Introduction to Financial Statement Fraud Risk Factors

- Financial Statement Fraud Risk Factors: While there is not a single definite fact as to why someone would commit the deliberate act of false financial statements, understanding the most common fraud risk factors and motivations can help with detection and prevention.

- Financial Statement Fraud: Referes to misstatements or omissions that result from fraudulent financial reporting.

- Types: Revenue recognition fraud, Revenue recognition fraud, kiability and expense manipulation, improper asset valuation, and improper discosures, among others.

- Risk Factors: Fincancial pressures, weak internal controls, an organization that does not prioritize a policy of ethics or integrity, or external pressures such to beat the street or make the numbers, impress peers among others.

- Liability: As an orgniation it is very important to know the signs and risk factors that may contribute to financial statemtent fraud, as it could subject the company to regulatry scrutiny or enforcement, penalites, or even worse, a class acation lawsuit that could cost the compny tens of millions or more to resolve.

Understanding Financial Statement Fraud: A Comprehensive Guide to Risk Factors and Prevention

- Financial statement fraud: A deliberate act committed by companies to mislead stakeholders by presenting false or manipulated financial data. This type of fraud is a significant concern for investors as it distorts the true financial health of a company, leading to misguided investment decisions.

- Tatics Employed: Understanding financial statement fraud involves recognizing the various tactics employed by companies to alter their financial results. These can range from inflating revenues, manipulating expenses, to misrepresenting assets and liabilities. The goal is to create a misleading impression of a company’s financial performance, often to influence stock prices or meet regulatory requirements.

- Industry Wide: Investors must be aware that financial statement fraud can occur in any industry and is not limited to small or struggling companies. Even well-established corporations can fall prey to unethical practices, especially when management is under pressure to deliver favorable results.

- Underminds Financial Integrity: This form of deception undermines the integrity of financial markets and can lead to significant financial losses for investors.

- Understanding the Mechanisms: The first step in Financial statement fraud is in safeguarding investments and ensuring that the financial information relied upon is accurate and trustworthy.

Financial Statement Fraud Risk Factors

- Reassons: Several critical risk factors increase the likelihood of financial statement fraud occurring within an organization.

- Financial pressure: Represents one of the most significant catalysts, particularly when companies face declining revenues, intense competition, or pressure to meet analyst expectations.

- Pressure: Management teams under extreme pressure to deliver favorable results may resort to fraudulent practices to maintain their positions or secure bonuses tied to financial performance.

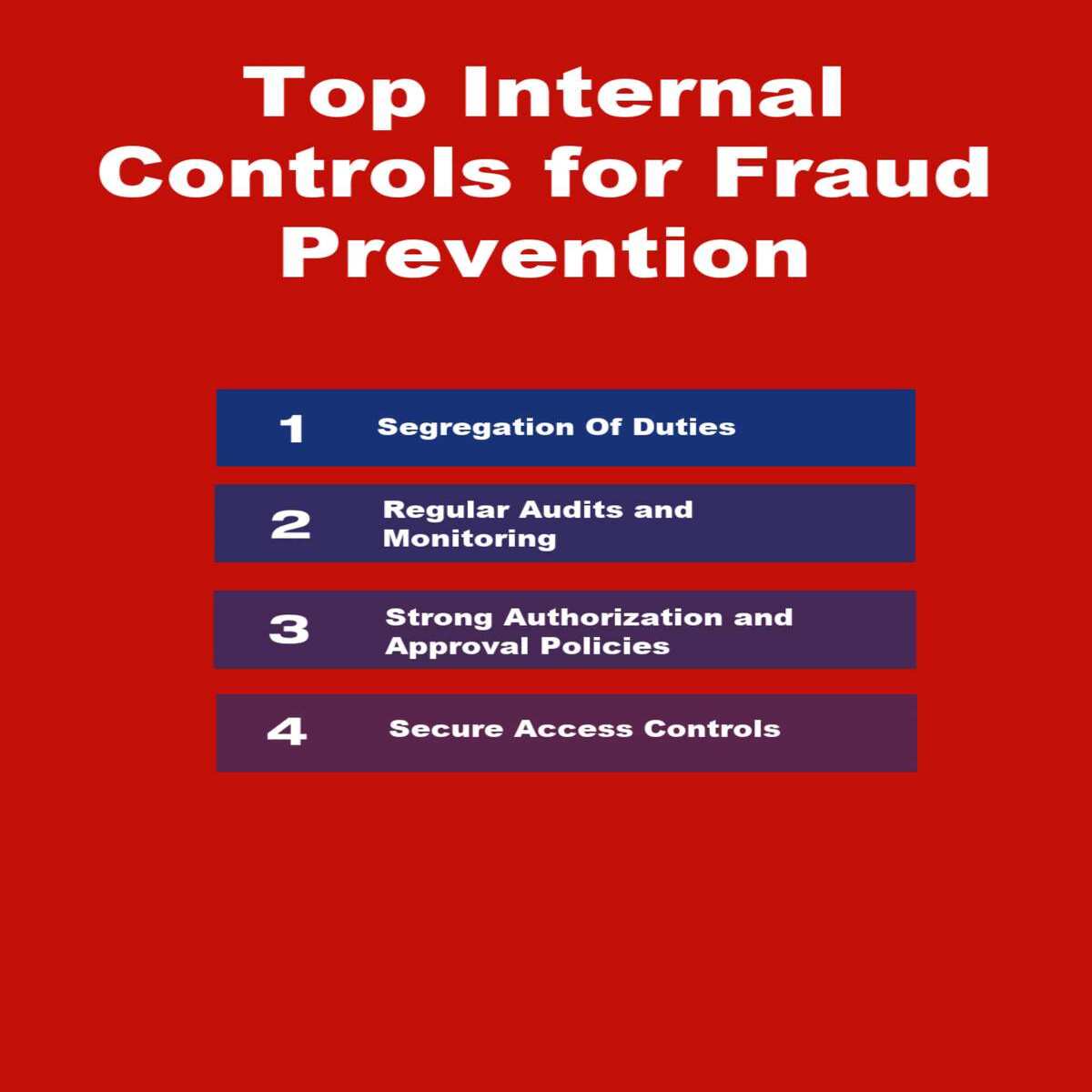

- Weak internal controls: Creates an environment where fraudulent activities can flourish undetected.

- Lack of Internal Controls: Companies with inadequate oversight mechanisms, poor segregation of duties, or insufficient audit functions provide opportunities for manipulation.

- Motivations: These control deficiencies often stem from rapid growth, inadequate resources allocated to compliance, or a corporate culture that prioritizes results over ethical conduct.

- Corporate Governance Failures: also contribute significantly to fraud risk.

- Lack of Independecee: When boards of directors lack independence, fail to provide adequate oversight, or when there’s an absence of strong ethical leadership, the risk of accounting irregularities increases substantially.

- Warning Signs: Companies with weak governance structures often exhibit warning signs such as frequent changes in auditors, aggressive accounting practices, or unusual related-party transactions.

Common Types of Financial Statement Fraud

- Revenue Recognition Fraud: This occurs when a company recognizes revenue before it is earned, often by recording fictitious sales or inflating sales figures. This practice misleads investors about the company’s actual performance. Companies may engage in channel stuffing, where they ship excessive products to distributors near quarter-end, or create fake invoices to inflate revenue numbers artificially.

- Expense Manipulation: Companies may understate expenses to present a more favorable profit margin. This can involve delaying expense recognition or misclassifying expenses to enhance reported earnings. Common tactics include capitalizing expenses that should be expensed immediately, understating warranty reserves, or manipulating depreciation schedules to reduce current-period expenses.

- Asset Valuation Fraud: Organizations may inflate the value of their assets, such as inventory or property, to enhance their financial position. This misrepresentation can lead to inflated stock prices and misinformed investment decisions. Asset valuation fraud often involves overstating inventory values, inflating accounts receivable, or failing to write down impaired assets to their fair market value.

- Improper Disclosures: Failing to disclose significant financial obligations or risks can mislead investors. Companies may omit transactions with related parties or fail to disclose contingent liabilities, creating a false sense of security. These omissions violate transparency requirements and prevent investors from making fully informed decisions about their investments.

Securities Litigation and Regulatory Enforcement

- When accounting fraud is discovered: It frequently triggers securities class action lawsuits filed by investors who suffered financial losses. These securities class actions serve as a critical mechanism for holding companies accountable and providing compensation to harmed investors. The threat of securities litigation acts as a deterrent, as companies face substantial financial penalties and reputational damage when fraud is uncovered.

- SEC regulations: Have evolved significantly to address financial statement fraud more effectively. The Securities and Exchange Commission has enhanced its enforcement capabilities, implementing stricter penalties for non-compliance and increasing the frequency of investigations. Recent regulatory changes have strengthened whistleblower protections and increased the maximum penalties for securities violations, creating stronger incentives for companies to maintain accurate financial reporting.

- The Regulatory Landscape: Continues to evolve, with new requirements for enhanced disclosure and stronger internal controls. Companies now face more rigorous scrutiny from regulators, with the SEC employing advanced data analytics to identify potential fraud patterns and anomalies in financial statements.

Corporate Governance Reforms and Prevention

- Corporate governance reforms: Have emerged as a critical response to high-profile fraud cases. These reforms focus on strengthening board independence, enhancing audit committee oversight, and improving internal control systems. Companies are now required to implement more robust regulatory compliance programs that include regular risk assessments, employee training, and clear reporting mechanisms for potential violations.

- Effective Fraud Prevention: Requires a multi-layered approach combining strong internal controls, ethical leadership, and a culture of transparency. Organizations must establish clear policies and procedures, implement regular monitoring systems, and ensure that employees understand the consequences of fraudulent behavior. Regular internal audits and independent external reviews help identify potential weaknesses before they can be exploited.

- Advanced Technology Solutions: These include data analytics and artificial intelligence, has enhanced companies’ ability to detect uunusual patterns that may indicate fraudulent activity. These tools enable real-time monitoring of financial transactions and can flag potential irregularities for further investigation.

Protecting Investor Interests

- Consequences: The consequences of financial statement fraud extend beyond financial losses. When fraud is uncovered, it can lead to a loss of investor confidence, regulatory sanctions, and legal action against the company and its executives. This can severely damage a company’s reputation and long-term viability. For investors, it emphasizes the importance of due diligence and the need to critically evaluate financial statements rather than taking them at face value.

- Understanding: Knowledge of financial statement fraud equips investors with the knowledge to make informed decisions and protect their investments from potential risks. By recognizing warning signs, understanding common fraud schemes, and staying informed about regulatory developments, investors can better protect themselves from the devastating effects of corporate fraud.

- Regularoy Environment: The ongoing evolution of regulatory enforcement and corporate governance standards demonstrates the financial markets’ commitment to maintaining integrity and protecting investor interests. As these systems continue to strengthen, the cost of engaging in fraudulent behavior increases, creating powerful incentives for companies to maintain honest and transparent financial reporting practices.

Financial Pressure and Environmental Risk Factors

- Financial pressure: Represents one of the most significant financial statement fraud risk factors. When companies face intense pressure to meet earnings expectations, maintain stock prices, or comply with debt covenants, management may resort to fraudulent practices. These pressures often manifest through:

- Declining industry conditions that force companies to appear more competitive than they actually are Unrealistic analyst expectations that create pressure to meet quarterly targets at any cost

- Debt covenant violations that threaten the company’s ability to access capital markets

- Management compensation structures tied heavily to stock performance or earnings metrics

- Weak internal controls: Create an environment where fraud can flourish undetected.

- Inadequate Oversight Mechanisms: Poor segregation of duties, or insufficient audit procedures are particularly vulnerable to accounting irregularities. Investors should pay attention to management’s discussion of internal control weaknesses, particularly those identified by external auditors.

Advanced Red Flags and Warning Signs

- Aggressive Accounting Practices: Such as recognizing revenue prematurely or delaying expense recognition. These tactics can artificially inflate earnings and create a misleading picture of a company’s financial health. Investors should also scrutinize non-recurring or one-time items, as companies may use these as a means to smooth earnings and hide underlying issues.

- Corporate governance deficiencies often correlate with increased fraud risk. Warning signs include:

- Domineering management that discourages questions or dissent from board members

- Lack of independent directors or audit committee members with insufficient financial expertise

- Frequent changes in key personnel, particularly in financial reporting roles

- Poor communication between management and the board of directors

- Fequent Restatements: Or amendments to financial statements is also cause for concern, as it may indicate a lack of accuracy or transparency in financial reporting. When companies repeatedly revise their previously filed statements, it suggests either incompetence in financial reporting or deliberate manipulation that was later discovered

Regulatory Compliance and Enforcement Implications

- Regulatory compliance Failures: Often precede or accompany financial statement fraud. SEC regulations require companies to maintain accurate books and records, implement adequate internal controls, and provide timely disclosure of material information. Penalties for non-compliance can be severe, including substantial fines, trading suspensions, and criminal charges against executives.

- Regulatory enforcement Actions: Serve as important warning signals for investors. Companies facing SEC investigations, receiving comment letters on their filings, or being subject to enforcement proceedings demonstrate elevated risk profiles. The threat of securities litigation and securities class action lawsuitsincreases significantly when companies fail to meet their disclosure obligations or engage in fraudulent practices.

- Corporate Governance Reforms: Have strengthened requirements for internal controls and executive certifications. However, determined fraudsters may still find ways to circumvent these protections, making investor vigilance essential.

Qualitative Assessment and Management Behavior

- Qualitative Factors: Investors should pay close attention to qualitative factors such as management’s tone and transparency in discussing financial results. Overly optimistic or vague explanations for financial performance can be a warning sign of potential fraud. Management teams that consistently blame external factors for poor performance while taking credit for positive results may be attempting to mask underlying problems.

- Management Turnover: Additionally, high levels of management turnover or frequent changes in auditors may suggest underlying issues within the company. When experienced executives leave suddenly or when companies change audit firms without clear business reasons, investors should investigate further.

- Litigation: Securities class actions and securities class action lawsuits often emerge when these red flags are ignored and fraud eventually comes to light. The resulting accounting fraud revelations can lead to significant investor losses and lengthy legal proceedings.

Protecting Your Investment Portfolio

- Watch for Red Flags: By keeping an eye out for these red flags, investors can better protect themselves against the risks of financial statement fraud and make more informed investment choices. The key lies in combining quantitative analysis of financial metrics with qualitative assessment of management behavior and corporate governance practices.

- Be Skeptic: Investors should maintain healthy skepticism when reviewing financial statements, particularly when companies report results that seem too good to be true or inconsistent with industry trends. Regulatory compliance monitoring and awareness of SEC regulations can provide additional layers of protection against fraudulent investments.

- Realize the Risks: Understanding these financial statement fraud risk factors empowers investors to identify potential problems before they result in significant losses, ultimately contributing to more robust and transparent capital markets for all participants.

Investors Must Be Proactive and Scrutinize Financial Statements

- Understanding Types: Understanding the different types of accounting fraud is crucial for investors aiming to protect their interests.

- Scrutinize Financial Statements: Knowledge of these fraudulent practices eenables investors to better scrutinize financial statements and identify potential discrepancies.

- Fed Flags: Furthermore, by familiarizing themselves with the common tactics used in accounting fraud, investors can develop a more critical eye and become proactive in questioning figures that appear too good to be true.

- Take the First Step: This foundational understanding is the first step in safeguarding investments from deceptive financial practices.

Securities Litigation and Class Action Implications

Investor Remedies though Securities Litigation

- Investor Remedy: When accounting fraud occurs, affected investors often seek recourse through securities class action lawsuits and securities litigation.

- Recovering Losses: These legal mechanisms provide a pathway for investors to recover losses resulting from materially misleading financial statements and other violations of federal securities laws.

- Collective Action: Securities class actions represent a powerful collective legal remedy that allows investors who suffered similar harm to join together in a single lawsuit.

- Accounting Fraud: This approach is particularly effective in accounting fraud cases, where numerous investors may have relied on the same fraudulent financial statements when making investment decisions.

- Effecient Resolution: The class action mechanism enables efficient resolution of claims while ensuring that companies face meaningful consequences for their fraudulent conduct.

Securities Litigation and Class Action Implications

Investor Remedies though Securities Litigation

- Investor Remedy: When accounting fraud occurs, affected investors often seek recourse through securities class action lawsuits and securities litigation.

- Recovering Losses: These legal mechanisms provide a pathway for investors to recover losses resulting from materially misleading financial statements and other violations of federal securities laws.

- Collective Action: Securities class actions represent a powerful collective legal remedy that allows investors who suffered similar harm to join together in a single lawsuit.

- Accounting Fraud: This approach is particularly effective in accounting fraud cases, where numerous investors may have relied on the same fraudulent financial statements when making investment decisions.

- Effecient Resolution: The class action mechanism enables efficient resolution of claims while ensuring that companies face meaningful consequences for their fraudulent conduct.

SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Risk Assessment and Monitoring Systems

Risk Assessments

- Fraud Risks: Comprehensive risk assessments must evaluate both inherent fraud risks and the effectiveness of existing controls in mitigating those risks.

- Evaluation: This evaluation should consider various fraud risk factors, including management’s attitude toward internal controls, unusual financial performance pressures, and significant related-party transactions that might create opportunities for manipulation.

Rise of the Machines

- Technology: Plays an increasingly important role in fraud detection and prevention.

- Advanced Analytics Platforms: Can continuously monitor financial data for anomalies, flagging transactions or account balances that deviate from expected patterns.

- Machine Learning Algorithms: Can identify subtle relationships and trends that might escape human detection, providing early warning signs of potential fraudulent activity.

Regular Testing

- Regular testing: Testing regularly and validation of internal controls ensure that prevention mechanisms remain effective over time.

- independent Testing; This includes both management’s ongoing monitoring activities and independent testing by internal audit functions.

- External auditors: Also contribute to this oversight through their annual assessments of internal control effectiveness and their substantive testing of financial statement assertions.

Conclusion: Safeguarding Your Investments Against Fraud

- Understanding Fraud Risk Factors: Safeguarding investments against financial statement fraud requires a comprehensive understanding of the risk factors, red flags, and regulatory framework associated with fraudulent activities. By staying informed and vigilant, investors can better protect their assets and make sound investment decisions. Understanding the role of corporate governance, forensic accounting, and regulatory oversight in preventing fraud is essential for evaluating the integrity of a company’s financial statements.

- Adopt Best Practices: Investors should adopt best practices such as conducting thorough due diligence, diversifying portfolios, and engaging with experts to enhance their ability to detect potential fraud. By recognizing the warning signs of financial statement fraud and understanding the legal implications, investors can reduce their exposure to fraud risks and safeguard their investments. The lessons learned from notable fraud cases underscore the importance of transparency, accountability, and ethical conduct in financial reporting.

- Emerging Markets: As financial markets continue to evolve, the threat of financial statement fraud remains a pressing concern for investors. By arming themselves with the knowledge and tools to identify and mitigate fraud risks, investors can enhance their overall investment strategy and navigate the complexities of financial reporting with confidence. This proactive approach is crucial for protecting investments and ensuring long-term financial success in an increasingly competitive market.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors