Introduction to Occupation Fraud

- Occupational fraud costs organizations 5% of their annual revenue—a staggering financial hemorrhage that translates to more than $5 trillion lost globally when projected against the Gross World Product. These figures represent real financial devastation affecting businesses, shareholders, and entire economic systems worldwide.

- The Association of Certified Fraud Examiners documents the scope of this crisis through analysis of 1,921 real cases that produced total losses exceeding $3.1 billion. The scale becomes even more alarming when considering that 22% of these cases resulted in losses exceeding $1 million. The consistent pattern across industries and borders demonstrates that no organization remains immune to this threat.

- Three primary categories define the landscape of occupational fraud: asset misappropriation, corruption, and financial statement fraud. The data reveals a critical paradox in fraud patterns. Asset misappropriation appears in 89% of fraud cases but generates the smallest median loss at $120,000.

- Financial statement fraud occurs in only 5% of cases yet inflicts devastating median losses of $766,000.

- The 2026 edition of Occupational Fraud: A Report to the Nations will compile ongoing research data, representing the most authoritative source of information on this global problem. Organizations cannot afford to ignore these warning signs or assume their current controls provide adequate protection against sophisticated fraud schemes.

- Understanding the mechanisms behind these devastating losses becomes essential for protecting organizational assets and maintaining stakeholder trust. The patterns revealed through systematic analysis of fraud cases provide clear guidance for identifying vulnerabilities and implementing effective prevention strategies.

Understanding Occupational Fraud

- Occupational fraud represents a fundamental breach of trust that threatens organizational stability across all industries and business structures. The deliberate misuse of position and access creates vulnerabilities that traditional security measures often fail to address.

- Understanding the true nature of this threat extends beyond simple awareness of fraud schemes. Organizations must recognize how occupational fraud differs from external threats, why internal perpetrators prove so difficult to detect, and how seemingly trusted employees exploit the very systems designed to protect company assets.

- The complexity of modern occupational fraud requires strategic thinking about prevention rather than reactive responses to discovered schemes. Companies that fail to understand these underlying dynamics remain vulnerable regardless of their size, industry, or perceived security measures.

Understanding Occupational Fraud: Definition and Fundamental Risks

- The Association of Certified Fraud Examiners (ACFE) defines occupational fraud as “the use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization’s resources or assets”. This formal definition encompasses fraudulent activities committed by individuals against the organizations that employ them.

- Two fundamental factors create the widespread vulnerability to this crime:

- Organizations must entrust employees with access to or control over assets

- The sheer number of individuals positioned to potentially commit these crimes

- Every occupational fraud scheme involves a breach of trust between employer and employee. Perpetrators deliberately conceal their activities to avoid detection, operating in secrecy while systematically extracting value from their employers.

The scope encompasses three distinct fraud categories:

- Asset misappropriation – Theft of cash, inventory, or physical assets representing 89% of cases with median losses of $120,000

- Corruption – Conflicts of interest, bribery, illegal gratuities, and economic extortion appearing in nearly half of all fraud cases

- Financial statement fraud – Manipulation of financial statements to misrepresent organizational condition, causing median losses of $766,000

- The ACFE’s 2024 Report to the Nations analyzed 1,921 cases from 138 countries, documenting $3.10 billion in total losses. These statistics demonstrate that occupational fraud represents a global crisis affecting organizations regardless of size, industry, or geographic location.

- The prevalence stems from the inherent trust relationship required for business operations. When this trust breaks down through employee misconduct, the financial and reputational consequences can devastate organizations and stakeholders alike.

The Escalating Threat: Why 2025 Demands Immediate Action

- The consequences of occupational fraud extend far beyond immediate monetary losses, creating cascading damage that can destroy organizations and devastate stakeholder confidence. When projected against global economic activity, these losses represent more than $5 trillion stolen annually from the world economy.

- The ripple effects prove equally destructive:

- Reputational destruction that erodes customer trust and market confidence

- Legal liability exposing both individuals and companies to substantial penalties

- Workforce demoralization reducing productivity and increasing turnover costs

- Enhanced compliance expenses requiring significant resource allocation for improved monitoring

- Small businesses face disproportionate vulnerability. Larger corporations may absorb fraud losses through diversified operations, but smaller enterprises often lack the robust internal controls necessary for adequate protection. These organizations frequently discover that a single fraud scheme can threaten their survival.

- Control deficiencies represent the primary enabler of occupational fraud in 2025. More than half of all fraud schemes succeed specifically because organizations either lack adequate internal controls (32%) or allow the override of existing safeguards (19%). This pattern reveals a fundamental weakness that persists across industries and organizational structures.

- Detection delays compound the financial damage substantially. The median fraud scheme operates undetected for approximately one year before discovery. This extended timeline allows perpetrators to extract maximum value while organizations remain unaware of their losses.

- The response pattern among victimized organizations demonstrates the severity of this threat. After experiencing fraud, 82% of companies immediately enhanced their anti-fraud controls. This reactive approach underscores a critical reality: organizations typically recognize their vulnerability only after suffering substantial losses.

- Proactive measures become essential for preventing these devastating outcomes rather than responding to them after the damage occurs.

Occupational Fraud: Three Critical Categories

Occupational fraud manifests through distinct pathways, each creating unique vulnerabilities within organizational structures. The classification system reveals critical patterns that enable targeted prevention strategies and risk assessment frameworks.

Asset Misappropriation: The Most Common Threat

- Asset misappropriation represents the fundamental breach of employee trust, appearing in 89% of cases while generating median losses of $120,000. This category encompasses direct theft of organizational resources through various sophisticated mechanisms

- Common asset misappropriation schemes create systematic vulnerabilities across multiple operational areas:

- Cash theft occurs through skimming operations, where employees intercept payments before recording them in accounting systems, or through direct manipulation of cash receipts and deposits.

- Billing schemes involve creating fictitious vendors, inflating legitimate invoices, or processing payments for goods and services never received. These schemes often exploit weaknesses in accounts payable controls and vendor verification processes.

- Expense reimbursement fraud transforms personal expenses into business costs through falsified documentation, inflated claims, or duplicate submissions. The schemes typically target organizations with inadequate expense reporting oversight.

- Check tampering includes forging signatures, altering payee information, or intercepting legitimate payments.

- Payroll fraud creates ghost employees, manipulates timesheets, or diverts legitimate payroll payments.

- Inventory theft ranges from simple pilferage to sophisticated schemes involving falsified shipping documents.

- Escalation patterns emerge consistently across asset misappropriation cases. Perpetrators begin with small amounts to test security measures, then gradually increase theft amounts once they identify control weaknesses. The schemes typically concentrate in three operational cycles: revenue collection, cash disbursements, and inventory management.

Corruption: The Influence-Based Threat

- Corruption schemes exploit positions of trust to influence business decisions improperly. Appearing in approximately 48% of occupational fraud cases, these schemes generate median losses of $200,000 while creating extensive reputational damage that often exceeds financial costs.

- Conflicts of interest represent the most subtle form of corruption, where employees make decisions benefiting personal interests rather than organizational objectives. Bribery schemes involve direct payments or benefits exchanged for favorable business decisions. Illegal gratuities provide compensation after favorable actions occur, while economic extortion uses coercion to demand payments or benefits.

- Multi-party coordination distinguishes corruption from other fraud types. These schemes frequently involve collusion between internal employees and external vendors, creating purchasing fraud, invoice manipulation, or bid rigging arrangements. The collaborative nature makes corruption particularly difficult to detect through traditional control mechanisms.

- Reputational consequences from corruption scandals often prove more devastating than immediate financial losses. Organizations face long-term brand damage, regulatory scrutiny, and market confidence erosion that can persist for years after resolution. Small businesses prove especially vulnerable because limited resources prevent effective recovery from corruption-related reputation damage.

Financial Statement Fraud: The Executive-Level Threat

- Financial statement fraud occurs in only 5% of cases but generates catastrophic median losses of $766,000. This category involves deliberate misstatement of financial information to deceive investors, creditors, and regulators about organizational performance.

- Revenue manipulation creates artificial sales through premature recognition, fictitious transactions, or timing schemes that shift revenue between reporting periods. Asset valuation fraud inflates inventory, real estate, or other asset values to improve balance sheet appearance. Expense manipulation understates costs, liabilities, or reserves to inflate reported profits. Improper disclosures omit material information required for accurate financial assessment.

- Executive involvement characterizes most financial statement fraud cases, as these schemes require authority over financial reporting processes and accounting systems. The concentration of control enables sophisticated manipulation that bypasses normal review mechanisms.

- Extended detection periods allow substantial damage accumulation before discovery occurs. Financial statement fraud often continues for several years, creating cascading effects throughout investment decisions, credit arrangements, and regulatory compliance obligations.

- The devastating impact extends beyond immediate financial losses to encompass investor litigation, regulatory enforcement actions, and systematic destruction of stakeholder trust. Organizations face years of recovery efforts following financial statement fraud revelations.

Identifying the Warning Signs of Occupational Fraud

Identifying the Warning Signs of Occupational Fraud

- Early detection of occupational fraud requires systematic attention to specific behavioral and organizational indicators. The Association of Certified Fraud Examiners reports that in approximately 85% of cases, perpetrators displayed at least one behavioral red flag before their fraud was discovered. Organizations that recognize these warning signs promptly can significantly reduce both financial losses and duration of fraudulent schemes.

- Critical Behavioral Indicators

- Research consistently reveals specific behavioral patterns that appear across fraud cases. At least one of the eight most common behavioral red flags was observed in 76% of all documented cases. These indicators provide early warning systems for vigilant organizations.

- Living beyond means represents the most persistent warning sign, ranking as the primary red flag in every ACFE study since 2008. Employees displaying affluence inconsistent with their known income—expensive cars, jewelry, homes, or boats—warrant careful attention from management.

- Financial difficulties affect approximately 26% of fraudsters. Personal financial pressures from debt, medical bills, divorce, or other hardships create motivations that can override ethical boundaries. These pressures often coincide with opportunities to exploit organizational vulnerabilities.

- Unusually close associations with vendors or customers appear in 19% of cases, potentially indicating collusion or conflicts of interest. When employees develop inappropriate relationships with external parties, the risk of kickbacks, bid rigging, or other corrupt practices increases substantially.

- Control issues or unwillingness to share duties characterize approximately 15% of fraudsters. These individuals often refuse to train others, resist delegation, or demonstrate excessive possessiveness over their responsibilities. Such behavior may indicate attempts to conceal ongoing fraudulent activities.

- Additional warning signs include irritability, suspiciousness, or defensiveness when questioned about work activities—present in 13% of cases. The “wheeler-dealer” attitude, exhibited by 13% of fraud perpetrators, involves unscrupulous or overly aggressive business behavior. Fraudsters also frequently refuse vacation or sick leave, fearing their schemes will be discovered during their absence.

- Behavioral changes indicating substance abuse, gambling problems, or fear of employment loss provide additional red flags. Five warning signs appear particularly among executives and owners: bullying or intimidation, unusually close vendor associations, control issues, “wheeler-dealer” attitude, and creating excessive organizational pressure.

Organizational Vulnerabilities and Systemic Weaknesses

- Certain organizational characteristics create environments where occupational fraud flourishes. These systemic vulnerabilities typically stem from weaknesses in governance, controls, or corporate culture.

- Inadequate internal controls represent fundamental organizational weaknesses. Signs include poorly defined duties without monitoring, absence of account reconciliation, or excessive reliance on manual processes. When organizations fail to implement appropriate segregation of duties, single individuals gain dangerous authority over critical functions.

- Excessive control by small groups creates dangerous concentrations of power. Management decisions dominated by individuals or small groups without appropriate oversight eliminate the checks and balances essential for fraud prevention.

- Accounting and documentation irregularities provide clear warning signals. Red flags include altered or photocopied documents, excessive year-end transactions, unsupported journal entries, and unexpected overdrafts. These indicators often reveal attempts to manipulate financial records or conceal fraudulent activities.

- Personnel patterns can indicate organizational weakness. High employee turnover, inexperienced accounting personnel, and disrespect for regulatory authorities create environments where fraud can develop without detection.

- Unusual financial activities warrant investigation. Multiple checking accounts, frequent banking changes, continuous loan rollovers, or under-market-value asset sales may indicate attempts to conceal fraudulent transactions or generate funds to cover losses.

- Procurement irregularities signal potential corruption. Frequent sole-source contracts, excessive voided receipts, unusual purchasing patterns, or vendor addresses matching employee information suggest possible kickback schemes or conflicts of interest.

- Cultural weaknesses undermine fraud prevention efforts. Low employee morale, absence of codes of ethics, lack of transparency, and ineffective management create conditions where fraudulent behavior becomes more likely.

- Organizations must address these vulnerabilities through systematic risk assessments that identify weak areas where fraudulent activities might occur. Regular training remains essential, particularly for front-line staff who should understand key red flag indicators related to fraud types the business faces.

The Profile of Occupational Fraudsters

- Understanding who commits occupational fraud provides critical intelligence for prevention efforts. Demographic analysis of fraud perpetrators reveals consistent patterns across positions, departments, and personal characteristics that enable organizations to target their anti-fraud resources more effectively.

Fraudster Demographics: Challenging Common Assumptions

- 87% of occupational fraudsters have no previous criminal history related to fraud-related offenses. This statistic fundamentally challenges the assumption that fraud perpetrators fit the profile of career criminals. First-time offenders constitute the vast majority of cases, demonstrating that individuals with clean backgrounds may still commit fraud under specific circumstances.

- Gender distribution shows males accounting for approximately 74% of all occupational fraud cases. This disparity has remained consistent across multiple studies, indicating persistent patterns in fraudulent behavior.

- Education levels among fraudsters exceed expectations: • 67% possess college education

• 52% have completed university degrees

- Behavioral warning signs provide the most reliable early detection indicators. 84% of documented cases involved perpetrators who exhibited at least one behavioral red flag before their fraud was discovered. The most prevalent indicators include:

- • Living beyond means (39%) – extravagant purchases inconsistent with known income

• Financial difficulties (27%) – debt problems and inability to pay essential bills

• Unusually close vendor/customer associations (20%) – potentially indicating conflicts of interest

• Control issues or unwillingness to share duties – demonstrated through reluctance to delegate responsibilities

- • Living beyond means (39%) – extravagant purchases inconsistent with known income

The Impact of Tenure, Age, and Authority

- Employee tenure directly correlates with fraud sophistication and financial impact. Employees with longer tenure (10+ years) cause dramatically higher losses ($250,000 median) compared to those employed for one year or less ($50,000 median). Extended organizational experience provides fraudsters with deeper knowledge of control weaknesses and greater access to assets.

- Age demographics reveal that most perpetrators fall between 36-50 years old (53%), with the 36-40 age bracket representing the highest single concentration at 19%. This middle-career stage combines sufficient organizational authority with personal financial pressures that may motivate fraudulent behavior.

- Position level creates exponential differences in fraud severity. Owner/executive frauds inflict losses more than seven times greater than those perpetrated by regular employees. The hierarchical breakdown shows: • Managers (41%) • Regular employees • Executives/owners

- Greater organizational authority enables access to more resources while reducing oversight, creating conditions for more substantial losses.

- Departmental Risk Concentrations

- 52% of occupational fraud cases originate from just five departments:

- Operations (14%)

- Accounting (12%)

- Sales (12%)

- Customer service (9%)

- Executive/upper management (9%)

- 52% of occupational fraud cases originate from just five departments:

- This concentration highlights areas requiring enhanced controls and monitoring. Operations departments typically have greater access to physical assets, while accounting staff control financial systems and records.

- Financial impact varies significantly by department. Despite occurring less frequently, fraud committed by board members, executive management, marketing, finance and accounting departments results in the highest median losses.

- Corruption emerges as the most common scheme type across almost every industry sector, appearing in up to 66% of cases in some industries. This prevalence underscores the importance of robust anti-bribery policies and careful monitoring of vendor relationships throughout organizations.

- The combination of departmental trends and position authority creates risk profiles that organizations can use to allocate anti-fraud resources effectively, focusing on high-risk areas while maintaining organization-wide vigilance.

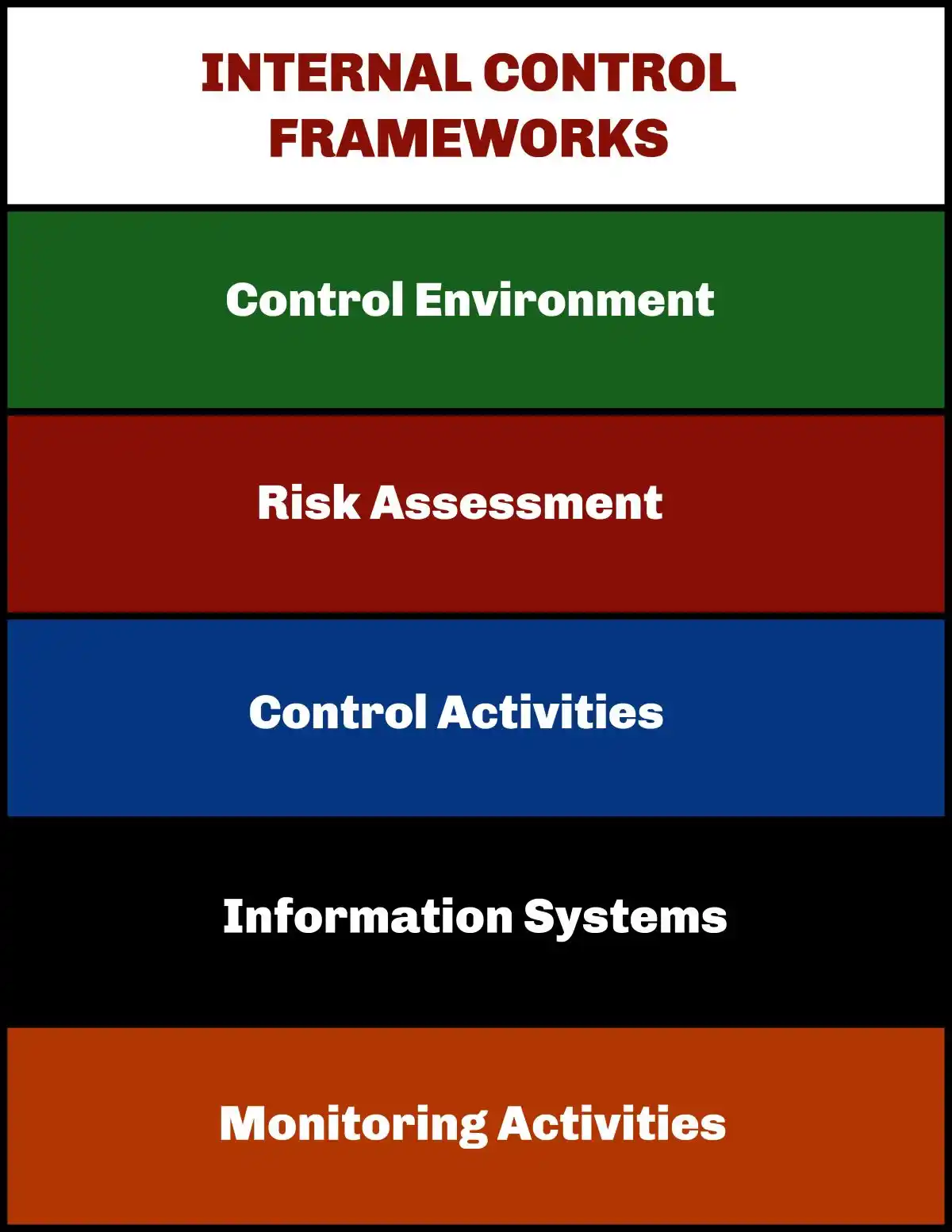

Effective Internal Controls: The First Line of Defense

- Robust internal controls represent the cornerstone of any successful anti-fraud strategy. Organizations that implement strong control systems consistently experience both reduced fraud losses and shorter scheme durations compared to those operating with inadequate safeguards.

- The data demonstrates that effective controls create measurable protection against occupational fraud schemes. Organizations cannot afford to treat control implementation as an optional expense—the cost of prevention remains significantly lower than the devastating impact of undetected fraud.

The Four Most Effective Anti-Fraud Controls

- Four specific anti-fraud controls demonstrate exceptional effectiveness, each associated with at least a 50% reduction in both fraud loss and duration:

- Surprise audits create unpredictability that serves as a powerful deterrent to potential fraudsters. Unannounced examinations catch ongoing schemes before substantial losses accumulate and signal to employees that misconduct will be discovered.

- Financial statement audits provide systematic review mechanisms that identify discrepancies indicating fraudulent activity. Regular, thorough examination of financial documents creates accountability and transparency throughout the organization.

- Dedicated hotlines prove remarkably effective in fraud detection. Organizations with tip hotlines are nearly twice as likely to detect fraud via tips than those without. This effectiveness explains why tips account for 43% of all fraud discoveries.

- Proactive data analysis enables organizations to identify unusual patterns and potential red flags before they develop into major losses. Systematic examination of transaction data provides early warning signs that manual reviews might miss.

Internal Audits and Job Rotation: Critical Fraud Prevention Tools

- Internal audit functions serve as essential defense mechanisms against occupational fraud. Internal auditors possess unique insider knowledge of organizational controls, enabling them to identify vulnerable points where fraud might occur. Their role extends beyond simple compliance checking to include comprehensive assessment of control effectiveness and strategic recommendations for strengthening defenses.

- Job rotation addresses a fundamental fraud risk factor. Employees who remain in positions for extended periods create dangerous vulnerabilities:

- Excessive familiarity with processes allows staff to identify and exploit system weaknesses. Inappropriate relationships with vendors or customers can develop over time. Fraud schemes remain undetected for longer periods when the same individuals maintain control.

- Rotating employees through different positions interrupts potential fraud schemes while ensuring cross-training that reduces organizational vulnerability. Mandatory vacation policies similarly help uncover ongoing fraud, as perpetrators typically must maintain continuous presence to conceal their activities.

Code of Conduct: Establishing Ethical Foundations

- A well-designed code of conduct establishes ethical guardrails that prevent fraud before it occurs. The code articulates expected behaviors and creates decision-making frameworks throughout the organization.

- Effective codes of conduct address several critical elements:

- Clear ethical principles and behavioral expectations provide employees with concrete guidance for difficult situations. Guidelines for handling conflicts of interest address one of the most common fraud risk factors. Procedures for reporting suspected violations create safe channels for early problem identification. Statements emphasizing that winning with integrity supersedes financial results establish organizational priorities.

- Dell’s approach exemplifies effective code design through its title “How We Win,” framing ethical behavior as essential to success rather than bureaucratic obligation. This positioning helps employees understand that code compliance represents a pathway to achievement.

- Robust codes of conduct require all employees to perform their duties ethically and transparently, deterring fraudulent behavior from the outset. These clear expectations create organizational culture that values integrity—the most fundamental fraud prevention tool available.

Detection Methods: Early Warning Systems That Work

- Effective fraud detection serves as the critical second line of defense when prevention measures fail to stop occupational fraud schemes. The speed of detection directly correlates with financial damage—organizations that identify fraud quickly suffer significantly lower losses than those where schemes operate undetected for extended periods.

The Power of Tips and Whistleblower Programs

- Tips represent the most effective fraud detection method, accounting for a staggering 43% of all fraud detections. This rate exceeds other detection methods by more than three times, establishing whistleblower programs as essential components of organizational fraud defenses.

- Organizations with dedicated tip hotlines achieve nearly twice the detection rate through tips compared to those without reporting systems. The effectiveness extends beyond simple detection rates to include substantial operational advantages.

- Key performance indicators for whistleblower programs:

- Detection speed: Hotlines identify fraud approximately six months sooner than organizations lacking reporting mechanisms

- Source diversity: Employee tips comprise roughly 50% of all reports, with customers, vendors, and anonymous sources providing the remainder

- Financial impact: Organizations without hotlines experience double the financial losses from fraud compared to those with established reporting channels

- Employee training amplifies hotline effectiveness, boosting tip-based detection by 38% when combined with fraud awareness education. This synergy demonstrates why successful detection programs require coordinated approaches rather than isolated measures.

Internal Audits and Management Review: Systematic Detection Approaches

- Internal audit functions provide the second most common detection pathway, identifying 14% of fraud cases through systematic examination of organizational controls and processes. Management review follows closely, uncovering 13% of fraudulent schemes.

- Internal auditors possess unique advantages in fraud detection due to their comprehensive understanding of organizational controls and risk management culture. Their independent assessment capabilities provide objective assurance regarding fraud risks that prove material to organizational operations.

- Active detection methods consistently outperform passive approaches in both speed and effectiveness. Management reviews, account reconciliations, and targeted examinations detect fraud more rapidly than passive methods, substantially reducing both detection timeframes and financial losses.

Advanced Analytics: Technology-Enabled Detection

Data analytics has revolutionized fraud detection by enabling organizations to analyze massive transaction volumes and identify unusual patterns that indicate potential fraudulent activity. These systems employ statistical and machine-learning techniques to flag suspicious transactions in real-time.

Proactive data analysis ranks among the four most effective controls, associated with at least a 50% reduction in both fraud loss and scheme duration. Modern analytics platforms demonstrate remarkable versatility in detecting various fraud schemes:

- Payment fraud: Credit card and debit card manipulation

- Account compromise: Unauthorized access and takeover attempts

- Identity fraud: Synthetic identity creation and abuse

- Behavioral anomalies: Spending patterns inconsistent with established customer profiles

Advanced analytics software can simultaneously deploy multiple detection methodologies, processing vast data sets while enabling organizations to stay ahead of evolving fraudulent tactics. The financial commitment to these technologies reflects their importance—companies invested approximately $44 billion globally in fraud detection programs during 2023.

The integration of these detection methods creates a multi-layered defense system that significantly reduces both the likelihood and impact of undetected occupational fraud schemes.

Protecting Your Organization: The Path Forward

- Occupational fraud represents a clear and present danger to organizational integrity, with consequences that extend far beyond immediate financial losses to threaten regulatory compliance, stakeholder trust, and long-term viability.

- Behavioral warning signs provide the earliest indicators of potential fraud schemes. Employees who live beyond their means, experience sudden financial difficulties, or demonstrate excessive control over their responsibilities require careful attention. Early recognition of these red flags can prevent devastating losses and protect your organization from becoming another fraud statistic.

- Effective fraud prevention demands a systematic approach that addresses multiple vulnerability points simultaneously. Robust internal controls create barriers that deter fraudulent activity while surprise audits introduce the unpredictability that fraudsters fear most. Whistleblower hotlines serve as your most powerful detection tool, uncovering 43% of all fraud cases when properly implemented and promoted.

- The perpetrator profile challenges common assumptions about who commits fraud. Most fraudsters begin their schemes without criminal backgrounds, often possessing advanced education and substantial organizational tenure. This reality requires vigilance across all levels, particularly regarding executives and managers whose positions enable significantly larger losses.

- Departmental risk concentration demands targeted attention. Operations, accounting, sales, customer service, and executive management collectively account for over half of all occupational fraud cases, requiring enhanced monitoring and controls in these critical areas without abandoning organization-wide vigilance.

- Corporate governance failures create the conditions where fraud flourishes. Strong ethical frameworks and comprehensive codes of conduct establish clear behavioral expectations and create cultures where integrity becomes the standard rather than the exception. Organizations that prioritize ethical conduct consistently experience lower fraud rates and reduced financial losses.

- Proactive compliance represents not merely a regulatory obligation but a fundamental business imperative that protects all stakeholders. The investment in comprehensive controls, robust reporting mechanisms, and strong ethical foundations pays substantial dividends through reduced losses and enhanced organizational resilience.

- Regulatory enforcement continues to intensify, with severe penalties for organizations that fail to implement adequate fraud prevention measures. The cost of prevention invariably proves far less than the price of remediation, making proactive anti-fraud strategies essential for long-term success.

Key Takeaways

Understanding occupational fraud is crucial for protecting your organization from the devastating financial impact that costs businesses 5% of their annual revenue globally.

• Occupational fraud costs organizations 5% of annual revenue globally, translating to over $5 trillion in losses worldwide, with asset misappropriation being most common but financial statement fraud causing the highest median losses.

• 87% of fraudsters have no previous criminal history and are often educated employees, making it essential to monitor behavioral red flags like living beyond means and financial difficulties rather than relying on criminal background assumptions.

• Tips through whistleblower hotlines detect 43% of all fraud cases, making them three times more effective than any other detection method and reducing losses by nearly 50% when implemented properly.

• Four key controls reduce fraud losses by at least 50%: surprise audits, financial statement audits, dedicated hotlines, and proactive data analysis create the most effective defense against occupational fraud.

• Operations, accounting, sales, customer service, and executive management departments account for 52% of all fraud cases, requiring targeted controls and enhanced monitoring in these high-risk areas.

The combination of robust internal controls, employee awareness training, and ethical frameworks creates the strongest defense against occupational fraud, protecting both financial assets and organizational reputation.

FAQs

Q1. What are the most common types of occupational fraud? The three main types of occupational fraud are asset misappropriation, corruption, and financial statement fraud. Asset misappropriation is the most frequent, occurring in 89% of cases, while financial statement fraud is the least common but most financially damaging.

Q2. How is occupational fraud typically detected? Tips through whistleblower hotlines are the most effective method, detecting 43% of all fraud cases. This is followed by internal audits (14%) and management review (13%). Organizations with hotlines detect fraud about six months sooner than those without.

Q3. What are some behavioral red flags of potential fraudsters? Common red flags include living beyond means, experiencing financial difficulties, having unusually close associations with vendors or customers, exhibiting control issues, and demonstrating a “wheeler-dealer” attitude. At least one of these behaviors was present in 85% of fraud cases.

Q4. Which departments are most prone to occupational fraud? Five departments account for 52% of all occupational fraud cases: operations (14%), accounting (12%), sales (12%), customer service (9%), and executive/upper management (9%). These areas require enhanced controls and monitoring.

Q5. What internal controls are most effective in reducing fraud losses? The top four controls that reduce fraud losses by at least 50% are surprise audits, financial statement audits, dedicated hotlines, and proactive data analysis. Implementing these measures can significantly decrease both the duration and financial impact of fraud schemes.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors