LAW OFFICES OF TIMOTHY L. MILES

TIMOTHY L. MILES

(855) TIM-M-LAW (855-846-6529)

[email protected]

(24/7/365)

The landscrape for securities class action lawsuits in 2024 exhibited notable shifts in filing patterns, with significant implications for issuers, investors, and market participants. This comprehensive analysis examines the quantitative and qualitative aspects of securities litigation activity, with particular focus on trend-related filings, sector-specific developments, litigation probabilities, and financial impact metrics.

The data reveals material increases in certain categories of litigation while others experienced substantial declines, resulting in a reconfiguration of the securities class action environment that warrants careful consideration by all stakeholders in the capital markets.

As noted below, after sucessive drops in the number of filings from 2019-2022, fileing rose in 2024 for the second straight year.

The total settlement amount reached for securities class actions in 2025 was $4.1 billion, which represens the highest annual figure in securities class action history. Below you will find detailed information on securities class action settlements as well as additional filing information.

The consumer non-cyclical sector experienced a notable increase in securities class action activity, with filings rising from 54 in 2023 to 67 in 2024. This 24 percent increase was substantially driven by heightened securities litigation targeting biotechnology companies. The concentration of filings in this sector merits particular attention, as non-cyclical stocks—characterized by relatively consistent demand patterns regardless of economic conditions—have historically been perceived as less susceptible to certain types of securities litigation.

The surge in biotechnology-related filings may reflect increased scrutiny of clinical trial results, regulatory interactions, or product development timelines, particularly as these companies navigate complex approval processes and face significant market expectations. This trend underscores the importance of rigorous disclosure practices and risk management protocols for companies operating in this sector, notwithstanding their relative insulation from economic cyclicality to avoid securities class action lawsuits.

Filings by Industry

In summary, AI and COVID-19-related core filings increased in 2024, while filings related to SPACs, cryptocurrency, and cybersecurity experienced a decline.

After seeeing an altime low of 333 filings with an accompaning deriviative action, filings shot back up for 2024 with 45 filings with an accompaning deriviative action compared to 42 filings withouot an accompaning deriviative action:

The likelihood of a U.S. exchange-listed company becoming the subject of a core federal filing increased from 3.2 percent in 2023 to 3.9 percent in 2024, representing a material increase in litigation risk for the average public company. This elevated probability suggests a broader targeting of alleged securities violations across the market and potentially signals increased scrutiny of corporate disclosures and representations.

Conversely, S&P 500 companies experienced a one percentage point decrease in litigation probability, declining from 7.1 percent to 6.1 percent. This divergence between large-cap and broader market litigation rates may indicate a shift in plaintiff focus toward smaller or mid-cap issuers, potentially reflecting perceived vulnerabilities in disclosure practices or corporate governance structures among these companies.

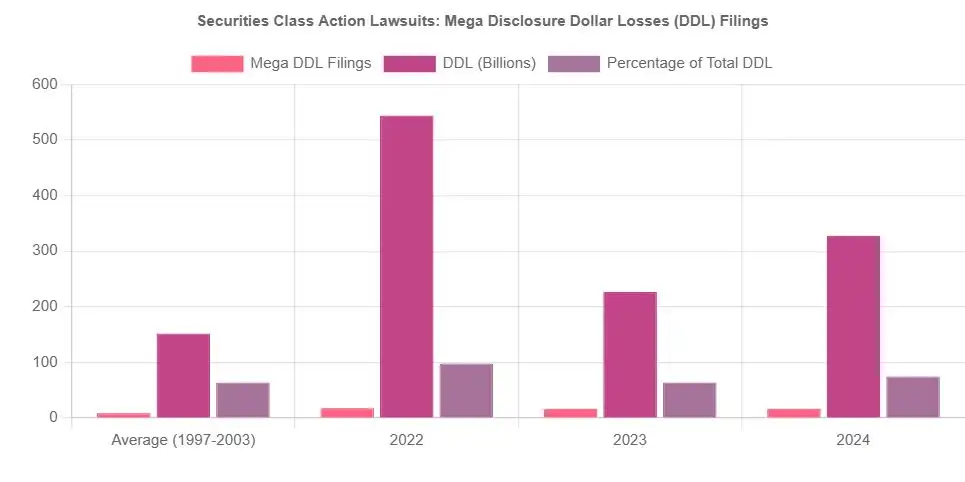

The Disclosed Dollar Loss (“DDL”) metrics for 2024 reveal significant developments in the magnitude of securities litigation. The number of mega DDL filings—defined as those with at least $5 billion in alleged losses—reached an unprecedented 27 cases in 2024, establishing a new historical record. The total DDL index value ranked as the third highest on record, underscoring the substantial financial stakes involved in contemporary securities litigation.

Particularly notable is the dramatic increase in average DDL, which reached $438 million in 2024—a figure nearly double the historical average of $237 million observed from 1997 to 2023. This substantial elevation in average loss allegations signals a potential shift toward cases involving more significant market capitalization impacts or more aggressive loss quantification methodologies by plaintiffs.

For Corporate Issuers: The increased probability of being subject to a securities class action, coupled with the rising magnitude of alleged losses, necessitates enhanced risk management protocols, particularly regarding public disclosures related to emerging technologies, pandemic impacts, and product development timelines. Companies in the biotechnology sector face particularly elevated litigation risk and should implement corresponding risk mitigation strategies.

For Investors: The concentration of filings in specific trend categories and sectors provides valuable insight for portfolio risk assessment. The dramatic increase in average DDL values suggests potentially greater financial exposure when allegations emerge, warranting careful consideration of disclosure quality and corporate governance practices in investment decisions.

For Insurers and Underwriters: The record number of mega DDL filings and substantially increased average loss allegations may necessitate reassessment of Directors and Officers liability coverage terms, pricing models, and risk selection criteria, particularly for companies operating in high-risk sectors or engaging with trend-vulnerable business activities.

For Legal Practitioners: The shifting distribution of cases across trend categories, coupled with divergent litigation probabilities between large-cap and broader market issuers, may indicate evolving plaintiff strategies and case selection criteria that warrant consideration in both plaintiff and defense contexts.

Institutional investors play a crucial role as lead plaintiffs in securities class action lawsuits, with statistics from 2023 and 2024 highlighting both their impact and a recent shift in their involvement:

The Securities and Exchange Commission (“SEC” or the “Commission”) issued its annual enforcement statistics on November 22, 2024, revealing a significant reduction in enforcement actions for the fiscal year concluded September 30, 2024. The data demonstrates a material decrease in both overall enforcement activity and standalone proceedings compared to the preceding fiscal period.

The Commission’s enforcement data indicates that the regulatory body initiated a total of 583 enforcement actions during fiscal year 2024, representing a 26 percent decline from the 784 actions filed in fiscal year 2023. This substantial reduction in aggregate enforcement proceedings warrants careful consideration by issuers, regulated entities, and market participants subject to the Commission’s oversight authority.

Of particular significance for securities class action practitioners and public companies is the marked decrease in standalone enforcement actions—proceedings that involve charges independently initiated by the Commission rather than those predicated upon prior findings of violations. The SEC reported 431 standalone enforcement actions for fiscal year 2024, compared to 501 such proceedings in the prior fiscal year, constituting a 14 percent reduction in this critical category of enforcement activity.

Standalone enforcement actions are widely recognized as the most meaningful indicator of the Commission’s enforcement priorities and resource allocation, as these proceedings reflect matters deemed sufficiently material to warrant independent investigation and prosecution by the agency’s Division of Enforcement.

The documented decline in both aggregate and standalone enforcement actions may signify evolving regulatory priorities, resource constraints, or strategic shifts in the Commission’s approach to securities law compliance and investor protection. Market participants would be well-advised to monitor forthcoming Commission statements regarding enforcement objectives and priorities to assess potential implications for regulatory risk profiles and compliance programs.

The securities class action filing data for 2024 reveals a dynamic litigation environment characterized by significant shifts in both the nature and magnitude of alleged violations. The record number of mega DDL filings, substantial increase in average alleged losses, and redistribution of cases across trend categories collectively indicate material changes in the securities litigation landscape.

Market participants would be well-advised to closely monitor these developments and implement appropriate risk management strategies to address the evolving nature of securities litigation exposure.

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action lawsuits, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube