Introduction to Financial Statement Fraud

Financial Statement Fraud: Represents one of the most devastating forms of corporate deception, creating catastrophic ripple effects that extend far beyond the perpetrating organization itself.The human toll proves particularly severe—employees at fraudulent firms lose approximately 50% of their cumulative annual wages compared to matched samples, with separation rates surging dramatically following fraud exposure.

Lower-wage employees, though rarely involved in perpetrating the deception, experience more severe wage losses than their higher-paid colleagues. The Financial Magnitude: The annual cost of fraud reaches trillions of dollars globally, establishing it as among the most expensive corporate crimes in modern financial markets.

Financial statement fraud creates disproportionate damage—despite representing merely 5% of all fraud cases, these schemes generate the highest median losses at $766,000 per incident.

Case Study Evidence: WorldCom’s accounting fraud demonstrates the devastating scope of these schemes, resulting in a $3.8 billion scandal and triggering a $750 million regulatory fine that ranks among the largest penalties in corporate enforcement history.

Cascading Consequences: The destruction extends beyond immediate monetary penalties. Financial statement fraud inflicts substantial losses that eliminate investment opportunities, destroy growth prospects, and frequently culminate in organizational bankruptcy. The reputational damage often exceeds legal penalties in severity, systematically undermining trust and credibility among all stakeholder groups.

When fraudulent activities become public knowledge, customers, partners, and investors immediately lose confidence in the organization’s fundamental integrity.

Detection Challenges: External auditors identify fraud in only a small percentage of cases, highlighting the sophisticated nature of modern deception schemes.

Whistleblower reports represent the primary detection method, accounting for 43% of discovered cases, with 52% of those tips originating from internal employees.These statistics underscore the critical importance of

Essential Knowledge for Stakeholder Protection: Understanding these deceptive practices becomes essential for protecting stakeholder value and avoiding the devastating effects of corporate fraud.

Critical Topics Examined:

- Fraud Techniques and Identification: Common manipulation methods and their distinctive characteristics that signal potential deception:

- Documented Case Studies: Real-world examples demonstrating catastrophic consequences when accounting fraud schemes collapse

- Legal and Regulatory Framework: Securities litigation processes and enforcement actions that follow fraud discovery

- Protective Strategies: Prevention mechanisms that safeguard stakeholder interests and organizational integrity

- Early Warning Systems: Detection methods that identify potential financial statement fraud before catastrophic losses materialize

Financial statement fraud encompasses deliberate misrepresentation within accounting records designed to deceive stakeholders about an organization’s true financial condition.These deceptive practices generate median losses of approximately $800,000 per incident, establishing them as the costliest form of white-collar crime.Organizations typically surrender around 5% of their annual revenues to such fraudulent activities. Understanding these manipulation techniques becomes essential for effective detection and prevention strategies.

Fictitious Revenue Recognition Schemes: The Foundation of Most Securities Cases

Revenue recognition fraud dominates accounting violations, representing 43% of cases investigated by the SEC. Companies engaging in these schemes employ sophisticated methods to artificially inflate reported performance and mislead investors about actual business conditions.

Primary Manipulation Techniques:

- Counterfeit Sales Transactions: Organizations record revenue for sales that never occurred, creating fictitious invoices and corresponding receivables that can never be collected.

- Premature Revenue Recognition: Companies accelerate revenue recording before completing service delivery or product shipment, violating fundamental accounting principles.

- Bill and Hold Arrangements: Customers receive incentives to place oversized orders near reporting periods, allowing companies to recognize revenue while retaining physical custody of products.

- Channel Stuffing Operations: Distributors receive excessive inventory shipments beyond reasonable demand, temporarily boosting quarterly sales figures.

- Timing Manipulation: Future period sales are improperly recorded in current periods to meet analyst expectations.

- Cookie Jar Accounting: Companies improperly defer legitimately earned revenue to create reserves that inflate future earnings during challenging periods. This practice enables organizations to smooth earnings patterns artificially while deceiving stakeholders about actual performance variability.

Asset Overstatement: Inflating Balance Sheet Strength

Asset manipulation enhances reported balance sheet strength, artificially improving crucial financial ratios that investors and creditors rely upon for decision-making. Current assets—particularly accounts receivable and inventory—remain vulnerable to systematic overstatement.

Common Manipulation Methods: Companies frequently refuse to establish appropriate reserves for uncollectible accounts receivable, simultaneously inflating reported assets and earnings. This practice becomes particularly dangerous during economic downturns when collection problems intensify.

Inventory Fraud Schemes: Organizations create phantom inventory through falsified records or maintain inventory at artificially bloated values. Laribee Wire Manufacturing exemplifies this approach, manipulating inventory records to secure $130 million in bank financing using the inflated inventory as collateral.

Depreciation Schedule Abuse: Assets face manipulation through improper depreciation schedules and valuation reserves, resulting in overstated net income and inflated shareholders’ equity. These practices create false impressions of organizational financial strength that mislead potential investors and lenders.

Liability Concealment: Sophisticated Equity Enhancement Schemes

Liability Concealment: Sophisticated Equity Enhancement Schemes

Concealing financial obligations represents an advanced form of accounting fraud that artificially enhances reported equity, assets, and net earnings. This deception frequently involves systematic underreporting or complete omission of legitimate financial obligations from published financial statements.

Systematically Concealed Obligations:

- Unrecorded Debt Arrangements: Financing obligations and loan commitments that remain hidden from financial statement users

- Warranty Liabilities: Product guarantee obligations that companies deliberately understate or omit

- Employee Benefit Obligations: Pension and healthcare liabilities that face systematic manipulation

- Deferred Tax Liabilities: Future tax obligations that companies improperly minimize or conceal

- Legal Settlement Exposure: Litigation risks and settlement obligations that remain undisclosed

Pension Manipulation Schemes:

- Companies exploit the future nature of pension obligations, which require management estimates and assumptions.

- Organizations overstate expected investment returns, artificially creating assets to reduce pension liabilities and enhance reported financial position.

- This understating of legitimate obligations distorts essential financial metrics that investors, creditors, and analysts depend upon for accurate assessment.

Material Omissions: When Silence Becomes Securities Fraud

Generally accepted accounting principles mandate that financial statements include all material information either within primary financials or accompanying footnotes without creating misleading impressions.

- Fraudulent disclosures typically involve calculated omissions concerning liabilities, significant events, management misconduct, accounting changes, and related party transactions.

- Critical Disclosure Failures: Companies must properly disclose contingent liabilities that are probable and subject to reasonable estimation. Failure to record these obligations creates understated liabilities while overstating net income and shareholders’ equity.

- Off-Balance-Sheet Deception: Complex transactions involving off-balance-sheet financing frequently remain undisclosed, effectively concealing the organization’s true financial condition from stakeholders. These arrangements can significantly impact future cash flows and financial flexibility while remaining invisible to investors and creditors.

Financial Statement Fraud: Key Data Visualizations

| Fraud Type | Frequency (% of Cases) | Median Loss |

|---|---|---|

| Asset Misappropriation | 89% | $120,000 |

| Corruption | 48% | $200,000 |

| Financial Statement Fraud | 5% | $766,000 |

Journal Entry Manipulation: The Backbone of Accounting Fraud

Journal entry manipulation forms the operational foundation for most financial statement fraud schemes. The AICPA Practice Alert 2003-02 identifies specific characteristics that distinguish fraudulent entries from legitimate accounting transactions.

Fraudulent Entry Indicators:

- Unusual Account Usage: Entries posted to seldom-used or inappropriate accounts that obscure their true nature and purpose.

- Unauthorized Personnel Activity: Accounting entries created by individuals who typically lack journal entry responsibilities or authority.

- Period-End Manipulation: Last-minute entries near reporting deadlines with minimal supporting documentation or explanation.

- Suspicious Transaction Patterns: Adjustments involving intercompany transfers and entries containing large, round-dollar amounts that suggest artificial manipulation.

Management Override Schemes: Corporate leadership frequently circumvents established internal controls to facilitate fraudulent journal entries. Forensic accountants examine specific manipulation patterns, including unusual account reclassifications, backdated entries, and repetitive use of particular accounts as potential indicators of accounting fraud.

These sophisticated manipulation techniques enable perpetrators to fundamentally transform organizational financial appearance, destroying authentic shareholder value while creating dangerous illusions of financial health and stability.

Primary Detection Methods for Financial Statement Fraud

| Detection Method | Percentage of Cases |

|---|---|

| Whistleblower Tips | 43% |

| Internal Audit | 14% |

| Management Review | 13% |

| By Accident | 7% |

| Account Reconciliation | 5% |

| Document Examination | 4% |

| External Audit | 4% |

| Surveillance/Monitoring | 3% |

Common Financial Statement Fraud Schemes

| Scheme Type | Description | Example |

|---|---|---|

| Fictitious Revenue | Recording non-existent sales | Counterfeit sales transactions, Bill and hold arrangements |

| Premature Revenue Recognition | Recording revenue before earned | Accelerating revenue before service delivery |

| Channel Stuffing | Forcing excess inventory to distributors | Shipping excessive product to boost quarterly sales |

| Asset Overstatement | Inflating asset values | Phantom inventory, inadequate depreciation |

| Liability Concealment | Hiding financial obligations | Unrecorded debt, understated warranty liabilities |

| Material Omissions | Withholding critical information | Undisclosed related party transactions |

| Journal Entry Manipulation | Falsifying accounting records | Last-minute entries near reporting deadlines |

Corporate Scandals: The Devastating Reality of Accounting Fraud

Recent Corporate Frauds: Have exposed severe financial manipulation practices and their catastrophic effects on stakeholders, demonstrating how executives systematically compromise financial integrity for personal gain while meeting market expectations at the expense of investor protection.

Documented Case Studies: These corporate scandals serve as stark reminders of how financial statement fraud triggers devastating securities litigation and destroys entire organizations when sophisticated deception schemes collapse. Below is a table of all the major accounting scandals.

Company | Year | Nature of Fraud | Financial Impact | Key Individuals | Legal/Regulatory Outcome |

|---|---|---|---|---|---|

Enron | 2001 | Off-balance sheet entities used to hide debt and toxic assets; revenue inflation through mark-to-market accounting; material omissions in financial disclosures | $74 billion in shareholder value destroyed; $67 billion in bankruptcy assets | Kenneth Lay (CEO), Jeffrey Skilling (CEO), Andrew Fastow (CFO) | Sarbanes-Oxley Act passage; Skilling sentenced to 24 years (later reduced); Lay convicted but died before sentencing; Arthur Andersen dissolved |

| WorldCom | 2002 | Capitalization of expenses improperly recorded $11 billion in operating expenses as capital expenditures; revenue recognition fraud through inflated revenues | $180 billion in investor losses; $107 billion bankruptcy (largest in US history until Lehman) | Bernard Ebbers (CEO), Scott Sullivan (CFO) | Ebbers sentenced to 25 years; Sullivan sentenced to 5 years after cooperation; $750 million SEC settlement |

Tyco | 2002 | Executive misappropriation of corporate funds; unauthorized bonuses; fraudulent accounting practices; $150 million in personal loans forgiven | $2.92 billion in unauthorized payments to executives; $900 million in shareholder value destruction | Dennis Kozlowski (CEO), Mark Swartz (CFO) | Kozlowski and Swartz sentenced to 8-25 years; $2.92 billion in restitution; $22.5 million SEC settlement |

| HealthSouth | 2003 | Income inflation through fictitious revenue entries; cookie jar reserves manipulation; overstatement of assets by $1.4 billion | $14 billion market value destruction; $2.7 billion accounting fraud | Richard Scrushy (CEO), Weston Smith (CFO), Bill Owens (CFO) | Scrushy acquitted on all 36 counts of accounting fraud (jury decision); later convicted of bribery charges; 5 CFOs received prison sentences; $100 million SEC settlement |

Lehman Brothers | 2008 | Repo 105 transactions to temporarily remove $50 billion of assets from balance sheet; material omissions in risk disclosures; liquidity misrepresentations | $691 billion bankruptcy (largest in US history); global financial crisis catalyst | Richard Fuld (CEO), Erin Callan (CFO) | No criminal charges filed; $90 million settlement for shareholder class action; major regulatory reforms through Dodd-Frank Act |

| Bernie Madoff Investment Securities | 2008 | Ponzi scheme claiming consistent returns through split-strike conversion strategy; fabrication of trading records and account statements | $64.8 billion in paper wealth destroyed; $17.5 billion in actual investor losses | Bernard Madoff (Chairman), Frank DiPascali (CFO) | Madoff sentenced to 150 years; creation of SEC Office of the Whistleblower; $7.2 billion settlement with Jeffry Picower estate |

Satyam Computer Services | 2009 | Cash inflation by $1.5 billion through falsified bank records; revenue overstatement through fictitious invoices; material omissions in disclosures | $2.2 billion in shareholder value destroyed; 77% stock price collapse | Ramalinga Raju (Chairman) | Raju sentenced to 7 years; $125 million SEC settlement; company eventually sold to Tech Mahindra |

| Theranos | 2015 | Material misrepresentations about blood testing technology capabilities; fabricated demonstrations; false revenue projections | $9 billion in valuation destroyed; $700 million in investor funds lost | Elizabeth Holmes (CEO), Ramesh Balwani (COO) | Holmes sentenced to 11.25 years; Balwani sentenced to 13 years; permanent SEC bar for Holmes; $500,000 civil penalty |

| Wells Fargo | 2016 | Account fraud through creation of 3.5 million unauthorized accounts; sales practice misrepresentations; cross-selling misrepresentations | $3 billion in fines and penalties; $70 billion in market capitalization loss | John Stumpf (CEO), Carrie Tolstedt (Head of Community Banking) | Stumpf banned from banking industry with $17.5 million penalty; $3 billion DOJ and SEC settlement; Federal Reserve asset cap imposed |

| Wirecard | 2020 | Balance sheet inflation through fictitious €1.9 billion in cash; revenue fabrication through round-trip transactions; material misrepresentations to auditors | €24 billion market value destroyed; €3.2 billion in debt outstanding at collapse | Markus Braun (CEO), Jan Marsalek (COO) | Braun in custody awaiting trial; Marsalek fugitive status; EY faces significant legal action; German financial regulatory reform |

| FTX | 2022 | Customer fund misappropriation; related party transactions without disclosure; material misrepresentations about reserves; token price manipulation | $8 billion in missing customer funds; $32 billion valuation destroyed | Sam Bankman-Fried (CEO), Caroline Ellison (Alameda CEO), Gary Wang (CTO) | Bankman-Fried sentenced to 25 years; Ellison and Wang pleaded guilty; $8.8 billion in restitution ordered; significant crypto regulatory proposals |

Market Impact After Fraud Exposure

Stock Price Impact After Fraud Disclosure

| Time Period | Average Stock Price Decline |

|---|---|

| Immediate Impact (1 Day) | 5-10% |

| Short-Term Impact (20 Days) | 12.3% |

| Companies with Settlements | 14.6-20.6% |

| Companies Later Cleared | 7.2% |

| Extreme Cases (e.g., Luckin Coffee) | 80%+ |

Legal and Regulatory Consequences: The Multi-Layered Enforcement Framework

Regulatory Enforcement: Companies engaged in financial statement fraud face a sophisticated multi-layered enforcement framework designed to protect investors and maintain market integrity. When fraudulent activities surface, organizations and individuals become subject to devastating legal consequences that extend far beyond simple financial penalties.

Criminal and Civil Liability: These enforcement mechanisms operate simultaneously, creating cascading legal exposure that can destroy both corporate entities and individual careers through coordinated federal prosecution efforts.

SEC Enforcement Actions: The Primary Line of Defense

The Securities and Exchange Commission (SEC): Serves as the primary federal enforcement agency responsible for investigating financial statement fraud and pursuing violators through both civil and administrative proceedings. The Commission wields broad authority to pursue organizations that violate federal securities laws, creating substantial legal exposure for fraudulent entities.

Enforcement Consequences:

- Civil Monetary Penalties: Including disgorgement of ill-gotten gains that strip away fraudulent profits

- Corporate Fines: Against both companies and individual executives involved in deceptive practices

- Officer and Director Bars: Prohibiting individuals from serving in leadership positions at public companies

Intensified Focus: The SEC has dramatically intensified its pursuit of financial statement fraud through increasingly aggressive enforcement actions. Recent enforcement activity demonstrates the agency’s commitment to pursuing major violations, with numerous Accounting and Auditing Enforcement Releases (AAERs) targeting companies and individuals for financial reporting violations.

Criminal Prosecution: The Department of Justice frequently coordinates with SEC investigations, bringing criminal charges against perpetrators of severe financial statement fraud. This dual enforcement approach creates both civil and criminal liability for the same fraudulent conduct.

Securities Class Action Lawsuits: Massive Financial Exposure

Securities Litigation: Companies face catastrophic financial exposure through securities class action lawsuits filed by investor groups who suffered losses due to fraudulent stock manipulation or materially false statements. These representative lawsuits create liability that often exceeds regulatory penalties by substantial margins.

Legal Framework: Securities class actions typically arise under the Securities Act of 1933 and the Securities Exchange Act of 1934. The Private Securities Litigation Reform Act of 1995 (PSLRA) established procedures requiring court appointment of lead plaintiffs who represent entire classes of affected investors.

Record-Breaking Settlements: Law firms specializing in securities litigation have recovered tens of billions of dollars for defrauded investors. Major settlements demonstrate the enormous financial consequences facing fraudulent companies:

- Household International Case: $1.57 billion settlement following 14 years of litigation

- Valeant Pharmaceuticals Case: $1.2 billion settlement for making false statements regarding business performance

- UnitedHealth Case: $895 million recovery plus stock option returns, totaling over $925 million

Financial Impact: These settlements represent only a fraction of total investor losses, as many harmed parties never fully recover their fraudulent investment losses.

THE SECURITIES LITIGATION PROCESS

Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

Motion to Dismiss | Defendants typically file a motion to dismiss the securities class action lawsuits, arguing that the complaint lacks sufficient claims. |

Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase of securities litigation can be extensive. |

Motion for Class Certification | Plaintiffs request that the court to certify the securities litigation as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

Settlement Negotiations and Approval | Most securities litigation cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members in the securities litigation, often by mail, informing them about the terms and how to file a claim. |

Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement of the securities litigation. |

Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Sarbanes-Oxley Act: Transforming Executive Accountability

Fundamental Transformation: The Sarbanes-Oxley Act of 2002 (SOX) fundamentally transformed corporate accountability and financial reporting requirements following major scandals. SOX established stringent regulations specifically designed to prevent accounting fraud and protect investors from deceptive financial practices.

Section 302: Executive Certification Requirements

Personal Accountability: Section 302 mandates that Chief Executive Officers and Chief Financial Officers personally certify the accuracy of financial statements, creating direct executive responsibility for:

• Comprehensive Review: All financial reports for accuracy and completeness

• Material Misstatement Confirmation: Ensuring reports contain no fraudulent or misleading information

• Fair Presentation: Verifying financial statements accurately represent company condition

• Control Effectiveness: Establishing and maintaining effective internal controls over financial reporting

Section 404: Internal Control Reporting

Annual Assessment: Section 404 requires companies to include internal control reports with annual filings, assessing the effectiveness of internal controls over financial reporting.

Severe Penalties: Non-compliance creates substantial legal exposure, including fines up to $5 million and imprisonment for up to 20 years for executives who knowingly certify false reports.

Whistleblower Protection: SOX Section 806 established comprehensive whistleblower protections, encouraging employees to report fraudulent activities without fear of retaliation. This provision proves essential, as whistleblower reports remain the primary method of fraud detection.

Coordinated Enforcement: This regulatory framework creates overlapping enforcement mechanisms that significantly increase the likelihood of detection and prosecution for companies engaging in financial statement fraud.

For convenience, set forth below is a table summary of each of the major laws passed in Sarbanes-Oxley by sequential sections:

SUMMARY TABLE SARBANES-OXLEY PERTINENT SECTIONS

(Sec. 101) | Prohibits Board membership from including more than two certified public accountants. |

(Sec. 302) | instructs the SEC to promulgate requirements that the principal executive officer and principal financial officer certify the following in periodic financial reports: (1) the report does not contain untrue statements or material omissions; (2) the financial statements fairly present, in all material respects, the financial condition and results of operations; and (3) such officers are responsible for internal controls designed to ensure that they receive material information regarding the issuer and consolidated subsidiaries.

Requires such senior corporate officers additionally to certify that they have disclosed to the auditors and audit committee of the board of directors; (1) significant internal control deficiencies; and (2) any fraud that involves staff who have a significant role in the issuer’s internal controls.

States that the rules governing corporate responsibility apply to issuers even if they have reincorporated or transferred their corporate domicile or offices from inside the United States to outside the United States. |

(Sec. 304) | Requires the chief executive officer and chief financial officer to forfeit certain bonuses and compensation received following an accounting restatement that has been triggered by a violation of securities laws. |

(Sec. 306) | Prohibits insider trades during pension fund blackout periods if the equity security was acquired in connection with services as either a director, or employment as an executive officer. States that profits realized from such trades shall inure to and be recoverable by the issuer irrespective of the intent of the parties to the transaction.

Limits actions to recover profits to two years after the date on which such profits were realized. |

(Sec. 308) | Allows civil penalties to be added to a disgorgement fund for the benefit of victims of securities violations if such penalties were obtained by the SEC in addition to an order for disgorgement.

Instructs the SEC to report to Congress on previous procedural actions taken to obtain civil penalties or disgorgement in order to identify where such procedures may be used to provide restitution efficiently for injured investors. |

(Sec. 402) | Prohibits personal loans extended by a corporation to its executives and directors.

Permits certain loans if: (1) made in the ordinary course of the consumer credit business of the issuer; (2) of a type generally made available by the corporation to the public; and (3) made on market terms, or on terms that are no more favorable than those offered to the public.

Permits loans for: (1) home improvement and manufactured homes; (2) consumer credit; (3) an open end credit plan or a charge card; (4) credit extended by a broker or dealer for employee securities trades; and (5) made by an insured depository institution if they are subject to the insider lending restrictions of the Federal Reserve Act. |

(Sec. 404) | Directs the SEC to require by rule that annual reports include an internal control report which: (1) avers management responsibility for maintaining adequate internal control mechanisms for financial reporting; and (2) evaluates the efficacy of such mechanisms. Requires the public accounting firm responsible for the audit report to attest to and report on the assessment made by the issuer.

|

(Sec. 406) | Directs the SEC to issue rules requiring an issuer to disclose whether it has adopted a code of ethics for its senior financial officers, including its principal financial officer or principal accounting officer.

|

(Sec. 408) | Mandates regular, systematic SEC review of periodic disclosures by issuers, including review of an issuer’s financial statement. |

(Sec. 806) | Amends Federal criminal law to prohibit a publicly traded company from retaliating against an employee because of any lawful act by the employee to: (1) assist in an investigation of fraud or other conduct by Federal regulators, Congress, or supervisors; or (2) file or participate in a proceeding relating to fraud against shareholders. |

Financial and Market Fallout

Market Destruction: The immediate aftermath of financial statement fraud exposure triggers devastating financial consequences that cascade throughout entire market sectors. These repercussions extend far beyond regulatory penalties, frequently resulting in permanent destruction of shareholder wealth and organizational collapse.

Stock Price Collapse After Fraud Exposure

Immediate Market Punishment: Market reactions to fraud revelations prove both swift and merciless, as investor confidence evaporates within hours of disclosure.

Statistical Reality:

• Companies face average abnormal stock price drops of 12.3% within just 20 days surrounding fraud announcement

• Firms ultimately paying settlements experience negative cumulative average abnormal returns of 14.6-20.6%

• Even companies later cleared of allegations suffer 7.2% negative returns

Catastrophic Value Destruction: These percentage declines translate into massive financial obliteration. Luckin Coffee’s stock cratered more than 80% in premarket trading following fraud revelations, wiping out nearly $5 billion from its market value in a single trading session. General Electric shares experienced their biggest drop in over a decade (11%) after fraud accusations, reducing market capitalization from $78.8 billion to $69.9 billion within hours.

Reputational Premium: The reputational damage consistently exceeds actual settlement amounts. For companies that eventually settle, market value destruction represents both settlement costs plus reputational loss, reaching $872 million for voluntary settlements and $497 million for ordered settlements. Even acquitted firms face lasting value destruction averaging $384 million.

Reputational and Financial Consequences of Fraud

Impact Assessment of Financial Statement Fraud

| Impact Category | Measurement | Severity |

|---|---|---|

| Stock Value Loss | 12.3-20.6% average decline | High |

| Reputational Damage | Up to 100x direct financial loss | Severe |

| Employee Impact | 50% loss in cumulative wages | Severe |

| Legal Penalties | $750M+ in major cases | High |

| Bankruptcy Risk | 3x higher than non-fraud firms | High |

| Market Recovery | Years to decades, if ever | Variable |

| Customer Trust | Immediate and often permanent loss | Severe |

| Investment Access | Permanently impaired in many cases | High |

Investor Losses in Securities Class Actions

Securities Litigation Consequences: Securities class action lawsuits emerge as inevitable consequences of fraud revelations, creating substantial monetary recoveries for harmed investors while highlighting the massive scale of investor damage.

Recovery Mechanisms:

- Large-Scale Recoveries: Institutional investors have recovered tens of billions of dollars through securities litigation

- Major Settlement Examples: Include $1.57 billion in the Household International case and $1.2 billion in the Valeant Pharmaceuticals case

- Comprehensive Relief: Recoveries typically include both disgorged ill-gotten gains and monetary penalties

- Incomplete Remedies: Harmed investors rarely recover their complete losses. Many victims receive substantially less than they lost, with distribution processes often requiring considerable time. Investors must understand that not all harmed parties will recover any compensation.

Bankruptcy and Delisting from Exchanges

Financial statement fraud frequently culminates in complete business failure through multiple destructive mechanisms:

Delisting Cascade:

- Stock delisting occurs when companies file for bankruptcy or face overwhelming evidence of accounting fraud

- Delisted shares experience additional selling pressure from institutional investors required to hold only exchange-traded securities

- Removal from major indexes like S&P 500 triggers additional selling from index-tracking funds

Historic Collapses: Enron exemplifies this devastating progression. When investigations began, its stock price collapsed from $90.75 at peak to merely $0.26 at bankruptcy. WorldCom filed for bankruptcy with $41 billion in debt after its fraud discovery. These bankruptcies resulted in complete losses for investors who maintained positions through the collapse.

Statistical Correlation: The connection between fraud and bankruptcy proves statistically significant. Research demonstrates companies filing for bankruptcy protection are three times more likely than non-bankrupt companies to face SEC enforcement actions related to financial statement fraud. Companies issued financial statement fraud-related SEC Enforcement Releases were twice as likely to file bankruptcy as those not issued such releases.

Market Rationality: Financial market reactions to fraud represent rational responses to both destroyed trust and fundamental business deterioration, making recovery exceptionally difficult even for organizations that survive the initial devastation.

Financial Statement Fraud Warning Signs

Common Red Flags of Financial Statement Fraud

| Warning Sign Category | Specific Indicators |

|---|---|

| Revenue Anomalies | • Sustained growth during industry decline • Quarter-end revenue spikes • Growing revenues without cash flow increase • Premature revenue recognition |

| Asset Issues | • Inventory overstatement • Improper asset valuation • Inadequate reserves for uncollectible accounts • Improper depreciation schedules |

| Financial Statements |

• Material omissions in disclosures |

| Journal Entries | • Unusual account usage • Period-end manipulation • Entries by unauthorized personnel |

| Control Issues | • Management override of controls • Inadequate segregation of duties |

Reputational Damage and Stakeholder Distrust: The Permanent Scars of Financial Deception

Reputational Destruction: The aftermath of accounting fraud creates profound damage that extends far beyond immediate financial losses and legal penalties. This intangible devastation often outlasts direct financial consequences and proves exponentially more challenging to repair, creating permanent barriers to organizational recovery.

Operational Relationships Collapse Following Fraud Exposure

Trust Evaporates Instantly: When financial statement fraud becomes public knowledge, stakeholders immediately question the fundamental trustworthiness of the organization. This erosion of trust systematically destroys operational relationships through multiple devastating mechanisms:

Customers abandon fraudulent organizations without hesitation, unwilling to maintain relationships with companies of questionable integrity. Corporate supply chains experience immediate disruption as vendors implement stricter payment terms or terminate partnerships entirely. The resulting decline in market share and customer confidence triggers cascading cash flow problems and severe working capital constraints.

Case Study Evidence: Noble Group, a Singaporean commodities trading company, demonstrates the severity of stakeholder abandonment following fraud exposure. After their 2018 accounting scandal, the organization experienced such complete loss of confidence from investors and business partners that they required a complete debt restructuring to survive. This pattern repeats consistently across fraud cases—once trust disappears, business relationships become fundamentally untenable.

Brand Value Destruction: The Hundred-Fold Multiplier Effect

Catastrophic Brand Impact: Research reveals that reputational harm from financial statement fraud can cost organizations up to 100 times more than the direct financial losses from the fraud itself. This destruction of brand equity manifests through systematic damage patterns:

Public perception deteriorates with devastating speed. Organizations that survive fraud face permanently damaged public images that extend beyond the specific company—entire industries or countries may suffer reputational damage through association. The Nigerian money fraud exemplifies this broader impact, damaging not only the perpetrators but tarnishing the brand equity of Nigeria and its entire region.

Executive Reputation Annihilation: High-profile accounting scandals frequently trigger complete leadership destruction, as executives become personally associated with ethical failures. Rebuilding organizational credibility typically demands total leadership transformation—a process that can take decades to complete successfully.

Irreversible Trust Destruction: Organizations invest decades building reputation capital through consistent performance and ethical conduct. Financial statement fraud destroys this accumulated goodwill overnight, often requiring years or decades to rebuild—if recovery proves possible at all.

Investment Capital Becomes Permanently Inaccessible

Investor Skepticism Creates Lasting Barriers: Financial statement fraud creates persistent, often insurmountable challenges in securing future capital for long-term organizational sustainability.

Investors develop inherent, lasting distrust toward organizations with fraud histories. Research demonstrates that stakeholders develop enduring skepticism toward company directors, professional accountants who prepare financial statements, and auditors responsible for verification. This distrust translates into tangible financial consequences including substantially higher capital costs, as lenders demand premium interest rates to offset perceived risks. Organizations face systematic exclusion from strategic alliances and partnerships that might facilitate growth. The difficulty in attracting new investors to replace those lost during fraud revelation often proves insurmountable.

![defecting financial statement fraud used in Internal Controls and Preventing Fraud: A Comprehensive and Instructive Guide [2025]](https://classactionlawyertn.com/wp-content/uploads/2025/10/ezgif-2c6f1646d24274.webp)

Behavioral Psychology Complicates Recovery: A study of pension fund investors revealed that even after fraud revelation, approximately two-thirds of affected investors failed to divest their holdings. This inertia particularly affects younger investors and those of lower socioeconomic status, suggesting certain investor segments remain vulnerable even after accounting fraud becomes public knowledge.

Recovery Demands Extraordinary Transformation: Restoring stakeholder trust requires extraordinary effort focused on demonstrating unwavering commitment to transparency, accountability, and governance reforms. Organizations must fundamentally transform their operations and communications to achieve any hope of rebuilding the trust essential for sustainable operations—a process that many organizations never successfully complete.

Effective Prevention Strategies

Financial Statement Fraud Prevention Framework

| Prevention Area | Key Components | Effectiveness |

|---|---|---|

| Internal Controls | • Segregation of duties • Management certification • Formal reconciliation processes | High |

| Whistleblower Programs | • Anonymous reporting • Retaliation protections • Independent management | High (49% detection rate) |

| Performance Alignment | • Ethical incentive structures • Realistic targets • Long-term metrics | Medium-High |

| Audit Functions | • Professional skepticism • Surprise audits • Targeted testing | Medium-High |

| Board Oversight | • Documented approvals • Independent audit committees • Whistleblower access | High |

Internal Organizational Devastation: The Human Cost of Financial Deception

Organizational Impact: lose approximately 50% of their cumulative annual wages compared to workers at matched non-fraud companies represents merely the beginning of internal devastation that follows accounting fraud exposure. The destruction extends far beyond financial metrics, systematically dismantling company culture, control structures, and leadership credibility.

Employee Displacement and Workforce Destruction

The workforce bears disproportionate consequences for management’s fraudulent decisions. Lower-wage employees—despite bearing no responsibility for perpetrating fraud—experience more severe wage losses than their higher-paid colleagues who may have participated in the schemes. This pattern reveals the cruel irony of financial statement fraud: those least capable of protecting themselves suffer the most devastating losses.

Employee separation rates surge dramatically following fraud exposure. Displaced workers often find themselves forced to abandon not only their companies but entire industries or geographic regions. These outcomes starkly contradict employment patterns during active fraud periods, when companies artificially expand operations to support their deceptive growth narratives. The reversal proves swift and merciless—organizations abruptly shed workers while unwinding their fraudulent expansion, leaving devastated communities in their wake.

Control System Collapse and Ethical Erosion

Internal control structures disintegrate systematically when financial statement fraud takes hold. Management frequently treats control systems as bureaucratic obstacles rather than essential safeguards. This dismissive attitude creates fertile ground where misconduct flourishes without detection or consequence.

The deterioration follows predictable stages that organizational leaders ignore at their peril:

Management Override: Executives routinely circumvent established controls, sending clear signals that ethical standards remain negotiable.

Cultural Contamination: Staff members observe leadership dismissing policies without consequences, correctly perceiving the organization as vulnerable to systematic deception.

System-Wide Breakdown: Control failures cascade throughout operations, creating dangerous gaps in financial reporting mechanisms.

Effective control systems demand organizational cultures that actively value ethics and systematically eliminate fraud opportunities. Without this foundational commitment, controls become worthless documentation rather than substantive protection against fraudulent activities.

Leadership Accountability Failures and Governance Transformation

Senior executives demonstrate willful blindness to misconduct, eagerly accepting increased profitability while studiously avoiding scrutiny of potentially fraudulent activities. This systematic failure of fiduciary responsibility necessitates complete leadership transformation following fraud discovery.

Behavioral science research identifies accountability frameworks that improve ethical decision-making through dual mechanisms:

• Explanation Obligations: Creating requirements for executives to justify actions to regulators and oversight authorities

• Consequence Frameworks: Establishing meaningful penalties when explanations prove inadequate or deceptive

Board oversight becomes absolutely critical in fraud aftermath. Directors must assume active roles in reviewing financial statements, approving operational procedures, and documenting substantial expenditures. Corporate governance reforms typically require implementing robust whistleblower protections and anonymous reporting systems that enable early detection of future misconduct.

The internal organizational damage from financial statement fraud extends far beyond immediate financial losses, creating lasting scars that affect employee welfare, operational integrity, and organizational culture for years following discovery.

Detection and Early Warning Signs: Identifying Financial Statement Fraud Before Catastrophic Losses

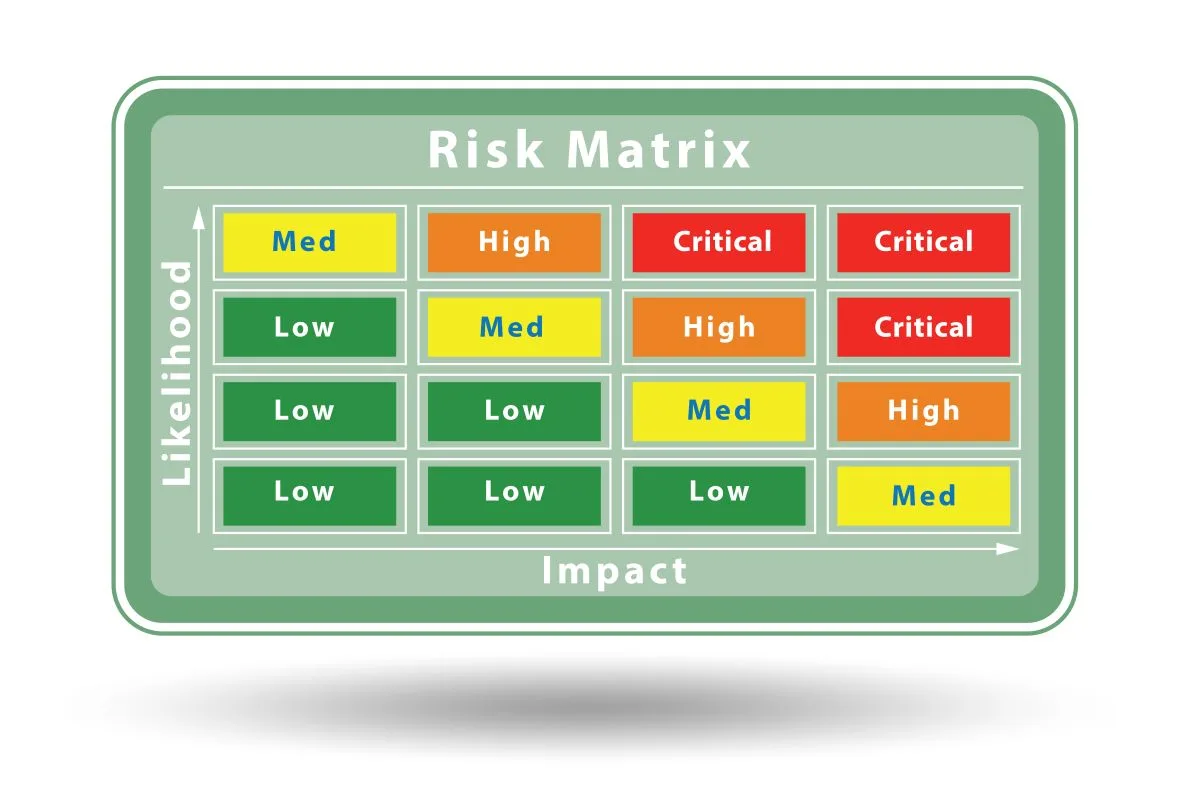

Early Detection: Represents the most powerful defense against financial statement fraud and the devastating securities litigation that follows. Vigilant stakeholders who recognize specific indicators can prevent substantial losses through timely intervention before schemes collapse and trigger widespread damage.

Warning Sign Recognition: Experienced analysts and forensic investigators have identified consistent patterns that precede major corporate scandals and the resulting accounting fraud revelations.

Unusual Revenue Spikes or Margins: Critical Red Flags

Abnormal Financial Patterns: Serve as the first line of defense against sophisticated accounting fraud schemes. Seasoned financial professionals examine these critical warning indicators:

• Sustained Growth During Industry Decline: Consistent sales growth during industry downturns or adverse economic conditions that affect all competitors

• Quarter-End Revenue Manipulation: Significant performance surges concentrated within final reporting periods

• Cash Flow Disconnection: Growing revenues without corresponding increases in actual cash generation

• Unexplained Margin Changes: Gross margin fluctuations lacking legitimate operational explanations

Quantitative Detection Methods: The Beneish Model provides mathematical fraud assessment through eight financial ratios, producing an M-score that signals potential financial statement fraud when values exceed -2.22. This analytical approach enables systematic evaluation of earnings manipulation probability.

Frequent Restatements of Financials: Patterns of Control Weakness

Restatement Trends: Often reveal underlying accounting fraud problems that auditors initially missed. Audit Analytics reports demonstrate that public companies amending annual reports increased by 18% in 2018, with 30 amendments (8%) resulting from financial restatements.

Common Restatement Categories: • Recognition errors affecting lease accounting or compensation reporting • Income statement and balance sheet classification mistakes

• Equity transaction recording errors • Stock issuance valuation discrepancies

Control System Failures: Regular restatements typically accompany material weaknesses in internal controls over financial reporting. Multiple restatements occurring within compressed timeframes create particularly serious concerns about management integrity and regulatory compliance.

Whistleblower Tips and Internal Audit Flags: Primary Detection Sources

Most Effective Detection Method: Whistleblower reports consistently provide the highest-value fraud intelligence. The SEC Whistleblower Program offers monetary incentives ranging from 10-30% of collected enforcement sanctions, creating powerful motivation for internal reporting.

Program Effectiveness Elements: • Tips identifying specific individuals or fraudulent schemes receive investigation priority • Anonymous reporting mechanisms protect employees from management retaliation

• Whistleblowing constitutes the leading fraud detection source across all industries

Internal Audit Red Flags: Include suspicious transactions clustered near reporting periods, unexplained account adjustments, and inconsistent financial disclosures. These indicators enable stakeholders to identify potential financial statement fraud before it escalates into catastrophic damage that destroys shareholder value and triggers costly securities class action lawsuits.

Proactive Intervention: Recognition of these warning signs provides essential protection against the devastating consequences of accounting fraud, enabling timely action that can prevent the widespread stakeholder damage documented throughout this analysis.

Prevention Strategies and Governance Measures: Essential Safeguards Against Securities Litigation

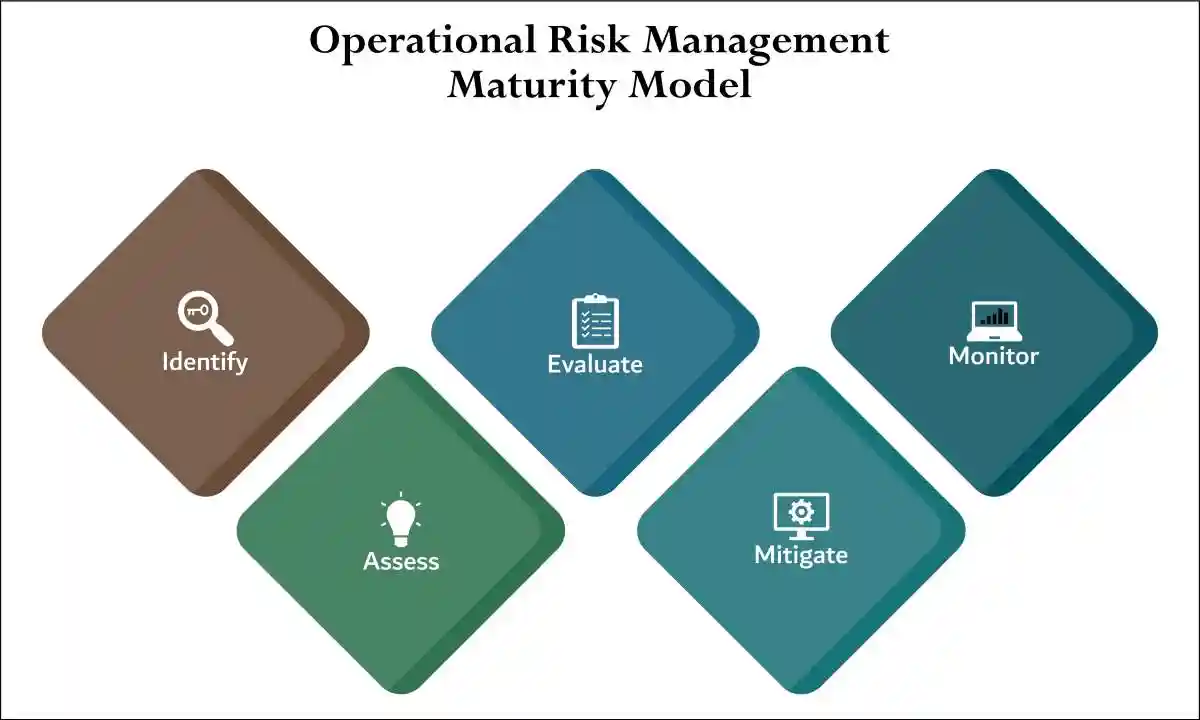

Preventing Financial Statement Fraud: Requires comprehensive strategies across multiple organizational dimensions that work systematically to create robust defenses against the devastating consequences examined throughout this analysis. Organizations that implement these protective measures significantly reduce their exposure to securities litigation and the catastrophic stakeholder losses that follow fraud discovery.

Robust Internal Controls: The Foundation of Fraud Prevention

Strong internal controls represent the primary defense mechanism against accounting fraud and the resulting securities class action lawsuits. Organizations must establish systematic checks and balances ensuring no individual controls all aspects of financial transaction processing.

Essential Control Components:

• Segregation of duties among different employees for record-keeping, authorization, and review activities prevents concentrated control that enables fraud

• Management certification requirements for financial statement accuracy create personal accountability and legal liability for executives

• Formal reconciliation processes for all key accounts provide systematic verification of financial data integrity

These control structures directly address the manipulation techniques discussed earlier—from revenue recognition fraud to journal entry alterations—by creating multiple verification points that make deception significantly more difficult to execute and conceal.

Whistleblower Programs: Early Detection and Prevention

Whistleblower protection systems consistently prove essential for fraud prevention and early detection. Companies with established hotlines detect fraud at significantly higher rates (49%) compared to those without such systems (31%). Given that whistleblower reports account for 43% of fraud discoveries, these programs represent critical safeguards against the types of schemes that devastated companies like Enron and WorldCom.

Program Requirements:

• Anonymous reporting channels that guarantee confidentiality and prohibit retaliation against reporting employees

• Independent third-party management of reports to ensure objectivity and prevent internal suppression

• Federal legal protections that encourage employee disclosures while providing strong safeguards against reprisal

Strategic Performance Alignment: Removing Fraud Incentives

Performance metrics profoundly influence organizational behavior and often create the pressure that leads to financial statement fraud. Compensation structures tied exclusively to financial targets frequently generate the incentives for manipulation seen in cases like HealthSouth and Theranos.

Ethical Alignment Strategies: Organizations must carefully design incentive systems that promote long-term value creation rather than short-term manipulation. This includes eliminating aggressive sales goals that encourage channel stuffing, implementing performance evaluations that incorporate ethical conduct measures, and ensuring executive compensation reflects sustainable business performance.

Independent Audit Functions: Professional Skepticism and Verification

External auditors serve as independent watchdogs applying professional skepticism to financial reporting processes. Effective audit procedures must include comprehensive fraud risk assessments, targeted testing of high-risk areas, and thorough evaluation of internal controls.

Enhanced Audit Protocols: Surprise audits specifically targeting fraud-prone areas maintain accountability and deter manipulation attempts. These procedures directly address the audit failures seen in major scandals where firms like Arthur Andersen failed to detect massive manipulation schemes.

Board Oversight: Establishing Tone and Accountability

Board vigilance remains essential for preventing the governance failures that enable accounting fraud. Directors must establish organizational tone that emphasizes ethical behavior and creates accountability mechanisms.

Governance Framework Requirements:

• Documented approval processes for financial procedures that create audit trails and prevent unauthorized changes

• Independent audit oversight that ensures external verification maintains objectivity

• Clear whistleblower channels that provide direct board access for fraud reporting

Comprehensive Integration: Preventing financial statement fraud demands integrating these protective measures into a systematic governance framework that prioritizes transparency, accountability, and stakeholder protection. Organizations that maintain these safeguards significantly reduce their risk of experiencing the devastating consequences—from stock price collapses to securities litigation—that destroy shareholder value and organizational reputation.

Conclusion

Financial Statement Fraud: Stands as one of the most destructive corporate crimes, costing organizations trillions of dollars annually while creating devastating ripple effects throughout entire stakeholder ecosystems. These accounting fraud schemes generate median losses of $766,000 per case despite representing merely 5% of fraud incidents, far exceeding other forms of corporate misconduct.

Sophisticated Deception Methods: The examination reveals how these schemes systematically undermine corporate integrity and destroy shareholder value through deliberate manipulation techniques:

- Revenue and Asset Manipulation: Deceptive recognition practices and overstatement schemes that artificially inflate company valuations

- Liability Concealment: Systematic hiding of financial obligations that masks true organizational healthRecord Falsification: Manipulation of accounting entries and journal records that transforms financial reality

- Disclosure Misrepresentation: Fraudulent footnote information designed to mislead stakeholders about material facts

Documented Consequences: HealthSouth, Theranos, WorldCom, and Enron demonstrate the catastrophic aftermath following fraud discovery. These cases establish clear patterns—executives who compromise financial integrity face severe penalties while leaving organizational devastation throughout stakeholder communities.

Legal and Market Consequences: Securities class action lawsuits, SEC enforcement actions, and Sarbanes-Oxley compliance failures generate massive financial penalties. Market reactions manifest through immediate stock price collapses, investor losses, and potential bankruptcy proceedings that permanently destroy shareholder value.

Reputational Destruction: Organizations experiencing financial statement fraud suffer profound damage that destroys stakeholder trust. This erosion creates lasting challenges in maintaining customer relationships, preserving brand equity, and attracting future investment capital. Internal damage extends to employee morale, internal controls structures, and leadership credibility.

Detection Remains Critical: Unusual revenue spikes, frequent financial restatements, and internal controls weaknesses serve as potential fraud indicators. Whistleblower tips account for 43% of cases identified, establishing anonymous reporting as the most effective detection mechanism.

Comprehensive Prevention Framework:

- Strong Internal Controls: Robust systems with appropriate segregation of duties that prevent single-person transaction control

- Whistleblower Protection Programs: Anonymous reporting mechanisms that guarantee protection against retaliation

- Ethical Performance Metrics: Incentive structures aligned with ethical behavior rather than exclusively financial targets

- Independent Audit Procedures: Regular external audits combined with surprise reviews targeting high-risk operational areas

- Board Oversight Excellence: Vigilant governance establishing organizational cultures of accountability and transparency

Fundamental Breach of Trust: Financial statement fraud represents not merely regulatory violations but fundamental breaches of trust that threaten organizational survival. Protecting stakeholder value demands unwavering commitment to transparency, ethical behavior, and corporate governance best practices.

Organizational Responsibility: Companies that implement comprehensive safeguards significantly reduce securities litigation exposure while building sustainable value for all stakeholders. The battle against accounting fraud requires collective commitment from management, boards, auditors, and regulatory authorities to maintain market integrity essential for healthy financial systems.

Key Takeaways

Financial statement fraud represents one of the most devastating corporate crimes, causing median losses of $766,000 per case while destroying stakeholder trust and organizational value through sophisticated accounting manipulations.

• Financial statement fraud costs organizations trillions annually, with companies losing 5% of revenues to fraudulent activities despite representing only 5% of fraud cases

• Stock prices collapse an average of 12-20% within days of fraud exposure, often leading to bankruptcy, delisting, and permanent destruction of shareholder value

• Employees at fraud firms lose approximately 50% of cumulative wages compared to non-fraud companies, with lower-wage workers suffering the most severe consequences

• Whistleblower reports detect 43% of fraud cases, making anonymous reporting systems and retaliation protection essential for early detection and prevention

• Prevention requires comprehensive strategies: strong internal controls, ethical performance metrics, regular audits, and board oversight that prioritizes transparency over short-term financial targets

The hidden costs of financial statement fraud extend far beyond legal penalties, creating lasting damage to reputation, stakeholder relationships, and organizational culture that can take decades to repair—if recovery is possible at all.

FREQUENTLY ASKED QUESTIONS

What is financial statement fraud and how does it differ from other types of fraud?

Financial statement fraud is the deliberate misrepresentation of an organization’s financial condition through intentional manipulation of accounting records. Unlike asset misappropriation (theft of company assets) or corruption (abuse of influence for personal gain), financial statement fraud specifically involves falsifying financial reports to deceive investors, creditors, and other stakeholders about the company’s true financial position. While it occurs in only 5% of fraud cases, it causes the highest median losses at $766,000 per incident.

What are the most common types of financial statement fraud schemes?

The most common financial statement fraud schemes include:

- Fictitious revenue recognition (recording non-existent sales)

- Premature revenue recognition (recording revenue before it’s earned)

- Asset overstatement (inflating inventory or other asset values)

- Liability concealment (hiding debt and financial obligations)

- Improper disclosures (omitting material information in footnotes)

- Journal entry manipulation (falsifying accounting records)

- Cookie jar accounting (improperly deferring revenue to create reserves)

- Channel stuffing (forcing excess inventory to distributors to boost sales figures)

Why is financial statement fraud so devastating compared to other fraud types?

Financial statement fraud creates catastrophic damage because it:

- Causes the highest median losses ($766,000) despite occurring in only 5% of fraud cases

- Destroys investor confidence, leading to stock price collapses averaging 12-20%

- Creates massive legal and regulatory liabilities through SEC enforcement and class-action lawsuits

- Damages relationships with customers, suppliers, and other business partners

- Often leads to bankruptcy (fraud companies are 3x more likely to fail)

- Creates reputational damage that can cost 100x more than direct financial losses

- Impacts employees who lose approximately 50% of their cumulative wages

What warning signs might indicate financial statement fraud is occurring?

Key warning signs include:

- Unusual revenue spikes or sustained growth during industry downturns

- Disconnection between revenue growth and cash flow generation

- Unexplained changes in gross margins or profitability metrics

- Frequent restatements of financial reports

- Quarter-end revenue surges or “hockey stick” growth patterns

- Altered or photocopied documents

- Excessive year-end transactions

- Unsupported journal entries

- Unusual account reclassifications

- Complex transactions without clear business purpose

- Management disputes with auditors

Who typically commits financial statement fraud within an organization?

Financial statement fraud typically requires authority over financial reporting systems and processes, making it predominantly an executive-level crime. Most cases involve C-suite executives, particularly CEOs and CFOs, who have both the authority to override controls and the pressure to meet market expectations. This differs from asset misappropriation, which can occur at any level. The concentration of control at executive levels enables sophisticated manipulation that bypasses normal review mechanisms, which is why financial statement fraud schemes often continue for years before discovery.

How does the Sarbanes-Oxley Act help prevent financial statement fraud?

The Sarbanes-Oxley Act of 2002 (SOX) established several crucial protections:

- Section 302 requires CEOs and CFOs to personally certify the accuracy of financial statements, creating direct accountability for false reporting

- Section 404 mandates companies to include internal control reports with annual filings

- It established whistleblower protections, encouraging reporting without fear of retaliation

- It created the Public Company Accounting Oversight Board (PCAOB) to oversee auditors

- It strengthened the independence of audit committees

- It enhanced penalties for securities violations, including fines up to $5 million and imprisonment for up to 20 years for knowingly certifying false reports

These provisions directly address the control failures seen in cases like Enron and WorldCom.

What happens to stock prices when financial statement fraud is discovered?

Stock prices typically collapse immediately following fraud disclosure:

- Companies experience average abnormal stock price drops of 12.3% within just 20 days surrounding fraud announcement

- Firms that ultimately pay settlements experience negative cumulative average abnormal returns of 14.6-20.6%

- Even companies later cleared of allegations suffer 7.2% negative returns

- Extreme cases show even more dramatic declines—Luckin Coffee’s stock fell more than 80% in premarket trading following fraud revelations, wiping out nearly $5 billion in market value in a single day

- These declines reflect both the direct financial impact and the severe loss of market trust

How effective are whistleblower programs in detecting financial statement fraud?

Whistleblower programs are the most effective detection method for financial statement fraud:

- Tips account for 43% of all fraud discoveries, more than three times the rate of any other method

- Organizations with tip hotlines detect fraud at nearly twice the rate (49%) of those without (31%)

- Hotlines identify fraud approximately six months sooner than organizations lacking reporting mechanisms

- Employee tips comprise roughly 50% of all reports, with customers, vendors, and anonymous sources providing the remainder

- Organizations without hotlines experience double the financial losses compared to those with established reporting channels

- The SEC Whistleblower Program offers monetary incentives ranging from 10-30% of collected enforcement sanctions, creating powerful motivation for reporting

What legal consequences do companies and executives face for financial statement fraud?

Legal consequences are severe and multi-layered:

- SEC enforcement actions resulting in disgorgement of ill-gotten gains, civil monetary penalties, and officer/director bars

- Criminal prosecution by the Department of Justice with potential prison sentences

- Securities class action lawsuits that can result in massive settlements (e.g., $1.57 billion in Household International case, $1.2 billion in Valeant Pharmaceuticals)

- Regulatory fines (WorldCom paid $750 million in SEC penalties)

- Personal liability for executives under Sarbanes-Oxley Section 302 certifications

- Potential imprisonment for knowingly certifying false reports (up to 20 years)

- Debarment from serving as officers or directors of public companies

- Professional licenses revocation for accountants and auditors involved

How does financial statement fraud affect employees?

Employees suffer disproportionate consequences:

- Workers at fraudulent firms lose approximately 50% of their cumulative annual wages compared to matched non-fraud companies

- Lower-wage employees—despite bearing no responsibility—experience more severe wage losses than higher-paid colleagues

- Employee separation rates surge dramatically following fraud exposure

- Displaced workers often must abandon not only their companies but entire industries or regions

- During active fraud periods, companies artificially expand operations, creating jobs that vanish when fraud is exposed

- Retirement funds invested in company stock can be decimated, destroying employee savings

- Career damage extends beyond the fraudulent company as association with the scandal can create stigma

What are the most effective internal controls for preventing financial statement fraud?

The most effective controls include:

- Segregation of duties: Ensuring no individual controls all aspects of financial transaction processing

- Management certification requirements: Creating personal accountability for financial statement accuracy

- Regular account reconciliations: Providing systematic verification of financial data integrity

- Surprise audits: Creating unpredictability that serves as a powerful deterrent

- Strong whistleblower programs: Establishing anonymous reporting channels with anti-retaliation protections

- Journal entry controls: Implementing approval processes for all manual entries

- Revenue recognition policies: Establishing clear guidelines for when revenue can be recorded

- Document authentication processes: Verifying the legitimacy of supporting documentation

- Related party transaction monitoring: Identifying and properly disclosing all related party dealings

- Analytics monitoring: Using data analysis to identify unusual patterns or transactions

How do auditors fail to detect financial statement fraud?

Auditors miss fraud for several key reasons:

- Audit procedures focus on sampling rather than comprehensive testing

- Sophisticated fraud schemes deliberately stay below detection thresholds

- Management override of controls circumvents normal verification processes

- Collusion among multiple parties makes concealment more effective

- Auditors may lack industry-specific knowledge needed to identify unusual patterns

- Time and budget constraints limit testing scope

- Inexperienced staff may handle critical audit procedures

- Overreliance on management representations without adequate verification

- Confirmation bias leads auditors to seek evidence supporting existing beliefs

- Close relationships with clients can compromise professional skepticism

- Complex transactions designed specifically to confuse and mislead auditors

What’s the difference between aggressive accounting and fraudulent financial reporting?

The key differences include:

- Intent: Aggressive accounting pushes boundaries while remaining technically within GAAP; fraud deliberately violates accounting principles with intent to deceive

- Materiality: Aggressive accounting typically involves judgment calls on borderline issues; fraud involves material misstatements that would change stakeholder decisions

- Disclosure: Aggressive accounting is usually disclosed in footnotes; fraud involves concealment and misrepresentation

- Legal status: Aggressive accounting may draw regulatory scrutiny but remains legal; fraud violates securities laws

- Documentation: Aggressive accounting has supporting rationales; fraud typically lacks legitimate documentation

- Authorization: Aggressive accounting goes through normal approval channels; fraud often involves management override

The line is crossed when there’s deliberate intent to mislead stakeholders about the company’s true financial condition

How does financial statement fraud differ across industries?

Financial statement fraud manifests differently across industries:

- Healthcare: Improper revenue recognition through upcoding and billing fraud

- Technology: Premature recognition of long-term contract revenue and channel stuffing

- Manufacturing: Inventory overstatement and improper capitalization of expenses

- Financial services: Hidden liabilities, improper loan loss reserves, and off-balance-sheet transactions

- Real estate: Improper asset valuation and project completion percentage manipulation

- Retail: Improper recording of vendor allowances and return reserves

- Energy: Commodity trading manipulation and reserve misstatements

- Telecommunications: Capacity swaps and improper capitalization (as in WorldCom)

Industry-specific knowledge is essential for detecting the unique fraud patterns in each sector.

What role does corporate culture play in enabling financial statement fraud?

Corporate culture is a critical factor:

- Leadership tone sets expectations about ethical behavior versus results at any cost

- Excessive performance pressure creates incentives for manipulation

- Fear-based cultures discourage questioning of suspicious activities

- Reward systems that exclusively value financial targets encourage gaming the system

- Lack of transparency allows deception to flourish undetected

- Absence of ethical frameworks leaves employees without clear guidance

- Lack of consequences for minor violations creates slippery slopes toward major fraud

- Cultural emphasis on appearance over substance encourages maintaining facades

- Siloed organizations prevent holistic views that might reveal inconsistencies

- Cultures of conformity discourage whistleblowing even when fraud is suspected

Strong ethical cultures with clear values, open communication, and consistent accountability significantly reduce fraud risk.

How can data analytics help detect financial statement fraud?

Advanced analytics transforms fraud detection through:

- Analyzing entire transaction populations rather than samples

- Identifying unusual patterns and relationships invisible to manual review

- Detecting timing anomalies in transaction recording

- Revealing unusual journal entry patterns near reporting periods

- Identifying statistical outliers in financial metrics

- Comparing performance patterns against industry benchmarks

- Tracking unusual changes in key ratios over time

- Monitoring for known fraud indicators (Benford’s Law violations, even/round numbers)

- Creating visualization tools that highlight suspicious patterns

- Establishing continuous monitoring rather than periodic reviews

Organizations using proactive data analysis experience at least 50% reduction in both fraud duration and financial impact.

What are the psychological factors that lead executives to commit financial statement fraud?

Key psychological factors include:

- Pressure: Market expectations, compensation incentives, debt covenants, and performance targets

- Rationalization: “Everyone does it,” “It’s temporary,” “No one is really harmed,” “We’ll fix it next quarter”

- Opportunity: Control over financial reporting systems and ability to override controls

- Incremental progression: Starting with small manipulations that gradually expand

- Overconfidence: Belief they won’t be caught or can manage consequences

- Entitlement: Feeling deserving of success regardless of actual performance

- Narcissism: Excessive self-importance and unwillingness to accept failure

- Ethical fading: Framing decisions in business rather than ethical terms

- Fear of loss: Stronger motivation than desire for gain (avoiding missing targets)

- Group dynamics: Diffusion of responsibility across multiple participants

Understanding these factors helps design prevention systems targeting the psychological aspects of fraud.

How long does financial statement fraud typically continue before discovery?

Financial statement fraud typically operates for extended periods:

- The median fraud scheme operates undetected for approximately 12 months before discovery

- Financial statement fraud specifically tends to continue longer, often 2-3 years

- Schemes involving executive participation last 24 months on average

- Organizations without hotlines experience fraud duration approximately 6 months longer than those with reporting systems

- Schemes uncovered by accident have the longest duration, while those detected by tips are discovered more quickly

- Each additional month of fraud duration correlates with approximately 3% increase in financial losses

- The extended timeline allows perpetrators to extract maximum value while organizations remain unaware

- Complex schemes involving off-balance-sheet entities (like Enron) can persist for many years before discovery

This extended duration significantly compounds damage and makes recovery more difficult.

What steps should an organization take immediately after discovering financial statement fraud?

Immediate actions should include:

- Secure evidence: Preserve all relevant documents, emails, and electronic records

- Engage independent investigators: Bring in forensic accountants and legal counsel not involved in the fraud

- Determine scope: Identify affected financial statements and the magnitude of misstatements

- Consider disclosure obligations: Evaluate SEC reporting requirements and investor communications

- Address personnel issues: Remove individuals involved from positions of authority

- Strengthen controls: Implement immediate enhancements to prevent continuing fraud

- Prepare for restatements: Begin the process of correcting financial statements

- Manage stakeholder communications: Develop transparent messaging while considering legal implications

- Cooperate with regulators: Establish proactive communication with relevant authorities

- Document remediation efforts: Create comprehensive records of all corrective actions

The organization’s response significantly affects legal outcomes, stakeholder trust, and recovery prospects.

How can investors protect themselves from financial statement fraud?

Investors can protect themselves by:

- Analyzing cash flow statements, which are harder to manipulate than income statements

- Watching for disconnects between revenue growth and cash from operations

- Being skeptical of companies consistently meeting or barely beating analyst expectations

- Reviewing footnotes carefully, particularly regarding accounting policies and related party transactions

- Comparing financial ratios to industry benchmarks and watching for unusual patterns

- Looking for frequent changes in accounting methods or auditors

- Being wary of complex transactions or organizational structures without clear business purposes

- Examining management integrity and corporate governance practices

- Diversifying investments to limit exposure to any single company

- Responding quickly to red flags rather than waiting for definitive proof of problems

What is financial statement fraud and how does it differ from other types of fraud?

Financial statement fraud is the deliberate misrepresentation of an organization’s financial condition through intentional manipulation of accounting records. Unlike asset misappropriation (theft of company assets) or corruption (abuse of influence for personal gain), financial statement fraud specifically involves falsifying financial reports to deceive investors, creditors, and other stakeholders about the company’s true financial position. While it occurs in only 5% of fraud cases, it causes the highest median losses at $766,000 per incident.

What are the most common types of financial statement fraud schemes?

The most common financial statement fraud schemes include: