Introduction to Robust Financial Reporting Systems

- The importance of robust financial reporting systems cannot be seriously debated in today’s regulatory environment where securities class action lawsuits and accounting fraud investigations continue to devastate unprepared organizations.

- Robust Financial Reporting Systems could save organizations approximately $125 billion globally through automation of finance and accounting tasks by 2030. Financial reporting failures represent one of the most significant triggers for securities litigation, as organizations struggle with consolidating massive volumes of data surrounding revenue recognition, transaction processing, and performance measurement.

- Core Financial Statements: The reporting process demands the transformation of extensive organizational data into three fundamental financial statements that provide critical insights for investors, creditors, and regulatory authorities.

- Automated Financial Reporting: Modern software solutions help teams streamline the creation of these core financial statements, including income reports, balance sheets, and cash flow summaries. Minimal Manual Intervention: Advanced reporting systems generate financial statements and reports with significantly reduced manual processing, substantially decreasing the burden on finance teams while improving accuracy.

- Internal Controls Over Financial Reporting: Strong control systems help businesses identify potential problems before they escalate into regulatory enforcement actions, attract investor confidence, and build the foundation of trust that supports long-term market credibility.

- Severe Consequences: Financial reporting errors can trigger devastating legal penalties, massive securities class action settlements, and irreparable loss of investor trust. Regulatory Compliance: Establishing effective reporting systems represents far more than a regulatory checkbox—these systems serve as the primary defense against accounting fraud allegations and the costly litigation that follows.

- Risk Mitigation: Organizations that maintain accurate, timely financial reporting systems position themselves to avoid the catastrophic consequences that follow when corrective disclosures reveal previously hidden problems and trigger sharp stock price declines.

- This guide provides essential guidance for building and maintaining robust financial reporting systemsthat ensure accuracy, regulatory compliance, and protection against the securities litigation risks that can destroy shareholder value and corporate reputations.

Understanding the Role of Financial Reporting Systems

- Financial reporting systems serve as the cornerstone of transparent corporate operations and market integrity. Accurate and timely financial reporting provides organizations with critical insights into performance trends while helping identify strategic opportunities that drive informed business decisions.

- Complex Financial Landscapes: Organizations operating in today’s sophisticated regulatory environment must understand how fundamental reporting failures can trigger securities class action lawsuits and regulatory enforcement actions.

Why Financial Reporting Matters in 2025

- Mounting Regulatory Expectations: The significance of financial reporting has evolved dramatically as businesses confront increasingly stringent regulatory requirements and technological disruptions that reshape compliance standards. Comprehensive Operational Insights:

- Financial reporting systems in 2025 hold unprecedented importance as they provide businesses with real-time, detailed insights into operational performance. User-Friendly Visualizations: Modern systems transform raw financial data into accessible presentations that convert complex numbers into understandable narratives for stakeholders across all organizational levels.

- Beyond Regulatory Compliance: Effective financial reporting systems deliver strategic advantages that extend well beyond meeting minimum regulatory requirements:

- Operational Optimization: Identify efficiency improvements and growth opportunities across business operations Performance Monitoring: Track divisional and product-line performance to guide resource allocation decisions

- Cash Flow Management: Monitor liquidity positions and maintain appropriate working capital levels

- Early Warning Detection: Identify emerging financial risks before they escalate into serious problems

- Investment Attraction: Accurate financial statements play a decisive role in securing investor confidence. Organizations that consistently deliver high-quality financial disclosures typically command higher valuations than those with questionable reporting practices, particularly during periods of market volatility.

- Transparent Financial Reporting: Creates the foundation for stakeholder trust, enabling organizations to access capital markets under more favorable terms while reducing borrowing costs.

Key Components of Effective Reporting Systems

- Interconnected Framework: Effective financial reporting structures depend on several coordinated components that work together to deliver accurate, timely, and actionable financial information:

- Core Financial Statements: Balance sheets, income statements, and cash flow statements form the essential foundation of financial reporting, each providing unique perspectives on business performance and financial health.

- Internal Controls Over Financial Reporting: These control systems support accuracy, reliability, and integrity in financial statements while limiting accounting fraud risk and ensuring compliance with Generally Accepted Accounting Principles.

- Standardized Reporting Templates: Consistent formats across business units reduce errors, enhance clarity in decision-making processes, and facilitate meaningful comparisons between divisions and time periods.

- Technology Integration: Automated financial reporting tools connected to existing business systems minimize manual processing errors while providing reliable, consistent data sources.

- Audit Mechanisms: Regular internal and external reviews verify reporting process effectiveness, identifying potential control gaps and opportunities for operational improvements.

- Real-Time Data Access: Modern systems allow stakeholders to analyze financial information, generate insights, and make informed decisions immediately, without depending exclusively on finance departments for every analysis or query.

Impact on Corporate Governance and Decision-Making

- Shareholder Protection: Corporate governance encompasses the mechanisms through which shareholders ensure that director and management interests align with their own investment objectives. Financial reporting plays a critical role in this framework by reducing the informational advantages that management typically holds over external stakeholders.

- Primary Agency Problems: Financial reporting helps address two fundamental conflicts of interest:

- Management-Shareholder Alignment: Financial reporting provides essential data for designing compensation structures and monitoring systems that ensure management acts in shareholder interests.

- Board-Shareholder Accountability: Timely and accurate reporting enables external stakeholders to monitor board effectiveness and hold directors accountable for governance decisions.

- Stronger Reporting Systems: Research demonstrates that companies with more robust financial reporting frameworks show improved accounting quality during periods of heightened market uncertainty. This relationship becomes particularly pronounced for organizations in jurisdictions with strong institutional frameworks where market participants can effectively monitor management performance.

- Business Intelligence: Financial reports transform complex operational data into clear business intelligence, enabling stakeholders to identify performance drivers while eliminating distracting noise.

- Early Problem Detection: Issues involving inventory manipulation, unprofitable product lines, and troubled business segments become readily apparent, allowing management to implement corrective measures before problems escalate into securities litigation risks.

- Strategic Value: Robust financial reporting systems transcend mere compliance obligations—they function as strategic assets that strengthen corporate governance, build stakeholder trust, and provide the analytical foundation for informed decision-making throughout the organization.

2. Setting Clear Objectives and KPIs for Reporting

Measurable Targets: Establishing clear, measurable targets forms the backbone of effective financial reporting systems that can withstand regulatory scrutiny and protect against securities litigation risks.

Clear Objectives: Without defined objectives, even sophisticated reporting infrastructure lacks the direction necessary to prevent accounting fraud and maintain regulatory compliance. Research demonstrates that timely and reliable financial information stands at the core of making informed decisions in dynamic business environments.

Aligning KPIs with Business Goals

- Key Performance Indicators: Creating meaningful financial reports requires connecting your Key Performance Indicators (KPIs) directly to organizational strategic objectives. Strategic Alignment: This alignment ensures every measurement contributes to broader business priorities while supporting the internal controls necessary to prevent financial statement fraud.

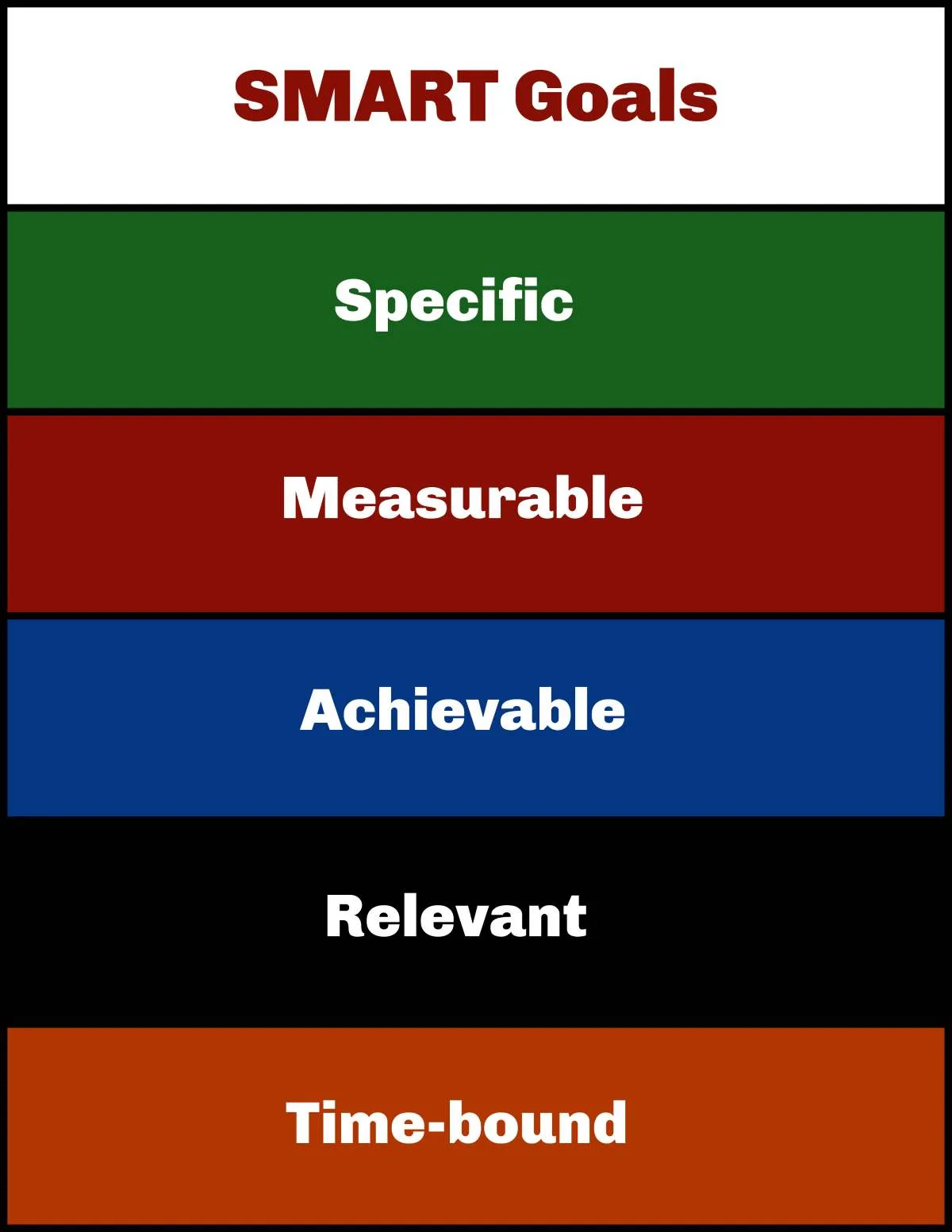

- SMART Goals: The process begins with setting SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound—which serve as guides for financial decisions and resource allocation.

- Organizational Benefits: When KPIs reflect larger organizational goals, several critical advantages emerge:

- Enhanced Clarity: Everyone from leadership to new employees understands the targets and how their work contributes to preventing compliance failures

- Informed Decision-Making: Managers make better decisions based on data directly linked to strategic priorities and risk management objectives

- Resource Optimization: Proper alignment prevents wasted resources by focusing efforts on what truly matters for long-term sustainability

- Accelerated Progress: Organizations achieve objectives faster when everyone focuses on the same goals

- Ongoing Attention: The alignment process requires continuous monitoring rather than one-time implementation. Organizations should periodically revisit KPIs to ensure they remain relevant as business conditions and regulatory requirements evolve.

Common Financial KPIs: EBITDA, Cash Flow, ROI

- Critical Metrics: Successful financial reporting systems track several essential metrics that provide insights into business performance while supporting regulatory compliance:

- Profitability Metrics:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Measures operating performance without the impact of non-operating expenses and accounting practices, providing clearer operational profitability assessment

- Gross Profit Margin: Calculates revenue percentage remaining after deducting cost of goods sold, indicating pricing effectiveness

- Net Profit Margin: Determines overall profitability after all expenses are considered

- Cash Flow Indicators:

- Operating Cash Flow: Reflects cash generated from core operations—positive flow indicates operations generate more cash than used

- Free Cash Flow: Shows cash generation after accounting for operating costs and investments

- Cash Conversion Cycle: Measures days needed to convert inventory purchases back to cash

- Investment Performance:

- Return on Investment (ROI): Evaluates profit generated relative to investment cost, helping compare efficiency of different investments

- Return on Equity (ROE): Measures profit generated from shareholder equity—high or increasing ROE indicates effective equity use

- Liquidity Assessments:

- Current Ratio: Measures ability to pay short-term obligations with current assets

- Quick Ratio: Evaluates capacity to cover current liabilities with most liquid assets

Avoiding Earnings Manipulations Through Transparency

- Concerning Trend: Recent research reveals a troubling pattern: more than 1 in 4 executives admitted to some form of earnings manipulation between 2018-2023. Public Trust: This frequency undermines public trust and creates significant exposure to securities class action lawsuits.

- Manipulation Categories: The study identified five manipulation categories with varying frequencies:

- Real Earnings Management (18%): Changing operational activities to meet near-term targets at the expense of long-term value

- Disclosure Obfuscation (8.8%): Altering disclosures to make unfavorable information harder to find or understand

- Accrual Manipulation (6.6%): Using accounting discretion within GAAP to misrepresent economic performance

- Material Omissions (3.9%): Deliberately withholding information that might discourage investors

- Prevention Strategies: To prevent manipulation and reduce securities litigation exposure, implement transparency measures:

- Maintain consistent revenue recognition policies across all reporting periods

- Monitor ratio analysis results, particularly comparing operating cash flow to net income

- Examine earnings patterns for anomalies, such as suspiciously high fourth-quarter results

- Utilize detailed financial disclosures that make manipulation more difficult

- Risk Mitigation: Organizations that establish clear objectives, track relevant KPIs, and emphasize transparency create financial reporting systems that deliver accurate information while supporting strategic decision-making and reducing manipulation risks that trigger costly regulatory enforcement actions.

Building Internal Controls Over Financial Reporting (ICFR)

Internal controls serve as the primary defense against accounting fraudand the securities litigation that inevitably follows when financial reporting systems fail. These systematic processes provide reasonable assurance regarding the achievement of organizational objectives through reliable financial reporting, operational effectiveness, andregulatory compliance. Strong Internal Controls: Organizations that fail to implement effective internal controls over financial reporting (ICFR) position themselves as prime targets for securities class actions when control deficiencies enable fraudulent activities.

COSO Framework: Control Environment and Risk Assessment

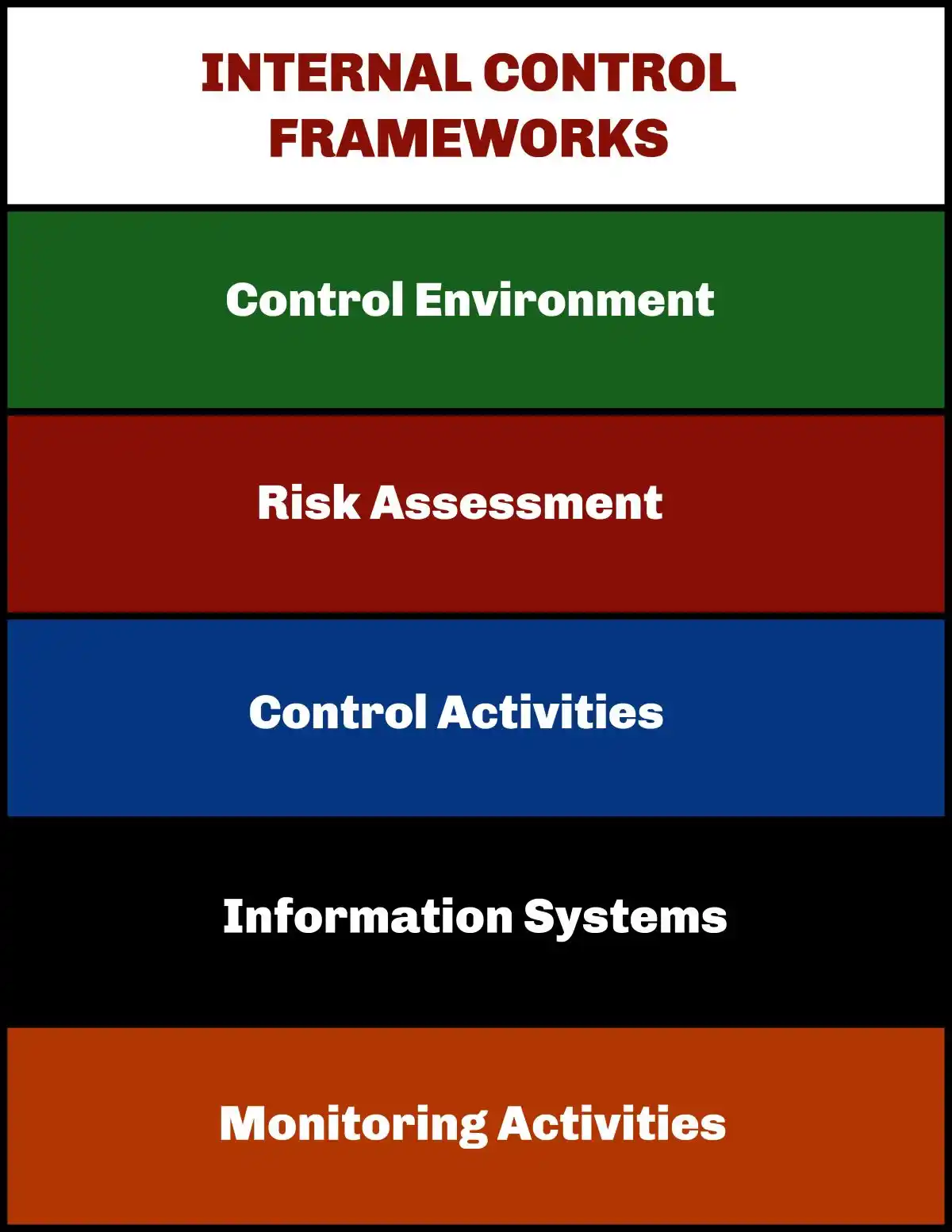

- COSO Framework: The Committee of Sponsoring Organizations (COSO) Internal Control-Integrated Framework, updated in 2013, offers the definitive guidance for implementing effective internal controls. This globally recognized framework helps organizations design and maintain systems that prevent, detect, and manage fraud risks related to financial reporting.

- Control Environment: The control environment forms the foundation of internal controls and establishes the organizational culture that either prevents or enables accounting fraud. Tone at the Top: Poor leadership commitment can lead to devastating fraudulent activities that trigger massive securities class action settlements.

- Strong Control Environment includes:

- Commitment to integrity and ethical values that prevent financial statement fraud

- Independent board oversight of internal control programs

- Clear organizational structure with defined reporting lines

- Recruitment and retention of competent personnel

- Established accountability for control responsibilities

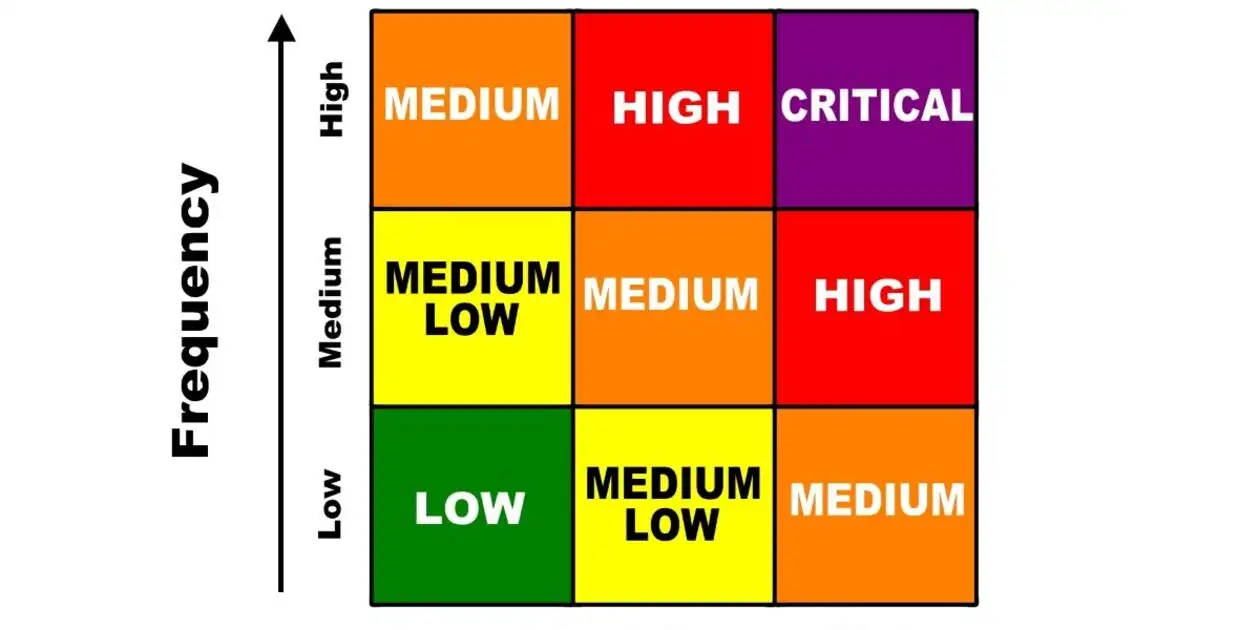

- Risk Assessment: Organizations must conduct periodic evaluations to identify potential threats that could lead to accounting irregularities and subsequent regulatory enforcement actions. Effective Risk Assessment involves:

- Establishing specific objectives that enable identification of fraud risks

- Identifying and analyzing risks to develop appropriate fraud prevention plans

- Explicitly considering accounting fraud possibilities during assessment

- Anticipating changes that might weaken internal controls

Segregation of Duties and Approval Workflows

Segregation of Duties: This fundamental internal control principle represents a critical barrier against both asset misappropriation and financial statement fraud. Single Point of Control: Organizations that allow single individuals complete control over transaction processes create dangerous vulnerabilities that enable accounting fraud schemes.

Optimal Segregation divides key functions among different employees:

- Initiation (requesting/recording transactions)

- Authorization (approval)

- Custody (handling assets)

- Reconciliation (reviewing and verifying)

Compensating Controls: Smaller departments facing segregation challenges must implement detailed supervisory reviews to prevent accounting irregularities. Common Segregation Examples:

- Cash receipts process: Separate collecting, depositing, recording, and reconciling functions among different individuals

- Purchasing process: Ensure the person initiating purchase orders differs from those approving purchases or initiating payments

- IT systems access: Limit access rights based on job responsibilities and regularly evaluate critical control areas

Approval Workflows: Automated approval systems strengthen internal controls by ensuring transactions undergo proper verification before posting. Benefits include:

- Enhanced visibility through real-time monitoring systems

- Regulatory compliance through enforced internal policies

- Reduced manual tasks that create opportunities for accounting fraud

- Stronger audit trails for regulatory enforcement investigations

Preventing Asset Misappropriation and Accounting Fraud

- Asset Misappropriation: This represents the most common occupational fraud scheme, with organizations losing an estimated 5% of revenue annually to fraud. Detection Timeline: Frauds lasting over five years resulted in median losses of $875,000, whereas those detected within six months limited losses to $30,000.

- Fraud Prevention requires implementing comprehensive protective measures:

- Proactive Data Monitoring: Organizations using analytics detected accounting fraud schemes twice as quickly (median duration of six months)

- Strong Control Environment: Clear policies and management commitment establish ethical standards that prevent financial statement fraud

- Fraud Triangle Awareness: Address opportunity (through internal controls), pressure (financial strain), and rationalization (justifications) that enable accounting fraud

- Physical Controls: Restrict access to assets based on job necessity

- Regular Testing: Ensure controls function as intended through periodic evaluation

- Reasonable Assurance: Effective internal controls provide reasonable—though not absolute—protection against accounting fraud. Collusion Risk: Multiple individuals working together can circumvent even robust systems, making continuous monitoring essential for preventing securities litigation.

- Risk Mitigation: Organizations with well-designed ICFR systems significantly reduce financial reporting risks while positioning themselves to avoid the devastating securities class actions that follow when control failures enable fraudulent activities.

Building Internal Controls Over Financial Reporting (ICFR)

Internal controls over financial reporting serve as the primary defense against the accounting fraud schemes that trigger costly securities class action lawsuits. These control mechanisms provide essential assurance regarding reliable financial reporting, operational effectiveness, and regulatory compliance . Building robust internal controls requires systematic implementation of proven frameworks that address the specific vulnerabilities that lead to securities litigation.

COSO Framework: Control Environment and Risk Assessment

The Committee of Sponsoring Organizations (COSO) Internal Control-Integrated Framework, updated in 2013, provides the definitive guidance for implementing effective internal controls that prevent financial statement fraud . This globally recognized framework helps organizations design and maintain systems that detect, prevent, and manage fraud risks before they escalate into regulatory enforcement actions .

Control Environment: The control environment establishes the organizational foundation from senior management down through all operational levels. Poor “tone at the top“ frequently precedes the devastating fraudulent activities that result in securities class action lawsuits . Strong control environments incorporate:

- Commitment to integrity and ethical values that prevent accounting irregularities

- Independent board oversight of internal control programs

- Clear organizational structure with defined reporting lines that prevent fraud

- Recruitment and retention of competent personnel committed to ethical conduct

- Established accountability for control responsibilities at every organizational level

Risk Assessment: Organizations must conduct comprehensive evaluations to identify potential threats that could lead to financial statement fraud and subsequent securities litigation . Effective risk assessment addresses:

Specific Objectives: Establishing clear objectives that enable identification of fraud-related risks Risk Analysis: Identifying and analyzing risks to develop appropriate prevention strategies Fraud Possibilities: Explicitly considering fraud scenarios during all assessment processes Control Changes: Anticipating changes that might compromise internal control effectiveness

Segregation of Duties and Approval Workflows

- Segregation of duties represents a fundamental internal control principle that reduces both intentional fraud and unintentional errors that can trigger securities litigation. This approach prevents any single individual from having complete control over transaction processes that could facilitate accounting fraud.

- Key Function Division: Organizations must distribute critical functions among different employees:

- Initiation: Requesting and recording transactions Authorization: Approving transactions and commitments Custody: Handling and safeguarding assets Reconciliation: Reviewing and verifying transaction accuracy

- Smaller departments where complete segregation presents challenges must implement compensating controls through detailed supervisory reviews . Common segregation applications include:

- Cash Receipts Process: Separate collecting, depositing, recording, and reconciling functions among different individuals to prevent misappropriation Purchasing Process: Ensure the person initiating purchase orders differs from those approving purchases or initiating payments IT Systems Access: Limit access rights based on job responsibilities and regularly evaluate critical control areas for potential vulnerabilities

- Approval workflows strengthen internal controls by ensuring all significant transactions undergo proper verification before posting. Automated workflows streamline these processes while maintaining control integrity . Key benefits include:

- Enhanced decision-making through timely notifications and approvals

- Improved visibility through real-time monitoring dashboards

- Stronger compliance through consistent enforcement of internal control policies

- Reduced manual processing that eliminates opportunities for manipulation

Preventing Asset Misappropriation and Accounting Fraud

- Asset misappropriation represents the most common occupational fraud scheme, with organizations losing an estimated 5% of annual revenue to fraudulent activities . Extended fraud schemes lasting over five years resulted in median losses of $875,000, while those detected within six months limited losses to $30,000.

- Prevention Strategies: Organizations must implement comprehensive measures to combat fraud risks:

- Proactive Data Monitoring: Organizations using advanced analytics detected fraud schemes twice as quickly, with median detection times of six months versus twelve months for traditional approaches Strong Control Environment: Clear policies and visible management commitment establish ethical standards that deter fraudulent behavior Fraud Triangle Awareness: Address opportunity (through internal controls), pressure (financial strain), and rationalization (justifications) that enable accounting fraud Physical Controls: Restrict asset access based on job necessity and implement monitoring systems Regular Testing: Ensure internal controls function as designed through periodic evaluation and validation

- Control Limitations: Effective internal controls provide reasonable—though not absolute—assurance against fraud. Collusion between multiple individuals can circumvent even robust control systems, making continuous monitoring essential . Organizations with comprehensive ICFR implementation significantly reduce financial reporting risks while maintaining operational effectiveness.

- Risk Mitigation: Strong internal controls create multiple barriers against the fraudulent activities that lead to regulatory enforcement actions and expensive securities class action settlements. The investment in comprehensive control systems represents far less than the devastating costs associated with accounting fraud revelations and resulting litigation.

5. Standardizing Financial Reports Across the Organization

- Standardization serves as a critical defense against the accounting irregularities that frequently trigger securities class action lawsuits. Organizations that fail to implement uniform reporting standards across business units create dangerous vulnerabilities where inconsistent methodologies and interpretation differences can lead to material misstatements.

- Financial Accuracy: Standardized reporting frameworks directly impact business decisions by ensuring that financial data remains consistent and reliable across all organizational levels. Transparency Requirements: These uniform standards help organizations maintain the transparency required to avoid regulatory enforcement actions while minimizing the risks of costly restatements.

Templates for income statements, balance sheets, and cash flow

- Structured Approach: Standardized templates provide essential safeguards that ensure completeness and comparability across all financial reporting functions. Income Statement Templates typically include:

- Revenue and sales sections

- Cost of goods sold (COGS) components

- Operating expense categories

- Net income calculations with embedded formulas

- Balance Sheet Templates offer structured protection through:

- Clearly defined asset categories

- Liability classifications

- Equity sections

- Automatic calculation functions for running totals

- Cash Flow Statement Templates contain:

- Operating activities section

- Investing activities breakdown

- Financing activities segment

- Beginning and ending cash balance reconciliations

- Reducing Manual Errors: These templates facilitate accurate data entry while maintaining consistency, as they include embedded formulas that automatically calculate totals based on entered values, reducing manual calculation errors. Business-Specific Customization: Properly designed templates accommodate specific business requirements while preserving the standardized formats essential for regulatory compliance.

Benefits of consistent formatting

- Enhanced Transparency: Consistent formatting delivers advantages that extend far beyond simple esthetic considerations. Clear Financial Disclosure: This formatting ensures that financial information receives clear, comprehensive presentation that builds trust among investors, creditors, and regulatory authorities.

- Strategic Advantages: Uniform formatting across departments creates several critical benefits:

- Enhanced comparability: Standardized reports enable straightforward comparison between different business units, time periods, or competitors within the same industry

- Streamlined review processes: Auditors and reviewers can validate information more efficiently when following familiar formats

- Improved collaboration: Team members can easily understand and build upon each other’s work when following consistent conventions

- Accelerated decision-making: Stakeholders can quickly locate and analyze key information without struggling to interpret varying formats

- Supporting Growth: Consistency in financial reporting transforms raw financial data into valuable insights that support growth, investor confidence, and informed decision making.

Reducing reporting errors through standardization

- Financial reporting errors can trigger devastating consequences, from undermining stakeholder trust to sparking regulatory investigations and securities litigation. Risk Mitigation: Standardization significantly reduces these risks through multiple protective mechanisms.

- Common Reporting Problems: Standardization reduces the occurrence of revenue and expense recognition problems, faulty valuations, and insufficient disclosures. Interpretation Consistency: When every department follows identical reporting protocols, opportunities for interpretation differences or methodological inconsistencies diminish substantially.

- Regulatory Compliance: Standardized approaches simplify compliance with regulatory frameworks like Generally Accepted Accounting Principles (GAAP), reducing the risk of non-compliance penalties. Operational Adaptation: This compliance foundation becomes increasingly important as regulations evolve, requiring companies to adapt operational processes and internal controls accordingly.

- Error Detection Support: Standardization supports error detection through:

- Simplified cross-checking procedures between related statements

- Consistent verification protocols across business units

- Streamlined audit trails for transaction tracing

- Enhanced visibility that makes anomalies more apparent

- Technology Integration: Organizations can reinforce standardization benefits through integrated financial planning software that enforces consistent accounting policies across all reporting periods. ERP Systems: Modern ERP systems offer particular value by automating standardized processes, reducing manual data entry, and providing real-time visibility into financial data.

- Implementation Strategy: Effective standardization requires organizations to evaluate existing reporting processes, identify inconsistencies, educate staff on standardization benefits, and gradually transition to uniform templates across departments. Continuous Improvement: Regular review and refinement ensure that standardization practices evolve with changing business needs and regulatory requirements

- Automated Financial Reporting Tools: Essential Technology for Risk Mitigation

- Modern financial reporting technology has become essential for organizations seeking to avoid the accounting irregularities that trigger costly securities litigation. Advanced automation tools eliminate the manual processes that create opportunities for human error and potential fraud, delivering real-time insights that support accurate financial reporting and regulatory compliance.

- Technology Solutions: These systems transform how organizations gather, analyze, and present financial data, making reporting both more efficient and more reliable for decision-makers while reducing exposure to the reporting failures that lead to securities class action lawsuits.

Real-Time Dashboards and Data Consolidation

- Real-time financial dashboards provide instant access to key financial metrics, enabling finance teams to monitor business health continuously rather than periodically. These dashboards automatically consolidate data from multiple sources into unified, visually compelling presentations that transform complex numbers into understandable narratives.

- Data Consolidation Advantages: Effective consolidation offers several critical benefits for organizations focused on risk mitigation:

- Immediate access to critical information: Decision-makers can obtain the exact data they need without delay, supporting proactive business choices

- Enhanced data accuracy: Automation reduces human error in the data collection and consolidation process

- Improved transparency: Detailed audit trails allow users to drill down into summary data to see underlying details in real time

- Reduced manual effort: Finance teams spend less time building reports and more time analyzing results and planning strategy

- Business Intelligence Solutions: Organizations utilizing business intelligence (BI) software for reporting have effectively addressed the limitations of manual processes, with 40% of companies now turning to these solutions for enhanced reporting capabilities. These systems provide the systematic approach necessary to prevent the financial statement fraud that can devastate organizational credibility.

Integration with ERP and CRM Systems

- System Integration: Connecting financial reporting tools with Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems creates a seamless flow of information across the organization. This integration provides a holistic view by connecting customer data with financial information.

- Operational Benefits: The synergy between these systems produces tangible advantages for corporate governance and internal controls:

- Automated Processes: Integrated systems enable a fully automated, paperless lead-to-cash process that converts CRM quotes into ERP orders with minimal manual intervention. Revenue Recognition: These systems facilitate proper revenue recognition by giving accounting teams visibility into sales activities. Data Integrity: Integration eliminates data silos by sharing information between platforms, reducing duplicate entries and associated errors.

- Strategic Decision-Making: This integration supports more informed decision-making by providing readily available, accurate insights that drive operational efficiency. For financial teams specifically, integration transforms reactive reporting into a dynamic, predictive financial management model where minor discrepancies can be identified and addressed immediately.

Leading Automated Reporting Solutions

- Technology Platform Examples: Several powerful tools have emerged as leaders in the automated financial reporting space, each offering unique advantages for organizations seeking to strengthen their regulatory compliance frameworks:

- Datarails CONNECT stands out for its user-friendliness and flexibility. The platform offers one-click data exporting from ERP systems to Excel, enabling ad-hoc and cross-departmental reporting with real-time automation. Finance professionals can maintain their existing Excel workflows while adding live data connectivity.

- Oracle NetSuite provides a cloud-based solution with customizable report creation and real-time visibility. Its capabilities include multi-dimensional reporting, consolidated reporting, and built-in financial analytics. NetSuite integrates seamlessly with many business applications, making it a versatile option for organizations seeking a unified financial platform.

- Workday Platform: Workday delivers powerful analytics by connecting data sources across the organization. Its platform enables users to drill into details, even down to transaction level, eliminating manual spreadsheet work. The system automates reporting with seamless connections to Google and Microsoft applications, making sharing results with stakeholders straightforward.

- Strategic Technology Investment: These tools represent essential investments for organizations seeking to avoid the securities fraud allegations that arise from reporting failures. For growing businesses, cloud-based platforms often provide the optimal balance of functionality and cost-effectiveness while supporting the audit readiness that protects against regulatory scrutiny.

7. Periodic Audits and Continuous Monitoring

- Verification mechanisms remain essential for preventing the financial statement fraud that triggers devastating securities class action lawsuits. Organizations that fail to implement regular assessment procedures through audits and continuous monitoring create vulnerabilities that regulatory enforcement agencies and plaintiff attorneys actively target.

- Early Detection: These oversight mechanisms help identify control weaknesses before they escalate into the material misstatements that lead to corrective disclosures, stock price collapses, and costly securities litigation.

Internal vs External Audits

- Complementary Functions: Internal and external audits serve distinct yet complementary purposes in maintaining the financial reporting integrity that protects against accounting fraud allegations.

- Internal Audits:

- Conducted by employees of the organization who report to the audit committee

- Focus on operational improvement, internal compliance, and risk mitigation

- Performed continuously throughout the year based on annual risk assessment plans

- Primarily serve management by identifying potential issues before they escalate

- External Audits:

- Performed by independent third-party firms with no ties to the organization

- Focus on financial statement assurance and regulatory compliance

- Typically conducted annually or at specific financial reporting milestones

- Serve external stakeholders including investors, lenders, and regulators

- Professional Standards: These audit types differ in scope and audience, yet both strive to deliver accurate information while maintaining professional standards and independence. Audit Failures: When either function breaks down, organizations become vulnerable to the securities litigation that follows accounting irregularities.

Sampling and Walkthroughs for Control Testing

- Resource Constraints: Auditors cannot examine every transaction due to time and budget limitations. Representative samples evaluate control effectiveness while maintaining audit efficiency.

- Sampling approaches include:

- Statistical sampling – Uses specific percentage thresholds or random selection software

- Nonstatistical sampling – Based on dollar thresholds or professional judgment

- Transaction Process Examination: Walkthroughs represent another crucial testing method, involving end-to-end examination of transaction processes.

- Effective walkthroughs should be:

- Performed before period-end, not just during fieldwork

- Conducted through direct observation and inquiry, not merely checklists

- Documented through clear flowcharts with screenshots

- Updated annually to capture changes in processes

- Operational Insights: Properly executed walkthroughs provide insights into operational processes, establish foundations for testing strategies, and enhance client engagement. Control Gaps: Inadequate walkthrough procedures often miss the control deficiencies that later surface in SEC enforcement actions.

Using Analytics to Detect Anomalies

- Advanced Detection: Analytics transform how organizations identify the financial irregularities that precede major corporate scandals. AI-powered anomaly detection combines multiple techniques to identify patterns that human reviewers might miss.

- Detection Methods:

- Statistical methods – Z-score analysis and Benford’s Law examine data patterns to flag unusual transactions

- Machine learning – Both supervised and unsupervised algorithms detect known fraud patterns and identify transactions that deviate from established norms

- Continuous monitoring – Real-time transaction analysis that shifts from periodic to embedded control testing

- Faster Detection: Organizations implementing continuous monitoring detect fraud schemes twice as quickly (median detection time of six months versus one year). Complete Coverage: Continuous monitoring enables 100% transaction coverage versus traditional sampling, significantly increasing anomaly detection capability.

- Proactive Approach: Combining periodic audits with continuous monitoring creates a more robust financial reporting system that identifies issues before they trigger the securities class action lawsuits that can devastate shareholder value and corporate reputations.

Mitigating Risks of Securities Litigation and Class Actions

- Securities litigation represents one of the most financially devastating consequences of inadequate financial reporting systems. Securities class action lawsuits emerge as powerful legal mechanisms when investors suffer losses due to misleading financial statements and accounting fraud.

How Poor Reporting Triggers Securities Class Actions

- Financial reporting deficiencies serve as primary catalysts for securities class action lawsuits, particularly when corrective disclosures reveal previously concealed problems and trigger dramatic stock price declines. Accounting irregularities frequently result in financial restatements that destroy investor confidence and create the foundation for costly litigation.

- The SEC charged Kraft Heinz for expense management schemes that resulted in the restatement of $208 million in improperly recognized cost savings. When the truth eventually emerged through regulatory investigation, shareholders who relied on the false financial statements filed securities class actions seeking to recover their losses.

- Poor readability in financial reports actually increases litigation risk, as firms attempting to avoid legal exposure by providing exhaustive detail inadvertently create more opaque documents. Securities Class Actions (SCAs) create lasting damage—organizations experience worse report readability after facing litigation, with this impact persisting several years afterward.

- Financial Statement Fraud often remains hidden until whistleblower reports, audit discoveries, or regulatory enforcement investigations expose the manipulation, triggering the corrective disclosures that devastate stock prices and lead to massive investor losses.

- Notable Securities Class Action Cases and Settlements

- The first half of 2025 saw 114 securities class actions filed in federal and state courts, comparable to the 115 filings in the second half of 2024. Artificial intelligence-related filings increased significantly, with 12 cases filed in early 2025, putting this category on track to surpass 2024 totals.

- Devastating Financial Consequences emerge when these cases reach settlement:

- Wells Fargo: $1 billion settlement for concealing compliance failures Kraft Heinz: $450 million settlement related to cost-cutting measures

- These settlements represent just the direct costs—organizations also face regulatory penalties, increased audit expenses, credit rating downgrades, and long-term reputational damage that can persist for years after resolution.

The legal ramifications extend beyond financial settlements. Corporate governance failures often result in ppersonal liability for board members and executives who failed to implement adequate oversight mechanisms.

Proactive Risk Mitigation and Litigation Defense

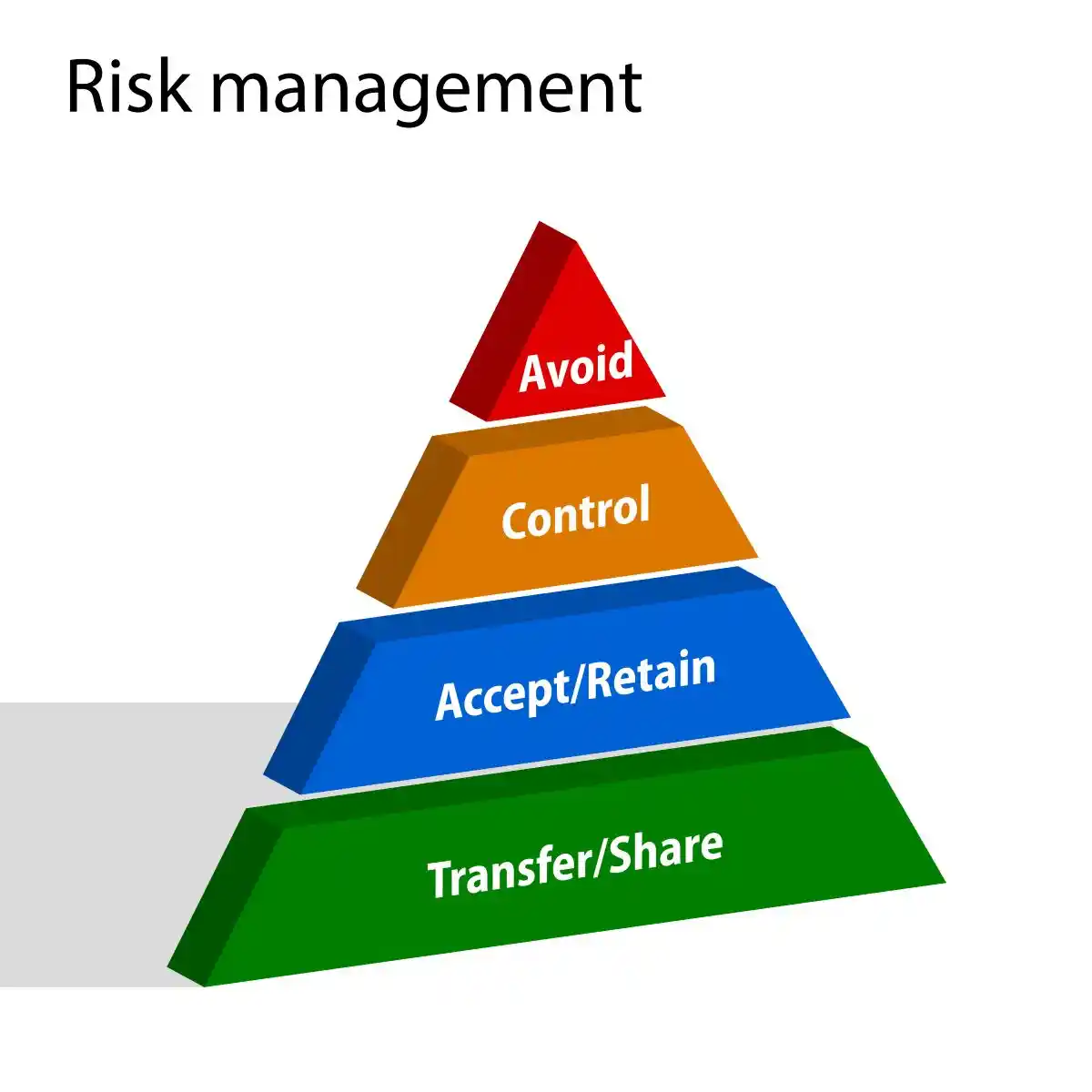

- Preventing securities litigation requires a comprehensive approach that addresses the root causes of financial statement fraud and accounting irregularities:

- Complete Risk Disclosure: Ensure thorough disclosure of risks associated with securities using appropriate cautionary language Accurate Financial Statements: Maintain precision through robust internal controls and regulatory compliance programs Regular Contract Reviews: Implement systematic reviews to identify potential compliance issues before they escalate Comprehensive Compliance Policies: Develop policies addressing compliance policies that specifically target regulatory requirements Internal Compliance Assessments: Conduct regular examinations to assess adherence to applicable laws

- Corporate Governance strength directly correlates with reduced litigation risk. Research demonstrates that firms with more diverse boards experience significantly lower securities litigation exposure.

- The investment in comprehensive fraud prevention proves far less costly than the devastating consequences of securities class actions. Organizations that prioritize transparency, maintain accurate financial reporting, and implement robust internal controls position themselves to avoid the catastrophic legal and financial consequences that can threaten their survival.

- Early Detection Systems enable companies to identify and address potential problems before they escalate into the material misstatements that trigger securities class action lawsuits and regulatory enforcement actions.

Conclusion

- Robust financial reporting systems represent far more than regulatory compliance mechanisms—they serve as the primary defense against the securities litigation risks that can devastate organizations and destroy shareholder value.

- The elements explored throughout this guide work together to create a comprehensive framework that protects against accounting fraud allegations and the costly legal battles that follow. COSO frameworks, proper segregation of duties, and well-designed approval workflows form the foundation of effective internal controls over financial reporting. These control systems prevent asset misappropriation while supporting compliance with SOX requirements and evolving regulatory expectations.

- Standardization creates consistency across income statements, balance sheets, and cash flow reports that reduces errors and facilitates meaningful analysis. When combined with automated tools and real-time dashboards, organizations can shift from reactive reporting to proactive risk mitigation strategies that identify problems before they escalate into regulatory enforcement actions.

- Continuous Monitoring: Advanced analytics and audit mechanisms provide ongoing verification of reporting integrity. Organizations implementing these comprehensive monitoring systems detect fraud schemes significantly faster than those relying on traditional periodic reviews alone.

- Strategic Asset: The investment in robust financial reporting systems delivers substantial returns through enhanced stakeholder trust, improved operational efficiency, and reduced exposure to securities class action lawsuits. Companies with strong governance structures and transparent financial practices experience fewer litigation challenges while attracting investment under more favorable terms.

- Market Integrity: The regulatory landscape continues to evolve, with SEC enforcement becoming increasingly sophisticated and penalties more severe. Organizations that recognize financial reporting systems as strategic business imperatives rather than compliance burdens position themselves for long-term success while protecting against the catastrophic consequences of governance failures.

- The cost of prevention proves far less than the price of remediation, making proactive compliance not just a legal necessity but a sound business strategy that protects all stakeholders’ interests. Companies that prioritize integrity and accountability in their financial reporting create multiple layers of protection against fraud and misconduct while building the foundation for sustainable growth.

- Forward-Looking Perspective: The organizations that thrive will be those that view robust financial reporting not as a burden to be minimized but as a competitive advantage that enables transparent operations, informed decision-making, and protection against the securities litigation risks that continue to challenge unprepared companies in today’s complex regulatory environment.

Key Takeaways

Building robust financial reporting systems is essential for organizational success, regulatory compliance, and stakeholder trust. Here are the critical insights every finance leader should implement:

• Align KPIs with strategic goals: Connect financial metrics like EBITDA, cash flow, and ROI directly to business objectives to ensure reporting drives meaningful decision-making and resource allocation.

• Implement strong internal controls: Use COSO frameworks, segregate duties, and establish approval workflows to prevent fraud and ensure accurate financial reporting across all organizational levels.

• Leverage automation for efficiency: Deploy real-time dashboards and integrate ERP/CRM systems to eliminate manual processes, reduce errors, and provide instant access to critical financial data.

• Standardize reporting formats: Create consistent templates for income statements, balance sheets, and cash flows to improve comparability, streamline reviews, and minimize reporting errors.

• Establish continuous monitoring: Combine periodic audits with analytics-driven anomaly detection to identify issues proactively rather than reactively, reducing fraud detection time by 50%.

• Prioritize regulatory compliance: Maintain SOX Section 302/404 compliance and audit readiness to avoid costly penalties and securities litigation that can damage stakeholder confidence.

When implemented effectively, these robust financial reporting systems transform from mere compliance tools into strategic assets that drive organizational growth, enhance stakeholder trust, and provide competitive advantages in today’s complex business environment.

FAQs

Q1. What are the key components of a robust financial reporting system? A robust financial reporting system includes core financial statements, internal controls, standardized reporting formats, integrated technology tools, and regular audit mechanisms. These components work together to ensure accuracy, reliability, and compliance in financial reporting.

Q2. How can organizations prevent earnings manipulation in financial reporting? Organizations can prevent earnings manipulation by implementing comprehensive transparency measures, maintaining consistent revenue recognition policies, monitoring ratio analysis results, examining earnings patterns for anomalies, and utilizing detailed financial disclosures that make manipulation more difficult.

Q3. What role do automated tools play in modern financial reporting? Automated tools like real-time dashboards and integrated ERP/CRM systems play a crucial role in modern financial reporting by eliminating manual processes, providing instant access to financial data, enhancing data accuracy, and allowing finance teams to focus more on analysis and strategic planning rather than data compilation.

Q4. How does standardization benefit financial reporting across an organization? Standardization in financial reporting enhances comparability between different business units and time periods, streamlines review processes, improves collaboration among team members, accelerates decision-making, and significantly reduces the risk of reporting errors and inconsistencies.

Q5. What strategies can companies use to mitigate risks of securities litigation related to financial reporting? To mitigate securities litigation risks, companies should ensure complete disclosure of risks associated with securities, maintain accurate financial statements through robust internal controls, implement regular contract reviews, develop comprehensive compliance policies, and conduct internal examinations to assess compliance with applicable laws.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors