Introduction to Hiding Liabilities in Financial Reporting

- Hiding Liabilities in Financial Reporting: Represents one of the most insidious forms of accounting fraud that systematically destroys investor confidence and triggers devastating securities class action lawsuits.

- Annual Fraud Costs: Organizations lose approximately 5% of their annual revenues to these deceptive practices according to the Association of Certified Fraud Examiners, with financial statement fraud accounting for a substantial portion of these losses.

- Devastating Financial Impact: The median loss reaches $954,000 per case, demonstrating how concealing liabilities can devastate organizational stability and shareholder value. When auditors examined one organization, they identified 85 out of 120 transactions that were not properly recorded—revealing the pervasive nature of liability concealment schemes that often operate undetected for extended periods.

- Widespread Deception: More than 60% of Chief Financial Officers report that hidden or underestimated costs create significant barriers to accurate financial forecasting, indicating how deeply embedded these practices have become in corporate financial reporting.

- Systematic Problem: This systematic problem manifests through various sophisticated forms of accounting fraud, from deliberate understating of existing liabilities to complete omission of financial obligations from corporate statements.

- Corporate Scandals: The Enron collapse demonstrates the catastrophic consequences when concealing liabilities schemes are eventually exposed—wiping out $74 billion in shareholder value and establishing crucial precedents for regulatory compliance and investor protection.

- Sophisticated Manipulation Techniques: These deceptive practices operate through increasingly complex mechanisms designed to mislead investors and regulators. Companies underreport payables by holding checks for weeks or months, creating artificial improvements in their apparent financial position while concealing true cash flow obligations.

- Failure to Accrue Liabilities: Others systematically fail to accrue liabilities for salary or vacation time, generating falsely positive financial pictures that can trigger securities litigation when eventually discovered.

- Off-Balance Sheet Concerns: Off-balance sheet liabilities represent particularly dangerous exposure areas for investors and stakeholders.

- Massive Scale: The Financial Accounting Standards Board discovered in February 2016 that public companies carried over $1 trillion in off-balance sheet financing for leasing obligations alone—demonstrating the massive scale of hidden financial commitments that traditional balance sheets failed to capture.

- Essential Knowledge Framework: Understanding these deceptive practices becomes essential for investors, executives, and financial professionals seeking to protect their investments and avoid the devastating effects of accounting fraud. This guide examines the critical aspects of liability concealment that every market participant must understand:

- Identification Strategies: How to detect concealed liabilities in financial statements before they result in significant losses

- Common Manipulation Methods: Sophisticated techniques used to hide financial obligations from investors and regulators

- Warning Signal Recognition: Red flags and patterns that consistently precede major corporate fraud revelations

- Prevention Implementation: Robust internal controls and governance frameworks that prevent liability concealment schemes

- Empowering Market Participants: This examination provides the analytical framework necessary to identify potential accounting fraud before corrective disclosures trigger stock price collapses and the inevitable wave of securities class action lawsuits that follow financial reporting violations.

Understanding Concealed Liabilities: The Foundation of Financial Statement Fraud

- Concealed liabilities represent a particularly sophisticated form of accounting fraud that systematically distorts organizational financial pictures while creating artificial impressions of financial health that can devastate stakeholder confidence and trigger catastrophic securities litigation.

- Dangerous Deception: These hidden obligations fundamentally mislead investors, creditors, and regulators about a company’s true financial condition, often serving as the catalyst for massive securities class action lawsuits when eventually discovered through regulatory enforcement actions or whistleblower disclosures.

1. What Constitutes a Concealed Liability: The Mechanisms of Deception

- Material Omissions: Concealed liabilities emerge whenever financial obligations are deliberately hidden, underreported, or misclassified in financial statements. The most direct method involves systematically failing to record these obligations in accounting systems, creating what appears to be unintentional oversight but constitutes deliberate financial statement fraud.

- Artificial Financial Enhancement: This deliberate omission artificially inflates equity, assets, and net earnings, generating falsely positive financial pictures that can mislead investors into making decisions based on fundamentally flawed information. Companies employing these techniques directly violate securities laws and create substantial exposure to securities class action lawsuits when their deceptive practices are eventually disclosed.

- Categories of Hidden Financial Obligations:

- Unrecorded Loans and Financing Arrangements: Debt obligations kept off primary financial statements

- Warranty Obligations: Product guarantees and service commitments deliberately understated

- Employee Benefit Liabilities: Unreported wages, benefits, and compensation obligations

- Deferred Tax Obligations: Future tax payments systematically concealed from investors

- Legal Settlement Exposure: Pending litigation and regulatory penalties withheld from disclosure

- Environmental Remediation Costs: Cleanup responsibilities and regulatory compliance expenses

- Strategic Manipulation Techniques: Companies deliberately withhold bills at year-end to avoid recording both payables and corresponding expenses. This systematic approach mismatches revenues and expenses while artificially enhancing reported profits, creating temporary improvements that can mislead analysts and investors about actual operational performance.

- Cash Flow Manipulation: Organizations frequently hold checks for extended periods, preserving cash balances while creating false impressions that supplier invoices are being paid promptly. This practice artificially improves working capital ratios while concealing true payment obligations from stakeholders.

- Off-Balance Sheet Sophistication: Off-balance sheet arrangements represent the most sophisticated concealment mechanisms, remaining unlisted on primary balance sheets while constituting significant financial obligations. The Financial Accounting Standards Board discovered in February 2016 that public companies carried over $1 trillion in off-balance sheet financing for leasing obligations alone, with approximately 85% of leases unreported on balance sheets—making accurate assessment of companies’ debt capacity and repayment ability nearly impossible for investors.

2. Omission vs. Misclassification: Understanding Fraud Mechanisms

- Regulatory Enforcement Distinguishes: Liability concealment employs distinct strategies that present unique challenges for detection and regulatory compliance. Understanding these differences proves essential for identifying potential accounting fraud before it escalates into costly securities litigation.

- Complete Information Exclusion: Material omissions involve the systematic failure to include essential financial information in required disclosures. This practice deliberately excludes critical financial obligations that would materially impact investor decision-making and stakeholder understanding of true financial conditions.

- Active Misrepresentation: Misrepresentation involves providing deliberately false or misleading information rather than merely withholding disclosures. This approach includes recording incorrect financial details, essentially presenting active falsehoods that can trigger immediate regulatory enforcement actions when discovered by auditors or investigators.

- Strategic Category Manipulation: Misclassification represents a common technique where organizations manipulate liability categories to temporarily obscure actual financial obligations from investors and regulators. Companies might improperly classify long-term debt as operating expenses or utilize off-balance sheet financing arrangements to conceal true leverage levels.

- Legal Implications Vary: The enforcement consequences differ significantly between these approaches, with certain jurisdictions allowing contract voidance for active misrepresentation while omission cases require proving deliberate fraudulent intent rather than mere oversight. This distinction becomes crucial when securities class action lawsuits are filed against companies accused of financial statement fraud.

3. Financial Ratio Distortion and Investor Harm

- Fundamental Metric Manipulation: Concealing liabilities fundamentally distorts crucial financial metrics that investors, creditors, and analysts rely upon for making informed investment decisions. These deceptive practices artificially improve debt-to-equity ratios while creating false impressions of reduced investment risk and enhanced financial stability.

- Profitability Inflation: Manipulated expense recognition artificially inflates profitability ratios, generating misleading operational efficiency indicators that can attract unwary investors seeking strong-performing companies. Gross profit margins and current ratios become unreliable when concealed liabilities systematically distort the underlying calculations.

- Investment Decision Impact: Investors and creditors make critical financial decisions based on inaccurate information, potentially resulting in significant monetary losses when corrective disclosures eventually reveal true financial conditions. Once falsification schemes are uncovered, stakeholder trust becomes irreparably damaged, making future investment attraction and customer retention extremely challenging.

- Corrective Disclosure Consequences: Discovery of concealed liabilities typically necessitates financial restatements following fraud exposure, triggering immediate stock price corrections and potential securities class action lawsuits. These revelations systematically undermine company credibility, diminish long-term investor confidence, and frequently trigger regulatory enforcement actions that create additional legal and financial consequences.

- Market Integrity Protection: Understanding these manipulation mechanisms empowers investors to identify warning signs before accounting fraud schemes result in devastating losses and costly securities litigation.

Eight Sophisticated Liability Concealment Techniques That Trigger Securities Litigation

- Financial Manipulation Schemes: Represent some of the most dangerous pathways to securities fraud, creating elaborate webs of deception that systematically mislead investors and trigger devastating securities class action lawsuits. These sophisticated concealment techniques typically emerge when management faces intense pressure to meet financial targets while operating under weak internal controls that enable systematic fraud.

- Recognizing Concealment Methods: Understanding these manipulation techniques becomes essential for investors and stakeholders seeking to identify potential accounting fraud before corrective disclosures trigger stock price collapses and the inevitable securities litigation that follows financial reporting violations.

1. Unrecorded Loans and Financing Arrangements

- Off-balance-sheet financing structures represent sophisticated methods companies employ to hide debt obligations from investors and creditors, creating substantial exposure that remains invisible to traditional analysis. These arrangements systematically circumvent disclosure requirements through multiple mechanisms:

- Complex Financing Structures: Participations in loans where servicing responsibilities are retained along with participating interest, revolving accounts receivable financing through commercial paper conduits, and Special Purpose Entities (SPEs) utilized to hold debt that should appear on primary financial statements.

- Regulatory Circumvention: ASC 860-20-50-5 requires entities to present gains or losses on sales of loans separately. However, companies deliberately structure these transactions to circumvent disclosure requirements, creating hidden obligations that eventually trigger securities litigation when discovered.

2. Underreported Employee Benefits and Wages

- Employee-Related Concealment: Creates significant legal and financial risks through systematic underreporting that exposes companies to substantial liability when benefits applications remain unprocessed or coverage gaps emerge during claims periods.

- Hidden Liability Categories:

- Unreported Waiting Period Obligations: Generate substantial hidden exposure when benefits applications remain unprocessed

- Improper Benefit Opt-Outs: Allow employees to waive mandatory coverage like Life, AD&D, or Disability benefits, potentially costing companies “tens or hundreds of thousands of dollars” during claims

- Unreported Compensation Adjustments: Create liability where employers must compensate for insurance amount shortfalls

- Criminal Exposure: Deliberate payroll underreporting often aims to obtain lower workers’ compensation premiums. Authorities consider material and intentional payroll underreporting “a serious crime that may result in civil or criminal penalties” . Wage theft costs American workers approximately $3 billion between 2017-2020, with this figure representing merely a fraction of actual losses .

3. Deferred Tax Liabilities and Accrued Interest

- Deferred Tax Obligations: Represent taxes owed but payable at future dates, arising from timing differences between when tax expense is recognized in accounting versus when actually paid . These obligations create substantial hidden liabilities through:

- Common Creation Scenarios: Installment sales recognized fully in accounting but taxed only upon payment receipt, and different depreciation methods for tax versus accounting purposes.

- Calculation Complexity: A deferred tax liability on company balance sheets represents future tax payments calculated as the company’s anticipated tax rate times the difference between taxable income and accounting earnings .

4. Pending Legal Obligations and Warranties

- Contingent Obligations: Represent particularly dangerous categories of concealed liabilities because their eventual disclosure often triggers dramatic corrective disclosures and securities litigation. These include warranty obligations unrecorded until claims are actually made and legal claims from lawsuits unreported until settlements are reached.

- Management Rationalization: Companies frequently rationalize non-disclosure by claiming these liabilities are “too unpredictable or remote to warrant disclosure” . External auditors should investigate thoroughly what remains hidden, as management often conceals obligations behind subjective standards of “reasonably estimable” and “more than likely” .

5. Environmental Cleanup Responsibilities

- Environmental remediation liabilities arise when reporting entities are associated with sites requiring remedial actions . These expenses encompass nuclear waste cleanup from weapons production facilities, chemical contamination remediation costs, and post-closure activities including surveillance and monitoring.

- Long-Term Financial Impact: Costs for post-closure activities are estimated for 75 years after balance sheet dates . Some cleanup monitoring activities may continue beyond this period with costs that cannot reasonably be estimated .

6. Off-Balance Sheet Liabilities Via SPEs

Special Purpose Entities: Gained notoriety following the Enron scandal, where they concealed billions in debt while artificially inflating reported earnings . Off-balance sheet items remain unlisted on companies’ main balance sheets yet represent significant financial obligations .

SPE Implementation Methods: Trust mechanisms that borrow funds without transferring asset title, synthetic leases eliminating residual-value risk while maintaining high loan-to-value ratios, and sale-leaseback arrangements recording only rental expenses instead of debt .

Bankruptcy Protection: The main benefit of an SPE involves bankruptcy remote status, limiting risk if the parent company declares bankruptcy.

TYPES OFF-BALANCE SHEET LIABILITIES

Operating Lease | Leaseback Agreements | Accounts Receivables |

An OBS operating lease is one in which the lessor retains the leased asset on its balance sheet. The company leasing the asset only accounts for the monthly rental payments and other fees associated with the rental rather than listing the asset and corresponding liability on its own balance sheet. At the end of the lease term, the lessee generally has the opportunity to purchase the asset at a drastically reduced price. | Under a leaseback agreement, a company can sell an asset, such as a piece of property, to another entity. They may then lease that same property back from the new owner.

Like an operating lease, the company only lists the rental expenses on its balance sheet, while the asset itself is listed on the balance sheet of the owning business. | Accounts receivable can be a big liability as they represent unpaid funds from customers, posing a default risk. Companies can sell these to a factor that takes on the risk, paying the company a percentage upfront and handling collections. After collecting from customers, the factor pays the company the remaining amount minus a service fee, which helps the business collect funds while outsourcing default risks. |

7. Improper Asset Valuation to Offset Liabilities

- Asset Valuation Manipulation: Frequently accompanies liability concealment schemes, creating compounded fraud that makes detection more difficult and securities litigation more likely when discovered.

- Warning Indicators: Recurring negative cash flows alongside reported earnings growth, assets or liabilities based on subjective judgments difficult to support, and non-financial management excessively participating in accounting principles selection .

- Securities Litigation Risk: These indicators often signal problematic asset valuations designed to mask concealed liabilities that trigger securities class action lawsuits when discovered .

8. Failure to Accrue Liabilities Like Vacation Pay

- Employee Benefit Accrual Fraud: Companies may deliberately omit accruing employee benefits such as vacation pay to artificially enhance their financial position. Under proper accounting standards, vacation entitlement based on employee anniversary dates rather than fiscal year end requires accrual for vacation earned but unused .

- Policy Manipulation: Even under “use it or lose it” vacation policies, if employees vest in their full year allotment on the first day of the year, companies should accrue liability as of the prior year-end . Failing to record these obligations artificially improves financial position while creating regulatory compliance violations.

- Adjustment Requirements: At accounting period ends, adjusting entries must be made in general journals to accrue unpaid wages, benefits, and vacation time . Failure to make these adjustments results in understated liabilities and overstated profits that can trigger securities litigation when eventually corrected.

Accounts Not Found on the Balance Sheet

| Dividends | Research and Development Expenses | Contingent Assets and Liabilities |

Dividend payments do not qualify as balance sheet items under Generally Accepted Accounting Principles (GAAP). This classification stems from their nature as equity distributions rather than corporate assets or outstanding liabilities. When companies declare dividends, these obligations temporarily appear as current liabilities until the payment date, after which they are eliminated from the balance sheet entirely. | Under current accounting standards, R&D expenses are predominantly classified as period costs and are expensed immediately upon incurrence, rather than being recognized as discrete assets on the balance sheet. This treatment reflects the inherent uncertainty regarding future economic benefits and the difficulty in establishing direct correlations between specific R&D investments and measurable revenue generation.

| Contingent liabilities represent potential financial obligations that may crystallize depending on uncertain future event outcomes. These prospective liabilities include: Litigation exposure from pending lawsuits and regulatory investigations; Environmental remediation costs; Product warranty obligations extending beyond standard coverage periods and Guarantee commitments on third-party debt obligations

|

Sophisticated Manipulation Techniques: How Companies Conceal Financial Obligations

- Financial statement manipulation through liability concealment employs increasingly sophisticated techniques designed to create artificial impressions of corporate financial strength.

- Deceptive Acts: These deceptive practices operate at the intersection of creative accounting and outright accounting fraud, systematically manipulating how financial obligations appear to stakeholders and regulatory compliance authorities.

Off-Balance Sheet Financing: The Foundation of Sophisticated Concealment

- Off-balance sheet arrangements represent the most sophisticated pathway for concealing liabilities from investors and creditors.

- Risk Adverse: These structures enable organizations to appear substantially less leveraged than actual financial reality, creating dangerous exposure that can trigger securities litigation when eventually discovered.

Primary Concealment Mechanisms:

- Special Purpose Entities (SPEs): Create separate legal structures for specific projects where the parent company maintains less than majority interest, allowing systematic avoidance of financial statement consolidation requirements and keeping substantial debt obligations hidden from investors.

- Operating Lease Manipulation: Operating leases traditionally allowed companies to record only monthly rental payments as expenses without displaying underlying liability obligations on balance sheets, concealing billions in future financial commitments.

- Sale-Leaseback Arrangements: Companies sell assets to external entities and lease them back, recording only rental expenses instead of associated debt obligations—artificially improving debt-to-equity ratios while maintaining operational control.

- Financial Impact: These methods significantly distort key financial metrics by lowering apparent borrowing costs when lenders remain unaware of unrecorded liabilities. Companies systematically avoid violating debt covenants that restrict borrowing capacity, while notes to financial statements provide inadequate disclosure of actual future obligations.

Expense Recognition Manipulation: Timing-Based Deception

- Delayed expense recognition creates artificial performance enhancement by systematically pushing current costs into future accounting periods. This manipulation technique proves particularly dangerous because it compounds over time, eventually requiring increasingly aggressive schemes to maintain the deception.

Systematic Manipulation Methods:

- Deferral Template Systems: Establish systematic frameworks that spread expenses across multiple accounting periods, creating artificial smoothing of financial results.

- Calculation Method Manipulation: Employ various approaches including straight-line, equal per period, days per period, or user-defined methods to minimize current-period expense recognition.

- Recognition Schedule Distortion: Create expense schedules that artificially minimize current obligations while systematically pushing recognition into later periods when market attention might be reduced.

- Seasonal Business Vulnerabilities: Organizations facing seasonal business cycles create particular opportunities for manipulation, as significant costs incurred during low-revenue periods can be systematically deferred to coincide with high-revenue seasons, fundamentally misrepresenting operational performance.

- Complex Transaction Exposure: Construction projects and similar multi-phase operations involve various components with unique costs, creating opportunities to manipulate expense allocation across periods through coordinated efforts between finance and project management teams.

Capital versus Operating Expense Misclassification

- Expense category manipulation provides substantial opportunities for liability concealment through systematic misclassification between capital and operating categories. These techniques create multiple pathways for financial statement distortion that can trigger regulatory enforcement when discovered.

Critical Distortion Mechanisms:

- Profit Margin Manipulation: Recording capital expenditures as operating expenses systematically distorts profit margins by artificially inflating current-period expenses, creating false impressions of operational efficiency.

- Financial Ratio Distortion: Improper classification affects crucial analytical metrics including EBITDA, working capital, and current ratios—making financial statements appear substantially healthier or riskier than actual business conditions warrant.

- Tax Implication Manipulation: Misclassifying costs that must be amortized over time rather than expensed immediately creates significant tax implications and regulatory compliance violations when discovered by authorities.

- Real-World Example: Recording property improvements such as kitchen remodels (capital expenditures) as repairs (operating expenses) fundamentally misrepresents financial impact and creates exposure to securities litigation when corrective disclosures are eventually required. Operating expenses immediately impact profit and loss statements, whereas capital expenses must be capitalized and amortized systematically over appropriate time periods.

Documentation Manipulation and Invoice Suppression

Physical documentation manipulation represents one of the most direct methods for concealing liabilities, involving systematic control of payment timing and record-keeping to create artificial financial improvements.

Direct Concealment Tactics:

- Year-End Bill Suppression: Deliberately withholding bills at reporting period boundaries to avoid recording both payables and associated expenses, creating artificial improvements in financial position.

- Payment Processing Delays: Systematically delaying payment processing until subsequent accounting periods to create false impressions of cash flow management.

- Documentation Error Creation: Deliberately creating documentation errors that prevent proper expense recording while maintaining plausible deniability regarding fraudulent intent.

- Revenue-Expense Matching Failure: Systematically failing to match expenses with corresponding revenue periods, violating fundamental accounting principles and creating distorted performance metrics.

- Cascading Consequences: These manipulation practices create multiple layers of financial damage. Companies face increased costs associated with error correction when misclassifications are eventually discovered through regulatory enforcement investigations.

- Documentation Gaps: Organizations incur substantial late payment fees and interest when expenses systematically slip through deliberately created documentation gaps. These manipulations cause fundamental violations of accrual accounting principles, creating distorted financial performance metrics that can trigger securities class action lawsuits when corrective disclosures reveal the true scope of financial obligations.

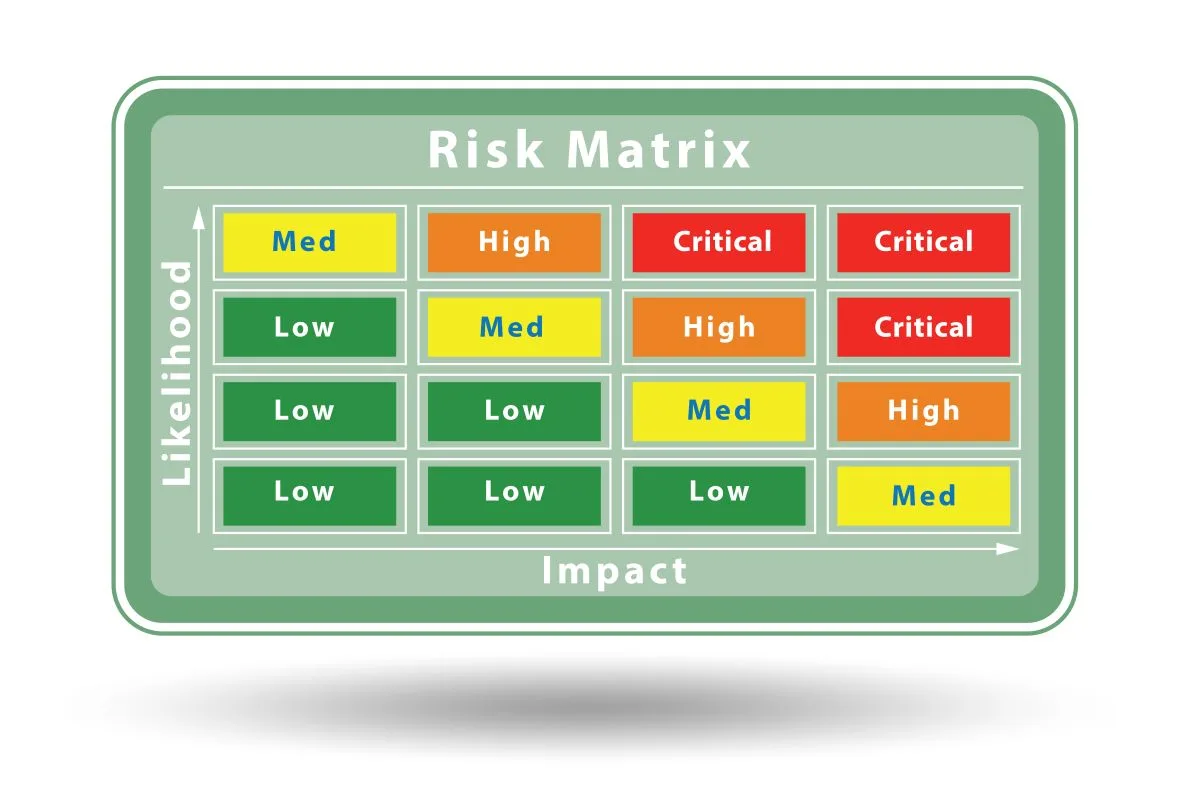

Red Flags and Warning Signs: Detecting Concealed Liabilities Before Catastrophic Losses

- Detecting Concealed Liabilities: Requires systematic analysis of specific warning patterns that consistently precede major corporate fraud revelations and the devastating securities class action lawsuits that follow. Organizations engaging in liability concealment typically exhibit distinctive characteristics that astute investors and auditors can identify before corrective disclosures trigger stock price collapses and regulatory enforcement actions.

- Early Warning Systems: These indicators serve as essential early detection mechanisms for investors, auditors, and stakeholders seeking to identify potential accounting fraud before it causes significant damage to investment portfolios and shareholder value.

Revenue Growth Without Matching Cash Flow: The Most Reliable Fraud Indicator

- Cash Flow Discrepancies: Persistent gaps between reported earnings and actual cash generation represent perhaps the most significant warning sign of liability concealment and accounting fraud through expense manipulation. When companies report strong profits yet fail to generate corresponding cash, this disconnect often indicates potential fraudulent financial reporting.

- Critical Indicators to Monitor:

- Revenue Increases: Without proportionate cash flow improvements may signal earnings manipulation through concealed liabilities

- Cash Conversion Ratios: Operating cash flow divided by net income consistently below 0.8 or showing downward trends warrant immediate investigation

- Fourth-Quarter Spikes: Earnings that appear unusually high without seasonal business justification often indicate period-end manipulation

- Fundamental Reality: Companies can manipulate accounting entries and conceal liabilities temporarily, but cash flow ultimately reveals the truth about financial performance. Organizations struggling to convert reported profits into actual cash create vulnerabilities that eventually trigger securities litigation when schemes unravel.

- Cash Flow Analysis: Values consistently below one for cash flow from operations to net income ratio indicate potential manipulation requiring deeper investigation into the company’s internal controls and financial reporting integrity.

Unusual Changes in Accounting Policies

- Policy Manipulation: Unexplained shifts in accounting methods frequently signal management’s attempts to conceal liabilities or manipulate financial results. Companies facing financial pressure often change accounting policies to temporarily improve their reported financial position while hiding true obligations.

Warning Patterns:

- Industry Deviation: Sudden adoption of policies that diverge from established industry standards without clear business rationale

- Retroactive Applications: New policies significantly impacting historical results raise concerns about management’s motives

- Inadequate Disclosure: Insufficient explanation regarding financial impact of policy changes suggests potential manipulation

- Auditor Relationships: Companies struggling financially might switch accounting firms, yet this change occasionally foreshadows negative financial results requiring regulatory compliance scrutiny. Accountants maintain ethical obligations to issue qualified audit opinions or terminate relationships when they suspect aggressive accounting tactics designed to conceal liabilities.

Accounts Payable Discrepancies

- Payable Manipulation: Inconsistencies in accounts payable patterns often reveal concealed liabilitiesthat companies attempt to hide from investors and creditors. These discrepancies indicate systematic efforts to manipulate financial statements through liability concealment schemes.

Critical Warning Signals:

- Credit Environment Inconsistencies: Unexpected reductions in accounts payable during industry credit crunches when competitors struggle with payment terms

- Margin Anomalies: Gross margins exceeding industry peers without clear operational advantages or cost structure improvements

- Days Outstanding Reductions: Unusual decreases in days’ purchases outstanding that lack business justification

- Cash Flow Contradictions: Earnings growth coupled with recurring negative operating cash flows

- Manipulation Techniques: Management teams sometimes underreport payables by holding checks for extended periods or instructing employees to hide invoices from auditors. These practices create artificial improvements in financial ratios while concealing liabilitiesfrom stakeholders and regulatory compliance oversight.

- Inventory Correlation: Deteriorating inventory turnover alongside accounts payable issues amplifies concern—increasing days in inventory or inventory as a percentage of total assets requires investigation for potential accounting fraud.

Missing or Altered Documentation

- Documentation Irregularities: Systematic document manipulation represents strong evidence of efforts to conceal liabilities from investors and auditors. Companies engaging in accounting fraud often manipulate or withhold documentation to prevent detection of fraudulent schemes.

- Problematic Patterns:

- Sub-ledger Discrepancies: Invoices missing from accounting sub-ledgers without reasonable explanation

- Reconciliation Issues: Unexplained discrepancies in account reconciliations that management cannot adequately justify

- Document Tampering: Financial documents showing signs of unauthorized alterations or manipulation

- Support Documentation: Significant transactions lacking proper supporting evidence or approvals

- Collusion Indicators: These irregularities typically emerge through collusion among management, employees, or third parties attempting to circumvent internal controls. False evidence may be presented to auditors, or false confirmations might be provided by parties colluding with management to conceal liabilities.

- Error Patterns: Approximately 30% of invoices contain errors that often benefit suppliers while passing through compromised approval processes.

High Turnover in Finance and Audit Staff

- Personnel Flight Risk: High turnover in financial positions often signals underlying problems that insiders recognize before public disclosure. Finance professionals with knowledge of questionable practices frequently depart to avoid association with potential accounting fraud and securities litigation.

- Concerning Departure Patterns:

- Early Detection Positions: Employees positioned to identify financial problems departing before issues become public

- Stock Option Timing: Staff leaving before anticipated problems cause stock options to lose value

- Management Instability: Frequent changes in financial leadership suggesting internal conflicts over reporting practices

- Pressure Situations: Departures typically occur when employees face pressure to participate in unethical activities or identify financial distress signals not yet disclosed to investors. Weak financial leadership compared to dominant CEOs often creates environments where concealed liabilities can flourish undetected.

- Financial Impact: The Association of Certified Fraud Examiners reports organizations lose an average of $3,041,103.10 per employee fraud case, demonstrating why early detection of these warning signs becomes essential for preventing catastrophic securities litigation and investor losses.

Legal and Regulatory Consequences: The Enforcement Framework Against Liability Concealment

- Organizations caught hiding liabilities in financial reporting face a devastating cascade of legal and financial repercussions that extend far beyond temporary reputational damage. The discovery of concealed liabilities triggers systematic enforcement actions across multiple regulatory regimes designed to protect investors and maintain market integrity.

- Cascading Legal Consequences: Companies engaging in accounting fraud through liability concealment expose themselves to simultaneous civil litigation, regulatory enforcement, and criminal prosecution that can permanently destroy organizational viability and shareholder value.

Securities Class Actions: Collective Investor Recovery

Securities litigation targeting companies with concealed liabilities generates substantial financial exposure for defendants and significant recoveries for harmed investors. The 2024 aggregate settlement amount for securities class actionsreached USD 4.4 billion, and average settlement value in 2024 ($43 million) is also the highest since 2016.

Legal Theory Foundation: Investors pursue these lawsuits through multiple established legal frameworks:

Section 10(b) Violations: Material misstatements or omissions in financial reporting that deceive reasonable investors

Section 12(a)(2) Claims: Misrepresentations contained in prospectuses and offering documents

Securities Act Violations: Fraudulent practices specifically related to securities offerings and disclosure requirements

Litigation Pattern: Securities class actions consistently follow predictable patterns where: (1) issuers make false statements that artificially inflate stock prices; (2) investors purchase securities during periods of inflated valuations; (3) fraud exposure causes dramatic price declines; and (4) investors suffer quantifiable losses directly attributable to the deceptive practices.

Market Prevalence: Approximately one in 18 companies listed on U.S. exchanges faced securities class action lawsuits in 2019, with S&P 500 firms experiencing an elevated 7.2% exposure rate. Since 1996, over USD 105.00 billion in damages has been awarded through more than 1,800 successful cases, demonstrating the systematic nature of regulatory enforcement against financial statement fraud.

Key Players in Securities Class Actions

- Lead Plaintiffs: Individuals or entities (such as Institutional Investors) who were appointed by the court to represent the class of investors affected by the alleged securities violations.

- Defendants: The corporation, and its officers, directors, and possibly other individuals accused of securities fraud.

- Lead Counsel (for Plaintiffs): The law firm representing the lead plaintiffs and the class.

- Defense Counsel: The law firm(s) representing the defendants.

- Special Master or Mediator: In certain cases, a neutral third party may be appointed to help facilitate settlement negotiations between the parties. This usually happens if a motion to dismiss is denied and/or class certification is granted.

- Expert Witnesses: Individuals with specialized knowledge in areas like accounting, finance, or market behavior may be called upon to provide testimony or analysis.

- Class Members: The investors who have suffered losses due to the alleged securities violations and are part of the class represented by the lead plaintiffs.

- Courts: The courts oversee the legal process and ultimately approve settlements or judgments.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

SEC and DOJ Enforcement Actions: Regulatory Prosecution

- Regulatory authorities pursue companies engaged in concealing liabilities through increasingly aggressive enforcement strategies. Since the late 1990s, almost 20% of SEC enforcement cases have targeted violations resulting from financial reporting and accounting irregularities, with approximately half involving revenue recognition and liability concealment issues.

- SEC Enforcement Categories: The SEC brings charges under established regulatory frameworks:

- Anti-Fraud Provisions: Violations of federal securities laws designed to protect investors from deceptive practices

- Books and Records Provisions: Requirements mandating accurate documentation and transparent financial reporting

- Internal Accounting Controls: Provisions requiring reasonable safeguards against accounting fraud and liability manipulation

- Substantial Penalties: Enforcement penalties demonstrate the serious nature of these violations. On June 20, 2019, Walmart entered into a US$282.7 million global settlement with the SEC” and Department of Justice (“DOJ”), ending a seven-year investigation into the company’s compliance with the U.S. Foreign Corrupt Practices Act (FCPA)

Criminal Liability: Executive Accountability Under Sarbanes-Oxley

- The Sarbanes-Oxley Act established stringent criminal penalties specifically targeting executives who certify fraudulent financial statements containing concealed liabilities. Chief executives and financial officers face severe personal accountability:

- Knowing Violations: Up to 10 years imprisonment and USD 1.00 million fines for executives who knowingly certify non-compliant reports

- Willful Violations: Up to 20 years imprisonment and USD 5.00 million fines for officers who willfully certify false financial statements

- Securities Fraud Enhancement: Additional 25-year maximum sentences under Section 807 for securities fraud activities

- Document Destruction: Section 802 establishes 20-year maximum prison sentences for knowingly altering or destroying documents to impede federal investigations—provisions that explicitly address document manipulation designed to facilitate concealing liabilities.

Financial Restatements and Market Devastation

- Market punishment for companies discovered hiding liabilities proves both swift and severe. From 1997 to 2002, companies announcing financial restatements lost nearly 10% of market capitalization on average within just three days of disclosure. These revelations translated to approximately USD 100.00 billion in aggregate market value destruction.

- Restatement Proliferation: Financial restatements increased dramatically, growing nearly eighteen-fold from 90 cases in 1997 to 1,577 in 2006. Although restatements directly attributed to fraud decreased from 29% of cases in 1997 to 2% in 2006, their market impact remains devastating for affected companies.

- Long-Term Business Consequences: The aftermath of concealed liability discoveries extends far beyond immediate market reactions. Average one-year returns following restatement announcements reached negative 4%, while debt ratings typically declined from BB to BB- within twelve months of disclosure.

- Enforcement Framework: This multi-layered legal framework demonstrates how regulatory compliance failures related to concealing liabilities trigger systematic consequences designed to protect investors while deterring future accounting fraud across financial markets.

Corporate Scandals: The Devastating Reality of Liability Concealment

- Major Corporate Fraud Cases demonstrate how concealing liabilities can trigger catastrophic securities litigation and destroy entire organizations. These landmark scandals serve as stark reminders of the consequences when companies systematically hide financial obligations from investors and regulators.

Enron: Off-Balance Sheet Debt and Special Purpose Entities

- The Enron scandal remains the quintessential example of howomissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

Under Armour: Pulling Forward

- The scandal: For several years leading up to 2017, the athletic apparel maker Under Armour used a practice known as “pulling forward” sales from future quarters to meet analysts’ revenue targets. After it became impossible to sustain the practice, the company reported a significant drop in revenue growth in 2017. An SEC investigation revealed that company executives were aware of the practices and misled investors and analysts by attributing revenue growth to other factors.

- The litigation: Following the revelations, Under Armour faced both an SEC enforcement action and a securities class action lawsuit from investors. The company agreed to a $9 million penalty in the SEC case and, in 2024, settled the shareholder suit for a record-setting $434 million.

Sunbeam: Bill and Hold Sales

- The scandal: During the 1990s, Sunbeam, under the leadership of CEO “Chainsaw Al” Dunlap, engaged in fraudulent accounting practices to meet aggressive financial targets. The company created “cookie-jar” reserves in 1996 and used them to artificially boost income in 1997. It also improperly recognized revenue from “bill and hold sales,” where products were billed to customers but not shipped.

- The litigation: The SEC charged Dunlap and other executives with fraud, and Sunbeam eventually filed for bankruptcy. A securities class action led to a $142 million settlement for investors.

Waste Management: Environmental Cost Misclassification

- Waste Management’s senior executives carried out the scheme through a series of fraudulent accounting manipulations.

- The specific mechanisms of the fraud included:

- Manipulated depreciation: Executives repeatedly extended the useful life of company assets, such as garbage trucks, and assigned arbitrary, excessive salvage values to them. This dramatically reduced the annual depreciation expense and artificially boosted profits.

- Improper capitalization of expenses: Maintenance and repair costs for landfills were improperly classified as capital expenses rather than as current-period expenses. This illegally deferred recognition of these costs, making short-term profits appear larger.

- Concealment through “netting”: Management secretly used one-time gains from asset sales to erase unrelated operating expenses and accounting misstatements. This practice, known as “netting,” concealed the true financial health of the company from investors and auditors.

- Inflated environmental reserves: Executives would intentionally inflate environmental liability reserves during strong financial quarters. Then, during weaker quarters, they would release the excess reserves into earnings to boost results.

- Failure to write off impaired assets: The company neglected to write off the costs of abandoned or impaired landfill projects, instead keeping the costs on the balance sheet to hide their negative financial impact.

The role of Arthur Andersen

- Waste Management’s longtime auditor, Arthur Andersen, was complicit in the fraud

- The audit firm was aware of Waste Management’s improper accounting practices and documented numerous issues, but it repeatedly approved the company’s financial statements with an “unqualified” or “clean” opinion.

- The relationship was tainted by a conflict of interest. Many of Waste Management’s top financial officers were former Arthur Andersen employees, and Andersen was highly protective of the lucrative relationship with its “crown jewel” client.

- Andersen also received substantial fees for non-audit consulting services, which compromised its independence.

Unraveling and consequences

- Discovery: The scheme was discovered in 1997 after a new CEO took over and ordered a review of the company’s accounting practices. He resigned months later after calling the accounting “spooky”.

- Financial restatement: In 1998, Waste Management announced it would restate its earnings from 1992 through 1997, revealing over $1.7 billion in overstated profits.

- Regulatory action: The Securities and Exchange Commission (SEC) charged Waste Management’s founder and five other top executives with perpetrating the fraud.

- Executives were fired and faced charges of securities fraud. The SEC also fined Arthur Andersen $7 million for its role.

- Stock price collapse: When the fraud was revealed, the company’s stock price plummeted, causing over $6 billion in losses for shareholders.

- Company restructure: Crippled by the scandal, Waste Management was acquired by a smaller competitor, USA Waste Services. The newly merged company kept the Waste Management name but relocated its headquarters and replaced nearly all top executives.

- Legacy for auditors: The scandal was a major contributing factor to the downfall of Arthur Andersen, which was also implicated in the Enron scandal just a few years later.

- Broader reforms: The Waste Management case, alongside other major financial scandals, helped trigger the push for stricter regulations in corporate governance and financial reporting, ultimately leading to the passage of the Sarbanes-Oxley Act in 2002.

Livent: Securing Financing and Misleading Investors

- The scandal: The Canadian theatrical company Livent, founded by Garth Drabinsky and Myron Gottlieb, manipulated its books throughout the 1990s to paint a picture of financial success. The accounting scheme involved capitalizing pre-production costs as long-term fixed assets, erasing expenses from the general ledger, and improperly recognizing revenue. The fraud was designed to secure financing and mislead investors about the company’s true performance.

- The litigation: After the fraud was uncovered, Livent collapsed, and Drabinsky and Gottlieb were criminally convicted of fraud. A lawsuit against the company’s auditor, Deloitte & Touche, found them negligent for failing to catch the extensive fraud.

Theranos: Omissions Intersects with Technolohy

- The Theranos fraud case represents a modern example of how omissions in financial statements can intersect with technological claims and investor relations. Founder Elizabeth Holmes was convicted of defrauding investors by making false claims about the company’s blood-testing technology while concealing the true state of its operations.

- Key Legal Developments:

- Enhanced scrutiny of private company disclosures to investors

- Stricter due diligence requirements for venture capital investments

- Expanded liability for executives making forward-looking statements

Prevention Strategies: Essential Frameworks for Eliminating Liability Concealment

- Effective prevention of hiding liabilities in financial reporting requires systematic institutional safeguards that create multiple barriers against accounting fraud. Organizations must implement comprehensive control frameworks that make concealment schemes virtually impossible to execute without detection.

- Risk Mitigation Framework: Companies that maintain robust fraud prevention systems significantly reduce their exposure to securities litigation while strengthening investor confidence and regulatory compliance requirements.

Segregation of Duties: The Foundation of Fraud Prevention

- Segregation of duties serves as the primary defense mechanism against liability concealment schemes by eliminating single-point control vulnerabilities that enable accounting fraud. This critical control framework prevents any individual employee from controlling entire financial processes through systematic separation of key functions:

- Authorization of transactions must remain separate from recording functions

- Custody of assets requires independent oversight from transaction approval

- Recording and reconciliation activities demand separation from authorization responsibilities

- Review functions must operate independently from operational transaction processing

- Systematic Implementation: Organizations should periodically evaluate control effectiveness by creating comprehensive segregation matrices that map responsibilities across departments and identify potential vulnerability areas. This methodical approach directly supports fraud prevention while ensuring regulatory compliance with Sarbanes-Oxley requirements.

Enterprise Resource Planning Systems: Automated Fraud Detection

- ERP systems provide essential monitoring capabilities that detect potential liability concealment before schemes can mature into costly securities litigation. Properly configured enterprise systems create automated barriers against fraudulent activities through several mechanisms:

- Process Automation: Eliminates vulnerable manual processes that create opportunities for manipulation

- Approval Enforcement: Implements strict authorization controls that prevent unauthorized transaction processing

- Baseline Metrics: Establishes standardized business processes for detecting anomalous patterns that signal potential fraud

- Access Control Management: Regular reviews remain critical—research indicates approximately 8% of system users possess access rights that could enable fraudulent activities. This systematic monitoring approach prevents the accumulation of unauthorized privileges that facilitate concealing liabilities.

Whistleblower Programs: Early Detection Systems

- Whistleblower programs represent vital early warning systems that significantly enhance fraud detection capabilities before schemes escalate into major accounting fraud cases. The Association of Certified Fraud Examiners demonstrates that companies with established hotlines detected fraud at substantially higher rates—49% compared to 31% for organizations lacking these systems.

- SEC Whistleblower Program provides comprehensive protections that encourage internal reporting:

- Financial Incentives: Whistleblowers receive 10-30% of recoveries exceeding $1 million

- Anonymity Protection: Tips can be submitted anonymously through qualified attorneys

- Confidentiality Safeguards: Strict protections prevent retaliation against reporting individuals

- Strategic Implementation: Companies should establish detailed policies that outline expected reporting processes while ensuring employees understand both the importance of fraud prevention and the protections available to those who report suspicious activities.

Audit Committee Oversight: Board-Level Fraud Prevention

- Audit committees serve as the primary institutional safeguard against concealed liabilities through comprehensive oversight that addresses fraud risks at the governance level. These committees function as critical checkpoints in the financial reporting process:

- Internal Control Monitoring ensures management maintains adequate fraud prevention systems

- Financial Reporting Integrity requires ongoing assessment of accounting practices and disclosure adequacy

- Fraud Risk Assessment involves systematic evaluation of vulnerabilities that could enable accounting fraud

- Independent Communication: Audit committees must meet separately with external auditors to examine sensitive matters requiring private discussion, creating additional layers of oversight that prevent management override of controls.

Regulatory Compliance Training: Building Fraud-Resistant Cultures

- Comprehensive training programs extend beyond basic compliance requirements to create organizational cultures that actively resist fraudulent activities. Effective fraud prevention education addresses multiple critical areas:

- Risk-Based Culture Development ensures employees understand their role in preventing securities litigation through ethical behavior

- Regulation-Specific Training covers industry standards, anti-bribery policies, and securities law requirements

- Fraud Detection Techniques educates staff on recognizing warning signs and reporting procedures

- Ethics Integration: Training should emphasize the connection between individual actions and broader market integrity, helping employees understand how their decisions impact investor protection and organizational reputation.

- Systematic Defense: Organizations that implement these comprehensive prevention strategies demonstrate commitment to financial integrity while creating multiple barriers against the devastating consequences of accounting fraud and the resulting securities class action lawsuits.

Protecting Your Business and Investments from Liability Concealment Fraud

- Concealed liabilities represent a fundamental threat to market integrity that demands constant vigilance from all market participants. This examination reveals how sophisticated accounting fraud schemes systematically destroy investor confidence while exposing organizations to catastrophic securities class action lawsuits and regulatory enforcement actions.

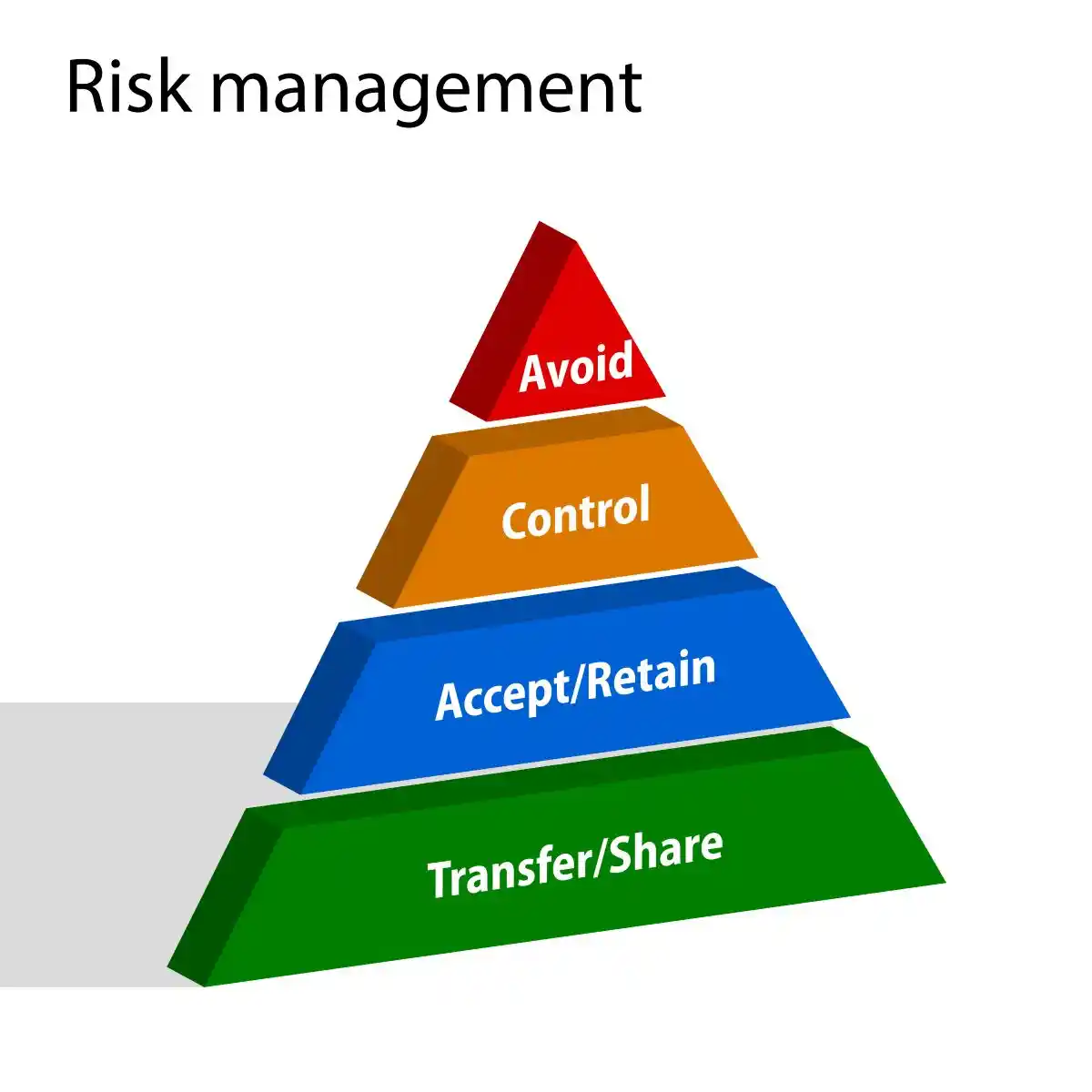

- Critical Knowledge Framework: Several essential insights emerge from this analysis of liability concealment schemes:

- Sophisticated Manipulation Methods: Concealing liabilities employs increasingly complex mechanisms—from off-balance sheet entities and deferred expense recognition to invoice suppression and asset valuation manipulation—all designed to create artificial impressions of financial stability.

- Early Warning Systems: Revenue growth without corresponding cash flow, unusual accounting policy changes, accounts payable discrepancies, and high financial staff turnover provide crucial detection signals before corrective disclosures trigger devastating market reactions.

- Severe Legal Consequences: Securities litigation settlements average $38 million while criminal penalties under Sarbanes-Oxley include up to 20 years imprisonment for executives who certify fraudulent statements, demonstrating how liability concealment creates multi-layered legal exposure.

- Corporate Governance Failures: The devastating collapses of Enron, Waste Management, and Theranos illustrate how quickly concealed liabilities can destroy shareholder value when inadequate internal controls fail to prevent or detect fraudulent schemes.

- Prevention Through Systematic Controls: Organizations that implement segregation of duties, robust ERP monitoring systems, effective whistleblower programs, vigilant audit committee oversight, and regulatory compliance training create formidable barriers against liability concealment schemes.

- Empowering Market Participants: Market participants who recognize the warning signs of concealed liabilities and understand their legal implications can reduce their exposure to fraud risks while supporting market integrity. This knowledge ultimately contributes to more robust and transparent capital markets that benefit all stakeholders.

- The Investment in Prevention: The price of ignorance regarding these deceptive practices remains far too high—both for individual organizations and the broader financial system. Companies that prioritize transparent financial reporting and ethical conduct benefit from enhanced investor confidence, lower capital costs, and reduced exposure to securities litigation.

- Collective Responsibility: The battle against concealing liabilities requires commitment from all stakeholders: management must establish tone at the top that does not tolerate fraud, boards must ensure robust oversight of financial reporting processes, auditors must maintain professional skepticism, and investors must exercise analytical vigilance when evaluating financial statements.

- Market Integrity: Organizations must recognize that financial integrity serves not merely as a regulatory compliance obligation but as a fundamental business necessity for sustainable operations and stakeholder trust. Companies and investors who work together to maintain transparency and accountability create the foundation for healthy capital markets that protect all participants from the devastating consequences of accounting fraud.

Key Takeaways

Understanding how companies hide liabilities is crucial for protecting investments and maintaining financial integrity. Here are the essential insights from this comprehensive analysis:

• Hidden liabilities cost organizations 5% of annual revenues – Financial statement fraud through concealed obligations creates median losses of $954,000 per case, making detection and prevention critical for business survival.

• Eight common concealment methods include off-balance sheet financing, unrecorded loans, and deferred expenses – Companies use sophisticated techniques like Special Purpose Entities and invoice suppression to artificially improve their financial appearance.

• Revenue growth without matching cash flow signals potential fraud – When reported profits don’t generate corresponding cash, this disconnect often indicates liability concealment or expense manipulation requiring immediate investigation.

• Legal consequences extend far beyond reputation damage – Securities litigation averages $38 million in settlements, while criminal penalties under Sarbanes-Oxley include up to 20 years imprisonment for executives certifying fraudulent statements.

• Prevention requires systematic institutional safeguards – Effective protection combines segregation of duties, robust ERP monitoring systems, whistleblower programs, audit committee oversight, and comprehensive compliance training to create fraud-resistant environments.

The devastating impact of cases like Enron ($74 billion in shareholder losses) and Colonial Bank ($2.9 billion fraud scheme) demonstrates why vigilance and strong internal controls remain essential for protecting stakeholders from the catastrophic consequences of concealed liabilities.

FAQs

Q1. What are some common methods companies use to hide liabilities? Companies often use techniques like off-balance sheet financing, unrecorded loans, deferred expense recognition, and special purpose entities to conceal liabilities from financial statements. Other methods include misclassifying expenses and manipulating documentation.

Q2. What are some red flags that may indicate concealed liabilities? Key warning signs include revenue growth without matching cash flow, unusual changes in accounting policies, accounts payable discrepancies, missing or altered financial documentation, and high turnover in finance and audit staff.

Q3. What are the potential consequences for companies that hide liabilities? Consequences can be severe, including securities class action lawsuits, SEC and DOJ enforcement actions, criminal liability for executives, substantial fines, and significant drops in stock price and market capitalization when the fraud is uncovered.

Q4. How can organizations prevent liability concealment? Prevention strategies include implementing proper segregation of duties, using robust ERP systems with monitoring capabilities, establishing effective whistleblower programs, ensuring strong audit committee oversight, and providing comprehensive regulatory compliance training for staff.

Q5. What impact can concealed liabilities have on investors? Concealed liabilities can lead to substantial investor losses when discovered. They distort key financial metrics that investors rely on for decision-making, potentially resulting in misguided investments based on artificially inflated financial health.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors