Introduction to Securities Fraud Class Actions

- Securities fraud class actions are a civil lawsuit brought by an investor or group of investors who have suffered economic damages as a result of fraudulent stock manipulation.

- This type of fraud can take many forms, including false disclosures, insider trading, and accounting fraud, each of which poses significant threats to market integrity.

- Understanding these practices is crucial for investors who aim to safeguard their investments and maintain confidence in the financial markets.

- As financial markets evolve and become more sophisticated, so too do the methods employed by those who commit fraud, making vigilance and awareness essential for investors.

- The complexity of securities fraud often lies in its subtlety and the sophisticated means by which it is carried out.

- Unlike other forms of fraud, securities fraud can involve complex financial instruments and transactions, making it difficult for even seasoned investors to detect.

- The perpetrators of securities fraud are often individuals or entities with significant knowledge and understanding of the financial markets, allowing them to exploit weaknesses and manipulate information to their advantage.

- This creates a challenging environment for investors who must remain constantly aware of potential threats to their financial security.

- Moreover, securities fraud undermines the trust that investors place in the markets, leading to broader economic impacts.

- When investors lose confidence in the integrity of the markets, they may become hesitant to invest, leading to reduced market liquidity and increased volatility.

- This can have a ripple effect throughout the economy, affecting everything from business growth to employment rates.

- Therefore, understanding securities fraud is not only crucial for individual investors but also for maintaining the overall health and stability of the financial system.

Securities Fraud Class Actions: The Legal Framework for Investor Protection

- Securities class action lawsuits serve as a powerful collective legal remedy for investors who have suffered financial losses due to corporate misconduct.

- These securities class actions enable groups of similarly situated investors to pool their resources and pursue claims against companies that have violated federal securities laws.

- The strength of securities litigation lies in its ability to hold corporations accountable for material misrepresentations, omissions, and fraudulent practices that damage investor confidence.

- Securities class actions typically arise when companies fail to disclose material information or make misleading statements about their financial condition, business prospects, or operational challenges.

- High-profile cases demonstrate the significant impact these legal actions can have on corporate behavior and investor recovery.

- Recent legal precedents have established clearer standards for pleading requirements, particularly following landmark Supreme Court decisions that have shaped the landscape of securities litigation.

- The effectiveness of securities class action lawsuits depends heavily on meeting stringent pleading standards established by the Private Securities Litigation Reform Act (PSLRA).

- Plaintiffs must demonstrate not only that material misstatements occurred, but also establish loss causation—showing that their financial losses directly resulted from the alleged fraud rather than general market conditions or other factors.

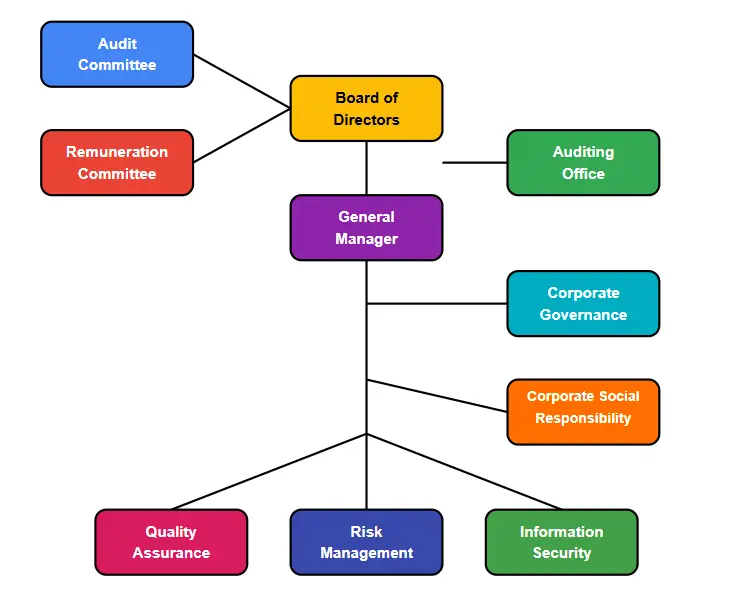

Corporate Governance and Internal Controls: The Foundation of Market Integrity

- Strong corporate governance practices serve as the first line of defense against securities fraud.

- Companies with robust governance structures, including independent board oversight, transparent reporting mechanisms, and effective internal controls, are significantly less likely to engage in fraudulent activities.

- These systems create accountability at the highest levels of corporate management and establish clear protocols for financial reporting and disclosure.

- Internal controls encompass the policies, procedures, and mechanisms that companies implement to ensure accurate financial reporting and compliance with applicable laws and regulations.

- When these controls fail or are deliberately circumvented, the risk of securities fraud increases dramatically.

- Investors should carefully evaluate a company’s governance structure and internal control effectiveness when making investment decisions.

- The Sarbanes-Oxley Act of 2002 significantly strengthened requirements for internal controls, mandating that public companies establish and maintain adequate internal control over financial reporting.

- This legislation also requires CEO and CFO certifications of financial statements, creating personal accountability for corporate executives.

Regulatory Compliance: Navigating the Complex Legal Landscape

- Regulatory compliance in securities law requires companies to adhere to a complex web of federal and state regulations, SEC rules, and industry-specific requirements.

- The Securities and Exchange Commission (SEC) serves as the primary federal regulator, enforcing compliance through examinations, investigations, and enforcement actions.

- Companies must navigate evolving disclosure requirements, particularly as new technologies and business models emerge.

- The regulatory environment continues to adapt to address emerging risks, including cybersecurity threats, environmental, social, and governance (ESG) considerations, and artificial intelligence implementations.

Future Trends in Corporate Disclosures: Looking Toward 2025

- Several emerging trends will significantly impact corporate disclosure requirements by 2025:

- Enhanced ESG Reporting: Companies will face increased pressure to provide detailed environmental, social, and governance disclosures, with potential SEC mandates for climate-related risk reporting

- Cybersecurity Disclosure Requirements: New regulations will likely require more comprehensive and timely disclosure of cybersecurity incidents and risk management practices

- Artificial Intelligence Governance: As AI becomes more prevalent in business operations, companies will need to disclose AI-related risks, governance frameworks, and potential impacts on operations

- Real-Time Disclosure Technologies: Blockchain and other technologies may enable more immediate and transparent disclosure of material information

- Stakeholder Capitalism Reporting: Growing emphasis on stakeholder value creation will drive expanded disclosure requirements beyond traditional financial metrics

Protecting Investor Rights Through Legal Action

- When securities fraud occurs, securities litigation provides essential mechanisms for investor recovery and corporate accountability.

- Successful cases not only compensate harmed investors but also serve as deterrents against future fraudulent conduct.

- The threat of significant legal consequences encourages companies to maintain robust compliance programs and transparent disclosure practices.

- Investors who believe they have been harmed by securities fraud should act promptly, as statutes of limitations and other procedural requirements can affect their ability to recover damages.

- Working with experienced securities litigation attorneys ensures that investors understand their rights and can effectively pursue available remedies.

- The intersection of corporate governance, internal controls, and regulatory compliance creates a comprehensive framework for preventing securities fraud and protecting investor interests.

- As markets continue to evolve and new challenges emerge, maintaining vigilance and understanding these interconnected systems remains essential for all market participants.

- By fostering transparency, accountability, and robust legal remedies, the securities litigation system helps maintain the integrity and efficiency of capital markets, ultimately benefiting investors, companies, and the broader economy.

THE SECURITIES CLASS ACTION PROCESS

Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

The Importance of Securities Class Actions for Investors

Securities class actions play a vital role in protecting the rights of investors by providing a means to seek redress for securities fraud and other financial misconduct.

For individual investors, the costs and complexities associated with pursuing a lawsuit can be prohibitive.

Securities class action level the playing field by pooling resources and legal expertise, enabling investors to take on powerful corporations and financial institutions that might otherwise evade accountability.

This collective approach serves as a deterrent to potential wrongdoers, reinforcing the principle that fraudulent behavior will not go unchallenged.

Beyond providing a practical avenue for seeking justice, class actions also promote transparency and accountability within the financial markets.

By bringing fraudulent activities to light, these lawsuits help to uncover systemic issues and prevent future misconduct.

The publicity surrounding class actions can also prompt regulatory bodies to take action, leading to reforms and stricter enforcement of securities laws.

This dual impact of securities class actions—addressing individual grievances while driving broader change—underscores their importance as a tool for investor protection.

Moreover, class actions serve an educational function by increasing awareness of securities fraud and the mechanisms available to combat it.

Investors who participate in securities litigation gain valuable insights into the legal process and the types of fraudulent activities that can occur.

This knowledge empowers them to make more informed investment decisions and to recognize potential red flags in the future.

By fostering a more informed investor base, securities fraud classs actions contribute to a more resilient and vigilant financial community, better equipped to uphold market integrity.

DETAILED SUMMARY TABLE OUTLINING THE ECONOMIC, OPERATIONAL, AND LEGAL FRAMEWORKS FOR SECURITIES CLASS ACTIONS

Category | Key Elements | Practical Implications | Recent Developments |

| Economic | |||

Corporate Financial Impact | • Legal fees and defense costs • Settlement payments • Penalties and fines • Remediation expenses | • Direct reduction in profitability • Potential stock price decline • Impact on shareholder value • Financial statement disclosures | • Average settlement amounts increased 15% in 2023 |

Operational Disruption | • Management distraction • Document production burden • Internal investigation requirements • Testimony preparation | • Reduced focus on core business • Resource reallocation • Strategic initiative delays • Compliance program overhauls | • Companies now spend average of 1,200+ hours on litigation response |

Investor Recovery Mechanism | • Class action procedures • Out-of-pocket damages • Lead plaintiff selection • Claims administration | • Financial loss compensation • Transaction-based calculations • Pro-rata distribution • Claims filing requirements | • Recovery rates average 2-3% of investor losses |

Market Confidence Effects | • Transparency enhancement • Accountability mechanisms • Governance improvements • Disclosure quality | • Investor trust restoration • Market participation incentives • Capital formation support • Information reliability | • Post-litigation governance reforms implemented in 72% of settled cases |

| Current Trends | |||

Individual Accountability Focus | • Officer and director liability • Personal financial consequences • Clawback provisions • D&O insurance implications | • Executive behavior modification • Personal risk assessment • Compliance prioritization • Leadership accountability | • 64% increase in named individual defendants |

Technology-Enhanced Detection | • AI-powered surveillance • Advanced analytics • Pattern recognition • Anomaly detection | • Increased violation detection • Stronger evidence collection • More sophisticated cases • Higher success rates | • SEC using machine learning to identify disclosure anomalies |

Litigation Process Modernization | • E-discovery platforms • Digital evidence management • Virtual proceedings • Automated document review | • Faster case processing • Cost efficiency improvements • Enhanced evidence organization • Remote participation | • 87% reduction in document review time |

Cross-Border Complexity | • Jurisdictional challenges • Regulatory differences • Enforcement coordination • International evidence gathering | • Multi-jurisdiction compliance • Global risk assessment • Harmonized defense strategies • International settlement considerations | • 38% of securities cases now involve cross-border elements |

| Legal Frameworks | |||

Pleading Standards | • PSLRA requirements • Scienter (intent) showing • Particularity in allegations • Strong inference threshold | • Higher dismissal rates • Front-loaded case investment • Detailed complaint preparation • Expert involvement earlier | • Macquarie Infrastructure Corp. v. Moab Partners (2024) reshaped omission standards • Motion to dismiss success rate at 47% |

Loss Causation Elements | • Corrective disclosure • Price impact evidence • Economic analysis • Event studies | • Causal chain demonstration • Market efficiency proof • Expert testimony requirements • Damages limitation | • Dura Pharmaceuticals v. Broudo remains controlling precedent |

Damages Calculation | • Out-of-pocket methodology • Inflation per share • 90-day lookback period • Transaction-based approach | • Expert-driven calculations • Trading pattern importance • Holding period considerations • Proportional recovery | • Forensic accounting techniques increasingly sophisticated |

Class Certification | • Commonality requirements • Typicality standards • Adequacy of representation • Predominance of common issues | • Class definition strategies • Lead plaintiff selection • Institutional investor preference • Certification challenges | • Institutional investors serve as lead plaintiffs in 58% of cases |

Investor Considerations | |||

Participation Decision Factors | • Loss threshold assessment • Lead plaintiff potential • Litigation timeline • Cost-benefit analysis | • Active vs. passive participation • Resource commitment evaluation • Recovery expectations • Reputational considerations | • Minimum loss threshold for lead plaintiff typically $100K+ |

Recovery Optimization | • Claims filing procedures | • Proof of transaction needs • Claims administrator interaction • Recovery maximization strategies • Tax implications | • Only 35% of eligible investors file claims |

Governance Implications | • Board oversight duties • Disclosure controls • Risk management systems • Compliance programs | • Director liability concerns • Committee responsibilities • Reporting procedures • Documentation practices | • Board-level disclosure committees now present in 78% of public companies |

Future Participation Rights | • Opt-out considerations • Individual action potential • Settlement objection rights • Appeal possibilities | • Strategic participation choices • Large loss alternative approaches • Settlement evaluation • Ongoing case monitoring | • Opt-out actions by large investors increased 47% |

Common Types of Securities Fraud and Their Market Impact

Insider Trading: The Erosion of Market Fairness

- Insider trading occurs when individuals with access to non-public, material information about a company use that information to make advantageous trades.

- This practice fundamentally violates the principle of market fairness by creating an uneven playing field where some participants possess significant advantages over ordinary investors.

- The practice not only violates federal securities laws but also undermines the foundational trust that enables capital markets to function effectively.

- The impact of insider trading extends far beyond individual transactions.

- When corporate executives, board members, or employees trade on material non-public information, they essentially steal from other investors who lack access to the same information.

- This creates a ripple effect that damages market confidence and can lead to securities class action lawsuits when the fraudulent activity is discovered.

- Corporate governance failures often enable insider trading by failing to establish adequate internal controls Regulatory compliance programs must include robust policies preventing unauthorized disclosure of material information

- Securities litigation frequently reveals patterns of insider trading that span months or years

Misrepresentation and Omission of Material Information

- The second major category of securities fraud involves the deliberate misrepresentation or omission of material information that investors rely upon to make informed investment decisions.

- This type of fraud strikes at the heart of market transparency, as investors depend on accurate corporate disclosures to evaluate investment opportunities and risks.

- Material misrepresentations can take numerous forms, including falsified financial statements, misleading earnings guidance, concealment of significant business risks, or failure to disclose regulatory investigations.

- When companies provide false or incomplete information, they create artificial market conditions that can inflate stock prices and mislead investors about the true value of their investments.

- The Enron scandal exemplifies how systematic misrepresentation can lead to catastrophic investor losses and widespread market disruption.

- In that case, the company’s complex accounting schemes and off-balance-sheet partnerships concealed billions of dollars in debt and losses, ultimately leading to one of the largest securities class actions in history.

- Corporate governance plays a crucial role in preventing misrepresentation fraud:

- Internal controls must ensure accurate financial reporting and disclosure processes • Independent audit committees should provide oversight of financial statement preparation

- Regulatory compliance programs must address disclosure obligations under federal securities laws Whistleblower protections encourage employees to report potential fraud internally

Pump-and-Dump Schemes: Manipulating Market Sentiment

- Pump-and-dump schemes represent a particularly insidious form of securities fraud that typically targets small-cap or penny stocks.

- These schemes involve artificially inflating a stock’s price through false or misleading promotional campaigns, creating artificial demand and trading volume.

- Once the price reaches the desired level, the fraudsters sell their shares at inflated prices, leaving unsuspecting investors with worthless securities when the artificial support disappears.

- These schemes often exploit social media platforms, email campaigns, and online forums to spread false information about a company’s prospects.

- The perpetrators may claim insider knowledge of pending contracts, revolutionary products, or other developments that will supposedly drive dramatic price increases.

- Novice investors are particularly vulnerable to these schemes because they may lack the experience to recognize warning signs or properly evaluate investment risks.

- The proliferation of online trading platforms and social media has made pump-and-dump schemes more sophisticated and harder to detect.

- Securities litigation in this area often involves complex investigations to trace the source of false information and identify the individuals behind coordinated manipulation campaigns.

Legal Remedies Through Securities Class Actions

- When securities fraud occurs, securities class action lawsuits provide investors with a powerful mechanism to seek compensation for their losses.

- These lawsuits allow multiple investors who suffered similar harm to pool their resources and pursue claims collectively, making it economically feasible to challenge even the largest corporations.

- Securities class actions must satisfy specific legal requirements under federal law, including:

- Materiality: The misrepresentation or omission must be significant enough that a reasonable investor would consider it important

- Reliance: Investors must have relied on the false information or been harmed by the omission

- Loss causation: The fraud must have actually caused the investors’ financial losses

- Damages: Investors must have suffered quantifiable economic harm

- The PSLRA establishes heightened pleading standards for securities fraud cases, requiring plaintiffs to plead fraud with particularity and demonstrate a strong inference of fraudulent intent.

- These requirements help prevent frivolous lawsuits while ensuring that legitimate claims can proceed.

- Securities litigation often involves complex economic analysis to determine the extent of artificial price inflation caused by fraudulent conduct.

- Expert witnesses, including forensic accountants and financial economists, play crucial roles in quantifying damages and establishing the connection between fraudulent conduct and investor losses.

Corporate Governance and Prevention Strategies

- Effective corporate governance serves as the first line of defense against securities litigation.

- Companies that prioritize transparency, accountability, and ethical conduct are far less likely to engage in fraudulent practices or fall victim to schemes that could trigger securities class action lawsuits.

- Internal controls represent a critical component of fraud prevention:

- Financial reporting controls ensure accurate preparation and disclosure of financial information

- Disclosure controls govern the collection, evaluation, and reporting of material information

- Trading controls prevent insider trading by restricting access to material non-public information

- Compliance monitoring systems detect potential violations before they escalate

- Regulatory compliance programs must address the complex web of federal securities laws, including the Securities Act of 1933, the Securities Exchange Act of 1934, and the Sarbanes-Oxley Act.

- These programs should include regular training for employees, clear policies regarding disclosure obligations, and robust procedures for identifying and reporting potential violations.

- Board oversight pplays an essential role in preventing securities fraud.

- Independent directors, particularly those serving on audit committees, must maintain skepticism regarding management representations and ensure that appropriate controls exist to prevent fraudulent conduct.

- When boards fail in their oversight responsibilities, they may face personal liability in securities litigation.

CORPORATE GOVERNANCE AND INTERNAL CONTROLS CHART

The Evolving Landscape of Securities Fraud Prevention

- As technology continues to transform financial markets, new challenges emerge in detecting and preventing securities fraud.

- Artificial intelligence and machine learning tools offer promising opportunities for identifying suspicious trading patterns and potential manipulation schemes.

- However, these same technologies can also be exploited by fraudsters to create more sophisticated schemes.

- Regulatory compliance programs must evolve to address emerging risks, including cybersecurity threats that could compromise material non-public information, social media communications that may constitute securities violations, and algorithmic trading systems that could facilitate market manipulation.

- The increasing focus on environmental, social, and governance (ESG) factors in investment decisions has created new areas where misrepresentation could occur.

- Companies making claims about their sustainability practices, social impact, or governance structures must ensure these representations are accurate and substantiated to avoid potential securities class actions.

Protecting Investor Rights Through Legal Action

- For investors who have suffered losses due to securities fraud, securities class action lawsuits provide an essential avenue for seeking justice and compensation.

- Securities litigation serves multiple important functions in maintaining market integrity:

- Deterrence: The threat of significant financial penalties encourages companies to maintain accurate disclosure practices

- Compensation: Successful class actions provide monetary recovery for harmed investors

- Market confidence: Effective enforcement demonstrates that fraudulent conduct will be punished

- Corporate reform: Settlement agreements often require companies to improve their internal controls and governance practices

- Securities litigation can be complex and time-consuming, often requiring several years to reach resolution. However, the potential for meaningful recovery and the broader benefits to market integrity make these cases essential for protecting investor rights.

- The landscape of securities fraud class actions continues to evolve as courts refine legal standards and Congress considers additional reforms.

- Recent Supreme Court decisions have clarified important aspects of securities law, including standards for materiality, loss causation, and the adequacy of fraud allegations.

- Understanding the various forms of securities fraud and the legal remedies available through securities class actions empowers investors to protect their interests and contribute to market integrity.

- When corporations prioritize corporate governance, maintain robust internal controls, and ensure regulatory compliance, they create an environment where securities fraud is less likely to occur and investors can make informed decisions based on accurate information.

- By recognizing the wwarning signs of securities fraud and understanding their rights under federal securities laws, investors can better navigate today’s complex financial markets while supporting the transparency and accountability that make capital markets function effectively for all participants.

How to Identify Potential Securities Fraud: A Comprehensive Guide for Investors

- Identifying potential securities fraud requires vigilance and a keen eye for irregularities in financial information and market behavior.

- In today’s complex financial landscape, where securities fraud class actions and securities litigation cases continue to rise, investors must arm themselves with the knowledge and tools necessary to protect their investments and recognize warning signs before significant losses occur.

Enhanced Due Diligence: The Foundation of Fraud Prevention

- One of the first steps investors can take is to conduct thorough due diligence before making an investment.

- This process extends far beyond simply reviewing a company’s financial statements, press releases, and regulatory filings.

- Sophisticated investors must examine the quality of corporate governance structures and evaluate the effectiveness of internal controls that companies have implemented to prevent fraudulent activities.

- Key areas to scrutinize include:

- Board composition and independence – Look for diverse, independent directors with relevant expertise Executive compensation structures – Excessive or poorly aligned incentives can signal potential misconduct Audit committee effectiveness – Strong oversight mechanisms reduce fraud risk

- Management turnover patterns – Frequent changes in key positions may indicate underlying issues

- Investors should be particularly wary of discrepancies or red flags, such as sudden changes in financial performance, unexplained revenue recognition patterns, or a lack of transparency in disclosures.

- These irregularities often serve as early warning signs that may later form the basis for securities class action lawsuits when fraud is eventually uncovered.

Regulatory Compliance: A Critical Fraud Detection Tool

- Regulatory compliance serves as a crucial barometer for identifying potential securities fraud.

- Companies that consistently struggle with regulatory requirements or face repeated enforcement actions demonstrate weaknesses in their control environment that fraudsters often exploit.

- Investors should monitor:

- SEC filing timeliness and accuracy – Late or amended filings can signal internal control deficiencies

- Regulatory correspondence – Comment letters and responses reveal areas of regulatory concern

- Compliance violations – Patterns of violations across different regulatory areas suggest systemic issues Whistleblower reports – Internal complaints often precede major fraud revelations

- Companies with robust internal controls and strong regulatory compliance programs are significantly less likely to engage in fraudulent activities or fall victim to management misconduct that leads to securities litigation.

Recognizing High-Risk Investment Schemes

- Investors should also be cautious of unsolicited investment opportunities, particularly those that promise high returns with little risk.

- Such opportunities are often associated with fraudulent schemes, including Ponzi schemes and pump-and-dump operations.

- These schemes frequently target investors through sophisticated marketing campaigns that exploit gaps in regulatory compliance oversight.

- Warning signs of fraudulent investment schemes include:

- Guaranteed returns with minimal risk disclosure

- Pressure tactics requiring immediate investment decisions

- Lack of regulatory registration or proper licensing

- Complex strategies that cannot be easily explained or verified

- Limited liquidity or restrictions on withdrawing investments

- If an investment opportunity seems too good to be true, it likely warrants further scrutiny.

- Conducting independent research and seeking advice from trusted financial advisors can help investors assess the legitimacy of an opportunity and avoid falling victim to scams that often result in securities fraud class actions.

Market Behavior Analysis and Fraud Detection

- Monitoring market behavior and staying informed about broader economic developments can also help investors identify potential securities fraud.

- Sudden, unexplained fluctuations in a stock’s price or trading volume may signal manipulation or insider trading activities that violate securities laws.

- Advanced investors should watch for:

- Unusual trading patterns preceding major announcements

- Analyst recommendation changes that seem disconnected from fundamentals

- Social media manipulation campaigns designed to inflate stock prices

- Coordinated buying or selling activities across multiple accounts

- Additionally, keeping abreast of news and regulatory developments provides insights into potential risks and emerging fraud trends.

- The rise in securities litigation cases across various industries, particularly in technology and healthcare sectors, demonstrates the importance of sector-specific fraud awareness.

Building a Comprehensive Fraud Prevention Strategy

- Successful fraud identification requires a systematic approach that combines traditional due diligence with modern analytical tools.

- Investors should develop relationships with legal professionals who practice in securities class actions and understand the evolving landscape of securities litigation.

- Essential components of an effective strategy include:

- Regular portfolio monitoring using both fundamental and technical analysis

- Diversification across industries and investment types to limit exposure

- Professional advisory relationships with experienced securities attorneys

- Continuous education about emerging fraud schemes and regulatory changes

- Documentation practices that preserve evidence for potential legal action

Taking Action When Fraud is Suspected

- When investors identify potential securities fraud, prompt action is essential.

- Understanding the connection between fraud identification and securities class action lawsuits can help investors protect their rights and potentially recover losses.

- Early detection and proper documentation of suspicious activities strengthen the foundation for successful securities litigation.

- By remaining informed and proactive, investors can better protect themselves from fraudulent activities and make more confident investment decisions.

- The combination of enhanced due diligence, corporate governance analysis, regulatory compliance monitoring, and market behavior assessment creates a comprehensive framework for fraud detection that serves as the first line of defense against securities fraud.

- Remember that identifying potential fraud is just the beginning—taking appropriate legal action through securities class actions when fraud is confirmed ensures that wrongdoers are held accountable and helps maintain market integrity for all investors.

10 INDICATORS COMPANY LACKS STRONG INTERNAL CONTROLS

1. | Lack of segregation of duties, particularly in financial functions |

2. | Frequent financial restatements or unexplained accounting adjustments |

| 3. | Unusual or complex transactions, especially near reporting periods |

4. | Excessive management override of established controls |

5. | Inadequate documentation for significant transactions |

| 6. | High employee turnover in accounting or finance departments |

| 7. | Delayed financial reporting or missed deadlines |

8. | Discrepancies between analytical expectations and reported results |

9. | Audit committee members lacking financial expertise |

| 10. | Weak or nonexistent whistleblower mechanisms |

Steps to Take if You Suspect Securities Fraud

- If an investor suspects securities fraud, it is ccrucial to act quickly and methodically to protect their interests and preserve evidence for potential legal action.

- The first step is to gather and document all relevant information, including communication records, transaction details, and any other evidence that may support the suspicion of fraud.

- This documentation will be essential for legal proceedings and can help authorities investigate the matter effectively.

Reporting the Suspected Fraud

- Next, investors should report the suspected fraud to the appropriate regulatory authorities.

- In the United States, this typically involves filing a complaint with the SEC or the Financial Industry Regulatory Authority (FINRA).

- These agencies have the authority to investigate securities fraud and can take enforcement actions against those found guilty of wrongdoing.

- Reporting suspected fraud not only helps protect the individual investor but also contributes to broader efforts to maintain market integrity.

Seeking Legal Advice

- Seeking legal advice is another critical step for investors who suspect securities fraud.

- An experienced securities attorney can provide guidance on potential legal remedies, including the possibility of joining a securities class action lawsuit.

- Legal counsel can also assist in evaluating the strength of the case and navigating the complexities of securities law.

- By engaging with legal professionals, investors can better understand their rights and options, ensuring they take the most appropriate course of action in response to suspected fraud.

PRE- AND POST-PSLRA STANDARDS FOR SECURITIES FRAUD LITIGATION

Feature | Pre-PSLRA Standard | Post-PSLRA Standard |

Motion to dismiss | Based on “notice pleading” (Federal Rule of Civil Procedure 8(a)), making it easier for plaintiffs to survive motions to dismiss. This often led to settlements to avoid costly litigation. | Requires satisfying PSLRA’s heightened pleading standards and the “plausibility” standard from Twombly and Iqbal. Failure to plead with particularity on any element can result in dismissal. |

Pleading | “Notice pleading” was generally sufficient, though fraud claims under Federal Rule of Civil Procedure 9(b) required particularity for the circumstances of fraud, but intent could be alleged generally. | Each misleading statement must be stated with particularity, explaining why it was misleading. Facts supporting beliefs in claims based on “information and belief” must also be stated with particularity. |

Scienter | Pleaded broadly; the “motive and opportunity” test was often sufficient to infer intent. | Requires alleging facts creating a “strong inference” of fraudulent intent, which must be at least as compelling as any opposing inference of non-fraudulent intent, as clarified in Tellabs, Inc. v. Makor Issues & Rights, Ltd.. |

| Loss causation | Not a significant pleading hurdle, often assumed if a plaintiff bought at an inflated price. | Requires pleading facts showing the fraud caused the economic loss, often by linking a corrective disclosure to a stock price drop. Dura Pharmaceuticals, Inc. v. Broudo affirmed this. |

Discovery | Could proceed while a motion to dismiss was pending. | Automatically stayed during a motion to dismiss. |

Safe harbor for forward-looking statements | No statutory protection. | Protects certain forward-looking statements if accompanied by “meaningful cautionary statements”. |

Lead plaintiff selection | Often the first investor to file. | Court selects based on a “rebuttable presumption” that the investor with the largest financial interest is the most adequate. |

| Liability standard | For non-knowing violations, liability was joint and several. | For non-knowing violations, liability is proportionate; joint and several liability applies only if a jury finds knowing violation. |

Mandatory sanctions | Available under Federal Rule of Civil Procedure 11, but judges were often reluctant to impose them. | Requires judges to review for abusive conduct |

The Securities Class Action Process

- Securities fraud class actions represent one of the most powerful legal mechanisms available to investors seeking redress for corporate misconduct.

- Understanding this complex process is essential for anyone who has suffered financial losses due to misleading statements, omissions, or other violations of federal securities laws.

- The class action framework provides a structured pathway for collective legal action that can hold corporations accountable while offering meaningful compensation to harmed investors.

Phase One: Filing and Certification – Building the Foundation

The securities class action process begins when a lead plaintiff identifies potential securities fraud and files a comprehensive lawsuit against the defendant corporation.

This initial filing serves as the cornerstone of the entire legal proceeding and must satisfy rigorous pleading standards under the PSLRA.

Key Elements of a Securities Class Action

- Key elements of the initial filing include:

- Material misrepresentation or omission allegations – Specific claims about false or misleading statements made by the corporation

- Loss causation arguments – Demonstrating the direct link between the alleged fraud and investor losses

Scienter pleading – Establishing the defendant’s intent to deceive or manipulate investors - Class period definition – Identifying the timeframe during which the alleged fraud occurred

- Damages calculations – Initial estimates of investor losses across the proposed class

Class Certiciation Stage

- The certification phase represents a critical juncture where the court determines whether the case can proceed as a collective action.

- This decision hinges on several fundamental requirements that ensure securities litigation serves its intended purpose of efficient dispute resolution.

Certification requirements focus on:

- Commonality of claims – Ensuring all class members suffered similar harm from the same alleged misconduct

- Typicality of representative claims – Verifying that the lead plaintiff’s situation reflects that of other class members

- Adequacy of representation – Confirming the lead plaintiff can effectively advocate for all class members • Superiority of class action format – Demonstrating that collective litigation is more efficient than individual lawsuits

- Manageability of the class – Ensuring the court can effectively oversee the proceedings

Phase Two: Discovery – Uncovering the Truth

- Once certification is achieved, securities class actions enter the discovery phase, which often represents the most intensive and revealing portion of the litigation process.

- This phase involves extensive investigation into the defendant corporation’s internal controls, corporate governance practices, and regulatory compliance measures.

The Discovery Phase

- Discovery activities typically encompass:

- Document production and review – Examining millions of corporate documents, emails, and internal communications

- Executive depositions – Questioning key corporate officers and directors under oath

- Expert witness preparation – Engaging financial analysts, forensic accountants, and industry specialists

- Market analysis – Studying stock price movements and trading patterns during the class period

- Regulatory filing examination – Reviewing SEC filings, earnings reports, and other public disclosures

- Internal audit investigation – Analyzing the company’s risk management and compliance systems

- The discovery process serves multiple critical functions in securities litigation.

- It allows plaintiffs to gather evidence supporting their fraud allegations while providing defendants the opportunity to challenge the claims and present alternative explanations for stock price movements.

- This comprehensive fact-gathering phase often reveals the true extent of any corporate misconduct and helps establish the strength of both sides’ positions.

Corporate Governance and Internal Control Remedies

- Corporate governance issues frequently emerge during discovery, as investigators examine:

- Board oversight mechanisms – How directors monitored company operations and risk factors

- Management reporting systems – Whether executives received accurate information about business conditions

Compliance program effectiveness – The adequacy of systems designed to prevent securities violations - Risk disclosure practices – How the company identified and communicated material risks to investors

Phase Three: Resolution – Settlement or Trial

- The final phase of securities class actions involves either negotiated settlement or trial proceedings.

- Statistical data shows that approximately 90% of securities class actions settle before trial, reflecting the practical realities of complex litigation and the desire for certainty among all parties.

Settlement Negotiations

- Settlement negotiations typically address:

- Total settlement amount – The aggregate funds available for distribution to class members

- Allocation methodology – How settlement proceeds will be distributed among different investors

- Claims administration process – The mechanism for class members to submit and validate their claims • Attorney fee arrangements – Compensation for legal counsel representing the class

- Corporate governance reforms – Changes to company practices designed to prevent future violations • Regulatory compliance enhancements – Improvements to internal controls and disclosure procedures

- When cases proceed to trial, the outcome depends on the strength of evidence gathered during discovery and the ability of both sides to present compelling arguments to the judge or jury.

- Trial proceedings in securities litigation often involve complex financial testimony and require extensive expert witness presentations to explain market dynamics and damage calculations.

The Trial

- Key trial considerations include:

- Burden of proof requirements – Plaintiffs must demonstrate fraud by a preponderance of the evidence Causation arguments – Establishing that alleged misstatements actually caused investor losses

- Damages quantification – Calculating the specific financial harm suffered by class members

- Affirmative defenses – Corporate arguments such as forward-looking statement safe harbors

- Market efficiency theories – Economic models eexplaining how information affects stock prices

Protecting Investor Rights Through Collective Action

- The class action process serves as a vital component of market integrity by providing investors with meaningful recourse against corporate fraud.

- This structured legal framework ensures that even individual investors with relatively small losses can participate in significant litigation against well-funded corporate defendants.

- Benefits of the securities class action system include:

- Access to justice – Enabling small investors to pursue claims that would be uneconomical individually

- Deterrent effect – Encouraging corporate compliance through the threat of significant liability

- Market confidence – Maintaining investor trust through effective enforcement mechanisms

- Resource efficiency – Resolving similar claims collectively rather than through numerous individual lawsuits Expert representation – Providing access to specialized legal counsel with securities litigation expertise

- For investors who believe they have been harmed by securities fraud, understanding the class action process is essential for making informed decisions about participation in collective litigation.

- The structured nature of this legal framework provides multiple opportunities for meaningful recovery while promoting broader market integrity through corporate accountability.

Key Legal Considerations for Investors

When considering participation in a securities fraud class action, investors should be aware of several key legal considerations that can impact their involvement and potential outcomes.

Statute of Limitations

One of the primary factors is the statute of limitations, which sets a time limit on when a lawsuit can be filed.

In securities fraud cases, this period is typically two to three years from the date the fraud was discovered or should have been discovered.

Missing this deadline can bar investors from pursuing legal action, making it crucial to act promptly upon suspecting fraud.

Recovery and Distribution of Proceeds

Another important consideration is the potential recovery and distribution of any settlement or judgment.

Class actions often result in financial compensation for affected investors, but the amount each class member receives can vary depending on the size of the settlement and the number of claimants.

Investors should be aware that legal fees and expenses are typically deducted from any recovery, reducing the overall payout.

Understanding the potential financial implications can help investors set realistic expectations and make informed decisions about participating in a class action.

Media Attention

Investors should also consider the reputational impact of participating in a class action, particularly if they hold significant positions in the financial industry.

While class actions are a legitimate means of seeking justice, they can attract media attention and scrutiny.

Investors should weigh the potential benefits of legal action against any potential consequences for their professional reputation and relationships.

Consulting with legal counsel can provide valuable insights into these considerations and help investors navigate the complexities of participating in a securities class action lawsuit.

Resources for Investors: Support and Legal Assistance

Investors seeking to address securities fraud have access to a variety of resources and support networks that can assist them in navigating the legal landscape.

One of the most valuable resources is the network of legal professionals experienced in securities law.

These attorneys can provide expert guidance on the intricacies of securities fraud cases, helping investors understand their rights and the potential legal remedies available.

Many law firms offer free consultations to evaluate the merits of a case and discuss the possibility of joining or initiating a class action.

Regulatory agencies, such as the SEC and FINRA, are also critical resources for investors dealing with securities fraud. These organizations provide tools and information to help investors report suspected fraud and track the progress of investigations.

They also offer educational resources to increase investor awareness and understanding of securities laws and regulations.

By engaging with these agencies, investors can contribute to the enforcement of securities laws and the protection of the financial markets.

In addition to legal and regulatory resources, investors can benefit from support networks and advocacy groups focused on investor protection.

Organizations such as the North American Securities Administrators Association (NASAA) and the Public Investors Advocate Bar Association (PIABA) offer resources and guidance for investors affected by securities fraud.

These groups can provide valuable information on the latest developments in securities regulation and connect investors with experienced professionals who can assist with their cases.

By leveraging these resources, investors can better equip themselves to pursue justice and protect their financial interests.

Conclusion and Next Steps for Investors

Navigating the complexities of securities fraud and class actions requires a proactive approach and a thorough understanding of the legal landscape.

By educating themselves on the types of fraud, recognizing the warning signs, and understanding the class action process, investors can better protect their interests and seek redress when wronged.

The journey toward justice is often challenging, but with the right resources and support, investors can hold those who undermine market integrity accountable and contribute to a more transparent and equitable financial system.

As investors move forward, it is essential to remain vigilant and informed about the ever-evolving landscape of securities fraud.

Staying abreast of regulatory developments, market trends, and emerging fraud tactics can help investors stay one step ahead of potential threats.

By continuing to engage with legal professionals, regulatory agencies, and support networks, investors can ensure they have the tools and knowledge necessary to protect their investments and pursue justice when needed.

Ultimately, the pursuit of accountability in securities fraud cases is not just about recovering financial losses; it is about reinforcing the principles of fairness and integrity that underpin the financial markets.

By taking informed and decisive action, investors can play a crucial role in upholding these values and fostering a more trustworthy and resilient financial system for all participants.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors