Introduction to Whistleblower Lawsuits and Programs

- Whistleblower Lawsuits and Programs: An Authoritative Step-by-Step Consumer Guide [2025] : Whistleblower lawsuits in the United States operate under several federal and state laws, most notably the False Claims Act (FCA), which empowers private citizens to sue on behalf of the government for fraud. Recent and proposed developments aim to strengthen whistleblower protections and encourage reporting, particularly through new Department of Justice (DOJ) and ongoing SEC programs.

- False Claims Act (FCA): The most common law used for whistleblower lawsuits, the FCA allows individuals (known as “relators”) with evidence of fraud against the federal government to file a qui tam lawsuit.

- Dodd-Frank Act: Enacted after the 2008 financial crisis, this law established whistleblower programs at the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

- Whistleblower Protection Act (WPA): Primarily protects federal employees from retaliation for disclosing waste, fraud, and abuse in the government.

- Sarbanes-Oxley Act of 2002 (SOX): Protects employees of publicly traded companies who report accounting or securities fraud.

- Retaliation protection: Numerous laws protect whistleblowers from retaliation, such as demotion, termination, or harassment.

- Legal representation: An attorney is required to file a qui tam lawsuit under the FCA, and legal counsel is highly recommended for other claims, as attorneys can maximize potential rewards and protect against retaliation.

- Confidentiality vs. anonymity: While some programs allow anonymous filing, your identity may be revealed if a case proceeds to litigation.

The Critical Foundation of Whistleblower Protection: Safeguarding Truth in Corporate America

Whistleblower protection: Represents far more than a regulatory requirement—it constitutes the bedrock of corporate accountability and market integrity. Without robust protections for whistleblowers who courageously expose wrongdoing, the financial markets would operate in a dangerous vacuum where fraud, misconduct, and regulatory violations could flourish unchecked.

Consequences: The consequences of such an environment extend beyond immediate financial losses to encompass systemic threats to public safety, environmental protection, and the fundamental trust that underpins our economic system.

Importance: The importance of whistleblower protection becomes starkly evident when examining the potential repercussions faced by those who speak truth to power. Whistleblower retaliation can manifest in devastating ways: termination, blacklisting within industries, professional ostracism, and even personal safety threats.

Legal Protection: These risks create a chilling effect that can silence potential whistleblowers, allowing unethical practices to persist and multiply. Legal protections serve as essential safeguards, providing both defensive mechanisms against retaliation and positive incentives for individuals to report misconduct.

The Comprehensive Legal Framework: Multiple Layers of Protection

The Sarbanes-Oxley Act: Foundation of Modern Whistleblower Protection

The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of whistleblower protections in corporate America. Born from the ashes of corporate scandals like Enron and WorldCom, this landmark legislation established comprehensive protections for employees who report securities violations, mail fraud, bank fraud, or violations of SEC rules and regulations.

Key provisions of the Sarbanes-Oxley Act include:

- Anti-retaliation protections that prohibit employers from taking adverse actions against whistleblowers

- Confidentiality requirements for companies receiving whistleblower complaints

- Criminal penalties for executives who retaliate against whistleblowers, including fines and imprisonment up to 10 years

- Restoration remedies for whistleblowers who face retaliation, including reinstatement, back pay, and compensation for litigation costs

The Act’s impact extends beyond individual protection to create systemic change in corporate governance. Companies must now establish whistleblower programs with clear reporting mechanisms and investigation procedures, fostering environments where ethical concerns can be raised without fear of reprisal.

WHISTLEBLOWER PROGRAMS: PURPOSE, PROTECTIONS, REWARD, ELIGIBILITY & REPORTING

Program | Purpose & Scope | Legal Protections | Reward Structure | Eligibility Criteria | Reporting Process |

SEC Whistleblower Program | Detects securities violations, accounting fraud, and investment adviser misconduct affecting public companies and financial markets | Anti-retaliation provisions under Dodd-Frank Act; job reinstatement, back pay, and compensatory damages | 10-30% of monetary sanctions exceeding $1 million | Original information about securities law violations; voluntary submission required | Submit Form TCR online through SEC website or mail; attorney representation recommended |

CFTC Whistleblower Program | Identifies derivatives fraud, manipulation of commodity markets, and violations of the Commodity Exchange Act | Employment protection against retaliation; remedies include reinstatement and double back pay | 10-30% of monetary sanctions over $1 million | Original information about CFTC violations; must be voluntarily provided | File Form TCR with CFTC; can submit anonymously through attorney |

IRS Whistleblower Program | Exposes tax evasion, unreported income, and fraudulent tax schemes by individuals and corporations | Limited anti-retaliation protections; primarily through other employment laws | 15-30% of collected proceeds for cases involving $2+ million in tax, penalties, and interest | Information about significant tax underpayments; substantial tax liability threshold | Submit Form 211 to IRS Whistleblower Office; detailed documentation required |

| False Claims Act (FCA) | Combats fraud against federal government programs including Medicare, defense contracting, and grant fraud | Strongest anti-retaliation protections; double back pay, special damages, attorney fees | 15-30% of government recovery in qui tam lawsuits | Knowledge of false claims submitted to government; first-to-file rule applies | File sealed complaint in federal court; government investigates and decides whether to intervene |

OSHA Whistleblower Protection | Protects workers reporting safety violations, environmental hazards, and retaliation across 23 federal statutes | Job reinstatement, back pay, compensatory damages, and attorney fees | No monetary rewards; focus on employment protection | Employees who report workplace safety violations or refuse unsafe work | File complaint with OSHA within statutory deadlines (30-180 days depending on law) |

EPA Whistleblower Program | Addresses environmental violations, pollution incidents, and regulatory non-compliance | Anti-retaliation protections under multiple environmental statutes | No direct monetary rewards through EPA program | Employees reporting environmental law violations | Report to EPA through online portal, hotline, or regional offices |

DOL Whistleblower Programs | Covers wage and hour violations, workplace safety, and employee benefit plan fraud | Reinstatement, back pay, and compensatory damages under various labor laws | No monetary rewards; employment protection focus | Workers reporting labor law violations | File complaints with appropriate DOL agency within statutory timeframes |

FDA Whistleblower Program | Identifies drug safety issues, medical device problems, and food safety violations | Limited retaliation protections; primarily through other employment laws | No direct monetary rewards | Information about FDA-regulated product violations | Report through FDA’s MedWatch system or other agency channels |

CFPB Whistleblower Program | Exposes consumer financial protection violations by banks, credit unions, and financial service providers | Anti-retaliation provisions under Dodd-Frank Act | No monetary rewards currently; employment protection focus | Information about consumer financial law violations | Submit complaints through CFPB website or consumer complaint database |

PCAOB Whistleblower Program | Identifies audit failures, independence violations, and misconduct by public accounting firms | Anti-retaliation protections for audit firm employees | No monetary rewards; regulatory enforcement focus | Information about auditing standard violations or PCAOB rule violations | Report through PCAOB’s confidential tip line or online portal |

SEC Whistleblower Program: Incentivizing Truth Through Financial Rewards

SEC Whistleblower Program: The SEC Whistleblower Program, established under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, revolutionized whistleblower protection by introducing substantial financial incentives alongside traditional protections. This program has proven extraordinarily effective, generating billions in penalties and returning substantial sums to harmed investors.

Whistleblower awards: Under the SEC program can range from 10% to 30% of monetary sanctions exceeding $1 million. As of the end of fiscal year 2024, the SEC has awarded more than $2.2 billion to 444 individuals who provided original information leading to successful enforcement actions. These awards serve dual purposes: compensating individuals for the risks they undertake and creating powerful incentives for reporting securities violations.

The program’s success metrics are impressive:

- Over $6.4 billion in total monetary sanctions resulting from whistleblower tips

- More than 444 awards granted to deserving whistleblowers

- Confidentiality and anonymity protections that allow tipsters to report through attorneys

- Global reach that protects foreign nationals reporting violations by U.S. companies

THE TOP SEC WHISTLEBLOWER AWARDS

SEC Whistleblower Award | Amount | Date |

SEC whistleblower award | $279 million | May 5, 2023 |

SEC whistleblower award | $114 million | October 22, 2020 |

| SEC whistleblower award | $110 million | September 15, 2021 |

| SEC whistleblower award | $104 million | August 4, 2023 |

SEC whistleblower award | $98 million | August 23, 2024 |

SEC whistleblower award | $50 million | April 15, 2021 |

| SEC whistleblower award | $50 million | June 4, 2020 |

SEC whistleblower award | $50 million | March 19, 2018 |

SEC whistleblower award | $39 million | September 6, 2018 |

| SEC whistleblower award | $37 million | December 19, 2022 |

SEC whistleblower award | $37 million | January 21, 2022 |

SEC whistleblower award | $37 million | March 26, 2019 |

| SEC whistleblower award | $36 million | September 24, 2021 |

SEC whistleblower award | $33 million | March 19, 2018 |

SEC whistleblower award | $32 million | October 15, 2021 |

SEC whistleblower award | $30 million | September 22, 2014 |

SEC whistleblower award | $28 million | January 23, 2023 |

SEC whistleblower award | $28 million | May 19, 2021 |

SEC whistleblower award | $28 million | November 3, 2020 |

False Claims Act: Combating Government Fraud

The False Claims Act represents one of the oldest and most powerful whistleblower protection statutes in American law. Originally enacted during the Civil War to combat defense contractor fraud, the Act has evolved into a comprehensive tool for addressing fraud against government programs.

Protections for whistleblowers under the False Claims Act include:

- Qui tam provisions allowing private citizens to file lawsuits on behalf of the government

- Financial rewards of 15% to 30% of recovered funds for successful whistleblowers

- Anti-retaliation protections including reinstatement, double back pay, and compensation for litigation costs

- Confidentiality protections during the initial investigation period

The Act’s effectiveness is demonstrated by recovery statistics: in fiscal year 2023 alone, False Claims Act cases resulted in over $2.68 billion in settlements and judgments, with a significant portion originating from whistleblower-initiated cases.

Addressing Whistleblower Retaliation: Comprehensive Protection Mechanisms

Whistleblower retaliation: Remains a persistent challenge despite robust legal protections. Retaliation can take subtle forms that are difficult to prove, including exclusion from meetings, assignment to less desirable projects, negative performance evaluations, or creation of hostile work environments. Understanding these dynamics is crucial for both potential whistleblowers and organizations seeking to maintain ethical cultures.

Modern anti-retaliation frameworks address these challenges through:

- Broad definitions of protected activity that encompass not only formal complaints but also internal reporting and cooperation with investigations

- Burden-shifting provisions that require employers to demonstrate legitimate reasons for adverse actions against whistleblowers

- Interim relief mechanisms that can provide immediate protection while cases are pending

- Comprehensive remedies including emotional distress damages and punitive awards in severe cases

Organizations implementing effective whistleblower programs must go beyond mere compliance to create cultures where ethical concerns are welcomed and addressed constructively. This requires training programs that educate employees about their rights, clear reporting channels that bypass potentially compromised supervisors, and demonstrated commitment from leadership to investigate complaints thoroughly and fairly.

Confidentiality and Anonymity: Protecting Whistleblower Identity

- Confidentiality and Anonymity Provisions: Represent critical components of effective whistleblower protection. These protections recognize that fear of identification often prevents individuals from reporting misconduct, even when legal protections exist.

- Multiple Layers: Modern whistleblower programs incorporate multiple layers of identity protection:

- Anonymous reporting systems that allow individuals to submit complaints without revealing their identity

- Third-party reporting services that create additional barriers between whistleblowers and their employers

- Attorney-client privilege protections for whistleblowers who report through legal counsel

- Strict confidentiality requirements for investigators and compliance personnel

- The SEC Whistleblower Program exemplifies best practices in identity protection. Whistleblowers can submit tips anonymously through attorneys, and the SEC maintains strict confidentiality even during enforcement proceedings. This approach has proven successful in encouraging reporting while protecting vulnerable individuals.

Real-World Impact: Case Studies in Whistleblower Protection

- Importance: The practical importance of whistleblower protection becomes evident through examination of significant cases where brave individuals exposed corporate wrongdoing despite personal risks.

- The Wells Fargo Account Fraud Scandal: Demonstrates both the necessity of whistleblower protection and the consequences of inadequate safeguards. Employees who attempted to report the bank’s fraudulent account creation practices faced retaliation, termination, and blacklisting. The scandal ultimately cost the bank billions in fines and damaged its reputation irreparably. Stronger protections for whistleblowers might have prevented the misconduct from reaching such devastating proportions.

- The Theranos Case: Illustrates how whistleblower courage can protect public safety. Multiple employees risked their careers to expose the company’s fraudulent blood testing technology. Their disclosures, protected by various whistleblower programs, prevented potentially dangerous medical devices from reaching broader markets and ultimately led to criminal convictions of company executives.

- Pharmaceutical Case: Recent pharmaceutical industry cases have highlighted the global impact of effective whistleblower protection. Whistleblower awards in cases involving off-label marketing, kickback schemes, and clinical trial fraud have totaled hundreds of millions of dollars while protecting patients from dangerous or ineffective treatments.

FALSE CLAIMS STATISTICS: KEY RECOVERY DATA (1986–2022)

Metric | Amount/Number | Details |

Total FCA Recoveries | $72+ Billion | Complete recoveries under the False Claims Act from 1986-2022 |

Whistleblower-Initiated Recoveries | $50+ Billion | Recoveries resulting from qui tam lawsuits filed by whistleblowers |

| Whistleblower Compensation | $7+ Billion | Total payments made to whistleblowers for their assistance |

| New FCA Lawsuits (2022) | 948 Total Cases | 652 initiated by whistleblowers, 296 by government |

Understanding the False Claims Act (FCA)

The False Claims Act represents one of the most powerful tools in combating fraud against the federal government. This federal statute imposes liability on individuals and companies who defraud governmental programs through false or fraudulent claims for payment.

Key FCA Provisions:

- Treble Damages: Violators face penalties of three times the government’s actual damages

- Civil Penalties: Additional fines ranging from $14,308 to $28,619 per violation.

- Qui Tam Actions: Private citizens can file lawsuits on behalf of the government

Treble damages

- Calculation: For each false claim submitted, the total liability includes a civil penalty plus three times the amount of the government’s damages.

- Example: If a contractor knowingly overcharges the government by $10 million, their liability would be $30 million in treble damages, plus penalties for each false claim submitted.

Civil penalties

- Amount: The specific penalty amount is set by statute and is periodically adjusted for inflation. As of July 3, 2025, FCA civil penalties range from $14,308 to $28,619 per violation.

- Application: These penalties are assessed on a per-claim basis. A single fraudulent scheme involving hundreds or thousands of false claims can quickly result in millions of dollars in total penalties.

- Factors: When determining the exact penalty, a judge may consider factors like the severity of the misconduct and acceptance of responsibility. A jury determines the number of individual violations.

Qui tam actions

- Mechanism: Under the FCA’s qui tam provisions, a private citizen with knowledge of fraud (known as a “relator”) can file a lawsuit on behalf of the government. The Latin phrase qui tam means “he who brings an action for the king as well as for himself”.

- Rewards: A whistleblower who files a successful qui tam lawsuit is entitled to a reward.

- Government intervention: If the government intervenes and takes over the case, the relator can receive 15% to 25% of the total recovery.

- No government intervention: If the government declines to intervene and the relator pursues the case successfully on their own, the reward can be 25% to 30%.

- Protections: The FCA also includes strong protections for whistleblowers against retaliation from their employers, such as firing, demotion, or harassment

- Recovery: Since 1986, False Claims Act recoveries total more than $78 billion, with approximately $7.8 billion paid in whistleblower awards.

- Recent recoveries: The Department of Justice (DOJ) announced that fiscal year (FY) 2024 FCA settlements and judgments exceeded $2.9 billion. The majority of these recoveries ($2.4 billion) came from cases initiated by whistleblowers.

The Critical Role of Whistleblowers

- Whistleblowers serve as the backbone of FCA enforcement, accounting for approximately 69% of all new FCA cases filed in 2022. Their contributions extend far beyond simple reporting:

Financial Impact:

- In fiscal year 2022, the total amount recovered was approximately $2.2 billion, of which over $1.9 billion came from qui tam (whistleblower) lawsuits. This means whistleblowers accounted for more than 86% of the 2022 recoveries, which is an even greater proportion than the figure cited

- The government’s return on investment in whistleblower rewards demonstrates the program’s effectiveness

Systemic Benefits:

- Early Detection: Whistleblowers identify fraud schemes before they can cause extensive damage

- Insider Knowledge: Their access to internal information enables comprehensive investigations

- Deterrent Effect: The prospect of insider reporting creates powerful incentives for compliance

Practical Guidance for Potential Whistleblowers

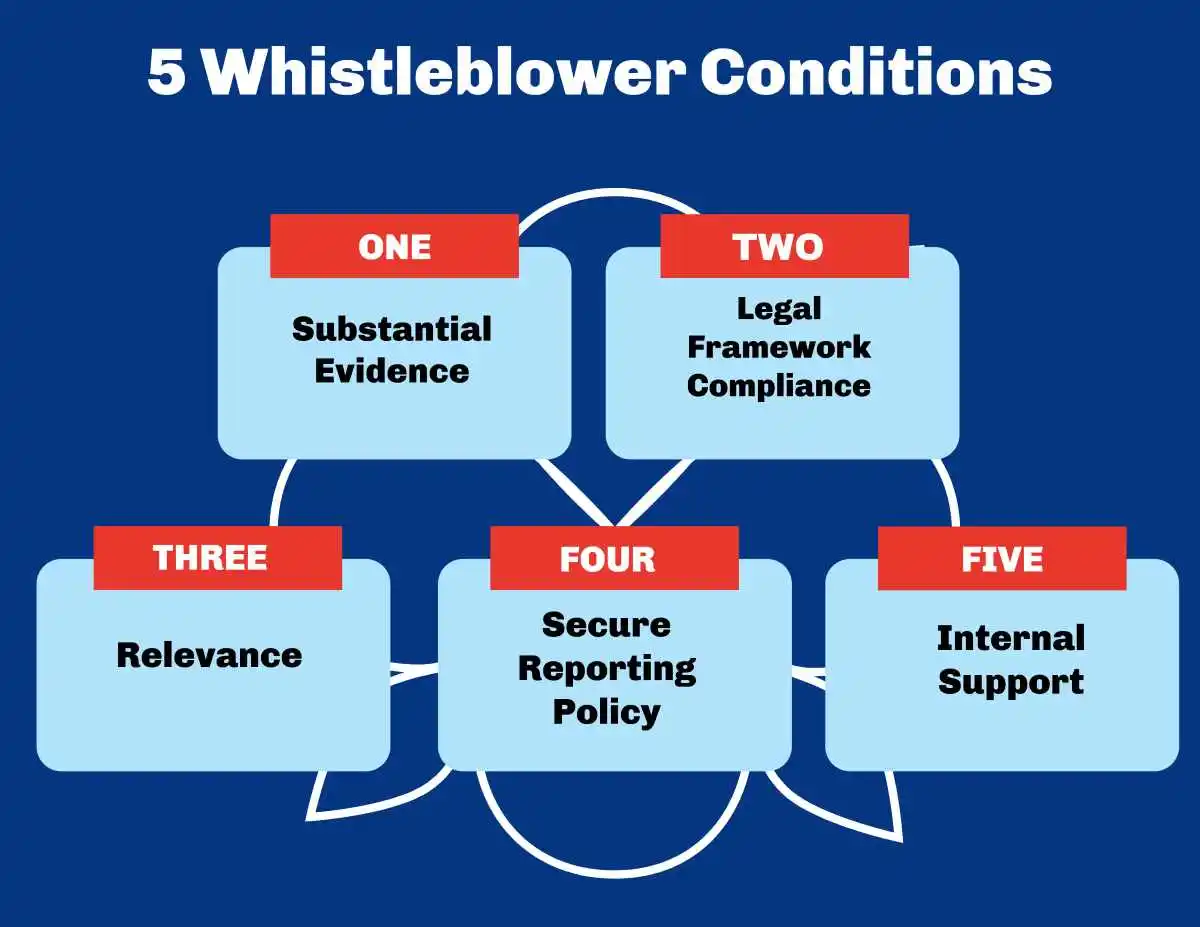

- Individuals considering reporting misconduct must navigate complex legal and practical considerations. Whistleblower protection laws provide substantial safeguards, but understanding these protections and utilizing them effectively requires careful planning.

- Key considerations for potential whistleblowers include:

- Documentation requirements: Maintaining detailed records of observed misconduct and any retaliation experienced

- Reporting channels: Understanding internal reporting requirements and external agency procedures

- Legal representation: Engaging experienced whistleblower protection attorneys who understand relevant statutes and procedures

- Timeline considerations: Meeting statutory deadlines for reporting and retaliation claims

- Financial planning: Preparing for potential career disruption despite legal protections

- Organizations serious about maintaining ethical cultures must recognize that effective whistleblower programs require ongoing investment and commitment. This includes regular training, clear communication about reporting procedures, and demonstrated follow-through on investigations and corrective actions.

The Future of Whistleblower Protection: Evolving Challenges and Solutions

- The landscape of whistleblower protection continues evolving in response to new challenges and technological developments. Whistleblower lawsuits increasingly involve complex international transactions, cryptocurrency fraud, and cybersecurity breaches that require sophisticated legal frameworks.

- Emerging trends in whistleblower protection include:

- Enhanced digital security measures protecting whistleblower communications and evidence

- International cooperation agreements facilitating cross-border investigations and protection

- Expanded coverage areas addressing environmental crimes, human trafficking, and other emerging concerns

- Improved support services providing psychological counseling and career transition assistance

- The integration of artificial intelligence and data analytics into compliance programs offers new opportunities for detecting misconduct while protecting whistleblower identity. These technologies can identify patterns suggesting fraudulent activity while maintaining the anonymity of reporting individuals.

Building Sustainable Cultures of Transparency

- Whistleblower protection: Ultimately serves a purpose far greater than individual case resolution—it fosters organizational cultures where transparency, accountability, and ethical conduct flourish. When employees trust that they can report concerns without facing retaliation, organizations benefit from early detection of problems, improved risk management, and enhanced stakeholder confidence.

- The most effective whistleblower programs: Create positive feedback loops where ethical reporting becomes normalized rather than exceptional. This transformation requires sustained leadership commitment, comprehensive training programs, and consistent demonstration that ethical concerns are valued and addressed constructively.

- Organizations implementing world-class whistleblower programs: Recognize that protection mechanisms represent investments in long-term sustainability rather than mere compliance costs. The financial and reputational costs of undetected misconduct far exceed the resources required to maintain effective reporting and protection systems.

- Whistleblower protection: Stands as an essential pillar of corporate accountability and market integrity. Through comprehensive legal frameworks like the Sarbanes-Oxley Act, innovative incentive programs like the SEC Whistleblower Program, and robust anti-retaliation protections, society creates mechanisms for addressing wrongdoing before it causes irreparable harm. The courage of individual whistleblowers, supported by strong legal protections and organizational cultures that value transparency, serves as a crucial safeguard for investors, consumers, and the broader public interest.

- The continued evolution and strengthening of whistleblower protection represents not merely a legal necessity but a moral imperative that reflects our collective commitment to justice, transparency, and ethical conduct in all aspects of business and government operations.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you are thinking of blowing the whistle, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors