Introduction to Corruption and Accounting Fraud

- Corruption and accounting fraud represent two of the most pervasive and destructive forces undermining the integrity of global financial markets.

- These interconnected phenomena not only erode investor confidence but also trigger complex securities litigation processes that can devastate corporate reputations and shareholder value.

- Understanding the intricate relationship between fraudulent corporate practices and their legal consequences has become essential for investors, corporate leaders, and regulatory bodies navigating today’s complex financial landscape.

The Foundation of Financial Misconduct

- Corruption typically manifests as the abuse of entrusted power for private gain, while accounting fraud involves the deliberate manipulation of financial statements to present a false picture of a company’s financial health.

- These unethical practices can take numerous forms, including bribery, embezzlement, revenue inflation, liability concealment, and asset misstatement.

- Each of these activities poses significant threats to the credibility of financial reporting and can trigger securities class action lawsuits when investors suffer losses as a result.

Financial Misstatements

- The sophistication of modern financial misstatements has evolved considerably, with perpetrators employing increasingly complex schemes to deceive auditors, regulators, and investors.

- Companies may engage in channel stuffing, round-trip transactions, or aggressive revenue recognition practices that technically comply with accounting standards while fundamentally misrepresenting their financial position.

- These practices often emerge from intense pressure to meet earnings expectations, maintain stock prices, or secure favorable lending terms.

Regulatory Framework and Compliance Challenges

SEC regulations provide the primary framework for combating securities fraud in the United States, establishing strict disclosure requirements and enforcement mechanisms designed to protect investors.

The Securities Exchange Act of 1934, particularly Rule 10b-5, serves as the foundation for most securities litigation cases involving investor fraud.

Compliance Failures

- However, the complexity of modern financial instruments and business models has created significant compliance failures across various industries.

- Regulatory compliance extends far beyond simple adherence to accounting standards.

- Companies must implement comprehensive internal controls systems that can detect and prevent fraudulent activities before they impact financial statements.

Sarbanes-Oxley and Corporate Governance

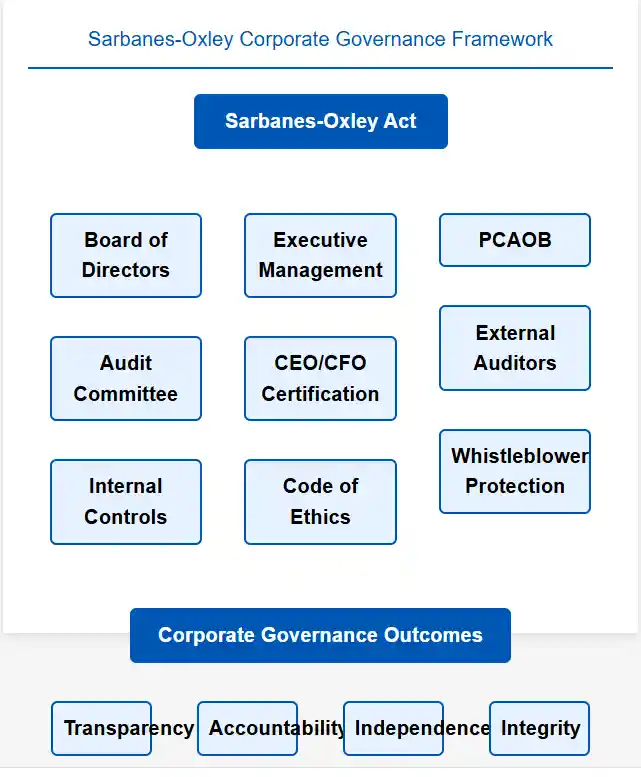

- The Sarbanes-Oxley Act of 2002 significantly strengthened these requirements, mandating that public companies maintain effective internal control over financial reporting and requiring CEO and CFO certification of financial statements.

- The challenge of maintaining effective corporate governance becomes particularly acute in rapidly growing companies or those undergoing significant operational changes.

- Weak governance structures often contribute to corporate scandals by failing to provide adequate oversight of management activities or creating environments where fraudulent behavior can flourish unchecked.

Securities Litigation and Investor Protection

- When accounting fraud and corruption come to light, affected investors frequently pursue remedies through securities class action lawsuits.

- These legal proceedings serve as a critical mechanism for holding corporations accountable for misleading statements or omissions that cause investor losses.

- The litigation process typically involves complex analyses of market efficiency, loss causation, and damages calculations that require extensive expert testimony and economic modeling.

- Securities litigation cases often reveal systemic weaknesses in corporate controls and governance structures. High-profile corporate scandals such as Enron, WorldCom, and more recently,

- Wells Fargo’s account fraud scheme, demonstrate how compliance failures can escalate into massive legal liabilities.

The Importance of Being Proactive in Risk Management

- These cases underscore the importance of proactive risk management and the potentially catastrophic consequences of inadequate oversight.

- The Private Securities Litigation Reform Act (PSLRA) established heightened pleading standards for securities fraud cases, requiring plaintiffs to demonstrate scienter (fraudulent intent) and loss causation with greater specificity.

- While these requirements help prevent frivolous litigation, they also emphasize the need for robust evidence when pursuing claims related to investor fraud and financial misstatements.

PRE AND POST-PSLRA STANDARDS FOR SECURITIES FRAUD LITIGATION

Feature | Pre-PSLRA Standard | Post-PSLRA Standard |

Motion to dismiss | Based on “notice pleading” (Federal Rule of Civil Procedure 8(a)), making it easier for plaintiffs to survive motions to dismiss. This often led to settlements to avoid costly litigation. | Requires satisfying PSLRA’s heightened pleading standards and the “plausibility” standard from Twombly and Iqbal. Failure to plead with particularity on any element can result in dismissal. |

| Pleading | “Notice pleading” was generally sufficient, though fraud claims under Federal Rule of Civil Procedure 9(b) required particularity for the circumstances of fraud, but intent could be alleged generally. | Each misleading statement must be stated with particularity, explaining why it was misleading. Facts supporting beliefs in claims based on “information and belief” must also be stated with particularity. |

Scienter | Pleaded broadly; the “motive and opportunity” test was often sufficient to infer intent. | Requires alleging facts creating a “strong inference” of fraudulent intent, which must be at least as compelling as any opposing inference of non-fraudulent intent, as clarified in Tellabs, Inc. v. Makor Issues & Rights, Ltd.. |

| Loss causation | Not a significant pleading hurdle, often assumed if a plaintiff bought at an inflated price. | Requires pleading facts showing the fraud caused the economic loss, often by linking a corrective disclosure to a stock price drop. Dura Pharmaceuticals, Inc. v. Broudo affirmed this. |

Discovery | Could proceed while a motion to dismiss was pending. | Automatically stayed during a motion to dismiss. |

Safe harbor for forward-looking statements | No statutory protection. | Protects certain forward-looking statements if accompanied by “meaningful cautionary statements”. |

Lead plaintiff selection | Often the first investor to file. | Court selects based on a “rebuttable presumption” that the investor with the largest financial interest is the most adequate. |

Liability standard | For non-knowing violations, liability was joint and several. | For non-knowing violations, liability is proportionate; joint and several liability applies only if a jury finds knowing violation. |

Mandatory sanctions | Available under Federal Rule of Civil Procedure 11, but judges were often reluctant to impose them. | Requires judges to review for abusive conduct |

Building Resilient Corporate Frameworks

- Effective prevention of corruption and accounting fraud requires a multi-layered approach combining strong internal controls, ethical leadership, and comprehensive compliance programs.

- Organizations must foster cultures of transparency and accountability that encourage ethical behavior at all levels while implementing rigorous auditing processes and monitoring systems.

- Corporate governance best practices include establishing independent audit committees, implementing whistleblower protection programs, and conducting regular risk assessments to identify potential vulnerabilities.

Investment in Training Programs

- Companies should also invest in ongoing training programs that help employees recognize and report suspicious activities before they escalate into significant compliance violations.

- The evolving regulatory landscape requires organizations to remain vigilant about emerging risks and compliance requirements.

- As SEC regulations continue to adapt to new business models and technologies, companies must ensure their internal control systems can effectively address these changing challenges while maintaining the transparency necessary to prevent securities litigation exposure.

Protecting Market Integrity

- The fight against corruption and accounting fraud represents a fundamental challenge to market integrity and investor confidence.

- Through robust regulatory compliance programs, effective internal controls, and strong corporate governance structures, organizations can significantly reduce their exposure to securities class action lawsuits and protect stakeholder interests.

- Understanding these complex relationships between fraudulent practices and their legal consequences enables all market participants to make more informed decisions and contribute to a more transparent, accountable financial system.

- As regulatory frameworks continue to evolve, maintaining vigilance against corruption and fraud remains essential for preserving the trust that underlies effective capital markets.

The Impact of Corruption on Financial Reporting: A Gateway to Securities Litigation and Regulatory Enforcement

- Corruption and accounting fraud represent two of the most destructive forces in modern financial markets, creating a cascade of consequences that extend far beyond individual companies to threaten the integrity of entire market systems.

- When corruption infiltrates the financial reporting process, it fundamentally undermines the reliability of financial statements, eroding investor confidence and market stability while opening the door to extensive securities litigation and regulatory enforcement actions.

- Financial reports tainted by corrupt practices fail to provide a true and fair view of a company’s financial position, which is essential for informed decision-making by investors, creditors, and regulators.

- This deliberate misrepresentation of financial data creates material misstatements that can lead to erroneous assessments of a company’s performance and risk profile, directly contributing to investor fraud on a massive scale.

Misrepresentation of Financial Statements

- The misrepresentation of financial data due to corruption can lead to catastrophic market consequences. This misinformation not only affects individual company stock prices and market valuations but also influences the broader financial ecosystem, potentially creating systemic risks that reverberate throughout capital markets.

- When investors direct their capital based on fraudulent information, it results in the misallocation of resources, undermining economic efficiency and growth while setting the stage for securities class action lawsuits.

Corporate Scandals

- Corporate scandals involving accounting fraud have demonstrated the devastating impact of corruption on financial reporting.

- These cases typically involve sophisticated schemes to manipulate earnings, hide liabilities, or inflate revenues, creating artificial market conditions that ultimately collapse when the truth emerges.

- The resulting corrective disclosures often trigger significant stock price declines, leading to substantial investor losses and subsequent litigation.

Regulatory Compliance

- SEC regulations play a crucial role in combating corruption in financial reporting through ccomprehensive oversight and enforcement mechanisms.

- The SEC has developed increasingly sophisticated tools to detect and prosecute accounting fraud, including advanced data analytics and whistleblower programs that incentivize the reporting of fraudulent activities.

- However, the complexity of modern financial instruments and reporting structures continues to present challenges for regulators attempting to maintain market integrity.

Robust Internal Conrols: The Firts Line of Defense

- Internal controls represent the first line of defense against corruption in financial reporting. Companies must implement robust control systems that include segregation of duties, regular audits, and comprehensive oversight mechanisms designed to detect and prevent fraudulent activities before they can impact financial statements.

- When these controls fail or are deliberately circumvented, the resulting compliance failures can expose organizations to significant legal and financial risks.

- Corporate governance structures must be designed to prevent corruption from taking root within organizations.

- This includes establishing independent audit committees, implementing comprehensive ethics programs, and creating clear reporting channels for employees to raise concerns about potential fraud.

- Effective governance requires active oversight by boards of directors who understand their fiduciary responsibilities and are committed to maintaining the highest standards of financial integrity.

Reputation Damage

- The consequences of corruption in financial reporting extend beyond immediate financial losses to encompass long-term reputational damage and regulatory compliance challenges.

- Companies that experience accounting fraud often face years of regulatory scrutiny, increased audit costs, and difficulty accessing capital markets.

- The resulting securities litigation can consume significant resources and management attention, diverting focus from core business operations.

Compliance

- Regulatory compliance requirements have become increasingly stringent in response to high-profile corporate scandals.

- Companies must now navigate complex webs of regulations, including Sarbanes-Oxley requirements, SEC disclosure obligations, and industry-specific compliance standards.

- Failure to meet these requirements can result in severe penalties and increased exposure to securities litigation.

A Comprehensive Approach to Compliance

- To mitigate the impact of corruption on financial reporting, organizations must adopt a comprehensive approach that combines stringent regulatory compliance with robust internal controls and ethical corporate governance.

- This multifaceted strategy should include regular risk assessments, employee training programs, and continuous monitoring systems designed to detect potential fraud before it can impact financial statements.

- Regulatory bodies must continue to evolve their enforcement strategies to address emerging threats and sophisticated fraud schemes.

Developing Technoligies

- This includes developing new technologies for fraud detection, enhancing cooperation between domestic and international regulators, and implementing more effective penalties that truly deter corrupt behavior.

- By fostering a culture of transparency and ethical conduct, organizations can protect their reputation and maintain stakeholder trust, thereby contributing to the overall health of financial markets.

- The fight against corruption in financial reporting requires sustained commitment from companies, regulators, and market participants working together to preserve the integrity of our capital markets and protect investors from fraud.

Accounting Fraud Detection and Securities Litigation

- Identifying accounting fraud requires sophisticated understanding of multiple red flags that often appear in combination.

- Beyond basic financial misstatements, experienced investigators look for complex patterns that suggest systematic corruption and accounting fraud.

- Revenue manipulation represents the most common form of fraud, typically manifesting through:

- Premature revenue recognition – recording sales before delivery or completion of services

- Channel stuffing – artificially inflating sales by pushing excessive inventory to distributors

- Round-trip transactions – creating artificial revenue through circular arrangements with third parties

Robust Corporate Governance

- Corporate governance failures often precede major accounting scandals.

- Warning signs include compliance failures such as:

- Board members lacking financial expertise or independence

- Audit committee dysfunction or limited oversight authority

- Executive compensation structures that incentivize short-term results over sustainable performance

- Inadequate internal controls or frequent control override by management

Regulatory Compliance and SEC Enforcement

- The Securities and Exchange Commission has significantly strengthened its enforcement mechanisms following major corporate scandals. SEC regulations now mandate enhanced disclosure requirements, particularly around:

- Material weakness reporting: Under Sarbanes-Oxley Section 404 requires companies to assess and report on internal control effectiveness annually. Companies must disclose any deficiencies that could reasonably result in material misstatements.

- Whistleblower programs: Have revolutionized fraud detection, with the SEC paying over $1 billion in awards since 2012. These programs create powerful incentives for insiders to report accounting fraud and investor fraud schemes.

- Cross-border enforcement: Has become increasingly sophisticated, with international cooperation agreements enabling regulators to pursue complex multinational fraud schemes. The SEC’s ability to freeze assets and coordinate with foreign regulators has dramatically improved recovery rates for defrauded investors.

Corporate Scandals: Legal Precedents and Financial Impact

- Recent securities class action lawsuits demonstrate the severe consequences of accounting fraud. The Wells Fargo fake accounts scandal resulted in multi=billion in regulatory fines and established new precedents for corporate accountability.

- Wirecard’s collapse in 2020 highlighted how sophisticated fraud schemes can evade detection for years. The company’s €1.9 billion accounting hole led to criminal charges and triggered enhanced audit requirements across Europe.

- These cases established critical legal precedents:

- Enhanced due diligence requirements for auditors

- Expanded liability for executives who should have known about fraudulent activities

- Stricter materiality thresholds for disclosure of internal control weaknesses

Internal Controls and Prevention Strategies

- Effective internal controls serve as the first line of defense against accounting fraud. Best practices include:

- Segregation of duties ensures no single individual controls all aspects of financial transactions. Critical functions like authorization, recording, and custody should be separated across different personnel.

- Regular internal audits should focus on high-risk areas including revenue recognition, expense classification, and related party transactions. Audit committees must have direct access to internal audit findings without management interference.

Technologies Advancements

- Technology solutions increasingly support fraud detection through:

- Data analytics that identify unusual transaction patterns

- Automated controls that prevent unauthorized journal entries

- Real-time monitoring systems that flag suspicious activities immediately

Future Trends in Corporate Disclosures

- By 2025, several emerging trends will reshape corporate governance and disclosure requirements:

- Artificial intelligence integration will revolutionize fraud detection capabilities, enabling real-time analysis of vast transaction datasets to identify anomalous patterns that human auditors might miss.

- Environmental, Social, and Governance (ESG) reporting will become mandatory for many companies, creating new areas of potential financial misstatements and requiring enhanced internal controls around non-financial data.

- Cybersecurity disclosures will expand significantly, with new SEC rules requiring detailed reporting of material cybersecurity incidents and risk management strategies.

- Real-time reporting capabilities will reduce the traditional quarterly reporting cycle, potentially enabling faster detection of accounting fraud but also creating new compliance challenges for companies.

Protecting Investor Interests

- The evolution of securities litigation continues to strengthen investor protections while maintaining market efficiency. Enhanced regulatory compliance requirements, combined with technological advances in fraud detection, create a more robust framework for preventing and detecting accounting fraud.

- Investors benefit from these improvements through:

- Faster fraud detection and disclosure

- Enhanced recovery mechanisms in securities class actions

- Improved corporate transparency through strengthened disclosure requirements

- Better risk assessment tools enabled by advanced analytics

- The intersection of technology, regulation, and market forces continues to evolve, creating an increasingly sophisticated environment for detecting and preventing investor fraud while maintaining the integrity of global financial markets.

The Comprehensive Legal Framework Surrounding Securities Litigation: A Deep Dive into Modern Market Protection

- The legal framework governing securities litigation represents one of the most intricate and consequential areas of corporate law, encompassing a vast network of statutes, regulations, and enforcement mechanisms designed to protect investors and ensure market integrity.

- This complex ecosystem has evolved dramatically over decades, particularly in response to high-profile corporate scandals that have shaken investor confidence and highlighted critical gaps in regulatory compliance.

Foundational Legislation and Modern Applications

- In the United States, the cornerstone legislation includes the Securities Act of 1933 and the Securities Exchange Act of 1934, which together establish the fundamental framework for securities regulation and litigation.

- These laws mandate accurate and truthful disclosure of financial information by publicly traded companies, creating a robust foundation for addressing investor fraud and financial misstatements.

- The 1933 Act focuses primarily on the initial offering of securities, requiring comprehensive disclosure of material information to potential investors.

- Meanwhile, the 1934 Act governs ongoing reporting requirements and trading activities, establishing the Securities and Exchange Commission (SEC) as the primary enforcement body. These statutes work in tandem to create multiple layers of protection against accounting fraud and corruption.

Material Misrepresentation and Corporate Accountability

- Central to securities litigation is the concept of material misrepresentation, wherein companies or their representatives provide false or misleading information that significantly impacts investor decision-making.

- This principle has been tested and refined through numerous landmark cases, creating a sophisticated body of jurisprudence that addresses various forms of corporate misconduct.

- Corporate governance failures often manifest through inadequate internal controls, leading to systematic compliance failures that can result in massive investor losses.

- Companies must maintain robust systems to ensure accurate financial reporting and prevent fraudulent activities from occurring or going undetected.

SEC Regulations and Enforcement Mechanisms

- The SEC’s regulatory framework encompasses comprehensive rules governing corporate disclosures, trading practices, and executive accountability.

- SEC regulations require public companies to maintain detailed records, implement effective internal controls, and provide regular updates on material developments that could affect investor decisions.

- Recent enforcement actions have demonstrated the SEC’s increasing focus on accounting fraud cases, with penalties reaching unprecedented levels.

- For instance, the agency has pursued aggressive enforcement strategies against companies that manipulate earnings, hide liabilities, or engage in other forms of financial misconduct.

Securities Class Action Lawsuits: Collective Investor Protection

- Securities class action lawsuits serve as a powerful mechanism for investors to seek collective redress when companies engage in fraudulent activities. These legal actions allow individual investors with relatively small claims to pool their resources and pursue justice against well-funded corporate defendants.

- The PSLRA established heightened pleading standards for securities fraud cases, requiring plaintiffs to demonstrate specific facts supporting their allegations of fraudulent intent. This legislation aims to balance investor protection with preventing frivolous lawsuits that could harm legitimate businesses.

Real-World Impact: Corporate Scandals and Lessons Learned

- The Enron scandal of 2001 exemplifies how accounting fraud and compliance failures can devastate investor confidence and highlight weaknesses in corporate governance.

- The company’s complex web of off-balance-sheet entities and aggressive accounting practices ultimately led to one of the largest corporate bankruptcies in U.S. history, resulting in billions of dollars in investor losses.

- Similarly, the WorldCom scandal revealed how systematic financial misstatements could inflate company revenues by billions of dollars, demonstrating the critical importance of robust internal controls and independent oversight.

- These cases led to significant legislative reforms, including the Sarbanes-Oxley Act of 2002, which strengthened corporate accountability requirements.

Global Harmonization and Cross-Border Cooperation

- The increasingly global nature of financial markets has prompted unprecedented harmonization of securities laws across jurisdictions.

- International cooperation agreements facilitate information sharing between regulatory bodies, enabling more effective investigation and prosecution of cross-border securities litigation cases.

- This collaborative approach has proven particularly valuable in addressing complex fraud schemes that span multiple countries, allowing regulators to trace financial flows and coordinate enforcement actions more effectively than ever before.

Emerging Trends and Future Challenges

- Looking toward 2025 and beyond, emerging technologies are reshaping corporate disclosure requirements and creating new challenges for regulatory compliance. Artificial intelligence, blockchain technology, and advanced data analytics are transforming how companies collect, analyze, and report financial information.

- These technological advances present both opportunities and risks for corporate governance, requiring companies to adapt their internal controls and disclosure practices to address evolving regulatory expectations and investor needs.

Strengthening Market Integrity Through Legal Evolution

- The evolving legal landscape surrounding securities litigation underscores the critical importance of maintaining robust compliance programs and ethical business practices.

- By strengthening legal frameworks and enhancing international collaboration, regulators continue to create an environment that deters fraudulent practices and protects investor interests.

- This comprehensive approach to securities regulation reflects a fundamental commitment to market integrity, ensuring that investors can make informed decisions based on accurate, complete, and timely information.

- The ongoing evolution of these legal frameworks demonstrates the dynamic nature of securities law and its adaptation to emerging challenges in the modern financial landscape.

Historical Cases of Securities Litigation Due to Fraud

Enron

- Examining historical cases of securities litigation reveals the profound impact of accounting fraud on companies and investors.

- One of the most notorious cases is the Enron scandal, where the energy giant used complex accounting techniques to hide debt and inflate profits, leading to its collapse in 2001.

- The ensuing litigation resulted in significant financial penalties for the company and its executives, as well as the dissolution of Arthur Andersen, Enron’s auditor.

Worldcom

- Another landmark case is the WorldCom scandal, which involved the telecommunications company falsely reporting billions of dollars in expenses as capital investments.

- This fraudulent activity inflated the company’s assets, leading to one of the largest bankruptcies in U.S. history.

- The subsequent securities litigation resulted in substantial settlements for defrauded investors and highlighted the need for stricter regulatory oversight and corporate governance.

Volkswagen

- More recently, the Volkswagen emissions scandal, where the company installed software to cheat on emissions tests, led to significant securities litigation.

- Investors who suffered losses due to the company’s fraudulent practices sought compensation through legal action, resulting in hefty fines and settlements.

- These cases underscore the severe consequences of accounting fraud and the critical role of litigation in holding companies accountable and recovering losses for affected investors.

Deeper Analysis of Landmark Corporate Scandals

Deep Dive Into Enron Scanday

- The Enron collapse represents a watershed moment in corporate governance and securities regulation.

- Beyond the surface-level accounting manipulations, the case revealed systematic compliance failures across multiple organizational levels.

- Enron’s executives employed special purpose entities (SPEs) to move debt off the balance sheet, creating an illusion of financial health that misled investors and analysts alike.

- The securities class action lawsuits that followed resulted in a $7.2 billion in settlements with investors.

- Internal controls at Enron were virtually non-existent, with the company’s board of directors waiving conflict-of-interest policies to allow CFO Andrew Fastow to manage the SPEs that ultimately destroyed the company.

- This breakdown in corporate governance led to the Sarbanes-Oxley Act of 2002, which mandated stricter SEC regulations regarding internal financial controls and executive certification of financial statements.

More on the WorldCom Scandal

- The WorldCom scandal demonstrated how accounting fraud could reach unprecedented scales.

- The company’s manipulation of $11 billion in expenses revealed critical weaknesses in regulatory compliance systems.

- WorldCom’s internal audit department, led by Cynthia Cooper, ultimately uncovered the fraud, highlighting the importance of robust internal controls in preventing financial misstatements.

- The subsequent securities litigation resulted in a $6.1 billion settlement, one of the largest in history at that time.

Additional Cases That Shaped Securities Litigation

Tyco Scandal

The Tyco International scandal under CEO Dennis Kozlowski exemplified how executive corruption and accounting fraud could devastate shareholder value.

Kozlowski and CFO Mark Swartz were convicted of stealing over $600 million from the company through unauthorized bonuses, fraudulent stock sales, and lavish personal expenses charged to the company.

The case resulted in significant securities class action lawsuits and highlighted the need for stronger oversight of executive compensation and corporate expenditures.

HealthSouth Scandal

HealthSouth Corporation presented another egregious example of accounting fraud orchestrated by CEO Richard Scrushy.

The company inflated earnings by $2.7 billion over several years, creating fictitious revenue and hiding expenses. The fraud involved over a dozen CFOs who participated in the scheme under pressure from senior management.

This case demonstrated how compliance failures could cascade through an organization when proper internal controls were absent.

Adelphia Communications scandal

The Adelphia Communications scandal revealed how family-controlled corporations could exploit their position to defraud public shareholders.

The Rigas family, which controlled the cable company, used corporate funds for personal expenses and hid $2.3 billion in debt through fraudulent accounting practices.

The case resulted in criminal convictions and substantial securities litigation settlements, emphasizing the importance of independent board oversight in family-controlled public companies.

Regulatory Response and Enhanced Compliance Frameworks

The Sarbanes-Oxley Act

These corporate scandals catalyzed significant changes in SEC regulations and corporate governance requirements.

The Sarbanes-Oxley Act established new standards for internal controls, requiring companies to maintain adequate financial reporting systems and mandating executive certification of financial statements.

Section 404 of the act specifically requires management to assess and report on the effectiveness of internal control over financial reporting.

Securities Class Actions

- Securities class action lawsuits have become increasingly sophisticated in addressing investor fraud.

- Courts now require more detailed pleadings under the PSLRA, which demands that plaintiffs plead fraud with particularity and establish a strong inference of scienter.

- This heightened standard helps prevent frivolous litigation while ensuring that legitimate cases of accounting fraud can proceed to trial.

- The establishment of the Public Company Accounting Oversight Board (PCAOB) created new oversight mechanisms for auditing firms, addressing the conflicts of interest that contributed to audit failures in cases like Enron and WorldCom.

- These regulatory enhancements have strengthened the framework for detecting and preventing financial misstatements before they can harm investors.

Modern Implications and Lessons Learned

Companies Must Evolve to Avoid New Forms of Corporate Misconduct

- Contemporary securities litigation continues to evolve in response to new forms of corporate misconduct.

- The rise of technology companies has introduced novel challenges in areas such as data privacy, artificial intelligence disclosures, and cybersecurity incidents.

- Companies must now navigate an increasingly complex regulatory landscape while maintaining robust internal controls to prevent compliance failures.

- Corporate governance practices have been fundamentally transformed by these historical cases.

- Independent directors now play more active roles in oversight, audit committees have enhanced responsibilities, and executive compensation structures include clawback provisions that allow companies to recover payments made based on fraudulent financial statements.

The Impact of Fraud Goes Beyond Monetary Settlements

- The financial impact of accounting fraud extends far beyond immediate settlements. Companies face long-term reputational damage, increased regulatory scrutiny, and higher costs of capital.

- The total cost of the Enron scandal, including legal fees, settlements, and lost market capitalization, exceeded $70 billion, demonstrating the enormous consequences of compliance failures.

- For investors, these cases underscore the importance of understanding the legal remedies available through securities class action lawsuits.

- When companies engage in investor fraud through financial misstatements, affected shareholders have the right to seek compensation for their losses.

- The development of sophisticated damage calculation methodologies has improved recovery rates for defrauded investors.

- These landmark cases of corruption and accounting fraud serve as enduring reminders of the critical importance of transparency, accountability, and robust regulatory compliance in maintaining market integrity.

- As new forms of corporate misconduct emerge, the lessons learned from these historical corporate scandals continue to inform both regulatory policy and litigation strategies, ensuring that investors have effective mechanisms to seek justice when their trust is violated.

Preventative Measures Against Accounting Fraud

Implementing a System of Checks and Balances

- Preventing accounting fraud requires a multi-faceted approach that combines robust internal controls, effective governance, and a strong ethical culture.

- Implementing a comprehensive system of checks and balances within an organization is crucial in detecting and deterring fraudulent activities.

- This includes regular audits, segregation of duties, and stringent approval processes for financial transactions.

Strong Corporate Governance Frameworks

- Another critical preventative measure is the establishment of a strong corporate governance framework.

- This involves having an independent and competent board of directors that provides oversight and ensures accountability at all levels of the organization.

- Training programs that emphasize ethical behavior and compliance with regulatory standards are also essential in fostering a culture of integrity and transparency.

The Advancement of Technology

- Technology can also play a significant role in preventing accounting fraud.

- Advanced data analytics and artificial intelligence can be employed to monitor financial transactions and identify suspicious patterns that may indicate fraudulent activity.

- By leveraging these tools, companies can enhance their ability to detect and respond to potential threats, thereby protecting their financial integrity and maintaining stakeholder trust.

The Consequences of Securities Litigation for Companies

- Securities litigation can have severe consequences for companies, both financially and reputationally. Financially, litigation can result in substantial settlements or judgments that can strain a company’s resources.

- Legal fees, fines, and restitution payments can add up quickly, potentially leading to bankruptcy in extreme cases.

- Additionally, the costs associated with litigation can divert funds from other critical areas, such as research and development or strategic investments.

- Reputational damage is another significant consequence of securities litigation. Companies involved in litigation due to fraud often suffer a loss of trust among investors, customers, and the general public.

- This erosion of confidence can lead to a decline in stock prices, reduced market share, and difficulties in securing financing or forming strategic partnerships.

The Long-Term Impact

- The long-term impact on a company’s brand and market position can be profound and challenging to overcome.

- To mitigate these risks, companies must prioritize ethical conduct and transparency in their operations.

- By fostering a strong compliance culture and implementing robust governance practices, organizations can reduce the likelihood of engaging in fraudulent activities and the associated legal repercussions.

- Proactively addressing potential vulnerabilities and maintaining open communication with stakeholders can help companies navigate the complexities of securities litigation and emerge stronger in the long run.

Conclusion: Mitigating Risks and Enhancing Transparency

In conclusion, the interplay between corruption, accounting fraud, and securities litigation highlights the critical importance of transparency and ethical conduct in the financial sector.

As companies navigate the complexities of a rapidly evolving financial landscape, mitigating the risks associated with fraud and litigation is paramount.

By adopting robust governance frameworks, implementing effective internal controls, and fostering a culture of integrity, organizations can protect themselves from the adverse consequences of fraudulent activities.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action lawsuits, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube