Introduction to Strong Corporate Governance Frameworks

Strong Corporate Governance Frameworks: Are essential for ensuring that organizations operate effectively, transparently, and with integrity and ethics and responsive to stakeholders.

Complex Environment: Businesses navigate an increasingly complex regulatory landscape, understanding these frameworks becomes crucial for investors seeking to protect their interests and foster sustainable growth.

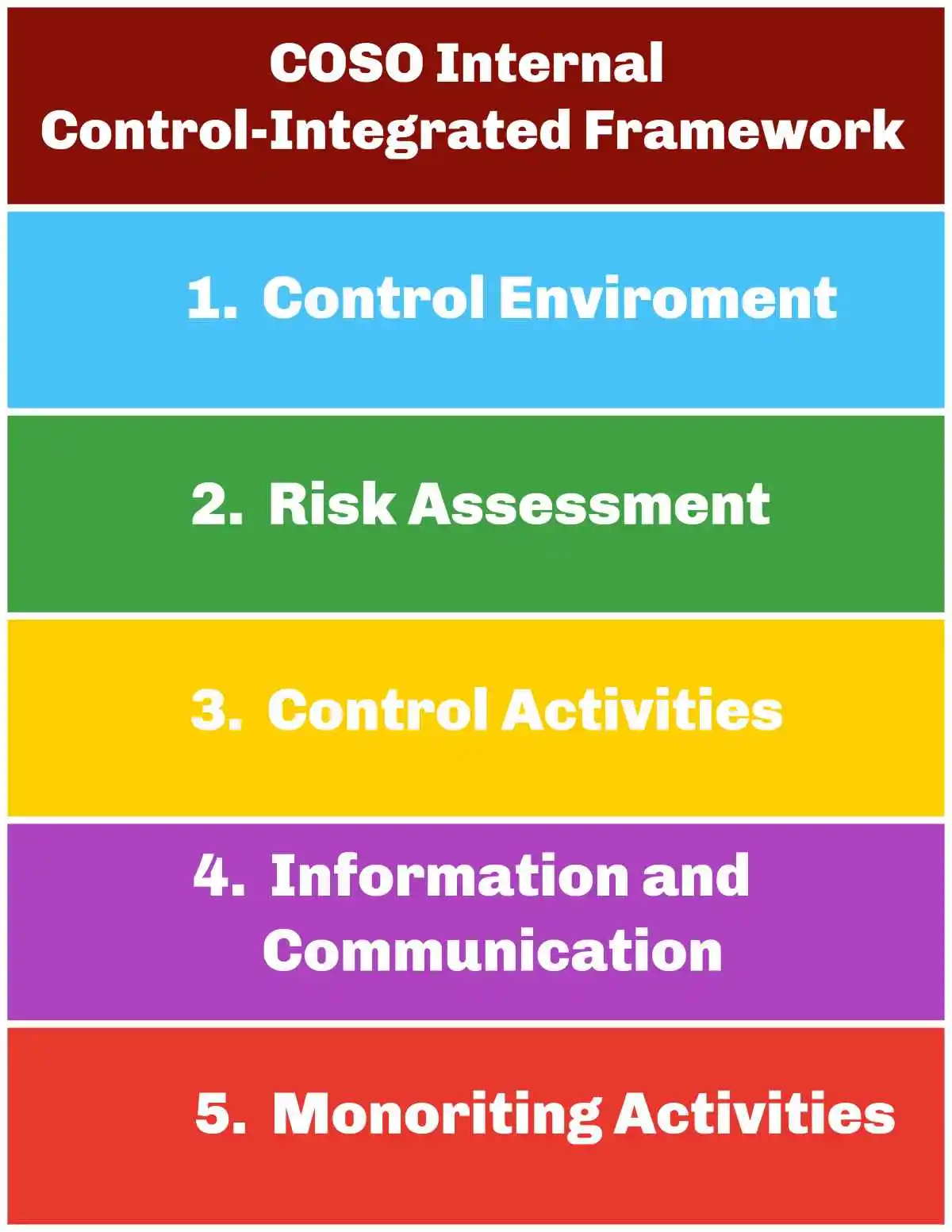

Internal Controls: The policies, procedures, and mechanisms that companies use to ensure the reliability of financial reporting, the efficiency of operations, and compliance with laws and regulations.

Accounting Fraud: Include fraudulent financial reporting, which manipulates financial financial statements to show a false picture of the company’s health

False Financial Reporting

- Overstating revenue: Recording revenue prematurely, for products not shipped, or for sales that didn’t happen (fictitious revenue).

- Understating expenses: Capitalizing normal operating costs instead of expensing them, or failing to record liabilities.

- Improper asset valuation: Overstating the value of assets or failing to write down impaired assets.

Manipulating accounting records:Falsifying or altering accounting records and supporting documents to misrepresent financial performance.

Misappropriation of assets

- Cash skimming: Stealing cash before it is recorded in the company’s booksFraudulent disbursements: Causing the company to issue payments for goods or services that were not received, often through fake invoices or shell companies.

- Inventory and supply theft: Stealing physical assets like inventory.

- Payroll fraud: Having ghost employees on the payroll or manipulating time sheets to steal wages.

- Bribery and corruption: Giving or receiving unearned rewards to influence business decisions or for unlawful gains.

Major types of accounting fraud include

- Overstating revenue: Companies can report nonexistent sales, record sales before they are final (channel stuffing or “bill-and-hold” schemes), or accelerate the recognition of future sales into the current period.

- Understating or unrecording expenses: This makes a company’s net income appear higher than it actually is. Tactics include delaying the recording of expenses to a future period, failing to record depreciation or asset impairments, or improperly capitalizing normal operating costs.

- Misstating assets and liabilities: This can involve overstating a company’s assets or understating its liabilities to improve the appearance of its financial health and liquidity.

- Asset misappropriation: The theft or misuse of a company’s assets by employees. This is one of the most common types of accounting fraud and can include stealing inventory or cash.

- Corruption: The misuse of one’s position for personal gain, which can include bribery, illegal kickbacks, or other schemes.

- Financial statement fraud: The intentional misrepresentation of a company’s financial statements to mislead investors and others. This can involve the overstatement or understatement of balances.

- Payroll fraud: A scheme where employees or employers illegally manipulate payroll systems for personal gain. This can include falsifying work hours, creating fictitious employees (“ghost payroll”), or improperly manipulating compensation rates.

This instructive guide will explore the key components of corporate governance frameworks, their significance, and practical considerations for investors.

Strong Corporate Governance Is the Backbone to Sucuess

Corporate Governance Frameworks: Are the backbone of any successful business. As an investor, understanding these frameworks is crucial for making informed decisions. They encompass the rules, practices, and processes by which companies are directed and controlled, ensuring that the interests of stakeholders are protected.

Structure: In today’s rapidly evolving business landscape, corporate governance frameworks are more significant than ever. They provide the structure through which the objectives of the company are set and provide the means of attaining those objectives and monitoring performance. As you delve into this guide, you will gain a deeper understanding of how these frameworks operate and their impact on your investments.

Common Financial Statement Fraud Schemes

Knowledge is Power

| Scheme Type | Description | Example |

|---|---|---|

| Fictitious Revenue | Recording non-existent sales | Counterfeit sales transactions, Bill and hold arrangements |

| Premature Revenue Recognition | Recording revenue before earned | Accelerating revenue before service delivery |

| Channel Stuffing | Forcing excess inventory to distributors | Shipping excessive product to boost quarterly sales |

| Asset Overstatement | Inflating asset values | Phantom inventory, inadequate depreciation |

| Liability Concealment | Hiding financial obligations | Unrecorded debt, understated warranty liabilities |

| Material Omissions | Withholding critical information | Undisclosed related party transactions |

| Journal Entry Manipulation | Falsifying accounting records | Last-minute entries near reporting deadlines |

For investors, knowledge of corporate governance and the types of business sghemes is not just an asset; it is a necessity. By understanding the intricacies of these frameworks, you can better evaluate the companies you are considering for investment, ensuring that they adhere to sound governance practices and are poised for long-term success.

The Importance of Corporate Governance in Modern Businesses

Role of Corporate Governance: The role of corporate governance in modern businesses cannot be overstated. It serves as a critical factor in the sustainability and ethical management of a company. Good governance practices ensure that a company is accountable and transparent to its shareholders, which in turn enhances its reputation and trustworthiness.

Robust Frameworks and Reduced Risks: As an investor, you should be aware that companies with robust corporate governance frameworks are less likely to encounter legal issues or financial scandals. This stability is vital in protecting your investments from unforeseen risks. Moreover, companies that prioritize strong governance often outperform their peers in terms of financial performance and market valuation.

Aligning Interests: Corporate governance is not just about compliance; it is about strategic management. It aligns the interests of management with those of shareholders, leading to better decision-making and resource allocation. Understanding this alignment can help you identify companies that are genuinely dedicated to achieving long-term growth and stability.

Key Components of Corporate Governance

Corporate Governance: Is built on a foundation of several key components that work together to ensure effective management and oversight.

These components include:

- Board of Directors: Responsible for making major decisions and overseeing the management team. A diverse and independent board can provide better oversight and reduce the risk of conflicts of interest.

- Shareholder Rights: Protection of shareholders’ interests is a priority, with mechanisms in place to ensure their voices are heard and respected in corporate decisions.

- Ethical Conduct: Companies must adhere to ethical standards, promoting integrity and fairness in their dealings.

- Transparency and Shareholder Interests: Understanding these components will allow you to assess the strength of a company’s corporate governance framework. Companies that excel in these areas are likely to be more resilient, transparent, and aligned with shareholder interests.

- Creating a Culture: Is also about creating a culture of accountability and responsibility. By fostering an environment where everyone, from the boardroom to the front lines, understands and commits to these principles, companies can achieve sustainable success.

Internal Controls: Safeguarding Assets and Ensuring Compliance

Internal Controls: Are a critical aspect of corporate governance frameworks. They are the systems and procedures put in place to ensure the integrity of financial and operational information, safeguarding assets, and ensuring compliance with laws and regulations.

Insight to Risk Management: As an investor, understanding a company’s internal controls can provide insight into its risk management strategies. Strong internal controls reduce the likelihood of fraud and financial misstatements, thereby protecting your investment. Companies with robust internal controls are better positioned to identify and mitigate risks before they escalate into significant issues.

Continuously Adapting Internal Controls: Internal controls require ongoing evaluation and enhancement. This dynamic nature means that companies must continuously adapt their controls to address emerging risks and changes in the regulatory environment. By staying informed about how companies manage their internal controls, you can make more informed investment decisions.

The Role of Transparency in Corporate Governance

Transparency: Is a cornerstone of effective corporate governance. It involves open and honest communication between a company and its stakeholders, ensuring that all parties have access to accurate and timely information. Transparency builds trust and confidence, essential for any successful business relationship.

Investor Transparency: Is crucial in evaluating the true performance and health of a company. Companies that prioritize transparency are more likely to provide clear insights into their operations, strategies, and financial performance. This openness allows you to make informed decisions based on a comprehensive understanding of the company’s position and prospects.

Transparency and Ethical Values: Transparency goes beyond financial disclosures; it includes the communication of strategic goals, risk management, and corporate governance practices. By valuing transparency, companies demonstrate their commitment to accountability and ethical behavior, which are vital for long-term success and investor confidence.

Accountability in Corporate Governance: Who is Responsible?

Corporate Governance Accountability: Is a fundamental principle of corporate governance, ensuring that individuals and entities are held responsible for their actions and decisions. It involves a system of checks and balances to maintain trust and integrity within an organization through risk management and effective internal controls.

Distinct Roles: Corporate governance, accountability extends to various stakeholders, including the board of directors, management, and shareholders. Each group has distinct responsibilities and is accountable for specific aspects of the company’s performance and governance practices. Understanding these roles will help you assess the effectiveness of a company’s governance framework.

Transparency: For you as an investor, accountability means that the company is committed to ethical practices and transparency, protecting your interests. Companies that uphold high standards of accountability are more likely to be responsive to shareholder concerns and adapt to changing market conditions, ensuring their long-term viability and success.

Effective Risk Management Strategies in Corporate Governance

Risk Management: Is a vital component of corporate governance frameworks. It involves identifying, assessing, and mitigating risks that could impact a company’s ability to achieve its objectives. Effective risk management strategies are essential for protecting your investments and ensuring the company’s long-term success.

Investor Risk Management: As an investor, you should look for companies that have comprehensive risk management processes in place. This includes risk assessment, monitoring, and mitigation strategies that are integrated into the company’s operations and decision-making processes. Companies with robust risk management are better equipped to navigate uncertainties and capitalize on opportunities.

Ongoing Risk Management: is not a one-time effort; it requires continuous evaluation and adaptation. Companies must stay vigilant and proactive in risk management and adjusting their strategies accordingly. By understanding a company’s approach to risk management, you can make more informed investment decisions and align your portfolio with your risk tolerance.

Trends in Corporate Governance Frameworks for 2025

As we approach 2025, several trends are shaping the future of corporate governance frameworks. Understanding these trends will help you anticipate changes and adapt your investment strategies accordingly.

- Increased Emphasis on ESG Factors: Environmental, Social, and Governance (ESG) factors are becoming integral to corporate governance. Companies are expected to prioritize sustainability and social responsibility, making ESG considerations a critical aspect of investment decisions.

- Technological Integration: The rise of digital technologies is transforming corporate governance. Companies are leveraging technology to enhance transparency, streamline processes, and improve risk management, offering new opportunities for investors.

- Regulatory Developments: As regulatory requirements continue to evolve, companies must adapt their governance practices to comply with new standards. Staying informed about these changes will help you assess a company’s ability to navigate the regulatory landscape.

By staying abreast of these trends, you can identify companies that are well-positioned to thrive in the future, ensuring that your investments align with emerging governance practices.

Best Practices for Implementing Corporate Governance Frameworks

Implementing effective corporate governance frameworks requires a commitment to best practices that promote transparency, accountability, and ethical behavior. As an investor, understanding these practices will help you evaluate the companies you consider for investment.

- Diverse and Independent Board: A diverse and independent board of directors enhances decision-making and reduces the risk of conflicts of interest, providing better oversight and strategic direction.

- Robust Internal Controls: Strong internal controls are essential for ensuring compliance and safeguarding assets. Companies should regularly assess and enhance their controls to address emerging risks.

- Clear Communication: Companies should prioritize transparency by providing clear and timely information to stakeholders, fostering trust and confidence.

By recognizing these best practices, you can identify companies that are committed to strong governance and are likely to deliver sustainable performance and value.

Corporate Scandals: The Result of Weak Corporate Governance

| Company | Year | Nature of Fraud | Financial Impact | Key Individuals | Legal/Regulatory Outcome |

|---|---|---|---|---|---|

Enron | 2001 | Off-balance sheet entities used to hide debt and toxic assets; revenue inflation through mark-to-market accounting; material omissions in financial disclosures | $74 billion in shareholder value destroyed; $67 billion in bankruptcy assets | Kenneth Lay (CEO), Jeffrey Skilling (CEO), Andrew Fastow (CFO) | Sarbanes-Oxley Act passage; Skilling sentenced to 24 years (later reduced); Lay convicted but died before sentencing; Arthur Andersen dissolved |

| WorldCom | 2002 | Capitalization of expenses improperly recorded $11 billion in operating expenses as capital expenditures; revenue recognition fraud through inflated revenues | $180 billion in investor losses; $107 billion bankruptcy (largest in US history until Lehman) | Bernard Ebbers (CEO), Scott Sullivan (CFO) | Ebbers sentenced to 25 years; Sullivan sentenced to 5 years after cooperation; $750 million SEC settlement |

Tyco | 2002 | Executive misappropriation of corporate funds; unauthorized bonuses; fraudulent accounting practices; $150 million in personal loans forgiven | $2.92 billion in unauthorized payments to executives; $900 million in shareholder value destruction | Dennis Kozlowski (CEO), Mark Swartz (CFO) | Kozlowski and Swartz sentenced to 8-25 years; $2.92 billion in restitution; $22.5 million SEC settlement |

| HealthSouth | 2003 | Income inflation through fictitious revenue entries; cookie jar reserves manipulation; overstatement of assets by $1.4 billion | $14 billion market value destruction; $2.7 billion accounting fraud | Richard Scrushy (CEO), Weston Smith (CFO), Bill Owens (CFO) | Scrushy acquitted on all 36 counts of accounting fraud (jury decision); later convicted of bribery charges; 5 CFOs received prison sentences; $100 million SEC settlement |

Lehman Brothers | 2008 | Repo 105 transactions to temporarily remove $50 billion of assets from balance sheet; material omissions in risk disclosures; liquidity misrepresentations | $691 billion bankruptcy (largest in US history); global financial crisis catalyst | Richard Fuld (CEO), Erin Callan (CFO) | No criminal charges filed; $90 million settlement for shareholder class action; major regulatory reforms through Dodd-Frank Act |

| Bernie Madoff Investment Securities | 2008 | Ponzi scheme claiming consistent returns through split-strike conversion strategy; fabrication of trading records and account statements | $64.8 billion in paper wealth destroyed; $17.5 billion in actual investor losses | Bernard Madoff (Chairman), Frank DiPascali (CFO) | Madoff sentenced to 150 years; creation of SEC Office of the Whistleblower; $7.2 billion settlement with Jeffry Picower estate |

Satyam Computer Services | 2009 | Cash inflation by $1.5 billion through falsified bank records; revenue overstatement through fictitious invoices; material omissions in disclosures | $2.2 billion in shareholder value destroyed; 77% stock price collapse | Ramalinga Raju (Chairman) | Raju sentenced to 7 years; $125 million SEC settlement; company eventually sold to Tech Mahindra |

| Theranos | 2015 | Material misrepresentations about blood testing technology capabilities; fabricated demonstrations; false revenue projections | $9 billion in valuation destroyed; $700 million in investor funds lost | Elizabeth Holmes (CEO), Ramesh Balwani (COO) | Holmes sentenced to 11.25 years; Balwani sentenced to 13 years; permanent SEC bar for Holmes; $500,000 civil penalty |

| Wells Fargo | 2016 | Account fraud through creation of 3.5 million unauthorized accounts; sales practice misrepresentations; cross-selling misrepresentations | $3 billion in fines and penalties; $70 billion in market capitalization loss | John Stumpf (CEO), Carrie Tolstedt (Head of Community Banking) | Stumpf banned from banking industry with $17.5 million penalty; $3 billion DOJ and SEC settlement; Federal Reserve asset cap imposed |

| Wirecard | 2020 | Balance sheet inflation through fictitious €1.9 billion in cash; revenue fabrication through round-trip transactions; material misrepresentations to auditors | €24 billion market value destroyed; €3.2 billion in debt outstanding at collapse | Markus Braun (CEO), Jan Marsalek (COO) | Braun in custody awaiting trial; Marsalek fugitive status; EY faces significant legal action; German financial regulatory reform |

| FTX | 2022 | Customer fund misappropriation; related party transactions without disclosure; material misrepresentations about reserves; token price manipulation | $8 billion in missing customer funds; $32 billion valuation destroyed | Sam Bankman-Fried (CEO), Caroline Ellison (Alameda CEO), Gary Wang (CTO) | Bankman-Fried sentenced to 25 years; Ellison and Wang pleaded guilty; $8.8 billion in restitution ordered; significant crypto regulatory proposals |

Market Impact After Major Corporate Scandals

Stock Price Impact After Fraud Disclosure

| Time Period | Average Stock Price Decline |

|---|---|

| Immediate Impact (1 Day) | 5-10% |

| Short-Term Impact (20 Days) | 12.3% |

| Companies with Settlements | 14.6-20.6% |

| Companies Later Cleared | 7.2% |

| Extreme Cases (e.g., Luckin Coffee) | 80%+ |

Conclusion: The Future of Corporate Governance

Corporate Governance: As we look toward the future, corporate governance frameworks will continue to evolve in response to changing market dynamics and stakeholder expectations. For investors, understanding these frameworks and their components is essential for making informed decisions and protecting your investments.

Shaped by Technology: The future of corporate governance will be shaped by trends such as ESG integration, technological advancements, and regulatory developments. By staying informed and adapting your investment strategies, you can capitalize on these changes and ensure that your portfolio aligns with best-in-class governance practices

Informed Investments: As you navigate the complexities of corporate governance, remember that knowledge is your most valuable asset. By understanding the principles and practices that drive effective governance, you can make informed investment decisions that contribute to long-term success. Now is the time to deepen your understanding of corporate governance frameworks and position yourself for a prosperous future.

FREQUENTLY ASKED QUESTIONS

What constitutes effective corporate governance?

Corporate governance encompasses the comprehensive framework of rules, practices, and processes that direct and control a corporation. Effective corporate governance balances the interests of stakeholders including shareholders, management, customers, suppliers, financiers, government, and the community. At its core, strong governance requires four fundamental elements: accountability, transparency, fairness, and responsibility. The structure establishes clear decision-making processes, authority limits, and oversight mechanisms designed to create long-term shareholder value while protecting stakeholder interests.

How does board composition impact corporate governance?

Board composition represents a critical determinant of corporate governance effectiveness and directly correlates with corporate performance. Research demonstrates that boards with diverse expertise, backgrounds, and perspectives make superior strategic decisions. A 2023 McKinsey study found that companies in the top quartile for gender diversity on executive teams were 25% more likely to experience above-average profitability.

Effective boards balance industry expertise with functional specialization across finance, technology, marketing, and risk management. Additionally, independence requirements ensure objective oversight—NYSE and NASDAQ mandate that a majority of board members qualify as independent directors without material relationships to the company.

What are the primary fiduciary duties of corporate directors?

Corporate directors operate under two fundamental fiduciary obligations:

- Duty of Care: Requires directors to exercise reasonable diligence and informed judgment when making decisions. Directors must review relevant information, ask probing questions, consult appropriate experts, and document their decision-making processes.

- Duty of Loyalty: Mandates that directors act in the best interest of the corporation and its shareholders, not their personal interests. This duty prohibits self-dealing, usurpation of corporate opportunities, and undisclosed conflicts of interest.

These duties establish the legal foundation for director liability. Delaware courts, which govern most public company jurisprudence, have established the Business Judgment Rule as a presumption that directors acted on an informed basis and in good faith—a presumption that plaintiffs must overcome to establish liability.

What specialized committees typically exist within corporate boards?

Effective boards organize specialized committees to provide focused oversight in critical areas:

- Audit Committee: Oversees financial reporting integrity, internal controls, and external auditor relationships. Sarbanes-Oxley mandates this committee comprise solely independent directors with at least one designated financial expert.

- Compensation Committee: Determines executive compensation structures, incentive plans, and performance metrics. This committee must maintain independence to prevent conflicts in setting executive pay.

- Nominating/Governance Committee: Evaluates board composition, identifies director candidates, establishes governance policies, and conducts board assessments.

- Risk Committee: Increasingly common, particularly in financial institutions, this committee oversees enterprise risk management systems and risk appetite frameworks.

- ESG Committee: Emerging as a dedicated committee to monitor environmental, social, and governance practices as these factors gain investor prominence.

\Each committee operates under a formal charter defining its responsibilities, membership requirements, and reporting obligations.

How has SEC regulatory oversight evolved regarding corporate governance and board responsibilities?

SEC regulatory oversight of corporate governance for board functions has intensified substantially, creating new disclosure obligations and compliance requirements. Significant developments include:

- Expanded proxy disclosure requirements detailing board diversity characteristics, skills matrices, and refreshment policies

- Human capital management disclosure mandates covering workforce demographics, compensation practices, and development programs

- Pay-versus-performance disclosure rules requiring detailed analysis of executive compensation relative to financial performance metrics

- Rule 10b5-1 amendments establishing cooling-off periods and certification requirements for executive trading plans

- Regulation S-K modernization requiring principles-based disclosures of material risks and governance practices

- Clawback rules requiring recovery of erroneously awarded incentive compensation following accounting restatements

- Universal proxy card requirements for contested director elections\

These evolving requirements necessitate more robust board oversight of disclosure controls and procedures, with particular attention to forward-looking statements and risk factor discussions.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action lawsuits, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors