Introduction to Indispensable Internal Controls for Detecting Financial Statement Fraud

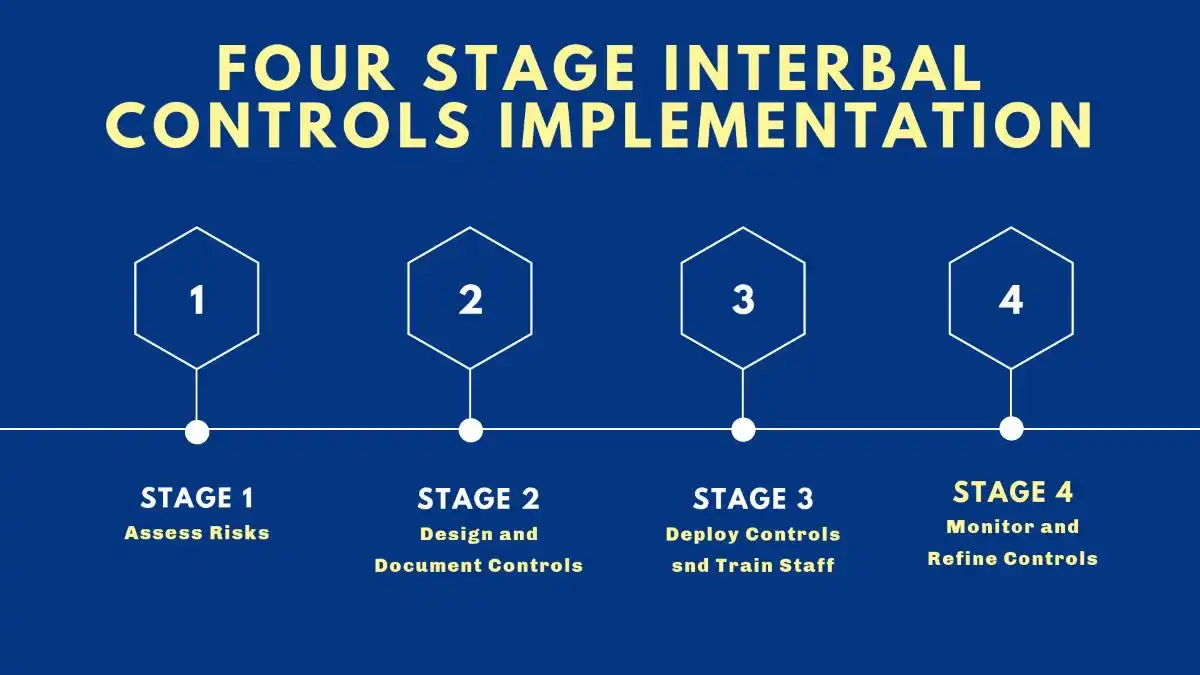

Internal Controls that Detect Financial Statement Fraud

- Include segregation of duties, reconciliations, physical asset counts, and independent audits Effective internal controls serve as the first line of defense against potential accounting fraud and form the foundation of reliable financial statements.

Key Indicators of Fraud:

- Inconsistencies in Revenue Recognition: Unexplained revenue spikes without corresponding cash flow increases or customer base expansion often signal premature or fictitious revenue recognition. Financial analysts and shareholders must carefully examine revenue timing, particularly during quarter-end or year-end periods. Strong internal controls over revenue recognition processes help prevent manipulation and ensure compliance with accounting standards. Companies should implement automated controls to flag unusual revenue patterns and require multiple levels of review for significant transactions.

- Unusual Financial Ratios: Dramatic changes in key financial metrics, including current ratio, debt-to-equity ratio, or gross margin percentages, may indicate deliberate manipulation of financial statements. When these ratios deviate significantly from industry benchmarks or historical patterns, it often suggests overvalued inventory, inflated receivables, or understated liabilities. Robust internal controls should include regular ratio analysis and investigation of significant variances.

- Complex Financial Instruments: The utilization of sophisticated financial products, including derivatives, special purpose vehicles, or off-balance-sheet arrangements, can mask a company’s true financial condition. Comprehensive disclosure and transparent reporting become crucial for stakeholder understanding. Companies must establish rigorous internal controls specifically designed to monitor and validate these complex transactions.

- Red Flags in Financial Statements: Common warning signs include aggressive asset valuations, undisclosed related party transactions, and frequent changes in accounting methodologies. Forensic audits play a vital role in uncovering these issues through detailed examination of financial relationships and comparative analysis against historical trends and industry standards. Effective internal controls should incorporate automated monitoring systems to detect these red flags early.

Types of Revenue Recognition Fraud

- Premature revenue recognition: Recording revenue before completing performance obligations or delivering products/services. This includes manipulative “bill-and-hold” arrangements where companies record sales while retaining physical possession of goods. Strong internal controls over revenue recognition timing are essential to prevent such practices.

- Fictitious sales: Creating false revenue through non-existent customer transactions. Fraudsters often generate fake invoices or ship products to undisclosed warehouses while recording sales. Proper internal controls should include customer verification procedures and regular reconciliation of shipping documents with sales records.

- “Channel stuffing”: Artificially inflating sales by sending excessive inventory to distributors despite low likelihood of quick resale. This practice often leads to future returns and revenue reversals. Effective internal controls must monitor distributor inventory levels and sales patterns.

- “Round-tripping”: Engaging in reciprocal service exchanges between companies to artificially boost revenues. These schemes often lack economic substance. Companies need internal controls to identify and properly account for related party transactions.

- Manipulating the percentage-of-completion method: Deliberately overstating project completion percentages to accelerate revenue recognition on long-term contracts. Strong internal controls should include independent verification of project progress and regular review of completion estimates.

- Improper use of side agreements: Utilizing undisclosed arrangements with customers to modify sale terms and manipulate revenue recognition timing. Comprehensive internal controls must ensure all sale terms are properly documented and reviewed.

- Impaired Assets: Failing to recognize asset value deterioration when required by accounting standards. This practice inflates asset values and understates expenses. Companies should implement internal controls to regularly assess asset impairment indicators.

- Falsely Inflating Net Income: Manipulating current period earnings by improperly deferring expenses or capitalizing costs that should be expensed. This includes inappropriately allocating costs between inventory and cost of goods sold. Effective internal controls over expense recognition and cost allocation are crucial.

- Creating Excess Reserves: Initially over-accruing liabilities to create “cookie jar” reserves that can be released in future periods to manage earnings. Strong internal controls should ensure accruals are based on reasonable estimates and properly documented.

- Fraudulent Management Estimates: Using inappropriate methodologies or assumptions to determine write-offs, reserves, or other estimates that materially impact financial statements. Companies must establish robust internal controls over the estimation process, including independent review and validation of significant assumptions.

- These fraudulent practices often result in securities litigation as shareholders suffer losses when the truth emerges. Implementing comprehensive internal controls helps companies prevent financial statement manipulation and protect stakeholder interests. Regular testing and updating of control systems ensures their continued effectiveness in detecting and preventing accounting fraud.

- Misleading Forecasts or Projections: A company’s issuance of misleading forecasts represents a serious breach of internal controls and market trust. When management deliberately avoids disclosing known, increased risks of missing key financial goals or metrics, they not only violate securities laws but also expose shareholders to significant potential losses. These deceptive practices often involve manipulating financial projections to maintain artificial stock prices or meet analyst expectations, despite awareness of deteriorating business conditions or emerging risks that could materially impact performance.

- Misleading Non-GAAP Reporting: The unethical manipulation of non-GAAP metrics has become increasingly sophisticated as companies attempt to present more favorable financial pictures when GAAP figures fail to meet expectations. This practice, often referred to as “cooking the books,” involves selective inclusion or exclusion of items to create misleading impressions of financial performance. Companies may exclude legitimate operating costs as “one-time” items or create novel metrics that lack standardization or comparability. Strong internal controls must govern non-GAAP reporting to ensure consistency, transparency, and alignment with SEC guidelines.

Common Financial Statement Fraud Schemes

Scheme Type | Description | Example |

Fictitious Revenue | Recording fabricated sales transactions that lack economic substance | Creating false customer orders, backdating contracts, recording sales to shell entities |

Premature Revenue Recognition | Accelerating revenue recognition before completion of performance obligations | Recording multi-year contract revenue upfront, shipping incomplete products |

Channel Stuffing | Artificially inflating sales by forcing excess inventory to distributors | Offering extreme discounts or extended payment terms to encourage excess orders |

Asset Overstatement | Deliberately inflating asset values to improve balance sheet appearance | Recording non-existent inventory, understating depreciation, capitalizing normal operating expenses |

Liability Concealment | Intentionally hiding or understating financial obligations | Classifying debt as equity, understating warranty reserves, omitting lease obligations |

Material Omissions | Withholding information crucial for investor decision-making | Concealing related party dealings, pending litigation, regulatory investigations |

Journal Entry Manipulation | Making unauthorized or unsupported accounting entries | Creating last-minute adjustments to meet targets, reversing legitimate expense accruals |

Financial Integrity: Maintaining financial integrity through robust internal controls represents not just a legal requirement but a fundamental strategic advantage in today’s complex business environment. Companies that prioritize:

- Transparent financial practices backed by comprehensive internal controls consistently demonstrate stronger market performance and investor confidence over time. These organizations typically experience lower costs of capital and better access to financing options.

- Ethical reporting standards supported by rigorous control systems help build enduring stakeholder trust and enhance corporate reputation. This commitment to integrity often translates into premium valuations and stronger stakeholder relationships.

- Long-term sustainable growth founded on reliable financial reporting and strong governance creates resilient business models capable of weathering market uncertainties and regulatory scrutiny.

Understanding the Landscape of Accounting Fraud in 2025

Understanding the Landscape of Accounting Fraud in 2025

- Accounting Fraud Landscape: The evolving landscape of accounting fraud in 2025 presents unprecedented challenges requiring enhanced internal controls and vigilance. Technological advancements have created new opportunities for sophisticated financial manipulation while also providing powerful tools for detection and prevention. Business leaders must understand these dynamics to implement effective control systems and protect shareholder interests.

- Enhancing Transparency: Global regulatory bodies continue strengthening oversight of financial reporting practices, implementing more stringent requirements for internal controls and disclosure. These enhanced regulations aim to:

- Improve financial statement reliability through mandatory control testing and certification

- Increase accountability for financial reporting accuracy at all organizational levels

- Require more detailed disclosure of significant accounting policies and estimates

- Mandate regular assessment and reporting on control effectiveness

- Globalization of Markets: The increasingly interconnected nature of global markets creates additional complexities in maintaining effective internal controls over financial reporting. Cross-border transactions and international operations require:

- Sophisticated monitoring systems capable of tracking complex international transactions

- Enhanced controls over currency translation and foreign subsidiary reporting

- Coordinated oversight of worldwide operations and accounting practices

- Regular testing of control effectiveness across multiple jurisdictions

- Red Flags for Detecting Revenue Fraud

- Rapid revenue growth inconsistent with cash flow: This critical warning sign often indicates potential accounting fraud through revenue manipulation. When companies report significant profit increases without corresponding cash flow improvements, it may suggest:

- Premature revenue recognition before completion of performance obligations

- Recording of fictitious sales that lack economic substance

- Manipulation of revenue timing to meet analyst expectations

- Creation of artificial transactions lacking genuine business purpose

- Unusual surge in sales at the end of a reporting period: Companies recording disproportionate revenue in the final days or weeks of a quarter frequently engage in questionable practices that may trigger securities litigation. These practices often involve:

- Improper acceleration of revenue recognition

- Channel stuffing to inflate sales figures

- Creation of side agreements modifying transaction terms

- Manipulation of cutoff procedures to include future period sales

- The implementation of robust internal controls specifically designed to monitor these warning signs helps organizations detect and prevent fraudulent practices before they result in material misstatements or regulatory violations. Regular testing and updating of these control systems ensures their continued effectiveness in protecting shareholder interests and maintaining market integrity.

- Discrepancies in shipping and billing: Misalignments between shipping records and billing documentation represent a critical warning sign of potential accounting fraud that often indicates premature or fictitious revenue recognition. When companies exhibit inconsistencies between quantities billed versus quantities shipped, or demonstrate unusual spikes in shipping costs without corresponding business justification, it may signal manipulation of financial statements designed to deceive investors. These discrepancies frequently result from:

- Backdating shipment documents to accelerate revenue recognition

- Creating false shipping records to support non-existent sales

- Deliberately overstating shipping quantities to inflate revenue

- Manipulating shipping costs to conceal fraudulent transactions

Sudden changes in accounting methods: Abrupt modifications to established accounting practices often signal attempts to manipulate financial statements through weakened internal controls. These changes may be designed to:

- Obscure deteriorating financial performance through altered recognition methods

- Make year-over-year comparisons more challenging for analysts and investors

- Create artificial improvements in reported financial metrics

- Exploit accounting complexity to hide fraudulent transactions

- Circumvent existing control systems designed to detect manipulation

Complex or unusual related-party transactions: Transactions involving related entities that lack clear business purpose frequently serve as vehicles for financial statement manipulation, particularly when internal controls over such dealings prove inadequate. These arrangements may involve:

- Circular transactions designed to artificially inflate revenue

- Complex financing structures that obscure true economic substance

- Undisclosed relationships that create conflicts of interest

- Transfer pricing schemes that distort reported profitability

- Special purpose entities used to hide liabilities or losses

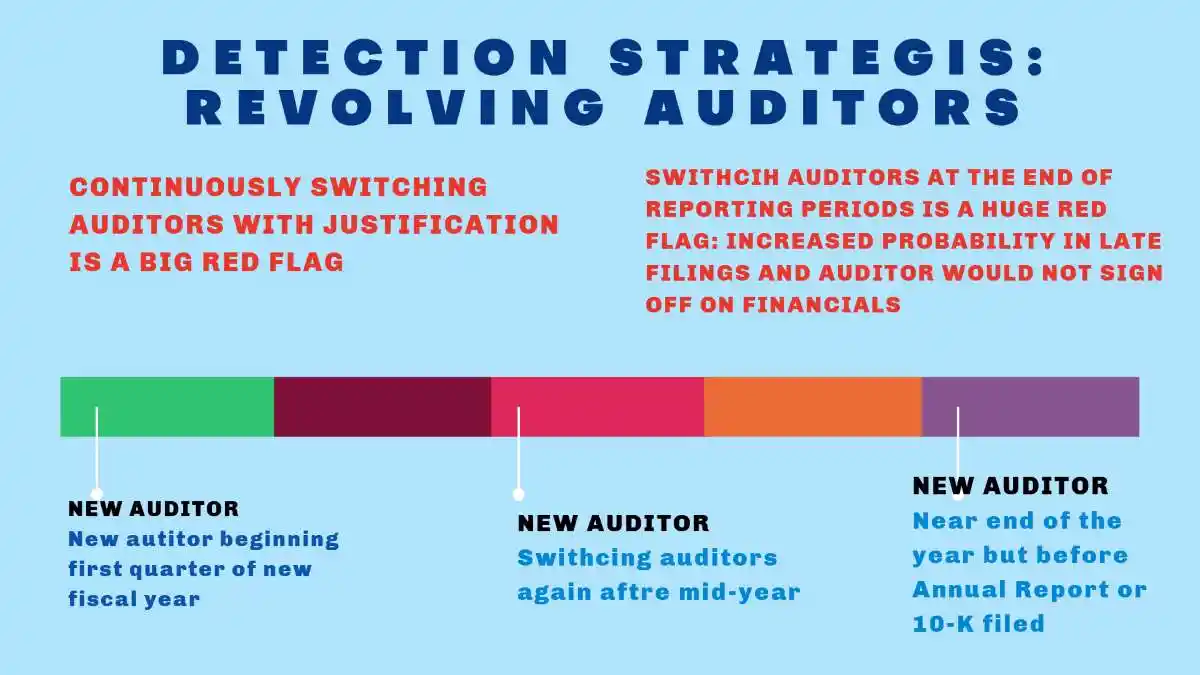

High turnover of senior management or auditors: Frequent changes in key personnel, especially within financial roles or external audit relationships, often indicate underlying governance issues that may lead to securities litigation. This pattern typically suggests:

- Internal conflicts over financial reporting practices

- Attempts to conceal fraudulent activities from new oversight

- Resistance to strengthening control environments

- Disagreements over accounting treatments or disclosures

- Pressure to manipulate financial results

Advanced analytical techniques

Anomaly detection: Modern machine learning algorithms have revolutionized fraud detection by automatically identifying suspicious patterns that may indicate financial statement manipulation. These sophisticated systems:

- Analyze millions of transactions in real-time

- Flag unusual patterns for immediate investigation

- Learn from historical fraud cases to improve accuracy

- Reduce false positives through adaptive modeling

- Complement traditional internal controls with AI-driven oversight

Benford’s Law analysis: This powerful statistical tool helps detect potential accounting fraud by examining the distribution of first digits in numerical data sets. Deviations from expected patterns often indicate:

- Manufactured or manipulated numbers in financial reports

- Systematic attempts to inflate or deflate figures

- Fraudulent journal entries or adjustments

- Deliberate manipulation of accounting records

Link analysis: Advanced graph technology enables visualization of complex relationships between entities, transactions, and individuals, helping identify potential fraud networks. This technique:

- Maps connections between seemingly unrelated parties

- Uncovers hidden relationships that bypass internal controls

- Identifies suspicious transaction patterns

- Reveals potential collusion networks

- Supports investigation of complex fraud schemes

Predictive modeling: Machine learning models trained on historical fraud cases can now predict potential fraudulent activities before significant losses occur. These systems:

- Analyze patterns indicative of future fraud risk

- Provide early warning of suspicious activities

- Support proactive intervention strategies

- Enhance effectiveness of internal controls

- Reduce exposure to securities litigation

Weaknesses in Internal Controls

Robust internal controls serve as the primary defense against financial statement fraud, making their effectiveness crucial for protecting shareholder interests. Vulnerabilities in these systems often create opportunities for:

- Asset misappropriation through unauthorized access

- Manipulation of financial records without detection

- Override of existing control procedures

- Concealment of fraudulent transactions

- Exploitation of system weaknesses

Segregation of duties

Incompatible duties create significant risk when single individuals control multiple aspects of critical processes. Proper segregation requires separation of:

- Authorization responsibilities

- Asset custody functions

- Record-keeping duties

- Reconciliation activities

This fundamental control principle helps prevent individuals from both perpetrating and concealing fraudulent activities. When one employee handles multiple incompatible functions, they gain the ability to:

- Execute unauthorized transactions

- Alter supporting documentation

- Manipulate accounting records

- Conceal fraudulent activities

- Bypass existing control systems

Management and oversight

Inadequate supervision: Weak monitoring of employees and business processes, particularly in remote locations, creates opportunities for fraudulent activities to flourish undetected. This deficiency often results in:

- Delayed detection of suspicious activities

- Increased risk of asset misappropriation

- Manipulation of financial records

- Breakdown of control procedures

- Erosion of compliance culture

Ineffective management review: When managers fail to regularly scrutinize transactions and supporting documentation, fraudulent activities may continue undetected. This weakness typically manifests through:

- Cursory review of critical documents

- Rubber-stamp approvals without proper analysis

- Inadequate questioning of unusual items

- Failure to investigate red flags

- Over-reliance on automated controls

Management override of controls: Senior executives’ ability to bypass established control procedures represents a significant risk factor for financial statement fraud. This practice:

- Undermines control effectiveness

- Sets poor example for employees

- Creates opportunities for manipulation

- Increases exposure to litigation

- Weakens organizational integrity

Poor hiring practices: Inadequate background screening and reference checking for employees in sensitive positions increases fraud risk. Weak hiring procedures may:

- Allow high-risk individuals access to assets

- Compromise existing control systems

- Create opportunities for collusion

- Increase vulnerability to fraud

- Undermine control environment

Physical and information safeguards

Inadequate physical controls: Insufficient security measures over cash, inventory, and other valuable assets create direct opportunities for misappropriation. These weaknesses typically involve:

- Unsecured storage areas

- Poor access controls

- Inadequate surveillance systems

- Weak custody procedures

- Insufficient asset tracking

Weak access controls: Insufficient or poorly monitored access to sensitive computer systems, data, and electronic records creates significant vulnerabilities that can lead to devastating financial losses through information theft or fraudulent transactions. Organizations with weak access controls often experience:

- Unauthorized system access by current or former employees

- Manipulation of financial data without detection

- Creation of fictitious transactions or accounts

- Theft of sensitive customer or corporate information

- Compromise of critical internal controls

These access control weaknesses frequently stem from:

- Failure to promptly revoke system access for terminated employees

- Sharing of login credentials between multiple users

- Excessive access rights granted beyond job requirements

- Inadequate monitoring of system activity logs

- Poor password management and security protocols

Recording and documentation

Poor record keeping: Missing, incomplete, or inaccurate documentation severely compromises the audit trail and creates opportunities for accounting fraud. Common documentation deficiencies include:

- Missing or altered invoices and receipts

- Incomplete shipping and receiving records

- Inconsistent transaction documentation

- Poor maintenance of supporting evidence

- Inadequate retention of critical records

These documentation weaknesses typically result in:

- Inability to verify transaction authenticity

- Challenges in detecting unauthorized activities

- Increased risk of securities litigation

- Difficulty proving fraud when discovered

- Compromised internal and external audits

Lack of independent checks: The absence of regular, independent reconciliations represents a critical control weakness that allows fraudulent activities to persist undetected. Essential checks that are often overlooked include:

- Bank statement reconciliations

- Inventory count verifications

- Account balance confirmations

- Asset existence verification

- Vendor payment reconciliations

This control weakness enables:

- Long-term concealment of theft

- Manipulation of financial records

- Unauthorized account adjustments

- Fictitious transaction processing

- Asset misappropriation schemes

Failure to enforce mandatory vacations: The importance of mandatory time off as a fraud detection mechanism cannot be overstated. When employees engaged in fraudulent activities must take extended leave:

- Other workers assume their duties

- Suspicious patterns become apparent

- Concealment schemes break down

- Documentation gaps surface

- Control weaknesses emerge

Organizations that fail to enforce vacation policies:

- Miss opportunities to detect ongoing fraud

- Allow perpetrators to maintain control

- Reduce effectiveness of job rotation

- Weaken segregation of duties

- Compromise internal controls

Technology and automation

Insufficient use of automation: Over-reliance on manual processes creates numerous vulnerabilities that automated systems could prevent. Manual processing increases:

- Opportunities for human error

- Risk of intentional manipulation

- Processing time and costs

- Difficulty in maintaining audit trails

- Susceptibility to fraud schemes

Organizations should leverage automation to:

- Strengthen internal controls

- Reduce manual intervention

- Enhance transaction monitoring

- Improve documentation accuracy

- Prevent unauthorized activities

Failure to update technology: Outdated systems lack critical security features and automated controls necessary to protect against modern fraud schemes. Legacy systems often:

- Lack robust authentication measures

- Cannot detect suspicious patterns

- Provide limited audit capabilities

- Offer weak access controls

- Miss fraudulent activities

Modern technology solutions provide:

- Enhanced fraud detection capabilities

- Improved control monitoring

- Better security features

- Real-time transaction analysis

- Advanced reporting capabilities

Poorly integrated systems: Disjointed or non-integrated software systems create dangerous control gaps that fraudsters can exploit. Integration issues often result in:

- Incomplete transaction tracking

- Reconciliation difficulties

- Duplicate data entry risks

- Poor information sharing

- Weak control environment

These system weaknesses frequently lead to:

- Undetected fraudulent transactions

- Increased risk of financial statement fraud

- Compromised data integrity

- Ineffective monitoring capabilities

- Enhanced fraud opportunities

The impact of poor “tone at the top” on asset misappropriation cannot be overstated, as it fundamentally erodes organizational ethics and undermines the control environment. When senior leadership fails to demonstrate commitment to integrity and ethical behavior, it creates a cascade of negative effects that increase fraud risk through multiple mechanisms.

Management override of controls

Rationalizing shortcuts: When managers regularly bypass established controls citing efficiency or expediency, it sends a dangerous message throughout the organization. This behavior:

- Normalizes control violations

- Encourages similar employee conduct

- Weakens compliance culture

- Increases fraud opportunities

- Compromises system integrity

Influencing accounting staff: The ability of senior managers to pressure accounting personnel into processing questionable transactions represents a significant risk factor. Staff members may comply due to:

- Fear of retaliation

- Misplaced loyalty

- Career advancement concerns

- Perceived authority

- Organizational pressure

Hiding theft through authority: Management’s ability to conceal asset misappropriation through legitimate-appearing transactions poses a serious control risk. Common techniques include:

- Unauthorized write-offs

- Fictitious adjustments

- Manipulated reconciliations

- False documentation

- Altered records

Normalization of unethical behavior

“They’re doing it too”: When employees observe management engaging in questionable practices, it creates a powerful rationalization for their own misconduct. This mindset leads to:

- Increased policy violations

- Widespread control breaches

- Ethical deterioration

- Enhanced fraud risk

- Weakened control environment

Rewarding results over ethics: Organizations that prioritize financial targets without regard for ethical conduct create environments ripe for fraud. This approach typically:

- Encourages corner-cutting

- Promotes deceptive practices

- Undermines controls

- Increases legal exposure

- Damages corporate culture

Erosion of trust and control

Weakened whistleblower protections: When management actively suppresses or retaliates against employees who report misconduct, it critically undermines the effectiveness of whistleblower programs and internal controls. This creates a chilling effect where employees:

- Fear career repercussions for reporting fraud

- Lose confidence in reporting mechanisms

- Become unwilling to escalate concerns

- Enable fraud through forced silence

- Compromise detection capabilities

Since employee tips represent the most common fraud detection method according to studies, a poor management tone effectively disables this crucial defense mechanism. Organizations with weakened whistleblower protections typically experience:

- Delayed fraud detection

- Increased financial losses

- Higher legal exposure

- Damaged employee morale

- Compromised control environment

Reduced morale and loyalty: A toxic corporate culture marked by low employee morale and weak organizational commitment significantly diminishes the psychological barriers that typically prevent fraud. When employees feel mistreated or undervalued, it:

- Reduces guilt about harming the organization

- Weakens ethical decision-making

- Creates fraud rationalization opportunities

- Increases theft likelihood

- Compromises internal controls

This erosion of loyalty manifests through:

- Increased absenteeism

- Higher turnover rates

- Reduced productivity

- Growing cynicism

- Widespread disengagement

Disregard for monitoring: Management’s failure to prioritize and enforce monitoring activities represents a critical control weakness that enables fraud. When leadership demonstrates indifference toward:

- Regular account reconciliations

- Surprise audits and inspections

- Transaction verification procedures

- Asset existence confirmation

- Documentation reviews

It creates an environment where:

- Fraud schemes persist undetected

- Control breaches multiply

- Documentation lapses increase

- Asset losses accumulate

- Legal exposure grows

The Consequences of Revenue Recognition Fraud

Financial standing:

Asset misappropriation, while not always the costliest form of fraud, can inflict significant financial damage on organizations through:

- Direct monetary losses averaging $120,000 per incident

- Increased insurance premiums

- Higher security costs

- Lost productivity

- Damaged credit standing

The ACFE study highlighting median losses of $120,000 demonstrates how seemingly minor thefts can:

- Erode profit margins

- Impact working capital

- Reduce investment capacity

- Increase operating costs

- Threaten financial stability

Legal penalties:

Organizations and individuals involved in fraudulent activities face severe legal consequences including:

- Substantial monetary fines

- SEC enforcement actions

- Criminal prosecution

- Prison sentences

- Professional sanctions

These penalties often involve:

- Multi-million dollar settlements

- Mandatory control improvements

- External monitoring requirements

- Reputation damage

- Career destruction

Loss of investor confidence:

The discovery of fraudulent activities severely damages market confidence through:

- Dramatic stock price declines

- Reduced market capitalization

- Investor wealth destruction

- Trading volume impacts

- Valuation multiple compression

This erosion of trust typically leads to:

- Higher borrowing costs

- Reduced investment interest

- Stricter lending terms

- Limited growth options

- Increased scrutiny

Reputational damage:

Fraud scandals inflict lasting reputational harm that affects:

- Customer relationships

- Business partnerships

- Talent acquisition

- Brand value

- Market position

Organizations often struggle with:

- Lost business opportunities

- Damaged industry standing

- Weakened competitive position

- Reduced market share

- Employee retention challenges

Corporate collapse:

In severe cases like Enron and WorldCom, sustained fraud can trigger:

- Bankruptcy proceedings

- Total business failure

- Massive job losses

- Shareholder devastation

- Industry disruption

These collapses typically result in:

- Billions in destroyed value

- Thousands of displaced workers

- Lost retirement savings

- Economic ripple effects

- Industry restructuring

The Role of Securities Litigation in Addressing Fake Revenue

Securities Litigation:

Serves as a vital enforcement mechanism for:

- Addressing revenue manipulation

- Protecting investor interests

- Ensuring accountability

- Recovering losses

- Deterring misconduct

Legal Avenue:

Securities litigation provides stakeholders with:

- Class action opportunities

- Individual claim rights

- Loss recovery methods

- Justice mechanisms

- Deterrence tools

Securities litigation and Enforcement:

Takes multiple forms including:

- Class action lawsuits

- Regulatory proceedings

- Criminal prosecutions

- Arbitration cases

- Civil litigation

The Primary Objective of Securities Litigation

Primary Objective:

Securities litigation aims to:

- Hold wrongdoers accountable

- Recover investor losses

- Deter future fraud

- Protect market integrity

- Enforce securities laws

Accountability:

Litigation promotes accountability through:

- Financial penalties

- Management removal

- Control improvements

- Governance reforms

- Reputation impacts

Compensation:

Provides mechanisms for:

- Investor restitution

- Loss recovery

- Damage compensation

- Asset recovery

- Wealth restoration

Understanding the Role of Securities Litigation

Securities Litigation Objective:

Understanding securities litigation helps:

- Companies manage risk

- Investors protect rights

- Boards improve oversight

- Management strengthen controls

- Stakeholders ensure compliance

Companies: For companies, securities litigation underscores the critical importance of maintaining robust transparency and strict compliance with financial regulations. Organizations must recognize that inadequate internal controls and misleading financial disclosures can trigger devastating legal consequences, including costly securities class actions that can severely impact shareholder value. Companies need to prioritize:

- Comprehensive financial reporting controls

- Regular internal audit programs

- Detailed documentation procedures

- Proactive compliance monitoring

- Transparent stakeholder communications

This heightened focus on transparency helps organizations:

- Reduce litigation exposure

- Build investor confidence

- Strengthen market position

- Maintain regulatory compliance

- Protect shareholder interests

Investors: For investors, securities litigation serves as a powerful reminder of the critical need for enhanced vigilance and thorough due diligence when assessing potential investments’ financial health. By understanding and leveraging securities litigation mechanisms, stakeholders can:

- Protect their investment interests

- Recover fraudulent losses

- Hold wrongdoers accountable

- Support market integrity

- Strengthen corporate governance

Effective investor due diligence includes:

- Detailed financial statement analysis

- Thorough governance review

- Comprehensive risk assessment

- Regular portfolio monitoring

- Active shareholder engagement

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A designated lead plaintiff initiates legal proceedings by filing a detailed lawsuit on behalf of similarly affected shareholders. The complaint must comprehensively outline specific allegations regarding accounting fraud and securities law violations, supported by substantial evidence of wrongdoing. This critical first step establishes the foundation for the entire securities litigation process. |

| Motion to Dismiss | Defense counsel typically responds by filing a motion to dismiss the securities class action lawsuits, arguing that the complaint lacks sufficient legal merit or fails to meet stringent pleading requirements. This defensive strategy aims to terminate the litigation before discovery begins, testing the strength of the plaintiff’s initial claims. |

| Discovery | When motions to dismiss fail, both parties engage in extensive evidence gathering, including document collection, email reviews, and witness depositions. This comprehensive phase of securities litigation often reveals critical details about potential financial statement fraud and control weaknesses, frequently spanning many months or even years. |

| Motion for Class Certification | Plaintiffs’ attorneys petition the court to formally certify the securities litigation as a class action, requiring detailed analysis of various factors including: the size of the affected investor group, commonality of legal claims, typical nature of allegations, and adequacy of proposed class representation. This certification dramatically expands the scope and impact of the litigation. |

| Summary Judgment and Trial | After class certification, parties may seek summary judgment to resolve the case without trial. If unsuccessful, the securities litigation proceeds to trial – though this outcome remains relatively rare, as most cases settle before reaching this stage. Trials involve extensive presentation of evidence and expert testimony regarding alleged fraudulent activities. |

| Settlement Negotiations and Approval | The vast majority of securities litigation cases conclude through negotiated settlements, often facilitated by experienced mediators. These agreements typically involve substantial monetary payments and corporate governance reforms. Courts must carefully review and grant preliminary approval to ensure settlements fairly and adequately compensate affected investors. |

| Class Notice | Following preliminary settlement approval, detailed notices are distributed to all potential class members, typically through mail and electronic communications. These notices explain settlement terms, claim filing procedures, and critical deadlines, ensuring affected investors can participate in recovery. |

| Final Approval Hearing | Courts conduct comprehensive final hearings to review potential objections and assess overall settlement fairness. This crucial step ensures proper protection of all class members’ interests before granting final approval of the securities litigation resolution. |

| Claims Administration and Distribution | Court-appointed administrators manage the complex process of notice distribution, claim processing, and fund allocation. Settlement funds are typically distributed proportionally based on recognized losses, with sophisticated calculations determining individual investor recoveries. This final phase ensures proper compensation reaches affected shareholders. |

Prevention strategies

To effectively protect against financial statement fraud and minimize securities litigation risk, companies must implement comprehensive internal controls and cultivate strong ethical corporate cultures. These preventive measures should include:

Implement strong internal controls: Organizations must enforce strict segregation of duties to prevent any single individual from controlling multiple aspects of financial transactions. This includes:

- Separating authorization duties

- Dividing recording responsibilities

- Implementing access restrictions

- Maintaining audit trails

- Conducting regular reviews

Additionally, robust system controls should protect accounting processes through:

- Multi-factor authentication

- Regular access reviews

- Change management procedures

- Automated validations

- Activity monitoring

Set an ethical “tone at the top”: Senior leadership must consistently demonstrate unwavering commitment to integrity and transparency through:

- Clear ethical guidelines

- Regular communications

- Personal example

- Swift issue response

- Consistent enforcement

This leadership commitment helps create:

- Strong ethical culture

- Employee engagement

- Reporting comfort

- Risk awareness

- Control consciousness

Perform regular audits: Organizations should maintain comprehensive audit programs including:

- Independent external audits

- Regular internal reviews

- Surprise inspections

- Process testing

- Control validation

These audit activities help:

- Detect control weaknesses

- Identify improvement areas

- Ensure accuracy

- Maintain compliance

- Prevent fraud

Establish a whistleblower program: Companies must develop formal, anonymous reporting systems that:

- Protect reporter identity

- Prevent retaliation

- Enable safe reporting

- Ensure investigation

- Track resolution

Effective programs typically include:

- Multiple reporting channels

- Clear procedures

- Regular training

- Swift response

- Proper documentation

Limit performance-based bonuses: Organizations should carefully structure executive compensation to avoid:

- Excessive short-term focus

- Risk-taking incentives

- Manipulation motivation

- Control override

- Ethical compromise

Better approaches include:

- Balanced metrics

- Long-term orientation

- Risk consideration

- Ethical components

- Sustainable targets

Maintaining Financial Integrity

Robust Internal Controls: Requires a comprehensive framework of internal controls and corporate governance practices that encompasses multiple layers of oversight and verification. These controls must be regularly tested, updated, and strengthened to address emerging risks and changing business conditions. Organizations should implement sophisticated monitoring systems that can detect anomalies and potential manipulation attempts in real-time, while maintaining detailed documentation of all control activities and their effectiveness.

Ensures Compliance: Companies must implement rigorous processes to ensure their financial statements are accurate, complete, and fully compliant with relevant accounting standards and regulatory requirements. This involves:

- Comprehensive documentation procedures

- Multi-level review processes

- Regular control testing

- Automated validation checks

- Continuous monitoring systems

- Expert consultation when needed

- Regular staff training

- Updated compliance policies

Motivation: This necessitates a robust program of regular audits, both internal and external, specifically designed to:

- Identify potential discrepancies early

- Detect control weaknesses

- Test control effectiveness

- Validate compliance

- Assess risk areas

- Review documentation

- Evaluate processes

- Recommend improvements

REPUTATIONAL AND FINANCIAL CONSEQUENCES OF FRAUD

Impact Assessment of Financial Statement Fraud

| Impact Category | Measurement | Severity | Detailed Analysis |

| Stock Value Loss | 12.3-20.6% average decline | High | Immediate market reaction typically triggers substantial selling pressure, leading to rapid value erosion that can persist for extended periods |

| Reputational Damage | Up to 100x direct financial loss | Severe | Long-lasting impact on brand value, customer trust, and market perception, often exceeding direct monetary losses by orders of magnitude |

| Employee Impact | 50% loss in cumulative wages | Severe | Significant reduction in workforce value through layoffs, lost bonuses, and devalued stock options, severely impacting employee morale and retention |

| Legal Penalties | $750M+ in major cases | High | Substantial fines, penalties, and legal costs that can drain company resources and impact ongoing operations |

| Bankruptcy Risk | 3x higher than non-fraud firms | High | Dramatically increased likelihood of business failure due to combined effects of legal costs, lost business, and market access restrictions |

| Market Recovery | Years to decades, if ever | Variable | Extended period required to rebuild market confidence, with some companies never fully recovering their pre-fraud market position |

| Customer Trust | Immediate and often permanent loss | Severe | Rapid erosion of customer confidence leading to lost business relationships and reduced market share |

| Investment Access | Permanently impaired in many cases | High | Restricted access to capital markets and higher financing costs due to increased risk perception |

Contact Timothy L. Miles Today About a MoonLake Class Action Lawsuit

The most important thing you need to know is you can call me at no charge if you wish to serve as lead plaintiff of the MoonLake class action lawsuit, or just have general questions about you rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors