Introduction to The Pressure to Beat-the-Street

- The Pressure to Beat-the-Street: The phrase points to the link between the intense pressure on public companies to meet or exceed quarterly earnings expectations and the risk of committing securities fraud, which can trigger securities litigation. Several legal trends in 2025 underscore this dynamic, particularly concerning mega-filings and the high dollar values associated with securities cases.

- Earnings Expectations: To meet or exceed Wall Street analysts’ earnings expectations.

- Increasing Stock Price: This phenomenon is driven by the fact that beating these earnings projections can significantly increase a company’s stock price and the value of executive stock options

- Erosion of Ethical Standards: Creates a toxic environment that can cloud judgment and erode ethical standards

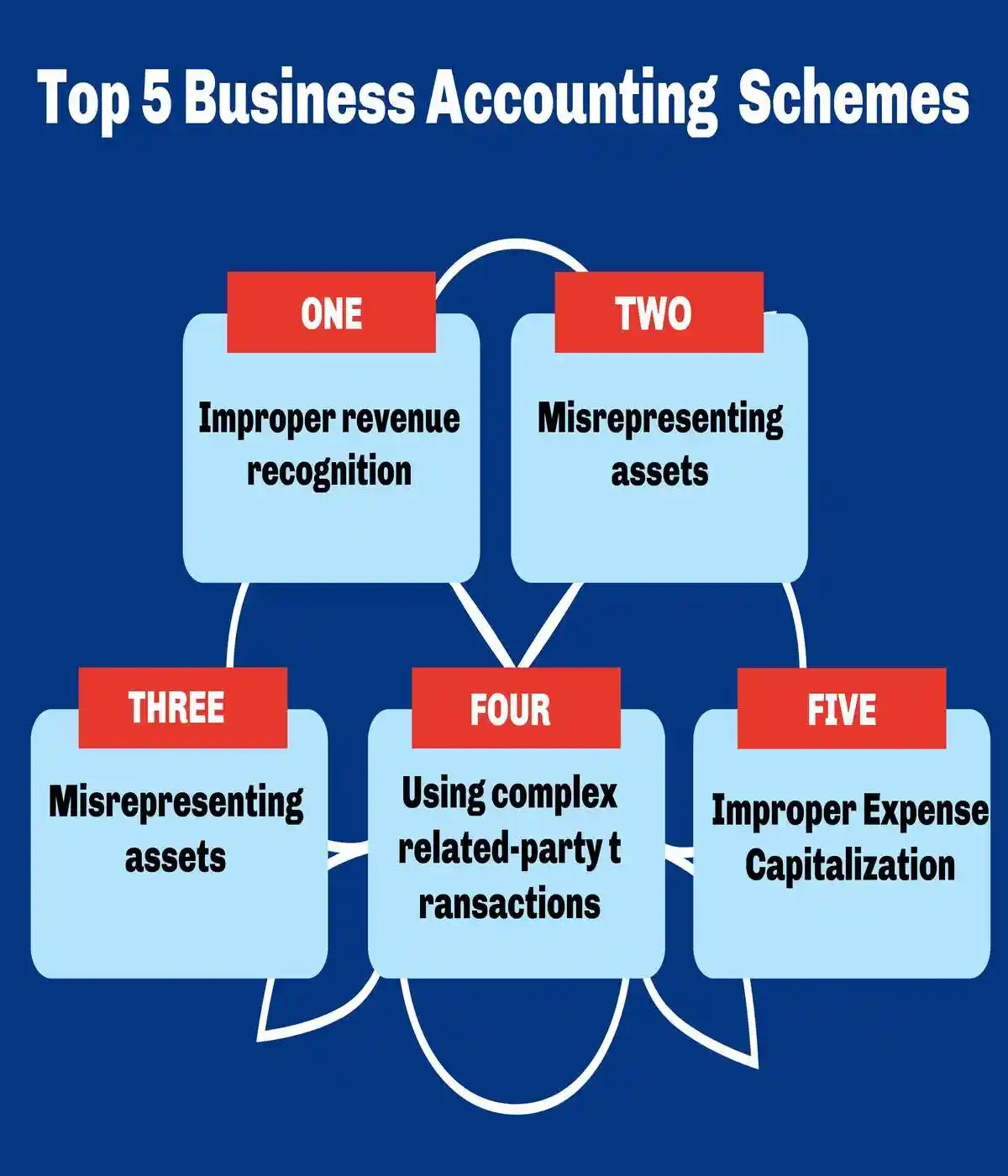

- Complex Accounting Transactions: Creative ways to misrepresent or manipulate information and commit financial statement fraud

- Financial pressure: External market pressures and competitive benchmarking demands from financial analysts, institutional investors, and industry peers create significant organizational stress hat may compel entities within the financial services sector to engage in fraudulent financial reporting practices to maintain perceived market competitiveness and meet stakeholder expectations.

- Compromise Financial Reporting Integrity: External competitive forces and performance measurement standards can inadvertently incentivize organizations to compromise their financial reporting integrity when facing intense scrutiny from market participants who demand consistent performance metrics aligned with industry benchmarks.

The Pressure to Beat-the-Street: A Catalyst for Corporate Misconduct

The pressure to “beat-the-street”: Has emerged as one of the most significant catalysts for securities litigation in modern financial markets.

Toxic Environment: This relentless drive to exceed analysts’ earnings expectations creates a toxic environment where corporate executives may resort to questionable practices to maintain their company’s stock price and market reputation.

Financial pressure: Manifests in multiple ways within corporate structures. When companies consistently face market demands to outperform quarterly projections, management teams often experience intense peer pressure from competitors, investors, and board members.

Erosion of Standards: This environment can lead to a gradual erosion of ethical standards, where the line between aggressive accounting practices and outright financial statement fraud becomes increasingly blurred.

The consequences of this pressure are far-reaching:

- Accounting fraud schemes: Designed to inflate revenue or hide expenses • Manipulation of internal controls to bypass standard oversight mechanisms

- Weak ethical structures: That fail to prevent or detect misconduct • Compromised corporate governance systems that prioritize short-term gains over long-term sustainability

The Core Components of the “Beat-The-Street” Trigger

- Market pressure and analyst influence: Analysts’ quarterly earnings estimates create intense pressure for public companies to deliver results that meet or exceed those expectations. Failure to do so can trigger a stock price decline, disappointing investors and tarnishing management’s reputation.

- Earnings management: In an effort to “beat the Street,” some companies engage in aggressive, or even fraudulent, earnings management techniques. These practices create a misleading picture of the company’s financial health and can involve:

- Improper revenue recognition: Booking sales prematurely or recognizing false revenue to inflate quarterly earnings.

- Adjusting financial metrics: Manipulating non-GAAP (Generally Accepted Accounting Principles) metrics or “pulling in” sales from future quarters to hit a target.

- Inadequate internal controls: Failing to maintain strong accounting controls, which allows fraudulent behavior to occur and go undetected.

- Corrective disclosure: Eventually, the truth behind the manipulated financials is revealed, often in the form of an earnings call, press release, or other public announcement of an investigation.

- Securities class action lawsuits: The corrective disclosure causes the company’s stock price to fall dramatically, harming investors who bought stock at the artificially inflated price. These investors then file securities class-action lawsuits, alleging that the company made materially false or misleading statements in violation of federal securities laws.

Recent trends and ongoing relevance in 2025

- Increased SEC scrutiny of earnings management: The Securities and Exchange Commission (SEC) ccontinues to focus on combating improper earnings management. Through initiatives like its Earnings Per Share (EPS) Initiative, the SEC uses data analytics to identify companies with suspicious patterns of meeting or narrowly exceeding analyst estimates.

- Focus on non-GAAP disclosures: The SEC is actively scrutinizing companies’ use of non-GAAP financial metrics. Recent enforcement actions and staff comments emphasize that these alternative measures must not be misleading.

- Impact of AI-related fraud: In 2025, the pressure to demonstrate growth and innovation in the AI space is creating a new vulnerability. “AI-washing”—overstating a company’s AI capabilities—is emerging as a significant litigation target, with numerous AI-related securities lawsuits filed in the first half of the year.

- Higher settlement values: While filings can vary year to year, the average settlement value for securities class actions has remained high, reinforcing the potential costs for companies that violate securities laws.

- Importance of crisis management: Companies now face the complex task of managing their public communications during crises without creating new misleading statements that could be used against them in a lawsuit.

- Aggressive plaintiffs’ bar: The plaintiff-side securities litigation market is becoming more aggressive, partly fueled by the increased availability of third-party litigation funding. Legal professionals report that plaintiffs’ lawyers are making higher and more aggressive settlement demands, suggesting that they are targeting high-value cases where they can maximize their return on investment. This incentivizes plaintiffs to pursue cases where a company has engaged in fraud to meet earnings targets.

- Rise of AI-related “earnings pressure” litigation: A major trend in 2025 is the surge in AI-related securities litigation. Many of these cases allege “AI washing,” where companies overstate their AI capabilities and prospects to impress investors and prop up stock prices. When the truth is later revealed and earnings fail to meet expectations, the stock price drops, triggering litigation.

- Vans lawsuit against V.F. Corporation: A real-world example from 2025 illustrating the concept involves a lawsuit filed against V.F. Corporation regarding its Vans brand.

- In a May 2025 earnings report, the company announced a drastic decline in Vans’ growth trajectory.

- The stock price dropped significantly following the announcement.

- A subsequent securities lawsuit alleged that management had previously made positive statements about the brand that were misleading, a scenario typical of companies that succumb to earnings pressure.

- Debate on shorter reporting cycles: The link between short-term pressure and litigation risk is not new. The SEC continues to consider moving from quarterly to semiannual reporting, in part to alleviate “managing to the quarter.” Proponents argue that a longer reporting cycle could encourage a more long-term business focus and reduce pressure on managers to manipulate results to beat short-term expectations, which would reduce fraud.

Key aspects of “pressure beat the street”

- Financial engineering: To meet or beat these expectations, managers may engage in “earnings management,” or financial engineering, to artificially create favorable results. Examples include:

- Changing depreciation methods: Companies can alter their depreciation estimates, such as extending the estimated useful life of an asset, to increase reported earnings in the near term.

- Altering accounting estimates: Adjusting estimates for things like residual values can also impact the bottom line.

- The role of analysts: Wall Street analysts provide forecasts that become the benchmark for a company’s success. Public companies are acutely aware of these projections, and many use internal guidance to manage the street’s expectations.

- Crowdsourced pressure: The rise of crowdsourced financial forecasts has created another benchmark for company performance. Studies have found that this can increase, rather than decrease, the pressure on firms to manage their earnings.

- Potential consequences: Intentionally misrepresenting financial results to meet expectations is a serious ethical issue and can harm investors and creditors who rely on accurate financial statements.

- Stress on executives: The constant pressure to outperform is a major source of stress for managers and employees at Wall Street firms and the companies they cover. Traders, for example, face the never-ending demand to generate profits in an ultra-competitive environment.

Peter Lynch and Beating the Street

- “Invest in what you know”: Lynch advocated that individual investors can gain an edge by researching and investing in companies they already understand from their daily lives.

- Do-it-yourself research: He encouraged individual investors to research companies to build a profitable investment portfolio rather than blindly following “experts.”

- Mutual fund strategies: The book also explains Lynch’s methods for devising a successful mutual fund strategy

Connect to regulatory enforcement

- Example: The SEC’s use of data analytics to catch companies that just barely beat analyst estimates can be presented as a way of catching out those who are trying to game the system in an unconscionable manner.

- Describe the fallout: The blog can mention the fines and penalties, framing them not just as legal consequences but as a societal response to behavior that goes beyond acceptable risk-taking.

Examples of Litigation Resulting from Trying to Beat-the-Street

1. Enron

- The Enron scandal remains the quintessential example of how omissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

2. Valeant Pharmaceuticals (now Bausch Health)

- The scandal: Between 2013 and 2015, Valeant (now Bausch Health) pursued a business model that relied on aggressively hiking drug prices and using a secret network of controlled pharmacies to boost sales. These actions inflated the company’s stock price and created the illusion of robust growth. When this deceptive strategy was exposed, the company’s stock plummeted.

- The litigation: In the aftermath, investors filed a securities class action lawsuit, leading to a $1.2 billion settlement, one of the largest ever against a pharmaceutical company. The SEC also charged Valeant and former executives with accounting violations, resulting in penalties and reimbursement of incentive compensation.

3. Under Armour

- The scandal: For several years leading up to 2017, the athletic apparel maker Under Armour used a practice known as “pulling forward” sales from future quarters to meet analysts’ revenue targets. After it became impossible to sustain the practice, the company reported a significant drop in revenue growth in 2017. An SEC investigation revealed that company executives were aware of the practices and misled investors and analysts by attributing revenue growth to other factors.

- The litigation: Following the revelations, Under Armour faced both an SEC enforcement action and a securities class action lawsuit from investors. The company agreed to a $9 million penalty in the SEC case and, in 2024, settled the shareholder suit for a record-setting $434 million.

4. Sunbeam

- The scandal: During the 1990s, Sunbeam, under the leadership of CEO “Chainsaw Al” Dunlap, engaged in fraudulent accounting practices to meet aggressive financial targets. The company created “cookie-jar” reserves in 1996 and used them to artificially boost income in 1997. It also improperly recognized revenue from “bill and hold sales,” where products were billed to customers but not shipped.

- The litigation: The SEC charged Dunlap and other executives with fraud, and Sunbeam eventually filed for bankruptcy. A securities class action led to a $142 million settlement for investors.

5. Livent

- The scandal: The Canadian theatrical company Livent, founded by Garth Drabinsky and Myron Gottlieb, manipulated its books throughout the 1990s to paint a picture of financial success. The accounting scheme involved capitalizing pre-production costs as long-term fixed assets, erasing expenses from the general ledger, and improperly recognizing revenue. The fraud was designed to secure financing and mislead investors about the company’s true performance.

- The litigation: After the fraud was uncovered, Livent collapsed, and Drabinsky and Gottlieb were criminally convicted of fraud. A lawsuit against the company’s auditor, Deloitte & Touche, found them negligent for failing to catch the extensive fraud.

6. Tyco Internationa

- The scandal: Former CEO L. Dennis Kozlowski and CFO Mark Swartz embezzled hundreds of millions of dollars from the company in the early 2000s, using it to fund lavish personal lifestyles. To conceal the theft and maintain the appearance of strong financial performance, they made false and misleading statements to investors.

- The litigation: Kozlowski and Swartz were convicted of grand larceny, securities fraud, and other crimes. Tyco settled shareholder lawsuits for $3 billion, one of the largest securities class action settlements at the time, and its auditor paid an additional $225 million to settle claims.

7. Theranos

The Theranos fraud case represents a modern example of how omissions in financial statementscan intersect with technological claims and investor relations. Founder Elizabeth Holmes was convicted of defrauding investors by making false claims about the company’s blood-testing technology while concealing the true state of its operations.

Key Legal Developments:

- Enhanced scrutiny of private company disclosures to investors

- Stricter due diligence requirementsfor venture capital investments

- Expanded liability for executives making forward-looking statements

8. Waste Management

- Waste Management’s senior executives carried out the scheme through a series of fraudulent accounting manipulations.

- The specific mechanisms of the fraud included:

- Manipulated depreciation: Executives repeatedly extended the useful life of company assets, such as garbage trucks, and assigned arbitrary, excessive salvage values to them. This dramatically reduced the annual depreciation expense and artificially boosted profits.

- Improper capitalization of expenses: Maintenance and repair costs for landfills were improperly classified as capital expenses rather than as current-period expenses. This illegally deferred recognition of these costs, making short-term profits appear larger.

- Concealment through “netting”: Management secretly used one-time gains from asset sales to erase unrelated operating expenses and accounting misstatements. This practice, known as “netting,” concealed the true financial health of the company from investors and auditors.

- Inflated environmental reserves: Executives would intentionally inflate environmental liability reserves during strong financial quarters. Then, during weaker quarters, they would release the excess reserves into earnings to boost results.

- Failure to write off impaired assets: The company neglected to write off the costs of abandoned or impaired landfill projects, instead keeping the costs on the balance sheet to hide their negative financial impact.

The role of Arthur Andersen

- Waste Management’s longtime auditor, Arthur Andersen, was complicit in the fraud.

- The audit firm was aware of Waste Management’s improper accounting practices and documented numerous issues, but it repeatedly approved the company’s financial statements with an “unqualified” or “clean” opinion.

- The relationship was tainted by a conflict of interest. Many of Waste Management’s top financial officers were former Arthur Andersen employees, and Andersen was highly protective of the lucrative relationship with its “crown jewel” client.

- Andersen also received substantial fees for non-audit consulting services, which compromised its independence.

Unraveling and consequences

- Discovery: The scheme was discovered in 1997 after a new CEO took over and ordered a review of the company’s accounting practices. He resigned months later after calling the accounting “spooky”.

- Financial restatement: In 1998, Waste Management announced it would restate its earnings from 1992 through 1997, revealing over $1.7 billion in overstated profits.

- Regulatory action: The Securities and Exchange Commission (SEC) charged Waste Management’s founder and five other top executives with perpetrating the fraud.

- Executives were fired and faced charges of securities fraud. The SEC also fined Arthur Andersen $7 million for its role.

- Stock price collapse: When the fraud was revealed, the company’s stock price plummeted, causing over $6 billion in losses for shareholders.

- Company restructure: Crippled by the scandal, Waste Management was acquired by a smaller competitor, USA Waste Services. The newly merged company kept the Waste Management name but relocated its headquarters and replaced nearly all top executives.

- Legacy for auditors: The scandal was a major contributing factor to the downfall of Arthur Andersen, which was also implicated in the Enron scandal just a few years later.

- Broader reforms: The Waste Management case, alongside other major financial scandals, helped trigger the push for stricter regulations in corporate governance and financial reporting, ultimately leading to the passage of the Sarbanes-Oxley Act in 2002.

9. HealthSouth (2003)

The outcome: When the fraud was uncovered, it led to massive financial restatements, the resignation and eventual conviction of several executives, and a steep drop in the company’s stock price. Although Scrushy was initially acquitted of accounting fraud, he was later convicted of bribery in a separate case.

10. Lehman Brothers (2008)

The outcome: The practice was exposed after the bank filed for bankruptcy in September 2008, triggering a global financial meltdown. While an official investigation exposed the fraudulent practice, no senior executives faced criminal charges.

Common Types of Financial Statement Fraud

- Revenue Recognition Fraud: This occurs when a company recognizes revenue before it is earned, often by recording fictitious sales or inflating sales figures. This practice misleads investors about the company’s actual performance and creates artificial growth patterns that cannot be sustained.

- Expense Manipulation: Companies may understate expenses to present a more favorable profit margin. This can involve delaying expense recognition or misclassifying expenses to enhance reported earnings. Such practices artificially inflate profitability metrics that investors rely upon for decision-making.

- Asset Valuation Fraud: Organizations may inflate the value of their assets, such as inventory or property, to enhance their financial position. This misrepresentation can lead to inflated stock prices and misinformed investment decisions, particularly when assets are significantly overvalued compared to market conditions.

- Improper Disclosures: Failing to disclose significant financial obligations or risks can mislead investors. Companies may omit transactions with related parties or fail to disclose contingent liabilities, creating a false sense of security about the company’s true financial position.

Financial Pressure and Environmental Risk Factors

- Financial pressure represents one of the most significant financial statement fraud risk factors. When companies face intense pressure to meet earnings expectations, maintain stock prices, or comply with debt covenants, management may resort to fraudulent practices. These pressures often manifest through:

- Declining industry conditions that force companies to appear more competitive than they actually are

- Unrealistic analyst expectations that create pressure to meet quarterly targets at any cost

- Debt covenant violations that thtreaten the company’s ability to access capital markets

- Management compensation structures tied heavily to stock performance or earnings metrics

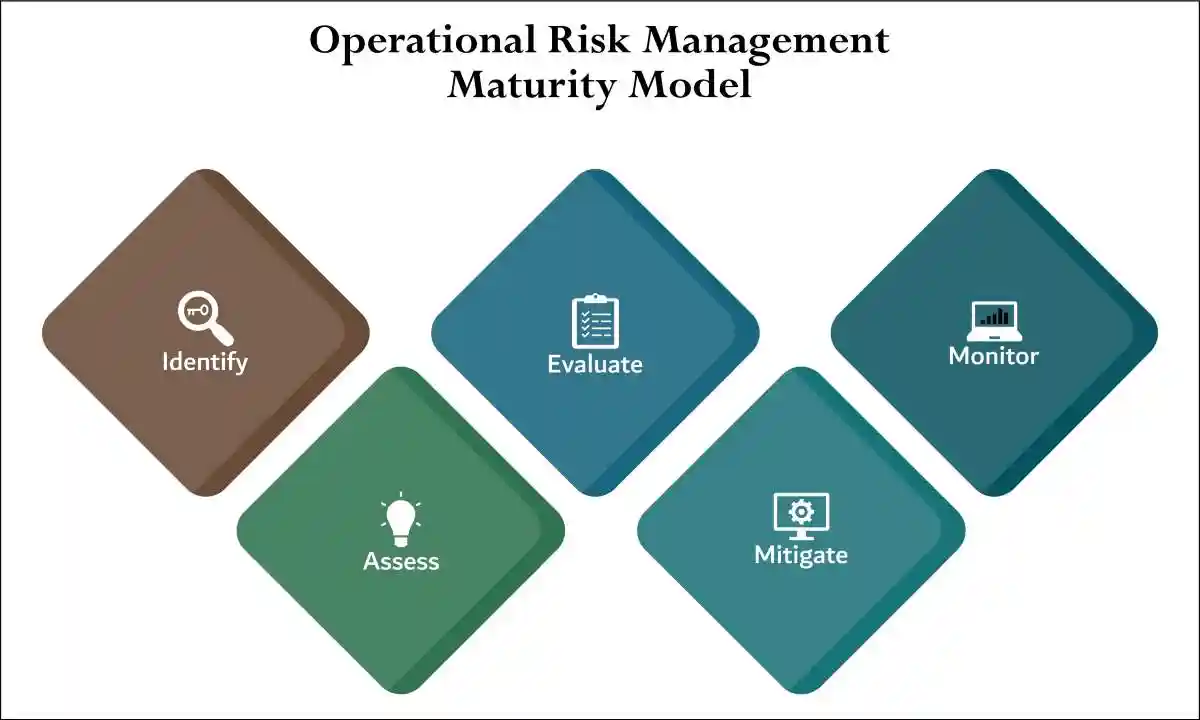

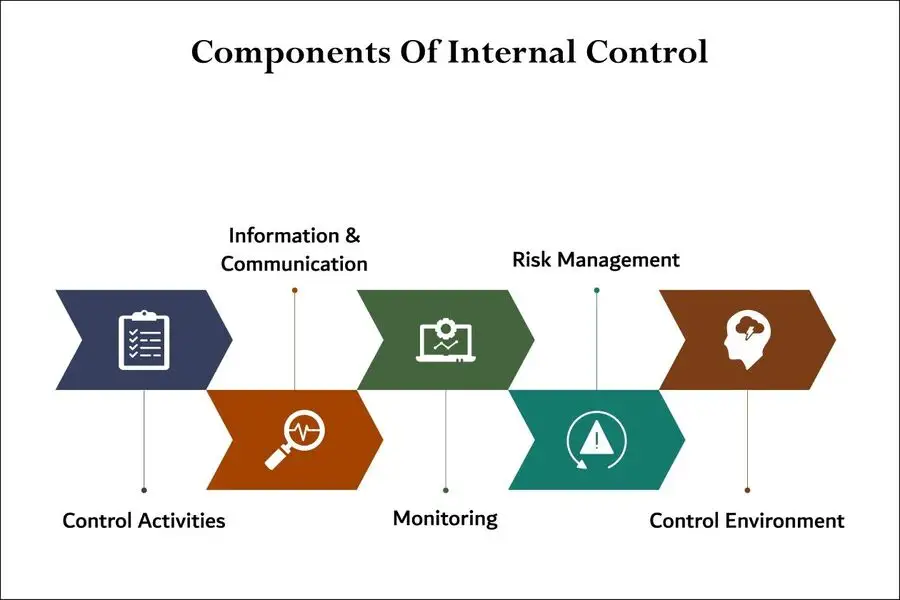

- Weak internal controls create an environment where fraud can flourish undetected. Companies with inadequate oversight mechanisms, poor segregation of duties, or insufficient audit procedures are particularly vulnerable to accounting irregularities.

- Investors should pay attention to management’s discussion of internal control weaknesses, particularly those identified by external auditors.

Advanced Red Flags and Warning Signs

- Another red flag to watch for is aggressive accounting practices, such as recognizing revenue prematurely or delaying expense recognition. These tactics can artificially inflate earnings and create a misleading picture of a company’s financial health. Investors should also scrutinize non-recurring or one-time items, as companies may use these as a means to smooth earnings and hide underlying issues.

- Corporate governance deficiencies often correlate with increased fraud risk. Warning signs include:

- Domineering management that discourages questions or dissent from board members

- Lack of independent directors or audit committee members with insufficient financial expertise

- Frequent changes in key personnel, particularly in financial reporting roles

- Poor communication between management and the board of directors

- A pattern of frequent restatements or amendments to financial statements is also cause for concern, as it may indicate a lack of accuracy or transparency in financial reporting. When companies repeatedly revise their previously filed statements, it suggests either incompetence in financial reporting or deliberate manipulation that was later discovered.

Regulatory Compliance and Legal Consequences

- Regulatory compliance in the realm of internal controls has become increasingly stringent following major corporate scandals of the early 2000s.

- The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of internal control requirements, mandating that public companies establish and maintain adequate internal control over financial reporting.

- Section 404 of the Act specifically requires management to assess and report on the effectiveness of these controls, while external auditors must attest to management’s assessment.

- The regulatory framework extends beyond Sarbanes-Oxley to encompass various industry-specific requirements and international standards.

- Companies operating in multiple jurisdictions must navigate complex webs of regulatory requirements, each with its own internal control implications.

Non-Compliance and Litigation

- Failure to maintain compliance with these requirements can result in regulatory sanctions, fines, and increased scrutiny from oversight bodies.

- Securities fraud litigation often follows in the wake of internal control failures and resulting financial misstatements.

- When investors suffer losses due to reliance on false or misleading financial statements, they may pursue legal remedies through securities fraud class action lawsuits.

- These lawsuits typically allege that companies and their executives violated federal securities laws by making material misrepresentations or omissions in their financial disclosures.

Qualitative Assessment and Management Behavior

- Qualitative Factors: Investors should pay close attention to qualitative factors such as management’s tone and transparency in discussing financial results. Overly optimistic or vague explanations for financial performance can be a warning sign of potential fraud. Management teams that consistently blame external factors for poor performance while taking credit for positive results may be attempting to mask underlying problems.

- Management Trunover: Additionally, high levels of management turnover or frequent changes in auditors may suggest underlying issues within the company. When experienced executives leave suddenly or when companies change audit firms without clear business reasons, investors should investigate further.

- Litigation Landscape: Securities class actions and securities class action lawsuits often emerge when these red flags are ignored and fraud eventually comes to light. The resulting accounting fraud revelations can lead to significant investor losses and lengthy legal proceedings.

![regulatory compliance in black on grey backgroud used in Financial Statement Fraud Risk Factors: An Instructive Investor Guide Litigation [2025]](https://classactionlawyertn.com/wp-content/uploads/2025/09/ezgif-1a786e1f5ca27f.webp)

Protecting Your Investment Portfolio

- Red Flags: By keeping an eye out for these red flags, investors can better protect themselves against the risks of financial statement fraud and make more informed investment choices. The key lies in combining quantitative analysis of financial metrics with qualitative assessment of management behavior and corporate governance practices.

- Maintain Skepticim: Investors should maintain healthy skepticism when reviewing financial statements, particularly when companies report results that seem too good to be true or inconsistent with industry trends. Regulatory compliance monitoring and awareness of SEC regulations can provide additional layers of protection against fraudulent investments.

- Empowering Investors: Understanding these financial statement fraud risk factors empowers investors to identify potential problems before they result in significant losses, ultimately contributing to more robust and transparent capital markets for all participants.

Identifying Financial Statement Fraud Risk Factors

- Understanding financial statement fraud risk factors: Is crucial for investors, auditors, and regulators. Key indicators include:

- Management Characteristics: Companies with aggressive management teams, frequent changes in senior leadership, or executives with questionable ethical backgrounds present elevated fraud risks.

- Financial pressure: On management to meet earnings expectations or debt covenant requirements often serves as a primary motivator for fraudulent activity.

- Industry and Economic Factors: Highly competitive industries, declining market conditions, or regulatory changes can create environments conducive to fraud. Companies operating in volatile sectors may face increased pressure to manipulate financial results to maintain investor confidence.

- Operational Red Flags: Unusual fluctuations in financial ratios, inconsistent cash flow patterns relative to reported earnings, and frequent disputes with auditors or regulatory authorities warrant careful scrutiny. These operational indicators ofte

Securities Class Action Lawsuits: The Legal Response

- Fraudulent Activities: When corporations succumb to beat-the-street pressures and engage in fraudulent activities, securities class action lawsuits become the primary mechanism for investor protection. These securities class actions serve as powerful collective legal remedies that allow investors to seek compensation for losses resulting from corporate misconduct.

- Securities Litigation: The litigation process typically unfolds when a company’s stock price experiences significant volatility following the disclosure of previously hidden information. Investors who purchased securities during periods of alleged fraud can band together to file securities class action lawsuits, seeking to recover their out-of-pocket losses through the legal system.

- Regulatory enforcement: Plays a crucial role in supporting these private actions. The SEC’s investigations often provide the foundation for subsequent class action litigation, as regulatory findings help establish the elements necessary for successful investor claims.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

The Path Forward: Strengthening Market Integrity

- The prevention of corporate scandals and the maintenance of market integrity depend fundamentally on the collective commitment of organizations to implement and maintain effective internal controls.

- This commitment must extend from the board of directors through all levels of management to every employee who participates in processes that could impact financial reporting.

- Investors, regulators, and other stakeholders play crucial roles in supporting this commitment by demanding transparency, holding organizations accountable for control failures, and supporting regulatory frameworks that promote effective internal control practices.

The Continual Need to Adopt and Address Control Challenges

- The ongoing evolution of internal control requirements reflects the dynamic nature of business risks and the continuous need to adapt control systems to address emerging challenges.

- By prioritizing the implementation of robust internal controls, organizations can protect themselves from the devastating consequences of financial misstatements, securities fraud litigation, and loss of stakeholder trust.

- The investment in effective controls represents not merely a compliance obligation but a fundamental business imperative that supports long-term success and market confidence.

- As the business environment continues to evolve, the organizations that thrive will be those that recognize internal controls not as a burden to be minimized but as a competitive advantage that enables

Why Accurate Financial Statements Are Essential for Market Integrity and Investor Protection

- Accurate financial statements serve as the cornerstone of sound business operations and investment decisions, providing stakeholders—including investors, creditors, and regulators—with a transparent view of a company’s financial health, performance, and cash flows.

- These documents represent far more than mere compliance exercises; they form the bedrock upon which the credibility and trustworthiness of an organization are built, directly influencing market confidence and economic stability.

Promoting Long-Term Economic Growth

- The significance of precise financial reporting extends beyond simple transparency.

- When companies maintain rigorous accuracy in their financial statements, they enable stakeholders to make informed decisions about investments and other business engagements.

- This transparency creates a foundation of trust that supports healthy market dynamics and promotes long-term economic growth.

The Devastating Impact of Accounting Fraud on Market Integrity

- Accounting fraud represents a deliberate attempt to deceive stakeholders through the manipulation of financial statements, often resulting in securities frauditigation and severe regulatory consequences.

- This type of fraud typically involves sophisticated schemes designed to inflate revenues, hide expenses, or misrepresent assets and liabilities to present a more favorable financial picture than reality warrants.

- The consequences of accounting fraud extend far beyond the immediate financial impact on investors.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors