Introduction to Accounting Fraud

- What Is Accounting Fraud?: Exist when an employee of a publicly-traded company submits false information on a required financial form, which investorss rely upon in making informed investment decisions.

- False Financia Statements: When accouting fraud occurs it renders the company’s financial statements materially false and misleading an artificially inflates the cost of the company’s shares.

- Investor Buy Inflated Stock: When investors buy stocks based on false and misleading financial statement, they are buying them at an artificially inflated price.

- Corrective Disclosure: When the company is finally forced to reveal the truth through a corrective disclosure, the artificial inflation comes out and the price of the stock plummets.

- Investors Losses: As a result of buying artifically inflated stockes, when the truth emerges and the stock tanks, investors suffer losses which can be susbstantial.

- Securities Fraud Litigation. Investors who lost money from the accounting fraud can ban together and file a securities fraud class action to recover their damages.

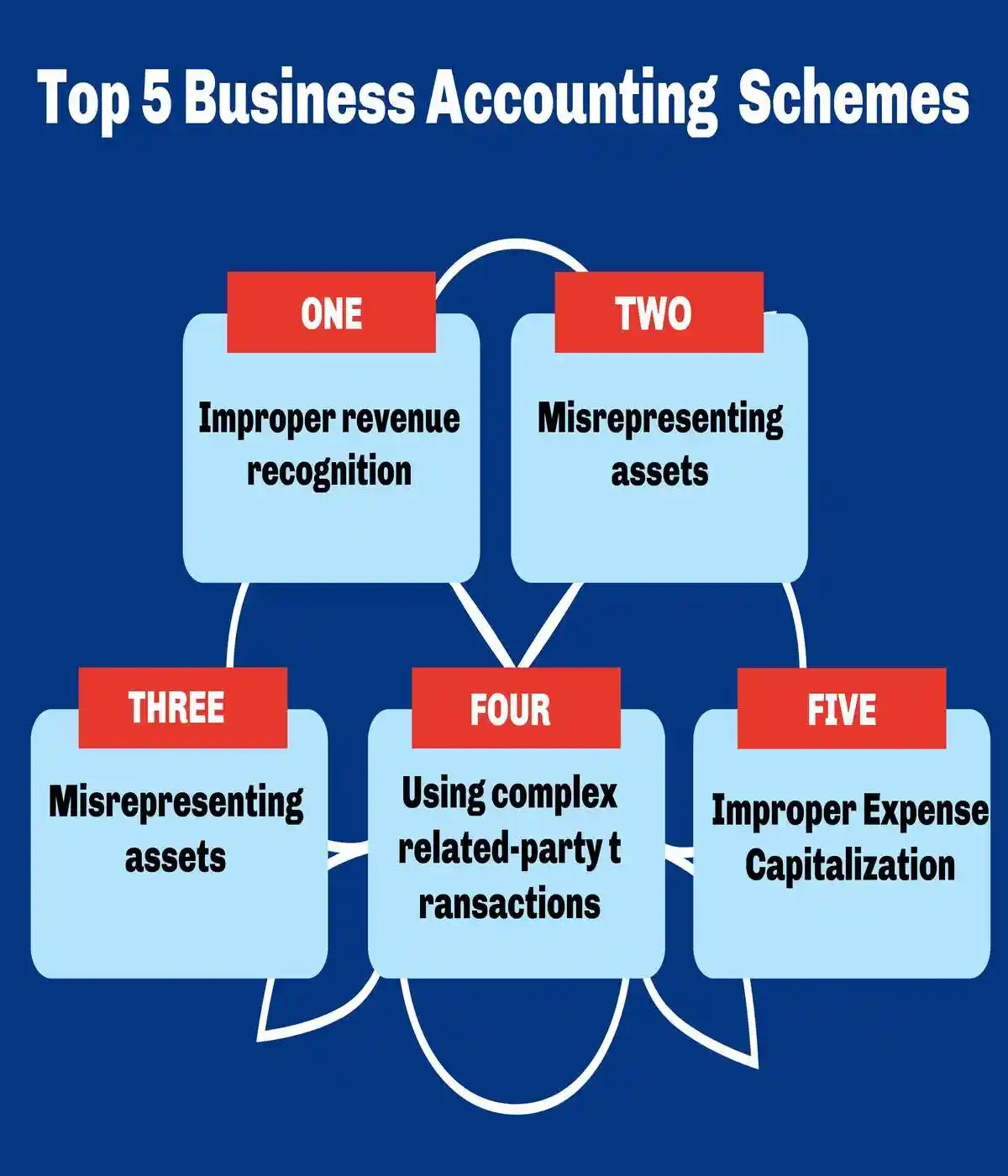

- Key Examples of Types of Accounting Fraud:

- Misrepresenting revenues or expenses: This involves inflating or deflating financial statements in order to present a more favorable financial picture. For example, a company may inflate its revenues by recording false sales or understating its expenses.

- Concealing liabilities: This involves hiding or failing to disclose certain liabilities, such as outstanding debts or pending lawsuits, in order to make the company appear more financially stable.

- Improper accounting methods: This involves using methods that do not comply with generally accepted accounting principles (GAAP) to manipulate financial statements. For example, a company may use creative accounting methods to avoid recognizing losses or expenses.

- Misusing assets: This involves using company assets for personal gain or to benefit friends or family members. For example, a company may use company funds to pay for personal expenses or allow employees to use company assets for personal use.

- Ponzi schemes: A Ponzi scheme is a fraudulent investment scheme in which returns are paid to existing investors from funds contributed by new investors rather than from profit earned. This creates the illusion of a successful enterprise and can lure in more investors, allowing the scheme to continue until it collapses, leaving the initial investors without money.

Understanding Accounting Fraud: Definition and Overview

- Accounting fraud: At its core, is the intentional manipulation or falsification of financial statements to present a misleading picture of a company’s financial health. This deceptive practice can involve a range of activities, from overstating revenues and understating expenses to concealing liabilities and inflating asset values. The primary goal of accounting fraud is often to deceive investors, creditors, and regulatory bodies, creating a false sense of security regarding the company’s financial position.

- Critical Tools for Investors: In a world where financial statements are critical tools for decision-making, the ramifications of such deception can be far-reaching and severe. Understanding the intricacies of accounting fraud is paramount for investors aiming to safeguard their interests. The practice is not limited to large corporations; it can occur in businesses of all sizes and industries.

- What is Accounting Fraud? The complexity and sophistication of fraud schemes have evolved over time, making it increasingly challenging to detect and prevent. As financial markets grow more complex, so do the methods employed by those perpetrating accounting fraud. It is essential for investors to familiarize themselves with these deceptive practices to better navigate the financial landscape and make informed investment decisions.

What is Accounting Fraud? A Comprehensive Analysis

- What is accounting fraud?: This fundamental question requires a multifaceted answer that encompasses various forms of financial statement fraud and deceptive practices. Financial statement fraud represents the deliberate misstatement or omission of amounts or disclosures in financial statements to deceive financial statement users. This sophisticated form of corporate misconduct has become increasingly prevalent, serving as a catalyst for numerous securities fraud class action lawsuits and regulatory enforcement actions.

- Mechanics: The mechanics of financial statement fraud involve several distinct categories of manipulation. Revenue recognition fraud stands as one of the most common forms, where companies prematurely recognize revenue or record fictitious sales to inflate their apparent performance.

- Expense manipulation: Represents another critical area, involving the improper capitalization of expenses or the deliberate understatement of costs to enhance profitability metrics.

- Asset valuation fraud: Encompasses the overstatement of asset values, including inventory manipulation, improper depreciation calculations, and the failure to recognize impairment losses.

- Financial statement fraud: This involves schemes often to exploit weaknesses in internal controls and corporate governance structures. Companies with inadequate oversight mechanisms become particularly vulnerable to fraudulent activities, as management can more easily circumvent established procedures and manipulate financial reporting processes. The absence of robust internal controls creates an environment where fraudulent transactions can occur without detection, ultimately leading to material misstatements that trigger securities fraud litigation when discovered.

The Role of Internal Controls in Fraud Prevention

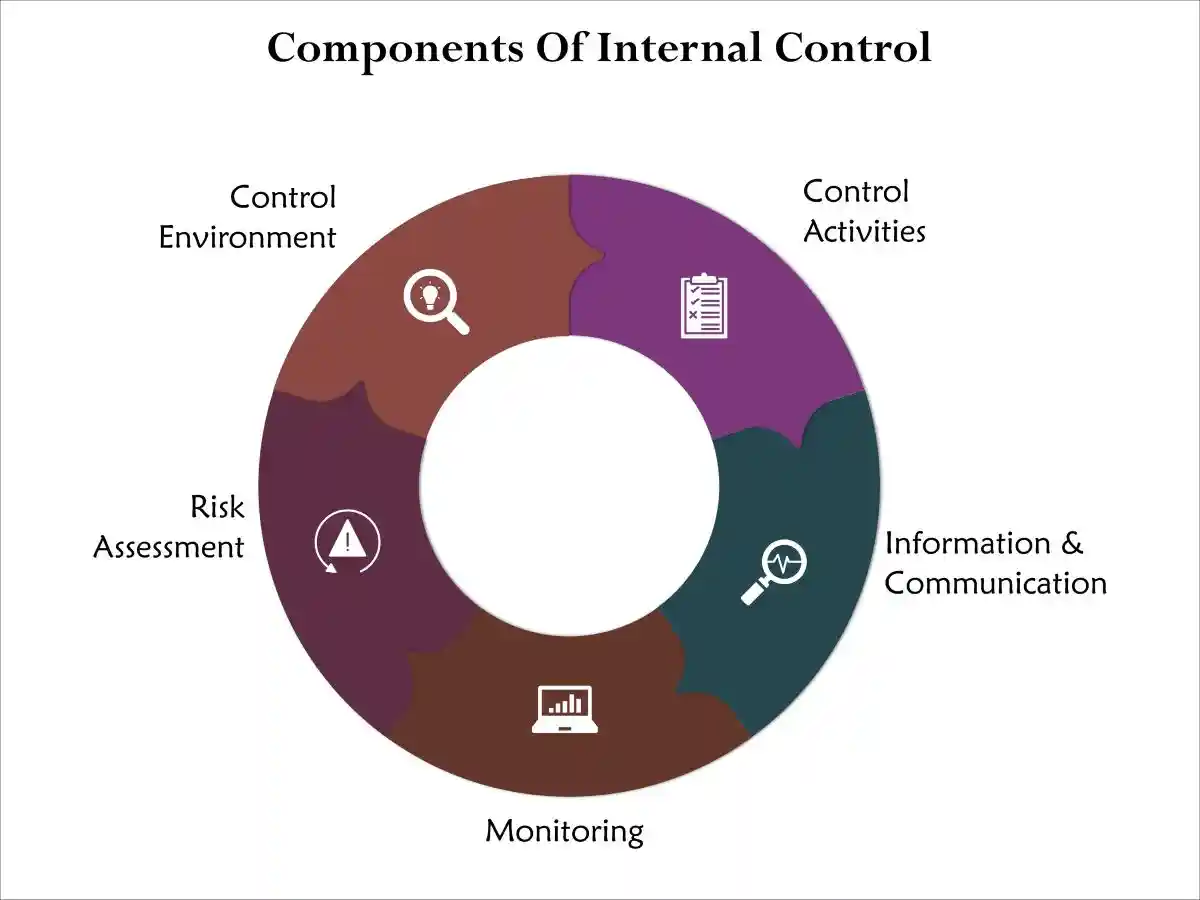

- Internal controls: Serve as the first line of defense against accounting fraud and financial statement fraud. These systematic procedures and policies are designed to ensure the accuracy and reliability of financial reporting while preventing unauthorized transactions and protecting company assets. Effective internal controls create multiple checkpoints throughout the financial reporting process, making it significantly more difficult for fraudulent activities to occur undetected.

- The Sarbanes-Oxley Act of 2002: Fundamentally transformed the landscape of internal control requirements, mandating that public companies establish and maintain adequate internal controls over financial reporting. This landmark legislation emerged in response to high-profile corporate scandals and established stringent requirements for corporate governance and regulatory compliance. Under Section 404 of Sarbanes-Oxley, management must assess the effectiveness of internal controls annually, while external auditors must attest to management’s assessment.

- Internal controls: Encompass five essential components: control environment, risk assessment, control activities, information and communication, and monitoring activities. The control environment establishes the tone at the top and influences the control consciousness of employees throughout the organization.

- Risk assessments: Identify and analyze relevant risks that could prevent the achievement of objectives, while control activities represent the policies and procedures that help ensure management directives are carried out effectively.

- Modern internal controls: Must address emerging risks associated with technological advancement and digital transformation. As companies increasingly rely on automated systems and electronic transactions, internal controls must evolve to address cybersecurity threats, data integrity issues, and the risks associated with cloud-based financial systems.

- Artificial Intelligence: The integration of artificial intelligence and machine learning technologies into financial reporting processes requires sophisticated internal controls that can monitor algorithmic decision-making and detect anomalous patterns that might indicate fraudulent activity.

Corporate Governance and Regulatory Framework

- Corporate governance represents the system of rules, practices, and processes by which companies are directed and controlled. Strong corporate governance frameworks serve as critical defenses against accounting fraud and financial statement fraud, establishing clear accountability mechanisms and oversight structures that promote transparency and ethical conduct.

- The board of directors: Plays a pivotal role in corporate governance, providing independent oversight of management activities and ensuring that appropriate internal controls are implemented and maintained.

- Regulatory compliance has become increasingly complex in the post-Sarbanes-Oxley era, with companies facing heightened scrutiny from multiple regulatory bodies. The Securities and Exchange Commission (SEC) serves as the primary regulatory enforcement agency for securities laws, conducting investigations and pursuing enforcement actions against companies and individuals who engage in financial statement fraud.

- Regulatory enforcement actions can result in significant financial penalties, injunctive relief, and criminal referrals that lead to imprisonment for responsible parties.

- The intersection of corporate governance and regulatory compliance creates a comprehensive framework for fraud prevention and detection. Audit committees, composed entirely of independent directors, bear primary responsibility for overseeing the financial reporting process and ensuring the effectiveness of internal controls. These committees must possess the financial expertise necessary to understand complex accounting issues and identify potential red flags that might indicate fraudulent activity.

- Corporate governance failures often precede major accounting fraud scandals, as weak oversight mechanisms allow management to circumvent established controls and manipulate financial reporting processes. Companies with strong corporate governance frameworks demonstrate lower incidences of financial statement fraud and face reduced exposure to securities fraud class action lawsuits and regulatory enforcement actions.

Securities FraudLitigation and Legal Consequences

Securities litigation: Represents the primary legal mechanism through which investors seek redress for losses resulting from accounting fraud and financial statement fraud. Securities class action lawsuits allow groups of similarly situated investors to collectively pursue claims against companies and their executives who have allegedly violated federal securities laws through fraudulent financial reporting practices.

Legal Framework: The laws governing securities fraud litigation encompasses multiple federal statutes, including the Securities Act of 1933 and the Securities Exchange Act of 1934. These foundational laws establish disclosure requirements and antifraud provisions that form the basis for most securities fraud class action lawsuits involving financial statement fraud. Section 10(b) of the Exchange Act and Rule 10b-5 promulgated thereunder represent the most commonly cited provisions in securities litigation, prohibiting the use of manipulative or deceptive devices in connection with the purchase or sale of securities.

Securities class actions: Typically follow a predictable pattern following the disclosure of accounting fraud. When companies announce financial restatements or regulatory investigations, stock prices often decline precipitously, triggering the filing of multiple securities class action lawsuits. These cases are then consolidated before a single federal judge, who appoints lead lead plaintiffs and lead counsel to represent the class of affected investors.

The financial consequences: The financial costs associated with securities class action lawsuits can be devastating for companies and their shareholders. Settlement amounts in major financial statement fraud cases often exceed hundreds of millions of dollars, while the associated legal costs, regulatory fines, and reputational damage can persist for years following resolution. Companies facing securities fraud litigation also experience increased scrutiny from regulators, auditors, and investors, leading to enhanced compliance costs and operational restrictions.

Risk Assessment Frameworks and Detection Strategies

- Risk assessments: These form the cornerstone of effective fraud prevention programs, enabling organizations to identify vulnerabilities and implement targeted controls to mitigate the risk of accounting fraud and financial statement fraud. Comprehensive risk assessments evaluate both internal and external factors that could contribute to fraudulent activity, including financial pressures, opportunities for mmanipulation, and rationalization factors that might motivate unethical behavior.

- Fraud Triangle: The fraud triangle model provides a useful framework for conducting risk assessments, identifying three conditions that must be present for fraud to occur: pressure, opportunity, and rationalization. Financial pressure often stems from the need to meet earnings expectations, maintain debt covenant compliance, or achieve performance-based compensation targets. Opportunities for fraud arise when internal controls are weak or when management can override established procedures without detection.

- Modern risk assessment: These thodologies incorporate advanced analytics and data mining techniques to identify unusual patterns or transactions that might indicate fraudulent activity. These technological tools can analyze vast amounts of financial data to detect anomalies that would be impossible to identify through traditional manual review processes. Machine learning algorithms can identify subtle patterns and relationships that might indicate financial statement fraud, enabling organizations to investigate potential issues before they result in material misstatements.

- Risk assessments: Must be conducted regularly and updated to reflect changing business conditions, regulatory requirements, and emerging fraud schemes. Organizations should establish formal risk assessment committees that include representatives from finance, internal audit, legal, and operational departments to ensure comprehensive coverage of potential fraud risks.

Regulatory Enforcement Evolution and Future Outlook

- Regulatory enforcement: Has evolved significantly since the enactment of Sarbanes-Oxley, with agencies adopting more sophisticated investigative techniques and pursuing increasingly aggressive enforcement strategies. The SEC has expanded its use of data analytics and artificial intelligence to identify potential violations, enabling the agency to detect patterns of misconduct that might otherwise go unnoticed.

- Recent regulatory enforcement: Trends indicate increased focus on individual accountability, with agencies pursuing charges against executives and other responsible parties rather than limiting enforcement actions to corporate entities. The Department of Justice has established specialized units focused on corporate fraud prosecution, while the SEC has implemented policies that prioritize cases involving senior executives and repeat offenders.

- Integration of Technology: Into regulatory compliance and fraud detection continues to transform the landscape of financial reporting oversight. Blockchain technology offers promising applications for creating immutable audit trails and enhancing the transparency of financial transactions. Artificial intelligence and machine learning systems are being deployed to monitor compliance with internal controls and iidentify potential violations in real-time.

- Looking forward: Regulatory enforcement agencies are likely to continue expanding their use of advanced technologies while increasing coordination with international counterparts to address cross-border fraud schemes. Companies must adapt their internal controls and corporate governance frameworks to address these evolving enforcement priorities while maintaining compliance with an increasingly complex regulatory environment.

- Future of Prevention: The future of fraud prevention lies in the integration of technological innovation with traditional internal controls and corporate governance principles. Organizations that proactively invest in advanced fraud detection systems and maintain strong ethical cultures will be best positioned to prevent accounting fraud and avoid the devastating consequences of securities fraud litigation and regulatory enforcement actions.

- Protecting Investors: By understanding these comprehensive frameworks for fraud prevention and detection, investors and corporate stakeholders can better protect their interests while contributing to the integrity and stability of financial markets. The ongoing evolution of regulatory compliance requirements and enforcement strategies underscores the critical importance of maintaining robust internal controls and corporate governance structures in today’s complex business environment.

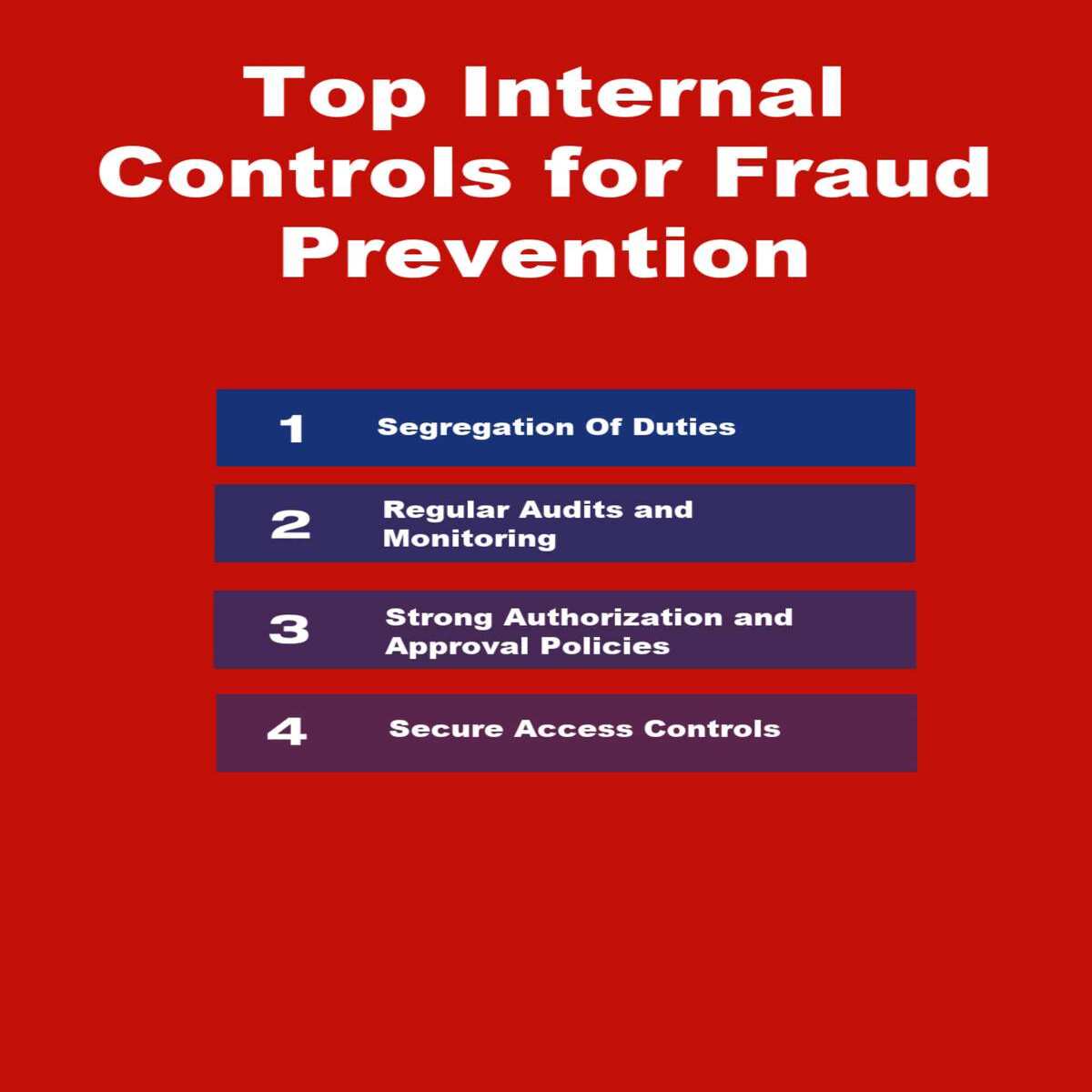

Top Internal Controls for Fraud Prevention

- Comprehensive: The most effective organizations implement comprehensive fraud prevention strategies that address vulnerabilities across all operational levels.

- Robust Framework: Top internal controls for fraud prevention form the backbone of any robust risk management framework, particularly in light of increasing regulatory enforcement actions and the rising threat of accounting fraud.

Segregation of Duties: The Foundation of Control

- Segregation of duties: Represents perhaps the most fundamental principle in fraud prevention and serves as the cornerstone of effective internal controls.

- Reduces Risk: This critical control mechanism ensures that no single individual has complete authority over any critical business process, creating a robust framework that significantly reduces the risk of accounting fraud and strengthens corporate governance across all organizational levels.

- Checkpoints: By dividing responsibilities among multiple employees, organizations create natural checkpoints that make fraudulent activities significantly more difficult to execute and conceal.

- Systematic Approach: To risk assessments and control implementation has become increasingly vital in today’s complex regulatory environment, where SEC enforcement actions continue to highlight the devastating consequences of inadequate internal control systems.

The Strategic Implementation of Segregation of Duties

Creating Layers of Verification

- Identify Coflicts: Effective segregation of duties requires comprehensive analysis of business processes to identify potential conflict points and vulnerabilities that could lead to securities class action lawsuits.

- Role Interaction: The implementation process demands careful consideration of how different roles interact within the organization’s operational framework, ensuring that regulatory compliance standards are met while maintaining operational efficiency.

- Segregation: For instance, the person who approves purchase orders should not be the same individual who receives goods or processes vendor payments.

- Multiple Layers: This fundamental separation creates multiple layers of verification that serve as powerful deterrents against fraudulent schemes.

Clearly Defined Responsibilities

- Boundries: Similarly, employees responsible for recording transactions should not have access to the underlying assets, establishing clear boundaries that prevent unauthorized manipulation of financial records.

- Encompases all Aspects: The principle extends beyond basic transaction processing to encompass all aspects of corporate governance.

- Distinct Responsibilities: Organizations must ensure that those who initiate transactions, those who authorize them, those who record them, and those who maintain custody of related assets represent distinct individuals with clearly defined responsibilities.

- Checks and Balances: This comprehensive approach to internal controls creates a system of checks and balances that serves as a powerful deterrent against accounting fraud.

The Sarbanes-Oxley Act: Transforming Auditor Responsibilities

Sarbanes=Oxley: The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of auditor responsibilities and internal control requirements. This landmark legislation mandated that public companies establish and maintain adequate internal control over financial reporting, with management required to assess and report on the effectiveness of these controls annually.

Cetifications: Section 404 of the Sarbanes-Oxley Act requires management to include an internal control report in the annual filing, while external auditors must attest to management’s assessment of internal control effectiveness. This dual-layer approach creates additional accountability and transparency in the financial reporting process.

Creation of PCAOB: The Act also established the Public Company Accounting Oversight Board (PCAOB), which oversees the auditing profession and establishes auditing standards for public company audits. These standards emphasize the importance of professional skepticism and require auditors to specifically assess the risk of fraud in every audit engagement.

Independence: Auditor independence provisions within the Sarbanes-Oxley Act prohibit auditing firms from providing certain non-audit services to their audit clients, reducing potential conflicts of interest that could compromise audit quality. These restrictions help ensure that auditors maintain the objectivity necessary to detect and report fraudulent activities.

![Risk management chart used inThe Sarbanes-Oxley Act: An Authoritative and Essential Guide [2025]](https://classactionlawyertn.com/wp-content/uploads/2025/09/ezgif-80262bf1b18911.webp)

Securities Litigation and Class Actions: Investor Recovery Mechanisms

- Remedy: When accounting fraud occurs, affected investors often seek recourse through securities class action lawsuits and securities litigation. These legal mechanisms provide a pathway for investors to recover losses resulting from materially misleading financial statements and other violations of federal securities laws.

- Securities class actions: Serve as a critical investor protection mechanism, allowing shareholders who suffered losses due to fraudulent financial reporting to band together and pursue claims against the responsible parties. These lawsuits typically target the company, its officers and directors, and sometimes the external auditors who failed to detect the fraud.

- The Securities Litigation Process: Involves several distinct phases, beginning with the filing of a complaint alleging securities law violations. Lead plaintiff selection follows, where the court appoints the investor with the largest financial interest to represent the class. Discovery proceedings allow both sides to gather evidence, often revealing the full extent of the fraudulent scheme.

- Recovery Mechanism: Class actions as investor mechanism for recovery have proven particularly effective in cases involving accounting fraud. These lawsuits not only provide financial compensation to harmed investors but also serve as a deterrent to future misconduct by imposing significant financial and reputational consequences on wrongdoers.

- Dual Protection: The intersection of accounting fraud and securities litigation creates powerful incentives for companies to maintain accurate financial reporting. The potential for massive legal settlements, regulatory fines, and reputational damage makes the cost of fraud far exceed any short-term benefits from misleading investors.

THE SECURITIES LITIGATION PROGRESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities fraud class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Advanced Risk Assessment and Red Flag Identification

- Proactive: Modern risk assessments require auditors to employ sophisticated analytical techniques and maintain heightened awareness of fraud indicators. Red flags often manifest as unusual fluctuations in financial ratios, unexplained changes in accounting policies, or inconsistencies between financial and operational data.

- Signals of Fraud: Revenue recognition anomalies frequently signal potential fraud, particularly when companies report consistent growth despite declining industry conditions or when revenue increases significantly without corresponding increases in cash flow from operations. These patterns warrant intensive scrutiny and additional audit procedures.

- Management behavior: Can provide crucial insights into fraud risk. Red flags include excessive pressure on auditors to complete work quickly, reluctance to provide access to personnel or records, and frequent disputes about accounting treatments or audit procedures. Auditors must remain alert to these behavioral indicators while maintaining professional relationships.

- Related party transactions: Deserve special attention, as these arrangements often provide opportunities for earnings manipulation or asset misappropriation. Complex organizational structures, unusual transaction terms, and inadequate disclosure of related party relationships all represent significant fraud risk factors.

Building Comprehensive Fraud Prevention Systems

Effective Fraud Prevention: Requires a multi-layered approach that combines robust internal controls, strong corporate governance, comprehensive risk assessments, and ongoing monitoring systems. Organizations must create cultures of integrity where ethical conduct is valued and rewarded while fraudulent behavior is swiftly identified and addressed.

Employee training Programs: Play a crucial role in fraud prevention by educating staff about ethical standards, reporting mechanisms, and the consequences of fraudulent behavior. Regular training updates ensure that employees remain aware of evolving fraud schemes and their responsibilities in maintaining accurate financial reporting.

Technology solutions: Are increasingly important in fraud detection and prevention. Advanced data analytics, artificial intelligence, and machine learning algorithms can identify unusual patterns and anomalies that might indicate fraudulent activities. These tools complement traditional audit procedures and enhance the overall effectiveness of fraud detection efforts.

Continuous monitoring Systems: Enable organizations to identify potential fraud indicators in real-time rather than waiting for periodic audits or reviews. These systems can track key performance indicators, monitor transaction patterns, and alert management to unusual activities that warrant further investigation.

Integration: The integration of preventive controls with detective controls creates a comprehensive defense system that both prevents fraud from occurring and quickly identifies fraudulent activities when they do occur. This balanced approach maximizes protection while minimizing the impact of any fraudulent schemes that might evade preventive measures.

The Future of Auditing and Fraud Prevention

- Evolving Proces: The auditing profession continues to evolve in response to emerging technologies, changing business models, and increasingly sophisticated fraud schemes. Artificial intelligence and machine learning are Securities Litigation Trends 2025: A Comprehensive Analysis of Class Action Shifts [2025], enabling auditors to analyze entire populations of data and identify subtle patterns that might indicate fraudulent activities.

- Blockchain technology: Offers promising applications in fraud prevention by creating immutable records of transactions and enhancing the transparency of financial reporting processes. As this technology matures, it may fundamentally change how companies record and report financial information.

- Regulatory frameworksa: Will continue to evolve in response to new fraud schemes and technological developments. Auditors must stay current with these changes while maintaining the fundamental principles of independence, objectivity, and professional skepticism that form the foundation of effective auditing.

- Multi-Prevention: The responsibility for preventing accounting fraud extends beyond auditors to include management, boards of directors, regulators, and investors. This collaborative approach, combined with advancing technology and strengthening regulatory frameworks, provides the best hope for maintaining market integrity and protecting investor interests in an increasingly complex financial environment.

- Critial Role of Auditors: By understanding the critical role of auditors in fraud prevention and the comprehensive systems required to detect and prevent fraudulent activities, stakeholders can work together to maintain the integrity of financial markets and protect the interests of investors worldwide. The investment in effective fraud prevention represents not merely a compliance obligation but a fundamental business imperative that supports long-term success and market confidence.

Conclusion: Staying Informed and Vigilant as an Investor

Complex Financal Landscrape: In a financial landscape fraught with complexity and potential pitfalls, staying informed and vigilant is essential for investors seeking to protect their interests.

Understanding the Red Flags: By understanding the various forms of accounting fraud and the red flags that may indicate its presence, investors can better navigate the financial markets and make informed decisions. The lessons learned from past fraud cases underscore the importance of due diligence, diversification, and ongoing education in safeguarding investments.

Remain Proactive: Investors must remain proactive in monitoring their portfolios and assessing the risks associated with their investments. This involves not only reviewing financial statements but also staying abreast of market developments, regulatory changes, and industry trends. By maintaining a critical eye and asking the right questions, investors can detect potential fraud and take appropriate action to mitigate its impact.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities fraud class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors