Introduction to Accounting Frauds in Financial Reporting

- Securities Class Actions: Accounting frauds in financial reporting triggers securites class action lawsuits filed by investors who have suffered financial losses due to fraudulent activities or false statements by corporations, typically relating to their securities.

- Governing Law: These actions are primarily governed by the pleading standards set forth in the Private Securities Litigation Reform Act (PSLRA) of 1995.

- Highented Pleading Standards: The PSLRA elevated the pleading standards for securities fraud cases, requiring plaintiffs to specify each misleading statement and the reasons why they are misleading.

- Scienter: Plaintiffs must demonstrate that the defendants acted with “scienter,” meaning they had the intent to deceive, manipulate, or defraud.

- Accounting Frauds in Financial Reporting: One of the crucial factors often involved in securities class actions is accounting frauds in financial reporting.

- Misleading Investors: These frauds can significantly mislead investors about the true financial health of a company, leading to distorted stock prices and subsequent financial losses when the truth comes to light.

- Types: Accounting frauds in financial reporting may include practices such as overstating revenues, understating expenses, misrepresenting asset values, or other manipulations that present a more favorable picture of the company’s financial status than is accurate.

- Consequences: When such fraudulent activities are uncovered, they can lead to substantial legal consequences for the company and its executives.

- Detailed Pleadings: The heightened pleading standards introduced by the PSLRA have a direct impact on cases involving accounting frauds in financial reporting. Plaintiffs must provide detailed allegations that clearly show how specific accounting practices were fraudulent and how they misled investors.

- Experts: Plaintiffs often need to rely on expert analysis and insider information to meet these stringent standards.

Navigating the legal complexities

- A significant challenge for plaintiffs is surviving a motion to dismiss, a common legal maneuver by defendants to have the case thrown out before it reaches trial.

- Understanding the specific details and nuances of a securities class action lawsuits is crucial for all stakeholders involved as it sets the stage for future strategic decisions.

Accounting Frauds in Financial Reporting: Triggers to Security Litigation

Understanding what is accounting fraud and recognizing the specific triggers that lead to securities litigation has become essential for investors, corporate executives, and legal professionals. The accounting fraud litigation landscape has evolved dramatically in 2024, with new patterns emerging across various sectors including technology, healthcare, and emerging areas like cryptocurrency and ESG reporting.

This analysis examines the ten most critical triggers that transform accounting irregularities into full-scale securities litigation, providing investors with the knowledge needed to identify potential red flags and protect their investments.

Reporting Requirements For All Public Companies

- For all publicly held company in the U.S., FASB is authorized by the SEC to establish the reporting requirements that all companies must follow.

- Pursuant to FASB, financial statements of public companies must be prepared in accordance with Generally Accepted Accounting Principles (GAAP), with the two foremost reporting being the Form 10-K and the compaines Annual Report.

- These reports require companie to provide investors with all the necessary information regarding a company to make informed decisions about the purchase or sale of securties. The standard structure and requrements as set forth below:

INFORMATION REQUIRED FOR FORM 10-K BY FASB

| Business | Description of the company’s history, key business divisions, product/service offerings, and the market(s) it operates in |

| Risk Factors | Information regarding the most significant risks to the company, such as new market entrants or the threat of disruption |

| Management Discussion and Analysis (MD&A) | Management commentary on the company’s fiscal year performance – will address the positive takeaways, plus the mitigating risk factors |

| Financial Statements | The audited financial statements of the company, namely the income statement, cash flow statement, and balance sheet |

| Supplementary Disclosures | To further clarify the financial statements, a section accompanies the financials with footnotes (i.e. full disclosure) |

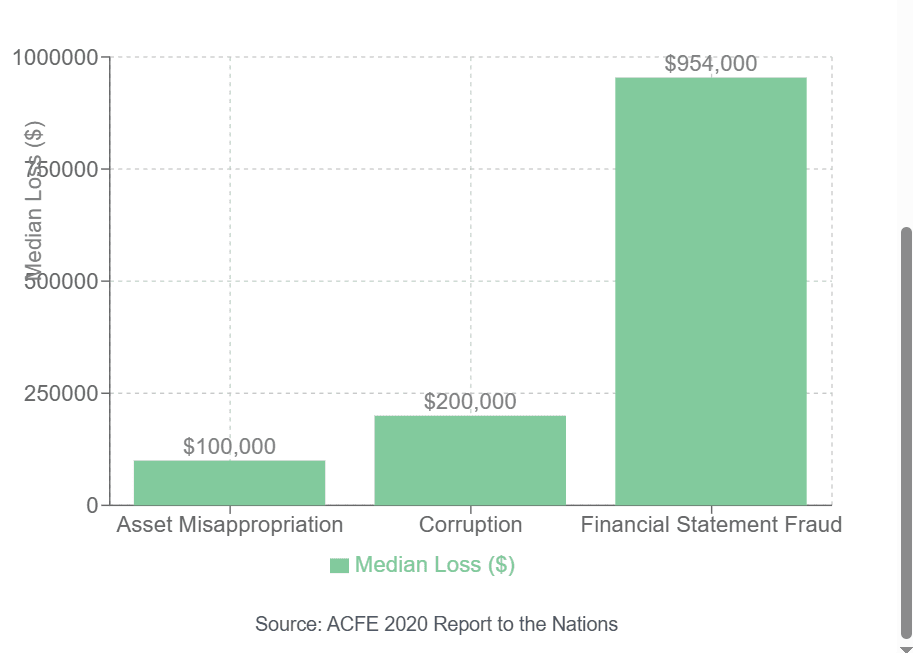

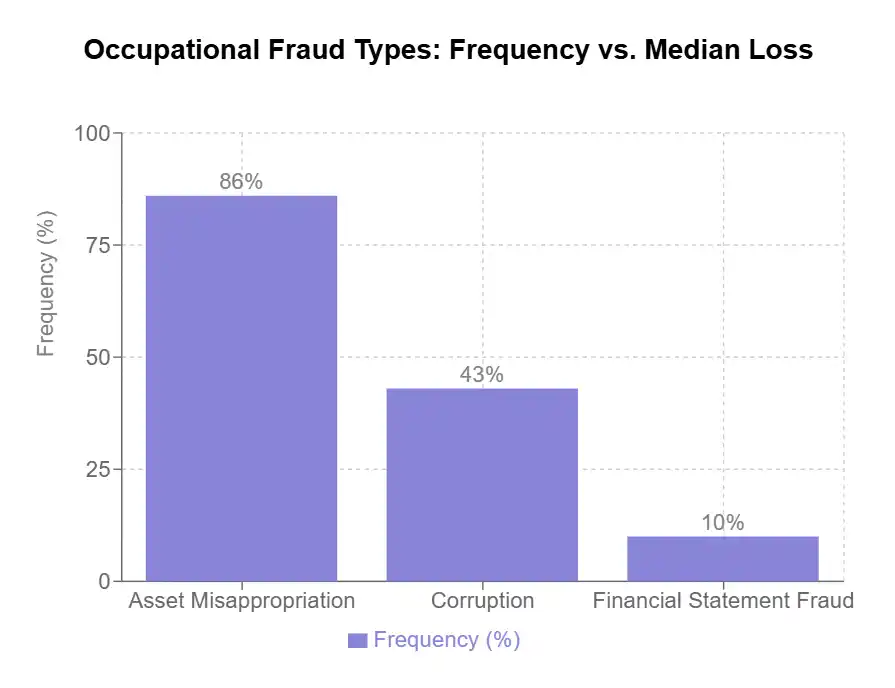

1. Revenue Recognition Manipulation and Premature Revenue Recording

- Revenue manipulation remains the most common trigger for securities litigation in accounting fraud cases. Companies engaging in financial reporting fraud often manipulate revenue recognition to meet analyst expectations or maintain stock prices.

- This practice involves recording revenue before it’s actually earned, inflating sales figures, or creating fictitious transactions.

- The impact of revenue recognition fraud extends far beyond simple accounting errors. When companies prematurely recognize revenue, they create an artificial inflation in their stock price that inevitably leads to corrective disclosures.

- These disclosures typically result in significant stock price drops, triggering securities litigation as investors seek to recover their losses.

- Recent cases have shown that revenue recognition fraud often involves complex schemes spanning multiple quarters or years.

- Companies may use techniques such as “channel stuffing” where they ship excessive products to distributors near quarter-end, or they may engage in “bill and hold” arrangements where revenue is recognized before goods are actually delivered to customers.

- The legal implications are severe. Under the PSLRA, plaintiffs must demonstrate that revenue manipulation caused their economic losses.

- Courts have consistently held that when companies engage in systematic revenue recognition fraud, the resulting stock price inflation creates a strong foundation for securities litigation claims.

- Expert testimony often plays a crucial role in these cases, as forensic accountants analyze the company’s revenue recognition practices and quantify the resulting damages.

- The complexity of modern revenue recognition standards, particularly under FASB Rule ASC 606, has made these cases increasingly technical, requiring specialized expertise to establish the connection between fraudulent practices and investor losses.

ASC 606 Revenue Recognition: The Five-Step Model

Step 1: Identify the Contract with a Customer

- Contract definition: A legally enforceable agreement between two or more parties that creates rights and obligations between them.

- Contract criteria: For revenue recognition purposes, contracts must meet specific criteria including approval by all parties, identifiable rights regarding goods/services, established payment terms, commercial substance, and probable collection of consideration.

- Contract modifications: Any change to the scope or price must be evaluated to determine whether it creates a new contract or modifies the existing agreement.

- Contract combination: Multiple contracts entered into at or near the same time with the same customer may need to be combined if negotiated as a package or if consideration in one contract depends on another.

Step 2: Identify Performance Obligations

- Performance obligation definition: A promise to transfer a distinct good or service to the customer.

- Distinctness test: A good or service is distinct if the customer can benefit from it on its own and the promise is separately identifiable from other promises in the contract.

- Series provision: A series of distinct goods or services that are substantially the same and have the same pattern of transfer can be treated as a single performance obligation.

- Material rights: Options to acquire additional goods or services at a discount may represent separate performance obligations if they provide a material right to the customer.

Step 3: Determine the Transaction Price

- Transaction price definition: The amount of consideration a company expects to be entitled to in exchange for transferring promised goods or services.

- Variable consideration: Estimates of variable amounts (discounts, rebates, penalties, performance bonuses) must be included using either the expected value or most likely amount method.

- Constraint principle: Variable consideration is included only to the extent it is probable that a significant revenue reversal will not occur when uncertainties are resolved.

- Significant financing component: Adjustment required when timing of payment provides customer or entity with significant financing benefit.

- Non-cash consideration: Measured at fair value when determinable, or by reference to standalone selling price.

Step 4: Allocate the Transaction Price

- Allocation objective: Transaction price must be allocated to each performance obligation based on relative standalone selling prices.

- Standalone selling price determination: Best evidence is observable price when sold separately; when not observable, estimation methods include adjusted market assessment, expected cost plus margin, or residual approach.

- Allocation of discounts: Discounts generally allocated proportionately to all performance obligations unless evidence suggests discount relates to specific obligations.

- Allocation of variable consideration: Variable amounts may be allocated entirely to a specific performance obligation if certain criteria are met.

Step 5: Recognize Revenue When Performance Obligations Are Satisfied

- Timing recognition principle: Revenue is recognized when (or as) the entity satisfies a performance obligation by transferring control of the promised good or service to the customer.

- Point in time recognition: Control transfers at a specific moment when the customer has the ability to direct the use of and obtain the remaining benefits from the asset.

- Over time recognition criteria: Revenue recognized over time when one of three criteria is met: customer simultaneously receives and consumes benefits, customer controls asset as it’s created, or asset has no alternative use and entity has enforceable right to payment for performance completed.

- Measurement of progress: For over-time recognition, progress toward complete satisfaction must be measured using either output methods (value transferred) or input methods (resources consumed).

Industry-Specific Implications

- SaaS and subscription businesses: Must recognize revenue monthly over subscription period rather than at initial contract signing, regardless of upfront payment.

- Construction and long-term projects: Often recognize revenue over time using percentage-of-completion or similar methods.

- Multiple-element arrangements: Require careful identification of separate performance obligations and allocation of transaction price

- Variable pricing models: Revenue recognition for usage-based pricing, performance bonuses, or royalties requires specific consideration of constraint principles.

Practical Implementation Considerations

- Contract costs: Incremental costs of obtaining a contract and costs to fulfill a contract may need to be capitalized and amortized.

- Disclosure requirements: Expanded qualitative and quantitative disclosures about contracts, significant judgments, and assets recognized from contract costs.

- Transition methods: Companies could adopt using either full retrospective approach or modified retrospective approach.

- System implications: May require significant changes to accounting systems, internal controls, and business processes to capture and analyze contract data.

Impact on Financial Statements

- Deferred revenue recognition: Advance payments recorded as liabilities until performance obligations are satisfied.

- Unbilled revenue: May recognize revenue before right to bill or receive payment when performance obligations are satisfied.

- Balance sheet presentation: Contract assets and contract liabilities must be presented separately from receivables.

- Income statement volatility: Potentially increased volatility in revenue recognition depending on contract terms and variable consideration constraints.

CIRCUIT COURT APPROACHES TO REVENUE RECOGNITION FRAUD CASES:

| Circuit | Key Precedents | Approach to Revenue Recognition Cases |

|---|---|---|

Second Circuit | In re Wachovia Equity Sec. Litig. (2012) | Requires showing that specific accounting violations were material and that executives had knowledge of improper recognition |

Ninth Circuit | In re Quality Systems, Inc. Sec. Litig. (2017) | Takes more lenient approach on allegations regarding internal revenue reports; focuses on core operations inference |

Eleventh Circuit | FindWhat Investor Grp. v. FindWhat.com (2011) | Emphasizes materiality of revenue misstatements relative to overall company performance |

2. Asset Valuation Fraud and Overstatement of Company Worth

Asset valuation fraud represents another significant trigger for securities litigation, particularly in industries where asset values are subjective or difficult to verify. This type of financial accounting fraud involves deliberately overstating the value of assets on the balance sheet to present a stronger financial position than actually exists.

Common Asset Valuation Fraud Schemes:

- Goodwill impairment manipulation: Failing to recognize impairment of goodwill and intangible assets

- Inventory overvaluation: Inflating inventory quantities or values

- Mark-to-model manipulation: Using unrealistic assumptions in fair value calculations

- Real estate valuation distortion: Employing aggressive capitalization rates

- Development costs capitalization: Improperly capitalizing expenses as assets

Asset Valuation Fraud Litigation Framework

The trigger for securities litigation often occurs when companies are forced to take significant write-downs or impairment charges, revealing that assets were previously overvalued. These corrective disclosures typically result in saubstantial stock price declines, providing the loss causation element necessary for securities litigation.

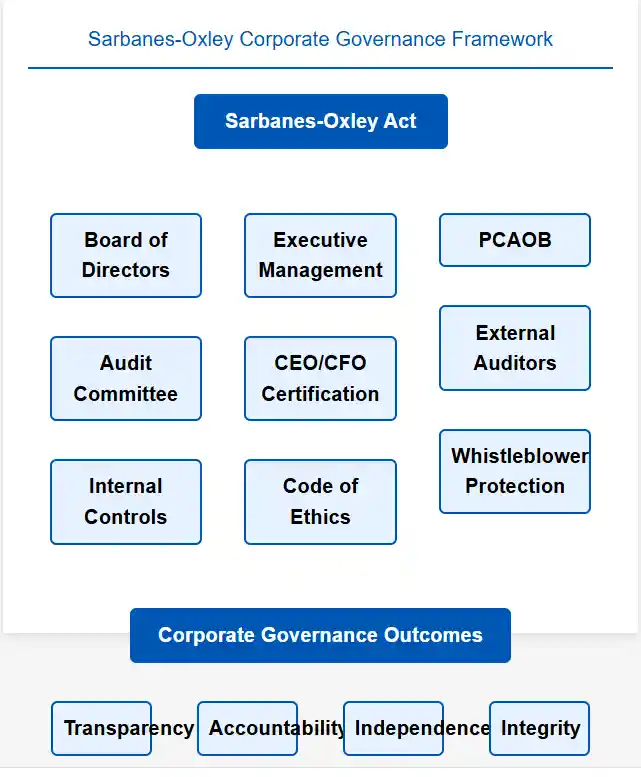

PRE-SARBANES-OXLEY VS. POST-SARBANES-OXLEY ACCOUNTING FRAUD LITIGATION

Element | Pre-SOX Practice | Post-SOX Requirement | Impact on Securities Litigation |

|---|---|---|---|

Internal Controls | Limited disclosure requirements; no certification | Section 404 mandates internal control reporting; CEO/CFO certification | Provides stronger basis for scienter allegations when controls certified as effective |

Whistleblower Protections | Limited protections; no financial incentives | Enhanced protections and financial incentives | Increased whistleblower tips leading to more fraud revelations and subsequent litigation |

Audit Committee Independence | Not required | Fully independent audit committees mandatory | Failure of independent committees to detect fraud strengthens scienter allegations |

Off-Balance Sheet Disclosures | Limited requirements | Enhanced disclosure requirements for off-balance sheet arrangements | Creates clearer basis for liability when such arrangements later cause losses |

Non-GAAP Financial Measures | Limited regulation | Regulation G provides strict requirements | Misuse of non-GAAP measures now a distinct litigation trigger |

Auditor Independence | Weaker standards; consulting allowed | Stricter independence requirements; limited non-audit services | Auditor independence issues increasingly cited in securities complaints |

3. Liability Concealment and Off-Balance Sheet Arrangements

Liability concealment has emerged as a critical trigger for securities litigation, particularly as companies become more creative in structuring their financial obligations. This form of accounting fraud involves hiding debts, contingent liabilities, or other financial obligations from investors and regulators through various off-balance sheet arrangements.

Common Liability Concealment Schemes:

- Special purpose entities (SPEs): Creating separate entities to hold debt

- Operating lease misclassification: Structuring financing leases as operating leases

- Contingent liability omission: Failing to disclose potential legal or environmental liabilities

- Related party transactions: Obscuring liabilities through undisclosed related party arrangements

- Repurchase agreements: Using repos to temporarily remove liabilities from balance sheet

Litigation Triggers for Liability Concealment

When these hidden liabilities are eventually disclosed, the impact on stock prices can be devastating. Investors who believed they were investing in a financially stable company suddenly discover significant undisclosed obligations, leading to immediate stock price corrections and subsequent securities class action lawsuits.

Major Liability Concealment Securities Litigation Cases

| Case | Year | Key Allegations | Outcome |

|---|---|---|---|

In re Enron Corp. Securities Litigation | 2001-2006 | Creation of SPEs to hide debt and inflate profits | $7.2 billion settlement; criminal convictions |

In re Lehman Brothers Securities Litigation | 2008-2012 | Use of Repo 105 transactions to conceal leverage | $616 million settlement |

In re General Electric Co. Securities Litigation | 2018-2021 | Failure to disclose long-term care insurance liabilities | $200 million settlement |

4. ESG Misrepresentation and Sustainability Claims Fraud

ESG-related fraud has become an increasingly significant trigger for securities litigation as investors place greater emphasis on Environmental, Social, and Governance factors. Companies making false or misleading claims about their sustainability practices, environmental impact, or governance structures now face heightened scrutiny and potential litigation.

Common ESG Misrepresentation Schemes:

- Greenwashing: Overstating environmental benefits or sustainability practices

- Carbon accounting manipulation: Misrepresenting emissions data or carbon footprint

- Supply chain misrepresentation: Falsely claiming ethical supply chain practices

- Diversity misstatements: Overstating diversity metrics or inclusion initiatives

- Governance structure misrepresentation: Mischaracterizing board independence or oversight

ESG Securities Litigation Framework

Recent data shows a significant increase in cases challenging ESG disclosures, with investors becoming more sophisticated in identifying discrepancies between companies’ ESG claims and their actual practices. These cases often involve complex technical issues related to carbon accounting, supply chain monitoring, and governance metrics.

5. AI and Technology Capability Exaggeration

The emergence of “AI washing” has created a new category of securities litigation triggers as companies exaggerate their artificial intelligence capabilities to boost their stock prices. This phenomenon, similar to greenwashing claims, involves misrepresentation of AI capabilities and associated risks.

Common AI Misrepresentation Schemes:

- Capability inflation: Claiming AI functionality that does not exist

- Performance exaggeration: Overstating effectiveness of AI systems

- Development timeline distortion: Misrepresenting stage of AI development

- Risk concealment: Hiding known limitations or risks of AI systems

- Integration misrepresentation: Falsely claiming integration of AI into products

Circuit Court Approaches to Technology Misrepresentation Cases

Circuit | Key Precedents | Approach to Technology Misrepresentation |

|---|---|---|

First Circuit | In re Biogen Inc. Securities Litigation (2021) | Applies core operations inference when technology is central to business model |

Second Circuit | In re Synchrony Financial Securities Litigation (2020) | Requires specific allegations about falsity of technical claims |

Ninth Circuit | In re Quality Systems, Inc. Securities Litigation (2017) | More lenient regarding knowledge inference for technology at core of business |

6. Cryptocurrency and Digital Asset Fraud

The cryptocurrency sector has seen a notable rise in litigation involving digital asset companies, with cases primarily focusing on misrepresentation of financial health and risk disclosures. As digital assets become more mainstream, accounting fraud in this sector has become a significant trigger for securities litigation.

Common Cryptocurrency Accounting Fraud Schemes:

- Asset valuation manipulation: Overstating value of digital asset holdings

- Transaction mischaracterization: IEmerging Trends in Securities Litigation

- Custody misrepresentation: Falsely claiming segregation of assets

- Exchange rate manipulation: Using favorable rates for financial reporting

- Stablecoin reserve misrepresentation: Overstating collateral backing stablecoins

Cryptocurrency Securities Litigation Triger Framework

The trigger for litigation often occurs when companies are forced to take significant write-downs on their cryptocurrency holdings or when their actual exposure to digital asset risks is revealed to be much greater than disclosed. These revelations can lead to substantial stock price declines and subsequent investor lawsuits.

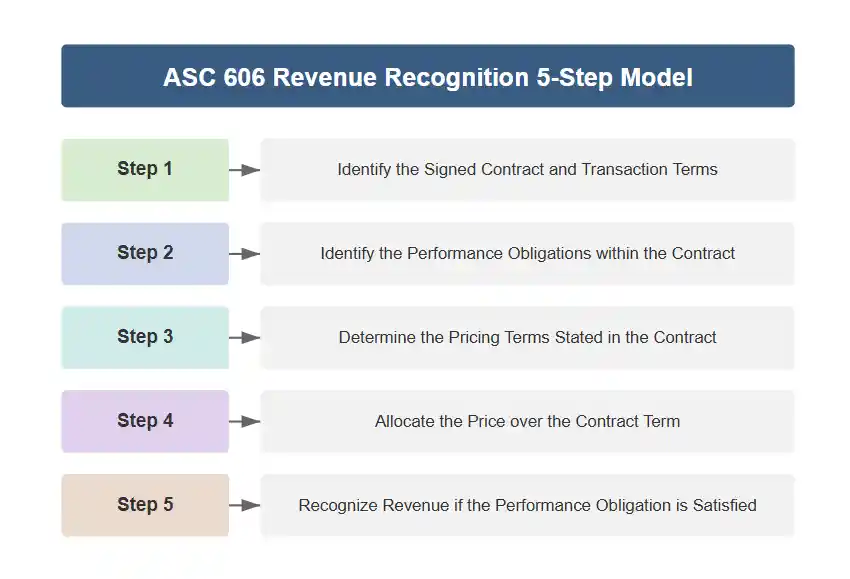

7. Internal Control Failures, Weak Corporate Govenane and Sarbanes-Oxley Violations

Internal control failures along with weak corporate governance framworks represent a critical trigger for securities litigation, particularly when they result in material weaknesses that allow accounting fraud to occur undetected. The Sarbanes-Oxley Act of 2002 requires public companies to maintain effective internal controls over financial reporting, and failures in these systems can lead to significant legal exposure.

Internal Control Failure Litigation Triggers:

- Material weakness over internal control disclosures: Revealing previously undisclosed control deficiencies

- Restatement announcements: Financial restatements indicating control failures

- SOX certification violations: CEO/CFO certifications contradicted by subsequent events

- Audit committee oversight failures: Breakdowns in audit committee supervision

- Whistleblower disclosures: Employee disclosures of intentionally bypassed controls

Sarbanes-Oxley Certification Cases

Case | Year | Key Allegations | Outcome |

|---|---|---|---|

In re HealthSouth Corp. Securities Litigation | 2003-2010 | False SOX certifications despite massive accounting fraud | $804.5 million settlement |

In re Hertz Global Holdings, Inc. Securities Litigation | 2013-2019 | CEO/CFO certified controls while knowing of accounting issues | $23 million settlement |

| In re Signet Jewelers Limited Securities Litigation | 2016-2020 | Executives certified controls while concealing weaknesses | $240 million settlement |

Key Corporate Governance Elements in SOX

Independent Audit Committees: SOX mandated that audit committees must be independent of the board of directors to ensure unbiased financial reporting and internal controls and strengthen corporate governance frameworks..

Executive Certification of Financial Statements: The Act established personal accountability for executives by requiring CEOs and CFOs to personally certify the accuracy of their companies’ financial statements — a provision considered one of the most impactful aspects of SOX.

Enhanced Board Responsibility: The legislation significantly increased the oversight responsibilities of corporate boards, particularly in financial reporting and risk management to enhance corporate governance.

Elimination of Corporate Loans to Executives: SOX restricted loans that public companies could make to their officers and directors, addressing a significant conflict of interest issue.

Standards of Conduct: The Act required corporations to establish a code of ethics for CEOs, CFOs, controllers, and other financial leaders.

“Clawback” Provisions: SOX instituted requirements for CEOs and CFOs to return bonuses or financial incentives based on financial results that were later restated.

Whistleblower Protections: The Act established protections for employees of public companies who report misconduct, encouraging ethical behavior at all levels.

Impact on Corporate Governance

The Sarbanes-Oxley Act fundamentally transformed corporate governance by emphasizing:

Transparency: Mandatory internal controls and comprehensive financial disclosures increased information available to investors.

Accountability: Corporate leaders were required to take personal responsibility for financial statements, with serious consequences for non-compliance.

Independence: The post-SOX world required greater independence in oversight functions, particularly in audit committees with more robust corporate governance.

Integrity: From requiring codes of ethics to protecting whistleblowers, SOX created multiple mechanisms to encourage ethical conduct.

While internal controls over financial reporting received significant attention, the Act’s corporate governance provisions were equally transformative in reshaping how public companies operate and are governed.

8. Whistleblower Disclosures and Employee Disclosures

Whistleblower disclosures have become an increasingly important trigger for securities litigation as employees with inside knowledge of accounting fraud come forward with their concerns. The Dodd-Frank Act strengthened whistleblower protections and created financial incentives for reporting securities violations, leading to more frequent disclosures of corporate misconduct originating from whistleblower diclosures.

Whistleblower Disclosures Litigation Dynamics:

- Insider knowledge: Whistleblowers provide detailed evidence of fraudulent schemes

- Management knowledge: Disclosures often demonstrate executive awareness of issues

- Temporal proximity: Stock price reactions to whistleblower revelations establish loss causation

- Credibility factors: Former executives or accounting personnel carry particular weight

- Retaliation elements: Attempted suppression of whistleblowers strengthens scienter allegations

SEC WHISTLEBLOWER PROGRAM STATISTICS

| Year | Whistleblower Tips | Awards Issued | Total Award Amount |

|---|---|---|---|

2020 | 6,911 | 39 | $175 million |

2021 | 12,210 | 108 | $564 million |

| 2022 | 12,322 | 103 | $229 million |

2023 | 18,354 | 68 | $590 million |

2024 (YTD) | 12,689 | 42 | $212 million |

9. Regulatory Investigations and SEC Enforcement Actions

SEC enforcement actions often serve as catalysts for private securities litigation, as regulatory investigations reveal evidence of corporate misconduct that supports investor claims. When SEC enforcement actions are announced related to accounting fraud, it typically triggers immediate stock price reactions and subsequent litigation.

SEC Enforcement Actions as Litigation Catalyst:

- Investigation announcements: Disclosure of SEC investigations often triggers stock price drops

- Wells notices: Formal indication of potential enforcement action strengthens litigation claims

- Settlement agreements: SEC findings provide evidentiary support for private securities litigation

- Individual charges: Actions against executives demonstrate scienter elements

- Parallel proceedings: Criminal investigations significantly impact private litigation dynamics

Accounting Fraud SEC Enforcement TrendsThe SEC’s enforcement division has increased investigations by 40% in 2024, focusing particularly on accounting fraud, disclosure violations, and emerging areas like ESG and cryptocurrency. These investigations often uncover evidence that supports private litigation claims.

10. Market Reaction Patterns and Corrective Disclosures

Market reaction patterns following corrective disclosures provide the final critical element that transforms accounting irregularities into securities litigation. The magnitude and timing of stock price reactions to fraud revelations often determine whether investors have viable claims for damages.

Corrective Disclosure Litigation Elements:

- Price impact evidence: Statistical significance of stock price reactions

- Market efficiency factors: Demonstration of efficient market absorption of information

- Confounding factors analysis: Isolation of fraud-related impact from other market forces

- Leakage patterns: Gradual revelation of truth through multiple partial disclosures

- Disaggregation requirements: Separating fraud-related losses from industry or market movements

CIRCUIT COURT STANDARDS FOR CORRECTIVE DISCLOSURES

Circuit | Key Precedents | Corrective Disclosure Requirements |

|---|---|---|

Second Circuit | Lentell v. Merrill Lynch & Co. (2005) | Disclosure must reveal the falsity of the prior statement rather than the subject matter |

Fifth Circuit | Public Employees’ Retirement System of Mississippi v. Amedisys (2014) | Requires disclosure that specifically reveals fraudulent practices, not just negative information |

Seventh Circuit | Glickenhaus & Co. v. Household Int’l, Inc. (2015) | Accepts partial corrective disclosures that gradually reveal the truth |

Ninth Circuit | Lloyd v. CVB Financial Corp. (2016) | Allows government investigations to serve as corrective disclosures without admitting wrongdoing |

Eleventh Circuit | FindWhat Investor Group v. FindWhat.com (2011) | Requires showing that disclosure revealed “some aspect” of the defendant’s prior misrepresentation |

Conclusion: Protecting Investors Through Legal Accountability

The landscape of accounting fraud litigation continues to evolve as new technologies, business models, and regulatory requirements create fresh opportunities for corporate misconduct. Understanding these ten critical triggers helps investors identify potential red flags and take appropriate action to protect their investments.

Multiple accounting frauds have triggered major class action lawsuits this year, with settlement values reaching record levels. The consequences of accounting fraud extend far beyond financial penalties, affecting market confidence, investor trust, and corporate reputations. Companies that engage in fraudulent practices face not only regulatory enforcement but also significant civil liability to harmed investors.

For investors who have suffered losses due to accounting fraud, understanding these triggers provides valuable insight into potential legal remedies. Securities litigation serves as a crucial mechanism for holding companies accountable and providing compensation to investors who have been harmed by corporate misconduct.

The role of accounting fraud litigation in maintaining market integrity cannot be overstated. By providing legal remedies for investors and imposing significant costs on companies that engage in fraudulent practices, securities litigation helps deter corporate misconduct and promotes transparency in financial reporting.

If you suffered substantial losses due to accounting fraud or have questions about securities litigation, or general questions about your rights as a shareholder, please contact attorney Timothy L. Miles for a free case evaluation. Our firm specializes in representing investors in securities class actions and has extensive experience in accounting fraud cases.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about accounting frauds in financial reporting, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors