Introduction to and Summary to Embezzlement and Securities Litigation

- Embezzlement and Securities Litigation: Embezzlement ian an untimate trigger to Securities litigation and Regulatory Enforcement.

- Embezzlement: is the fraudulent conversion of property by a person entrusted with its care, differing from theft by involving a breach of trust rather than initial unlawful taking.

- Abuse of Trust: This white-collar crime occurs when an individual abuses their lawful access to funds, goods, or data for personal gain and can involve various methods, including cash skimming, inventory theft, data breaches, payroll fraud, and digital embezzlement.

- Penalties vary significantly by jurisdiction and the value of the assets, potentially including significant fines, restitution, and imprisonment.

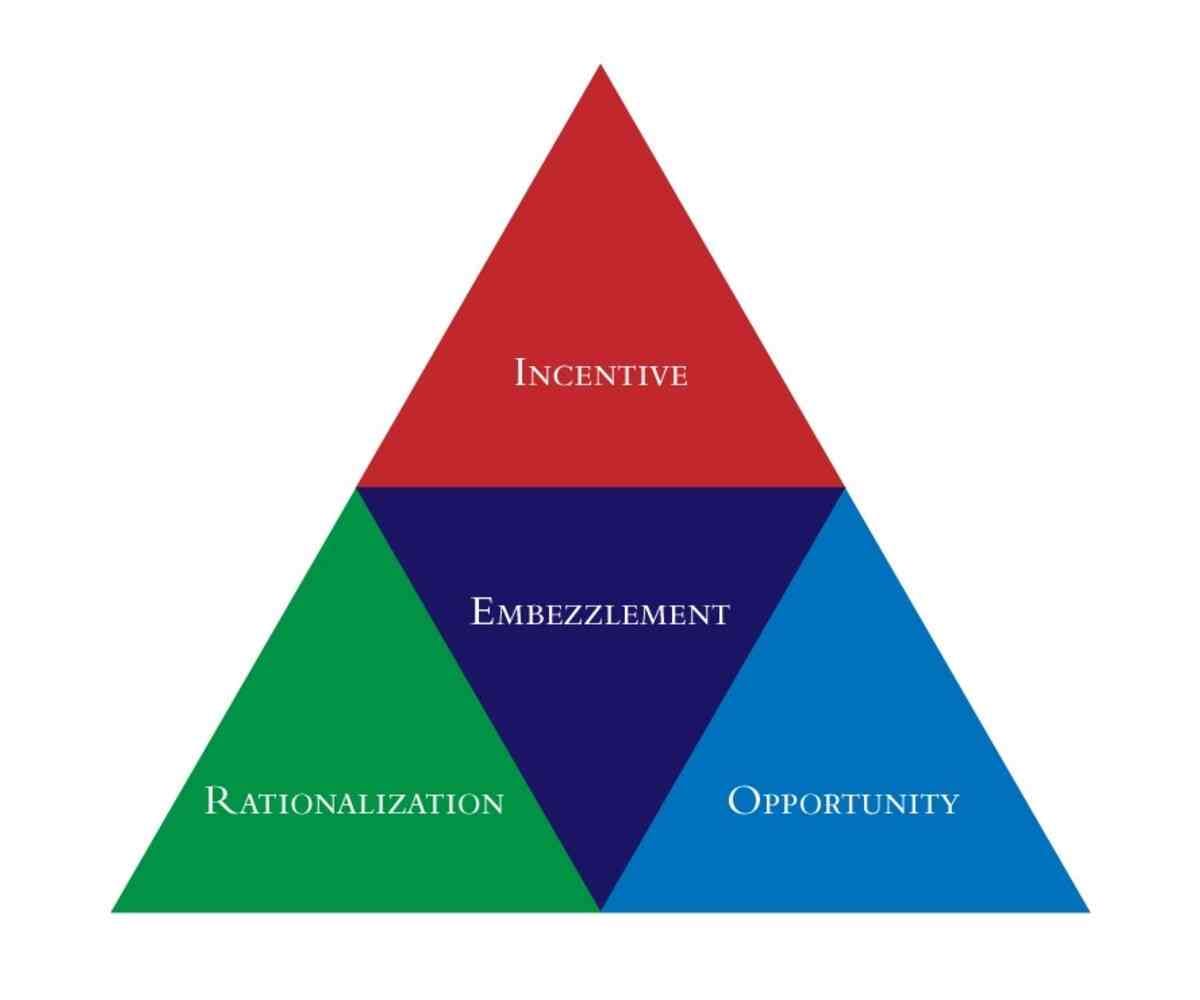

How Embezzlement Works

- Embezzlement involves a three-step process: Entrustment: An individual is legally given possession or care of property or funds, such as an employee with access to company accounts.

- Misappropriation: The trusted individual fraudulently converts or uses that property for their own benefit.

- Intent to Deprive: There is an intention to permanently or temporarily deprive the rightful owner of the property.

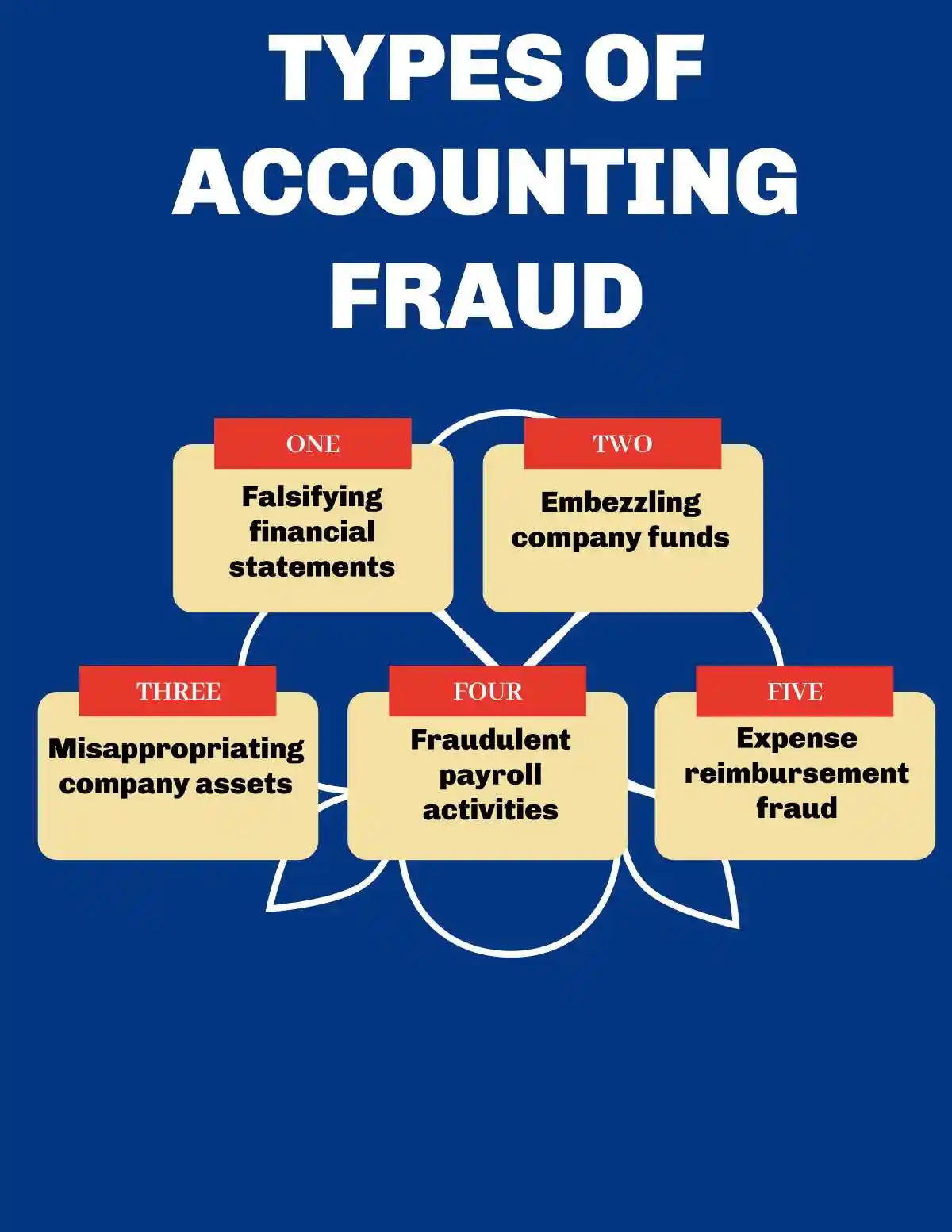

Common Types of Embezzlement

- Cash Embezzlement: Pocketing cash from sales, creating fake invoices, or altering financial records to divert funds.

- Inventory Theft: Stealing physical goods, raw materials, or products for resale or personal use.

- Data Theft: Stealing sensitive company data, financial information, or intellectual property for sale or personal gain.

- Digital Embezzlement: Manipulating financial software or unauthorized electronic transfers to hide theft.

- Payroll Fraud: Falsifying work hours, creating ghost employees, or manipulating time-tracking systems.

Consequences of Embezzlement

- Legal Penalties: Can range from misdemeanor charges to felonies, resulting in fines, restitution to the victim, and imprisonment.

- Securities Fraud Litigation: Embezzement is on of the top triggers to regulatary complaince and triggering securiteis litigation.Reputational Harm: Organizations that suffer from embezzlement can face severe damage to their reputation.

Preventing Embezzlement

- Rigorous Hiring Practices: Thorough background checks to assess candidate integrity.

- Strong Internal Control: Implementing clear policies and procedures for handling assets and finances.

- Segregation of Duties: Ensuring that no single person has complete control over a financial process.

- Auditing: Regular financial audits to detect discrepancies and fraudulent activity.

- Culture of Honesty: Fostering a work environment that values transparency and accountability

Understanding Embezzlement: Definition, Impact, and Securities Litigation Consequences

- Embezzlement: Represents one of the most sophisticated yet devastating forms of accounting fraud that continues to plague modern financial markets, serving as a catalyst for numerous securities fraud class action lawsuits and regulatory enforcement actions.

- Postion of Trust: Unlike theft, where assets are taken without any prior access or permission, embezzlement occurs when a person in a position of trust or responsibility violates that trust through the misappropriation of funds or property entrusted to them for personal gain. This could involve employees, managers, or executives who have access to company funds or assets and use them for unauthorized personal purposes.

- Key Concepts Surrounding Embezzlement: include thefiduciary duty and the breach of this duty. Fiduciary duty refers to the obligation of an individual to act in the best interest of another party, such as a company or client. When this trust is violated through the fraudulent conversion of assets, it constitutes embezzlement.

- Foundational Concepts: Understanding these foundational concepts proves crucial for identifying potential breaches and implementing measures to detect and prevent such misconduct within an organization.

Embezzlement cases: The challenge often lies in the subtlety and sophistication with which the crime is committed. perpetrators may use various methods to conceal their actions, such as falsifying records, creating fake vendors, or manipulating financial statements. These deceptive practices frequently trigger securities fraud class actions when publicly traded companies become involved, as shareholders suffer losses from the resulting stock price declines following disclosure of the fraudulent activities.

The Devastating Impact of Embezzlement on Businesses and Stakeholders

- The Eepercussions of Embezzlement: Extend far beyond the immediate financial loss suffered by a company. Embezzlement can have a devastating impact on a business’s reputation, leading to a loss of trust among customers, investors, and the public. The damage to a company’s credibility can result in decreased sales, reduced stock prices, and difficulty in securing future investments.

Statistical Evidence:

- 5% of annual revenue to fraud: In 2024, the Accociation of Cerifified Fraud Examinated ) (ACFE) releaasews a comprehensive suty detailing, among other things, the methods, consts, victimes and the perpertrators of cocupational fraud (2024 Report). The 2024 Report confirms that organizations lose an estimated 5% of their revenue to fraud annually. This figure is considered a conservative estimate because many cases go undetected.

- Embezzlement represents 90% of asset misappropriation cases: The 2024 Report confirmed that asset misappropriation schemes—a category that includes embezzlement—are the most common type of fraud, accounting for 89% of cases.

- Median loss from schemes is $150,000: The 2024 report found a global median loss of $145,000 for all fraud cases. However, the median loss for asset misappropriation (embezzlement) specifically was $120,000.

- Senior executive losses exceed $1 million: Owners and executives cause the largest fraud losses. The median loss for frauds committed by owners and executives was $500,000, significantly higher than for other employees. It’s also worth noting that 22% of all fraud cases studied involved losses of $1 million or more.

Industries most vulnerable to embezzlement

- Banking and Financial Services: As the industry with the most financial activity, it is not surprising that it experiences the highest number of reported fraud cases. Common schemes include check tampering, cash larceny, and sophisticated kiting schemes.

- Manufacturing: This industry is vulnerable to both cash and non-cash embezzlement. In addition to billing fraud, Manufacturers often face inventory and equipment theft by employees. Despite a high number of cases, manufacturing, along with wholesale trade and mining, has also historically faced high median losses per incident.

- Healthcare: Embezzlement schemes are rampant in the healthcare industry, with frequent cases of insurance fraud, false claims, and billing scams. The complexity of medical billing and the large volume of transactions create opportunities for fraud.

- Retail and hospitality: With a high volume of cash transactions and a constant flow of inventory, these sectors are at heightened risk for internal theft. Common schemes include cash skimming, fraudulent refunds, and inventory theft.

- Government and public administration: This sector faces a variety of fraud risks, often involving non-cash asset theft and billing schemes. The ACFE consistently reports a high number of cases in this sector, highlighting vulnerabilities in public systems.

- Construction: The construction industry is particularly vulnerable to occupational fraud, and it suffers some of the highest median losses of any sector. This risk comes from a combination of complex projects, reliance on multiple contractors and vendors, and the handling of valuable materials and equipment.

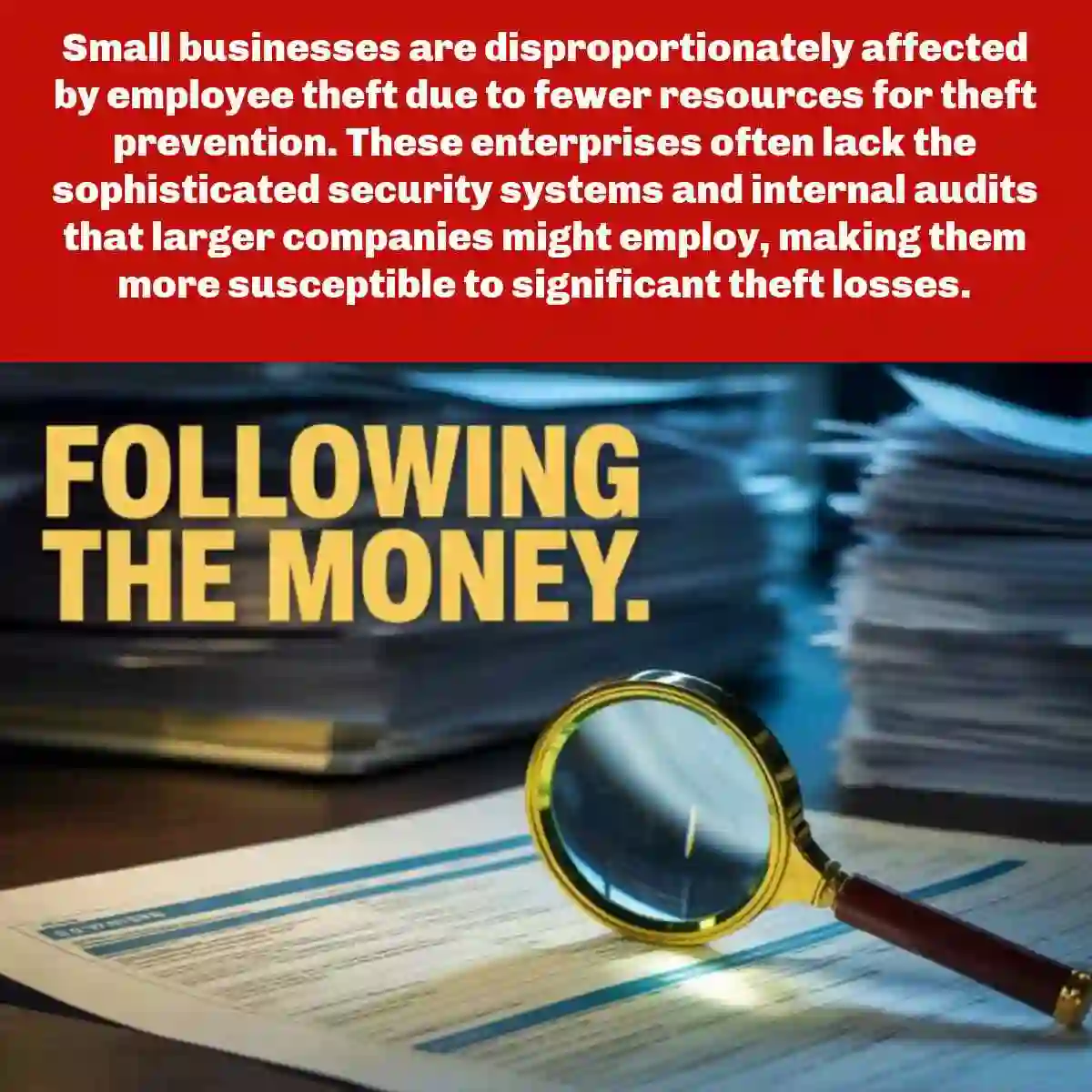

Why small businesses are especially at risk

- In addition to specific industries, small businesses are a particularly vulnerable target for embezzlement.

- Fewer controls: Small businesses often lack the robust system of controls and segregation of duties found in larger organizations.Higher trust: With a smaller team, there is often a higher level of trust, which can make it easier for embezzlement to go unnoticed.

- Disproportionate impact: While the dollar amount lost per incident is often smaller than in large corporations, the financial impact is much greater, sometimes crippling or bankrupting the business.

- Anti-Fraid Traing: Here are the three most relevant questions to discuss during an anti-fraud training session, along with a rationale for each:

- How does our company’s control system prevent a single employee from committing and concealing embezzlement?

Rationale: The statistical evidence highlights that schemes by senior executives lead to the largest losses, often exceeding $1 million. The most effective method for preventing most types of fraud, including embezzlement, is the proper segregation of duties. A control system that separates the functions of approving transactions, handling assets, and recording transactions minimizes the opportunity for a single person—especially a high-level executive—to execute and cover up a large-scale fraud.This question directly addresses a major risk area and educates all employees on why these control procedures are in place.

2. What are the common behavioral red flags associated with embezzlement, and how should they be reported?

- Rationale: Employees who commit fraud often exhibit behavioral signs such as living beyond their means or refusing to take vacation. Training employees to recognize these warning signs is an effective detective control. The most common method of detecting fraud is through employee tips. This question encourages employee vigilance and teaches them how to safely and confidentially report suspicious behavior, a crucial component of any anti-fraud program.

3. What are the specific types of asset misappropriation, particularly cash embezzlement, that our employees should be aware of?

- Rationale: Embezzlement accounts for approximately 90% of all asset misappropriation cases, making it the most significant type of fraud for most businesses. Cash embezzlement, in particular, is the most common form of embezzlement. By training employees to recognize the specific tactics fraudsters use, such as manipulating expense reports, tampering with checks, or altering financial records, a company can improve its detective and preventive controls. This focused question makes the threat of fraud tangible and relevant to an employee’s daily work.

Methods of Detecting Occupational Fraud

- The 2024 study reveals critical insights into how organizations uncover fraudulent activities, with tips emerging as the predominant detection method. The data shows that:

- Tips from various sources account for 43% of fraud discoveries, highlighting the crucial role of whistleblowers in exposing misconduct

- Internal and external audits collectively identify 17% of cases, demonstrating the importance of systematic review processes

- Management review processes detect 13% of fraud schemes, underscoring the value of active oversight

- Employee whistleblowers prove particularly valuable, providing over half (52%) of all fraud-related tips. Customer reports comprise 21% of tips, while vendor notifications account for 11%. Anonymous submissions represent 15% of total tips received.

- The landscape of reporting mechanisms has evolved significantly, with digital platforms now dominating traditional methods. Web-based reporting systems lead at 40%, followed closely by email at 37%, while telephone hotlines have declined to 30%. This marks a historic shift in the study’s findings, as web-based reporting becomes the preferred channel for the first time. This represents a notable change from 2020, when the three primary reporting methods – web, email, and phone – each received roughly equal usage at approximately one-third of tips.

The Types of Schemes Employed by Fraudsters

The Types of Schemes Employed by Fraudsters

- According to the 2024 Report, the study concluded three prominet types of occupational frauds:

- Asset Missappropriation: The 2024 Report found tha this fraudulent scheme represented a whopping 89% of cases in the study. This is a reslut, accouding to the 2024 Report of the company having cash or inventory stolen.

- Corruption: The 2024 Report found that nearly one-half (48%) involved corruption, for example, bribes, extortion or kickbacks.

- Financial Mistatment: Surprisingly, this was the least common of the shemes, occuring in a mere 5% of cases. This scheme is the result of dishonest employees, usually exectuives, or manages or employees in the accounting department, causing mistatements in fiancial statements by reporting false revenue or ommitting liabilities.

- The 2024 Report found that median losses were lowest for asset misappropriation ($120,000) and highest for financial misstatement ($766,000). Many cases involved more than one type of fraud scheme. For example, 35% of the frauds in the 2024 study involved both asset misappropriation and corruption. Only 1% of the cases involved financial misstatement alone.

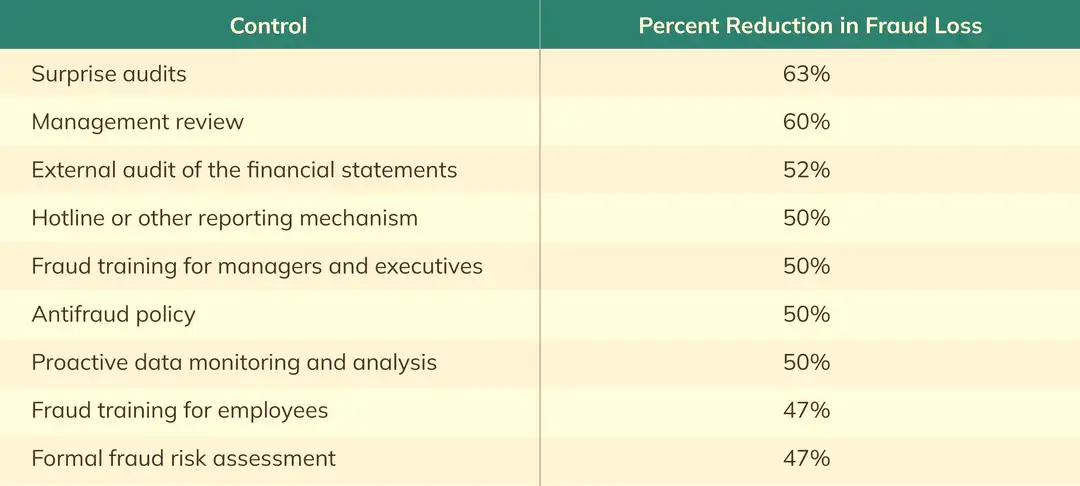

As far as lower losses from fraud, the 2024 Report determined the most effective internal oversight contols were as noted in the chart below:

MOST EFFECTIVE INTERNAL CONTROLS DETERMINED BY THE 2024 REPORT

Regulatory Framework and Enforcement Mechanisms

- The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of corporate governance and controls requirements, mandating that public companies establish and maintain adequate control over financial reporting. This legislation emerged as a direct response to major corporate scandals involving accounting fraud and embezlement, including the spectacular collapses of Enron and WorldCom.

- SEC enforcement actions related to embezzlement have intensified significantly in recent years. The Securities and Exchange Commission has imposed penalties exceeding $4.2 billion in fiscal year 2024 alone, with many cases involving embezzlement schemes that resulted in materially false financial statements. These regulatory enforcement actions serve multiple purposes: deterring future misconduct, compensating harmed investors, and maintaining market integrity.

- PCAOB oversight has become increasingly stringent, with auditors facing enhanced scrutiny when embezzlement schemes go undetected during financial statement audits. The Public Company Accounting Oversight Boarb has issued numerous inspection reports highlighting deficiencies in auditors’ procedures for detecting embezzlement and other forms of accounting fraud.

Regulatory reporting requirements under the Sarbanes-Oxley Act of 2002 mandate that companies maintain detailed documentation of their controlsand report any material weaknesses that could facilitate embezzlement. Companies must conduct annual risk assessments to identify vulnerabilities in their financial reporting processes and implement appropriate safeguards.

High-Profile Cases and Their Consequences

- Recent high-profile cases demonstrate the devastating consequences of embezzlementon publicly traded companies and their shareholders. In 2023, a major retail corporation disclosed that its former CFO had orchestrated an embezzlement scheme involving $47 million over a four-year period. The executive created fictitious vendor accounts and authorized payments to entities he controlled, while manipulating controls to conceal the fraud.

- When the scheme was revealed, it triggered immediate securities fraud litigation as shareholders filed securities class action lawsuits alleging that the company’s financial statements were materially false and misleading. The company’s stock price plummeted 38% in the week following disclosure, wiping out approximately $2.1 billion in market capitalization. The SEC enforcement action resulted in a $28 million penalty, while the securities fraud class action settlement reached $156 million.

- Another significant case involved a technology company where senior executives engaged in a sophisticated embezzlement scheme that inflated revenues by $89 million over three years. The perpetrators created fake customer contracts and manipulated the company’s revenue recognition policies to meet quarterly earnings targets. This accounting fraud violated multiple provisions of the Sarbanes-Oxley Act of 2002 and triggered both regulatory enforcement actions and securities fraud class actions.

- The corporate governance failures in these cases highlight the critical importance of effective controls and proper oversight mechanisms. Companies with weak controls create environments where embezzlement can flourish undetected for extended periods, ultimately resulting in massive financial and reputational damage.

Detection and Prevention Through Enhanced Controls

Detection and Prevention Through Enhanced Controls

- Preventing embezzlement requires a comprehensive approach that combines robust controls, regular risk assessments, and strong corporate governance practices. The Sarbanes-Oxley Act of 2002 mandates that companies implement specific control procedures designed to prevent and detect accounting fraud, including embezzlement schemes.

- Effective controls include segregation of duties, requiring multiple approvals for significant transactions, regular reconciliation of accounts, and surprise audits of high-risk areas. Companies must establish clear authorization protocols that prevent any single individual from having complete control over financial transactions. These serve as the first line of defense against embezzlement and other forms of accounting fraud.

- Risk assessments play a crucial role in identifying vulnerabilities that could facilitate embezzlement. Companies must regularly evaluate their processes, systems, and personnel to identify areas where controls may be insufficient. These assessments should consider factors such as employee access to assets, the complexity of financial transactions, and the effectiveness of monitoring procedures.

- Corporate governance structures must include independent oversight of financial reporting processes. Board audit committees bear primary responsibility for ensuring that management maintains adequate internal controlsand promptly addresses any identified deficiencies. The Sarbanes-Oxley Act of 2002 requires that audit committee members possess financial expertise and independence from management.

Regulatory Compliance and Future Outlook

Regulatory compliance in the realm of controls has become increasingly stringent following major corporate scandals of the early 2000s. Companies must demonstrate not only that they have implemented appropriate controls but also that these controls operate effectively to prevent embezzlement and other forms of accounting fraud.

The integration of technology into controls systems offers promising opportunities for enhanced fraud detection. Advanced analytics and artificial intelligence can identify unusual patterns in financial transactions that may indicate embezzlement schemes. These technological solutions complement traditionalcontrols by providing real-time monitoring capabilities and automated alerts for suspicious activities.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities fraud class action, or have questions about securities fraud class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors