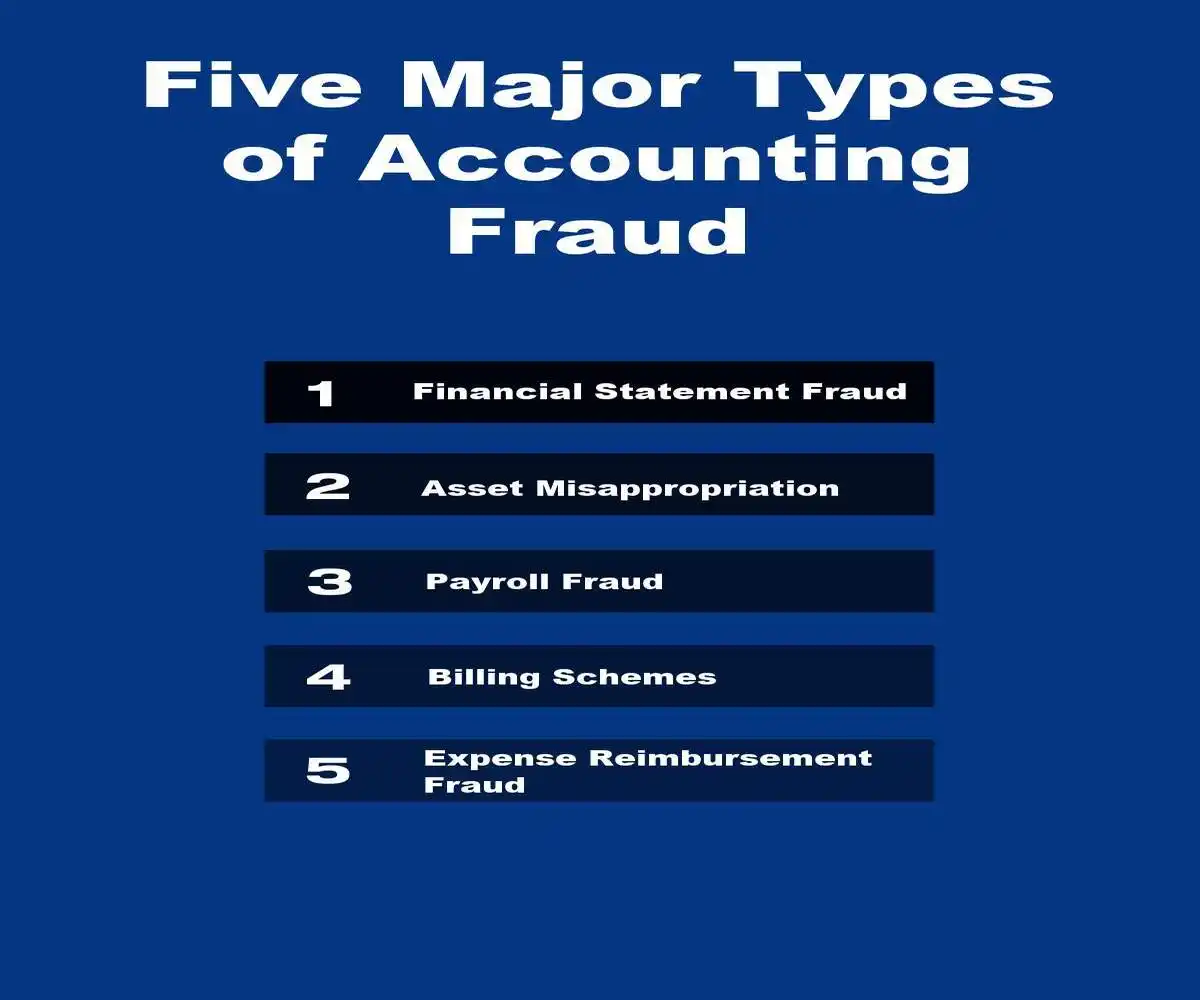

Introduction to Five Major Types of Accounting Fraud

- Five major types of accounting fraud are:

- Financial Statement Fraud: Where financial reports are intentionally misleading.

- Asset Misappropriation: The theft of company assets like cash or inventory.

- Payroll Fraud: Includes things such as creating ghost employees or inflating hours.

- Billing Schemes: Involves fake or inflated invoices from shell companies; and

- Expense Reimbursement Fraud: Where employees submit fraudulent or inflated expense claims to get reimbursed for personal expenses.

Understanding Accounting Fraud: An Overview

Diliberate Misrepesentations

- Accounting fraud represents a calculated manipulation of financial statements designed to deceive stakeholders about a company’s true financial condition.

- This deliberate misrepresentation poses significant risks to investors, who rely on accurate financial reporting to make informed investment decisions.

- The practice undermines the foundational principles of financial markets – transparency and trust – which are essential for efficient capital allocation.

- When companies engage in fraudulent accounting practices, the repercussions extend beyond immediate financial losses to include severe legal consequences and long-term reputational damage.

Mechanics of Accounting Fraud

- For investors, understanding the mechanics and indicators of accounting fraud is crucial for protecting their portfolios and conducting thorough due diligence.

- The persistence of accounting fraud in modern financial markets, despite enhanced regulatory oversight and sophisticated auditing procedures, highlights its evolving nature.

- Perpetrators employ increasingly complex schemes to obscure their activities, leveraging technological advances and intricate financial instruments to their advantage.

- The digitalization of financial transactions has introduced new vectors for fraudulent practices, while also creating challenges for detection and enforcement.

- Modern accounting fraud often involves multiple layers of deception, making it difficult for even experienced investors and auditors to identify suspicious activities promptly.

- The sophistication of these schemes necessitates heightened vigilance and a deeper understanding of potential red flags among the investment community.

Ramifications of Accounting Fraud

- The ramifications of accounting fraud extend far beyond individual companies, potentially destabilizing entire market segments and eroding investor confidence.

- When fraudulent practices come to light, the immediate impact often triggers a chain reaction affecting various stakeholders – from institutional investors managing pension funds to individual retail investors saving for retirement.

- The discovery of accounting fraud typically leads to sharp declines in stock prices, litigation, and regulatory investigations, all of which can significantly impact investment portfolios.

- Moreover, these incidents can create broader market uncertainty, as investors question the reliability of financial reporting across similar companies or sectors.

- Understanding the various manifestations of accounting fraud is therefore essential for investors to implement effective risk management strategies and protect their investments.

- This knowledge enables investors to identify potential warning signs early, make more informed investment decisions, and contribute to overall market integrity.

- The following sections will examine five primary categories of accounting fraud, providing investors with practical insights and protective measures to safeguard their investments.

Financial Statement Fraud: Definition and Examples

- Financial statement fraud represents a severe form of accounting misconduct where companies deliberately misstate their financial performance or position.

- This deceptive practice typically involves senior management or executives who possess authority over financial reporting processes.

- The primary objective behind such fraud is to deceive key stakeholders – investors, creditors, and regulators – by presenting an artificially enhanced picture of financial health and profitability.

- These manipulative actions can result in artificially inflated stock valuations, unwarranted executive compensation, and misplaced market confidence.

Common Methodologies Employed

- Common methodologies employed in financial statement fraud encompass revenue inflation, liability concealment, and expense manipulation.

- For instance, organizations might prematurely recognize revenue before it materializes or deliberately omit liabilities to portray a stronger financial position.

- Such fraudulent activities can materially distort a company’s financial statements, providing stakeholders with a fundamentally misleading representation of its true economic condition.

- Notable cases, particularly the Enron scandal, have highlighted the catastrophic impact of financial statement fraud, lleading to enhanced regulatory oversight and intensified scrutiny from auditors and regulatory authorities.

Implementation of Prodedures to Identify Financial Statement Fraud

- Investors must develop proficiency in identifying potential indicators of financial statement fraud to safeguard their capital.

- Key warning signals include unexplained inconsistencies in financial reports, profit margins significantly exceeding industry standards, and frequent modifications to accounting methodologies.

- Additionally, investors should exercise heightened caution regarding companies that consistently achieve or surpass earnings projections without substantive justification.

- Through comprehensive due diligence and maintaining a skeptical approach toward exceptional financial performance claims, investors can better protect themselves against risks associated with financial statement fraud.

- The implementation of robust analytical procedures and verification processes serves as a crucial defense mechanism against potential financial misrepresentation, enabling investors to make more informed investment decisions based on accurate financial information.

Asset Misappropriation: How It Works and Its Impact

Intentionally Divert Company Resources

- Asset misappropriation constitutes a prevalent form of accounting fraud wherein organizational insiders misappropriate or divert company resources for personal enrichment.

- This fraudulent activity occurs across all organizational levels, from entry-level employees to executive management.

- While asset misappropriation manifests in various forms, including cash theft, expense report manipulation, and unauthorized asset utilization, its relative simplicity compared to other fraud schemes does not diminish its potential to inflict substantial financial damage on organizations.

Heightened Regulatory Scrutiny and Reputational Damages

- The implications of asset misappropriation extend well beyond direct monetary losses.

- Organizations face reputational damage, deteriorating employee morale, and heightened regulatory and audit scrutiny.

- The occurrence of fraudulent activities signals deficiencies in internal control mechanisms and ethical organizational culture.

- This erosion of trust among stakeholders creates challenges in attracting investment capital and retaining valuable talent.

- Furthermore, the expenses associated with investigating and remedying asset misappropriation cases can significantly strain organizational resources, compounding the initial financial impact.

Key Warning Indicators

- Investors must exercise vigilance in identifying potential asset misappropriation within their investment portfolio companies.

- Key warning indicators include financial record inconsistencies, unexplained losses, and elevated employee turnover rates.

- Investors should prioritize companies demonstrating robust internal controls and organizational cultures emphasizing transparency and accountability.

- The implementation of regular audits, whistleblower mechanisms, and comprehensive oversight frameworks serves to deter asset misappropriation and safeguard investor interests.

- Through supporting organizations that prioritize ethical practices and effective governance, investors contribute to establishing a more secure investment environment.

Payroll Fraud: Common Tactics and Prevention Strategies

Deliberate Manipulation of Payroll Systems

- Payroll fraud constitutes a deliberate manipulation of payroll systems by employees to obtain unauthorized compensation.

- This financial malfeasance manifests in multiple forms, including phantom employees, timesheet falsification, and unauthorized salary increases.

- The perpetrators typically hold positions with payroll system access, creating significant vulnerability across organizations regardless of size.

- The financial implications of payroll fraud are considerable, directly impacting operational costs and diminishing corporate profitability.

Phantom Employee Schemes

- Phantom employee schemes represent a prevalent form of payroll fraud, wherein fictitious personnel are entered into payroll systems, enabling fraudsters to misappropriate their wages.

- Time theft through falsified work hours constitutes another common violation.

- Additionally, collusion between employees and payroll staff can result in unauthorized salary adjustments or bonus payments.

- Such fraudulent activities often persist undetected, particularly in environments lacking robust internal controls or sufficient oversight mechanisms.

Implementation of Robust Internal Controls

- Organizations can mitigate payroll fraud risk through implementation of comprehensive internal controls, robust corporate governance, and systematic payroll process reviews.

- Segregation of duties serves as a fundamental preventive measure, ensuring no individual maintains complete control over payroll operations.

- Regular audits and reconciliation procedures facilitate detection of irregularities and potential fraudulent activities.

- Organizations should establish clear reporting protocols for suspicious activities while fostering a culture of integrity and transparency.

- Through implementation of these preventive measures, organizations can effectively reduce payroll fraud exposure and maintain financial integrity.

Billing Schemes: Identifying Red Flags

Manipulation of Payment Systems

- Billing schemes represent a sophisticated form of accounting fraud where employees manipulate payment systems to misappropriate corporate funds.

- These fraudulent activities typically involve personnel with accounts payable access who create fictitious vendors or alter legitimate payment records.

- Detection proves challenging as perpetrators often collaborate with external parties, enabling them to circumvent standard audit procedures and internal controls.

Commno Methodologies Used

- Common methodologies include establishing shell vendors, processing duplicate payments, and artificially inflating invoice amounts.

- Employees may orchestrate kickback arrangements with vendors or establish fictitious companies to process fraudulent invoices.

- The increasing complexity of modern supply chains and prevalence of electronic payment systems have elevated the risk of billing schemes, resulting in substantial financial losses and damaged vendor relationships for affected organizations.

Investors Should Look for Key Indicators of Billing Schemes

- Investors must exercise heightened vigilance in monitoring potential billing schemes within their portfolio companies.

- Key indicators include payment irregularities, disproportionate expense categories, and frequent vendor relationship changes.

- Investors should prioritize companies demonstrating robust internal controls and regular accounts payable audits.

- Supporting organizations committed to transparency and accountability helps mitigate billing scheme risks and safeguard investment value.

- Thorough due diligence and ongoing monitoring of vendor payment practices remain essential for protecting shareholder interests against this sophisticated form of financial fraud.

Expense Reimbursement Fraud: What Investors Should Know

Employees Submit Fraudulent Expense Claims

- Expense reimbursement fraud occurs when employees submit fraudulent or inflated expense claims to obtain unwarranted reimbursements from their organization.

- This fraudulent practice is typically executed by employees with privileged access to expense reimbursement systems who can manipulate them for personal gain.

- Common methods include submitting fabricated receipts, overstating legitimate business expenses, and claiming personal expenditures as business-related costs.

- Such fraudulent activities can result in substantial financial losses and compromise an organization’s fiscal integrity.

Consequences of Expense Reimbursement Fraud

- The ramifications of expense reimbursement fraud extend beyond monetary damages.

- This misconduct can deteriorate employee-management relationships and foster a culture of dishonesty within the company.

- Organizations may face heightened scrutiny from auditors and regulatory bodies, potentially leading to reputational damage and legal consequences.

- Additionally, the resources required to investigate and remediate expense fraud cases can impose significant operational costs on the company.

Key Warning Signs

- Investors must recognize key warning signs of expense reimbursement fraud to safeguard their investments.

- Red flags include inconsistencies in expense reports, abnormally high travel and entertainment costs, and frequent modifications to expense policies.

- Investors should seek companies demonstrating robust internal controls and a culture emphasizing transparency and accountability.

- Regular audits, well-defined expense reimbursement procedures, and comprehensive oversight mechanisms help prevent fraud and protect investor interests.

Robust Internal Controls Architecture

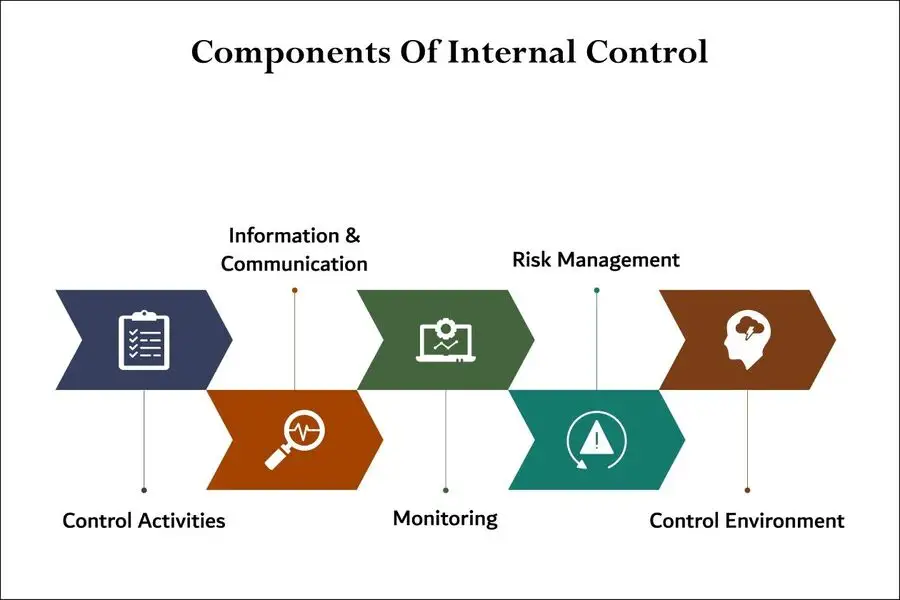

- Segregation of duties represents one of the most fundamental control principles, ensuring that no single individual has complete control over any significant financial transaction or process.

- This principle requires that the authorization, recording, and custody functions be distributed among different individuals, creating natural checks and balances that make fraudulent activities more difficult to execute and conceal.

- Authorization controls must be clearly defined and consistently enforced, with appropriate approval limits established based on risk levels and organizational hierarchy.

- These controls should include both preventive measures, such as required approvals for expenditures above certain thresholds, and detective measures, such as regular review of transactions that approach or exceed authorization limits.

Physical Safeguards

- Physical safeguards remain critical for protecting tangible assets, including cash, inventory, and equipment.

- These safeguards should encompass secure storage facilities, restricted access controls, regular physical counts, and comprehensive insurance coverage.

- Modern physical security systems should integrate with digital monitoring capabilities to provide real-time alerts and comprehensive audit trails.

Advanced Detection Methodologies

Data Analytics

- Data analytics has revolutionized the detection of asset misappropriation schemes by enabling organizations to identify unusual patterns and anomalies that might indicate fraudulent activity.

- Advanced analytics tools can process vast amounts of transactional data to identify outliers, duplicate payments, unusual vendor relationships, and other red flags that warrant further investigation.

Continuous Monitoring Systems

- Continuous monitoring systems provide real-time oversight of financial transactions and can automatically flag suspicious activities for immediate review.

- These systems can be configured to detect specific fraud indicators, such as transactions occurring outside normal business hours, payments to new vendors without proper documentation, or unusual patterns in expense reimbursements.

Whistleblower Programs

- Whistleblower programs serve as a critical component of any comprehensive fraud detection strategy.

- Research consistently demonstrates that tips from employees, customers, and vendors represent the most common method of fraud detection, accounting for more than 40% of all discovered schemes.

- Effective whistleblower programs must provide multiple reporting channels, ensure confidentiality protection, and establish clear procedures for investigating reported concerns.

Corporate Governance and Executive Accountability

Effective Corporate Governance

- Effective corporate governance serves as the cornerstone of fraud prevention, with the board of directors and audit committee.

- It plays crucial roles in establishing the “tone at the top” that influences organizational culture and ethical behavior.

- The audit committee’s responsibilities extend beyond financial statement oversight to encompass the evaluation of internal control effectiveness, fraud risk assessment, and the organization’s overall risk management framework.

Independent Directors

- Independent directors bring objective perspectives and specialized expertise that enhance the board’s ability to identify and address potential fraud risks.

- These directors should possess relevant financial expertise and maintain independence from management.

- This ensures they can effectively challenge management decisions and provide meaningful oversight of fraud prevention efforts.

Certification Requirements Under Sarbanes-Oxley

- Sarbanes-Oxley: The Sarbanes-Oxley Act of 2002 significantly strengthened the regulatory framework governing financial reporting and corporate governance.

- The PCAOB: This landmark legislation established the Public Company Accounting Oversight Board (PCAOB), enhanced auditor independence requirements, and imposed personal certification obligations on chief executive and financial officers regarding the accuracy of financial statements.

- Certification Requirements: The Act’s Section 404 requires management to assess and report on the effectiveness of internal control over financial reporting, creating additional accountability mechanisms.

- Liability: These certifications create personal accountability for senior executives and establish clear consequences for financial reporting failures, including potential criminal liability for knowingly certifying false information.

- Whistleblower Protections: Sarbanes-Oxley Act provisions include enhanced criminal penalties for securities fraud, mandatory internal control assessments, and whistleblower protection programs that encourage the reporting of potential violations.

Management’s Role in Fraud Prevention

Internal Controls

- Management’s assessment of internal controls must be comprehensive and ongoing, encompassing both the design and operational effectiveness of control procedures.

- This assessment should include regular testing of key controls, evaluation of control deficiencies, and implementation of remediation plans to address identified weaknesses.

- Section 404 of Sarbanes-Oxley requires management to assess and report on the effectiveness of internal control over financial reporting, creating additional accountability mechanisms.

Risk Assessment

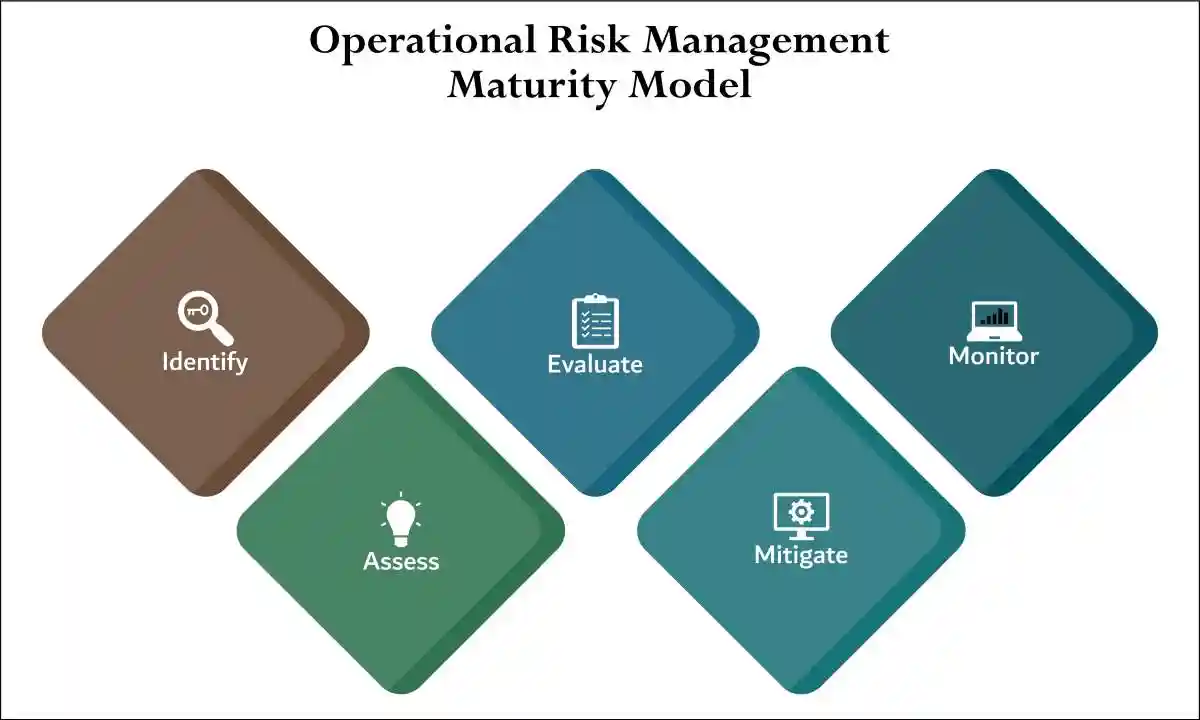

- A fraud risk assessment is a systematic process for an organization to identify, analyze, and mitigate potential fraud risks.

- It involves examining business processes, assets, and controls to uncover vulnerabilities to both internal fraud

- Fraud risk assessment should be integrated into the organization’s overall risk management framework, with regular updates to reflect changes in business operations, technology systems, and external threats.

- This assessment should consider both the likelihood and potential impact of various fraud scenarios, enabling management to prioritize prevention and detection efforts appropriately.

Employee Training Programs

- Employee training is a critical, cost-effective component of fraud risk management, leading to lower losses and faster fraud detection.

- Employee training and awareness programs play a vital role in creating a culture of integrity and ethical behavior.

- These programs should educate employees about fraud risks, reporting procedures, and their individual responsibilities for maintaining effective controls.

- Regular training updates should address emerging threats and reinforce the organization’s commitment to ethical conduct.

Steps to Integrate Fraud Risk Assessment with Employee Training

- Conduct a Fraud Risk Assessment:

- Identify risks: Analyze your industry, past frauds, and internal weaknesses to understand your organization’s specific fraud risks.

- Benchmark: Use reports and other organizations’ experiences to identify common risks and understand potential vulnerabilities.

- Evaluate internal controls: Review your organization’s policies and procedures to find gaps that could be exploited.

- Define Training Needs:

- Identify knowledge gaps: Interview managers and employees to determine areas where they lack the skills or knowledge to combat fraud.

- Tailor content: Based on the fraud risk assessment, develop training that addresses the specific types of fraud relevant to your organization.

- Develop and Implement the Training Program:

- Key content: Educate employees on what constitutes fraud, its harm to the organization, and how to report it.

- Red flags: Teach employees to recognize the behavioral red flags of fraudsters, such as living beyond their means or financial difficulties.

- Reporting mechanisms: Clearly outline the organization’s reporting channels, such as whistleblower policies.

- Consistency: Avoid a one-time training session; provide regular, ongoing training to reinforce key concepts.

- Supplement: Supplement formal training with ongoing resources like articles, videos, and workplace visual checklists to keep fraud top-of-mind.

- Monitor and Evolve:

- Test knowledge: Consider testing employees on their understanding of anti-fraud measures.

- Update training: Regularly update content to address new fraud schemes and tactics as the fraud landscape evolves.

- Continuous assessment: Fraud risk assessments are not one-time events; they should be repeated to account for changes in business operations and the evolving risk environment.

- Test knowledge: Consider testing employees on their understanding of anti-fraud measures.

The Connection Between Accounting Fraud and Securities Litigation

Misrepresent Company’s True Financial Condition

- Accounting fraud schemes represent a critical intersection between financial misrepresentation and securities law violations.

- When organizations engage in fraudulent accounting practices, they produce false financial statements that materially misrepresent their true financial condition and performance.

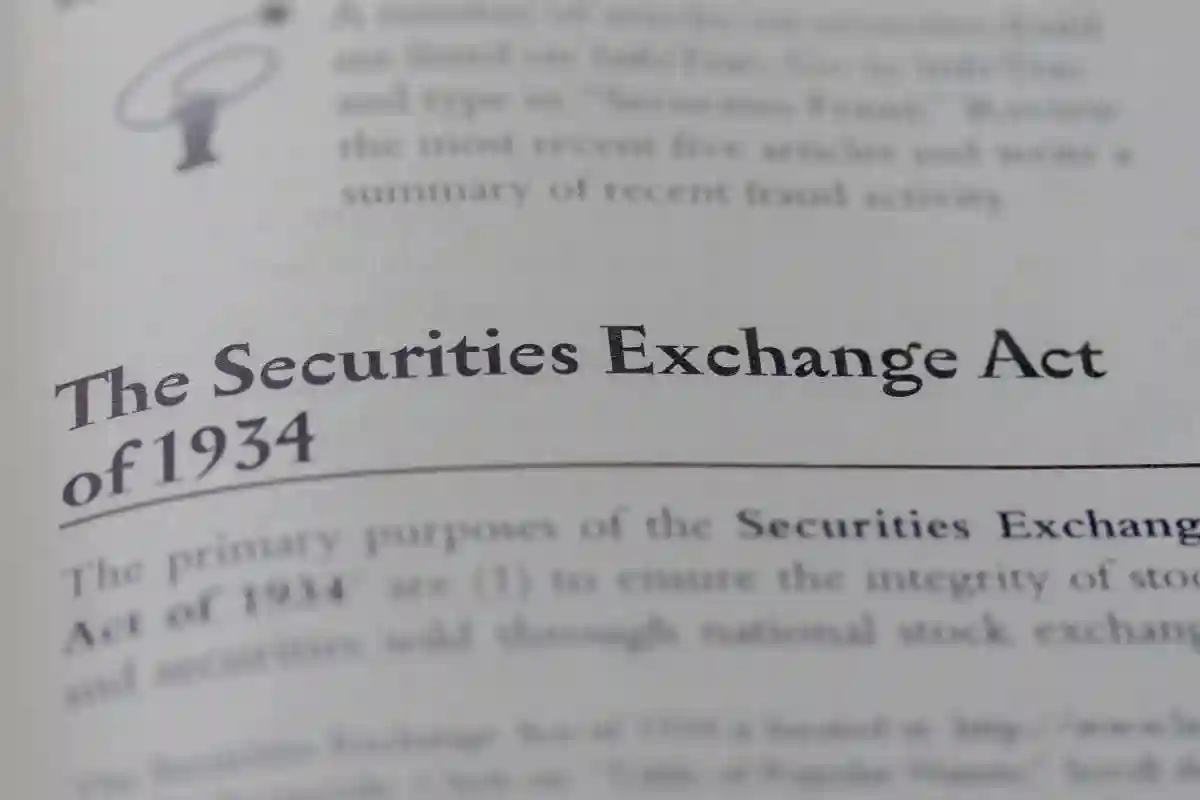

- These misstatements, when significant enough to influence investment decisions, frequently trigger securities class action lawsuits under federal securities laws, particularly Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5.

- The materiality threshold is crucial – minor accounting discrepancies may not warrant legal action, but substantial misrepresentations that affect market valuations typically do.

Consequences: Securities Litigation

- Securities litigation stemming from accounting fraud cases involves sophisticated forensic analysis and complex damages calculations. Expert forensic accountants must conduct detailed examinations to:

- Quantify the precise impact of fraudulent activities on financial statements

- Determine the extent of artificial stock price inflation

- Calculate resulting investor losses upon fraud discovery

- Establish clear causal links between misappropriation and stock price declines

- Document the materiality of misstatements to investment decisions

Company Is Subjected to Massive Liability

- Class action settlements in these cases frequently reach substantial amounts, particularly involving major public companies where numerous investors suffer losses.

- Recent settlements have ranged from tens of millions to over a billion dollars in high-profile cases. Beyond monetary compensation, these settlements typically mandate:

- Implementation of enhanced internal controls

- Strengthened corporate governance procedures

- Independent monitoring and compliance programs

- Regular audits and reporting requirements

- Updated fraud prevention protocols

- Improved disclosure practices

- These comprehensive settlement terms serve dual purposes – compensating affected investors while instituting reforms to prevent future fraudulent conduct.

- The reforms often become industry standard practices, elevating corporate governance across entire sectors.

- This demonstrates how securities litigation can drive systemic improvements in financial reporting and corporate accountability.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

SEC Enforcement Actions and Regulatory Response

- The Securities and Exchange Commission (SEC) has significantly increased its enforcement efforts related to accounting fraud and internal control deficiencies.

- SEC enforcement actions often target not only the individuals who perpetrated the fraud but also the organizations that failed to maintain adequate controls to prevent or detect the misconduct.

- Regulatory compliance requirements have become increasingly stringent, with the SEC focusing particular attention on management’s assessment of internal control effectiveness and the adequacy of disclosure controls and procedures.

Company Is Subjected to Signifcant Regulatory Penalties

- Organizations that experience significant asset misappropriation may face SEC investigations that examine whether proper controls were in place and whether investors were adequately informed about fraud risks and control deficiencies.

- Civil penalties imposed by the SEC in accounting fraud cases can be substantial, often exceeding the amount of funds misappropriated.

- These penalties are designed to deter future misconduct and reflect the broader impact of fraud on market integrity and investor confidence.

- In addition to monetary penalties, the SEC may require organizations to implement specific remedial measures, including enhanced controls, independent monitoring, and executive accountability measures.

The Sarbanes-Oxley Act’s Continuing Impact

Certifcation of Financial Statements

- The Sarbanes-Oxley Act continues to shape how organizations approach accounting fraud prevention and detection more than two decades after its enactment.

- Section 302 requires CEOs and CFOs to certify the accuracy of financial statements and the adequacy of disclosure controls, while Section 404 mandates annual assessments of internal control effectiveness.

Enhanced Auditor Responsibilities

- Auditor responsibilities under Sarbanes-Oxley include not only expressing an opinion on financial statements but also evaluating and reporting on the effectiveness of internal control over financial reporting.

- This dual responsibility creates additional scrutiny of control environments and increases the likelihood that significant deficiencies will be identified and addressed promptly.

The Threat of Criminal Penalities

- Criminal penalties under Sarbanes-Oxley can include substantial fines and prison sentences for executives who knowingly certify false financial statements or fail to maintain adequate internal controls.

- These penalties create powerful incentives for management to take fraud prevention seriously and invest in robust control systems.

Best Practices for Investors and Stakeholder Protection

Due Diligence and Risk Assessment

- Investors must conduct thorough due diligence to assess the adequacy of an organization’s fraud prevention and detection capabilities before making investment decisions.

- This assessment should include evaluation of the company’s internal control environment, corporate governance structure, and history of regulatory compliance.

- Financial statement analysis should focus not only on reported results but also on the quality of earnings and the adequacy of disclosures related to internal controls and risk factors.

- Investors should pay particular attention to management’s discussion of control deficiencies, remediation efforts, and changes in key personnel responsible for financial reporting.

- Third-party assessments can provide valuable insights into an organization’s control environment and fraud risk exposure.

- These assessments might include reviews by independent auditors, forensic accountants, or specialized risk management consultants who can identify potential vulnerabilities that might not be apparent from public disclosures.

Monitoring and Ongoing Oversight

- Regular monitoring of investee companies should include attention to changes in management, auditor relationships, and internal control assessments.

- Significant turnover in key financial positions, changes in external auditors, or reports of material weaknesses in internal controls may indicate increased fraud risk that warrants additional scrutiny.

- Stakeholder engagement can provide early warning signs of potential problems through direct communication with management, board members, and external auditors.

- Institutional investors, in particular, should leverage their influence to encourage robust fraud prevention measures and transparent reporting of control issues.

- Proxy voting decisions should consider the adequacy of proposed corporate governance measures, including board composition, audit committee qualifications, and executive compensation structures that align management incentives with long-term value creation rather than short-term results that might encourage fraudulent behavior.

Technology Integration and Future Considerations

Artificial Intelligence and Machine Learning Applications

- Advanced analytics powered by artificial intelligence and machine learning are revolutionizing accounting fraud detection by enabling organizations to identify subtle patterns and anomalies that traditional methods might miss.

- These technologies can process vast amounts of data in real-time, continuously learning from new information to improve detection accuracy and reduce false positives.

- Predictive modeling can help organizations identify high-risk scenarios and individuals before fraud occurs, enabling proactive intervention rather than reactive investigation.

- These models can incorporate multiple risk factors, including behavioral indicators, transactional patterns, and external data sources to create comprehensive risk profiles.

- Blockchain technology offers potential solutions for enhancing transaction transparency and creating immutable audit trails that make acounting fraud more difficult to execute and conceal. While still emerging, blockchain applications in financial reporting and asset management may provide new tools for fraud prevention and detection.

Regulatory Evolution and Emerging Standards

- Regulatory frameworks continue to evolve in response to emerging threats and technological developments.

- Organizations must stay current with changing requirements and best practices to ensure their fraud prevention and detection capabilities remain effective and compliant with applicable standards.

- International coordination among regulatory bodies is increasing, creating more consistent global standards for internal controls and fraud prevention.

- This coordination helps address the challenges posed by multinational organizations and cross-border fraudulent schemes that can exploit regulatory gaps and jurisdictional limitations.

- Industry-specific guidance is becoming more detailed and prescriptive, reflecting the unique risks and challenges faced by different sectors.

- Organizations should ensure they understand and comply with industry-specific requirements while also implementing broader best practices that address common fraud risks.

Conclusion: Building a Comprehensive Defense Against Accounting Fraud

- The fight against accounting fraud requires a multifaceted approach that combines robust internal controls, effective corporate governance, advanced detection technologies, and strong regulatory compliance programs.

- Organizations that fail to adequately address these risks face not only direct financial losses but also potential securities class action lawsuits, SEC enforcement actions, and long-term reputational damage that can affect their ability to access capital markets and maintain investor confidence.

- The evolution of fraud schemes, particularly those leveraging advanced technologies and exploiting digital vulnerabilities, demands continuous adaptation and improvement of prevention and detection capabilities.

- Organizations must invest in both traditional control measures and emerging technologies while maintaining a culture of integrity and ethical behavior that discourages fraudulent conduct.

- For investors, understanding the complexities of the various types of accounting fraud and their potential impact on investment returns is essential for making informed decisions and protecting their financial interests.

- By conducting thorough due diligence, monitoring investee companies for warning signs, and engaging with management on governance issues, investors can help promote transparency and accountability while protecting their own interests.

- The regulatory environment will continue to evolve, with enforcement agencies like the SEC maintaining their focus on internal control effectiveness and corporate accountability.

- Organizations that proactively address fraud risks and maintain robust control environments will avoid regulatory enforcement, litigaton and other potential penalties from weak internal controls.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors