Introduction to Manipulating Inventory and Securities Litigation

- Sophisticated: Manipulating inventory represents one of the most sophisticated yet devastating forms of accounting fraud that continues to plague modern financial markets, serving as a catalyst for numerous securities class action lawsuits and regulatory enforcement actions.

- Deliberater Misstatement: This deceptive practice involves the deliberate misstatement of inventory values, quantities, or classifications to artificially inflate a company’s financial performance and present a misleading picture of its true economic health.

- Various Schemes: Companies engaging in manipulating inventory typically employ various schemes, including phantom inventory creation, where non-existent goods are recorded as assets, or the deliberate overvaluation of existing stock through inflated cost calculations or obsolete inventory that should have been written down.

- Difficult to Detect: The sophistication of these schemes often makes them difficult to detect initially, as perpetrators may create elaborate documentation trails and coordinate across multiple departments to maintain the illusion of legitimacy.

- Corrective Disclosure: When the scheme falls apart and the truth emerges, the stock plummets and investors suffer massive losses and investors file Securities litigation over accounting fraud.

- Securities Litigation: Investors who lost money once the artificial inflation was removed by the corrected file security class action lawsuits to recover their losses.

Understanding Inventory Manipulation in Accounting: A Critical Threat to Market Integrity

The Motivations Behind Manipulating Inventory and Committing Accounting Fraud

- Motivation: The motivations behind inventory manipulation are deeply rooted in corporate governance failures and the intense pressure to meet Wall Street expectations, analyst forecasts, and debt covenant requirements.

- Fraudulent Practices: When companies face declining sales, increased competition, or economic downturns, management may resort to these fraudulent practices to avoid reporting losses that could trigger securities litigation or damage their market reputation.

- Pressure to Beat the Street: manipulating investory typically occurs during critical reporting periods, such as quarter-end or year-end closings, when companies scramble to meet previously announced guidance or maintain their stock prices.

- Accounting Fraud: This fraudulent activity directly violates fundamental accounting principles and securities regulations, creating substantial liability for securities class actions filed by investors who suffered financial losses due to the misleading financial statements alleging accounting fraud.

The Consequencess of Inventory Manipulation

- Consequences: The consequences of manipulating inventory extend far beyond simple accounting errors, often resulting in catastrophic financial restatements, regulatory investigations, and extensive securities class action litigation that can span years and cost companies hundreds of millions in settlements and legal fees defending itself against accounting fraud allegations.

- Corrective Disclosure: When these schemes inevitably unravel, the corrective disclosures typically trigger significant stock price declines, leading to substantial investor losses and creating the foundation for securities class action lawsuits alleging violations of federal securities laws.

- Regulatory enforcement: Regulatory agencies, including the Securities and Exchange Commission (SEC), aggressively pursue these cases, often imposing substantial civil penalties and requiring comprehensive remediation measures that can fundamentally reshape a company’s operations and governance structure.

Defecting and Manipulating Inventory

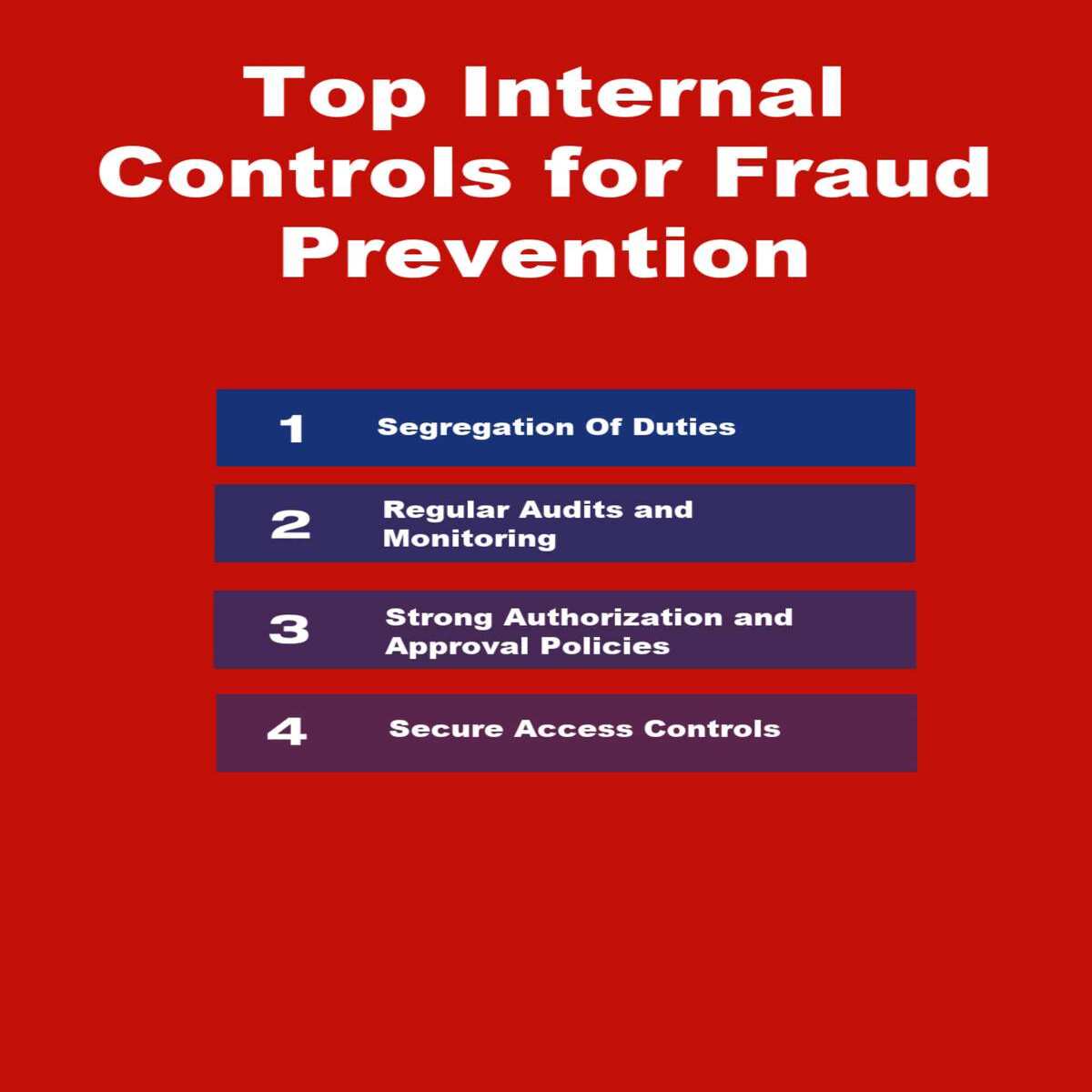

- Detection and Prevention: Manipulating inventory requires robust internal controls and comprehensive risk assessments that specifically address inventory-related fraud risks.

- Effective Prevention Strategies: Include implementing segregation of duties in manipulating inventory, conducting surprise physical inventory counts, utilizing advanced data analytics to identify unusual patterns or transactions, and maintaining detailed documentation of all inventory movements and valuations.

- Regular audits: By independent external auditors, combined with strong internal audit functions, serve as critical safeguards against these fraudulent schemes, though auditors must remain vigilant given the increasingly sophisticated nature of modern inventory manipulation techniques.

- Corporate governance: Plays a pivotal role in preventing inventory manipulation, as strong oversight by independent board members and audit committees can identify red flags before they escalate into full-blown fraud schemes.

- Implement Clear Policies: Companies must establish clear policies regarding inventory valuation, implement whistleblower programs that encourage employees to report suspicious activities, and maintain a culture of transparency and ethical behavior throughout the organization.

- Regulatory compliance: Programs implemented should specifically address inventory-related risks and ensure that all personnel understand the severe legal and financial consequences of engaging in fraudulent activities through accounting fraud.

Understanding the Red Flags of Manipulating Inventory

- Warning Signs: For investors and stakeholders, understanding the warning signs of potential inventory manipulation is essential for making informed investment decisions and protecting their financial interests.

- Key Indicators: Include unusual fluctuations in inventory levels relative to sales, declining inventory turnover ratios, significant differences between reported inventory and industry norms, and management’s reluctance to provide detailed explanations of inventory accounting policies.

- Red Flags: When these red flags appear, investors should exercise heightened scrutiny and consider the potential for securities class action participation if material misstatements are subsequently revealed.

- Technology: The landscape of inventory manipulation continues to evolve as companies adopt new technologies and accounting methodologies, requiring constant vigilance from regulators, auditors, and investors alike.

- Regulatory Enforcement: Continues to become increasingly sophisticated and penalties more severe, companies must recognize that the short-term benefits of inventory manipulation are vastly outweighed by the catastrophic long-term consequences, including ccriminal liability for executives, massive financial settlements, and permanent damage to corporate reputation and stakeholder trust.

Understanding Manipulating Inventory in Accounting: A Critical Threat to Market Integrity

- Manipulating Inventory: Represents one of the most insidious pathways to securities fraud, creating a dangerous web of deception that can devastate investor confidence and trigger costly securities class action lawsuits.

- Artificially Inflate Inventory: When companies artificially inflate their inventory values through fraudulent accounting practices, they fundamentally distort their financial statements, misleading investors about their true operational performance and financial health and commit accounting fraud.

- Overstating Inventory: This manipulation typically involves overstating inventory quantities, inflating unit costs, or failing to properly account for obsolete or damaged goods, all of which directly impact critical financial metrics such as cost of goods sold, gross margins, and net income.

- Consequences: The ripple effects extend far beyond mere accounting fraud—they create a false narrative of corporate success that can artificially inflate stock prices and attract unwarranted investor confidence.

Manipulating Inventory and Securties Litigation: The Connection

- Disclosure Violations: The connection between inventory manipulation and securities litigation becomes particularly evident when examining how these practices violate fundamental disclosure requirements under federal securities laws.

- Lack of Internal Controls: Companies engaging in such manipulation often fail to maintain adequate internal controls and regulatory compliance frameworks, making them vulnerable to regulatory enforcement actions and private litigation.

- Corrective Disclosure and Litigation: When the truth eventually emerges—often through whistleblower reports, audit discoveries, or regulatory enforcement investigations—the resulting corrective disclosures can trigger dramatic stock price declines, leading to substantial investor losses and the inevitable wave of securities class actions alleging accounting fraud.

Sophisticated Accounting Fraud in Manipulating Inventory

- Complext Accounting Schemes: The sophistication of modern inventory manipulation schemes requires equally sophisticated detection and prevention mechanisms.

- Red Flages: Regular audits conducted by independent accounting firms serve as the first line of defense, employing advanced analytical techniques to identify unusual inventory patterns, inconsistent reporting practices, and discrepancies between physical counts and recorded amounts.

- Risk Assessments: However, audits alone are insufficient without robust internal controls that include segregation of duties, systematic inventory tracking systems, and comprehensive risk assessments that evaluate the potential for manipulating inventoryat every level of the organization.

- Mult-Layered Verification Processes: Companies must implement multi-layered verification processes, including surprise inventory counts, third-party confirmations, and advanced data analytics that can detect anomalies in real-time.

The Legal Ramifications of Inventory Manipulation

The Legal Ramifications of Inventory Manipulation

- Consequences: The legal ramifications of inventory manipulation extend well beyond immediate financial penalties, creating long-term reputational damage that can persist for years after resolution.

- Litigation: Securities class action plaintiffs typically allege that inventory manipulation constitutes material misrepresentation under Rule 10b-5, arguing that investors relied on false financial statements when making investment decisions.

- Substantial Setttlements: These cases often result in substantial settlements, with companies facing not only direct financial losses but also increased insurance premiums, regulatory scrutiny, and diminished access to capital markets.

- Inadquate Control Processes: The corporate governance implications are equally severe, as boards of directors may face personal liability for failing to implement adequate oversight mechanisms.

Regulatory Scrutiny

- Evolving Regulatory Landscape: The evolving regulatory landscape demands that companies remain vigilant about emerging risks and continuously update their prevention strategies.

- Regulatory compliance: Requirements are becoming increasingly stringent, with enforcement agencies employing sophisticated analytical tools to detect potential manipulation patterns across entire industries.

- Long-Term Effects: Companies that fail to adapt to these changing requirements face not only immediate legal consequences but also long-term competitive disadvantages as investors increasingly prioritize transparency and accountability when making investment decisions.

Red Flags

- Warning Signs: For investors, understanding the warning signs of potential inventory manipulation is crucial for making informed investment decisions and protecting their financial interests.

- Red Flags: Include unusual fluctuations in inventory levels relative to sales, significant changes in inventory accounting policies, frequent restatements of financial results, and management turnover in key financial positions.

- Inadequate Controls over Finacial Reporting: When these warning signs appear, investors should carefully evaluate whether the company maintains adequate internal controls and whether management has demonstrated a commitment to transparent financial reporting.

- Breach of Trust: The intersection of inventory manipulation and securities fraud ultimately represents a fundamental Omissions in Financial Statements: An Absolute Trigger to Securities Litigation [2025]

- Implementation of Comprehensive Controls: By implementing comprehensive prevention strategies that combine robust internal controls, regular audits, thorough risk assessments, and strong corporate governance practices, companies can protect themselves from the devastating consequences of securities litigation while maintaining the investor confidence essential for long-term success.

- Proactive Compliance: The cost of prevention invariably proves far less than the price of remediation, making proactive compliance not just a legal necessity but a sound business strategy that protects all stakeholders’ interests.

Common Methods of Inventory Manipulation

- Forms on Inventor Manipulation: Inventory manipulation can manifest in various forms, each designed to achieve the same end: presenting a more favorable financial position than what truly exists.

- Overstating Inventory Quantities: One common method is the overstatement of inventory quantities. Companies may report higher inventory levels than they physically possess, thereby inflating asset values on their balance sheets.

- Exaggered Profits: This artificial boost in inventory can lead to a decrease in the cost of goods sold, resulting in exaggerated gross profits.

- Manipulating Inventory Valuations: Another prevalent method of inventory manipulation is the manipulation of inventory valuation.

- Accounting Fraud: Companies may employ inappropriate accounting methods to value their inventory, such as using outdated cost figures or failing to account for inventory obsolescence.

Misrepresentation of Company’s True Financial Health

- Misrepresentation: By inflating the value of inventory, firms can misrepresent their financial health, enticing investors to make decisions based on faulty data.

- Obsolete Inventory: This practice is particularly concerning in industries with rapidly changing product lifecycles, where inventory obsolescence is a significant risk.

- False Fincial Statements: Additionally, companies may engage in the timing of inventory transactions to manipulate financial results.

- Pressure to Meet Short Term: By delaying the recording of inventory oburchases or accelerating sales, firms can alter their financial statements to meet short-term targets. This manipulation not only distorts reported earnings but also undermines the integrity of financial reporting.

- False Fincancial Reporting: As stakeholders become more aware of these tactics, the challenge lies in developing robust detection and prevention strategies to combat such fraudulent activities

Case Studies: Notable Securities Litigation Involving Inventory Accounding Fraud

- Real Inventory Manipulation Casess: To truly grasp the impact of inventory manipulation, it is essential to examine real-world examples where such practices have led to significant securities litigation.

- Inflating Investory Levels: One of the most notable cases is that of a well-known retail giant that faced accusations of inflating its inventory levels to enhance its financial appearance.

- Intentional Mistatements: The subsequent investigation revealed a pattern of deliberate misstatements, resulting in a substantial legal battle and a multi-million dollar settlement.

Manipulating Inventor Valuations to Hide Declining Sales and Profits

- Manipulating Invetory Valuations: In another high-profile case, a technology firm was found to have manipulated its inventory valuations to mask declining sales and profitability.

- Corrective Disclosure and Lawsuits: The discrepancies were uncovered during an external audit, leading to a sharp decline in the company’s stock price and a wave of shareholder lawsuits.

- Auditors Did Not Catch: This case underscored the critical role of auditors in identifying and addressing inventory manipulation, as well as the severe legal consequences that can ensue.

- Pervasive Nature of Investor Manipulaton: These case studies highlight the pervasive nature of manipulating inventory and its potential to trigger significant legal and financial repercussions.

- Non-Transparency: They serve as cautionary tales for companies tempted to engage in such practices, emphasizing the importance of transparency and ethical conduct in financial reporting.

- Corporate Governance Frameworks: As we continue to explore the broader implications of inventory manipulation, it becomes clear that the lessons learned from these cases are invaluable in shaping future regulatory and corporate governance and internal controls frameworks.

The Anatomy of Inventory Manipulation: A Deeper Dive

- Accounting fraud through inventory manipulation: Takes many sophisticated forms, each designed to present a rosier financial picture than reality warrants.

- Channel Stuffing: Companies may engage in channel stuffing, where they accelerate sales by shipping excessive quantities to distributors near quarter-end, artificially inflating revenue and reducing reported inventory levels.

- Manipulating Physical Count: Others manipulate the physical count process, instructing warehouse staff to double-count items or include damaged goods that should be written off.

- Toll on Employees: The psychological toll on employees forced to participate in these schemes cannot be understated.

- Former Warehouse Manager: One former warehouse manager, speaking anonymously about a major retailer’s inventory fraud, described the crushing weight of being asked to “massage the numbers” during quarterly counts. “You know it’s wrong, but you’re told your job depends on hitting the targets,” they recalled, their voice heavy with regret.

Financial Impact: The True Cost of Deception

- Financial Inpact: The financial impact of inventory manipulation extends far beyond the immediate accounting adjustments. When the retail giant’s scheme unraveled, shareholders lost approximately $2.8 billion in market capitalization within the first week following the disclosure.

- Stock Crashes: The company’s stock price plummeted from $47 per share to $18 per share, representing a devastating 62% decline that wiped out retirement savings and institutional investments alike.

- Huge Fraud: The technology firm’s case proved equally catastrophic from a financial perspective. The company’s name – TechFlow Industries – became synonymous with corporate deception when investigators discovered the firm had overstated inventory values by $450 million over three years.

- Mass Class Action: The revelation triggered a cascade of securities class action lawsuits, with investors seeking damages totaling over $1.2 billion.

- Key Financial Consequences Include:

- Immediate stock price volatility and long-term value destruction

- Massive legal settlements ranging from $50 million to $500 million

- Regulatory fines imposed by the SEC, often exceeding $25 million

- Increased audit costs and enhanced compliance requirements

- Credit rating downgrades affecting borrowing capacity and interest rates

Legal Consequences: When the Scales of Justice Tip

- The legal consequences of inventory manipulation create a domino effect that can destroy careers, companies, and investor confidence.

- In the retail giant case, three C-suite executives faced criminal charges, with the CFO ultimately sentenced to four years in federal prison.

- The company itself entered into a deferred prosecution agreement, paying $185 million in fines and agreeing to enhanced oversight for five years.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

New requirements for disaggregated expenses

New requirements for disaggregated expenses

- FASB’s Accounting Standards Update (ASU) 2024-03, issued in November 2024, adds new expense disaggregation disclosures for public companies.

- Inventory purchases: Public companies must disclose the amount of inventory purchases included in each relevant expense caption in the income statement, for both annual and interim periods.

- Effective date: The new rules are effective for annual reporting periods beginning after December 15, 2026.

Existing requirements for inventory valuation and accounting policies in securities litigation

- Valuation methodologies: Companies must disclose the cost flow assumptions used, such as First-In, First-Out (FIFO) or Weighted-Average.

- LIFO disclosures: If a company uses Last-In, First-Out (LIFO), it must disclose the difference between the LIFO inventory amount and the FIFO amount.

- Accounting policy changes: Any changes in accounting policies, such as a change in the cost flow assumption, require disclosure.

Auditing standards for physical counts and controls

- Third-party warehouses: The PCAOB is evaluating whether additional guidance is needed for auditors who rely on third-party custodians or external firms for inventory counts.

- Technology integration: The potential for using drones, radio frequency identification (RFID), and real-time tracking systems to conduct physical inventory counts is also being reviewed.

- Internal controls: Under the Sarbanes-Oxley Act (SOX), management is already required to publicly report on the adequacy of its internal controls over financial reporting, which includes controls over inventory.

Requirements for inventory write-downs

- Write-down policy: If the net realizable value falls below cost, the inventory must be written down. Public companies must disclose their policy for making these write-downs for obsolete, damaged, or slow-moving inventory.

- Reversal of write-downs: If the net realizable value later increases, previous write-downs can be reversed, but only up to the original cost.

General requirements for third-party arrangements

- Related-party transactions: Consignment inventory arrangements must be disclosed if they involve related parties.

- Financial statement impact: Companies must disclose the effects of inventory stored in third-party locations and how they ensure its proper reporting, especially when auditors rely on third-party assurances.

- Inventory Valuation Methodologies and Changes: Companies must disclose the methods they use to value their inventory (e.g., FIFO, LIFO, weighted-average) and explain any changes in those accounting policies, including the impact of such changes on financial statements.

- Physical Inventory Count Procedures and Internal Control Assessments: Publicly traded companies are required to disclose their inventory annually, and maintaining strong internal controls over inventory is crucial to ensure accurate financial reporting and safeguard assets.

- Write-down Policies for Obsolete, Damaged, or Slow-Moving Inventory: Companies must disclose their policies for writing down inventory that has lost value due to obsolescence, damage, or slow movement, and the impact of these write-downs on financial performance.

- Third-Party Warehouse Arrangements and Consignment Inventory Practices: If a company uses third-party warehouses or engages in consignment inventory arrangements, they need to disclose information about these practices to ensure proper accounting and accountability for the inventory.

Corporate Governance and Internal Controls: Building Fortress-Like Defenses

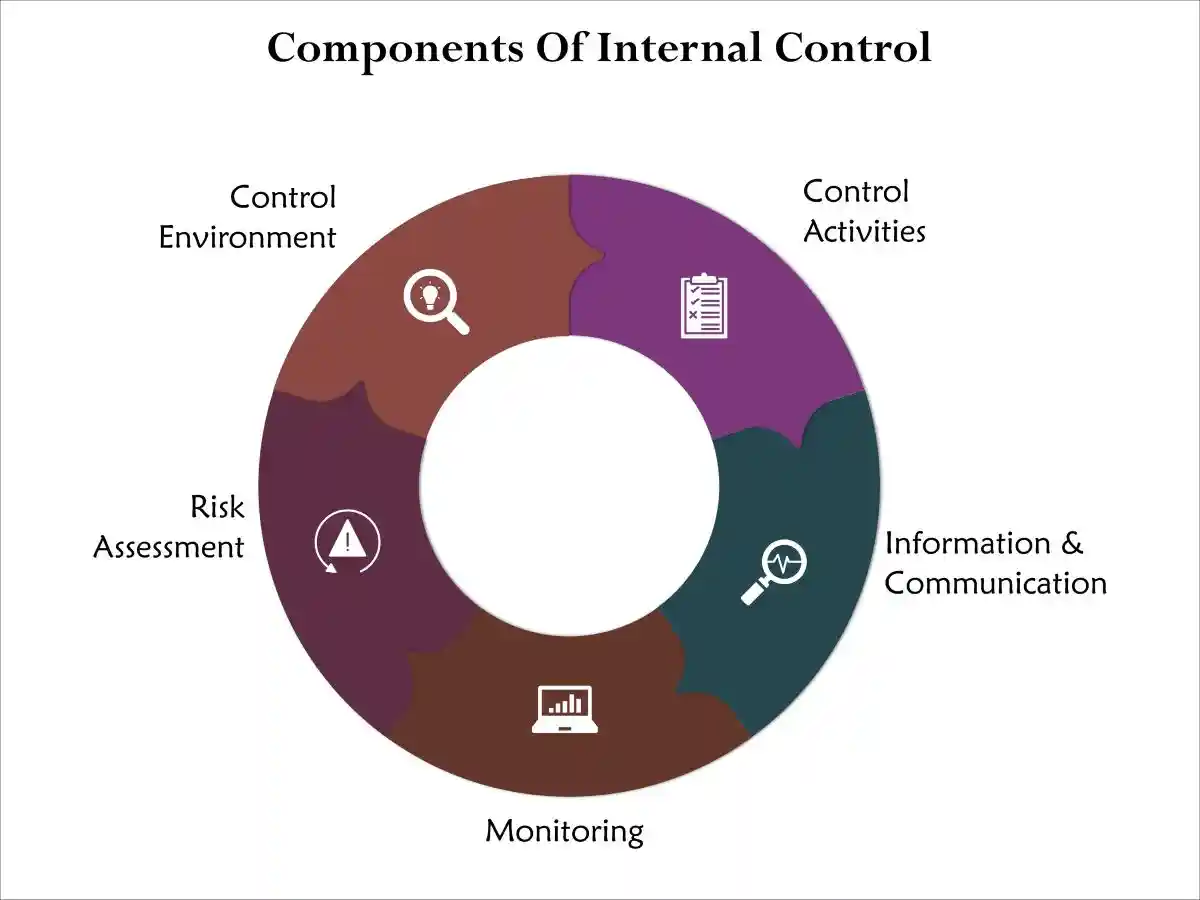

- Effective corporate governance serves as the first line of defense against inventory manipulation. Companies that have successfully avoided inventory-related securities litigation share common characteristics in their governance structures and internal controls.

The Role of Auditors in Detecting Inventory Manipulation

- Pivotal Role: Auditors play a pivotal role in the detection and prevention of inventory manipulation.

- Accuracy of Financisl Statements: As external evaluators of a company’s financial statements, auditors are tasked with ensuring the accuracy and integrity of reported figures.

- Crucial in Identifying Discrepancies: Their objective and independent assessments are crucial in identifying discrepancies that may indicate potential manipulation.

- Rigorous Testing: Through rigorous testing and analysis, auditors can uncover irregularities that might otherwise go unnoticed.

- Myrid of Procedures for Inventory: The detection of inventory manipulation requires auditors to employ a combination of analytical procedures and substantive testing.

- Trends and Ratios: By analyzing trends and ratios, auditors can identify anomalies in inventory levels and valuations.

- Further Testing: Substantive testing, such as physical inventory counts and verification of inventory valuation methods, further strengthens the audit process.

- Cross-Check Reported Numbers: These techniques enable auditors to cross-check reported figures against actual data, reducing the risk of manipulation.

- Due Dilligence: However, the effectiveness of auditors in detecting inventory manipulation is contingent upon their diligence and skepticism.

- Critical Line of Defense: While the responsibility for accurate reporting ultimately lies with the company, auditors serve as a critical line of defense in safeguarding against fraudulent practices.

- Indispensible Role: Their role is indispensable in promoting transparency and accountability within the financial reporting process.

Key Provisions of Sarbanes-Oxley

The Sarbanes-Oxley Act addresses many of the governance weaknesses that contributed to corporate scandals through several key provisions:

Section 302: Requires CEOs and CFOs to personally certify the accuracy of financial statements and the effectiveness of internal controls

Section 404: Mandates management assessment and auditor attestation of internal control effectiveness

Section 906: Establishes criminal penalties for executives who knowingly certify false financial statements Whistleblower protections: Provides safeguards for employees who report potential violations

These requirements create a framework that makes it more difficult for governance failures to go undetected and increases accountability for senior executives.

Implementation Challenges and Benefits

- While the Sarbanes-Oxley Act has significantly improved corporate governance practices, implementation has not been without challenges. Companies have invested substantial resources in compliance efforts, including:

- Enhanced documentation: Detailed policies and procedures must be documented and regularly updated

- Testing and monitoring: Internal controls must be regularly tested to ensure they are operating effectively

- Third-party assessments: External auditors must evaluate and report on the effectiveness of internal controls

- Management oversight: Senior executives must take active roles in overseeing compliance efforts

- Despite these costs, the benefits of Sarbanes-Oxley compliance are substantial.

- Companies with strong internal controls are better positioned to prevent fraud, ensure accurate financial reporting, and maintain investor confidence.

The Cascade Effect

- When one aspect of corporate governance fails, it often triggers a cascade of additional problems.

- For example, weak board oversight may lead to inadequate internal controls, which in turn increases the risk of accounting fraud.

- Once fraud occurs, the company becomes vulnerable to securities litigation and regulatory sanctions, further weakening its governance structure.

- This cascade effect explains why governance failures can be so devastating.

- What begins as a relatively minor control deficiency can quickly escalate into crisis that threatens the organization’s survival.

SARBANEX-OXLEY AUDITOR CHECKLIST

| Breaches | Systems should be able to detect unusual activity, respond quickly, and defend against threats like ransomware and phishing attacks. Software and systems should be updated with security patches. DLP systems should be in place to prevent sensitive financial data from being leaked, shared, or stolen. |

| Checklist | Systems should be able to detect unusual activity, respond quickly, and defend against threats like ransomware and phishing attacks. Software and systems should be updated with security patches. DLP systems should be in place to prevent sensitive financial data from being leaked, shared, or stolen. |

| Storage | Sensitive data must be stored securely. It should be encrypted and organized so it can be indexed, searchable, and easily retrieved. This applies to on-premise as well as cloud environments. SOX compliance also requires companies to retain data for specific periods, so data retention should not be taken easy. |

| Access | Each user should have unique credentials, with session tracking and role-based permissions to prevent unauthorized activity. Companies should regularly review the list of users who have access to critical systems, and readily remove access for employees who leave or change roles. |

| Logs | Split up responsibilities so that no one person manages a process from start to finish. Strengthen it with system checks and employee training. |

| Segregation of Duties | Split up responsibilities so that no one person manages a process from start to finish. Strengthen it with system checks and employee training. |

| Audit Trail | Keep records of every transaction or system change with timestamps. |

| Backup Systems | Backup procedures should be documented, and data restore procedures should be tested as per compliance standards. |

| Third-Party Vendors | Verify that service providers, such as cloud platforms, follow proper security and compliance practices, since their inadequacies can negatively impact your controls. |

Breaking the Cycle

- Preventing governance failures requires a comprehensive approach that addresses all aspects of the corporate governance framework. Organizations must:

- Establish strong tone at the top: Senior leadership must demonstrate unwavering commitment to ethical behavior and compliance

- Implement robust internal controls: Comprehensive control systems must be designed, implemented, and regularly tested

- Ensure effective board oversight: Independent directors must actively monitor management performance and risk management

- Maintain transparent communication: Stakeholders must receive timely, accurate information about the company’s performance and risks

- Foster a culture of accountability: All employees must understand their responsibilities and the consequences of misconduct

By addressing these fundamental elements, organizations can build resilient governance structures that protect against the various risks and consequences associated with governance failures.

Legal Consequences of Inventory Manipulation

- The legal repercussions of inventory manipulation are severe and far-reaching. severe and far-reaching. Companies found guilty of such practices, and, in extreme cases, criminal charges.

- These legal consequences serve as a deterrent, underscoring the importance of ethical conduct in financial reporting.

- Regulatory bodies, such as the SEC, are vigilant in their pursuit of companies engaging in fraudulent activities, prioritizing the protection of investors and the integrity of financial markets.

- In addition to regulatory action, companies may also face civil litigation from shareholders and other stakeholders affected by the manipulation. Shareholder lawsuits often arise when investors suffer financial losses due to misleading financial statements.

- These lawsuits can result in substantial settlements or judgments against the company, further compounding the financial damage

- The reputational harm associated with such legal battles can be equally devastating, eroding investor trust and diminishing market confidence.

- The legal landscape surrounding inventory manipulation continues to evolve, with increasing emphasis on accountability and transparency.

- Companies are encouraged to implement robust internal controls and compliance programs to prevent manipulation and ensure accurate financial reporting.

- As legal consequences become more stringent, the onus is on companies to foster a culture of ethical conduct and integrity, safeguarding against the risks associated with inventory manipulation.

Preventive Measures Against Inventory Manipulation

- Preventing manipuling inventory requires a multi-faceted approach that involves robust internal controls, corporate governance, and a culture of ethical conduct.

- Companies must establish comprehensive internal control systems that include checks and balances to ensure accurate inventory reporting or become a defendant in a securities class action.

- These controls should encompass inventory management, valuation, and reporting processes, minimizing the opportunity for manipulation.

- Corporate governance and internal controls plays a crucial role in preventing inventory manipulation.

- Boards of directors and audit committees must actively oversee financial reporting processes, holding management accountable for the accuracy of inventory data.

- By fostering a culture of transparency and accountability, companies can reduce the manipulating investory.

- Regular training and ethical guidelines can further reinforce the importance of accurate reporting and deter unethical behavior.

- Additionally, whistleblower programs can serve as an effective tool in preventing inventory manipulation.

- By providing employees with a safe and confidential means to report suspected misconduct, companies can identify and address potential issues before they escalate.

- Whistleblower protections encourage employees to come forward without fear of retaliation, promoting a culture of integrity and transparency.

- As these preventive measures become more widespread, the incidence of inventory manipulation is likely to decline, fostering greater trust in financial reporting.

Corporate Governance and Regulatory Compliance

- Effective corporate governance extends beyond mere regulatory compliance—it creates a culture where ethical behavior becomes the norm rather than the exception.

- This cultural transformation requires leadership commitment at every organizational level, from the C-suite to front-line employees.

- Key Implementations:

- Compliance failures often result from inadequate training or unclear expectations.

- Organizations must invest in comprehensive compliance education, ensuring every employee understands their role in maintaining financial integrity.

- Regular training updates keep staff informed about evolving regulations and emerging fraud schemes.

- The presence of strong internal controls acts as a powerful deterrent to fraud by creating a culture of accountability and transparency within organizations.

- Employees become less likely to engage in fraudulent activities when they know rigorous controls exist and any discrepancies will be promptly identified.

- This preventive measure not only protects companies from financial losses but also helps maintain investor confidence in financial integrity.

Understanding the Critical Indicators of Governance Failure

Lack of Transparency: The Foundation of Governance Breakdown

The absence of transparency in financial reporting and decision-making processes serves as the most fundamental indicator of weak corporate governance.

This deficiency manifests in multiple ways that create dangerous vulnerabilities within organizations.

Companies eexhibiting poor transparency often provide incomplete financial disclosures, delay the release of material information, or present data in ways that obscure rather than illuminate their true financial condition.

When organizations fail to maintain transparent communication channels, they create an environment where false financial statements can flourish undetected.

This lack of transparency becomes particularly dangerous when combined with inadequate oversight mechanisms, as it allows management to manipulate information without appropriate checks and balances.

The resulting information asymmetry between management and stakeholders creates fertile ground for accounting fraud and other forms of financial misconduct.

Internal controls play a crucial role in maintaining transparency, yet companies with weak governance structures often neglect these essential safeguards.

Without proper internal controls, Weak Internal Controls and False Financial Statements: A Double Trigger to Securities Litigation [2025], monitor compliance with regulations, or detect fraudulent activities before they cause significant damage.

This deficiency in internal controls frequently leads to compliance failures that expose companies to regulatory penalties and legal challenges.

The Impact of Technology on Inventory Management and Fraud Detection

- Technology has transformed the landscape of inventory management and fraud detection, offering innovative solutions to combat manipulation.

- Advanced inventory management systems enable real-time tracking and monitoring of inventory levels, reducing the potential for discrepancies.

- These systems provide companies with accurate and up-to-date information, enhancing decision-making processes and minimizing the risk of manipulation.

- In addition to improving inventory management, technology plays a crucial role in fraud detection.

- Data analytics and Preventing and Detecting Accounting Fraud: An Authoritative and Painstaking Investor Guide [2025] and anomalies indicative of manipulation.

- By analyzing vast amounts of data, these technologies can detect irregularities that may signal fraudulent activity. Machine learning algorithms can continuously adapt and improve, enhancing their ability to identify potential manipulation.

- The integration of blockchain technology into inventory management systems offers further promise in preventing fraud.

- Blockchain’s decentralized and immutable nature ensures the authenticity and integrity of inventory data, reducing the opportunity for manipulation.

- By providing a transparent and tamper-proof record of transactions, blockchain enhances trust and accountability within the supply chain.

- As technology continues to evolve, its impact on inventory management and fraud detection will be profound, paving the way for more secure and transparent financial reporting.

Best Practices for Ethical Inventory Accounting

- Ethical inventory accounting is paramount in maintaining the integrity and transparency of financial reporting. Companies must adhere to best practices that promote accurate and reliable inventory reporting.

- One such practice is the consistent application of inventory valuation methods, ensuring that inventory is valued accurately and in accordance with accounting standards.

- This consistency is crucial in providing stakeholders with a clear and accurate picture of a company’s financial health.

- Regular inventory audits are another best practice that enhances the accuracy of inventory reporting.

- By conducting periodic audits, companies can verify inventory levels and valuations, identifying any discrepancies that may indicate manipulation.

- These audits provide an additional layer of assurance, reinforcing the reliability of reported figures and fostering investor confidence.

- Transparency in financial reporting is a cornerstone of ethical inventory accounting. Companies must provide clear and comprehensive disclosures regarding their inventory management and valuation practices.

- By being transparent about their accounting policies and assumptions, companies can build trust with investors and other stakeholders.

- Emphasizing ethical conduct and transparency in inventory accounting is essential in safeguarding against manipulation and ensuring the integrity of financial reporting.

Conclusion: The Future of Inventory Management and Legal Compliance

As we look to the future, the landscape of inventory management and legal compliance is poised for significant transformation.

The lessons learned from past cases of inventory manipulation and securities litigation have underscored the critical importance of transparency and accountability in financial reporting.

Companies must embrace a proactive approach to inventory management, implementing robust internal controls and fostering a culture of ethical conduct.

The integration of technology will continue to play a pivotal role in enhancing inventory management and fraud detection.

Advanced systems and data analytics will provide companies with the tools to track and monitor inventory levels in real-time, reducing the potential for manipulation.

As technology evolves, its impact on financial reporting and compliance will be profound, paving the way for more secure and transparent markets.

Ultimately, the future of inventory management and legal compliance hinges on a commitment to ethical conduct and transparency.

Companies, regulators, and stakeholders must work collaboratively to promote accurate and reliable financial reporting.

By prioritizing integrity and accountability, the business community can safeguard against the risks of inventory manipulation, fostering investor trust and confidence in the financial markets.

Protected Whistleblower Channels

The act created protections and anonymous reporting mechanisms that encourage employees to expose corporate misconduct without fear of retaliation.

- Secure reporting: SOX mandates that companies establish internal procedures for the anonymous and confidential submission of complaints regarding questionable accounting or auditing matters.

- Anti-retaliation protections: The act prohibits public companies from discharging, demoting, suspending, or otherwise discriminating against an employee who reports alleged misconduct.

- Legal recourse: If an employee is retaliated against for whistleblowing, they can seek relief through the Department of Labor and may be entitled to remedies such as reinstatement and back pay.

Regulatory Evolution and Emerging Standards

- Regulatory frameworks continue to evolve in response to emerging threats and technological developments.

- Organizations must stay current with changing requirements and best practices to ensure their fraud prevention and detection capabilities remain effective and compliant with applicable standards.

- International coordination among regulatory bodies is increasing, creating more consistent global standards for internal controls and fraud prevention.

- This coordination helps address the challenges posed by multinational organizations and cross-border fraudulent schemes that can exploit regulatory gaps and jurisdictional limitations.

- Industry-specific guidance is becoming more detailed and prescriptive, reflecting the unique risks and challenges faced by different sectors.

- Organizations should ensure they understand and comply with industry-specific requirements while also implementing broader best practices that address common fraud risks.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors