Introduction to Preventing and Detecting Accounting Fraud

- Preventing and Deferring: Preventing and detecting accounting fraud required organizations to establish strong internal controls, including segregation of duties and authorization policies, and conduct regular audits and risk assessments to identify vulnerabilities.

- Accounting Fraud: Accounting fraud is when a company’s financial statements or tax returns are intentionally manipulated to project better financial health than what is real.

- Monitor Transactions: Implementing fraud detection software and data analytics can help monitor transactions for suspicious patterns, while fostering a culture of employee awareness and providing clear avenues for whistleblowing are also critical components of a robust anti-fraud program.

- Erode Investor Trust: These sophisticated accounting schemes do not just damage individual portfolios—they erode the fundamental trust that keeps our entire economic system functioning.

- Distort Financial Reality: When corporate executives deliberately distort financial reality, they weaponize information asymmetry against the very investors who fuel their companies’ growth.

- Regulatory Compliance: Companies who faile to implement strong interal controls will be subject to reglatory enforcment which could include huge penalities.

- Securities Ligitation: When companies distort financial realitity investors to not get the true financial health of the company and when a corrective disclosure is made, investors file securities class action lawsuts subjecting the comapany to tens of millions or much more in liability

Understanding Accounting Fraud

Manipulating Financial Records

- Accounting fraud: encompasses a variety of illicit activities undertaken to manipulate financial records for personal or corporate gain.

- Intentional Misreprsentation: At its core, it involves intentional misrepresentation of financial information, designed to deceive stakeholders such as investors, creditors, and regulators.

- Deception: These deceptions can take many forms, ranging from overstating revenues and assets to understating liabilities and expenses.

- Misleading Investors: The ultimate goal is often to present a more favorable financial position than actually exists, thereby misleading decision-makers who rely on these financial statements.

Types of Accouting Fraud

- Types: There are several types of accounting fraud, each with unique characteristics and motivations.

- Revenue Reconition Fraud: One common type is revenue recognition fraud, where companies prematurely recognize revenue or record fictitious sales to inflate earnings.

- Expense Manipulaton: Another prevalent form is expense manipulation, where costs are either understated or improperly classified to enhance profitability.

- Asset misappropriation: Involving theft or misuse of a company’s assets, is another significant category.

- Financial statement fraud: Perhaps the most damaging, involves the deliberate alteration of financial reports to present a misleading picture of a company’s financial health.

Investors Must Be Proactive and Scrutinize Financial Statements

- Understanding Types: Understanding the different types of accounting fraud is crucial for investors aiming to protect their interests.

- Scrutinize Financial Statements: Knowledge of these fraudulent practices eenables investors to better scrutinize financial statements and identify potential discrepancies.

- Fed Flags: Furthermore, by familiarizing themselves with the common tactics used in accounting fraud, investors can develop a more critical eye and become proactive in questioning figures that appear too good to be true.

- Take the First Step: This foundational understanding is the first step in safeguarding investments from deceptive financial practices.

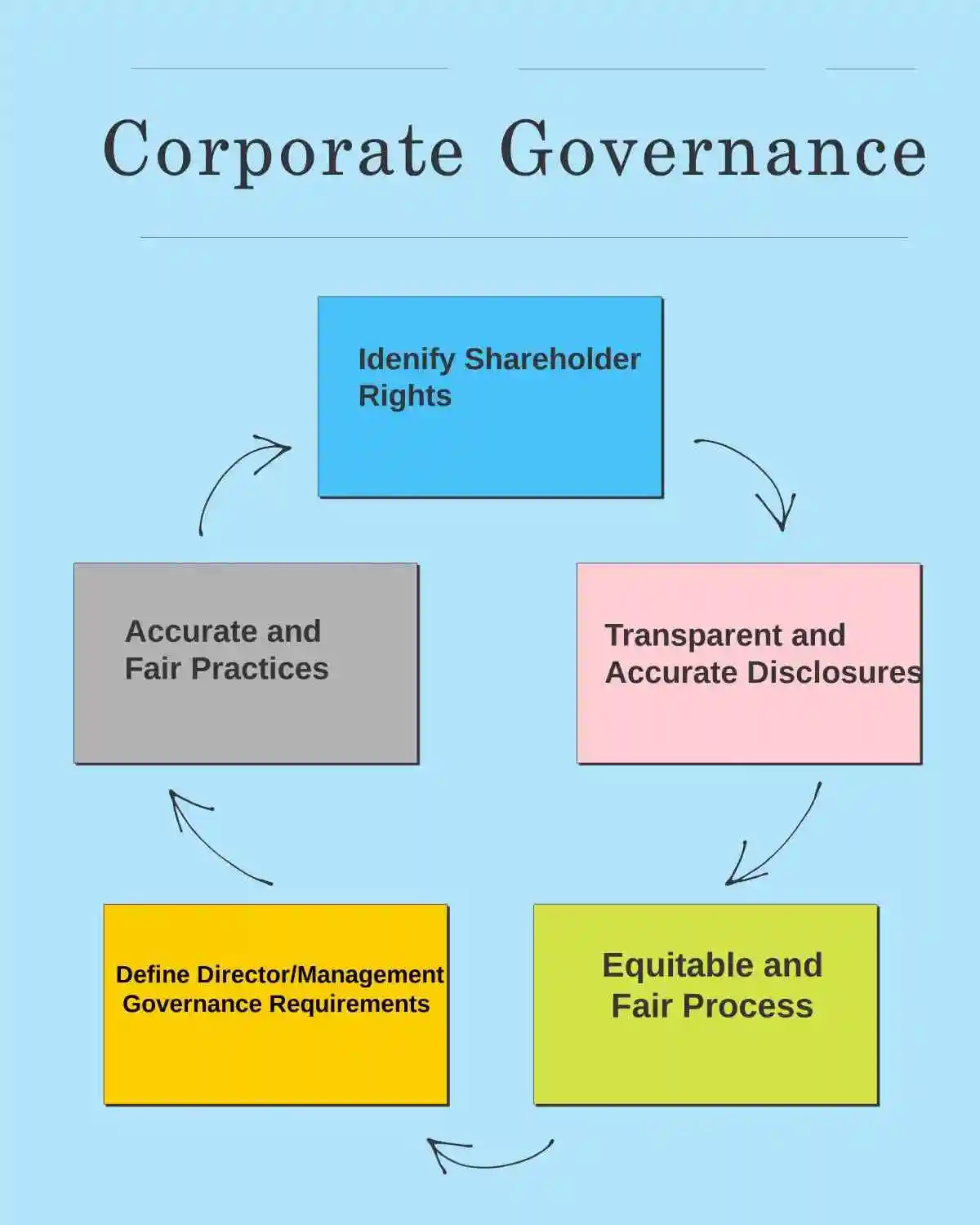

Corporate Governance and Regulatory Compliance Framework

Corporate Governance

Effective corporate governance serves as the foundation for preventing accounting fraud by establishing clear accountability structures and ethical standards throughout the organization.

The board of directors, particularly through its audit committee, plays a critical role in overseeing financial reporting processes and ensuring the independence and effectiveness of internal and external auditors.

Regulatory Complaince

- Evolving Compliance: Regulatory compliance requirements have evolved significantly in response to high-profile accounting scandals.

- Establish and Maintain Internal Controls: The Sarbanes-Oxley Act of 2002 introduced stringent requirements for internal controls over financial reporting, mandating that public companies establish and maintain adequate internal control structures.

- Certificy Effective of Controls: Section 404 of the Act requires management to assess and report on the effectiveness of these controls annually, while external auditors must attest to management’s assessment.

Enforment by Regulatory Bodies

- Regulatory enforcement: Has intensified in recent years, with agencies taking increasingly aggressive action against companies and individuals involved in accounting fraud.

- SEC enforcement actions: Have become more frequent and severe, reflecting the agency’s commitment to maintaining market integrity and protecting investors from fraudulent financial reporting.

- Substantial Penalitites: The SEC has demonstrated its resolve through substantial monetary penalties and criminal referrals for the most egregious cases.

- Enforcement Trends: Recent enforcement trends show particular focus on revenue recognition schemes, improper expense capitalization, and failures in internal controls that enable fraudulent activities to persist undetected.

Securities Litigation and Class Action Implications

Investor Remedies though Securities Litigation

- Investor Remedy: When accounting fraud occurs, affected investors often seek recourse through securities class action lawsuits and securities litigation.

- Recovering Losses: These legal mechanisms provide a pathway for investors to recover losses resulting from materially misleading financial statements and other violations of federal securities laws.

- Collective Action: Securities class actions represent a powerful collective legal remedy that allows investors who suffered similar harm to join together in a single lawsuit.

- Accounting Fraud: This approach is particularly effective in accounting fraud cases, where numerous investors may have relied on the same fraudulent financial statements when making investment decisions.

- Effecient Resolution: The class action mechanism enables efficient resolution of claims while ensuring that companies face meaningful consequences for their fraudulent conduct.

Legal Framework of Securities Fraud Litigation

- Key Elements: The legal framework governing securities class actions requires plaintiffs to demonstrate several key elements, including material misrepresentations or omissions, reliance on those misstatements, and economic losses caused by the fraud.

- Experts: In accounting fraud cases, expert testimony from forensic accountants and financial analysts often plays a crucial role in establishing these elements and quantifying investor damages.

- Strong Controls: Recent developments in securities litigation have emphasized the importance of strong internal controls and corporate governance in defending against fraud claims.

- Untimate Defense: Companies with robust control environments and effective oversight mechanisms are better positioned to argue that any accounting irregularities were isolated incidents

SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

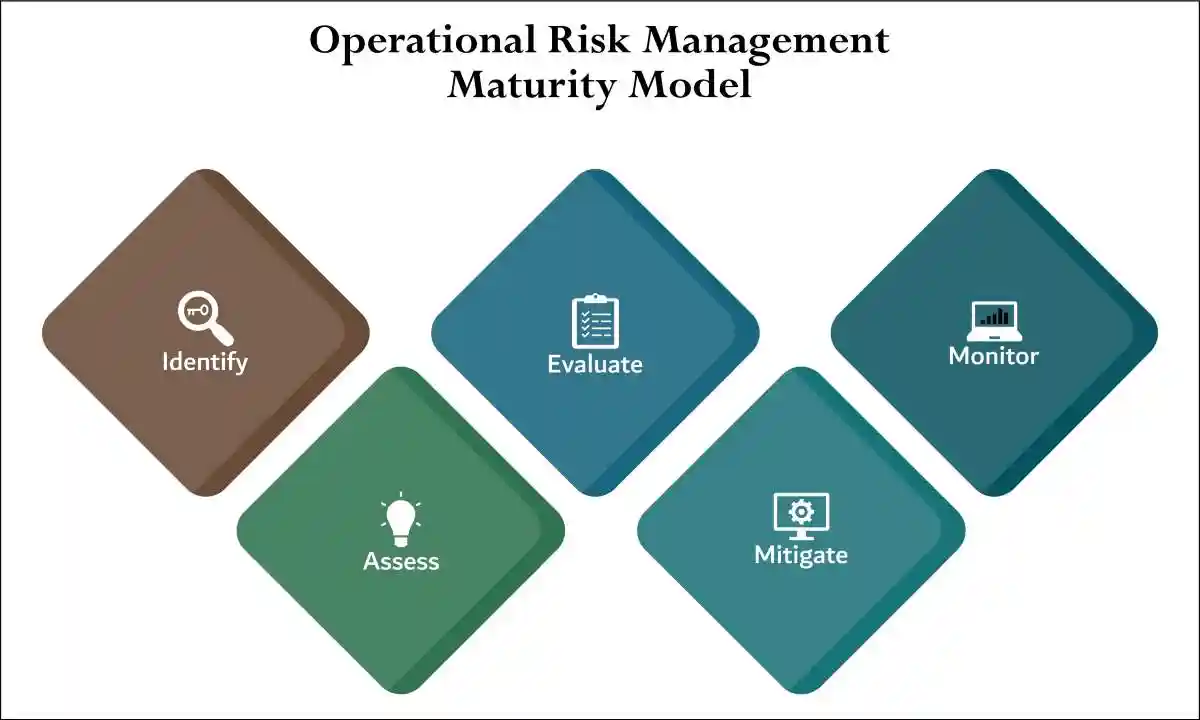

Risk Assessment and Monitoring Systems

Risk Assessments

- Fraud Risks: Comprehensive risk assessments must evaluate both inherent fraud risks and the effectiveness of existing controls in mitigating those risks.

- Evaluation: This evaluation should consider various fraud risk factors, including management’s attitude toward internal controls, unusual financial performance pressures, and significant related-party transactions that might create opportunities for manipulation.

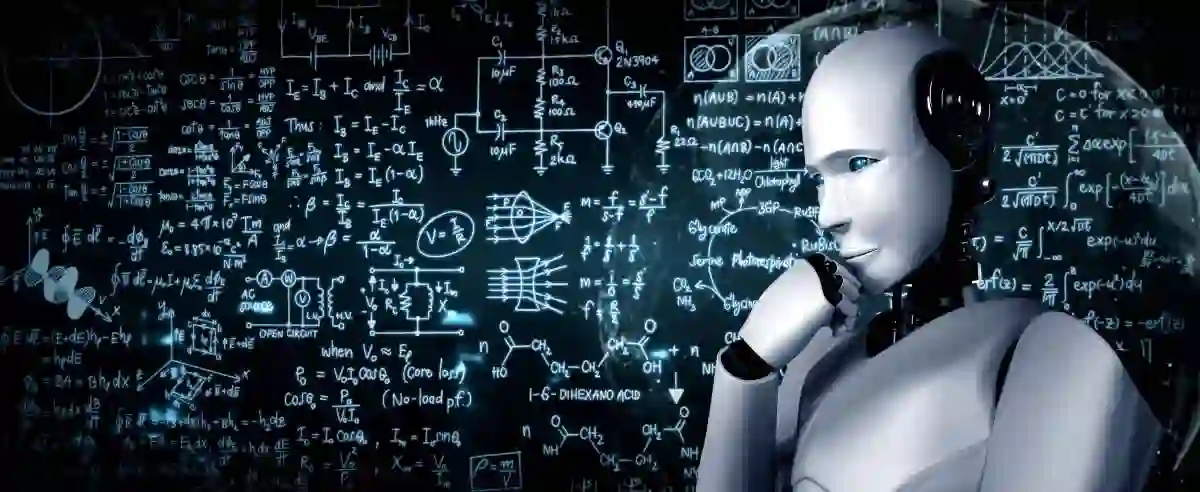

Rise of the Machines

- Technology: Plays an increasingly important role in fraud detection and prevention.

- Advanced Analytics Platforms: Can continuously monitor financial data for anomalies, flagging transactions or account balances that deviate from expected patterns.

- Machine Learning Algorithms: Can identify subtle relationships and trends that might escape human detection, providing early warning signs of potential fraudulent activity.

Regular Testing

- Regular testing: Testing regularly and validation of internal controls ensure that prevention mechanisms remain effective over time.

- independent Testing; This includes both management’s ongoing monitoring activities and independent testing by internal audit functions.

- External auditors: Also contribute to this oversight through their annual assessments of internal control effectiveness and their substantive testing of financial statement assertions.

Critical Red Flags: Expanded Analysis of Accounting Fraud Indicators

Financial Statement Inconsistencies: The Foundation of Fraud Detection

- Inconsistency in financial reports: Remains the most telling indicator of potential accounting fraud.

- Discrepancies: Often manifest in multiple ways that sophisticated investors must learn to identify.

- Restatements: Companies engaged in fraudulent activities frequently restate their earnings, sometimes multiple times within short periods, creating a pattern that should immediately raise investor concerns.

Timing of Inconsistencies

- Unexplained Variances: Beyond simple restatements, investors should scrutinize unexplained variances in financial results that don’t align with industry trends or economic conditions.

- Sector Peers: When a company’s performance dramatically diverges from sector peers without clear operational justification, this variance often suggests manipulation designed to meet analyst expectations or hide deteriorating business fundamentals.

- Critical Timing: The timing of these inconsistencies also provides crucial insights. Companies that consistently announce “one-time” charges or extraordinary items may be using these mechanisms to smooth earnings artificially.

- Internal controls weaknesses often contribute to these patterns, as inadequate oversight systems fail to catch or prevent manipulative accounting practices.

Revenue Recognition Manipulation: Advanced Warning Signs

- Overly aggressive revenue recognition: Practices represent a sophisticated form of accounting fraud that requires careful analysis to detect.

- No Busness Purpose: Companies may report unusually high revenue growth that appears disconnected from underlying business performance, market conditions, or competitive positioning within their industry.

- Revenue Methods: Investors should examine the methods used for revenue recognition with particular attention to changes in accounting policies that lack clear business rationale.

- Premature Revenue Recognition: Often involves rrecording sales before delivery, recognizing revenue from incomplete transactions, or creating fictitious sales through related-party transactions.

Channel Stuffing

- Channel stuffing: represents another common revenue manipulation technique where companies artificially inflate current-period sales by pushing excessive inventory to distributors or customers.

- Subsequent Periods: This practice typically results in subsequent periods showing declining sales as the market absorbs the excess inventory, creating a telltale pattern of volatile revenue performance.

- Revenue Quality: The quality of revenue also matters significantly.

- Acquisitions: Companies generating increasing revenue primarily through acquisitions rather than organic growth may be masking underlying business deterioration.

- Declining Cash Flow: Similarly, revenue growth accompanied by declining cash flows often indicates timing manipulation or fictitious sales transactions.

Management and Personnel Red Flags: Human Indicators of Fraud Risk

- Low Retention Rate: High turnover rates among key financial personnel create significant fraud risk indicators that investors must monitor closely.

- Executive Departures: When CFOs or auditors leave frequently, particularly under unexplained circumstances, these departures often signal underlying problems with financial reporting integrity or internal controls systems.

- Risk Pattern: The departure patterns provide additional insights into potential fraud risk.

- Urgent Proplems: Sudden resignations, especially when accompanied by immediate replacement searches or interim appointments, suggest urgent problems requiring immediate attention.

Struggle in Retaining Qualified Executives

- Retaining Executives: Companies that struggle to retain qualified financial executives may lack the corporate governance structures necessary to prevent fraudulent activities.

- Regulatory compliance: Issues often emerge alongside personnel changes, as new management teams discover previously hidden problems or face pressure to correct past misstatements.

- Securities Litigation: These situations frequently lead to securities litigation as investors seek to recover losses resulting from the discovered fraud.

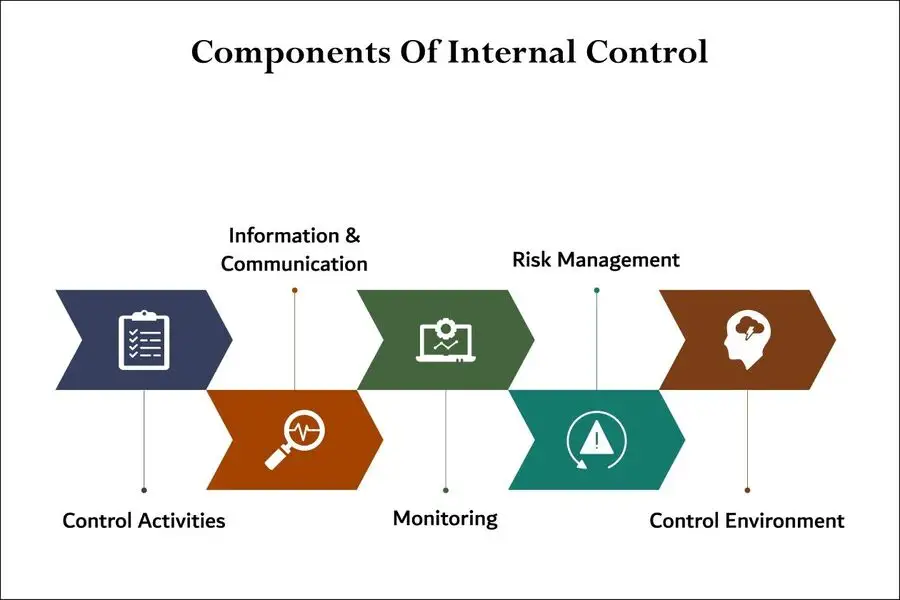

Internal Controls and Corporate Governance: The Foundation of Fraud Prevention

Internal Controls

- Effective internal controls: Serve as the primary defense against accounting fraud, yet many companies maintain inadequate systems that fail to prevent or detect manipulative practices.

- Corporate governance: Weaknesses often compound these problems, creating environments where fraudulent activities can flourish without detection.

Risk Assessments:

- Risk assessments: Should evaluate the strength of a company’s internal control environment, including segregation of duties, authorization procedures, and oversight mechanisms.

- Fraud Risk Factors: Companies with weak internal controls often exhibit multiple fraud risk factors simultaneously, including inadequate documentation, poor reconciliation procedures, and insufficient management oversight.

Sarbanes-Oxley Act

- The Sarbanes-Oxley Act of 2002: Requires public companies to maintain effective internal controls over financial reporting, yet compliance varies significantly across organizations.

- Adverse Control Opinins: Companies that receive adverse internal control opinions from their auditors face elevated fraud risk and potential regulatory enforcement actions.

- Corporate governance structures: Also play crucial roles in fraud prevention.

- Independent Oversight: Companies with independent board oversight, strong audit committees, and effective whistleblower programs demonstrate commitment to financial reporting integrity.

- Management Dominated: Conversely, organizations dominated by management or lacking independent oversight create environments conducive to fraudulent activities.

The Important of Employee Training to Spot Red Flags and Build a Culture of Ethics

- Employee Training: Building an ethical culture and training employees to spot red flags are crucial for mitigating risks and creating a positive, productive work environment.

- Clear Communication: This requires clear communication from leadership, consistent policy enforcement, and ongoing training that goes beyond basic legal requirements.

Training Employees to Spot Red Flags

- An effective training program equips employees with the knowledge to recognize and respond to unethical behavior, from minor policy violations to potential fraud. Key topics should include:

- Conflicts of interest: Recognize situations where personal interests could improperly influence professional decisions. Examples include favoritism in hiring, steering contracts to a vendor with personal ties, or using insider information.

- Dishonesty: Identify actions such as misrepresenting facts in reports, exaggerating expenses, falsifying records, or lying to colleagues.

- Misuse of company resources: Watch for improper use of company time, funds, or property, such as using corporate credit cards for personal expenses or taking office supplies for home use.

- Harassment and discrimination: Be aware of hostile behavior, biased decision-making, and verbal or physical aggression based on age, gender, race, or other protected characteristics.

- Lack of transparency: Recognize when information is consistently withheld, decisions are secretive, or explanations are vague.

- Unrealistic pressure: Understand how management pressure to achieve unrealistic goals or deadlines can push employees toward unethical shortcuts.

- Behavioral changes: In fraud awareness training, it’s important to know the top behavioral red flags, including employees living beyond their means, refusing to take holidays, or being overly defensive when questioned.

Fostering An Ethical Culture

- Lead by example: Ethical behavior must start at the top. When senior leaders act with honesty and integrity, it sets the standard for the entire organization.

- Communicate clear values: Articulate and regularly reinforce the company’s core ethical values through mission statements, codes of conduct, and internal communications.

- Enforce rules consistently: Hold all employees accountable for ethical violations, regardless of their position or performance. Eliminating double standards is critical for building trust.

- Encourage reporting: Provide multiple, accessible, and confidential channels for employees to report misconduct without fear of retaliation. Ensure the reporting process is transparent and that concerns are addressed promptly.

- Create realistic incentives: Evaluate incentive and reward structures to ensure they do not unintentionally encourage unethical shortcuts. Rewards should recognize ethical behavior, not just results.

- Prioritize psychological safety: Foster an environment where employees feel safe speaking up, asking questions, and admitting mistakes without fear of punishment.

- Reinforce with ongoing communication: Embed ethical ideals into daily operations, not just annual training sessions. Use newsletters and team meetings to provide reminders and share stories of ethical “beacons” within the company.

In Practical Application

- Use real-world scenarios: Move beyond theoretical rules with interactive training that uses realistic, job-specific scenarios. This helps employees practice eethical decision-making in a safe environment.

- Focus on process over outcomes: Prioritize fair and transparent decision-making. Include affected individuals in deliberations and consider potential negative consequences before acting.

- Address violations fairly: When ethical violations occur, the response should be transparent and consistent with the organization’s code of conduct. This reinforces to all employees that ethical behavior is a priority.

Personal and Financial Red Flags

- Financial distress: An employee who has financial problems, significant debt, or frequent creditors calling or appearing at the workplace.

- Addictions and personal problems: Issues with gambling, alcohol, or substance abuse can create a constant and desperate need for cash.

- Wheeler-dealer attitude: A risk-taking, unscrupulous, or consistently cunning approach to business dealings.

- Family or peer pressure: Feeling pressure from family or peers for success, leading to unethical shortcuts to achieve goals.

Workplace Behavioral Red Flags

- Refusal to take vacations: An employee who avoids taking time off may be afraid that their illicit activities will be discovered while they are gone.

- Excessive control issues: Being unwilling to share duties or delegate tasks, potentially to prevent others from discovering misconduct.

- Unusually close association with vendors or customers: A conflict of interest can arise from a relationship that is too close and is often a red flag for kickbacks or bribes.

- Irritability and defensiveness: An employee may become easily annoyed or defensive when questioned about their work or specific transactions.

- Blaming others: Consistently pointing fingers and refusing to take responsibility for mistakes or problems.

- Bullying or intimidation: Using aggressive tactics to prevent colleagues or subordinates from questioning their decisions.

- Knowledge hoarding: Deliberately withholding information or failing to keep proper records to make oneself seem indispensable.

- Secretive behavior: Acting evasive or secretive about work-related activities or communications.

Procedural And Systemic Red Flags

- Ignoring policies: Consistently violating or disregarding company or industry policies.

- Inadequate documentation: An employee who fails to keep appropriate or accurate records and receipts for transactions.

- Unusual transactions: Excessive, unaccounted-for, or manual checks, or a high number of year-end transactions.

- Unexplained resource use: Missing supplies, unexplainable charges on company credit cards, or increased purchases without a rise in sales.

- Favoritism: Giving preferential treatment to certain vendors, suppliers, or employees without a fair process.

Responding to Corporate Red Flags: A Strategic Approach

When you identify unethical patterns within corporate environments, particularly those involving accounting fraud or securities litigation risks, your response strategy becomes critical for both personal protection and organizational integrity.

Assessment and Documentation

- Evaluate the Severity – Distinguish between isolated incidents and systematic issues that could trigger securities class action lawsuits.

- Consider whether the concern involves preventing and detecting accounting fraud or broader regulatory compliance failures that might attract SEC enforcement actions.

- Conduct Thorough Analysis – Before escalating, perform informal risk assessments to understand potential implications. Document patterns that could indicate weaknesses in internal controls or corporate governance structures.

Strategic Response Options

- Seek Clarification First – Many apparent violations stem from communication gaps rather than intentional misconduct. Direct dialogue can often resolve concerns without formal regulatory enforcement involvement.

- Utilize Established Channels – When direct confrontation is not viable, leverage available resources including ethics hotlines, compliance departments, or securities fraud litigation specialists. These channels provide structured approaches to addressing accounting issues concerns while protecting whistleblowers.

- Strengthen Professional Defenses – If organizational culture consistently conflicts with ethical standards or regulatory compliance requirements, consider whether your professional integrity requires exploring alternative career paths.

Long-term Considerations

- Governance: Effective corporate governance depends on employees who recognize their role in preventing and detecting accounting irregularities.

- Maintaining Controls: By maintaining robust internal controls awareness and understanding securities fraud class actions implications, professionals contribute to organizational resilience against regulatory enforcement actions.

Examples of Strong Ethhical Companies

Patagonia

- Environmental activism: The founder transferred ownership of the company to a trust and nonprofit dedicated to fighting the climate crisis.

- Sustainable sourcing: It has long used organic cotton and recycled materials in its products and ensures animal welfare in its wool and down sourcing.

- Supply chain ethics: The company’s “4-Fold” vetting approach considers social and environmental practices alongside business requirements when evaluating factory partners.

- Encouraging repair and reuse: Patagonia campaigns encourage customers to repair old gear rather than buying new to reduce consumption and waste

Ben & Jerry’s

- Social missions: The company advocates for climate justice, LGBTQ+ rights, and voter rights. It also works to create economic opportunities for historically marginalized communities.

- Responsible sourcing: Ben & Jerry’s sources ingredients, including cocoa and eggs, under Fair Trade and Certified Humane standards.

- Sustainable practices: It minimizes its environmental impact through initiatives like waste reduction and sourcing sustainable packaging.

- Inclusive employment: The company partners with Greyston Bakery, a supplier that uses an “Open Hiring” policy to provide jobs for people who face barriers to employment.

Conclusion: Empowering Investors Against Accounting Fraud

- Remain Vigilant: As the financial landscape continues to evolve, investors must remain vigilant in their efforts to detect and prevent accounting fraud.

- Red Flags: This comprehensive guide has highlighted the importance of understanding the different types of fraud, recognizing red flags, and implementing best practices for prevention.

- Internal Controls: By leveraging internal controls, advanced technologies, and a strong ethical culture, companies can significantly reduce the risk of fraudulent activities and protect the interests of investors.

- Due Dilligence: Empowering investors requires a proactive approach, combining due diligence with a commitment to ethical practices.

- Continous Evaluation: Investors must stay informed about the latest developments in fraud detection and prevention, continuously evaluating the financial health of their investments.

- Stay Informed: By remaining vigilant and informed, investors can navigate the complexities of the financial markets with confidence and ssafeguard their assets from deceptive practices.

- Hollistic Approach: Ultimately, preventing accounting fraud is a collective effort that requires the collaboration of companies, regulators, and investors.

- Transparency and Ethics: By working together to promote transparency, accountability, and ethical behavior, we can create a more secure and trustworthy financial environment.

- Combatting Fraud: As we move forward into 2026 and beyond, let us remain steadfast in our commitment to combating accounting fraud and ensuring the integrity of our financial markets.

- Empowering Investors: With diligence and determination, we can empower investors to protect their financial interests and achieve lasting success.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors