Introduction to the Causes of Accounting Frauds

- Causes: The Causes of Accounting Frauds are meant to intentionally distort a compant’s true financial health through a myriad of deceptive practices including false financial statements.

- Threats to Investors: Accounting fraud represents one of the most serious threats to market integrity and investor confidence in today’s complex financial landscape.

- Mechanisms: This deliberate manipulation of financial statements creates a false impression of a company’s financial health through various illegal acts, including misstating revenues, inflating assets, and hiding liabilities.

- Purpose: These deceptive practices are specifically designed to mislead stakeholders such as investors, creditors, and regulatory bodies, undermining the fundamental principles of transparency and honesty that capital markets depend upon.

- Motivation: The motivation for accounting frauds often stems from intense pressure to present favorable financial status, meet aggressive market expectations, or achieve lucrative performance-based bonuses.

- Consequences: However, the consequences extend far beyond immediate financial misrepresentation, creating ripple effects that can devastate entire industries and erode public trust in financial reporting systems.

The Root Causes of Accounting Fraud

- Understanding the causes of accounting frauds requires examining both individual motivations and systemic pressures that create environments conducive to financial misconduct.

- The fraud triangle—opportunity, pressure, and rationalization—provides a framework for understanding how these elements converge to enable fraudulent behavior.

- Pressure factors include unrealistic performance targets, declining financial performance, personal financial difficulties of executives, and the need to maintain stock prices or secure financing.

The Result of Weak Corporate Governance Frameworks

- When companies face mounting pressure to deliver consistent growth or meet analyst expectations, management may resort to creative accounting practices that gradually evolve into outright fraud.

- Opportunity arises from weak internal controls, inadequate oversight mechanisms, and complex organizational structures that obscure accountability.

- Companies with poor corporate governance practices, limited board independence, or insufficient audit committee oversight create environments where fraudulent activities can flourish undetected.

- The rationalization component involves the mental gymnastics that perpetrators use to justify their actions, often viewing fraud as a temporary measure to overcome short-term difficulties or as acceptable industry practice.

Sophisticated Methods of Financial Deception

- Modern accounting fraud schemes have evolved in complexity and sophistication, making detection increasingly challenging for investors and regulators.

- Revenue recognition manipulation remains one of the most common forms, involving premature revenue recognition, fictitious sales transactions, or channel stuffing to inflate current period earnings.

- Asset inflation techniques include overstating inventory values, capitalizing expenses that should be recorded as operating costs, and creating fictitious assets or inflating existing asset valuations.

- These practices artificially enhance balance sheet strength and profitability metrics that investors rely upon for investment decisions.

Concealment and Manipulation

- Liability concealment involves hiding debt through off-balance-sheet financing arrangements, understating accrued expenses, or failing to record contingent liabilities.

- This manipulation presents a misleadingly strong financial position that can attract investment or credit under false pretenses.

- Expense manipulation encompasses various techniques such as capitalizing operating expenses, understating depreciation, or creating cookie jar reserves that can be released to smooth earnings in future periods.

- These practices distort the true cost structure and operational efficiency of the business.

The Critical Role of Internal Controls and Corporate Governance

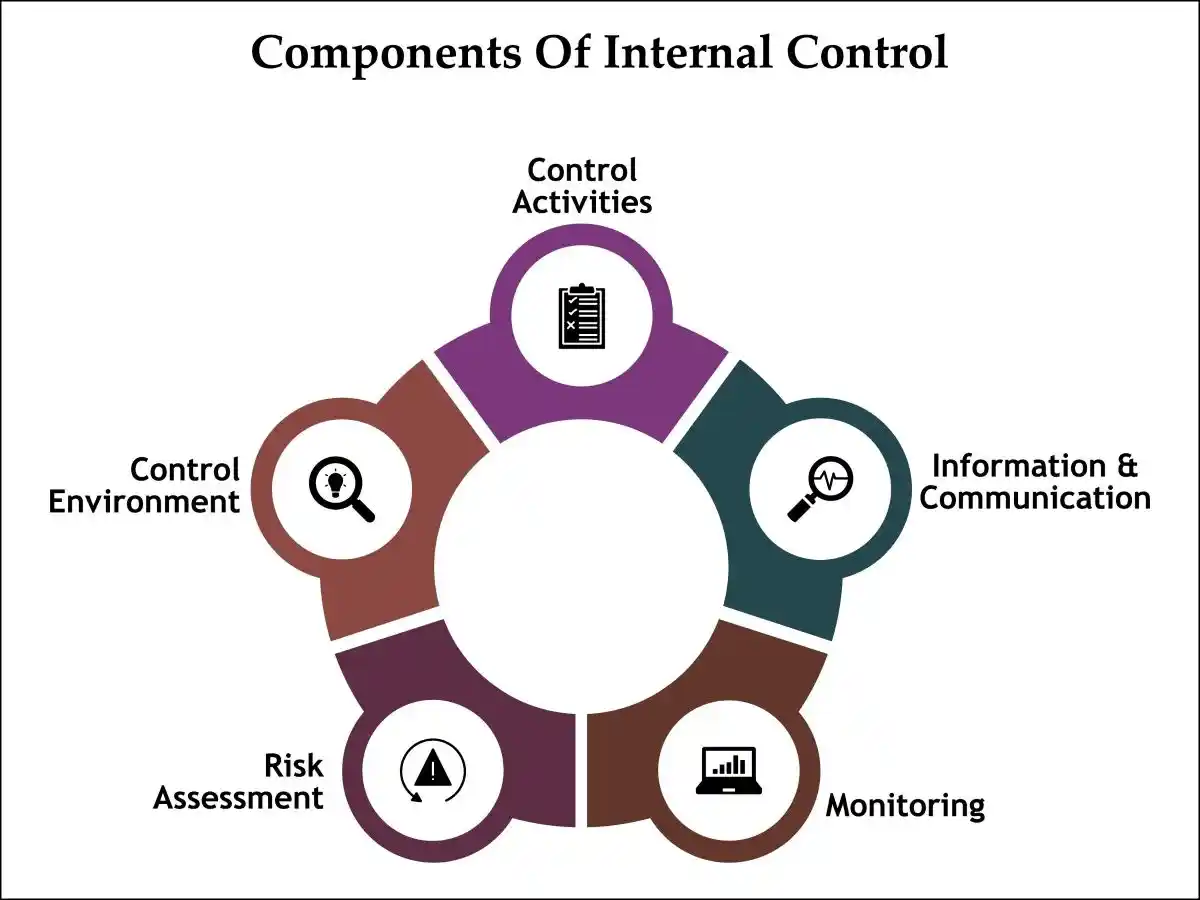

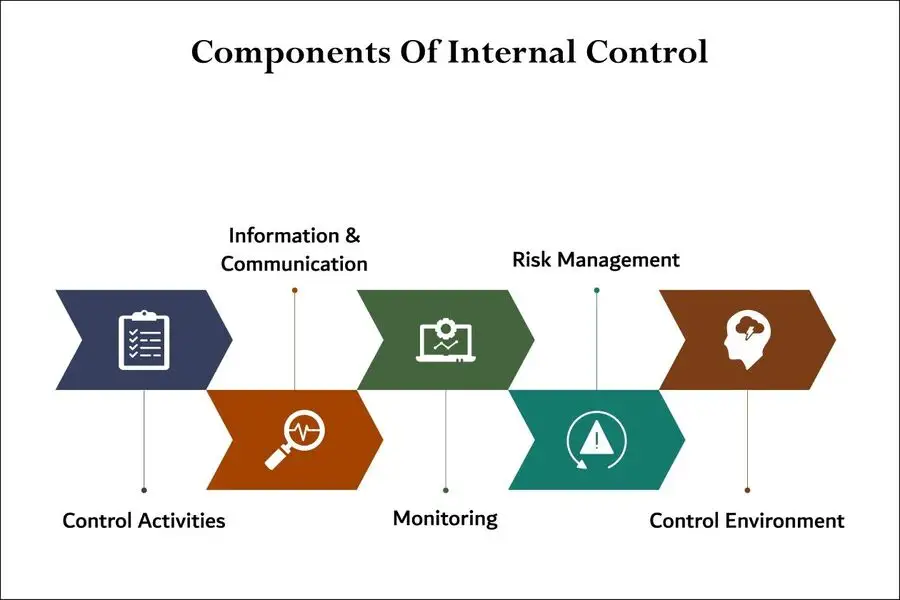

- Effective internal controls serve as the first line of defense against accounting fraud, creating systematic checks and balances that prevent, detect, and correct financial misstatements.

- The Committee of Sponsoring Organizations (COSO) framework provides comprehensive guidance for designing and implementing robust control environments.

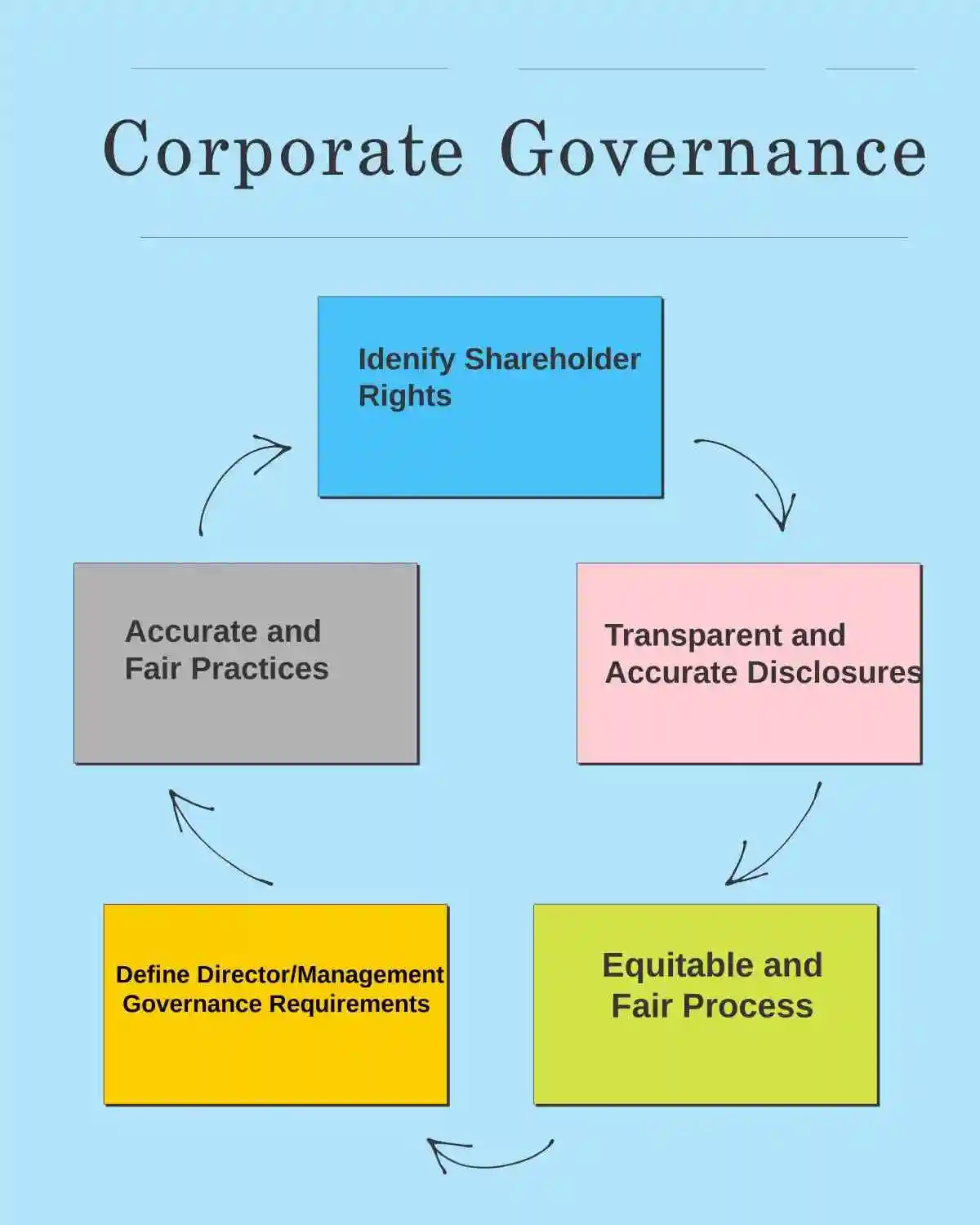

- Corporate governance mechanisms must establish clear accountability structures, with independent board members who possess the expertise and authority to challenge management decisions.

- Audit committees play a particularly crucial role in overseeing financial reporting processes and maintaining direct communication with external auditors.

- Regular internal audits, segregation of duties, and comprehensive documentation requirements create multiple layers of protection against fraudulent activities.

- However, these controls are only effective when properly implemented and consistently monitored by qualified personnel who understand their importance in maintaining financial integrity.

Securities Class Action Lawsuits: Investor Protection and Recovery

- When accounting fraud occurs, securities class action lawsuits provide investors with a powerful mechanism to seek compensation for their losses and hold corporate wrongdoers accountable.

- These securities class actions allow similarly situated investors to pool their resources and pursue claims collectively, making litigation economically viable even for individual investors with relatively modest losses.

- Securities litigation typically alleges violations of federal securities laws, particularly Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5, which prohibit the making of material misstatements or omissions in connection with the purchase or sale of securities.

- Successful securities class actions can result in significant monetary settlements that provide partial recovery for defrauded investors.

- The legal process involves complex procedural requirements, including the appointment of lead plaintiffs, class certification procedures, and extensive discovery processes that can uncover the full scope of fraudulent activities.

- Expert testimony from forensic accountants and financial analysts often plays a crucial role in quantifying damages and establishing the causal connection between false financial statements and investor losses.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Regulatory Enforcement: The SEC’s Expanding Authority

- SEC enforcement actions represent the primary regulatory response to accounting fraud, with the Securities and Exchange Commission (SEC) wielding broad investigative and enforcement powers to protect investors and maintain market integrity.

- The SEC’s enforcement division actively pursues both civil and administrative actions against companies and individuals involved in financial fraud.

- Recent SEC enforcement actions have demonstrated increasingly sophisticated investigative techniques, including data analytics, whistleblower programs, and cooperation with international regulators.

- The agency’s ability to impose substantial monetary penalties, disgorgement of ill-gotten gains, and industry bars against individual defendants creates powerful deterrent effects.

The Sarbanes-Oxley Act of 2002

- The Sarbanes-Oxley Act of 2002 significantly strengthened the regulatory framework governing financial reporting and corporate governance.

- This landmark legislation established the Public Company Accounting Oversight Board (PCAOB), enhanced auditor independence requirements, and imposed personal certification obligations on chief executive and financial officers regarding the accuracy of financial statements.

- Sarbanes-Oxley Act provisions include enhanced criminal penalties for securities fraud, mandatory internal control assessments, and whistleblower protection programs that encourage the reporting of potential violations.

- The Act’s Section 404 requires management to assess and report on the effectiveness of internal control over financial reporting, creating additional accountability mechanisms.

Regulatory Compliance and Risk Management

- Regulatory compliance extends beyond mere adherence to accounting standards, encompassing comprehensive risk management programs that identify, assess, and mitigate fraud risks throughout the organization.

- Companies must establish robust compliance frameworks that address both domestic and international regulatory requirements.

- Regulatory enforcement trends indicate increasing coordination between various regulatory agencies, including the SEC, Department of Justice, and international counterparts.

A Coordinated Approach to Compliance

- This coordinated approach enhances the likelihood of detection and prosecution while increasing potential penalties for violations.

- Effective compliance programs require regular training, clear communication of ethical standards, and mechanisms for reporting suspected violations without fear of retaliation.

- Companies that demonstrate genuine commitment to compliance and cooperation with regulatory investigations may receive more favorable treatment in enforcement proceedings.

Broader Impact on Market Participants and Economic Systems

- The consequences of accounting fraud extend far beyond the immediate financial losses experienced by direct investors.

- These scandals erode confidence in financial markets, increase the cost of capital for all companies, and can trigger broader economic disruptions that affect entire industries or geographic regions.

- Institutional investors, including pension funds and mutual funds, often suffer disproportionate losses due to their large holdings in affected companies.

- These losses ultimately impact individual beneficiaries and retirement savers who depend on these institutions for long-term financial security.

- Credit markets also suffer when false financial statements lead to inappropriate credit ratings and lending decisions.

- Banks and other financial institutions may extend credit based on fraudulent financial information, creating systemic risks that can propagate throughout the financial system.

Prevention Strategies and Best Practices

- Preventing accounting fraud requires a multi-faceted approach that combines strong ethical leadership, robust control systems, and continuous monitoring mechanisms.

- Companies must foster cultures of integrity where ethical behavior is rewarded and misconduct is swiftly addressed.

- Board oversight responsibilities include selecting qualified audit committee members, ensuring adequate resources for internal audit functions, and maintaining open communication channels with external auditors.

- Regular executive sessions without management present allow board members to discuss concerns and receive unfiltered information about company operations.

- Technology solutions, including automated controls and data analytics, can enhance the effectiveness of traditional control mechanisms while reducing reliance on manual processes that are more susceptible to manipulation.

- However, technology must be properly implemented and regularly updated to address evolving fraud schemes.

Strengthening Market Integrity

The fight against accounting fraud requires ongoing vigilance from all market participants, including iinvestors, regulators, auditors, and corporate management. Investors must develop the skills necessary to analyze financial statements critically and recognize potential warning signs of fraudulent activity.

Securities class action lawsuits and regulatory enforcement actions serve essential functions in maintaining market discipline and providing deterrent effects against potential wrongdoers. However, prevention remains preferable to remediation, emphasizing the importance of robust internal controls and effective corporate governance practices.

The evolving regulatory landscape, including enhanced SEC enforcement actions and the continuing impact of the Sarbanes-Oxley Act, demonstrates the commitment of regulatory authorities to combat financial fraud and protect investor interests.

Companies that embrace transparency and maintain the highest standards of financial reporting will be best positioned to thrive in this environment.

Contact us today for guidance on securities litigation matters, regulatory compliance, or if you believe you have been affected by accounting fraud. We can help you understand your rights and explore available legal remedies to recover your investment losses.

The Critical Role of Corporate Culture in Accounting Fraud

- Corporate culture serves as the invisible foundation that either fortifies ethical behavior or creates fertile ground for accounting fraud to flourish.

- A culture that genuinely emphasizes ethical behavior, transparency, and accountability creates multiple layers of protection against fraudulent activities.

- This protective environment significantly reduces the likelihood of false financial statements and other deceptive practices that can devastate investor confidence and trigger securities class action lawsuits.

- The tone established by top management reverberates throughout every level of an organization, creating what experts call the “ethical climate.”

- When leadership consistently demonstrates integrity through both words and actions, employees receive clear signals about acceptable behavior.

Creating a Cultural Foundation of Ethics and Transparency

- This cultural foundation becomes particularly crucial during periods of financial pressure, when the temptation to manipulate results may be strongest.

- Leadership accountability extends beyond mere policy statements.

- Effective leaders who prioritize ethical conduct over short-term financial gains create an environment where employees feel empowered to raise concerns about questionable practices.

- This open communication culture serves as an early warning system, potentially preventing minor ethical lapses from escalating into major fraud schemes that could result in securities litigation.

- Conversely, toxic corporate environments that reward aggressive financial tactics while overlooking ethical violations create significant risks.

- In such cultures, employees may perceive fraudulent behavior as not only acceptable but necessary for career advancement.

- This normalization of unethical conduct can lead to widespread accounting frauds that ultimately expose companies to severe regulatory enforcement actions and substantial legal liabilities.

Psychological Drivers: Understanding the Human Element in Fraud

- The psychological factors contributing to accounting fraud extend far beyond simple greed, encompassing complex interactions between individual motivations, cognitive biases, and social pressures.

- Understanding these psychological drivers is essential for developing effective prevention strategies and recognizing early warning signs of potential fraudulent behavior.

- Individual motivations often stem from personal financial pressures, career ambitions, or the desire to maintain a certain lifestyle or status.

- Executives facing stock option deadlines, employees struggling with personal debt, or managers under intense performance pressure may rationalize fraudulent behavior as a temporary solution to their problems.

- This rationalization process allows individuals to maintain their self-image as ethical people while engaging in clearly unethical behavior.

- Cognitive biases play a particularly insidious role in fraud development.

- Overconfidence bias leads individuals to believe they can manipulate financial statements without detection, often underestimating the sophistication of audit procedures and regulatory oversight.

- The sunk cost fallacy compels individuals to continue fraudulent activities to avoid admitting past mistakes, creating a spiral of increasingly complex deceptions.

Pressure from Within a Company with an Embedded Culture of Fraud

- Social pressures within organizations can create powerful incentives for fraudulent behavior.

- The phenomenon of groupthink, where individuals conform to perceived group norms rather than exercising independent judgment, can normalize unethical behavior across entire departments or divisions.

- When fraudulent practices become embedded in organizational culture, new employees may adopt these behaviors without fully understanding their implications.

- The fraud triangle concept identifies three conditions that typically must be present for fraud to occur: opportunity, pressure, and rationalization.

- While internal controls primarily address opportunity, understanding psychological factors helps organizations recognize and address the pressure and rationalization ccomponents that make fraud more likely.

Regulatory Framework and Enforcement Actions

- The regulatory landscape surrounding accounting fraud has evolved significantly in response to high-profile corporate scandals.

- SEC enforcement actions have become increasingly sophisticated, utilizing advanced data analytics and forensic accounting techniques to identify potential fraud indicators.

- The SEC’s Division of Enforcement has expanded its resources and capabilities, resulting in more frequent and substantial penalties for fraudulent behavior.

- Regulatory compliance requirements extend beyond basic financial reporting standards to encompass comprehensive risk management and internal control systems.

- The Sarbanes-Oxley Act established criminal penalties for securities violations, including potential prison sentences for executives who certify false financial statements.

- These enhanced penalties reflect the serious nature of accounting fraud and its potential impact on market integrity.

SEC Enforcement and Whistleblower Protections

- Recent SEC enforcement actions demonstrate the agency’s commitment to pursuing both individual and corporate accountability.

- The Commission has increasingly focused on holding senior executives personally responsible for fraudulent financial reporting, even when they did not directly participate in the manipulation of financial data.

- This approach recognizes that ultimate responsibility for financial reporting accuracy rests with corporate leadership.

- The regulatory framework also includes provisions for protecting whistleblowers who report potential fraud.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act established financial incentives for individuals who provide information leading to successful enforcement actions, creating additional mechanisms for detecting fraudulent behavior.

- These whistleblower programs have proven highly effective in uncovering complex fraud schemes that might otherwise remain hidden.

Prevention and Detection Strategies

- Effective fraud prevention requires a comprehensive approach that addresses cultural, operational, and technological factors.

- Organizations must develop internal controls that are both robust and adaptable to evolving business risks and fraud techniques.

- Regular assessment and updating of these controls ensures they remain effective as business operations and external threats evolve.

- Corporate governance structures should include independent oversight mechanisms that provide objective evaluation of financial reporting processes.

- Audit committees composed of independent directors with relevant financial expertise can provide valuable oversight and challenge management assumptions about financial reporting decisions.

The Rise of the Machines

- Technology plays an increasingly important role in fraud detection and prevention.

- Advanced data analytics can identify unusual patterns or transactions that may indicate fraudulent activity.

- Continuous monitoring systems can provide real-time alerts about potential control violations or suspicious activities, enabling rapid response to emerging threats.

- Employee training and awareness programs help create a culture of ethical behavior and provide individuals with the knowledge and tools necessary to identify and report potential fraud.

- These programs should address not only technical aspects of fraud detection but also the psychological and social factors that can contribute to fraudulent behavior.

Building Sustainable Ethical Frameworks

- The prevention of accounting fraud requires sustained commitment to ethical behavior at all organizational levels.

- This ccommitment must be reflected in hiring practices, performance evaluation systems, compensation structures, and disciplinary procedures.

- Organizations that successfully prevent fraud typically embed ethical considerations into every aspect of their operations.

- Regulatory compliance should be viewed not as a burden but as an opportunity to strengthen organizational controls and improve operational efficiency.

- Companies that proactively exceed minimum compliance requirements often discover operational improvements and risk mitigation benefits that provide competitive advantages.

- The costs of accounting fraud extend far beyond immediate financial losses to include reputational damage, regulatory scrutiny, and long-term operational constraints.

Investing in Comprehensive Control Frameworks

By investing in comprehensive prevention programs, organizations can avoid these costs while building stronger, more resilient business operations.

Understanding the complex interplay between corporate culture, individual psychology, and regulatory requirements provides the foundation for developing effective fraud prevention strategies.

Organizations that successfully address these multiple dimensions create environments where ethical behavior flourishes and fraudulent conduct becomes both unlikely and quickly detected when it occurs.

The ongoing evolution of fraud techniques and regulatory requirements demands continuous vigilance and adaptation.

Companies that remain committed to ethical excellence while maintaining robust operational controls will be best positioned to avoid the devastating consequences of accounting fraud and the resulting securities class action lawsuits that can threaten their very existence.

Warning Signs of Accounting Fraud

- Accounting fraud represents one of the most significant threats to market integrity, often leading to devastating securities class action lawsuits and substantial investor losses.

- Understanding the warning signs can help investors identify potential red flags before becoming victims of false financial statements and corporate misconduct.

Financial Performance Disparities: The First Red Flag

- When a company’s reported financial performance consistently outperforms industry benchmarks without clear justification, investors should exercise heightened scrutiny.

- This disparity often indicates potential manipulation of financial statements, creating artificial inflation in stock prices that eventually leads to securities litigation.

- Accounting frauds frequently manifest through unrealistic revenue growth, unusually high profit margins, or cash flow patterns that don’t align with reported earnings.

- These discrepancies become particularly concerning when they persist across multiple reporting periods, suggesting systematic manipulation rather than temporary market advantages.

The Causes of Accounting Frauds: Policy Changes and Red Flags

- Causes of accounting frauds often stem from management pressure to meet earnings expectations, inadequate internal controls, and poor corporate governance structures.

- Frequent changes in accounting policies or practices serve as critical warning signs, as they may indicate attempts to manipulate financial results.

- Companies that repeatedly modify their revenue recognition methods, depreciation schedules, or reserve calculations without legitimate business justifications raise significant concerns.

- These changes can artificially smooth earnings, hide losses, or inflate asset values, creating the foundation for future securities class actions.

Complex Financial Transactions and Transparency Concerns

- The presence of complex or opaque financial arrangements represents another crucial warning sign.

- Companies utilizing off-balance-sheet entities, complicated derivative instruments, or convoluted corporate structures may be attempting to conceal liabilities or inflate assets.

- Regulatory compliance becomes particularly challenging when companies engage in these sophisticated financial maneuvers.

- The lack of transparency in financial reporting, combined with inadequate disclosures about material transactions, often precedes major accounting scandals that result in securities class action lawsuits.

Internal Controls and Corporate Governance Deficiencies

- Weak internal controls create environments where accounting fraud can flourish undetected.

- Companies with inadequate segregation of duties, insufficient oversight mechanisms, or compromised audit functions face elevated risks of financial statement manipulation.

- Corporate governance failures, including ineffective board oversight, compromised audit committees, or excessive management influence over financial reporting, contribute significantly to fraud risk.

- These deficiencies often become apparent only after regulatory enforcement actions expose the underlying problems.

Management History and Personnel Turnover Patterns

Investors should carefully evaluate management teams with histories of financial restatements, regulatory violations, or involvement in previous scandals.

Companies experiencing frequent turnover in key financial positions—particularly chief financial officers, controllers, or internal auditors—may be struggling with integrity issues.

These personnel changes often occur when individuals refuse to participate in questionable accounting practices or when management seeks to install more compliant financial leadership.

Such patterns frequently precede the discovery of false financial statements and subsequent legal action.

Conclusion: Safeguarding Your Investments Against Fraud

- As we look to 2026 and beyond, understanding the causes of accounting fraud is more critical than ever for investors seeking to protect their financial interests.

- By recognizing the systemic flaws, individual motivations, and psychological factors that contribute to fraud, investors can better identify red flags and take proactive measures to safeguard their portfolios.

- Additionally, staying informed about regulatory developments and engaging with financial professionals can provide valuable insights and guidance.

- While accounting fraud can have devastating consequences, investors can protect themselves by remaining vigilant and conducting thorough due diligence.

- By understanding the warning signs of fraud and implementing preventative measures, investors can reduce their exposure to potential risks and make more informed investment decisions.

- Ultimately, the key to safeguarding your investments lies in staying informed, remaining skeptical, and prioritizing ethical considerations in your investment strategy.

- In conclusion, accounting fraud represents a significant threat to investors and the broader financial markets.

- However, by understanding its causes and taking proactive steps to detect and prevent fraud, investors can better protect their financial futures.

- By fostering a culture of transparency, accountability, and ethical behavior, we can work towards a more trustworthy and resilient financial system for all stakeholders.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors