Introduction to Misleading Statements or Omissions in Financial Reporting

- Misleading Statements or Omissions in Financial Reporting: Represents one of the most devastating catalysts for securities class action lawsuits in modern financial markets.

- Deceptive Acts: These deceptive practices involve the deliberate misrepresentation of a company’s financial information designed to deceive stakeholders, including investors, creditors, and regulators.

- Consequences: The consequences extend far beyond simple accounting errors—they can trigger widespread economic instability and result in catastrophic securities litigation

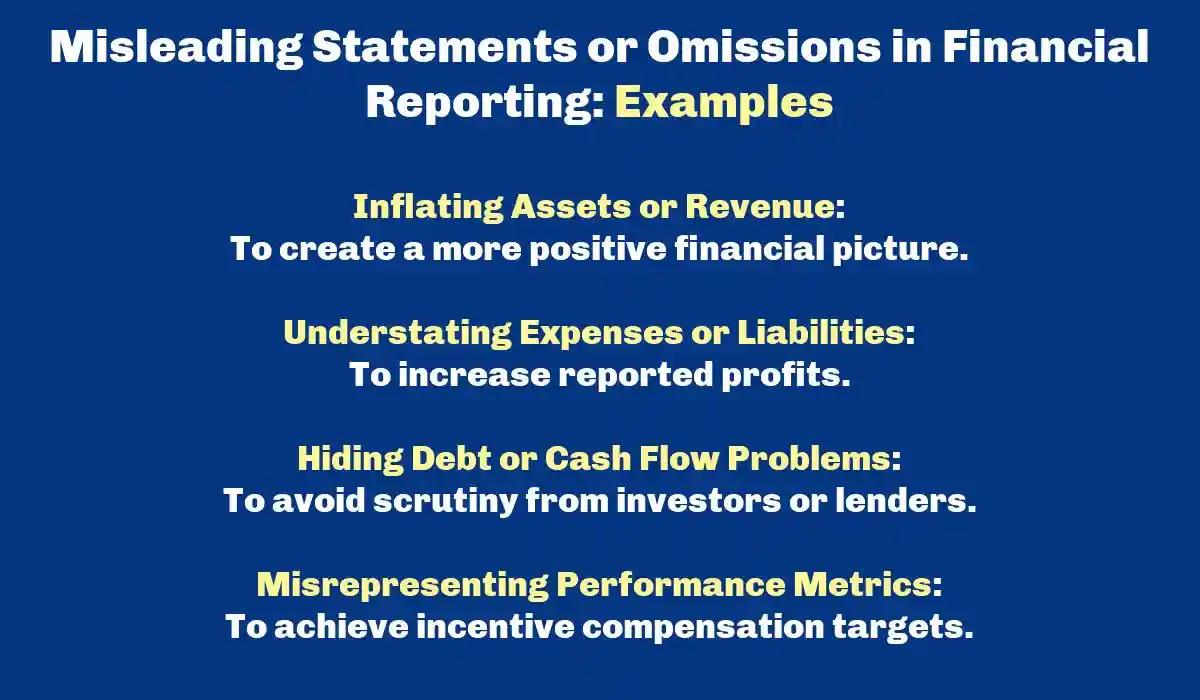

- Accounting fraud: Done through misleading financial statements typically involves sophisticated manipulation designed to inflate a company’s apparent financial health.

- Schemes: Companies engaging in these practices employ various schemes, including revenue inflation, expense manipulation, and asset misrepresentation, all of which directly violate federal securities laws and create substantial liability for securities class actions.

- Omissions in financial statements: Prove particularly insidious because they create deceptions that appear unintentional on the surface. This strategy involves deliberately omitting transactions from financial statements and withholding critical information from supporting documents.

- Truth Emerges: When the truth eventually emerges—often through whistleblower reports, audit discoveries, or regulatory enforcement investigations—the resulting corrective disclosures can trigger dramatic stock price declines, leading to substantial investor losses and the inevitable wave of securities class action lawsuits alleging accounting fraud.

Regulatory Enforcement and Legal Consequences

- The Securities and Exchange Commission (SEC) aggressively investigates and prosecutes financial fraud cases, establishing crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

- Potential Defendants: Both brokers and brokerage firms may be held liable for any misleading statements or omissions concerning their clients’ investments.

- Financial Statement Fraud: Creates a dangerous web of deception that can devastate investor confidence and trigger costly securities class action lawsuits.

- Recognizing Red Flags: Understanding these fraudulent practices becomes essential for investors seeking to protect their investments and avoid the devastating effects of corporate fraud.

Understanding Financial Reporting Fraud: Essential Components

- Critical Aspects: This guide examines the critical aspects of misleading financial reporting that every investor must understand:

- Financial Statement Fraud Risk Factors: The pressure to meet earnings expectations, weak internal controls, and corporate governance failures that create environments conducive to fraud.

- Common Manipulation Techniques: Revenue recognition fraud, expense manipulation, asset valuation fraud, and improper disclosures that companies use to deceive stakeholders.

- Red Flags and Warning Signs: Unusual financial patterns, frequent restatements, and discrepancies that signal potential accounting fraud.

- Securities Litigation Process: How misleading financial statements trigger securities class actionsand the legal remedies available to harmed investors.

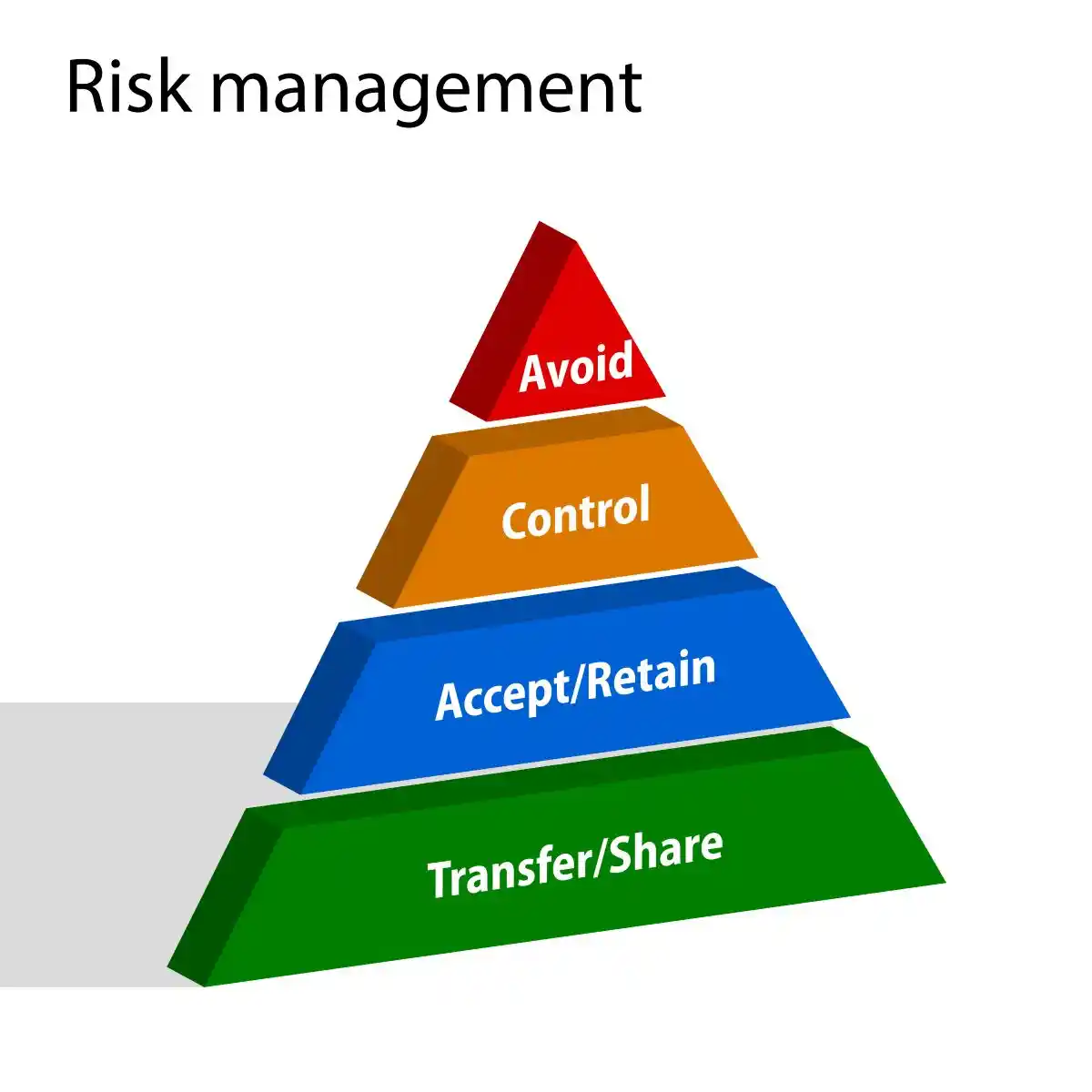

- Prevention and Detection Strategies: Internal controls, audit procedures, and risk management practices that companies must implement to avoid becoming defendants in securities litigation.

- Investor Protection: Due diligence practices and analytical techniques that help investors identify potential fraud before significant losses occur.

- Empowering Investors: Understanding these financial statement fraud risk factors empowers investors to identify potential problems before they result in significant losses, ultimately contributing to more robust and transparent capital markets for all participants.

Understanding Financial Statement Fraud: Critical Definitions for Investor Protection

- Financial Statement Fraud: Encompasses the intentional falsification, misrepresentation, or omission of financial data designed to deceive stakeholders such as investors, regulators, and creditors.

- Consequences: These deceptive practices represent far more than simple accounting errors—they constitute deliberate violations of federal securities laws that frequently trigger securities class action lawsuits and regulatory enforcement actions.

- Essential Investor Learning: Understanding the fundamental distinctions between different types of misleading financial reporting becomes essential for recognizing these schemes before they result in significant investor losses.

False and Misleading Financial Statements: Deliberate Deception of Investors

- False and misleading financial statements: Represents calculated acts designed to manipulate a company’s financial picture and deceive investors.

- Deliberate Act: Unlike honest mistakes or oversights, these misrepresentations involve deliberate intent to commit accounting fraud.

- Pervasive Fraud: Research indicates that an estimated 41% of businesses report misleading financial information, demonstrating the pervasive nature of this problem across modern financial markets.

Primary Motivations for Financial Deception:

- Stock Price Manipulation: Companies inflate financial results to artificially boost stock prices and attract unsuspecting investors.

- Credit Enhancement: Organizations present false financial stability to secure loans or favorable credit terms from lenders.

- Regulatory Avoidance: Firms hide actual financial weakness to avoid regulatory compliance scrutiny and enforcement actions.

- Executive Compensation: Management meets performance targets tied to bonuses and incentives through fraudulent reporting.

- Intent Determines Fraud: The International Auditing and Assurance Standards Board emphasizes that the primary difference between fraud and error hinges on whether the action resulting in financial statement misstatement was intentional or unintentional.

- Substantial Liability: When companies engage in deliberate financial deception, they create substantial liability for securities litigation and expose themselves to devastating securities class actions filed by harmed investors.

Accounting Fraud: Sophisticated Schemes to Manipulate Financial Results

- Accounting Fraud: Involves the intentional manipulation of financial records to create a misleading picture of a company’s financial health.

- Complex Methods: This deliberate deception employs complex methods designed to misuse funds, overstate revenues, understate expenses, inflate asset values, or conceal liabilities.

Common Accounting Fraud Techniques:

- Journal Entry Manipulation: Altering accounting records to disguise financial irregularities and hide the true scope of organizational problems.

- Off-Balance-Sheet Entities: Creating shell companies or special-purpose entities to hide debt and obligations from investors and regulators.

- Fraudulent Adjustments: Making unauthorized modifications to revenues and expenses to meet earnings expectations.

- Executive Incentive Conflicts: Corporate executives often face direct incentives to manipulate financial statements since their compensation frequently depends on meeting established performance metrics.

- Dangerous Conflict: This dangerous conflict of interest creates an environment where decision-makers prioritize short-term personal gain over long-term corporate sustainability and investor protection.

- Fraudulent Schemes: These fraudulent practices directly violate securities laws and create the foundation for securities class action lawsuits when investors suffer losses due to reliance on false financial statements.

Material Omissions: Concealing Critical Information from Investors

- Material Omissions: Represent an equally dangerous form of financial statement fraud that involves withholding information that significantly impacts investor decision-making. The Australian Securities & Investments Commission defines this fraud as deliberately omitting amounts or disclosures in an attempt to deceive financial statement users.

- Materiality Standards: The current regulatory definition establishes that “the omission or misstatement of an item in a financial report is material if, in light of surrounding circumstances, the magnitude of the item is such that it is probable that the judgment of a reasonable person relying upon the report would have been changed or influenced by the inclusion or correction of the item”.

Critical Types of Improper Omissions:

- Concealing related-party transactions that benefit insiders at shareholder expense

- Hiding contingent liabilities that could significantly impact future financial performance

- Failing to disclose significant events that affect the company’s operations or financial condition

- Withholding information about management fraud or internal controls deficiencies

- Obscuring accounting changes that materially affect financial statement comparability

- Securities Litigation Consequences: When material omissions are eventually discovered—often through whistleblower reports or regulatory enforcement investigations—the resulting corrective disclosures typically trigger significant stock price declines and securities class action lawsuits alleging violations of federal disclosure requirements.

- Protecting Market Integrity: Misleading statements and omissions in financial reporting represent a spectrum of deceptive practices that undermine the integrity of financial markets and destroy investor confidence. Understanding these definitions provides the foundation for identifying potential accounting fraud and protecting investment portfolios from the devastating effects of corporate deception.

- Companies that engage in these practices face not only regulatory compliance failures but also the prospect of costly securities litigation that can permanently damage their reputation and financial stability.

Eight Sophisticated Techniques That Trigger Securities Litigation

- Financial Manipulation Schemes: Represent some of the most insidious pathways to securities fraud, creating dangerous webs of deception that can devastate investor confidence and trigger costly securities class action lawsuits.

- Deceptive Practices: These deceptive practices typically occur when three critical conditions align: intense pressure to meet earnings targets, opportunities created through weak internal controls, and management’s rationalization of fraudulent behavior.

- Recognizing Red Flags: Understanding these manipulation techniques becomes essential for investors seeking to identify red flags before they result in significant losses and subsequent securities litigation.

Revenue Recognition Fraud: The Foundation of Most Securities Cases

- Revenue Manipulation: Remains the most prevalent catalyst for securities class action lawsuits in modern financial markets. Companies engaging in these schemes typically employ three primary methods:

- Premature Revenue Recognition: Involves recording sales before completing services or shipping products, creating artificial revenue spikes that mislead investors about actual business performance.

- Fictitious Revenue Schemes: Involve creating completely fabricated sales that never occurred, often through shell companies or related-party transactions. Companies may also misclassify investment income as operational revenue, obscuring the true sources of their earnings.

- WorldCom Scandal: WorldCom’s infamous case demonstrates the devastating consequences of revenue manipulation. The company inappropriately used manual journal entries to capitalize expenses as fixed assets, inflating net income and total assets by $3.8 billion.

- Truth Emerges: When the scheme unraveled, shareholders filed securities class actions seeking billions in damages. HealthSouth Corporation employed similar tactics, inflating earnings by $2.8 billion over six years.

Expense Manipulation: Concealing True Operating Costs

- Expense manipulation: Creates equally dangerous exposure to securities litigation through systematic misrepresentation of operating costs. Companies typically employ several tactics to artificially boost reported profits while concealing their true financial obligations.

- Delayed Expense Recognition: Involves postponing current-period costs to future periods, creating temporary improvements in reported earnings.

- Capitalizing Normal Operating Expenses: Improperly records routine costs as balance sheet assets.

- Off Balance Sheet Scheme: The most sophisticated schemes involve off-balance-sheet arrangements, where companies create special purpose entities to hide debt and expenses—the hallmark of Enron’s collapse.

- Dangerous Fraud: These tactics prove particularly dangerous because they create cumulative effects that compound over time, ultimately requiring increasingly aggressive manipulations to maintain the deception.

Material Omissions: When Silence Becomes Securities Fraud

- Omissions in financial statements often prove more damaging than active misrepresentations because they create deceptions that appear unintentional. Companies engaging in improper disclosure fraud typically withhold critical information including:

- Related-party transactions: This could indicate conflicts of interest or artificial revenue enhancement. Contingent liabilities that could significantly impact future financial performance. Changes in accounting methods that materially affect comparability with prior periods. Subsequent events that occur between financial statement dates and filing deadlines.

- Example: A Department of Defense agency case illustrates the severity of omission fraud, where managers deliberately failed to disclose facility contamination that significantly impacted their financial position. The resulting regulatory enforcement action and investor losses demonstrate how omissions can trigger substantial legal consequences.

Asset Valuation Manipulation: Inflating Balance Sheet Strength

- Asset Valuation Fraud: Involves deliberately overstating company assets to enhance reported financial strength and net worth.

- Management Discretion: These schemes typically target areas where management has significant discretion in valuation judgments.

- Depreciation Schedules: Companies may fail to apply appropriate depreciation schedules, particularly for technology or equipment assets.

- Inventory Manipulation: Involves inflating quantities or unit costs to boost reported assets. Management may refuse to write down impaired assets to their fair market values. Improper valuation methods for fixed assets can significantly overstate balance sheet strength.

- Artificial Inflation: These practices artificially inflate net worth and shareholders’ equity, creating false impressions of financial stability that can attract unwary investors and lenders.

Asset Misappropriation: Theft Hidden Through False Reporting

- Asset misappropriation: Involves the theft or misuse of company resources concealed through accounting manipulation.

- Inadequate Internal Controls: While typically less costly than financial statement fraud, these schemes appear more frequently in organizations with inadequate internal controls.

- Check Tampering: Involves forging signatures or altering payee information to redirect company funds.

- Billing Schemes: Create fictitious invoices for non-existent goods or services.

- Theft of Inventory, Equipment, or Intellectual Property: requires corresponding false entries to conceal the missing assets.

- Skimming Schemes: Involve taking cash before it enters the accounting system.

Channel Stuffing: Manufacturing Artificial Sales Growth

- Channel Stuffing: Occurs when companies force distributors to accept excessive inventory beyond reasonable demand, typically near reporting periods to inflate quarterly sales figures.

- Unusual Incentives: This practice involves offering unusual incentives such as deep discounts, extended payment terms, or rebate arrangements.

- Timing: The timing element becomes critical—companies typically ship products near quarter-end to boost reported sales. Many arrangements allow distributors to return unsold inventory, raising questions about whether genuine sales occurred.

- Example Case: Bristol-Myers Squibb’s case demonstrates the legal consequences of channel stuffing. The company paid $150 million to settle SEC charges for channel stuffing, having deceived investors by stuffing distribution channels with excess inventory to meet financial projections. The securities class actions that followed resulted in additional hundreds of millions in investor settlements.

Round-Trip Transactions: Creating Revenue Without Economic Substance

- Round-tripping schemes: Involve creating circular transactions where money flows out of a company and returns with no genuine economic benefit. Products or services sold to one entity ultimately return to the original seller. Both companies record revenue despite the absence of real economic activity.

- Related Party Fraud: These arrangements frequently involve related parties or shell companies designed to obscure the circular nature of transactions.

- Example Case: Qwest Communications exemplifies the consequences of round-tripping fraud, receiving a $250 million fine for using “swap” contracts to artificially inflate reported revenue by $3.8 billion.

Cookie Jar Reserves: Smoothing Earnings Through Reserve Manipulation

- Cookie Jar Accounting: Involves creating excessive reserves during profitable periods to later release during challenging times, artificially smoothing earnings patterns.

- Fake Reserves: Companies typically establish unnecessarily large restructuring reserves, set aside excessive amounts for warranty costs or bad debts, then release these reserves to boost profits during shortfalls.

- Example Case: Sunbeam Corporation created $35 million in improper restructuring and “cookie jar” reserves, later reversing them into income to create the illusion of a successful turnaround.

- Truth Emerges: When the manipulation was discovered, investors filed securities class actions that resulted in substantial settlements.

Warning Signs for Investors

- These manipulation techniques often leave detectable patterns that alert investors can identify.

Smooth, consistent earnings growth may indicate reserve manipulation.

Revenue spikes near quarter-end suggest potential channel stuffing.

Discrepancies between cash flow and reported earnings often reveal revenue recognition fraud.

- Understanding these sophisticated schemes empowers investors to identify potential accounting fraud before it results in devastating losses and costly securities litigation.

Red Flags and Warning Signs: Detecting Financial Statement Fraud Before Catastrophic Losses

- Detecting Financial Statement Fraud: Requires vigilance toward specific warning signs that consistently precede major corporate scandals and the devastating securities class action lawsuits that follow.

- Annual Losses to Fraud: Organizations lose approximately 5% of annual revenue to fraud, making recognition of these indicators essential for protecting investments and avoiding substantial financial losses.

- Sudden Revenue Patterns That Deviate From Industry Norms: Unexpected revenue patterns that deviate significantly from industry benchmarks often signal potential manipulation.

- Characteristics: Companies engaging in revenue fraud typically exhibit several distinctive characteristics that astute investors can identify before corrective disclosures trigger stock price collapses.

- Sales Spikes without Clear Business Drivers: Such as new products, expanded marketing, or market entry represent immediate red flags. Real business growth typically correlates with identifiable operational changes, marketing campaigns, or market expansion initiatives.

- Smooth, Consistent Growth Patterns: When real business activity typically shows variability should raise investor suspicions. Legitimate businesses rarely achieve perfectly linear growth, especially during periods of economic uncertainty or industry volatility.

- Strong Performance During Industry Downturns: Especially when competitors struggle, warrants careful scrutiny. Companies that mysteriously outperform during sector-wide challenges may be manipulating their financial results to maintain artificial growth trajectories

- SEC Enforcement: More than 60% of SEC enforcement actions against companies for financial statement fraud relate to improper revenue recognition schemes.

- End-Of-Year Revenue Increases: Followed by reversals in the beginning of the following year represent classic indicators of channel stuffing and other revenue manipulation techniques.

Financial Restatements: Warning Signs of Deeper Problems

- Financial Restatements: Represent corrections of previously issued statements and often indicate underlying problems with accounting practices or internal controls.

- Insights: The frequency and materiality of these restatements provide crucial insights into a company’s financial reporting integrity.

- Delayed or Amended Financial Reports: The number of public companies that amended their annual reports increased by 18% in 2018.

- Repeat Offenders: Repeated corrections of previously issued financial statements, delayed financial reports, or numerous amendments signal potential control weaknesses that could facilitate fraud.

- Relationship with Controls: Audit Analytics reports that “material restatements often go hand-in-hand with material weakness in internal controls over financial reporting”.

- Frequent Restatements: Companies experiencing frequent restatements create environments where accounting fraud can flourish undetected, ultimately leading to more serious violations and securities litigation.

Management and Auditor Turnover: Personnel Changes Signal Trouble

- Changes in Leadership: Frequent changes in financial leadership positions often precede or accompany fraudulent activities. These personnel patterns provide early warning signs that investors can identify before fraud schemes fully develop.

- Excessive turnover in Key Positions: Such as CFO, controller, or internal auditor roles suggests potential disagreements over financial practices.

- Resignation of External Auditors: Resignation without clear explanation raises immediate concerns about the company’s accounting practices and financial reporting integrity.

- High Personnel Turnover: Frequently correlates with attempts to conceal improper accounting.

- Financial Stress: Employees, who are often the first to recognize problems, may abandon their positions when aware of financial distress.

- Unqualified Individuals: When placed in crucial financial positions indicate weakened oversight and increased fraud risk.

Suspicious End-of-Quarter Activity

- Under Pressure: Companies under pressure to meet financial targets often engage in suspicious activity that clusters around reporting deadlines. These patterns become particularly evident when executives face intense scrutiny from analysts and investors.

- Unusual Transaction Timing: Especially near quarter or year-end to meet performance targets, deserves immediate attention.

- Last-Minute Adjustments: That significantly affect financial results often involve related-party transactions or complex financial instruments designed to obscure their true nature.

- Unexplained Revenue Spikes: At reporting period boundaries, particularly when followed by reversals in subsequent periods, indicate potential channel stuffing or other revenue manipulation schemes.

- Complicated Financial Instruments: Or transactions that are difficult to understand may be designed to confuse auditors and investors about their true economic impact.

The Most Reliable Fraud Indicator: Cash Flow Discrepancies

- Discrepancies: The disconnect between reported profits and actual cash generation represents perhaps the most reliable indicator of potential financial statement fraud.

- Manipulate Earnings: Companies can manipulate earnings through various accounting techniques, but cash flow ultimately reveals the truth about financial performance.

- Increasing Profits without Corresponding Cash Flow: May signal earnings manipulation. Companies showing negative operating cash flow for 2-3 consecutive years while posting positive profits raise serious concerns about the sustainability and accuracy of their reported results.

- Ballooning Receivables: Without proportionate increases in cash collection suggest potential fake sales or channel stuffing activities.

- High debt-to-asset ratios (e.g., 95%) are common characteristics of companies with accounting fraud.

- Cash Flow Analysis: Reveals that companies reporting growth in revenues without corresponding growth in cash flows warrant immediate investigation.

- Control Environment: When these warning signs appear, investors should carefully evaluate whether the company maintains adequate internal controls and whether management has demonstrated a commitment to transparent financial reporting.

- Multiple Red Flags: Companies exhibiting multiple red flags create significant Accounting Machinations Exposed: Essential Safeguards for Your Business [2025]Accounting Machinations Exposed: Essential Safeguards for Your Business [2025] when their fraudulent practices are eventually disclosed. Understanding these warning signs empowers investors to identify potential problems before they result in significant losses.

Legal and Regulatory Consequences of Misleading Financial Reporting

- Sarbanes-Oxley: The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of financial reporting compliance, creating severe legal and financial repercussions that extend far beyond simple regulatory violations.

- Investor Protections: Companies and executives who engage in accounting fraud through misleading statements or omissions face a multi-layered enforcement framework designed to protect investors and maintain market integrity.

SEC Enforcement Actions: The Primary Line of Defense

- Primary Enforcement Agency: The SEC serves as the primary enforcement agency for financial reporting violations, wielding increasingly substantial penalties that reflect the serious nature of these offenses:

- Record-Breaking Financial Penalties: In fiscal year 2024, the SEC obtained orders for $8.2 billion in financial remedies, representing the highest amount in SEC history. This included $6.1 billion in disgorgement and prejudgment interest and $2.1 billion in civil penalties.

- Escalating Enforcement Activity: The SEC filed 583 total enforcement actions in 2024, including numerous actions against companies for financial reporting violations. Companies that knowingly submit reports failing to meet regulatory compliance requirements face fines up to $2 million.

- Landmark Cases: The SEC’s jury trial victory against Terraform Labs and Do Kwon resulted in a judgment exceeding $4.5 billion, demonstrating the agency’s commitment to pursuing major securities fraud cases.

- Investor Recovery: These enforcement efforts returned $345 million to harmed investors in 2024 alone, with more than $2.7 billion returned since the beginning of fiscal year 2021.

Securities Class Actions: Collective Investor Remedies

- Substantial Financial Exposure: Companies face massive financial liability through private securities litigationthat operates independently of regulatory enforcement.

- Securities Class Actions: Provide a powerful The Role of Institutional Investors due to misleading financial statements to seek collective compensation.

- Enron Settlement: The largest securities class action recovery in history exceeded $7.2 billion.

- Institutional Investor Control: The Private Securities Litigation Reform Act of 1995 established a framework that typically appoints the investor with the largest financial interest as lead plaintiff.

- Institutional Investors: This shift has moved control of securities litigation to large institutional investors rather than individual shareholders.

- Significant Settlements: The UnitedHealth case demonstrates the substantial financial consequences, with shareholders recovering $895 million and the former CEO personally paying $30 million.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Criminal Liability for Corporate Executives

- Personal Accountability: Executives bear direct criminal liability for financial reporting accuracy under Sarbanes-Oxley provisions.

- Knowing Violations: Certifying officers who knowingly submit non-compliant reports face up to $1 million in fines and 10 years imprisonment.

- Willful Violations: Officers who willfully certify false reports face up to $5 million in fines and 20 years imprisonment.

- Certification Requirements: Corporate officers must personally certify that financial reports fully comply with requirements and fairly present financial conditions.

- Extended Criminal Penalties: Title XI of SOX extends criminal penalties to anyone involved with corporate fraud, tampering with accounting records, or obstructing proceedings, with potential imprisonment up to 20 years.

Market Reaction and Long-Term Consequences

Immediate Market Impact: The market reaction to financial reporting fraud proves both swift and devastating.

- Kraft Heinz’s stock price fell approximately 28% (about $15 billion in market capitalization) in a single day following disclosure of an SEC investigation into its accounting practices. Similar cases demonstrate consistent patterns of severe market punishment for accounting irregularities.

- Sustained Damage: Food manufacturer stocks have lost 20% of their value in single trading sessions after allegations of inflated profits. Even fake news alleging accounting fraud at Farmland Partners caused its stock price to drop over 40% in one day.

- Permanent Consequences: Companies that fail to maintain transparent financial reporting face higher borrowing costs, investor wariness, and diminished valuations even years after violations are addressed.

- Complete Destruction: Financial reporting fraud can destroy companies entirely, as evidenced by businesses whose stock values plummeted from $90 per share to under $1 following revelations of deceptive accounting practices.

- The legal consequences of misleading financial statements extend far beyond immediate penalties, creating cascading effects that can permanently damage corporate reputation, destroy shareholder value, and fundamentally alter a company’s ability to operate in financial markets.

Corporate Scandals: The Devastating Reality of Financial Statement Fraud

- Major Scadals: Major accounting fraud cases demonstrate how misleading statements and omissions can trigger catastrophic securities litigation and destroy entire organizations.

- Lessons Learned: These corporate scandals serve as stark reminders of the consequences whenfinancial statement fraud risk factors are ignored and internal controls fail.

Enron

- The Enron scandal remains the quintessential example of howomissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

Waste Management

- Waste Management’s senior executives carried out the scheme through a series of fraudulent accounting manipulations.

- The specific mechanisms of the fraud included:

- Manipulated depreciation: Executives repeatedly extended the useful life of company assets, such as garbage trucks, and assigned arbitrary, excessive salvage values to them. This dramatically reduced the annual depreciation expense and artificially boosted profits.

- Improper capitalization of expenses: Maintenance and repair costs for landfills were improperly classified as capital expenses rather than as current-period expenses. This illegally deferred recognition of these costs, making short-term profits appear larger.

- Concealment through “netting”: Management secretly used one-time gains from asset sales to erase unrelated operating expenses and accounting misstatements. This practice, known as “netting,” concealed the true financial health of the company from investors and auditors.

- Inflated environmental reserves: Executives would intentionally inflate environmental liability reserves during strong financial quarters. Then, during weaker quarters, they would release the excess reserves into earnings to boost results.

- Failure to write off impaired assets: The company neglected to write off the costs of abandoned or impaired landfill projects, instead keeping the costs on the balance sheet to hide their negative financial impact.

The role of Arthur Andersen

- Waste Management’s longtime auditor, Arthur Andersen, was complicit in the fraud.

- The audit firm was aware of Waste Management’s improper accounting practices and documented numerous issues, but it repeatedly approved the company’s financial statements with an “unqualified” or “clean” opinion.

- The relationship was tainted by a conflict of interest. Many of Waste Management’s top financial officers were former Arthur Andersen employees, and Andersen was highly protective of the lucrative relationship with its “crown jewel” client.

- Andersen also received substantial fees for non-audit consulting services, which compromised its independence.

Unraveling and consequences

- Discovery: The scheme was discovered in 1997 after a new CEO took over and ordered a review of the company’s accounting practices. He resigned months later after calling the accounting “spooky”.

- Financial restatement: In 1998, Waste Management announced it would restate its earnings from 1992 through 1997, revealing over $1.7 billion in overstated profits.

- Regulatory action: The Securities and Exchange Commission (SEC) charged Waste Management’s founder and five other top executives with perpetrating the fraud.

- Executives were fired and faced charges of securities fraud. The SEC also fined Arthur Andersen $7 million for its role.

- Stock price collapse: When the fraud was revealed, the company’s stock price plummeted, causing over $6 billion in losses for shareholders.

- Company restructure: Crippled by the scandal, Waste Management was acquired by a smaller competitor, USA Waste Services. The newly merged company kept the Waste Management name but relocated its headquarters and replaced nearly all top executives.

- Legacy for auditors: The scandal was a major contributing factor to the downfall of Arthur Andersen, which was also implicated in the Enron scandal just a few years later.

- Broader reforms: The Waste Management case, alongside other major financial scandals, helped trigger the push for stricter regulations in corporate governance and financial reporting, ultimately leading to the passage of the Sarbanes-Oxley Act in 2002.

Lehman Brothers (2008)

- The fraud: Leading up to the 2008 financial crisis, the investment bank Lehman Brothers engaged in a deceptive accounting practice known as “Repo 105”. The company used this temporary sale-and-buyback scheme to move tens of billions of dollars in toxic assets off its balance sheet at the end of each quarter.

- The cover-up: By hiding these risky loans, Lehman was able to present a healthier financial position than was actually the case, misleading investors and regulators about the bank’s true leverage.

The outcome: The practice was exposed after the bank filed for bankruptcy in September 2008, triggering a global financial meltdown. While an official investigation exposed the fraudulent practice, no senior executives faced criminal charges.

HealthSouth (2003)

- The fraud: The healthcare company HealthSouth, led by CEO Richard Scrushy, was caught in an accounting scandal involving the fraudulent inflation of its earnings. Between 1996 and 2002, the company systematically overstated its profits by billions of dollars to meet analyst expectations.

- The cover-up: The fraud was carried out by executives who would meet to “fill the gap” between actual and reported earnings. The scheme involved falsifying financial records to inflate revenue and hide expenses.

- The outcome: When the fraud was uncovered, it led to massive financial restatements, the resignation and eventual conviction of several executives, and a steep drop in the company’s stock price. Although Scrushy was initially acquitted of accounting fraud, he was later convicted of bribery in a separate case.

Under Armour

- The scandal: For several years leading up to 2017, the athletic apparel maker Under Armour used a practice known as “pulling forward” sales from future quarters to meet analysts’ revenue targets. After it became impossible to sustain the practice, the company reported a significant drop in revenue growth in 2017. An SEC investigation revealed that company executives were aware of the practices and misled investors and analysts by attributing revenue growth to other factors.

- The litigation: Following the revelations, Under Armour faced both an SEC enforcement action and a securities class action lawsuit from investors. The company agreed to a $9 million penalty in the SEC case and, in 2024, settled the shareholder suit for a record-setting $434 million.

The Broader Impact on Corporate Governance and Investor Protection

- Regulatory Compliance: These cases established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors. Each scandal triggered significant securities class action lawsuits that resulted in billions of dollars in investor losses and fundamentally reshaped corporate governance requirements.

- Penalty: The devastating consequences of these corporate scandals led directly to the passage of the Sarbanes-Oxley Act and enhanced SEC regulations designed to prevent similar failures.

- Securities Fraud Litigation: Companies that engage in financial statement fraudnow face more severe penalties, enhanced oversight requirements, and increased likelihood of securities litigation from harmed investors.

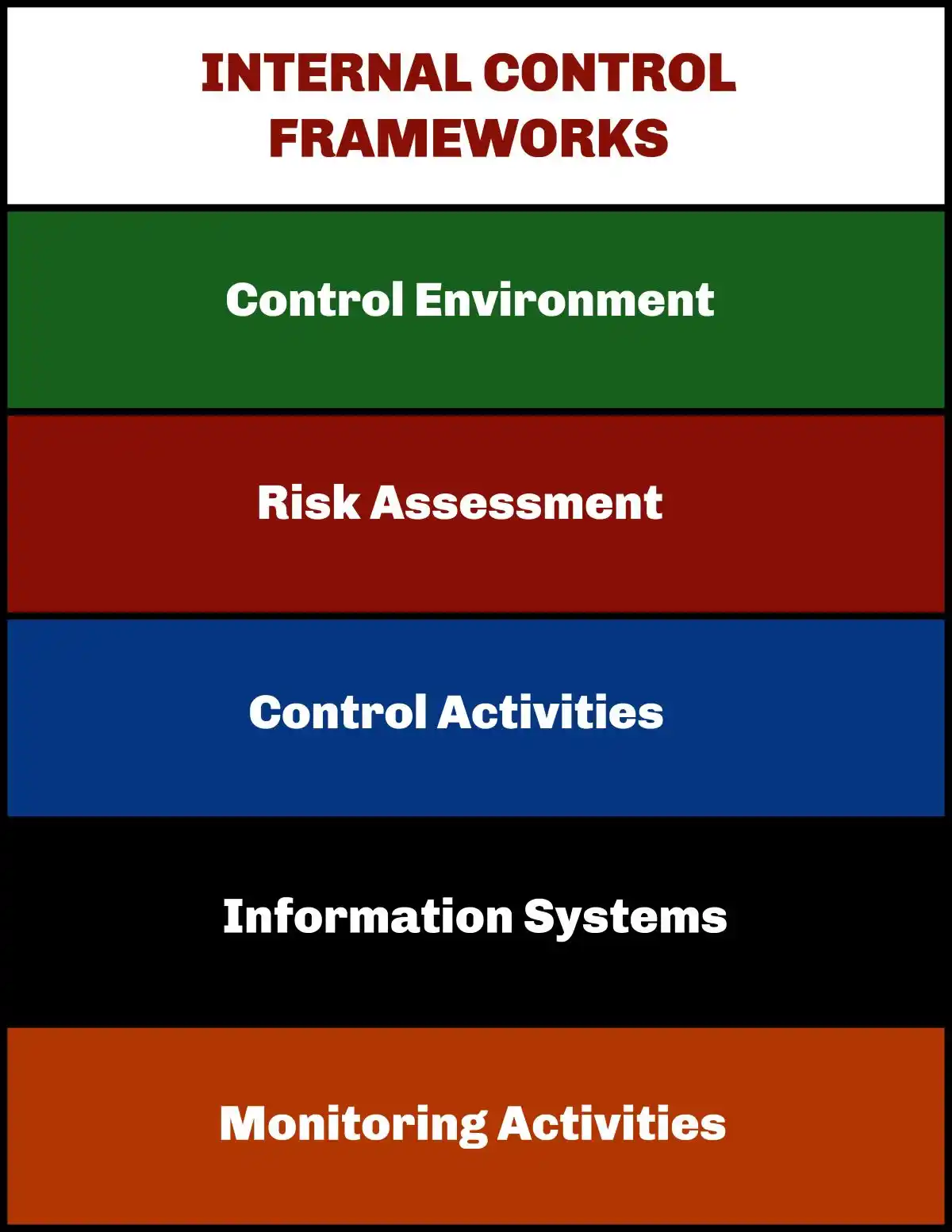

Internal Controls and Corporate Governance: The Foundation of Securities Litigation Prevention

- Internal controls and corporate governance: Form the critical defense against misleading statements and omissions that trigger devastating securities class action lawsuits. Organizations with weak governance structures and inadequate control systems create environments where accounting fraud can flourish undetected, ultimately exposing themselves to catastrophic securities litigation and regulatory enforcement actions.

- Corporate governance Deficiencies: Often precede major financial reporting scandals. When boards of directors lack independence, fail to provide adequate oversight, or when there’s an absence of strong ethical leadership, the risk of accounting irregularities increases substantially. Companies with weak governance structures often exhibit warning signs such as frequent changes in auditors, aggressive accounting practices, or unusual related-party transactions.

Sarbanes-Oxley Act Section 404: The Regulatory Framework

- Regulatory compliance in the realm of internal controls over financial reporting has become increasingly stringent following major corporate scandals of the early 2000s. The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of internal control requirements, mandating that public companies establish and maintain adequate internal control over financial reporting.

- Section 404 of the Act specifically requires management to assess and report on the effectiveness of these controls, while external auditors must attest to management’s assessment. The regulatory framework extends beyond Sarbanes-Oxley to encompass various industry-specific requirements and international standards.

- Compliance Costs and Benefits: Organizations experience both fixed start-up costs and recurring expenses for compliance, with Section 404(a) costs primarily coming from internal labor and outside vendors, while Section 404(b) costs manifest through increased auditor fees. Financial statement users view these disclosures as beneficial, noting they increase confidence in companies’ financial reports.

Board Oversight: The First Line of Defense Against Securities Litigation

- Board oversight and audit committee responsibilities represent critical safeguards against financial statement fraud.

- Effective boards: Serve as the primary mechanism for preventing the corporate governance failures that lead to securities class actions and regulatory enforcement actions.

Key Responsibilities of Effective Boards:

- Fraud Risk Management: Ensuring management has designed effective fraud risk controls and conducting comprehensive fraud risk assessments to identify vulnerabilities.

- Tone at the Top: Setting appropriate organizational tone that does not tolerate fraud and establishing fraud policies focused on deterrence, detection, and correction.

- Audit Committee Function: Audit committees specifically monitor financial reporting processes, review revenues and expenditures regularly, and establish monitoring procedures for internal controls. They function as communication hubs between management, internal auditors, and external auditors.

- Cultural Alignment: Playing a principal role in building organizational culture aligned with values and risk appetite that prevents the conditions leading to securities litigation.

Segregation of Duties: Preventing Fraudulent Control

Segregation of duties: Represents a critical internal control that reduces both error risk and fraud opportunity by distributing tasks between different individuals. This fundamental control mechanism serves as a powerful deterrent against the types of manipulation that trigger securities class action lawsuits.

Effective Control Framework:

- Three-Way Segregation: Effective segregation prevents any single person from controlling an entire transaction process by separating approval (authorizing transactions), accounting/reconciling (recording and reviewing transactions), and asset custody (maintaining physical control of assets).

- Minimum Standards: No single individual should initiate, authorize, record, and reconcile a transaction. At minimum, two sets of eyes must review any transaction.

- Risk Mitigation: This systematic approach to transaction management directly supports the Robust Financial Reporting Systems: A Meticulous and Extremely Instructive Guide [2025] and regulatory compliance, creating multiple checkpoints that make fraudulent activities significantly more difficult to execute and conceal.

Whistleblower Programs: Early Detection Mechanisms

- Whistleblower protections: Provide vital early detection mechanisms for potential fraud when properly designed and monitored. These programs serve as essential components in preventing accounting fraudbefore it escalates into costly securities litigation.

- Enhanced Legal Framework: The Dodd-Frank Act expanded protections for whistleblowers by enabling SEC legal action against employers who retaliate against whistleblowers, creating private rights of action allowing whistleblowers to sue employers in federal court, and prohibiting actions that impede individuals from communicating directly with the SEC about possible securities law violations.

- Implementation Requirements: Companies should establish detailed whistleblower policies that outline expected processes for reporting fraudulent actions and consequences for those who commit fraud. Audit committees must ensure whistleblower policies are understood by stakeholders and effective in encouraging people to speak up when witnessing wrongdoing.

- Prevention Through Controls: The investment in effective controls represents not merely a compliance obligation but a fundamental business imperative that supports long-term success and market confidence.

- Reduced Exposure: Companies that maintain robust internal controls and strong corporate governance practices significantly reduce their exposure to securities class actions and regulatory enforcement actions, protecting both shareholders and organizational reputation.

Advanced Detection and Prevention Strategies: Protecting Against Securities Litigation

- Risk Mitigation: Through proactive detection and prevention strategies represents the most effective defense against financial statement fraud and the resulting securities class action lawsuits.

- Reduced Exposure: Organizations that implement comprehensive fraud prevention programs significantly reduce their exposure to securities litigation while strengthening investor confidence and regulatory compliance.

Independent Audits and Forensic Accounting: The First Line of Defense

- Independent Auditors: Serve as critical gatekeepers in maintaining financial reporting integrity and preventing accounting fraud. Under Public Company Accounting Oversight Board (PCAOB) standards, auditors must:

- Reasonable Assurance: Obtain reasonable assurance about whether financial statements are free of material misstatement, whether caused by fraud or error

- Professional Skepticism: Exercise professional skepticism throughout the audit process

- Substantive Procedures: Perform substantive procedures, including tests of details, for significant risks

- Detection Limitations: External auditors detect fraud merely 4% of the time, highlighting the critical need for additional safeguards.

- Forensic Accounting becomes essential as it combines accounting expertise, investigative skills, and legal knowledge to analyze suspicious financial activities. This specialized approach provides enhanced detection capabilities that traditional audits may miss, particularly for sophisticated accounting fraud schemes that could trigger securities litigation.

Advanced Technology Solutions: AI and Data Analytics for Fraud Detection

- Technology-Driven Fraud Detection: Has emerged as a powerful tool for preventing financial statement fraud before it escalates into securities class actions.

- Continuous Monitoring: AI-powered systems continuously analyze financial data, identifying patterns and anomalies that suggest potentially fraudulent behavior

- Enhanced Accuracy: Machine learning models reduce false positives while improving detection accuracy

- Real-Time Analysis: Data analytics enables continuous monitoring of transactions rather than periodic sampling

- Transaction Transparency: Automated tools provide transparency into underlying transactions, offering insights into unusual relationships

- These advanced systems create multiple layers of protection against fraud, directly supporting risk mitigation objectives and regulatory compliance requirements.

Ethics Training Programs: Building a Culture of Compliance

- Strong Ethical Frameworks: Serve as fundamental preventive measures against accounting fraudand subsequent securities litigation.

- Proven Effectiveness: Organizations that implement ethics training experience fewer incidents of financial misconduct

- Comprehensive Education: Educational programs should define various forms of accounting fraud and explain regulatory compliance requirements

- Early Detection Systems: Ethics hotlines increase chances of discovering fraud through tips—organizations with hotlines detected fraud 50% faster than those without

- Clear Standards: Written codes of conduct outlining expectations with zero tolerance policies for fraud prove effective

- Risk Mitigation through ethics programs creates an organizational culture where employees understand the severe consequences of financial statement fraud, including potential securities class action lawsuits.

Risk-Based Internal Audit Planning: Strategic Resource Allocation

- Risk-Based Auditing: Pioritizes limited resources toward areas of highest financial statement fraud risk, creating targeted defenses against securities litigation.

- Strategic Focus: This approach addresses management’s highest-priority risks rather than routine processes

- Comprehensive Assessment: The audit risk assessment identifies and evaluates potential fraud exposure across the organization

- Flexible Implementation: Risk-based plans allow for more flexibility in designing audit processes

- Resource Optimization: High-risk areas receive more frequent audit attention, preventing resource dilution on low-risk functions

- Prevention Strategy Integration: These systematic approaches must be integrated with broader corporate governance frameworks to ensure comprehensive protection against the devastating consequences of securities litigation and regulatory enforcement actions.

- Multi-Layered Approach: Companies that implement these multi-layered prevention strategies demonstrate their commitment to financial integrity while significantly reducing their exposure to the catastrophic financial and reputational damage associated with accounting fraud and the resulting securities class action lawsuits.

Investor Protection and Due Diligence Practices

Analytical Skills: Investors must develop strong analytical capabilities to identify misleading statements or omissions in financial reports before they result in significant losses.

Due Diligence: Thorough due diligence provides essential protection against accounting fraud risks that can devastate investment portfolios.

Analyzing Financial Ratios and Trends

- FinancialRatio Analysis: Offers a straightforward method for detecting potential financial statement fraud.

- Specific Patterns: Companies engaging in fraudulent practices often exhibit specific patterns that careful analysis can reveal.

Critical ratios require close examination:

- Leverage ratios signal elevated fraud risk when companies carry significant debt burdens, as management faces increased pressure to manipulate revenue figures to meet covenant requirements.

- Capital Turnover Ratios: May reveal management’s inability to generate sales from assets, indicating potential competitiveness issues that create incentives for fraudulent reporting.

- Cash flow versus profitability represents perhaps the most reliable indicator of potential manipulation. Discrepancies between reported profits and actual cash generation often reveal earnings manipulation, as companies can manipulate accounting entries but cannot easily fabricate cash flow

- Restatement Homework: Research analyzing 40 sets of fraudulent financial statements alongside 125 non-fraudulent ones identified specific ratios as key fraud indicators. Companies showing consistent profit growth without corresponding cash flow improvements warrant immediate scrutiny.

Reviewing Auditor Opinions and Restatements

- Financial Restatements: Serve as critical warning signals that often precede major fraud revelations. Investors should pay careful attention to restatement patterns and their implications.

- Lack of Strong Framework: Frequent restatements correlate directly with material weakness in internal controls. Companies that repeatedly revise their financial statements demonstrate either incompetence in financial reporting or deliberate manipulation that auditors later discover.

- Restatement Numbers Increase: Non-restating clients are more likely to dismiss auditors as restatement numbers increase. This pattern suggests potential disagreements between management and auditors over accounting practices. Interim restatements negatively affect year-end financial reporting quality, creating additional uncertainty about the reliability of subsequent reports.

Understanding Litigation History and SEC Filings

- SEC filings constitute an essential due diligence tool, providing insights that can reveal potential problems before they escalate into major fraud cases.

Critical filing components include:

- Financial statements: Those revealing profitability, liquidity, and leverage patterns that may indicate manipulation. Risk factors sections often disclose business vulnerabilities that create pressure for fraudulent reporting. Management details including backgrounds and stock ownership can reveal conflicts of interest or questionable ethical track records.

- Class Action: Ongoing litigation that may impact investment decisions deserves particular attention, as companies facing regulatory investigations or securities class actionsoften exhibit elevated fraud risk.

Evaluating Corporate Governance Structures

- Corporate governance: Quality directly impacts fraud risk and long-term investment performance. Investors should assess governance structures as part of their fraud prevention strategy.

- Strong Shareholder Rights: Companies with Securities Class Action Lawsuits: Analyzing the Long-Term Effects on Investor Trust [2025] those with weakest rights by 8.5% annually. Well-governed firms in emerging markets garnered 22-30% investment premiums, demonstrating that investors recognize and reward good governance practices.

- Board diversity: Board independence, and separation of CEO/Chairman roles require careful assessment. Companies with independent boards and diverse leadership teams prove less susceptible to the groupthink and conflicts of interest that often precede major fraud cases.

Strong governance indicators include:

- Independent Audit Committee: Members with financial expertise, regular executive sessions without management present, and clear policies for handling whistleblower complaints. Companies lacking these basic governance elements face substantially higher fraud risk.

- A Wise Investment: The investment in thorough due diligence proves far less costly than the losses that result from fraud-related investment failures. Investors who combine ratio analysis with governance evaluation and comprehensive review of public filings significantly reduce their exposure to fraudulent schemes.

Safeguarding Investments Against Financial Reporting Fraud: The Path Forward

Misleading financial reporting: represents a fundamental threat to market integrity that demands constant vigilance from all market participants. The sophisticated deception schemes examined throughout this guide demonstrate how omissions in financial statements and deliberate misrepresentations can devastate entire organizations while triggering massive securities litigation that destroys shareholder value.

Understanding Financial Statement Fraud Mechanisms

The analysis reveals several critical insights that every investor must recognize:

- Sophisticated Fraud Schemes: Modern accounting fraud employs increasingly complex methods, from revenue manipulation and expense capitalization to off-balance-sheet entities and round-tripping transactions that create elaborate webs of deception.

- Warning Signs Provide Protection: Companies exhibiting unusual revenue patterns, frequent financial restatements, high executive turnover, and discrepancies between reported profits and actual cash flow often signal underlying financial statement fraud risk factors.

- Regulatory Enforcement Creates Consequences: The SEC’s aggressive pursuit of financial reporting violations—resulting in billions of dollars in penalties and criminal charges for executives—demonstrates the severe legal ramifications facing companies that engage in fraudulent practices.

- Historical Lessons Remain Relevant: The spectacular collapses of Enron, WorldCom, Lehman Brothers, and HealthSouth serve as stark reminders of how accounting fraud can trigger catastrophic securities class action lawsuits and destroy investor confidence.

- Prevention Requires Multi-Layered Defense: Effective internal controls, robust corporate governance, whistleblower protections, and advanced detection technologies create essential barriers against fraudulent activities.

The Cost of Prevention vs. Remediation

- Companies that prioritize transparent financial reporting and ethical conduct benefit from enhanced investor confidence, lower capital costs, and reduced exposure to securities litigation. The investment in effective controls represents not merely a regulatory compliance obligation but a fundamental business imperative that supports long-term success and market confidencr

- Organizations with strong ethical frameworks are better positioned to identify potential problems before they escalate into serious legal or reputational issues. This proactive approach proves far less costly than the price of remediation following the discovery of misleading financial reporting.

Investor Empowerment Through Knowledge

- Empowering Investors: Those who understand these financial statement fraud risk factors can better protect themselves through:

- Analytical Vigilance: Examining financial ratios, cash flow patterns, and corporate governance structures provides crucial insights into potential fraud risks.

- Due Diligence Practices: Reviewing SEC filings, auditor opinions, and restatement histories helps identify red flags before significant losses occur.

- Skeptical Assessment: Maintaining healthy skepticism toward unusually positive financial results or management explanations that seem inconsistent with industry trends.

Market Integrity Depends on Collective Vigilance

- The Fight Continues: The battle against financial reporting fraud requires commitment from all stakeholders. Shareholders must exercise skepticism toward suspiciously positive results. Boards must ensure robust oversight of financial reporting processes. Regulators must continue aggressive enforcement actions against violators.

- Regulatory compliance: Monitoring and awareness of SEC regulations provide additional layers of protection against fraudulent investments. When employees understand the serious consequences of ethical violations—including the potential for securities class actions—they become more likely to report concerns early and seek guidance when facing difficult decisions.

Building Stronger Capital Markets

- Market participants who recognize the warning signs of potential accounting fraud and understand the legal implications can reduce their exposure to fraud risks while supporting market integrity. This knowledge ultimately contributes to more robust and transparent capital markets that benefit all participants.

- The price of ignorance regarding these deceptive practices remains far too high—both for individual portfolios and the broader economic system. Companies, investors, and regulators must work together to maintain the trust and transparency essential for healthy financial markets.

Key Takeaways

Financial statement fraud represents a sophisticated threat that costs organizations approximately 5% of annual revenue while devastating investor confidence and market integrity. Understanding these deceptive practices is essential for protecting investments and maintaining business trust.

• Fraud takes multiple forms: Revenue inflation, expense manipulation, asset misappropriation, and material omissions are common techniques used to deceive stakeholders and manipulate financial outcomes.

• Watch for critical red flags: Unusual revenue growth misaligned with industry trends, frequent financial restatements, high executive turnover, and discrepancies between reported profits and actual cash flow signal potential fraud.

• Legal consequences are severe: SEC enforcement actions resulted in $8.2 billion in penalties in 2024 alone, with executives facing up to 20 years imprisonment for willful certification violations.

• Prevention requires layered defenses: Effective internal controls, independent audits, AI-powered analytics, ethics training, and robust whistleblower programs create essential safeguards against financial reporting fraud.

• Due diligence protects investors: Analyzing financial ratios, reviewing auditor opinions, understanding litigation history, and evaluating corporate governance structures help identify potential fraud before significant losses occur.

The collapse of major corporations like Enron, WorldCom, and Lehman Brothers demonstrates how misleading financial reporting can destroy entire organizations and trigger widespread economic instability. By recognizing warning signs and implementing comprehensive prevention strategies, stakeholders can better protect themselves and contribute to market integrity.

FAQs

Q1. What are some common ways financial statements can be misleading? Financial statements can be misleading through techniques like inflating revenue, understating expenses, overstating asset values, and hiding liabilities. Companies may also use complex transactions or accounting methods to obscure their true financial position.

Q2. What are the potential consequences for falsifying financial statements? Falsifying financial statements can lead to severe consequences, including large SEC fines, criminal charges for executives, shareholder lawsuits, and significant drops in stock price. Companies may face reputational damage, loss of investor trust, and even bankruptcy in extreme cases.

Q3. How can investors protect themselves from misleading financial reporting? Investors can protect themselves by analyzing financial ratios, reviewing auditor opinions, examining SEC filings, and evaluating corporate governance structures. It’s also important to watch for red flags like unusual revenue growth, frequent restatements, or discrepancies between profits and cash flow.

Q4. What role do internal controls play in preventing financial statement fraud? Internal controls are crucial in preventing financial statement fraud. They include measures like segregation of duties, approval workflows, and whistleblower programs. Strong internal controls make it more difficult for individuals to manipulate financial data without detection.

Q5. How has technology improved the detection of financial statement fraud? Technology has significantly enhanced fraud detection through AI and data analytics. These tools can continuously monitor transactions, identify anomalies, and detect patterns indicative of fraudulent behavior. Machine learning models have improved detection accuracy while reducing false positives.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors