Understanding Internal Controls in Financial Reporting: The Foundation of Market Integrity

- Weak internal controls and false financial statements are a double trigger for security litgation.

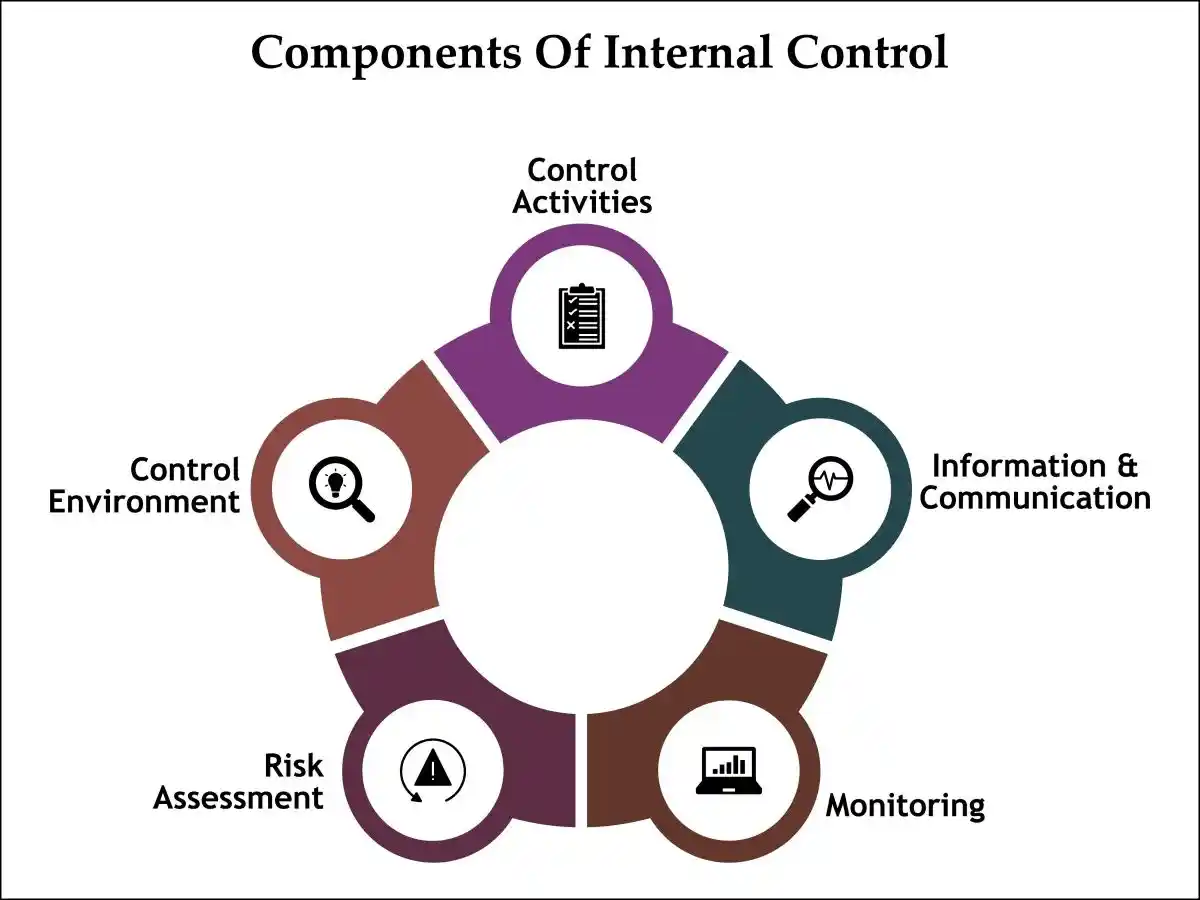

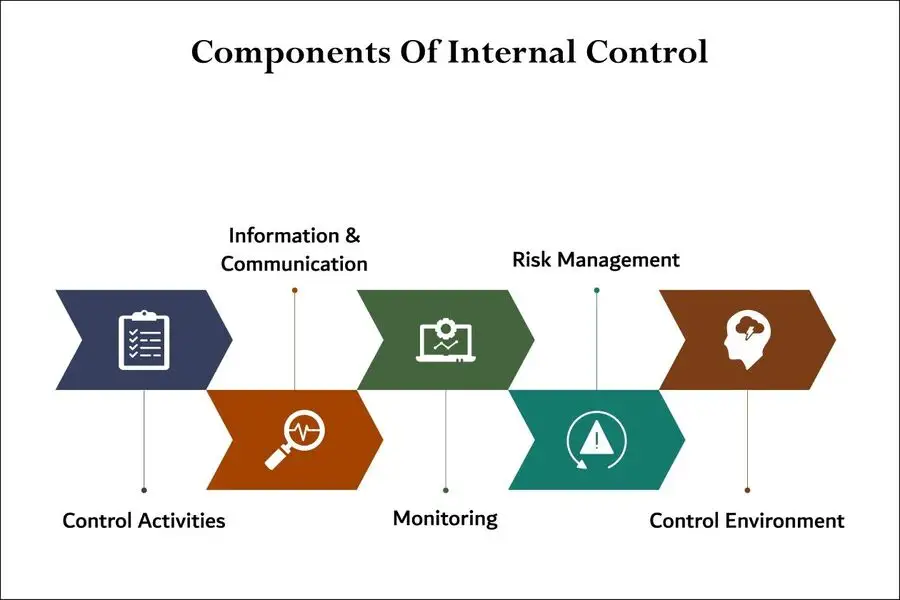

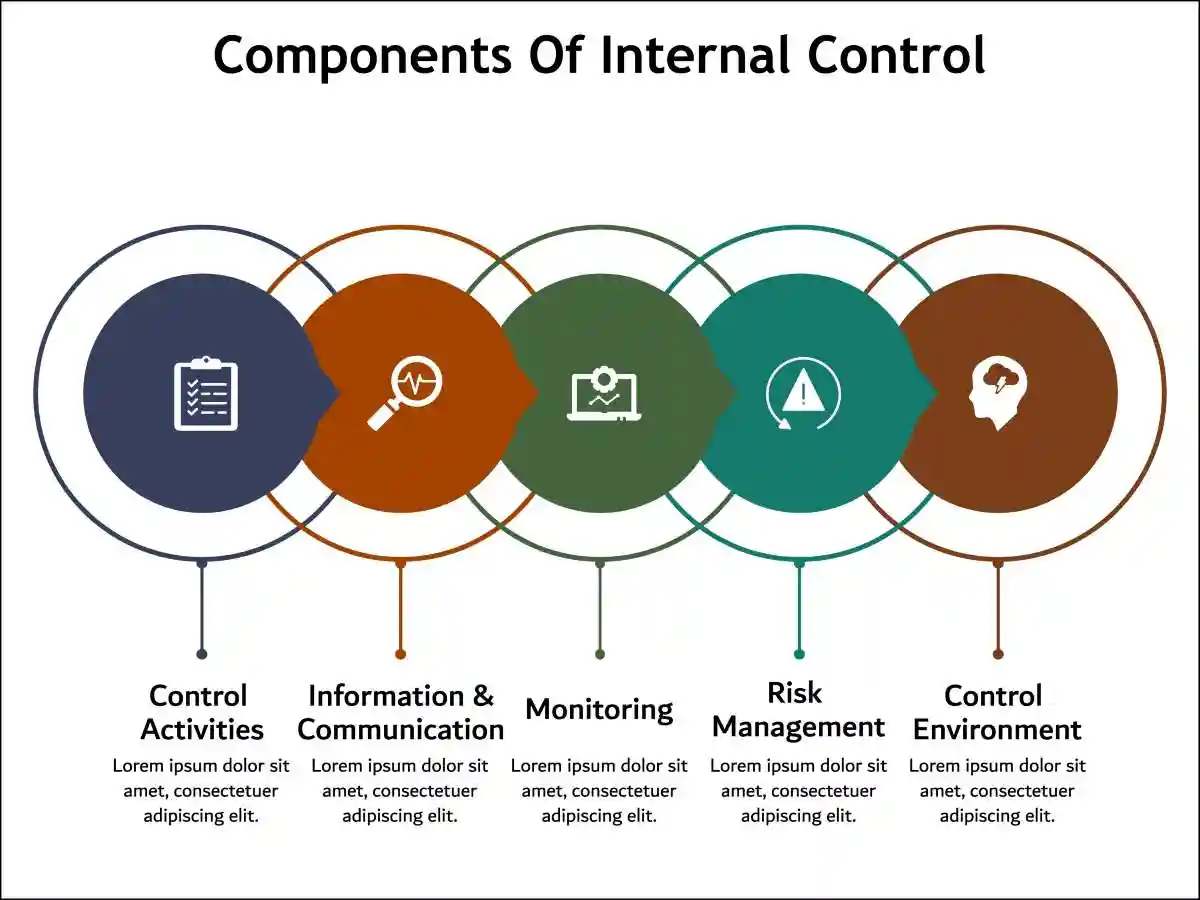

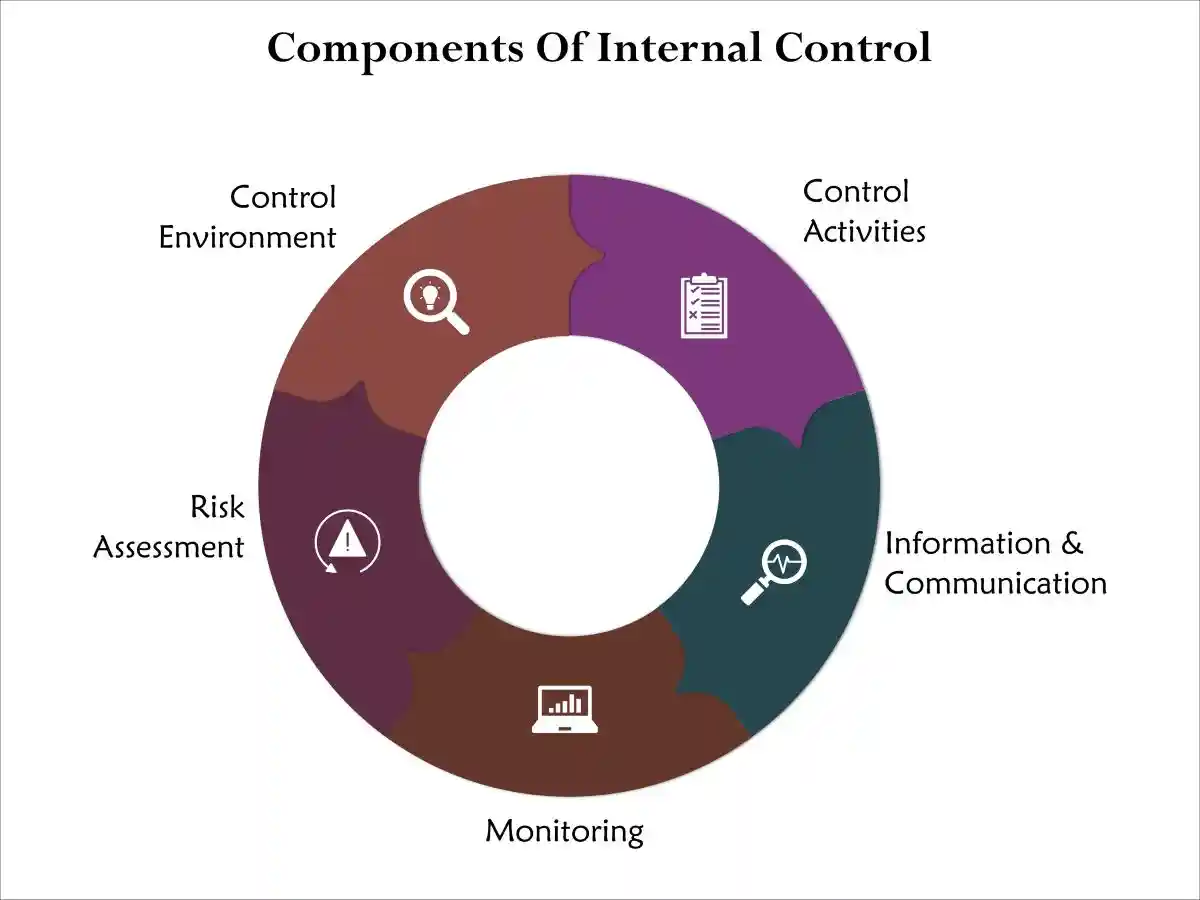

- Effective internal controls are the backbone of reliable financial reporting.

- These controls are systematic measures implemented by organizations to ensure the accuracy and integrity of financial and accounting information, promote accountability, and prevent fraud.

- They encompass a wide range of activities, including protocols for authorization, verification processes, and the segregation of duties.

- In essence, internal controls are designed to provide reasonable assurance that a company’s financial statements are free from material misstatement, whether due to error or fraud.

- The complexity of modern businesses, coupled with the rapid pace of technological advancement, has made robust internal controls more critical than ever.

- With businesses operating globally and handling vast amounts of data, the risk of inaccuracies or fraudulent reporting increases.

- Internal controls not only help in safeguarding assets but also play a crucial role in maintaining investor confidence and ensuring compliance with laws and regulations.

- Without these, organizations are vulnerable to financial misstatements that can lead to significant legal and financial repercussions.

Creating an Environment of Accountability

- Moreover, the role of internal controls extends beyond mere compliance.

- They foster an environment of accountability and operational efficiency by ensuring that all financial transactions are conducted in accordance with the company’s policies and strategies.

- This creates a solid foundation for decision-making and strategic planning.

- As businesses strive to enhance their competitiveness, the importance of maintaining strong internal controls cannot be overstated. Failure to do so can result in damaging outcomes, including litigation and loss of trust from stakeholders.

The Devastating Impact of Weak Internal Controls

- Weak internal controls represent one of the most significant threats to corporate integrity and market stability.

- When organizations fail to implement or maintain adequate control systems, they create an environment ripe for accounting fraud and financial misstatements.

- These deficiencies often manifest in various forms, from inadequate segregation of duties to insufficient oversight of financial reporting processes, ultimately compromising the reliability of financial information that investors and other stakeholders depend upon.

- The consequences of weak internal controls extend far beyond simple accounting errors.

- They create pathways for deliberate manipulation of financial records, enabling management to present false financial statements that misrepresent the company’s true financial position.

- This manipulation can take numerous forms, including revenue recognition fraud, expense manipulation, asset overstatement, or liability concealment.

- Each of these practices undermines the fundamental principle that financial statements should provide a true and fair view of a company’s financial health.

The Anatomy of Control Failures

- When internal controls fail, the ripple effects can be catastrophic.

- Weak internal controls and false financial statements often go hand in hand, creating a dangerous cycle where inadequate oversight enables fraudulent activity, which in turn necessitates further control circumvention to maintain the deception.

- This pattern has been observed in numerous corporate scandals throughout history, from Enron and WorldCom to more recent cases involving technology and healthcare companies.

Weak Controls Involves Multiple Levels of Failure

- The relationship between control weaknesses and fraudulent reporting is particularly concerning because it often involves multiple levels of organizational failure.

- Compliance failures typically begin with inadequate tone at the top, where senior management either actively participates in fraudulent schemes or creates an environment where such behavior is tolerated or encouraged.

- This cultural breakdown then cascades through the organization, affecting middle management, accounting personnel, and even external auditors who may fail to detect or properly respond to control deficiencies.

Corporate Governance and the Control Environment

- Corporate governance plays a pivotal role in establishing and maintaining effective internal controls.

- The board of directors, audit committees, and senior management collectively bear responsibility for creating an organizational culture that prioritizes accuracy, transparency, and ethical behavior in financial reporting.

- When corporate governance structures are weak or compromised, the entire control environment suffers, creating opportunities for fraud and misstatement.

- Effective corporate governance requires active oversight of internal control systems, including regular assessment of control effectiveness, prompt remediation of identified deficiencies, and ongoing monitoring of the control environment.

Oversight Is Critical in Complex Organizations

- This oversight function becomes particularly critical in complex organizations where multiple business units, geographic locations, and reporting systems must be coordinated to produce consolidated financial statements.

- The Securities Class Action Recovery Made Simple: A Comprehensive and Essential Investor Guide [2025] has been a common thread in many high-profile corporate scandals.

- When boards fail to exercise proper oversight, when audit committees lack the expertise or independence to challenge management, or when senior executives prioritize short-term results over long-term integrity, the stage is set for control failures and potential fraud.

Regulatory Compliance and Legal Consequences

- Regulatory compliance in the realm of internal controls has become increasingly stringent following major corporate scandals of the early 2000s.

- The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of internal control requirements, mandating that public companies establish and maintain adequate internal control over financial reporting.

- Section 404 of the Act specifically requires management to assess and report on the effectiveness of these controls, while external auditors must attest to management’s assessment.

- The regulatory framework extends beyond Sarbanes-Oxley to encompass various industry-specific requirements and international standards.

- Companies operating in multiple jurisdictions must navigate complex webs of regulatory requirements, each with its own internal control implications.

Non-Compliance and Litigation

- Failure to maintain compliance with these requirements can result in regulatory sanctions, fines, and increased scrutiny from oversight bodies.

- Securities fraud litigation often follows in the wake of internal control failures and resulting financial misstatements.

- When investors suffer losses due to reliance on false or misleading financial statements, they may pursue legal remedies through securities fraud class action lawsuits.

- These lawsuits typically allege that companies and their executives violated federal securities laws by making material misrepresentations or omissions in their financial disclosures.

The Litigation Landscape

The connection between weak internal controls and securities fraud litigation is well-established in legal precedent.

Courts have consistently held that material weaknesses in internal controls can constitute important information that reasonable investors would consider in making investment decisions.

When companies fail to disclose known control deficiencies or when these deficiencies contribute to financial misstatements, they may face significant legal exposure.

Securities fraud class action lawsuits arising from internal control failures often involve complex damages calculations, expert testimony regarding the adequacy of control systems, and extensive discovery processes to uncover the extent of control deficiencies.

Substantial Legal Consequences

- These cases can result in substantial settlements or judgments, reflecting not only direct investor losses but also the broader market impact of undermined confidence in financial reporting integrity.

- The legal consequences extend beyond civil litigation to include potential criminal liability for executives who knowingly participate in fraudulent schemes enabled by weak controls.

- The Department of Justice has increasingly focused on prosecuting corporate executives whose actions contribute to accounting fraud, recognizing that effective deterrence requires personal accountability at the highest levels of corporate leadership.

The Evolving Nature of Control Challenges

- Modern businesses face increasingly sophisticated challenges in maintaining effective internal controls.

- Digital transformation, remote work arrangements, and complex financial instruments have created new vulnerabilities that traditional control frameworks may not adequately address.

- Financial misstatements can now occur through subtle manipulations of automated systems, cyber attacks that compromise data integrity, or failures in controls over emerging technologies.

- The globalization of business operations has also complicated internal control implementation and monitoring.

Maintaining Consistent Control Standards

- Companies with operations spanning multiple countries must contend with varying legal requirements, cultural differences in control consciousness, and the challenges of maintaining consistent control standards across diverse business environments.

- These complexities can create gaps in control coverage that fraudsters may exploit.

- Furthermore, the increasing reliance on third-party service providers and complex supply chains has extended the boundaries of internal control considerations.

- Companies must now assess and monitor controls not only within their own operations but also at key vendors, partners, and service providers whose failures could impact the accuracy of financial reporting.

Building Resilient Control Systems

Organizations seeking to prevent compliance failures and avoid the devastating consequences of weak internal controls must adopt a comprehensive approach to control system design and implementation.

This approach should encompass not only traditional financial controls but also operational controls, information technology controls, and governance controls that collectively support reliable financial reporting.

Effective control systems require ongoing investment in people, processes, and technology.

Regular Training Updating Internal Controls

Organizations must ensure that personnel responsible for control activities possess appropriate competencies and receive regular training on evolving requirements and best practices.

Control processes must be regularly updated to address changing business conditions, regulatory requirements, and emerging risks.

Technology plays an increasingly important role in modern control systems, offering opportunities for automation, enhanced monitoring, and real-time detection of potential issues.

However, technology also introduces new risks that must be carefully managed through appropriate controls over system access, data integrity, and change management.

The Path Forward: Strengthening Market Integrity

- The prevention of corporate scandals and the maintenance of market integrity depend fundamentally on the collective commitment of organizations to implement and maintain effective internal controls.

- This commitment must extend from the board of directors through all levels of management to every employee who participates in processes that could impact financial reporting.

- Investors, regulators, and other stakeholders play crucial roles in supporting this commitment by demanding transparency, holding organizations accountable for control failures, and supporting regulatory frameworks that promote effective internal control practices.

The Continual Need to Adopt and Address Control Challenges

- The ongoing evolution of internal control requirements reflects the dynamic nature of business risks and the continuous need to adapt control systems to address emerging challenges.

- By prioritizing the implementation of robust internal controls, organizations can protect themselves from the devastating consequences of financial misstatements, securities fraud litigation, and loss of stakeholder trust.

- The investment in effective controls represents not merely a compliance obligation but a fundamental business imperative that supports long-term success and market confidence.

- As the business environment continues to evolve, the organizations that thrive will be those that recognize internal controls not as a burden to be minimized but as a competitive advantage that enables

Why Accurate Financial Statements Are Essential for Market Integrity and Investor Protection

- Accurate financial statements serve as the cornerstone of sound business operations and investment decisions, providing stakeholders—including investors, creditors, and regulators—with a transparent view of a company’s financial health, performance, and cash flows.

- These documents represent far more than mere compliance exercises; they form the bedrock upon which the credibility and trustworthiness of an organization are built, directly influencing market confidence and economic stability.

Promoting Long-Term Economic Growth

- The significance of precise financial reporting extends beyond simple transparency.

- When companies maintain rigorous accuracy in their financial statements, they enable stakeholders to make informed decisions about investments and other business engagements.

- This transparency creates a foundation of trust that supports healthy market dynamics and promotes long-term economic growth.

The Dangerous Connection: Weak Internal Controls and False Financial Statements

- Weak internal controls represent one of the most significant risk factors leading to false financial statements and subsequent corporate scandals.

- Internal controls encompass the policies, procedures, and mechanisms that companies implement to ensure accurate financial reporting, prevent fraud, and maintain compliance with applicable laws and regulations.

- When these internal controls fail or prove inadequate, organizations become vulnerable to both intentional manipulation and unintentional errors that can materially misstate their financial position.

Fraud Flourishes when a Lock of Robust Controls Does not Exist

The absence of robust control systems creates an environment where accounting fraud can flourish unchecked, often escalating from minor discrepancies to major financial misstatements that can devastate investor confidence and trigger widespread market disruption.

Companies with weak internal controls frequently exhibit common warning signs: inadequate segregation of duties, insufficient oversight of financial reporting processes, poor documentation practices, and lack of regular internal audits.

These deficiencies create opportunities for Omissions in Financial Statements: An Absolute Trigger to Securities Litigation [2025], whether through revenue recognition schemes, expense manipulation, or asset misrepresentation.

The Devastating Impact of Accounting Fraud on Market Integrity

- Accounting fraud represents a deliberate attempt to deceive stakeholders through the manipulation of financial statements, often resulting in securities frauditigation and severe regulatory consequences.

- This type of fraud typically involves sophisticated schemes designed to inflate revenues, hide expenses, or misrepresent assets and liabilities to present a more favorable financial picture than reality warrants.

- The consequences of accounting fraud extend far beyond the immediate financial impact on investors.

A Definitie Trigger to Securities Fraud Litigation

- When fraud is discovered, it often triggers a cascade of events including securities fraud class action lawsuits, regulatory investigations, and criminal prosecutions.

- The reputational damage can persist for years, affecting the company’s ability to raise capital, attract talent, and maintain customer relationships.

- For investors, accounting fraud can result in substantial financial losses when stock prices collapse following the revelation of fraudulent activities.

- These situations often give rise to securities fraud class action lawsuits, where groups of investors band together to seek compensation for their losses through the legal system.

Landmark Corporate Scandals: Lessons from History

- The business world has witnessed several devastating corporate scandals that illustrate the catastrophic consequences of false financial statements and weak internal controls.

- These cases serve as powerful reminders of why accurate financial reporting remains essential for market integrity.

The Waste Management Scandal: A Decade of Deception

- Waste Management’s senior executives carried out the scheme through a series of fraudulent accounting manipulations.

- These schemes allowed them to meet earnings targets, secure large bonuses, and sell their inflated stock holdings.

- The specific mechanisms of the fraud included:

- Manipulated depreciation: Executives repeatedly extended the useful life of company assets, such as garbage trucks, and assigned arbitrary, excessive salvage values to them. This dramatically reduced the annual depreciation expense and artificially boosted profits.

- Improper capitalization of expenses: Maintenance and repair costs for landfills were improperly classified as capital expenses rather than as current-period expenses. This illegally deferred recognition of these costs, making short-term profits appear larger.

- Concealment through “netting”: Management secretly used one-time gains from asset sales to erase unrelated operating expenses and accounting misstatements. This practice, known as “netting,” concealed the true financial health of the company from investors and auditors.

- Inflated environmental reserves: Executives would intentionally inflate environmental liability reserves during strong financial quarters. Then, during weaker quarters, they would release the excess reserves into earnings to boost results.

- Failure to write off impaired assets: The company neglected to write off the costs of abandoned or impaired landfill projects, instead keeping the costs on the balance sheet to hide their negative financial impact.

The role of Arthur Andersen

- Waste Management’s longtime auditor, Arthur Andersen, was complicit in the fraud.

- The audit firm was aware of Waste Management’s improper accounting practices and documented numerous issues, but it repeatedly approved the company’s financial statements with an “unqualified” or “clean” opinion.

- The relationship was tainted by a conflict of interest. Many of Waste Management’s top financial officers were former Arthur Andersen employees, and Andersen was highly protective of the lucrative relationship with its “crown jewel” client.

- Andersen also received substantial fees for non-audit consulting services, which compromised its independence.

Unraveling and consequences

- Discovery: The scheme was discovered in 1997 after a new CEO took over and ordered a review of the company’s accounting practices. He resigned months later after calling the accounting “spooky”.

- Financial restatement: In 1998, Waste Management announced it would restate its earnings from 1992 through 1997, revealing over $1.7 billion in overstated profits.

- Regulatory action: The Securities and Exchange Commission (SEC) charged Waste Management’s founder and five other top executives with perpetrating the fraud.

- Executives were fired and faced charges of securities fraud. The SEC also fined Arthur Andersen $7 million for its role.

- Stock price collapse: When the fraud was revealed, the company’s stock price plummeted, causing over $6 billion in losses for shareholders.

- Company restructure: Crippled by the scandal, Waste Management was acquired by a smaller competitor, USA Waste Services. The newly merged company kept the Waste Management name but relocated its headquarters and replaced nearly all top executives.

- Legacy for auditors: The scandal was a major contributing factor to the downfall of Arthur Andersen, which was also implicated in the Enron scandal just a few years later.

- Broader reforms: The Waste Management case, alongside other major financial scandals, helped trigger the push for stricter regulations in corporate governance and financial reporting, ultimately leading to the passage of the Sarbanes-Oxley Act in 2002.

Enron: The Collapse That Shocked the World

- The Enron scandal remains the quintessential example of how omissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

WorldCom: Telecommunications Fraud on an Unprecedented Scale

- Arthur Andersen faces justice as the firm is convicted of obstruction of justice charges, effectively ending its role as one of the “Big Five” accounting firms and serving as a stark reminder of the scandal’s far-reaching consequences.

- The collapse of WorldCom was caused by an $11 billion accounting fraud carried out from 1999 to 2002.

- The scheme involved improperly categorizing billions of dollars in “line costs”—the fees WorldCom paid to other telecommunications companies for network access—as capital expenditures instead of operating expenses.

- This manipulation created the false appearance of a profitable and fast-growing company, which kept its stock price inflated and met Wall Street’s expectations.

- The fraud explained costs, from the income statement to the balance sheet, WorldCom was able to inflate its current profits.

- Instead of deducting these costs immediately, the company treated them as long-term investments that could be depreciated over many years.

- Inflated profits and revenue: The fraudulent accounting turned large quarterly losses into reported profits. The company also inflated its revenue by recording false transactions and improperly booking revenue from capacity swaps with other telecom companies.

- Misuse of reserve accounts: WorldCom’s executives also used reserve accounts to boost reported earnings and smooth out financial performance, further misleading investors.

The key players and discovery

- The fraud was directed by senior management, including CEO Bernard Ebbers and CFO Scott Sullivan, who felt immense pressure to maintain high stock prices and meet aggressive growth targets.

- However, internal auditor Cynthia Cooper and her team uncovered the deception. Despite facing pressure to halt their investigation, they persisted and eventually reported their findings to the company’s audit committee.

The fallout

- Bankruptcy and asset inflation: After the fraud was exposed in 2002, WorldCom filed for Chapter 11 bankruptcy in what was then the largest such filing in U.S. history. Investigations revealed that the company had inflated its assets by more than $11 billion.

- Penalties for executives: Both Ebbers and Sullivan were convicted for their roles in the scandal, receiving prison sentences. Other accounting executives involved also pleaded guilty.

- Legacy and regulation: Coming on the heels of the Enron scandal, the WorldCom collapse led to the passage of the Sarbanes-Oxley Act of 2002. The law was designed to prevent similar corporate fraud by strengthening corporate governance, requiring independent auditors, and increasing penalties for executives who misrepresent financial statements.

- Acquisition by Verizon: After emerging from bankruptcy and rebranding as MCI, the company was ultimately acquired by Verizon Communications in 2005.

Regulatory Response: SEC Regulations and Enhanced Oversight

In response to these major corporate scandals, regulatory bodies, particularly the SEC, have implemented comprehensive reforms designed to strengthen regulatory compliance and prevent future accounting fraud.

SEC regulations now require enhanced disclosure requirements, stricter internal controls testing, and more rigorous oversight of financial reporting processes.

The Sarbanes-Oxley Act, enacted following the Enron and WorldCom scandals, established new standards for corporate governance and required companies to implement more robust internal controls over financial reporting.

These regulations mandate that executives personally certify the accuracy of their company’s financial statements, creating personal accountability for compliance failures.

SEC regulations also require companies to maintain adequate internal controls and provide detailed assessments of their effectiveness.

This regulatory framework helps prevent weak internal controls from creating opportunities for accounting fraud and financial misstatements.

Securities Fraud Litigation: Protecting Investor Rights

- When companies issue false financial statements or engage in accounting fraud, affected investors often pursue remedies through securities fraud litigation.

- Securities fraud class action lawsuits provide a mechanism for investors to collectively seek compensation for losses resulting from financial misstatements and fraudulent activities.

- These legal actions serve multiple purposes: they provide compensation to harmed investors, create deterrent effects that discourage future fraud, and promote greater transparency in financial reporting.

- Securities fraud litigation often reveals the extent of compliance failures and weak internal controls that enabled fraudulent activities to occur.

- The success of securities fraud class action lawsuits depends heavily on demonstrating that defendants made material misrepresentations or omissions in their financial statements, that these statements were false or misleading, and that investors suffered damages as a result of relying on these false financial statements.

Corporate Governance: Building Sustainable Integrity

- Effective corporate governance serves as the primary defense against accounting fraud and financial misstatements.

- Strong governance structures ensure that companies maintain adequate internal controls, promote ethical behavior throughout the organization, and provide appropriate oversight of financial reporting processes.

- Key elements of effective corporate governance include independent board oversight, robust audit committees, clear ethical standards, and comprehensive risk management programs.

- These components work together to prevent weak internal controls and create an organizational culture that prioritizes accuracy and transparency in financial reporting.

- Companies with strong corporate governance are better positioned to identify and address potential compliance failures before they escalate into major scandals.

- Regular assessments of internal controls, ongoing training programs, and clear accountability structures help prevent the conditions that enable accounting fraud to flourish.

The Modern Landscape: Evolving Challenges and Solutions

- Today’s business environment presents new challenges for maintaining accurate financial statements and preventing accounting fraud.

- Technological advances, complex financial instruments, and global operations create additional complexity that can strain traditional internal controls and create new opportunities for financial misstatements.

- Companies must continuously evolve their internal controls to address emerging risks and maintain regulatory compliance in an increasingly complex environment.

- This includes implementing advanced data analytics, enhancing cybersecurity measures, and developing more sophisticated monitoring systems to detect potential fraud indicators.

The Consequences of Non-Compliance Can Be Severe

- The consequences of compliance failures continue to be severe, with securities fraud class action lawsuits and regulatory penalties reaching unprecedented levels.

- Companies that fail to maintain adequate internal controls face not only financial penalties but also lasting reputational damage that can affect their long-term viability.

Building a Culture of Accuracy and Transparency

Creating sustainable accuracy in financial reporting requires more than just implementing technical internal controls; it demands building an organizational culture that values transparency, integrity, and accountability.

This cultural foundation serves as the most effective defense against accounting fraud and financial misstatements.

Leadership plays a crucial role in establishing this culture by demonstrating commitment to accurate financial reporting, providing adequate resources for internal controls, and creating an environment where employees feel comfortable reporting potential compliance failures without fear of retaliation.

Regular training programs, clear communication of ethical standards, and consistent enforcement of policies help reinforce the importance of accurate financial reporting throughout the organization.

These efforts create multiple layers of protection against weak internal controls and reduce the likelihood of corporate scandals.

Protecting Stakeholder Interests Through Vigilant Oversight

- The responsibility for maintaining accurate financial statements extends beyond company management to include board members, auditors, regulators, and investors themselves.

- Each stakeholder group plays a vital role in the system of checks and balances that helps prevent accounting fraud and protect market integrity.

- Investors can protect themselves by carefully analyzing financial statements, understanding the warning signs of potential fraud, and staying informed about regulatory compliance requirements.

- When false financial statements are discovered, affected investors should understand their rights and options for pursuing remedies through securities fraud litigation.

Schedule a consultation with a securities law attorney→ 855-846-6529 or [email protected] (24/7/365)

- The ongoing evolution of SEC regulations and corporate governance standards reflects the continuous effort to strengthen financial reporting integrity and prevent future corporate scandals.

- These regulatory developments create new requirements for internal controls and establish higher standards for regulatory compliance.

- As the financial landscape continues to evolve, the fundamental importance of accurate financial statements remains constant.

- Companies that prioritize transparency, maintain robust internal controls, and foster cultures of integrity will be best positioned to avoid the devastating consequences of accounting fraud and compliance failures while building sustainable value for all stakeholders.

- The lessons learned from past corporate scandals continue to inform current practices and regulatory requirements, creating a more resilient financial reporting system that better protects investors and promotes market confidence.

- Through continued vigilance and commitment to accuracy, the business community can work together to prevent future scandals and maintain the integrity that underpins our financial markets.

Consequences of Weak Internal Controls

- Weak internal controls can have dire consequences for organizations, leading to financial losses, regulatory penalties, and reputational harm.

- Without adequate controls, companies are susceptible to errors and fraud, which can result in misstated financial statements.

- Such inaccuracies can mislead investors and other stakeholders, potentially leading to poor investment decisions and financial losses. In severe cases, weak controls can result in the collapse of the organization, as was seen in the infamous cases of Enron and WorldCom.

- In addition to financial repercussions, weak internal controls can damage a company’s reputation and erode trust among stakeholders.

- Once a company’s credibility is questioned, it can be incredibly challenging to regain the confidence of investors, customers, and partners.

Reputational Damages Can Cause a Myriad of Serious Consequences

- This loss of trust can lead to a decline in stock prices, increased scrutiny from regulators, and a loss of business opportunities.

- Furthermore, companies with inadequate internal controls may face higher insurance premiums and borrowing costs, as lenders and insurers perceive them to be riskier investments.

- Moreover, the absence of strong internal controls can lead to a toxic corporate culture where unethical behavior is tolerated or even encouraged.

- This can result in a demotivated workforce, increased employee turnover, and a decrease in overall productivity.

- A company’s internal environment is a reflection of its values and priorities, and weak controls send a message that integrity and accountability are not important.

- As such, companies must prioritize the implementation of strong internal controls to protect their financial health and uphold their reputation in the marketplace.

The Link Between Internal Controls and Litigation

- The connection between weak internal controls and securities fraud litigation is a critical concern for businesses in today’s financial environment.

- Inadequate controls can lead to financial misstatements, which, in turn, can trigger lawsuits from investors who feel misled by inaccurate financial information.

- Securities fraud litigation can be costly, both in terms of financial settlements and legal fees, and can significantly impact a company’s bottom line.

- Additionally, the public nature of such litigation can further damage a company’s reputation and erode investor confidence.

- Investors rely on accurate financial statements to make informed decisions about where to allocate their resources.

- When these statements are found to be inaccurate due to weak internal controls, it can lead to claims of securities fraud. Investors may argue that they were misled about the financial health of the company, resulting in financial losses.

Weak Internal Controls Are the Untimate Trigger to Securities Litigation

- In such cases, companies may face class-action lawsuits, regulatory investigations, and increased scrutiny from the SEC and other regulatory bodies.

- The legal landscape surrounding securities litigation is complex, and the consequences of litigation can be severe.

- Companies found to have violated securities laws may face significant penalties, including fines, disgorgement of profits, and injunctions against future violations.

- Additionally, individuals within the company, such as executives and board members, may be held personally liable for their roles in the financial misstatements.

- Given the potential for such outcomes, it is imperative for companies to ensure the robustness of their internal controls to mitigate the risk of securities litigation.

Weak Internal Controls and False Financial Statements

Weak internal controls represent the primary gateway through which false financial statements enter the marketplace, creating the foundation for securities litigation.

When companies fail to implement robust control systems, they create environments where accounting fraud can flourish undetected.

These deficiencies manifest in various forms: inadequate segregation of duties, insufficient oversight of financial reporting processes, poor documentation procedures, and lack of proper authorization controls.

The relationship between weak internal controls and false financial statements follows a predictable pattern. Initially, control deficiencies allow minor irregularities to go unnoticed.

Over time, these gaps expand, enabling more significant financial misstatements that materially impact investor decisions.

The cumulative effect often results in corporate scandals that trigger securities class action lawsuits as investors seek compensation for losses caused by misleading financial information.

Corporate governance failures frequently compound these issues.

When boards of directors fail to provide adequate oversight or when audit committees lack the expertise to identify control weaknesses, the risk of accounting fraud increases exponentially.

This governance breakdown creates a cascade effect where weak internal controls enable false financial statements, ultimately leading to compliance failures and regulatory sanctions.

The Evolution of Regulatory Frameworks

- As the global financial landscape continues evolving, regulatory frameworks adapt to address emerging challenges and ensure internal controls effectiveness in mitigating financial reporting risks.

- Recent developments include enhanced cybersecurity requirements, expanded disclosure obligations for environmental and social factors, and increased focus on artificial intelligence governance.

- The regulatory environment increasingly emphasizes proactive risk management rather than reactive compliance.

- Companies must anticipate potential control weaknesses and implement preventive measures before compliance failures occur.

- This forward-looking approach reduces the likelihood of corporate scandals and securities class action lawsuits while enhancing overall market confidence.

- Regulatory compliance now encompasses broader stakeholder considerations, including eenvironmental, social, and governance (ESG) factors.

- Companies must ensure their internal controls address these expanded reporting requirements to avoid financial misstatements related to ESG disclosures.

Building Resilient Internal Control Systems

- Effective internal controls require continuous evolution to address changing business environments and emerging risks.

- Companies must regularly assess control effectiveness, identify potential weaknesses, and implement improvements before problems manifest as false financial statements or accounting fraud.

- Technology plays an increasingly important role in strengthening internal controls.

- Automated controls, data analytics, and artificial intelligence can identify unusual transactions, detect potential fraud, and ensure compliance with regulatory requirements.

- However, technology implementation must be carefully managed to avoid creating new control weaknesses.

The Ultimate Goal Is Regulatory Compliance

- The ultimate goal of robust internal controls extends beyond regulatory compliance to encompass broader stakeholder protection.

- When companies maintain effective controls, they reduce the risk of corporate scandals, minimize exposure to securities litigation, and enhance investor confidence in financial markets.

- Through comprehensive understanding of the relationship between weak internal controls and false financial statements, companies can implement effective strategies to prevent accounting fraud, avoid compliance failures, and maintain the trust essential for healthy capital markets.

- This proactive approach benefits not only individual companies but also the broader financial system by reducing the frequency and severity of corporate scandals that undermine market integrity.

The Sarbanes-Oxley Act: Transforming Auditor Responsibilities

- The Sarbanes-Oxley Act fundamentally transformed the landscape of auditor responsibilities, particularly regarding internal controls assessment.

- Section 404 of the Act requires management to assess and report on the effectiveness of internal controls over financial reporting, while auditors must independently evaluate and opine on these controls for public companies.

- This regulatory framework emerged directly from corporate scandals like Enron and WorldCom, where weak internal controls enabled massive accounting fraud schemes.

Stringent Requirement for Auditor Independence

- The Act established stringent requirements for auditor independence and created the Public Company Accounting Oversight Board (PCAOB) to oversee audit quality and standards.

- Under Sarbanes-Oxley, auditors must identify material weaknesses in internal controls – deficiencies severe enough to create reasonable possibilities that material misstatements will not be prevented or detected on a timely basis.

- This requirement directly addresses the root causes of false financial statements that often trigger securities litigation.

Auditor Methodologies for Detecting Control Deficiencies

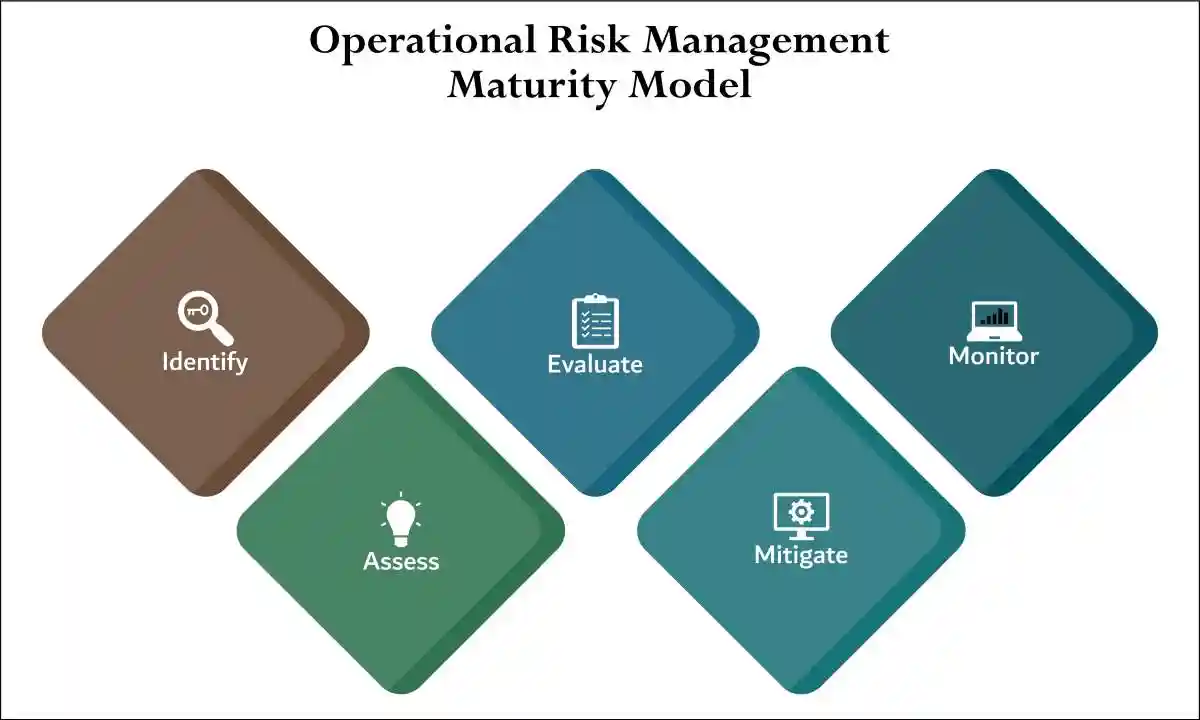

- Effective auditors employ comprehensive methodologies to identify weak internal controls before they result in financial misstatements. These approaches include:

- Risk Assessment Procedures: Auditors must understand the company’s business environment, identify areas susceptible to fraud, and evaluate management’s risk assessment processes.

- This involves examining corporate governance structures and assessing the tone at the top that influences control consciousness throughout the organization.

Control Testing: Auditors Must Test Internal Control Effectiveness

- Control Testing: Beyond design evaluation, auditors must test the operational effectiveness of controls throughout the reporting period.

- This testing helps identify compliance failures that might not be apparent from design assessment alone.

- Substantive Procedures: When internal controls prove unreliable, auditors must expand substantive testing to detect potential financial misstatements directly.

- This approach becomes critical when control deficiencies increase the risk of material errors.

The Stakes of Audit Failures in Securities Litigation

- When auditors fail to detect weak internal controls that enable false financial statements, the consequences extend far beyond audit firm liability.

- Securities class action lawsuits frequently name auditors as defendants, alleging they failed to exercise professional skepticism or follow auditing standards.

- These cases often involve claims that auditors should have detected the control deficiencies that enabled accounting fraud.

Schedule a consultation with a securities law attorney→ 855-846-6529 or [email protected] (24/7/365)

- Corporate scandals involving audit failures demonstrate the devastating impact on investor confidence and market stability.

- Companies with undetected weak internal controls may face not only securities litigation but also regulatory compliance violations that result in significant penalties and reputational damage.

- The connection between audit quality and corporate governance becomes particularly evident in these cases.

- Effective auditors serve as external monitors of management’s stewardship, providing independent verification that internal controls function as designed to prevent financial misstatements.

Conclusion: The Path Forward for Companies in 2025

As we navigate the complex financial landscape of 2025, the importance of robust internal controls and accurate financial reporting cannot be overstated.

The intersection of weak internal controls and false financial statements presents a double trigger to securities litigation, posing significant risks to companies and their stakeholders.

To safeguard against these risks, companies must prioritize the implementation of strong internal controls, foster a culture of transparency and accountability, and leverage technology to enhance their financial reporting processes.

The lessons learned from past securities litigation cases underscore the dire consequences of inadequate internal controls.

As such, companies must remain vigilant in their efforts to strengthen their internal control systems and ensure the accuracy and integrity of their financial statements.

By doing so, they can protect their financial health, maintain the trust of their stakeholders, and navigate the complexities of today’s financial markets with confidence.

Looking ahead, companies that embrace a proactive approach to risk management and internal controls will be better positioned to thrive in the dynamic and ever-evolving financial landscape.

By prioritizing transparency, accountability, and innovation, they can mitigate the risk of securities litigation and chart a path forward that ensures long-term success and sustainability in 2025 and beyond.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities fraud class action, or have questions about securitiesfraud class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors