Introduction to Conflicts of Interest and Accounting Fraud

- Relationship: Conflicts of interest and accounting fraud share an intricate relationship that often culminates in false financial statements.

- Result: When financial professionals prioritize personal gain over fiduciary duties, they may engage in fraudulent activities such as revenue recognition manipulation, expense concealment, or asset overvaluation.

- Trigger: These practices directly compromise the accuracy of financial reporting and can trigger securities litigation.

- Reason: The pressure to meet earnings expectations, combined with personal financial incentives, creates a perfect storm for fraudulent behavior.

- Investor Harm: Executives facing stock option vesting schedules or performance-based compensation may resort to accounting manipulation to inflate short-term results, ultimately harming long-term stakeholder interests.

Legal Implications and Regulatory Consequences

- False Statements: Companies that issue misleading financial statements face severe legal repercussions.

- Fines: Regulatory fines imposed by agencies such as the Securities and Exchange Commission can reach millions of dollars, while civil liabilities expose organizations to substantial financial damages through securities fraudclass action lawsuits.

- Lawsuits: Securities fraud class actions have become increasingly common as investors seek compensation for losses resulting from fraudulent financial reporting.

- Settlements: These lawsuits not only result in significant financial settlements but also damage corporate reputation and erode investor confidence.

- Enforcement: Regulatory enforcement actions can include disgorgement of ill-gotten gains, cease-and-desist orders, and permanent injunctions against future violations.

The Role of Corporate Governance and Internal Controls

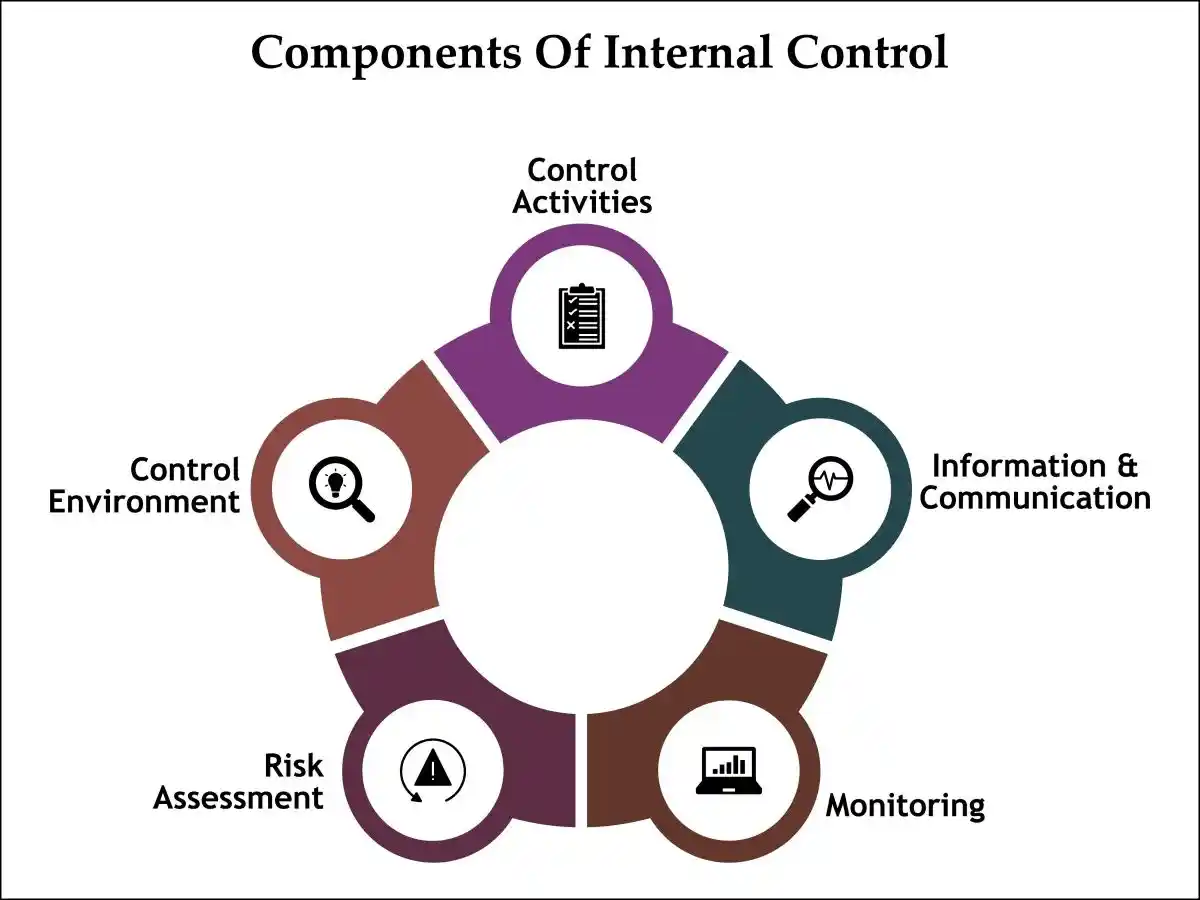

- Governance: Effective corporate governance serves as the first line of defense against conflicts of interest.

- Oversight: Board oversight plays a crucial role in establishing ethical standards and ensuring management accountability.

- Independence: Independent directors, particularly those serving on audit committees, must maintain vigilance in reviewing financial reporting processes and identifying potential conflicts.

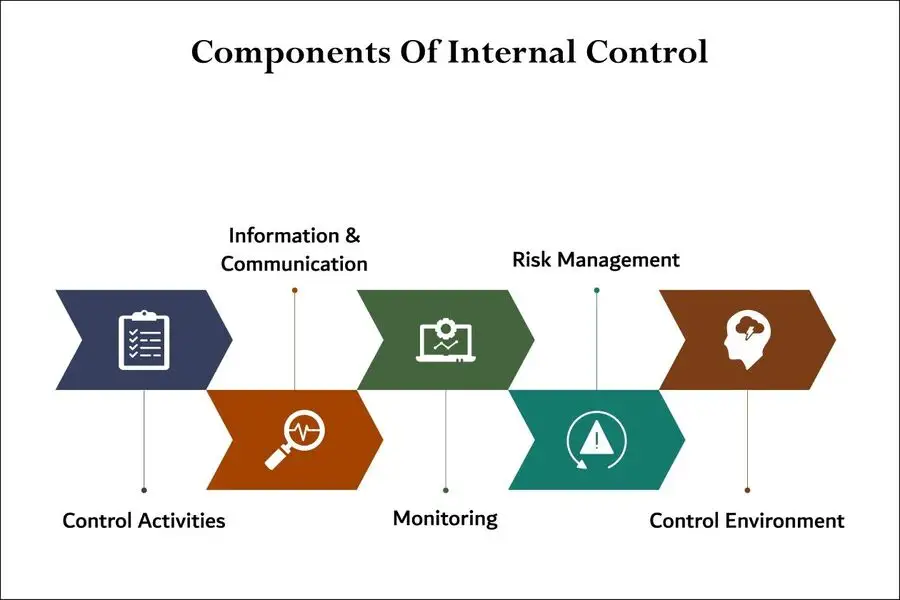

- Controls: Robust internal controls form the foundation of fraud prevention.

- Segregation: These systems include segregation of duties, authorization protocols, and regular monitoring procedures that detect irregularities before they escalate into significant problems.

- Address Conflicts: Companies must implement comprehensive policies that address potential conflicts and establish clear reporting mechanisms for suspected violations.

Preventive Measures and Best Practices

- Organizations can implement several strategies to mitigate conflicts of interest and prevent accounting fraud.

- Robust internal controls should encompass regular internal audits, whistleblower protection programs, and mandatory ethics training for all employees.

- These measures create a culture of transparency and accountability that discourages fraudulent behavior.

- Board oversight mechanisms must include regular executive sessions without management present, direct communication channels between internal auditors and the audit committee, and comprehensive background checks for key financial personnel.

- Additionally, companies should establish clear policies regarding related-party transactions and require detailed disclosure of potential conflicts.

Ensuring Regulatory Compliance

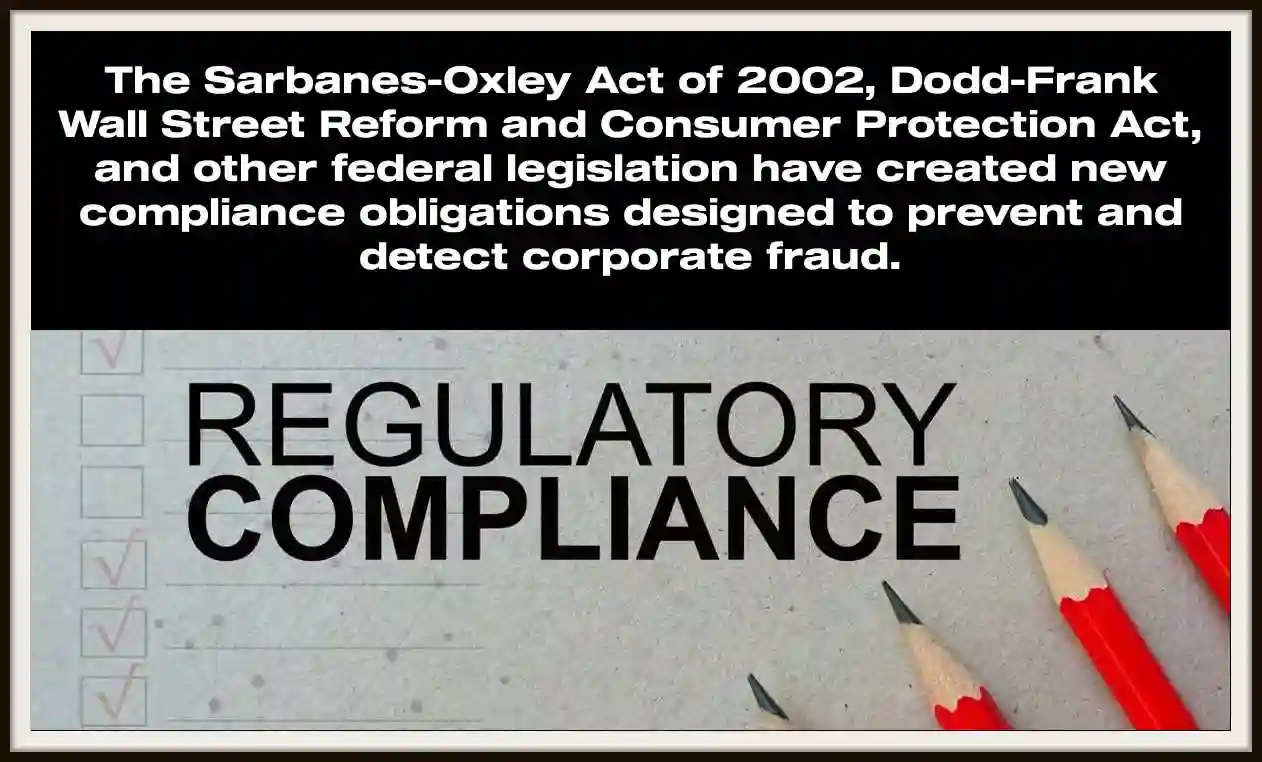

- Regulatory compliance requires ongoing commitment to maintaining accurate financial records and transparent reporting practices.

- Companies must stay current with evolving accounting standards and regulatory requirements while implementing systems that ensure consistent adherence to these guidelines.

- The lack of clear boundaries and oversight often exacerbates conflicts of interest.

- Many financial institutions have dual roles, such as being both an advisor and a lender to a company, which can lead to conflicting priorities.

The Benefits of Being Proactive

- This conflict can result in biased advice or actions that benefit the financial institution rather than the client.

- Understanding these dynamics is crucial for investors, as it helps them recognize situations where their interests might be compromised.

- Ultimately, addressing conflicts of interest requires a comprehensive approach that combines strong governance, effective internal controls, and unwavering commitment to ethical behavior.

- Only through such measures can organizations protect themselves from the devastating consequences of accounting fraud and securities fraud litigation while maintaining the trust of their stakeholders.

The Link Between Conflicts of Interest and Accounting Fraud

- Accounting fraud often stems from unchecked conflicts of interest, where personal incentives overshadow ethical considerations.

- When individuals or organizations prioritize personal gain over honesty, it paves the way for manipulative financial practices.

- These practices might include inflating revenues, understating expenses, or misrepresenting financial health to deceive investors and stakeholders.

- The connection between conflicts of interest and fraud is thus both direct and insidious, often hidden beneath layers of complex financial transactions.

Factors Leading to Conflicts of Interests

- The pressure to meet financial targets can exacerbate conflicts of interest, leading to fraudulent behavior that creates a domino effect throughout the financial ecosystem.

- Executives may resort to creative accounting to mask underperformance, ensuring that their bonuses or stock options remain secure.

- Consider the case of a CEO whose compensation package is heavily tied to quarterly earnings targets – the temptation to manipulate numbers becomes almost irresistible when personal wealth hangs in the balance.

- Similarly, auditors with close ties to a client might overlook discrepancies to maintain business relationships, compromising their role as impartial watchdogs.

- This intertwining of personal and professional interests can erode the trust that is foundational to financial markets.

- Corporate governance failures often amplify these risks, creating environments where conflicts of interest flourish unchecked.

- When board oversight is weak or compromised, management teams operate with minimal accountability, making it easier to engage in fraudulent activities.

The Result of a Weak Control Environment

- The absence of robust internal controls creates blind spots that fraudsters exploit, manipulating financial data with devastating consequences for investors and market integrity.

- Moreover, the competitive nature of the financial industry can tempt individuals and firms to engage in fraudulent activities as a means to stay ahead.

- When conflicts of interest are not adequately managed or disclosed, they can create a breeding ground for fraud.

- For investors, recognizing the signs of such conflicts is essential to protect their investments from being manipulated through fraudulent financial reporting.

- The ripple effects extend beyond individual portfolios, potentially triggering securities class action lawsuits and widespread market volatility.

Common Types of Accounting Fraud Investors Should Know

- Accounting fraud can manifest in numerous ways, each posing significant risks to investors and triggering potential securities litigation.

- One of the most prevalent forms is revenue recognition fraud, where companies record revenue before it is actually earned, giving a false impression of financial health.

- This practice can inflate earnings and deceive investors into overvaluing a company’s stock, leading to potential losses when the truth is revealed.

- Imagine discovering that a company you invested in had been counting future sales as current revenue – the psychological impact alone can be devastating, not to mention the financial losses.

False Financial Statements

- False financial statements often involve sophisticated schemes designed to mislead even experienced analysts.

- Revenue manipulation might include channel stuffing, where companies accelerate sales by offering excessive discounts or extended payment terms to customers, artificially boosting current period revenues at the expense of future performance.

- This creates a vicious cycle where increasingly aggressive tactics become necessary to maintain the illusion of growth.

- Another common type of fraud is asset misappropriation, which involves the theft or misuse of a company’s assets.

- This can include anything from simple theft by employees to more sophisticated schemes like falsifying invoices or creating fictitious expenses.

Asset Misappropriation

- Asset misappropriation not only impacts a company’s financial statements but also undermines investor confidence in the management’s ability to safeguard resources.

- The emotional toll on stakeholders extends beyond financial losses – it represents a fundamental breach of trust that can take years to rebuild.

Fraudulent Financial Reporting

- Finally, investors should be aware of fraudulent financial reporting, where company management intentionally misrepresents financial information.

- This can involve manipulating earnings, concealing liabilities, or inflating asset values to present a more favorable financial position.

- Such deceitful practices can have severe repercussions, leading to a loss of trust in financial markets and significant financial losses for investors.

- The cascading effects often result in securities class actions that can drag on for years, creating prolonged uncertainty for all parties involved.

Legal Implications and Securities Litigation

- The legal ramifications of accounting fraud and conflicts of interest are severe and far-reaching.

- Companies that issue false financial statements face substantial securities fraud penalties that can include hefty fines, criminal charges for executives, and long-term reputational damage.

- The SEC has significantly increased its enforcement efforts, with regulatory enforcement actions resulting in billions of dollars in penalties annually.

- Civil liabilities represent another critical dimension of legal consequences.

- When investors suffer losses due to fraudulent financial reporting, they often pursue securities class action lawsuits seeking compensation for their damages.

- These lawsuits can result in massive settlements that dwarf the original fraudulent gains, creating powerful deterrent effects.

- The emotional and financial devastation experienced by retirees who lost their life savings due to corporate fraud underscores the human cost of these financial crimes.

Securities Class Action Lawsuits

- Securities litigation has evolved into a sophisticated area of law, with firms dedicating entire practices to pursuing securities class actions.

- The legal process typically involves extensive discovery, expert testimony, and complex damage calculations that can take years to resolve.

- During this period, companies face ongoing legal costs, management distraction, and continued negative publicity that can permanently damage their market position.

- Regulatory compliance failures that contribute to accounting fraud can trigger additional penalties from various regulatory bodies.

- The Public Company Accounting Oversight Board (PCAOB), Financial Industry Regulatory Authority (FINRA), and state securities regulators all have enforcement powers that can compound the legal consequences for fraudulent companies.

Preventive Measures and Internal Controls

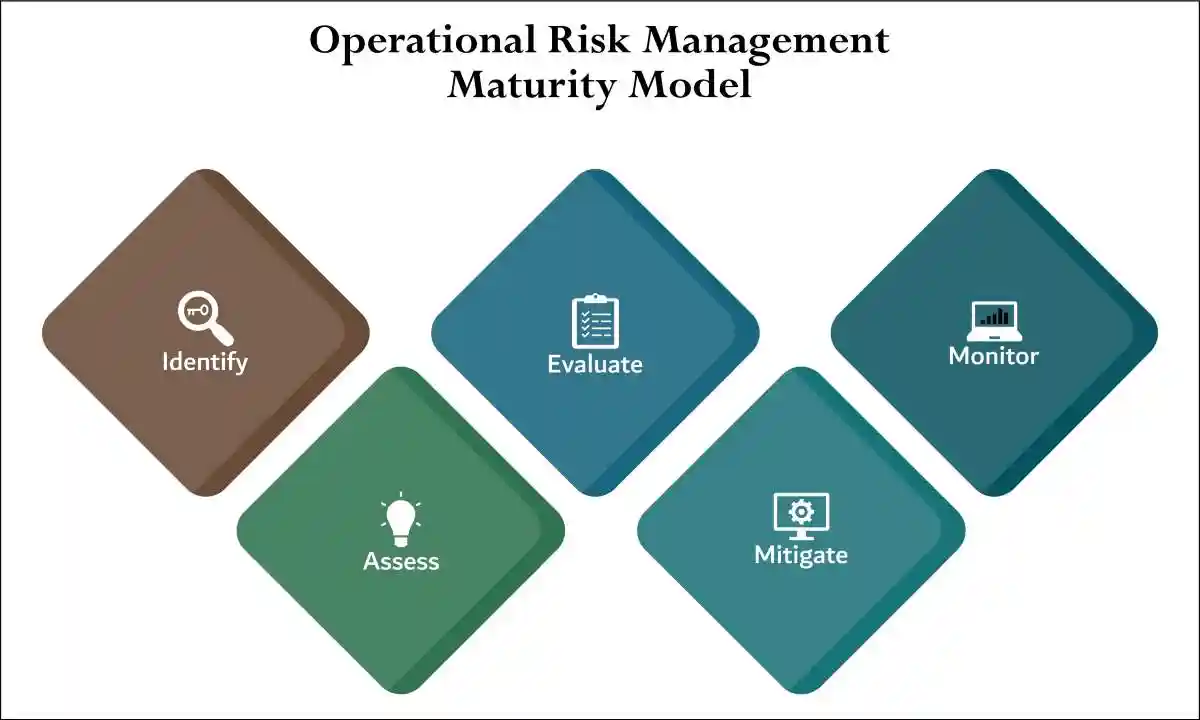

- Implementing robust internal controls represents the first line of defense against accounting fraud and conflicts of interest.

- These controls should include segregation of duties, regular reconciliations, and comprehensive audit trails that make fraudulent activities difficult to conceal.

- Picture a well-designed control system as a sophisticated alarm system – multiple layers of protection that trigger alerts when unusual activities occur.

- Board oversight plays a crucial role in preventing fraudulent financial reporting.

- Independent directors with relevant financial expertise should actively challenge management assumptions and demand transparency in financial reporting processes.

Regular Employee Training and Technology

- Audit committees must maintain regular communication with external auditors and ensure that any concerns about conflicts of interest are promptly addressed.

- Corporate governance best practices include establishing clear policies for managing conflicts of interest, implementing whistleblower programs, and creating a culture of ethical behavior throughout the organization.

- Regular training programs should educate employees about the risks of accounting fraud and the importance of regulatory compliance.

- Technology solutions can enhance traditional internal controls by providing real-time monitoring capabilities and advanced analytics that identify unusual patterns or transactions.

- These systems can flag potential red flags before they escalate into significant fraud schemes, protecting both the company and its investors.

Regulatory Enforcement and Compliance Framework

- Regulatory enforcement has intensified significantly in recent years, with agencies adopting more aggressive approaches to combating accounting fraud.

- The SEC’s enforcement division has expanded its resources and capabilities, utilizing advanced data analytics to identify potential fraud schemes more quickly and effectively.

- Regulatory compliance requirements continue to evolve, with new standards and reporting obligations designed to enhance transparency and reduce opportunities for conflicts of interest.

- Companies must stay current with these changing requirements and invest in compliance infrastructure to avoid inadvertent violations that could trigger enforcement actions.

- The interconnected nature of global financial markets means that regulatory enforcement actions in one jurisdiction can have worldwide implications.

- Companies operating internationally must navigate complex compliance requirements across multiple regulatory frameworks, making comprehensive compliance programs essential for avoiding costly violations.

Protecting Your Investment Future

- Understanding the complex relationship between conflicts of interest and accounting fraud empowers investors to make more informed decisions and protect their financial futures.

- By recognizing warning signs, demanding transparency, and supporting companies with strong corporate governance practices, investors can help create market conditions that discourage fraudulent behavior.

- The fight against accounting fraud requires ongoing vigilance from all market participants.

- As regulatory frameworks evolve and enforcement efforts intensify, the cost of fraudulent behavior continues to increase, creating powerful incentives for ethical conduct.

Identifying Red Flags: How to Spot Potential Fraud

- Spotting potential fraud requires vigilance and an understanding of the common red flags associated with accounting malfeasance.

- One key indicator is inconsistent or overly complex financial statements. Companies that frequently revise their financial reports or employ complex accounting methods may be attempting to obscure fraudulent activities.

- Investors should be wary of unexplained discrepancies or sudden changes in financial data.

- Conflicts of interest represent a particularly insidious form of accounting fraud that often goes undetected until significant damage occurs.

- When executives, board members, or auditors maintain undisclosed relationships with vendors, customers, or competitors, they create opportunities for manipulating financial statements.

- These conflicts can manifest in various ways: related-party transactions recorded at inflated values, revenue recognition from shell companies controlled by insiders, or expenses deliberately understated to benefit connected entities.

Aggressive Revenue Recognition Practices

- Another red flag is aggressive revenue recognition practices.

- If a company consistently reports revenue growth that significantly outpaces its industry peers without clear justification, it could be a sign of fraudulent reporting.

- Additionally, investors should be cautious of companies that frequently change auditors or have a high turnover in key financial positions, as these may indicate deeper issues within the organization.

- The absence of robust internal controls often serves as a breeding ground for accounting fraud.

Sepregation of Duties and the Lack of Transparency

- Companies lacking proper segregation of duties, inadequate approval processes, or insufficient documentation create environments where false financial statements can flourish undetected.

- When employees can both record transactions and reconcile accounts, or when management bypasses established controls without proper oversight, the risk of fraudulent activity increases exponentially.

- Finally, a lack of transparency or restricted access to information should raise concerns.

- Companies that are reluctant to provide detailed financial disclosures or limit access to financial documents may be hiding fraudulent activities.

- Investors should seek out companies with strong governance practices and transparent reporting to minimize the risk of falling victim to accounting fraud.

The Role of Regulatory Bodies in Preventing Accounting Fraud

- Regulatory bodies play a crucial role in preventing accounting fraud by setting standards and enforcing compliance.

- Organizations like the SEC in the United States and similar entities worldwide are tasked with ensuring that companies adhere to strict financial reporting standards.

- These bodies conduct audits, investigate suspicious activities, and impose penalties on those found guilty of fraud.

- Regulatory enforcement has become increasingly sophisticated in recent years, employing advanced data analytics and whistleblower programs to detect fraudulent activities.

- The SEC’s enforcement division now utilizes artificial intelligence to identify patterns in financial filings that may indicate manipulation.

Advancements in Technology

- This technological advancement allows regulators to process vast amounts of data and flag potential issues before they escalate into full-blown scandals.

- In recent years, regulatory frameworks have evolved to address the growing complexity of financial transactions and the increasing risk of fraud.

- Enhanced disclosure requirements, stricter auditing standards, and more rigorous oversight have been implemented to curb fraudulent behavior.

- These measures aim to increase accountability and ensure that companies provide accurate and transparent financial information to investors.

Beyond Regulatory Compliance

- Regulatory compliance extends beyond mere adherence to reporting requirements.

- Companies must now demonstrate active commitment to preventing fraud through comprehensive risk management programs, regular internal audits, and continuous monitoring of financial processes.

- Failure to maintain adequate compliance programs can result in severe penalties, even when no actual fraud occurs.

- Despite these efforts, regulatory bodies face challenges in keeping pace with the ever-changing landscape of financial markets.

- The rise of digital currencies, complex financial instruments, and globalized transactions require continuous adaptation and innovation in regulatory approaches.

- Investors must remain informed about the regulatory environment and support initiatives that strengthen oversight and accountability in the financial sector.

Legal Consequences and Securities Litigation

- The legal ramifications of issuing misleading financial statements extend far beyond regulatory fines.

- Companies caught engaging in accounting fraud face a complex web of legal challenges that can devastate their operations and reputation.

- Securities fraud penalties imposed by regulatory bodies represent just the beginning of potential legal exposure.

- Civil liabilities arising from fraudulent financial reporting can result in massive financial settlements.

- Shareholders who suffer losses due to misleading statements often pursue securities class action lawsuits, seeking compensation for their investment losses.

Reputational Damages

- These lawsuits can drag on for years, consuming significant management attention and resources while creating ongoing uncertainty for investors and stakeholders.

- The financial impact of securities fraud litigation extends beyond direct settlement costs.

- Legal fees, expert witness expenses, and the opportunity costs associated with management distraction can cripple even well-established companies.

- Moreover, the reputational damage from high-profile fraud cases often persists long after legal proceedings conclude, affecting customer relationships, employee morale, and access to capital markets.

Securities Fraud Litigation Is a Powerful Deferrent

- Securities fraud class actions have evolved into powerful deterrents against accounting fraud. Institutional investors, armed with sophisticated analytical tools and substantial resources, actively monitor companies for signs of financial manipulation.

- When irregularities surface, these investors can quickly organize class action suits that threaten the very survival of fraudulent enterprises.

- Regulatory fines imposed by agencies like the SEC have also increased substantially in recent years.

- Companies found guilty of accounting fraud now face penalties that can reach hundreds of millions of dollars, reflecting regulators’ determination to make the cost of fraud prohibitive.

- These fines often accompany other sanctions, including restrictions on business activities and requirements for enhanced oversight.

SECURTIES FRAUD CLASS ACTION PROCESS

Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Strengthening Corporate Governance and Preventive Measures

- Effective corporate governance serves as the first line of defense against accounting fraud. Companies must establish comprehensive frameworks that promote transparency, accountability, and ethical behavior throughout their organizations.

- This begins with board oversight that extends beyond ceremonial approval of management recommendations to active engagement in risk assessment and control evaluation.

- Independent directors play a crucial role in preventing accounting fraud by providing objective oversight of financial reporting processes.

- These board members must possess the expertise and independence necessary to challenge management assumptions, question unusual transactions, and ensure that internal controls function effectively.

- Regular executive sessions without management present allow independent directors to discuss concerns openly and take corrective action when necessary.

The Importance of Robust Controls

- Robust internal controls form the foundation of fraud prevention efforts. Companies must implement comprehensive systems that include segregation of duties, regular reconciliations, and multiple levels of approval for significant transactions.

- These controls should be documented, tested regularly, and updated to address emerging risks and changing business conditions.

- The audit committee bears special responsibility for overseeing financial reporting integrity.

- Committee members must maintain regular communication with both internal and external auditors, ensuring that all significant issues receive proper attention.

- They should also establish clear protocols for investigating potential fraud allegations and protecting whistleblowers who report suspicious activities.

Advances in Technology

- Technology plays an increasingly important role in fraud prevention.

- Advanced analytics can identify unusual patterns in financial data, while automated controls can prevent unauthorized transactions and ensure proper approvals.

- Companies that invest in sophisticated monitoring systems often detect potential fraud earlier, minimizing both financial losses and reputational damage.

- Training and awareness programs help create a culture of integrity throughout the organization.

- Employees at all levels must understand their roles in preventing fraud and feel comfortable reporting suspicious activities without fear of retaliation.

Implementation of a Strong Fraud Prevention Program

- Regular communication from senior leadership about the importance of ethical behavior reinforces these messages and demonstrates management’s commitment to integrity.

- The implementation of comprehensive fraud prevention programs requires ongoing commitment and resources.

- Companies must regularly assess their control environments, update procedures to address new risks, and ensure that all employees understand their responsibilities.

- This proactive approach not only reduces the risk of fraud but also demonstrates to regulators, investors, and other stakeholders that the organization takes its fiduciary responsibilities seriously.

- By combining strong governance practices, robust internal controls, and a culture of integrity, companies can significantly reduce their exposure to accounting fraud while building trust with investors and other stakeholders.

- This comprehensive approach creates value that extends far beyond mere compliance, establishing a foundation for sustainable long-term success.

Best Practices for Investors to Avoid Conflicts of Interest and Protect Against Accounting Fraud

- Conflicts of interest represent one of the most significant threats to investor portfolios, often serving as precursors to devastating accounting fraud schemes that can obliterate shareholder value overnight.

- Smart investors understand that protecting their investments requires a multi-layered approach that goes far beyond basic portfolio diversification.

Enhanced Due Diligence: Your First Line of Defense

- Conducting thorough due diligence before investing remains the cornerstone of fraud prevention, but today’s sophisticated investment landscape demands a more comprehensive approach.

- Investors must sscrutinize not only a company’s financial history but also examine the intricate web of relationships between executives, board members, and external auditors that could signal potential conflicts of interest.

- Modern due diligence should include analyzing regulatory compliance records, reviewing any history of securities fraudlitigation, and examining whether the company has faced regulatory enforcement actions.

- Pay particular attention to companies that have previously been involved in securities fraud class action lawsuits, as this history often indicates systemic governance issues that may resurface.

- Key due diligence checkpoints include:

- Reviewing SEC filings for red flags in management discussion sections

- Analyzing auditor independence and tenure

- Examining executive compensation structures that might incentivize fraudulent behavior

- Investigating related-party transactions that could mask conflicts of interest and accounting fraud

Strategic Diversification Beyond Traditional Approaches

- While diversification across sectors and asset classes provides essential protection, sophisticated investors must also diversify across corporate governance quality levels and regulatory environments.

- This approach minimizes exposure to any single company’s internal controls failures or susceptibility to false financial statements.

- Advanced diversification strategies include:

- Geographic diversification across different regulatory jurisdictions to reduce exposure to region-specific enforcement gaps

- Governance-quality diversification by investing in companies with varying but consistently high standards of transparency

- Audit-firm diversification to avoid concentration risk from any single auditing practice’s potential oversights

- This multi-dimensional approach ensures that even if one investment becomes entangled in securities fraud class actions due to accounting irregularities, the overall portfolio remains resilient.

Evaluating Corporate Governance and Transparency Standards

- Companies with robust corporate governance frameworks and unwavering commitments to transparency create natural barriers against conflicts of interest that could lead to investor harm.

- Independent boards, comprehensive internal controls, and proactive regulatory compliance programs serve as early warning systems that can prevent minor issues from escalating into major fraud scandals.

- Essential governance indicators include:

- Board independence ratios exceeding industry standards

- Regular rotation of audit partners and comprehensive internal controls testing

- Transparent disclosure of potential conflicts in proxy statements

- Proactive communication during regulatory inquiries rather than defensive posturing

- Companies that prioritize these elements demonstrate institutional commitment to preventing the conditions that typically precede accounting fraud schemes.

Implementing Robust Internal Monitoring Systems

- Successful investors develop their own internal controls for monitoring portfolio companies, creating systematic approaches to identify potential red flags before they become material issues.

- These monitoring systems should track key performance indicators that often deteriorate before accounting fraud becomes apparent.

- Effective monitoring includes:

- Quarterly analysis of cash flow patterns versus reported earnings

- Tracking changes in accounting policies or auditor relationships

- Monitoring insider trading patterns and executive turnover

- Reviewing regulatory filings for subtle changes in risk disclosures

Leveraging Regulatory Resources and Professional Networks

Regulatory enforcement agencies provide valuable resources for investors seeking to identify potential conflicts of interest before they impact investment performance.

The SEC’s enforcement actions, PCAOB inspection reports, and other regulatory communications offer insights into emerging fraud patterns and enforcement priorities.

Professional networks within the investment community also serve as valuable early warning systems, as experienced investors often share insights about potential governance concerns or regulatory issues affecting specific companies or sectors.

Conclusion: Building a Comprehensive Defense Strategy

- Protecting investments from conflicts of interest and accounting fraud requires a sophisticated, multi-layered approach that combines traditional due diligence with modern monitoring techniques and regulatory awareness.

- By implementing enhanced due diligence practices, strategic diversification approaches, and robust internal monitoring systems, investors can significantly reduce their exposure to fraudulent activities while positioning themselves to benefit from companies with superior governance standards.

- The investment landscape will continue evolving, but the fundamental principles of transparency, accountability, and systematic risk management remain constant.

- Investors who commit to these comprehensive best practices not only protect their portfolios but also contribute to overall market integrity by rewarding companies that prioritize ethical behavior and transparent communication with their stakeholders.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities fraud class action, or have questions about securities fraud class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors