Introduction to the Securities Litigation

The fraud on the market theory comes into play in a class action context when a group of investors collectively brings the lawsuit against defendants, which could include corporations, executives, auditors, or underwriters. This collective approach proves particularly powerful in securities litigation because individual investors often lack the resources to pursue complex litigation independently.

The class action mechanism offers several distinct advantages:

Cost Efficiency: Legal expenses are shared among class members, making litigation economically feasible.

- Enhanced Discovery Power: Pooled resources enable comprehensive investigation of corporate wrongdoing.

- Uniform Resolution: All similarly situated investors receive consistent treatment

- Deterrent Effect: Large collective damages create meaningful consequences for corporate misconduct

- Lead plaintiff selection plays a crucial role in class action success.

- Under the Private Securities Litigation Reform Act (PSLRA), the investor with the largest financial interest typically serves as lead plaintiff, ensuring adequate representation for the entire class. This system prevents frivolous lawsuits while empowering legitimate claims.

Pilotinge the Complex and Legal Procedural Hurdles

The complexity of securities class action lawsuits requires plaintiffs to transverse legal standards and procedural challenges. Surviving a motion to dismiss represents the most significant early hurdle, where defendants attempt to have cases thrown out before reaching the costly discovery phase.

Key Pleading Requirements

Scienter Standard: Plaintiffs must plead facts creating a “strong inference” of fraudulent intent. This heightened standard, established in Tellabs, Inc. v. Makor Issues & Rights, Ltd. (2007), requires specific allegations showing defendants acted with intent to deceive, manipulate, or defraud investors.

Loss Causation: Under Dura Pharmaceuticals, Inc. v. Broudo (2005), plaintiffs must demonstrate a direct causal link between alleged misrepresentations and economic losses. This typically requires showing that stock price declines resulted from disclosure of the fraud, not unrelated market factors.

Materiality: Information is material if a reasonable investor would consider it important in making investment decisions. The Supreme Court’s “total mix” standard requires analyzing whether omitted or misrepresented facts would significantly alter the overall information available to investors.

An Overview of Secuitgies Litigation

- Securities class action lawsuits represent a critical legal mechanism for investors who have suffered financial losses due to corporate malfeasance.

- Securities litigation typically arise when a company or its executives engage in deceptive practices that mislead investors about the company’s financial health or prospects, creating artificial inflation in stock prices that ultimately collapses when the truth emerges.

- The goal of such litigation extends beyond individual compensation—it serves as a powerful deterrent against corporate misconduct while maintaining market integrity.

- Securities fraud encompasses a range of activities, including insider trading, false financial statements, misleading disclosures, and omissions of material facts, all of which can severely impact market confidence and cause substantial investor losses.

Understanding the Scope of Securities Fraud

- Material misrepresentations: In securities fraud cases often involve companies overstating revenues, understating expenses, or concealing significant risks from investors.

- For example, when a pharmaceutical company fails to disclose adverse clinical trial results that could affect drug approval prospects, or when a technology firm inflates user engagement metrics to boost stock prices, these actions constitute securities fraud.

- Insider trading: Represents another significant category, where corporate insiders use non-public information to trade securities, giving them unfair advantages over ordinary investors.

- The 2020 case involving executives at Moderna who sold shares before announcing vaccine trial delays exemplifies how insider knowledge can be exploited at investors’ expense.

- Accounting fraud: Remains particularly damaging, as seen in historical cases like Enron and WorldCom, where companies manipulated financial statements to present false pictures of profitability and financial stability.

- The Power of Collective Action: In a class action context, a group of investors collectively brings the lawsuit against defendants, which could include corporations, executives, auditors, or underwriters.

- This collective approach proves particularly powerful in securities litigation because individual investors often lack the resources to pursue complex litigation independently.

The class action mechanism offers several distinct advantages:

- Cost Efficiency: Legal expenses are shared among class members, making litigation economically feasible

- Enhanced Discovery Power: Pooled resources enable comprehensive investigation of corporate wrongdoing

- Uniform Resolution: All similarly situated investors receive consistent treatment

- Deterrent Effect: Large collective damages create meaningful consequences for corporate misconduct

- Lead plaintiff selection plays a crucial role in class action success. Under the PSLRA, the investor with the largest financial interest typically serves as lead plaintiff, ensuring adequate representation for the entire class. This system prevents frivolous lawsuits while empowering legitimate claims.

Understanding the Fraud on the Market Theory

- The “fraud on the market theory” serves as a fundamental principle in securities litigation, offering investors a mechanism to address corporate deceit.

- This theory presupposes that the price of a company’s stock in an efficient market reflects all public information, including any misrepresentations.

- When material misstatements are made, it distorts the stock’s price, thus defrauding investors who rely on the integrity of the market price.

- In essence, this theory provides a pathway for investors to claim damages without having to prove individual reliance on false information, a challenging feat in the fast-paced world of securities trading.

- Understanding this theory requires an examination into its foundational elements. At its core, the fraud on the market theory assumes that markets are efficient and that stock prices are a direct reflection of all available information.

- Consequently, when false or misleading information is disseminated, it misleads the entire market, impacting the stock’s price.

- Investors who buy or sell stock at distorted prices are inadvertently harmed by the misinformation, providing grounds for legal action.

- The theory’s significance extends beyond its role in litigation; it also serves as a deterrent against corporate malfeasance.

- By holding companies accountable for disseminating false information, the theory promotes transparency and honesty, encouraging better corporate practices.

- For investors, understanding and leveraging this theory is crucial in protecting their financial interests and ensuring that they can seek redress when misled by fraudulent corporate actions.

The Evolution and Modern Impact of Fraud on the Market Theory

Historical Foundations and Contemporary Relevance

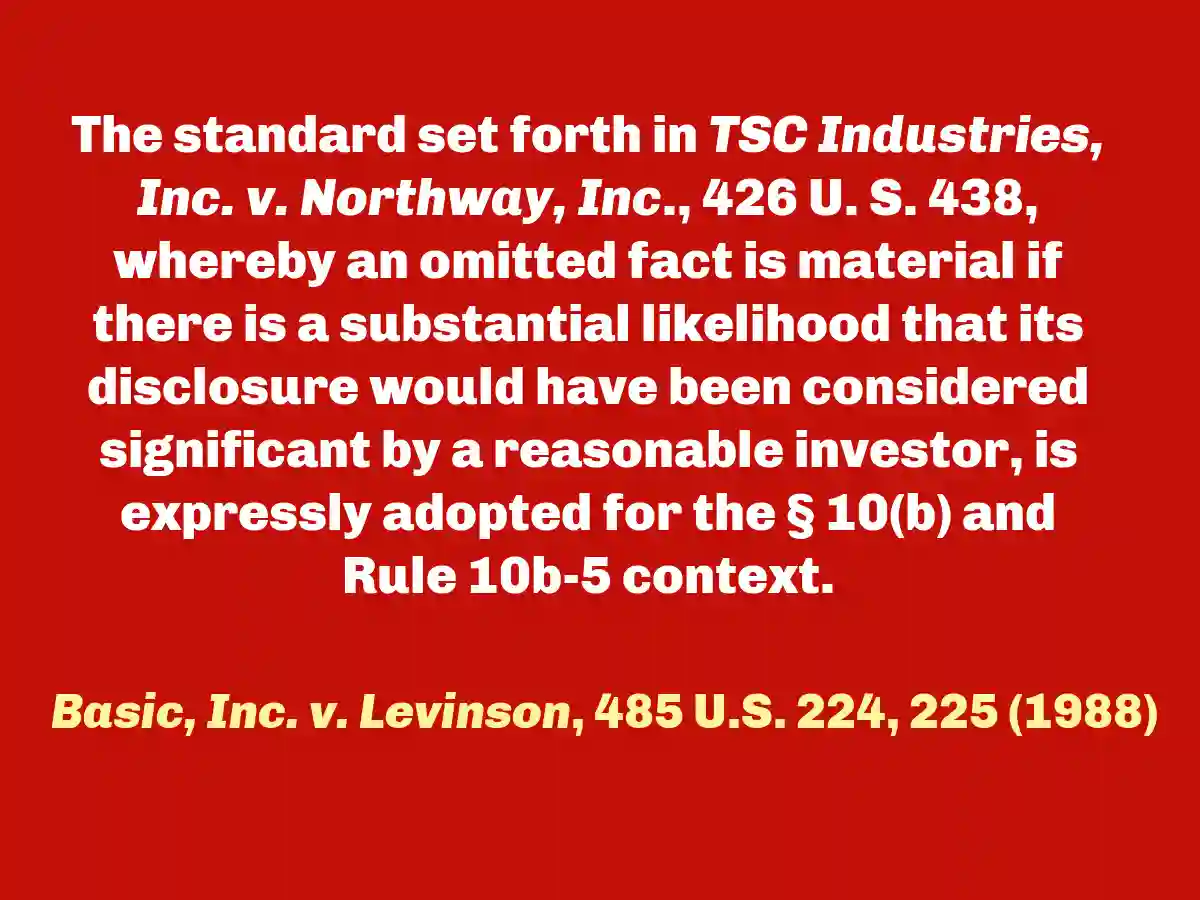

- The fraud on the market theory has its roots in the land mark 1988 Supreme Court case, Basic, Inc. v. Levinson, 485 U.S. 224 (1988). This securities class action established the precedent for the theory’s application, marking a pivotal moment in securities law.

- The court’s decision underscored the notion that investors rely on the integrity of market prices, which are presumed to reflect all public, material information.

- This presumption of reliance fundamentally shifted the landscape of securities litigation, making it easier for investors to pursue claims without having to prove direct reliance on specific misstatements.

- Before the Basic decision, claims in securites class action lawsuits were often hampered by the onerous requirement for plaintiffs to demonstrate that they individually relied on false statements when making investment decisions.

- This requirement posed significant challenges, particularly for class actions, where proving individual reliance for each class member was practically unfeasible.

- The fraud on the market theory alleviated this burden by allowing reliance to be presumed, thereby broadening access to legal recourse for defrauded investors.

Recent Legal Developments and Refinements

- The theory has undergone substantial refinement through recent court decisions that have shaped its modern application.

- The Supreme Court case Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258 (2014) reinforced the theory while introducing crucial nuances. The court maintained the Basic presumption but allowed defendants greater opportunity to rebut it by demonstrating that alleged misrepresentations did not actually affect stock prices.

- More recently, the 2021 decision in Goldman Sachs Group, Inc., et al. v. Arkansas Teacher Retirement System, et al. 594 U.S. ___ (2021) further refined the doctrine. The Court emphasized that generic statements about business integrity and compliance are less likely to move stock prices, requiring plaintiffs to demonstrate more concrete connections between specific misstatements and market impact.

- These developments highlight the dynamic evolution of securities litigation, where courts continuously balance investor protection with preventing frivolous litigation. The trend shows increasing scrutiny of the causal relationship between alleged fraud and market movements.

Economic Implications and Market Dynamics

- The economic implications of the fraud on the market theory theory extend far beyond individual litigation outcomes.

- The theory fundamentally assumes market efficiency – that stock prices rapidly incorporate all publicly available information.

- This assumption has profound implications for how we understand market behavior and investor protection.

Market Efficiency and Information Processing

- Modern markets process information at unprecedented speeds, with Securities Class Action Lawsuits and the Safe Harbor Provision: A Painstaking, Comprehensive and Authoritative Guide to Everything You Need to Know [2025]

- This technological evolution has strengthened the theoretical foundation of the fraud-on-the-market presumption in securities class action lawsuits while simultaneously creating new challenges.

- High-frequency trading and automated systems can amplify the impact of false information, creating more dramatic price movements when corrective disclosures occur.

The theory’s economic impact manifests in several key areas:

- Corporate Disclosure Incentives: Companies face stronger incentives to maintain accurate, timely disclosures knowing that material misstatements can trigger securities litigation.

- Market Confidence: The availability of securities class action remedies enhances overall market confidence and participation

- Cost of Capital: Enhanced disclosure requirements and ffraud deterrence can reduce information asymmetries, potentially lowering companies’ cost of capital

Industry-Specific Applications and Recent Rulings

Technology Sector Developments

- The technology sector has seen particularly significant applications of the theory, especially regarding artificial intelligence disclosures and cybersecurity incidents.

- Recent cases involving major tech companies have tested the boundaries of materiality in rapidly evolving technological landscapes.

- In 2023, several technology companies faced securities litigation related to AI capability claims and data privacy breaches.

- Courts have increasingly scrutinized whether forward-looking statements about AI capabilities constitute actionable misrepresentations under the fraud-on-the-market framework.

Healthcare and Pharmaceutical Applications

- The pharmaceutical industry continues to generate substantial fraud-on-the-market litigation, particularly around clinical trial results and regulatory approvals.

- Recent rulings have emphasized the importance of distinguishing between legitimate business risks and actionable securities fraud.

- The 2022 case involving a major pharmaceutical company’s COVID-19 vaccine efficacy claims demonstrated how courts apply the theory to rapidly developing scientific information.

- The decision highlighted the need for plaintiffs to show that specific misstatements, rather than general market volatility, caused their losses.

Practical Implications for Modern Investors

- Understanding the current state of fraud on the market theory is crucial for investors navigating today’s complex securities markets.

- The theory provides essential protection while requiring sophisticated analysis of market dynamics and causation.

Key Considerations for Investor Protection

- Modern investors should understand that successful fraud-on-the-market claims require:

- Clear demonstration of market efficiency in the relevant security

- Specific identification of actionable misstatements rather than general corporate optimism

- Robust analysis of loss causation connecting alleged fraud to actual economic losses

Strategic Importance for Market Integrity

- The theory serves as a critical deterrent against corporate misconduct by ensuring that companies face meaningful consequences for material misstatements.

- This deterrent effect helps maintain market integrity and promotes investor confidence in capital markets.

Looking Forward: The Theory’s Continuing Evolution

- As markets become increasingly complex and interconnected, the fraud on the market theory continues adapting to new challenges.

- Emerging technologies, global market integration, and evolving disclosure requirements will undoubtedly shape future applications of this fundamental doctrine.

- The theory remains a cornerstone of investor protection, providing essential access to justice while promoting market transparency and corporate accountability.

- For investors seeking to understand their rights and remedies in securities litigation, staying informed about these developments is crucial for making educated decisions about potential legal claims.

- The ongoing refinement of this theory reflects the dynamic nature of securities law and the courts’ commitment to balancing investor protection with market efficiency and corporate governance principles.

The Role of Market Efficiency in Fraud Cases: A Comprehensive Analysis

Understanding Market Efficiency Assessment Factors

- The efficiency of a market undergoes rigorous evaluation based on several interconnected factors that courts examine with increasing sophistication.

- Trading volume serves as a primary indicator, with higher volumes typically suggesting more efficient price discovery mechanisms.

- Markets with daily trading volumes exceeding millions of shares generally demonstrate stronger efficiency characteristics, as increased trading activity facilitates rapid information incorporation.

- Analyst coverage represents another crucial efficiency metric. Securities followed by numerous research analysts—typically ten or more—benefit from enhanced information processing and dissemination.

- These analysts serve as information intermediaries, conducting detailed research and publishing reports that help incorporate new information into stock prices.

- The presence of market makers further strengthens efficiency by providing liquidity and facilitating continuous price discovery throughout trading sessions.

- The speed of information incorporation has become increasingly important in modern markets, particularly with algorithmic trading and high-frequency trading systems.

- Courts now examine whether material information affects stock prices within minutes or hours of disclosure, rather than days or weeks.

- This temporal analysis has become more sophisticated, with expert testimony often including detailed event studies showing precise timing of price movements relative to information releases.

Recent Legal Developments Reshaping Market Efficiency Standards

- Recent circuit court decisions have established new precedents for evaluating market efficiency in emerging market sectors

- The Second Circuit’s ruling in In re Tesla Inc. Securities Litigation, No. 3:2018cv04865 – Document 634 (N.D. Cal. 2023) addressed market efficiency questions in the context of social media disclosures and cryptocurrency-related statements, establishing new frameworks for analyzing efficiency in rapidly evolving market segments.

Economic Implications of Market Efficiency Determinations

- The economic implications of market efficiency determinations extend far beyond individual litigation outcomes, affecting broader market dynamics and investor behavior.

- When courts find markets efficient, they essentially validate the integrity of price discovery mechanisms, encouraging continued investor participation and market liquidity. Conversely, findings of market inefficiency can undermine confidence in specific securities or market segments.

- Institutional investors face particular challenges when market efficiency determinations affect their portfolio holdings. Large pension funds and mutual funds often rely on market efficiency assumptions for portfolio construction and risk management strategies.

- When courts question market efficiency for specific securities, these institutions must reassess their investment methodologies and potentially adjust their holdings.

- The cost of capital implications prove equally significant. Companies operating in markets deemed less efficient may face higher borrowing costs and reduced access to capital markets.

- Credit rating agencies increasingly consider market efficiency factors when evaluating corporate credit worthiness, recognizing that efficient markets provide more reliable pricing signals for risk assessment.

- Market microstructure research has revealed that efficiency determinations can create feedback effects, where court rulings about market efficiency actually influence subsequent market behavior.

- Securities identified as trading in less efficient markets may experience increased volatility as investors adjust their trading strategies and risk assessments.

Practical Challenges in Efficiency Determinations

- In litigation practice, defendants frequently challenge efficiency presumptions through sophisticated economic arguments and empirical analysis.

- Defense strategies often focus on demonstrating that specific market segments or time periods exhibited characteristics inconsistent with efficiency.

- For example, defendants may argue that during periods of extreme market volatility, normal efficiency mechanisms broke down, preventing accurate price discovery.

- Expert testimony plays an increasingly crucial role in efficiency determinations, with both sides presenting detailed econometric analyses of trading patterns, price movements, and information flow.

- These analyses often include sophisticated statistical tests measuring the speed and accuracy of information incorporation, correlation analyses between news events and price movements, and comparisons with benchmark efficient markets.

- The complexity of modern financial markets has created new challenges for efficiency analysis. High-frequency trading, dark pools, and algorithmic trading systems have fundamentally altered market microstructure, requiring courts to update their understanding of how efficiency operates in contemporary markets.

- Some courts have struggled to apply traditional efficiency tests to markets dominated by algorithmic trading, where human decision-making plays a reduced role.

Case Studies Demonstrating Efficiency Analysis

- Recent court rulings provide illuminating examples of how efficiency determinations affect litigation outcomes.

- In IN RE: Petrobras Securities Litigation, No. 1:2014cv09662 – Document 834 (S.D.N.Y. 2018), the Southern District of New York conducted an extensive analysis of market efficiency for American Depositary Receipts (ADRs) trading on U.S. exchanges.

- The court examined trading volumes, analyst coverage, and price responsiveness to news, ultimately finding sufficient efficiency to support the fraud-on-the-market presumption despite the foreign issuer’s complex corporate structure.

- The In re Facebook, Inc. Securities Litigation, No. 5:2018cv01725 – Document 168 (N.D. Cal. 2021) presented unique efficiency challenges related to newly public companies.

- Courts grappled with whether traditional efficiency metrics applied to securities in their initial trading periods, when information asymmetries and trading patterns differ significantly from established public companies.

- Cryptocurrency-related securities cases have pushed efficiency analysis into uncharted territory.

- In several recent cases involving blockchain companies and digital asset securities, courts have struggled to apply traditional efficiency tests to markets characterized by extreme volatility, limited institutional participation, and novel information sources. These cases are establishing new precedents for efficiency analysis in emerging asset classes.

Strategic Implications for Market Participants

- For plaintiffs’ attorneys, demonstrating market efficiency requires increasingly sophisticated economic analysis and expert testimony.

- Successful efficiency arguments now demand comprehensive data analysis, including detailed examination of trading patterns, news flow analysis, and comparative studies with benchmark securities.

- The costs and complexity of this analysis have increased substantially, affecting case selection and litigation strategy decisions.

- Corporate defendants have developed more sophisticated strategies for challenging efficiency presumptions.

- These strategies often involve detailed analysis of company-specific factors that may impair efficiency, such as limited analyst coverage, concentrated ownership structures, or unusual trading patterns.

- Some companies have begun incorporating efficiency considerations into their disclosure strategies, recognizing that market structure factors can affect litigation risk.

- Institutional investors increasingly consider market efficiency factors when making investment decisions and assessing litigation risk.

- Sophisticated investors now conduct their own efficiency analyses when evaluating potential securities class action claims, recognizing that efficiency determinations can significantly affect recovery prospects.

Advanced Strategies for Investors to Identify and Navigate Securities Fraud

- Identifying potential securities fraud requires more than basic vigilance—it demands a sophisticated understanding of market dynamics, regulatory developments, and the evolving tactics employed by fraudulent actors.

- Modern investors must develop a multi-layered approach that combines traditional red flag recognition with cutting-edge analytical techniques and awareness of recent legal developments that reshape the fraud detection landscape.

Enhanced Red Flag Recognition: Beyond Surface-Level Indicators

- The foundation of fraud detection lies in recognizing anomalous patterns that deviate from normal market behavior. Sudden and unexplained stock price movements often serve as the first warning signal, but sophisticated investors must dig deeper.

- Unusual trading volume spikes preceding earnings announcements, particularly when accompanied by insider trading activity, frequently indicate advance knowledge of material information.

- Discrepancies between public statements and financial results represent another critical warning sign that requires detailed analysis.

- When management consistently provides overly optimistic guidance that fails to materialize in actual performance, investors should examine the underlying business fundamentals.

- This pattern becomes particularly concerning when coupled with aggressive accounting practices or frequent restatements of previously filed financial reports.

- Recent developments in artificial intelligence and data analytics have enabled more sophisticated fraud detection methods. Companies now utilize advanced algorithms to identify unusual patterns in financial reporting, trading behavior, and management communications that might escape traditional analysis methods.

Comprehensive Due Diligence: A Systematic Approach

- Effective due diligence extends far beyond reviewing quarterly reports and annual filings.

- Investors must adopt a forensic mindset when analyzing potential investments, examining not only what companies report but how they report it.

- This involves scrutinizing footnotes in financial statements, analyzing cash flow patterns, and comparing reported metrics with industry benchmarks.

- Management track record analysis requires investigating not just current leadership but also their previous roles and any regulatory actions or litigation history.

- The competitive landscape evaluation should include assessing market share trends, customer concentration risks, and the company’s ability to maintain competitive advantages in rapidly evolving industries.

- Technology sector fraud cases have become increasingly sophisticated, Securities Litigation Trends 2025: A Comprehensive Analysis of Class Action Shifts [2025] or misrepresentation of artificial intelligence capabilities.

- The recent surge in AI-related securities filings demonstrates how emerging technologies create new opportunities for fraudulent representations.

Recent Legal Developments and Economic Implications

- The 2024 Supreme Court decision in Macquarie Infrastructure Corp. v. Moab Partners, L. P., 601 U.S. ___ (2024) fundamentally reshaped pleading standards for omissions in private securities fraud actions.

- ‘This unanimous decision established that companies have no general duty to disclose material information unless specific circumstances create such an obligation.

- The economic implications are profound, as this ruling potentially reduces the number of successful class actions while requiring more precise allegations from plaintiffs.

- Recent court rulings have also addressed the intersection of ESG (Environmental, Social, and Governance) disclosures and securities fraud.

- Courts are increasingly scrutinizing companies’ environmental claims and sustainability metrics, particularly in industries facing climate-related regulatory pressures.

- The economic impact of these developments extends beyond individual cases, influencing how companies approach disclosure obligations and risk management strategies.

- The PSLRA continues to evolve through judicial interpretation, with recent decisions clarifying the standards for loss causation and materiality.

- These developments have significant economic implications for both investors and corporations, affecting settlement values and litigation strategies.

Industry-Specific Fraud Patterns and Case Studies

- Healthcare and pharmaceutical companies face unique fraud risks related to clinical trial data, FDA approval processes, and drug pricing strategies.

- The Theranos scandal exemplifies how revolutionary technology claims can mask fundamental scientific failures.

- Recent cases have involved companies misrepresenting the efficacy of COVID-19 treatments or inflating the commercial potential of experimental therapies.

- Technology sector fraud haevolved beyond traditional accounting manipulation to include user engagement metrics inflation, misrepresentation of AI capabilities, and premature revenue recognition from cloud services.

- The economic implications of these fraud patterns extend throughout the technology ecosystem, affecting venture capital valuations and public market pricing.

- Financial services securitities litigation has adapted to include cryptocurrency-related schemes, misrepresentation of digital asset holdings, and manipulation of algorithmic trading systems.

- Recent court rulings have addressed how traditional securities laws apply to digital assets, creating new precedents for fraud prosecution.

- Energy sector cases increasingly involve ESG-related misrepresentations, particularly regarding carbon emissions, renewable energy capabilities, and environmental compliance.

- The economic impact of these cases extends beyond individual companies to affect entire industry valuations and regulatory approaches.

PRE- AND POST-PSLRA STANDARDS FOR SECURITIES FRAUD LITIGATION

Feature | Pre-PSLRA Standard | Post-PSLRA Standard |

Motion to dismiss | Based on “notice pleading” (Federal Rule of Civil Procedure 8(a)), making it easier for plaintiffs to survive motions to dismiss. This often led to settlements to avoid costly litigation. | Requires satisfying PSLRA’s heightened pleading standards and the “plausibility” standard from Twombly and Iqbal. Failure to plead with particularity on any element can result in dismissal. |

| Pleading | “Notice pleading” was generally sufficient, though fraud claims under Federal Rule of Civil Procedure 9(b) required particularity for the circumstances of fraud, but intent could be alleged generally. | Each misleading statement must be stated with particularity, explaining why it was misleading. Facts supporting beliefs in claims based on “information and belief” must also be stated with particularity. |

Scienter | Pleaded broadly; the “motive and opportunity” test was often sufficient to infer intent. | Requires alleging facts creating a “strong inference” of fraudulent intent, which must be at least as compelling as any opposing inference of non-fraudulent intent, as clarified in Tellabs, Inc. v. Makor Issues & Rights, Ltd.. |

Loss causation | Not a significant pleading hurdle, often assumed if a plaintiff bought at an inflated price. | Requires pleading facts showing the fraud caused the economic loss, often by linking a corrective disclosure to a stock price drop. Dura Pharmaceuticals, Inc. v. Broudo affirmed this. |

Discovery | Could proceed while a motion to dismiss was pending. | Automatically stayed during a motion to dismiss. |

Safe harbor for forward-looking statements | No statutory protection. | Protects certain forward-looking statements if accompanied by “meaningful cautionary statements”. |

Lead plaintiff selection | Often the first investor to file. | Court selects based on a “rebuttable presumption” that the investor with the largest financial interest is the most adequate. |

| Liability standard | For non-knowing violations, liability was joint and several. | For non-knowing violations, liability is proportionate; joint and several liability applies only if a jury finds knowing violation. |

Mandatory sanctions | Available under Federal Rule of Civil Procedure 11, but judges were often reluctant to impose them. | Requires judges to review for abusive conduct |

Advanced Detection Techniques and Economic Analysis

- Quantitative analysis tools now enable investors to identify statistical anomalies in financial reporting that may indicate fraudulent activity.

- Benford’s Law analysis can reveal unusual patterns in reported numbers, while ratio analysis can identify inconsistencies between related financial metrics.

- Event study methodology helps investors assess whether stock price movements align with the materiality of disclosed information.

- When corrective disclosures fail to produce expected market reactions, it may indicate that the market had already incorporated negative information through other channels.

- Network analysis of corporate relationships can reveal hidden connections between companies, executives, and financial institutions that may facilitate fraudulent schemes.

- This approach has proven particularly valuable iin identifying pump-and-dump schemes and other market manipulation tactics.

Economic Implications of Enhanced Fraud Detection

- The economic benefits of sophisticated fraud detection extend beyond individual investor protection with securities class action lawsuits as remedies.

- Market integrity improves when fraudulent actors face higher detection risks, leading to more efficient capital allocation and reduced systemic risk.

- Academic research demonstrates that markets with robust fraud detection mechanisms exhibit lower volatility and higher long-term returns.

- Corporate governance improvements result from enhanced scrutiny, as companies invest more resources in compliance systems and internal controls.

- The deterrent effect of successful fraud prosecutions creates positive externalities throughout the market ecosystem.

- Regulatory developments continue to evolve in response to emerging fraud patterns, with agencies like the Securities and Exchange Commission (SEC) adapting enforcement strategies to address new technologies and market structures.

- The economic impact of these regulatory changes influences corporate behavior and market dynamics across all sectors.

Implementation Strategy for Modern Investors

Successful fraud detection requires integrating multiple information sources and analytical techniques into a coherent investment process.

Investors should establish systematic monitoring procedures that combine automated screening tools with human judgment and expertise.

Collaboration with legal and financial professionals becomes essential when fraud indicators emerge, as the complexity of modern securities litigation requires specialized knowledge.

Understanding recent court rulings and their implications helps investors make informed decisions about potential legal remedies.

The evolving landscape of securities fraud detection demands continuous education and adaptation to new threats and opportunities.

Investors who master these advanced techniques position themselves not only to avoid fraudulent investments but also to identify legitimate opportunities that others may overlook due to excessive caution or inadequate analysis capabilities.

The Comprehensive Legal Process of Filing a Securities Fraud Claim: A Detailed Guide for Investors

- Filing a securities class action represents one of the most complex legal undertakings in modern litigation, requiring investors to navigate an intricate web of federal regulations, procedural requirements, and substantive legal standards.

- The process demands not only a thorough understanding of securities law but also strategic planning and meticulous execution at every stage.

Initial Assessment and Strategic Legal Consultation

- The foundation of any successful securities class action begins with a comprehensive case evaluation conducted by experienced counsel practicing in securities class action lawsuits.

- Attorneys must analyze the specific nature of alleged misrepresentations, evaluate the strength of available evidence, and determine whether the case meets the heightened pleading standards established by the PSLRA.

- During this critical phase, legal counsel examines several key factors: the materiality of alleged misstatements, the presence of scienter (fraudulent intent), loss causation, and the availability of class certification.

- Expert economic analysis often plays a crucial role at this stage, as forensic accountants and financial analysts provide preliminary assessments of potential damages and market impact.

- The selection of lead counsel is particularly important, as securities class action lawsuits require experience expertise in both federal securities litigation and complex litigation management.

- Investors should seek attorneys with demonstrated experience in similar cases and a track record of successful outcomes in their specific industry sector.

Complaint Drafting: Meeting Rigorous Pleading Standards

- The complaint filing process in securities fraud litigation has been fundamentally shaped by recent legal developments.

- The 2024 Supreme Court decision in Macquarie Infrastructure Corp. v. Moab Partners, L.P. significantly reshaped pleading standards for omissions claims, requiring plaintiffs to demonstrate that defendants had a duty to disclose omitted information.

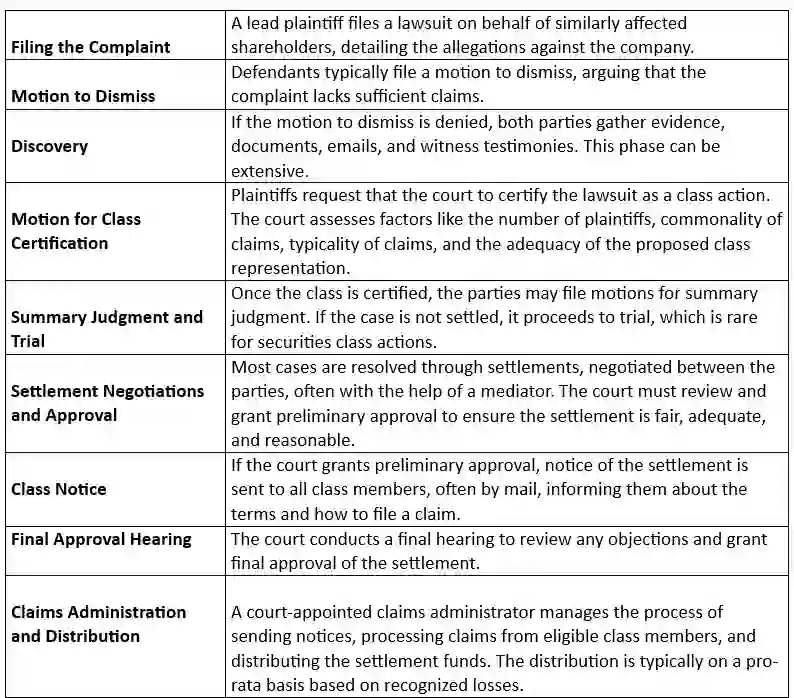

SECURITIES LITIGATION PROCESS

Modern complaints must satisfy multiple stringent requirements:

- Particularized Fraud Allegations: Every material misstatement must be identified with specificity, including the who, what, when, where, and how of each alleged misrepresentation

- Strong Inference of Scienter: Plaintiffs must plead facts that create a “strong inference” of fraudulent intent, meeting the standard established in Tellabs, Inc. v. Makor Issues & Rights, Ltd.

- Loss Causation: The complaint must establish a direct causal link between the alleged fraud and investor losses, following the precedent set in Dura Pharmaceuticals, Inc. v. Broudo

- The Multi-Stage Litigation Process Dscovery Phase: Comprehensive Evidence Gathering

Once a complaint survives initial motion practice, the discovery phase begins—often the most resource-intensive stage of securities litigation. This process typically involves:

- Document Discovery: Extensive review of internal company communications, board minutes, analyst reports, and regulatory filings. In recent technology sector cases, this has included examination of artificial intelligence disclosures and algorithmic trading data.

- Expert Witness Preparation: Economic experts conduct detailed event studies to establish market impact and calculate damages using sophisticated econometric models. These analyses have become increasingly important following recent court decisions emphasizing the need for rigorous damage calculations.

- Depositions: Key corporate executives, auditors, and industry experts provide sworn testimony that often proves crucial to establishing both liability and damages.

Motion Practice: Critical Legal Determinations

- Throughout the litigation process, parties engage in extensive motion practice addressing fundamental legal issues.

- Motions for summary judgment have become particularly significant, with courts increasingly willing to resolve cases at this stage when the evidence clearly supports one party’s position.

- Recent industry-specific examples demonstrate the complexity of this phase. In healthcare sector litigation, courts have grappled with the adequacy of clinical trial disclosures and FDA regulatory compliance.

- The 2023 settlement in the Biogen Alzheimer’s drug case illustrates how regulatory developments can significantly impact litigation strategy and outcomes.

Industry-Specific Considerations and Recent Developments

Technology Sector Challenges

- The technology industry presents unique challenges in securities litigation, particularly regarding artificial intelligence disclosures.

- Recent cases have highlighted the importance of adequate disclosure regarding AI implementation risks, data privacy concerns, and algorithmic bias potential.

- Cybersecurity incidents have also generated significant litigation, with courts examining whether companies adequately disclosed cyber risks and incident response capabilities.

- The involving regulatory landscape, including new SEC cybersecurity disclosure requirements, continues to shape litigation strategies.

Healthcare and Pharmaceutical Litigation

- Healthcare sector securities fraud cases often involve complex scientific and regulatory issues.

- Recent pharmaceutical litigation has focused on clinical trial data integrity, FDA approval processes, and drug pricing transparency.

- The ongoing opioid-related securities litigation demonstrates how public health crises can generate substantial securities exposure to securities class actions.

Trial Preparation and Resolution Strategies

- When cases proceed to trial, plaintiffs face the demanding burden of proving fraud elements by a preponderance of the evidence. This requires comprehensive preparation including:

- Expert testimony coordination to present complex financial and industry-specific evidence clearly to juries

- Demonstrative evidence preparation using advanced graphics and financial modeling to illustrate market impact

- Witness preparation ensuring that fact witnesses can effectively communicate technical concepts

- However, the vast majority of securities class action cases resolve through settlement, often following mediation or other alternative dispute resolution processes.

- Recent settlement statistics indicate that average recoveries have increased significantly, with several 2024 settlements exceeding $100 million.

Practical Guidance for Investors

- Investors considering securities litigation should maintain detailed records of all transactions, monitor company disclosures carefully, and seek legal counsel promptly when potential fraud is suspected.

- Early consultation with experienced securities litigation attorneys can significantly impact case outcomes and recovery potential.

- The evolving legal landscape requires investors to stay informed about changing standards and emerging areas of liability.

- As courts continue to refine pleading standards and damage calculation methodologies, working with knowledgeable counsel becomes increasingly critical to successful claim resolution.

Conclusion: Navigating Securities Litigation with Confidence

- In the ever-evolving landscape of securities markets, understanding the intricacies of the Fraud on the Market Theory is essential for investors seeking to protect their financial interests.

- By grasping the historical context, key components, and legal processes associated with this theory, investors can navigate the complexities of securities litigation with greater confidence.

- Recent case studies and developments in 2025 underscore the dynamic nature of this field, highlighting the importance of staying informed and adaptable.

- Armed with these insights and strategies, investors are well-positioned to navigate the complex world of securities litigation with confidence and purpose.

Contact the Law Offices of Timothy L. Miles Today

If you suffered substantial losses in any case and wish to serve as lead plaintiff in the case, or if you just have general questions about you rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected].

For more information on shareholder rights, investor protection, and securities law in general, please visit our Investor Resources Center and our Frequently Asked Questions page with answers to over 350 questions on every area of securities law, civil procedure and much more. Also, please see our Lead Plaintiff Deadline page which has a calendar when lead plaintiff motions are due in various securities cases.

We hope you enjoy, you will find a wealth of information on shareholder rights, protections, and securities law in general.

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors