Introduction to Securities Fraud Class Actions in Crypto

Securities fraud class actions have reached new heights in market capitalization losses. The Maximum Dollar Loss Index jumped to $1.85 trillion in the first half of 2025. This shows a massive 154% rise from the second half of 2024. These numbers reveal how securities class action lawsuits now play a bigger role in the digital asset space.

The Disclosure Dollar Loss Index also climbed to $403 billion during this time. This marks a 56% jump from the previous six months. Mega filings with losses of at least $5 billion for disclosure dollar loss or $10 billion for maximum dollar loss made up most of the total losses. They factored in 83% of disclosure losses and 91% of maximum losses.

The cryptocurrency securities litigation map has altered a lot lately. Federal cases dropped to 108 in the first half of 2025, showing a yearly decrease compared to 2024. The average settlement value rose to $56 million through the first half of 2025. This stands as the highest figure since 2016 when adjusted for inflation.

Crypto-related securities class action lawsuits show a different pattern. Only eight cases were filed in 2024, down from 14 cases in 2023, 23 cases in 2022, 12 cases in 2021, and 13 cases in 2020. The legal world of digital assets now faces a crucial turning point in 2025. Several key cases could revolutionize how these assets are governed, traded, and regulated across the United States.

- The number of filings in the Consumer Non-Cyclical sector increased by 31% in 2025 H1 relative to 2024 H2, largely driven by a surge in Biotechnology and Pharmaceutical filings.

- Mega filings accounted for the vast majority of total MDL and total DDL (91% and 83%, respectively), significantly above the 1997–2024 semiannual averages.

- The count of mega DDL filings (15) in 2025 H1 was three times the 1997–2024 semiannual average (five) and between the number of mega DDL filings in 2024 H2 (17) and 2024 H1 (10).

- The number of core filings in the Second and Ninth Circuits decreased by nearly one-fifth from 2024 H2 to 2025 H1 but still accounted for 69% of total DDL.

- The likelihood of a core filing against a U.S. exchange-listed company is on pace to decrease slightly to an annualized rate of 3.8%.

- Core federal filings against non-U.S. issuers as a percentage of total core federal filings in 2025 H1 was 11%, reaching a 15-year low.

2025 Filing Trends in Securities Class Actions

Federal securities class action lawsuits show unique filing patterns throughout 2025. The cryptocurrency and digital asset spaces saw dramatic quarterly changes that reshaped the scene.

Q1 vs Q2 Filing Volume Comparison

Securities class actions in 2025’s first half painted an interesting picture. Q1 filings hit a five-year peak with 65 cases. Q2 numbers dropped to a five-year low with only 43 cases. This pattern completely flips 2024’s trend where Q2 numbers were higher than Q1.

The first six months of 2025 saw 108 federal securities class action cases. Year-end projections suggest around 216 total cases – just below 2024’s 229 filings. The sharp 33% drop from Q1 to Q2 could hint at new litigation strategies or changing market conditions.

NERA Economic Consulting data shows Rule 10b-5 filings make up most federal securities class actions this year. These anti-fraud rules are the foundations of securities litigation, while other filing types hit multi-year lows.

Core vs M&A-Related Filings Breakdown

Securities class action filings show a big move away from merger-related cases toward core securities fraud claims:

- Core filings (excluding M&A cases): 111 cases in H1 2025

- M&A-related filings: Only 3 cases in H1 2025

- Cryptocurrency unregistered securities filings: 5 cases in H1 2025

Core filings in H1 2025 are a big deal as it means that they exceeded the 1997-2024 historical semiannual average of 97. Traditional securities fraud litigation keeps dominating despite fewer overall cases. The proportion of substantial securities fraud cases has grown even as total numbers dipped slightly.

Health and Technology Services sector’s filing percentages climbed in 2025 after dropping in 2023. Electronic Technology and Technology Services sectors helped push these categories beyond half of all filings.

Historical Average vs 2025 Filing Rates

The numbers tell an interesting story when we look at 2025 against past trends. H1 2025 saw 114 total securities class action filings, including state court cases. These numbers match H2 2024’s 115 filings and the 1996-2024 historical semiannual average of 113.

Projections show about 4% of major U.S. exchange-listed companies might face securities class action lawsuits in 2025. This matches 2024’s rate but tops 2023’s 3.3%. The expected 4% rate stays under the 2011-2024 yearly average of 5%.

Filing locations stick to their usual spots:

- Second and Ninth Circuits lead but show lower yearly numbers

- Third Circuit’s cases tripled, mostly from biotech and pharmaceutical suits

- Eleventh Circuit also saw more filings

Consumer Non-Cyclical sector grew the most with 31% more filings in H1 2025 compared to H2 2024. Biotech and pharmaceutical companies drove this increase. Consumer Cyclical sector went the other way, dropping from sixteen to just six cases.

Characteristics

- Insulation from economic cycles: Consumer staples companies produce necessities, so demand for their products and services remains relatively stable even during a recession.

- Predictable revenue and earnings: Because of consistent demand, these companies typically have more reliable earnings, cash flows, and dividends compared to cyclical companies.

- Lower volatility: Their share prices are generally less volatile than cyclical stocks and are often called “defensive stocks” because they provide stability during market uncertainty.

- Conservative growth: While they offer stability, consumer non-cyclical stocks typically do not experience the explosive growth seen during economic expansions.

Examples of companies in the sector

- Food and beverages: Companies like PepsiCo, Coca-Cola, and General Mills.

- Household and personal products: Companies like Procter & Gamble (P&G), Kimberly-Clark, and Colgate-Palmolive.

- Food and staples retailing: Supermarket chains and big-box retailers such as Walmart and Costco.

- Tobacco: Companies like Philip Morris and Altria Group.

Role in an investment portfolio

- Hedge against downturns: Adding consumer non-cyclical stocks to a portfolio can help temper losses during a bear market, balancing the performance of more sensitive, cyclical holdings.

- Diversification: The inclusion of both cyclical and non-cyclical stocks can provide balance and diversification, which helps to manage risk as the economy moves through its different cycles.

- Income generation: For investors seeking a steady income stream, the consistent and often high dividend yields of many consumer staples companies are a key benefit.

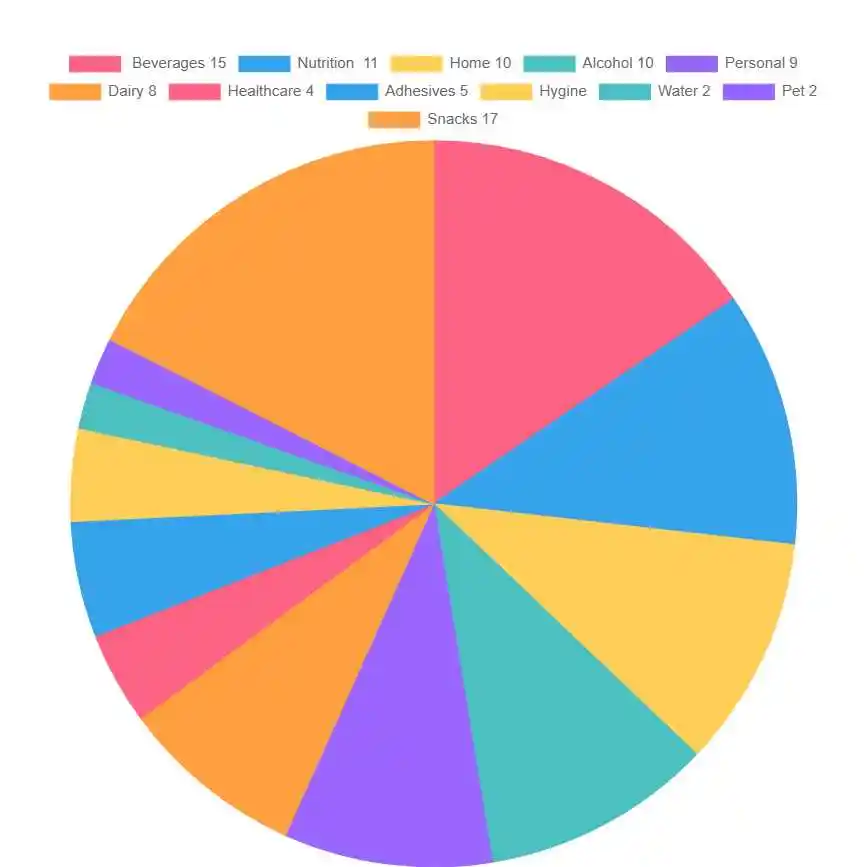

Consumer Staples Category Exposures

Rise of Cryptocurrency Litigation in Securities Fraud

Securities fraud class actions look quite different now as new technologies alter filing patterns in 2025. Traditional litigation areas have taken a back seat while cases involving new technologies now lead the securities class action docket.

12 AI-Related Cases Filed in H1 2025

Artificial intelligence-related securities litigation saw a big jump in the first half of 2025. Plaintiffs filed 12 cases that claimed AI-related disclosure violations. This is a big deal as it means that AI cases will likely surpass the 2024 total of 15 cases. These cases now make up a larger slice of all securities class actions, showing how investors worry about companies’ AI disclosures.

The cases landed in these locations:

- California became the top choice with six total filings (four in Northern District, two in Central District)

- New York, Illinois, New Jersey, Washington and Idaho split the rest

- Courts haven’t resolved any of the 12 AI-related filings from H1 2025

Plaintiffs’ lawyers picked these locations carefully to get favorable precedents or find judges who know technology cases well.

Crypto Securities Class Actions Nearly Match 2024 Total

Cryptocurrency-related securities class actions grew faster in 2025. Cornerstone Research counted six cryptocurrency-related filings in the first half, while NERA Economic Consulting found eight. Both numbers almost match or equal the full 2024 total of seven or eight cases.

Crypto securities cases could double in 2025 compared to 2024. This jump comes as the SEC changes how it handles crypto companies. Private investors seem to step in with class actions where regulators leave gaps.

These crypto cases show clear patterns:

- New York leads with three cases (two in Southern District, one in Eastern District)

- Virginia, Georgia, and Florida share the other cases

- None of the six cryptocurrency cases from H1 2025 have wrapped up yet

Legal claims in these cases usually fall into two groups:

- Claims about unregistered securities breaking Sections 5 and 12(a)(1) of the Securities Act for token offerings

- Claims about false statements breaking Section 10(b) of the Exchange Act and Rule 10b-5 regarding crypto disclosures

One case targeted a gaming company that raised millions through NFT sales marketed as investments. Another went after a bitcoin investment firm that allegedly pumped up profits while downplaying risk.

Decline in COVID-19-Related Filings

While crypto and AI cases grow, COVID-19 securities cases keep dropping. Companies talk less about pandemic issues, so investors file fewer claims. NERA Economic Consulting found just two COVID-related filings in H1 2025. This category will hit its lowest yearly total since COVID began.

Businesses now focus less on pandemic operations and more on tech breakthroughs. The drop in COVID-19 cases matches both the rise in AI and crypto cases and fewer special purpose acquisition company (SPAC) related filings.

NERA counted four SPAC-related filings in H1 2025. This points to lower yearly totals than before. All the same, Cornerstone Research noted that yearly SPAC filings might end up close to 2024’s numbers. This area stays active but doesn’t dominate like before.

Securities class action plaintiffs adapt faster to market changes and new cryptocurrency disclosure practices. They have moved from pandemic and SPAC cases to focus more on technology issues.

Types of Defendants in 2025 Crypto Class Actions

The scope of cryptocurrency litigation has expanded in 2025. Securities fraud class actions now target many different players in the digital asset world. Court filings show clear patterns in how plaintiffs go after various industry participants.

Crypto Exchanges: Coinbase Global, Inc.

Legal challenges keep piling up for Coinbase throughout 2025, as multiple securities class actions hit courts across jurisdictions. Shareholder Wenduo Guo filed a federal complaint in New Jersey this February. The complaint accused the exchange of hiding that customer’s assets could become part of Coinbase’s bankruptcy estate, which would make retail customers unsecured creditors. More cases surfaced in May about biometric privacy violations in Illinois:

- Plaintiffs Scott Bernstein, Gina Greeder and James Lonergan claimed the exchange’s “wholesale collection” of faceprints violated the Biometric Information Privacy Act

- The lawsuit pointed out Coinbase’s failure to “publicly provide a retention schedule or guidelines for permanently destroying Plaintiffs’ biometric identifiers”

The situation got worse when Coinbase revealed a data breach on May 15. Cybercriminals had bribed overseas support agents to leak customer data, which triggered at least six lawsuits within days. Original remediation estimates ranged between $180 million and $400 million. Investor Brady Nessler stated on May 22 that the breach caused “significant losses and damages” for stockholders.

NFT Issuers: Dolce & Gabbana USA Inc.

Dolce & Gabbana USA Inc.’s case offers valuable insights into NFT-related securities litigation. The company won a complete dismissal of all 12 claims in a putative class action that challenged its digital NFT program. The lawsuit had pushed forward “a novel and meritless theory that NFT offerings constituted securities”.

The complaint, filed on May 16, 2024, claimed Dolce & Gabbana and NFT marketplace UNXD Inc. created the “DGFamily” digital asset project by exploiting the fashion brand’s popularity. Plaintiff Luke Brown described the NFT sale as a “fraudulent and manipulative scheme” that enriched defendants after they made “false and materially misleading statements” about value and benefits. The court threw out the case with prejudice on July 11, 2025.

Meme Coin Promoters: Caitlyn Jenner and OverHere Limited

Meme coin cases emerged as their own category in 2025, with celebrity promoters in the spotlight. Caitlyn Jenner faced a class action lawsuit over her self-titled memecoin ($JENNER), but a California federal judge dismissed it due to lack of U.S. jurisdiction.

The lawsuit claimed Jenner and business partner Sophia Hutchins:

- Offered and sold unregistered securities without SEC registration

- Made mmaterially false statements regarding profitability and value

- Failed to disclose associated risks including regulatory concerns

British investor Lee Greenfield lost over $40,000 on the JENNER token. The token’s market cap plummeted from nearly $7.5 million to around $170,000. Notwithstanding that, Judge Stanley Blumenfeld Jr. ruled the suit could not prove how token purchases happened in the U.S., which meant no jurisdiction.

Crypto Miners: Hut 8 Corp. and Iris Energy Limited

Crypto mining companies face unique securities allegations about operational misrepresentations. Hut 8 Corp. moved to dismiss a class-action lawsuit on December 2. The company said the case stemmed from a short-seller report trying to “sink Hut 8’s stock for its own gain”. Hut 8’s stock price has recovered fully, jumping about 300% since the report came out.

Iris Energy Limited battles ongoing litigation about ooverstating its data center and high-performance computing potential. The lawsuit states Iris Energy:

- Misrepresented itself as an HPC “data center play” rather than simply a bitcoin miner

- Failed to disclose material deficiencies in its Childress County, Texas site

- Lacked adequate power redundancy, cooling systems, and fiber connectivity for AI applications

These allegations hit hard, and Iris Energy’s shares dropped 15% to $11.20 on July 11, 2024.

Legal Allegations in Crypto Securities Class Actions

Legal theories in crypto-related litigation reveal distinct patterns that plaintiffs use against cryptocurrency entities. These allegations focus on three main types of securities law violations that are the foundations of most cryptocurrency securities class actions.

Section 10(b) and Rule 10b-5 Anti-Fraud Claims

Anti-fraud provisions under Section 10(b) of the Exchange Act and Rule 10b-5 serve as the basis for many cryptocurrency securities fraud allegations. Rule 10b-5 stops any “device, scheme, or artifice to defraud” or making “any untrue statement of a material fact” in securities transactions. Plaintiffs must prove several key elements to win these claims:

- Material misrepresentation or omission by the defendant

- Scienter (intent to deceive, manipulate, or defraud)

- Connection between the misrepresentation and security purchase/sale

- Reliance on the misrepresentation

- Economic loss resulting from the misrepresentation

Courts have made it clear that scienter requirements go beyond mere negligence but do not reach strict liability. Plaintiffs often claim that companies made knowingly false statements about token utility, platform security, or regulatory compliance in cryptocurrency cases. The Ninth Circuit has emphasized that marketing slogans alone will not trigger these provisions without looking at the “total mix” of information available to reasonable investors.

Unregistered Securities Sales under Sections 5 and 12(a)(1)

Unregistered securities claims are the life-blood of cryptocurrency litigation. Section 5 of the Securities Act bans unregistered securities sales, while Section 12(a)(1) lets private parties sue for such violations.

The Tezos case settlement of $25 million in 2020 was a soaring win as “the largest recovery ever in a cryptocurrency class action” and “one of the first to assert that a cryptocurrency issuer had violated the federal securities laws by failing to register an initial coin offering”. SEC Chair Gensler believes that “the vast majority of crypto assets” are securities that need registration.

The “statutory seller” requirement restricts who can face lawsuits under Section 12(a)(1):

- Direct sellers who pass title to the plaintiff

- Persons who successfully solicit purchases motivated by financial interests

Courts disagree on what “solicitation” means in digital assets. Some jurisdictions need “direct and active participation” in solicitations with “direct contact between the seller and purchaser”. The Eleventh and Ninth Circuits suggest that social media ads might be enough.

Control Person Liability under Section 20(a)

Control person liability extends beyond primary violators to those with control relationships. Section 20(a) of the Exchange Act states that anyone controlling a person liable for securities violations “shall be liable jointly and severally with and to the same extent” as the controlled person.

Plaintiffs must prove two things to establish control person liability:

- A primary violation of securities laws

- The defendant’s control over the primary violator

The Second and Third circuits also need plaintiffs to show “culpable participation” in the violation. Parent companies often face these claims for their subsidiaries’ actions. The SEC’s case against Coinbase shows this, where they tried to hold Coinbase Global Inc. liable as a control person for Coinbase Inc.’s alleged securities law violations.

Control person liability differs from primary claims by offering an escape route: defendants can avoid liability if they prove they “acted in good faith and did not directly or indirectly induce” the violation. Defendants usually start their defense by trying to disprove the primary violation.

The circuit split on solicitation

- Restrictive interpretation: The Second, Third, and Fifth Circuits have generally required a showing of “direct” and “active” participation in the solicitation, suggesting a higher bar for liability. Courts in these jurisdictions have dismissed Section 12 claims against defendants whose communications did not directly target the purchaser.

- Broad interpretation: The Ninth and Eleventh Circuits, however, have taken a more expansive view of what qualifies as solicitation.

- Ninth Circuit: In Pino v. Cardone Cap., LLC (2022), the Ninth Circuit reversed a district court’s decision, holding that mass communications via social media and videos can constitute solicitation under Section 12(a)(2). The court found no requirement that the solicitation be targeted at a specific plaintiff.

- Eleventh Circuit: Similarly, in Wildes v. BitConnect Int’l PLC (2022), the Eleventh Circuit held that online videos promoting a cryptocurrency could qualify as solicitation. The court noted that sellers should not be able to evade liability simply by choosing a method of mass communication instead of direct communication with individuals.

Why the conflict exists

- The Supreme Court’s definition of “statutory seller” was articulated in an era before social media and the widespread use of mass digital communication.

- Courts following a more restrictive view emphasize the Pinter ruling’s focus on a “buyer-seller relationship not unlike traditional contractual privity”.

- Conversely, circuits with a broader view emphasize that the Securities Act is meant to be flexible and cover any “means” of “communication,” including modern technology.

Implications for digital assets

- The same promotional activity, such as posting a social media video, could expose a person to Section 12 liability in some parts of the country while not in others.

- Given the potentially “outcome-determinative” nature of jurisdiction at the pleading stage, the location where a case is filed becomes a crucial strategic consideration.

- Until the Supreme Court or Congress provides clearer guidance, the legal risks associated with promoting digital assets through mass communication will remain inconsistent.

Market Impact: Token and Share Price Declines

Price volatility is a key feature of cryptocurrency securities litigation. Digital assets tend to drop more sharply than traditional securities when regulators make announcements or legal challenges emerge.

Future FinTech Group Inc.: 20.93% Drop

Future FinTech Group Inc. shows how regulatory actions can trigger immediate market reactions. The company’s stock took a steep dive of 20.93% after the SEC charged CEO Shanchun Huang with alleged fraud and disclosure failures. Reuters noted that shares dropped about 17% in after-hours trading right after the news broke. This sharp decline shows why securities fraud class actions often follow big market moves that can hurt investors.

Coinbase: 5.52% Drop Post-FCA Announcement

Coinbase Global, Inc. felt similar market pressure after regulators stepped in. The Financial Conduct Authority’s fine announcement led to:

- A 5.52% stock price drop, falling $13.52 to close at $231.52 that day

- Further decline in trading, with an extra 3.23% drop by May 23

The exchange also dealt with investor worries about a customer data breach that could cost between $180 million and $400 million. These regulatory and security issues show how cryptocurrency litigation can create mounting financial pressure.

NFT and Meme Coin Losses: 90–99% Declines

The most dramatic cases involve NFT and meme coin investments targeted by securities class actions:

- Dolce & Gabbana NFTs crashed from $6,000 to $200, a 96.67% value wipeout

- Midnight Hub NFT project tokens lost 99% of their value

- Caitlyn Jenner’s meme coin ($JENNER) fell 99% from its peak

- OverHere Limited’s $HAWK meme coin dropped more than 90% from its highest point

These percentage drops are nowhere near what we see in traditional securities litigation cases. Such extreme swings create higher litigation risks for cryptocurrency companies and make it harder to calculate damages in securities fraud class actions with digital assets.

Mega Filings and Financial Risk Concentration

Securities fraud class actions in 2025 showed remarkable financial concentration. Mega-sized cases dominated the risk landscape. These largest litigation matters now make up most of the potential investor losses.

83% of Disclosure Losses from Mega Filings

Mega filings with losses of $5 billion or more have become the driving force in securities litigation:

- These large cases made up 83% of total disclosure losses during the first half of 2025

- The Disclosure Dollar Loss (DDL) Index reached $403 billion in 2025 H1. This marks a 56% jump from the previous six months

- These numbers are well above historical averages, which signals a new reality in litigation risk

91% of Maximum Dollar Losses from Top Cases

The concentration of potential damages looks even more striking in terms of maximum dollar losses:

- Major cases generated 91% of maximum dollar losses in early 2025

- The Maximum Dollar Loss (MDL) Index jumped to $1.85 trillion. This shows a dramatic 154% rise from late 2024

- MDL has stayed above its historical average of $622 billion for eight straight periods

Consumer Non-Cyclicals: 62% of Total Disclosure Losses

Key sectors felt significant financial effects throughout 2025:

- Consumer non-cyclical companies took 62% of total disclosure losses but represented only 44% of core filings

- This sector saw filings increase by 31% compared to late 2024

- Biotech and pharmaceutical litigation led this uptick as companies faced closer scrutiny

Class action plaintiffs’ firms seem to target high-value companies more often. These cases offer bigger recoveries that justify major litigation investments.

Conclusion

Cryptocurrency securities fraud class actions have changed dramatically throughout 2025. Our analysis of data and trends reveals several key developments:

• The financial effects of securities fraud class actions reached new heights, with market capitalization losses hitting $1.85 trillion in the first half of 2025.

• Quarter-to-quarter filing numbers showed extreme swings. First quarter filings reached a five-year peak while second quarter numbers dropped to a five-year low.

• Mega filings now control the risk landscape. These cases make up 83% of total disclosure losses and 91% of maximum dollar losses, creating a new pattern in securities litigation concentration.

• Cryptocurrency and AI-related cases grew at a high rate. COVID-19 related filings kept declining, showing how market priorities have changed.

• Legal claims focused on three main areas: Section 10(b) and Rule 10b-5 anti-fraud claims, unregistered securities sales under Sections 5 and 12(a)(1), and control person liability under Section 20(a).

• Digital assets face steeper price drops than traditional securities when hit with regulatory actions or legal challenges. This magnifies their litigation risks.

• Consumer non-cyclical companies took 62% of total disclosure losses while making up only 44% of core filings. This shows a heavy concentration in one sector.

The rise of cryptocurrency securities litigation shows how plaintiffs adapt their strategies faster to match market changes. Technology-focused cases took center stage in 2025 as pandemic and SPAC litigation faded away. On top of that, average settlement values jumped higher, raising the stakes for everyone involved.

Digital asset litigation has reached a turning point. Many groundbreaking cases will alter the regulatory map for years ahead. Courts will set precedents through these legal battles to define how cryptocurrencies, NFTs, and other digital assets work within existing securities frameworks. Companies in this space must watch their regulatory compliance and disclosure practices as this legal field keeps changing at an incredible pace.

Key Takeaways

Securities fraud class actions in cryptocurrency are reshaping digital asset regulation through unprecedented financial impacts and evolving legal precedents that will define the industry’s future.

• Record-breaking financial losses: Securities fraud class actions generated $1.85 trillion in market cap losses during H1 2025, marking a 154% increase from the previous period.

• Crypto litigation surge: Cryptocurrency-related securities cases nearly doubled in 2025, with six filings in H1 alone matching most of 2024’s total annual cases.

• Mega cases dominate: Just a handful of large cases account for 83% of disclosure losses and 91% of maximum dollar losses, creating extreme risk concentration.

• Three primary legal theories: Most crypto securities cases rely on Section 10(b) anti-fraud claims, unregistered securities violations, and control person liability allegations.

• Extreme price volatility: Digital assets face catastrophic declines of 90-99% following legal challenges, far exceeding traditional securities’ typical losses.

The cryptocurrency industry faces an unprecedented wave of securities litigation that’s fundamentally reshaping how digital assets are regulated, traded, and governed. Companies in this space must prioritize regulatory compliance and transparent disclosure practices as courts establish binding precedents through these watershed cases.

FAQs

Q1. What are the main types of legal claims in cryptocurrency securities class actions? The three primary types of legal claims are: anti-fraud claims under Section 10(b) and Rule 10b-5, unregistered securities sales violations under Sections 5 and 12(a)(1), and control person liability claims under Section 20(a).

Q2. How have cryptocurrency-related securities class action filings changed in 2025? Cryptocurrency-related securities class action filings have nearly doubled in 2025 compared to 2024, with six filings in just the first half of 2025 matching or exceeding the total for all of 2024.

Q3. What impact do securities fraud class actions have on cryptocurrency prices? Cryptocurrencies typically experience severe price declines following legal challenges or regulatory actions, often seeing drops of 90-99% in value, which is far more extreme than losses seen with traditional securities.

Q4. Which sectors are most affected by securities fraud class actions in 2025? Consumer non-cyclical companies, particularly in the biotechnology and pharmaceutical industries, have been disproportionately affected, accounting for 62% of total disclosure losses despite comprising only 44% of core filings.

Q5. How significant are “mega filings” in recent securities fraud class actions? Mega filings, defined as cases involving losses of $5 billion or more, have become dominant in securities litigation, accounting for 83% of total disclosure losses and 91% of maximum dollar losses in the first half of 2025.

Contact Timothy L. Miles Today for a Free Case Evaluation About Securities Class Action Lawsuits

If you need reprentation in securities class action lawsuits, call us today for a free case evaluation. 855-846-6529 or tmiles@timmileslaw.com (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: tmiles@timmileslaw.com

Website: www.classactionlawyertn.com

Visit Our Extensive Investor Hub: Learning for Informed Investors