Introduction to Misappropriation of Assets Accounting Fraud

Misappropriation of Assets Accounting Fraud

- A form of accounting fraud where an employee or insider steals or misuses a company’s assets for personal gain, which can involve theft of cash or inventory, and can be concealed through false records.

Examples

- Include check and billing schemes, falsified expense reports, and stealing physical inventory or intellectual property.

Direct Impact on Organization

- This type of accounting fraud directly impacts an organization’s financial well-being, unlike fraudulent financial reporting, which manipulates financial statements to deceive investors.

Key Indicators of Fraud

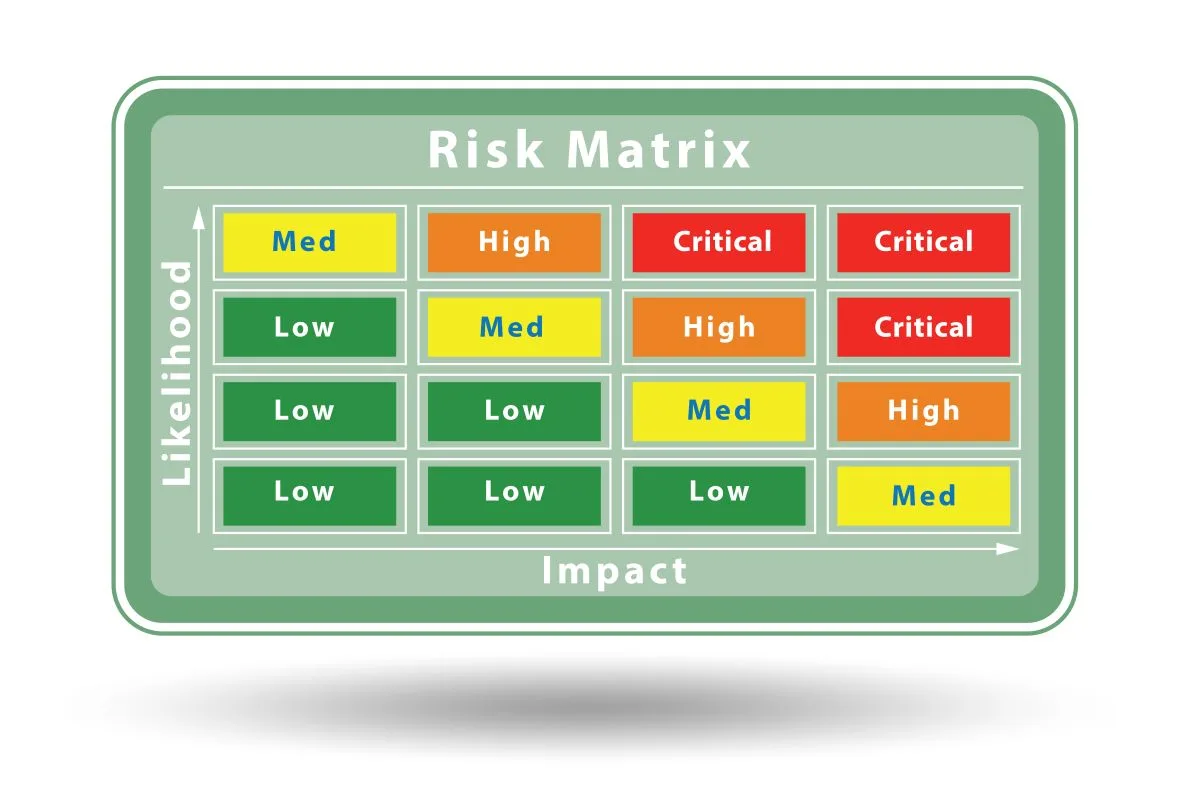

- Inconsistencies in Revenue Recognition: A sudden spike in revenue without a corresponding increase in cash flow or customer base may indicate premature revenue recognition or fictitious sales. Analysts should scrutinize the timing of revenue recognition, especially near the end of reporting periods.

Complex Financial Instruments

- The use of complex financial instruments, such as derivatives or off-balance sheet arrangements, can obscure a company’s true financial position. Transparency in disclosures is essential to mitigate these challenges.

How the Scheme is Accomplished

The Act

- The fraudster commits the initial act, such as writing a fraudulent check or stealing inventory.

The Concealment

- False or misleading records, forged signatures, or other alterations are used to hide the act from detection.

The Conversion

- The stolen cash or assets are converted for personal use.

Types of asset misappropriation

- Skimming: Stealing incoming cash before it is recorded in the accounting system, making it very difficult to detect.

- Cash larceny: Stealing cash after it has been recorded on the company’s books.

- Check tampering: Forging, altering, or intercepting company checks for personal use.

Fraudulent disbursements

- Billing schemes: Submitting false invoices for fictitious goods or services, or for personal purchases.

- Payroll schemes: Manipulating the payroll system by creating “ghost employees” or falsifying hours or wages.

- Expense reimbursement fraud: Filing false or inflated expense reports, such as submitting personal expenses as business costs or claiming expenses that were never incurred.

- Register disbursements: Processing false transactions, like fake refunds or voids, to cover the theft of cash from the register.

Misuse or theft of non-cash assets

- Inventory theft: Stealing physical goods, inventory, or materials from the company.

- Misuse of company assets: Using company property, such as vehicles, equipment, or supplies, for personal use without permission.

- Intellectual property (IP) theft: Stealing confidential information, trade secrets, or business plans.

Red flags of asset misappropriation

- Unexplained accounting discrepancies or missing documents.

- Unauthorized transactions or irregular journal entries.

- Unusual employee behavior, such as a reluctance to take vacations, being overly controlling of processes, or sudden changes in work habits.

- Employees living beyond their means or having unusually close relationships with vendors.

- Complaints from customers or vendors about billing issues.

How to prevent asset misappropriation

- Segregation of duties: No single person should control all aspects of a financial transaction. For example, the person who handles cash should not also be the one who records it.

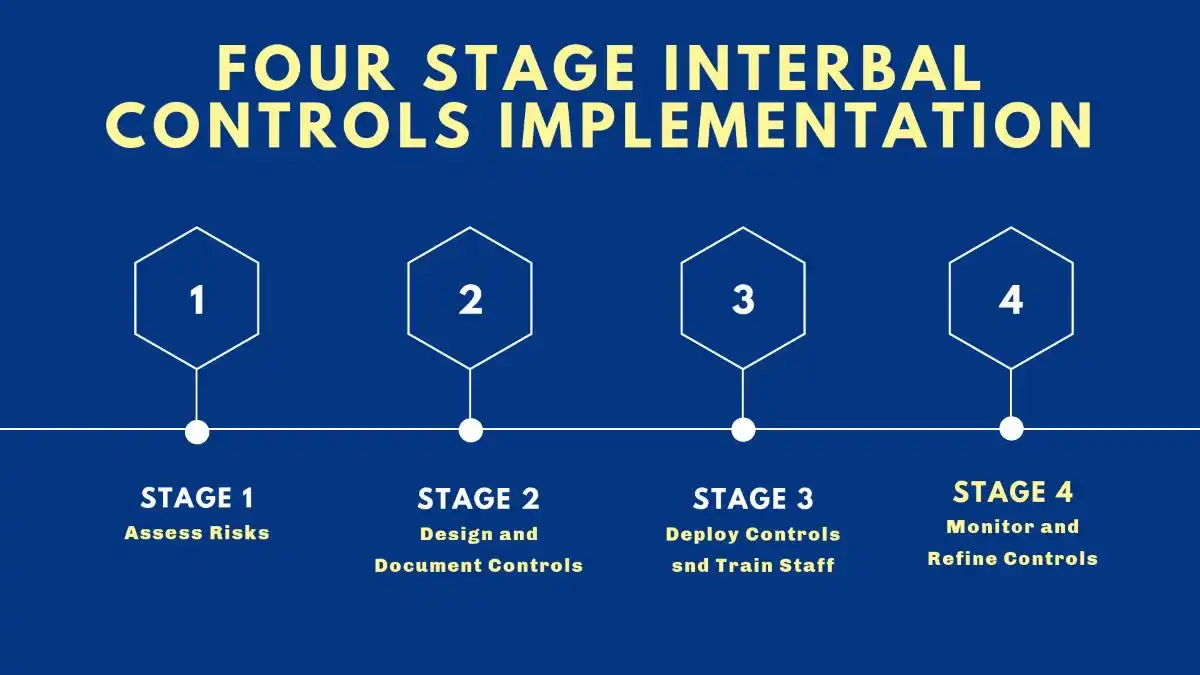

- Internal controls: Implement strong internal control policies and conduct regular internal audits.

- Access controls: Restrict access to sensitive areas and systems, both physical and digital.

The Impact of Asset Misappropriation

- Direct theft of company resources, from cash and inventory to data.

- Causing the financial statements to be not in conformity with Generally Accepted Accounting Principles (GAAP).

- Eroding the financial stability and integrity of the organization.

Detection Methods

- Unexplained shortages or other accounting discrepancies.

- Unauthorized transactions or unusual account activity.

- Falsified or altered records.

- Excessive use of company resources.

- Employees living beyond their means.

Common Financial Statement Fraud Schemes

| Scheme Type | Description | Example |

|---|---|---|

| Fictitious Revenue | Recording non-existent sales | Counterfeit sales transactions, Bill and hold arrangements |

| Premature Revenue Recognition | Recording revenue before earned | Accelerating revenue before service delivery |

| Channel Stuffing | Forcing excess inventory to distributors | Shipping excessive product to boost quarterly sales |

| Asset Overstatement | Inflating asset values | Phantom inventory, inadequate depreciation |

| Liability Concealment | Hiding financial obligations | Unrecorded debt, understated warranty liabilities |

| Material Omissions | Withholding critical information | Undisclosed related party transactions |

| Journal Entry Manipulation | Falsifying accounting records | Last-minute entries near reporting deadlines |

Advanced analytical techniques

- Anomaly detection: Machine learning algorithms can automatically identify transactions that deviate significantly from a baseline of normal behavior.

- Benford’s Law analysis: This statistical test flags unnatural patterns in the first digits of numerical data, such as invoices, which is often a sign of manufactured or falsified numbers.

- Link analysis: Using graph technology, analysts can visualize relationships between different entities (employees, vendors, transactions) to uncover hidden fraud rings or connections.

- Predictive modeling: By analyzing historical fraud cases, machine learning models can be trained to predict the likelihood of a transaction being fraudulent in real time, preventing loss before it happens

Weaknesses in Internal Controls

A strong internal control environment is the first line of defense against fraud, so vulnerabilities in these systems are often exploited by employees seeking to commit theft or misuse company assets.

Segregation of duties

- Incompatible duties involve having responsibility for two or more of the following key functions:

- Authorization: Approving a transaction

- Custody: Handling the physical asset (cash, inventory)

- Record-keeping: Entering the transaction into the accounting system

- Reconciliation: Comparing records to physical assets or bank statements

- Example: If one employee is responsible for receiving cash payments, recording the payment in the accounting system, and reconciling the bank statement, they could easily take cash and cover it up by altering the records.

Management and oversight

- Inadequate supervision: Weak monitoring of employees and business processes, especially in remote locations, allows fraudulent activity to go unnoticed.

- Ineffective management review: If managers do not regularly review and approve transactions, it creates an opportunity for employees to hide fraudulent activity.

- Management override of controls: Senior leaders can bypass established internal control policies to achieve business goals or for personal gain, sending a message that controls can be ignored.

- Poor hiring practices: Inadequate background checks or screening for employees with access to assets can allow individuals with financial or behavioral red flags to be hired.

Physical and information safeguards

- Inadequate physical controls: Not locking up cash or valuable assets, using poorly guarded storage areas, or failing to restrict access to secure areas allows employees to easily steal inventory, equipment, or cash.

- Weak access controls: Insufficient or poorly monitored access to sensitive computer systems, data, and electronic records can lead to information theft or the creation of fraudulent transactions.

Recording and documentation

- Poor record keeping: Missing or inaccurate documentation, such as invoices, receipts, or shipping records, makes it difficult to trace transactions and compromises the audit trail.

- Lack of independent checks: Not performing regular, independent reconciliations of assets and accounts, such as bank statements, can allow discrepancies to go undetected.

- Failure to enforce mandatory vacations: Fraudulent schemes are often discovered when the perpetrator is on vacation and another employee takes over their duties. Without mandatory time off, fraudsters can maintain their schemes for longer periods.

Technology and automation

- Insufficient use of automation: Relying heavily on manual processes creates more opportunities for human error and intentional fraud.

- Failure to update technology: Outdated systems can lack the security features and automated controls needed to protect against modern threats.

- Poorly integrated systems: Disjointed or non-integrated software systems can create gaps that allow fraudulent transactions to slip through undetected

A poor “tone at the top” is a key driver of asset misappropriation because it erodes the ethical foundation of an organization and undermines the control environment. The attitude and actions of senior management and the board of directors set the standard for employee behavior. When that tone is weak, it creates opportunities for fraud through several mechanisms.

Management override of controls

- Rationalizing shortcuts: Managers who feel pressure to meet unrealistic financial targets may override controls under the guise of efficiency or speed. Employees observe this behavior and may interpret it as permission to do the same.

- Influencing accounting staff: High-level managers can coerce accounting staff into making questionable journal entries or transactions to hide theft. Staff may comply out of loyalty, fear of losing their job, or the belief that the manager is more trustworthy than the official policy.

- Hiding theft through authority: Management can use its authority to write off receivables or inflate revenue, which can be a way of concealing asset misappropriation. These overrides are hard to detect because they are performed by individuals with high levels of system access and authority.

Normalization of unethical behavior

- “They’re doing it too”: Employees often take behavioral cues from their superiors. If employees see managers exaggerating expenses, taking company property for personal use, or tolerating minor infractions, they are more likely to justify their own dishonest actions with the rationalization, “upper management is doing it as well”.

- Rewarding results over ethics: If the company culture focuses exclusively on meeting aggressive targets, employees may feel intense pressure to cut corners. A manager’s focus on profits at all costs, with no regard for the process, can motivate employees to manipulate data or engage in fraud to avoid negative consequences.

Erosion of trust and control

- Weakened whistleblower protections: A management team that ignores or retaliates against employees who report misconduct will destroy a company’s ethics hotline and encourage employees to remain silent. Since tips are the most common way fraud is detected, a poor tone effectively disables a key defense.

- Reduced morale and loyalty: Employees in an environment with low morale and a toxic culture feel less loyalty to the company and its goals. This reduces the rationalization barrier to committing fraud, as employees feel less guilt about hurting an organization that they feel has wronged them.

- Disregard for monitoring: When management does not take internal controls seriously, they are less likely to enforce monitoring activities, such as regular reconciliations or surprise audits. This increases the opportunity for fraud to occur and remain undetected.

The Primary Objective of Securities Litigation

- Primary Objective: The primary objective of securities litigation is to hold companies and their executives accountable for fraudulent activities.

- Accountability: Securities litigation causers accountability can deter future misconduct by signaling to other market participants that unethical behavior will be met with legal consequences.

- Compensation: Additionally, securities litigation can result in financial compensation for affected investors, helping to restore some of the losses incurred due to misleading information.

Understanding the Role of Securities Litigation

- Securities Ligation Objective: Understanding the role of securities litigation is vital for both companies and investors.

- Companies: For companies, it underscores the importance of maintaining transparency and compliance with financial regulations.

- Investors For investors, it highlights the need for vigilance and due diligence in assessing the financial health of potential investments. By leveraging securities litigation, stakeholders can help uphold the integrity of financial markets.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss the securities class action lawsuits, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase of securities litigation can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the securities litigation as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the securities litigation is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most securities litigation cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement in the securities litigation is sent to all class members in the securities litigation, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement of the securities litigation. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Prevention strategies

To protect against accounting fraud, companies can implement a range of internal controls and foster an ethical corporate culture.

- Implement strong internal controls: Enforce a strict segregation of duties, so that no single person controls all aspects of a financial transaction, and protect accounting systems with strong access controls.

- Set an ethical “tone at the top”: Management should lead by example, demonstrating ethical behavior and a commitment to integrity and transparency.

- Perform regular audits: Conduct both independent external and internal audits to regularly test financial statements for accuracy and uncover weaknesses in internal controls.

- Establish a whistleblower program: Create a formal, anonymous reporting system for employees to safely report suspicious activities without fear of retaliation.

- Limit performance-based bonuses: Be cautious about tying executive compensation too closely to short-term financial targets, which can incentivize reckless or fraudulent behavior.

Maintaining Financial Integrity

Robust Internal Controls: Requires a robust framework of internal controls and corporate governance practices.

- Ensures Compliance: Companies must ensure that their financial statements are accurate, complete, and compliant with relevant accounting standards.

- Motivation: This involves regular audits, both internal and external, to identify and rectify any discrepancies or irregularities in financial reporting.

REPUTATIONAL AND FINANCIAL CONSEQUENCES OF FRAUD

Impact Assessment of Financial Statement Fraud

| Impact Category | Measurement | Severity |

|---|---|---|

| Stock Value Loss | 12.3-20.6% average decline | High |

| Reputational Damage | Up to 100x direct financial loss | Severe |

| Employee Impact | 50% loss in cumulative wages | Severe |

| Legal Penalties | $750M+ in major cases | High |

| Bankruptcy Risk | 3x higher than non-fraud firms | High |

| Market Recovery | Years to decades, if ever | Variable |

| Customer Trust | Immediate and often permanent loss | Severe |

| Investment Access | Permanently impaired in many cases | High |

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors