you can begin to restore confidence in your organization.

THE SECURITIES CLASS ACTION PROCESS

Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

Motion to Dismiss | Defendants typically file a motion to dismiss the securities class action lawsuits, arguing that the complaint lacks sufficient claims. |

Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase of securities litigation can be extensive. |

Motion for Class Certification | Plaintiffs request that the court to certify the securities litigation as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

Settlement Negotiations and Approval | Most securities litigation cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members in the securities litigation, often by mail, informing them about the terms and how to file a claim. |

Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement of the securities litigation. |

Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Best Practices for Corporate Governance to Mitigate Securities Fraud

- Risk Assessment

- Mitigating securities fraud requires the implementation of best practices that strengthen your corporate governance framework.

- These practices focus on enhancing transparency, promoting ethical conduct, and ensuring compliance with relevant regulations.

- Enhance Transparency

- Regularly update your stakeholders on your company’s financial health and strategic decisions.

- Providing clear and accurate information reduces the likelihood of misinterpretation and builds trust.

- Promote Ethical Conduct: Establish a code of ethics that outlines expected behavior for all employees.

- This code should be reinforced through regular training and communication, ensuring that everyone understands the importance of maintaining ethical standards.

- Ensure Compliance: Stay informed about changes in securities regulations and adjust your policies accordingly.

- Regular audits and compliance checks can help identify potential issues before they escalate into significant problems.

- By adopting these best practices, you can create a governance structure that effectively mitigates the risk of securities fraud and enhances the overall integrity of your organization.

T

Types of Securities Fraud

Fraud Type | Description |

| Affinity Fraud | Scammers target members of specific groups—like religious or ethnic communities—and exploit their trust to sell them fraudulent investments. |

| Boiler Rooms | A common tactic where salespeople use high-pressure sales tactics, often over the phone, to sell bogus investments or inflated stocks to unsuspecting investors. |

| Embezzlement | A broker or financial manager pockets client funds instead of investing them as promised, and tells the client the assets were lost in the market. |

| Insider Trading | Trading securities based on material, non-public information about a company. |

| Misleading Financial Statements | Companies or individuals manipulate financial reports to present a false picture of financial health, often to attract investors or inflate stock prices. |

| Ponzi Schemes | A fraudulent investment operation where the operator pays returns to earlier investors using capital from more recent investors. |

| Pump and Dump Schemes | Fraudsters inflate the price of a stock through false and misleading positive statements, then sell their shares, causing the price to fall and other investors to lose money. |

| Pyramid Schemes | Similar to Ponzi schemes, but with a strong emphasis on recruiting new members to generate money for existing ones. |

| Recovery Room Schemes | Scammers promise to help victims recover money lost in previous scams, but require up-front payments to fund the recovery, only to disappear with the funds. |

| Unsuitable Investments | Financial advisors may recommend or sell financial products that are not appropriate for the investor’s risk tolerance or financial situation, but earn the advisor a higher commission. |

Developing a Robust Whistleblower Policy

- Whistleblower Policy

- A robust whistleblower policy is a critical component of your corporate governance framework.

- It encourages employees to report unethical or illegal activities without fear of retaliation, thereby playing a vital role in fraud prevention.

- Establish Reporting Channels

- To develop an effective whistleblower policy, you must first establish clear and accessible reporting channels.

- Employees should know how and where to report concerns, whether through a dedicated hotline, email, or online platform.

- Ensuring anonymity and confidentiality is essential to encourage more employees to come forward with information.

- Outline Protections for Whistleblowers

- Your whistleblower policy should also outline the protection measures in place for those who report misconduct.

- This includes assurances that there will be no retaliation or negative consequences for whistleblowers.

- By fostering a supportive environment, you empower employees to act as your first line of defense against fraud.

TOP SEC WHISTLEBLOWER AWARDS

SEC Whistleblower Award | Amount | Date |

SEC whistleblower award | $279 million | May 5, 2023 |

SEC whistleblower award | $114 million | October 22, 2020 |

SEC whistleblower award | $110 million | September 15, 2021 |

SEC whistleblower award | $104 million | August 4, 2023 |

SEC whistleblower award | $98 million | August 23, 2024 |

SEC whistleblower award | $50 million | April 15, 2021 |

SEC whistleblower award | $50 million | June 4, 2020 |

SEC whistleblower award | $50 million | March 19, 2018 |

SEC whistleblower award | $39 million | September 6, 2018 |

SEC whistleblower award | $37 million | December 19, 2022 |

SEC whistleblower award | $37 million | January 21, 2022 |

SEC whistleblower award | $37 million | March 26, 2019 |

SEC whistleblower award | $36 million | September 24, 2021 |

SEC whistleblower award | $33 million | March 19, 2018 |

SEC whistleblower award | $32 million | October 15, 2021 |

SEC whistleblower award | $30 million | September 22, 2014 |

SEC whistleblower award | $28 million | January 23, 2023 |

SEC whistleblower award | $28 million | May 19, 2021 |

SEC whistleblower award | $28 million | November 3, 2020 |

Establishing an Ethics Policy for a Stronger Governance Framework

- Ethics Policy

- An ethics policy serves as a foundation for your corporate governance framework, guiding the behavior of all employees and stakeholders.

- It sets the tone for ethical conduct throughout your organization and is crucial in preventing fraud.

- Defining Core Values

- Developing an ethics policy involves defining core values and principles that align with your organization’s mission.

- These values should be clearly communicated to all employees and reinforced through regular training and workshops.

- By embedding ethical behavior into your corporate culture, you create an environment where fraud is less likely to occur.

- Provisions for Ethical Violations

- Your ethics policy should also outline the procedures for addressing ethical violations.

- This includes clear steps for investigating allegations and implementing corrective action

- By providing a transparent process for handling ethical issues, you demonstrate your commitment to maintaining a fair and honest business environment.

![defecting financial statement fraud used in Internal Controls and Preventing Fraud: A Comprehensive and Instructive Guide [2025]](https://classactionlawyertn.com/wp-content/uploads/2025/10/ezgif-2c6f1646d24274.webp)

Ensuring Regulatory Compliance and Understanding Enforcement

- Regulatory compliance

- Is a cornerstone of effective corporate governance and fraud prevention. It involves adhering to all relevant laws, regulations, and standards that apply to your industry.

- Understanding the implications of regulatory enforcement is crucial in maintaining compliance and avoiding legal repercussions.

- To ensure compliance, you must stay informed about changes in regulations and adjust your policies and procedures accordingly.

- This requires a dedicated compliance team or officer who monitors regulatory developments and communicates them to the rest of your organization.

- Regular Employee Training is a Must

- Regular training sessions can help keep employees informed about compliance requirements and their role in maintaining them.

- In addition to internal compliance efforts, understanding regulatory enforcement is vital.

- Regulators have the authority to investigate and penalize non-compliant organizations, which can result in significant financial and reputational damage.

- By proactively addressing compliance issues, you can minimize the risk of regulatory enforcement actions and demonstrate your commitment to ethical business practices.

The Sarbanes-Oxley Act: A Pillar of Corporate Governance

The Sarbanes-Oxley Act of 2002 (SOX)

- Is a landmark legislation that has reshaped corporate governance and financial reporting standards. It was enacted in response to high-profile corporate scandals and aims to protect investors by improving the accuracy and reliability of corporate disclosures.

- The Sarbanes-Oxley Act mandates several key requirements for public companies, including the establishment of internal controls over financial reporting and the certification of financial statements by top executives. These provisions are designed to enhance transparency and accountability, making it more difficult for fraudulent activities to go undetected.

- Compliance with SOX is not just a legal obligation but also a strategic opportunity to strengthen your corporate governance framework. By implementing the necessary controls and procedures, you can improve the reliability of your financial reporting and build trust with investors and stakeholders.

Classic Red Flags for Potential Fraud

Inventory Costing Method Manipulation | Inventory costing method manipulation refers to altering the choice of valuation methods (like FIFO, LIFO, or weighted average) or changing production levels to influence reported earnings. Companies may also manipulate the physical count of inventory to misrepresent asset values. While changing methods can affect financial metrics and potentially lower tax liabilities, this practice can be considered a form of earnings management and may require IRS approval. |

Deliberate Physical Count Misstatement | A deliberate physical count misstatement is an intentional manipulation or falsification of inventory quantities during a physical count. In accounting, this action constitutes inventory fraud or fraudulent financial reporting, and is done to deceive financial statement users by misrepresenting the company’s financial position and performance. |

| Improper Cutoff Procedures | Improper cutoff procedures occur when a transaction is recorded in the wrong accounting period, which can be caused by prematurely recording revenue or delaying expense recognition. This misstatement can be accidental or intentional, leading to inaccurate financial statements that overstate revenue and understate expenses. Examples include recording a sale before a good is shipped or including goods received after year-end in the current period’s inventory. |

Failure to Apply Lower-of-Cost-or-Market Rule | Failure to apply the lower-of-cost-or-market (LCM) rule is a violation of accounting and tax regulations, leading to penalties such as fines and legal action. It can also result in inaccurate financial statements, reputational damage, and potential operational disruptions. Regulatory bodies like the IRS and GAAP require that inventory be valued at its historical cost or current market value, whichever is lower, to properly reflect income and asset value. |

Neglecting Obsolescence Accounting | Neglecting obsolescence in accounting means failing to recognize and report the decline in value of assets (like inventory or long-term equipment) that have become outdated or no longer useful due to factors like technological advancements or changes in market demand. |

Implementing Internal Accounting Controls for Fraud Detection

- Internal Accounting Controls

- Are essential tools for detecting and preventing fraud within your organization.

- These controls are designed to ensure the accuracy and integrity of financial records and to prevent unauthorized access to assets.

- Risk Assessment

- To implement effective internal accounting controls, you must first conduct a risk assessment to identify areas where fraud is most likely to occur.

- This involves analyzing your financial processes and identifying vulnerabilities that could be exploited by fraudsters. Once identified, you can develop and implement controls to address these risks.

- Examples

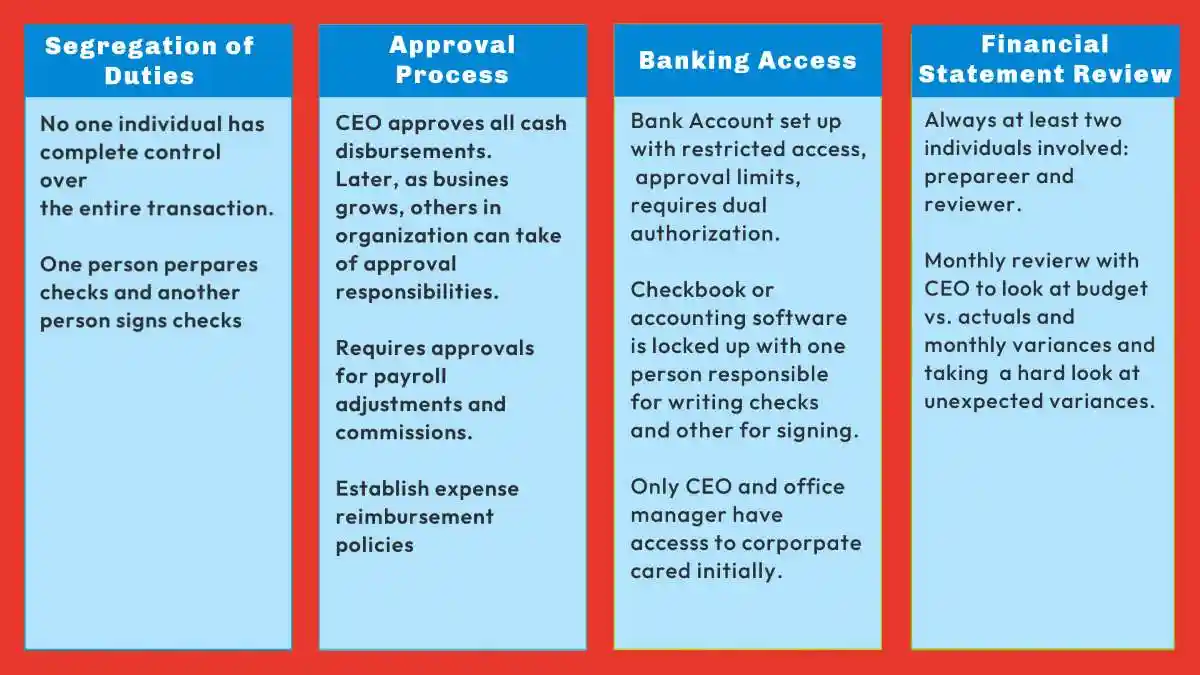

- Examples of internal accounting controls include segregation of duties, regular reconciliation of accounts, and the implementation of approval processes for financial transactions.

- By putting these controls in place, you create a system of checks and balances that deters fraudulent activities and ensures the accuracy of your financial reporting.

Controls for Start-Up Companies

Essential Defense Against Organizational Destruction

- Internal control systems represent the fundamental barrier between organizational survival and catastrophic fraud-related collapse. Multi-layered defense strategies combining preventive internal controls, detective internal controls, and corrective controls create essential protection against fraudulent activities that can destroy business operations and stakeholder confidence along with robust corporate governance.

- Financial Reality: Recovery costs consistently exceed stolen amounts, making fraud prevention an economic imperative rather than a discretionary expense. Organizations that treat internal controls as investments rather than administrative burdens position themselves for sustainable operations and market credibility.

- Four Critical Foundation Elements:

- Segregation of duties prevents single-person transaction control and eliminates fraud opportunities

- Regular risk assessments identify vulnerabilities before exploitation occurs

- Comprehensive policy documentation establishes clear operational standards and accountability measures

- Strong ethical culture led through management example creates organizational integrity expectations

- Integrated Defense Architecture: Detective internal controls including surprise audits and account reconciliations identify fraud attempts that bypass preventive measures. Corrective controls ensure continuous system strengthening after incident discovery and response.

- Cultural Foundation: Internal controls effectiveness depends fundamentally on organizational culture. Management must demonstrate personal commitment to ethical conduct while establishing clear behavioral expectations. Whistleblower protections and anonymous reporting channels encourage early fraud detection and intervention.

- Regulatory Framework: SOX provisions provide structured guidance for public companies, though all organizations benefit from adopting similar accountability principles. Regular monitoring ensures controls remain effective against evolving fraud tactics while demonstrating stakeholder commitment.

- Organizational Vigilance: Fraud prevention requires sustained attention across all organizational levels as part of strong internal controls . Anti-fraud programs that integrate technological safeguards with human awareness create environments where fraudulent activities become increasingly difficult to execute and conceal.

Protection Strategy: Organizations implementing these systematic strategies significantly reduce fraud risk with robust internal controls while protecting assets, reputation, and stakeholder trust. Truth emerges that proactive defense measures cost substantially less than post-fraud recovery efforts and reputational rehabilitation.

Recent trends and ongoing relevance in 2025

- Increased SEC scrutiny of earnings management: The Securities and Exchange Commission (SEC) ccontinues to focus on combating improper earnings management. Through initiatives like its Earnings Per Share (EPS) Initiative, the SEC uses data analytics to identify companies with suspicious patterns of meeting or narrowly exceeding analyst estimates.

- Focus on non-GAAP disclosures: The SEC is actively scrutinizing companies’ use of non-GAAP financial metrics. Recent enforcement actions and staff comments emphasize that these alternative measures must not be misleading.

- Impact of AI-related fraud: In 2025, the pressure to demonstrate growth and innovation in the AI space is creating a new vulnerability. “AI-washing”—overstating a company’s AI capabilities—is emerging as a significant litigation target, with numerous AI-related securities lawsuits filed in the first half of the year.

- Higher settlement values: While filings can vary year to year, the average settlement value for securities class actions has remained high, reinforcing the potential costs for companies that violate securities laws.

- Importance of crisis management: Companies now face the complex task of managing their public communications during crises without creating new misleading statements that could be used against them in a lawsuit.

Examples of Litigation Resulting from Weak Corporate Governance

Enron

- The Enron scandal remains the quintessential example of how omissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities fraud litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

Under Armour

- The scandal: For several years leading up to 2017, the athletic apparel maker Under Armour used a practice known as “pulling forward” sales from future quarters to meet analysts’ revenue targets. After it became impossible to sustain the practice, the company reported a significant drop in revenue growth in 2017. An SEC investigation revealed that company executives were aware of the practices and misled investors and analysts by attributing revenue growth to other factors.

- The litigation: Following the revelations, Under Armour faced both an SEC enforcement action and a securities class action lawsuit from investors. The company agreed to a $9 million penalty in the SEC case and, in 2024, settled the shareholder suit for a record-setting $434 million.

Tyco International

- The scandal: Former CEO L. Dennis Kozlowski and CFO Mark Swartz embezzled hundreds of millions of dollars from the company in the early 2000s, using it to fund lavish personal lifestyles. To conceal the theft and maintain the appearance of strong financial performance, they made false and misleading statements to investors.

- The litigation: Kozlowski and Swartz were convicted of grand larceny, securities fraud, and other crimes. Tyco settled shareholder lawsuits for $3 billion, one of the largest securities class action settlements at the time, and its auditor paid an additional $225 million to settle claims.

Conclusion: Strengthening Corporate Governance for a Fraud-Free Environment

- Strengthening Corporate Governance

- In conclusion, strengthening corporate governance is a multi-faceted approach that requires a commitment to transparency, accountability, and ethical conduct.

- By implementing the strategies outlined in this article, you can create a governance framework that effectively prevents fraud and enhances the integrity of your organization.

- Investing in governance controls is not only a protective measure but also a strategic advantage.

- By fostering a culture of trust and accountability, you can attract investors, enhance your reputation, and ensure the long-term success of your business.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities fraud class action, or have questions about securities fraud class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors