Introduction to Premature Revenue Recognition

Common techniques for premature revenue recognition

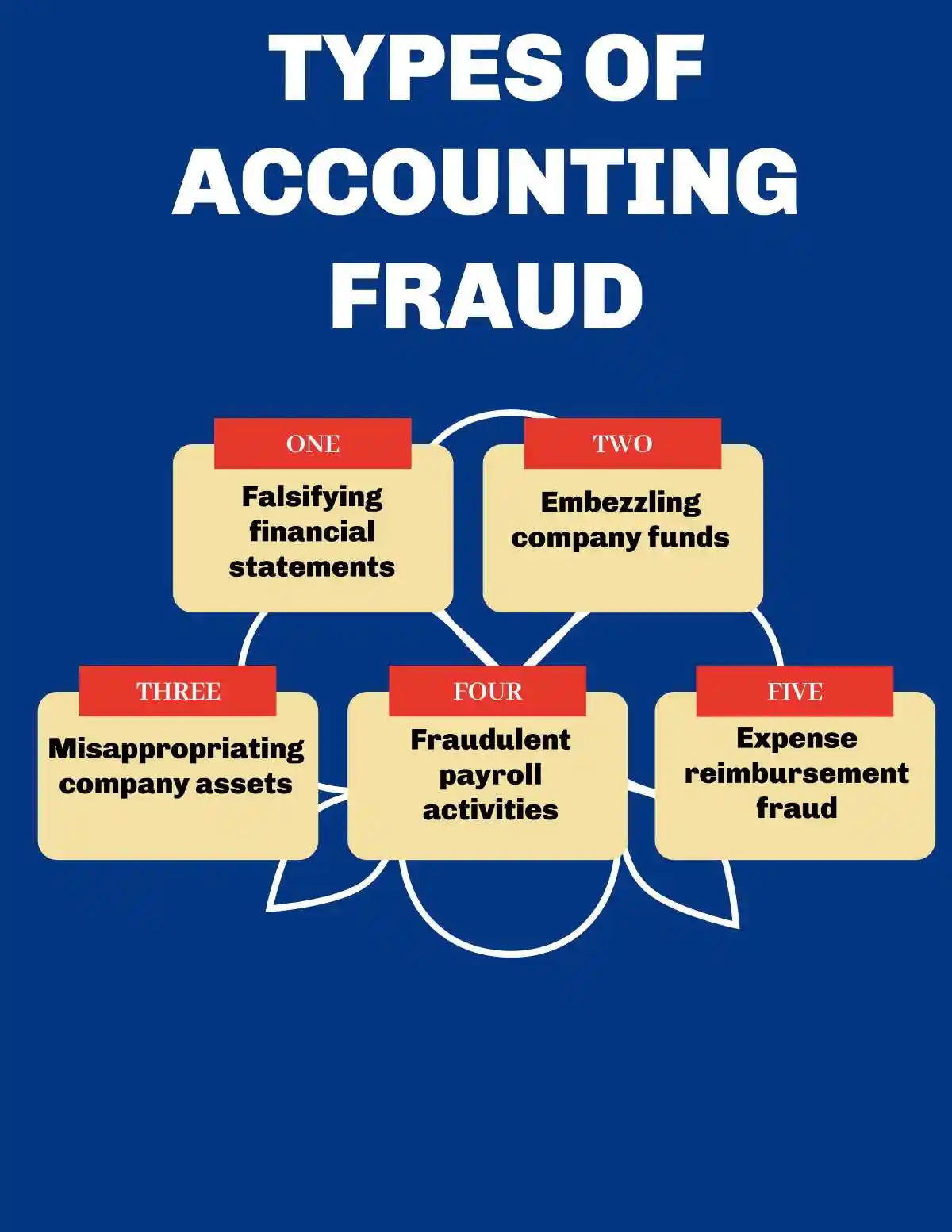

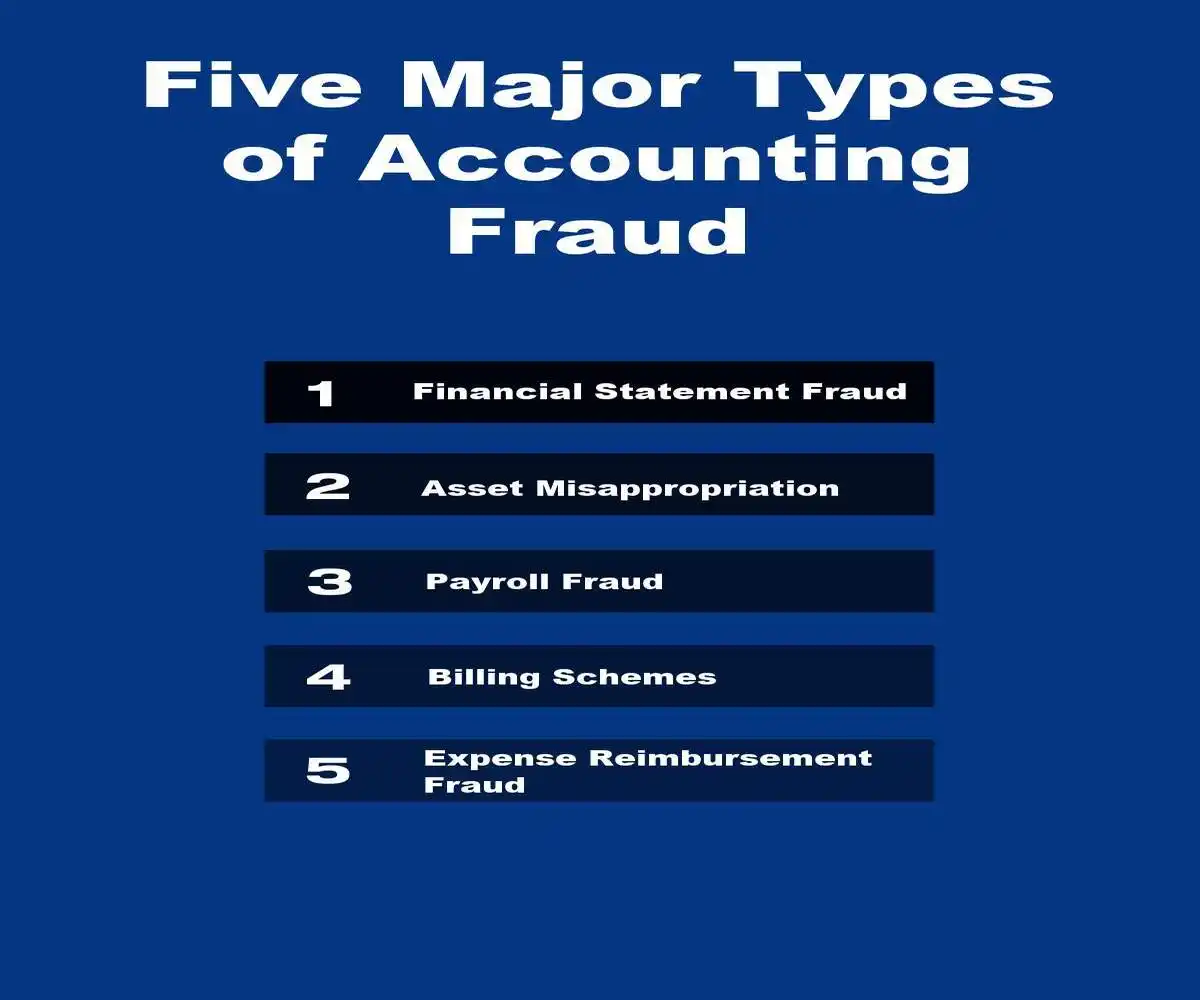

- “Keeping the books open”: The company delays closing the books past the end of the accounting period, allowing it to record sales from the next period to boost the current one.

- “Bill-and-hold” arrangements: Revenue is recognized for goods that have been invoiced and are ready for shipment, but are “held” in the company’s warehouse. Fraud occurs when the strict conditions for this practice are not met, such as when the customer has not requested the delay in delivery.

- Channel stuffing: Companies offer deep discounts or other incentives to distributors or retailers to get them to buy more product than they need near the end of a reporting period. The excess inventory often leads to high returns and write-offs in the next period.

- Backdating agreements: Executives forge contracts with earlier dates to record revenue in a prior period.

- Improper “percentage of completion”: For long-term projects, ccompanies misrepresent the percentage of a contract that is complete in order to recognize more revenue earlier than appropriate.

- Round-tripping: A company sells a product with an undisclosed agreement to repurchase it, creating a fictitious transaction with no real economic benefit.

- Manual journal entries: In cases like WorldCom and HealthSouth, executives simply made manual, fraudulent journal entries to prematurely recognize revenue and capitalize expenses.

Financial red flags that indicate potential fraud

- Divergence of revenue and cash flow: A key indicator of aggressive revenue recognition is when reported revenue increases significantly, but cash flow from operating activities remains stagnant or declines.

- Growing accounts receivable: If accounts receivable (money owed by customers) grows faster than sales, it may signal that customers are delaying payment or that the company is recognizing revenue prematurely.

- Unusual sales patterns: A large spike in sales at the very end of a reporting period (the last few days or week) can be a red flag. Forensic experts often compare monthly sales to identify such anomalies.

- Higher shipping costs: A sudden and significant increase in shipping costs could indicate that the company is rushing products out the door at the end of a quarter to meet revenue targets.

- Inconsistent profit margins: Maintaining consistent or growing profit margins while the rest of the industry experiences price pressure could indicate that financial reporting is being manipulated.

Legal and regulatory implications

- SEC enforcement: The SEC consistently pursues enforcement actions against companies for improper revenue recognition, especially since the implementation of ASC 606, which provides specific guidance on the timing of revenue recognition. The SEC also utilizes advanced data analytics through its Earnings Per Share (EPS) Initiative to detect reporting anomalies.

- Securities class actions: Once the fraud is revealed and the stock price drops, investors can file a securities class action lawsuit to recover losses. Plaintiffs’ attorneys focus on proving that executives acted with fraudulent intent (scienter).

- Whistleblower awards: Insiders with knowledge of the fraud can receive ssubstantial financial awards by reporting it to the SEC Whistleblower Program.

- Executive accountability: As part of the SEC’s crackdown, executives are frequently held personally accountable for their involvement in revenue recognition schemes.

Understanding Revenue Recognition: Risks, Legal Implications, and Prevention Strategies

Revenue recognition: Serves as the fundamental cornerstone of financial accounting, dictating when and how companies record their earnings.

Critical Process: This critical process extends far beyond simple bookkeeping—it represents the bbedrock upon which investor confidence, regulatory compliance, and market integrity rest.

The Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB): Have established comprehensive frameworks to ensure consistency and transparency across financial reporting, yet the complexity of modern business transactions continues to create opportunities for manipulation and fraud.

Accounting-Related Class Actions

- Allegations concerning asset valuations and/or impairments became the most frequent type of accounting-related allegation in 2024, exceeding those related to revenue recognition for the first time since tracking began in 2019.

- In 2024, 33% of accounting-related securities suit filings involved asset valuations and/or impairments.

- Accounting cases filed in 2024 were over 2.5 times more likely to reference a short-seller report compared to non-accounting cases.

Revenue recognition enforcement

- Continued priority: Regulators like the SEC and the Public Company Accounting Oversight Board (PCAOB) continue to focus on revenue recognition, given its importance to investors and its susceptibility to fraud.

- Examples of violations: The SEC has brought actions against companies using improper “pull-forward” or “bill-and-hold” practices to accelerate revenue.

- Accountability for individuals: The SEC has a history of holding executives responsible for perpetrating revenue recognition schemes.

- Case study: FY 2022: One-third of the SEC’s settled disciplinary orders were related to improper revenue recognition. For cases involving accounting restatements, 63% included allegations about revenue recognition.

The Growing Threat of Premature Revenue Recognition

- Premature revenue recognition represents one of the most insidious forms of financial statement fraud, creating a dangerous web of deception that can devastate investor confidence and trigger costly securities litigation. This practice occurs when companies deliberately record revenue before it meets the established criteria for recognition, artificially inflating financial performance to meet analyst expectations, secure financing, or maintain stock price momentum.

- The pressure to engage in premature revenue recognition has intensified dramatically in today’s hyper-competitive business environment. Companies face relentless quarterly earnings pressure, with missed estimates often resulting in immediate stock price volatility and potential securities class actions. The “beat-the-street” mentality has created a toxic environment where short-term financial engineering takes precedence over long-term sustainable growth and ethical financial reporting.

- Recent tech startups have become particularly vulnerable to premature revenue recognition schemes. The rapid growth expectations inherent in venture capital funding models create enormous pressure to demonstrate consistent revenue acceleration. Multiple high-profile cases in 2023 and 2024 involved emerging technology companies that engaged in sophisticated revenue manipulation schemes, including recognizing subscription revenue upfront, recording fictitious transactions with related parties, and manipulating contract terms to accelerate revenue recognition timing.

- One particularly egregious example involved a cloud-based software company that recorded three years of subscription revenue in a single quarter by restructuring customer contracts and creating artificial “acceleration clauses.” When the Securities and Exchange Commission investigation revealed the fraud, the company’s stock price collapsed by 78% in a single trading session, triggering multiple securities class actions and resulting in a $127 million settlement with affected investors.

Devastating Legal Consequences and Regulatory Response

Devastating Legal Consequences and Regulatory Response

- The legal ramifications of premature revenue recognition extend far beyond immediate financial penalties, creating llong-term reputational damage that can persist for years after resolution. Companies engaging in these practices face a multi-pronged legal assault that includes SEC penalties, shareholder lawsuits, criminal charges, and regulatory fines that can collectively exceed hundreds of millions of dollars.

- SEC penalties for revenue recognition violations have become increasingly severe, with the average enforcement action resulting in fines exceeding $15 million. The Commission has demonstrated particular aggression in pursuing cases involving premature revenue recognition, viewing these violations as fundamental breaches of investor trust that undermine market integrity. Recent enforcement actions have included disgorgement of ill-gotten gains, civil monetary penalties, and officer and director bars that prevent executives from serving in leadership roles at public companies.

- Shareholder lawsuits represent perhaps the most financially devastating consequence of premature revenue recognition schemes. When corrective disclosures reveal the true extent of revenue manipulation, stock prices typically experience dramatic declines, creating substantial investor losses that form the basis for securities class actions. These lawsuits often result in settlements ranging from $50 million to $500 million, depending on the scope of the fraud and the resulting investor damages.

- Criminal charges against individual executives have become increasingly common in cases involving systematic premature revenue recognition. Federal prosecutors have successfully pursued criminal convictions under mail fraud, wire fraud, and securities fraud statutes, with sentences ranging from probation to multiple years in federal prison. The threat of criminal prosecution has created a powerful deterrent effect, as executives increasingly recognize that accounting fraud can result in personal criminal liability rather than mere civil penalties.

- Regulatory fines imposed by various oversight bodies compound the financial impact of premature revenue recognition violations. Beyond SEC enforcement actions, companies may face additional penalties from industry-specific regulators, state securities commissioners, and international regulatory bodies for companies with global operations.

Corporate Governance Failures and Internal Control Deficiencies

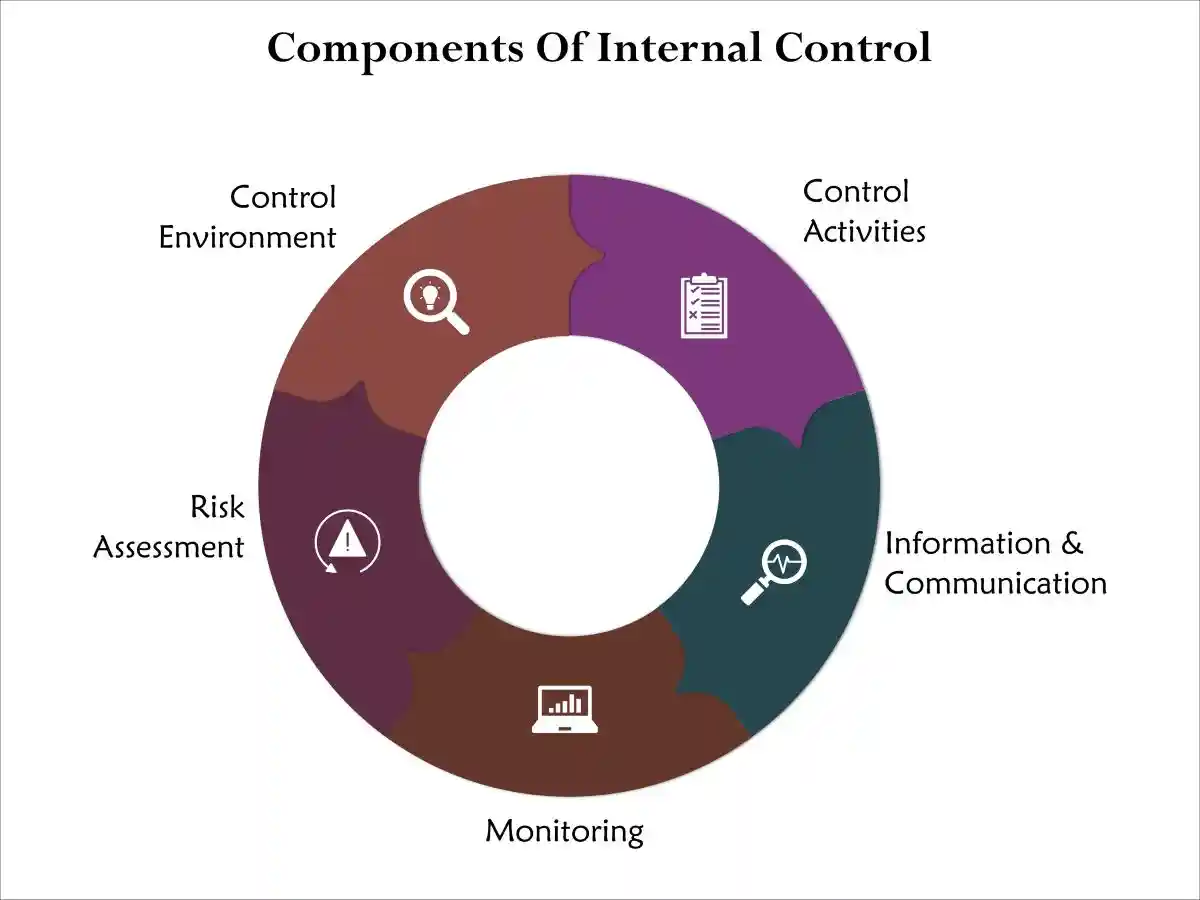

- Premature revenue recognition schemes rarely occur in isolation—they typically reflect broader failures in corporate governance and internal controls that create environments conducive to financial statement fraud. Companies that engage in revenue manipulation often exhibit systematic weaknesses in their governance structures, including inadequate board oversight, compromised audit committee independence, and management cultures that prioritize short-term results over ethical conduct.

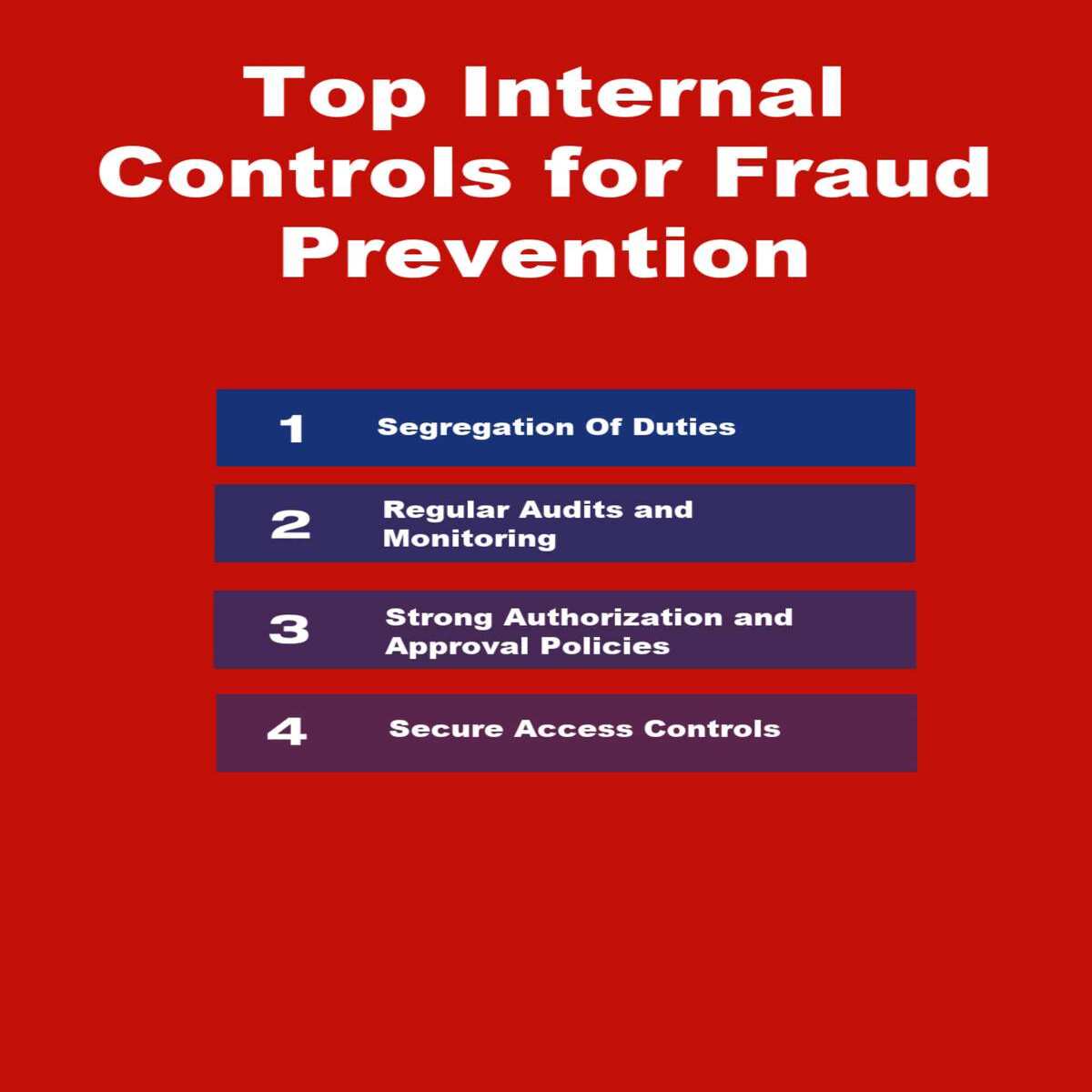

- Internal controls represent the first line of defense against premature revenue recognition and other forms of accounting fraud. The Sarbanes-Oxley Act of 2002 mandated that public companies establish and maintain adequate internal control over financial reporting, yet many organizations continue to struggle with implementation and effectiveness. Common control deficiencies that enable revenue manipulation include inadequate segregation of duties, insufficient documentation requirements, weak approval processes, and inadequate monitoring of revenue recognition policies.

- Effective corporate governance requires active engagement from independent directors who possess the expertise and commitment necessary to challenge management decisions and ensure compliance with accounting standards. Audit committees must maintain robust oversight of financial reporting processes, including regular evaluation of revenue recognition policies and procedures. The failure of governance mechanisms to detect and prevent premature revenue recognition often reflects broader cultural issues within organizations that prioritize results over integrity.

Advanced Risk Assessment and Detection Strategies

- Risk assessments for premature revenue recognition require sophisticated analytical techniques that go beyond traditional financial statement analysis. Investors and auditors must develop comprehensive frameworks that incorporate quantitative metrics, qualitative indicators, and industry-specific risk factors to identify potential manipulation schemes before they result in significant losses.

- Key quantitative indicators of potential premature revenue recognition include unusual fluctuations in revenue growth rates, particularly when revenue growth significantly exceeds cash flow growth, accounts receivable growth that outpaces revenue growth, and days sales outstanding metrics that deteriorate without clear business justification. Companies exhibiting these patterns warrant enhanced scrutiny and additional due diligence procedures.

- Qualitative risk factors often provide early warning signals of potential financial statement fraud. These include frequent changes in accounting policies, particularly those affecting revenue recognition timing, management turnover in key financial positions, aggressive acquisition strategies that may be used to obscure organic growth challenges, and compensation structures that create excessive incentives for short-term performance.

- Industry-specific risk factors must be incorporated into comprehensive risk assessments. Technology companies face unique risks related to subscription revenue models, software licensing arrangements, and multi-element revenue recognition. Healthcare companies must navigate complex reimbursement structures and regulatory requirements that create opportunities for manipulation. Manufacturing companies may engage in channel stuffing or bill-and-hold arrangements that accelerate revenue recognition inappropriately.

Regulatory Compliance Framework and Enforcement Trends

- Regulatory compliance in revenue recognition has become increasingly complex as accounting standards continue to evolve and enforcement priorities shift. The implementation of ASC 606(Revenue from Contracts with Customers) fundamentally transformed revenue recognition requirements, creating new compliance challenges while closing many traditional loopholes used for manipulation.

- Regulatory enforcement trends indicate heightened scrutiny of revenue recognition practices across all industries. The SEC has established specialized units focused on accounting fraud detection, utilizing advanced data analytics and artificial intelligence to identify potential manipulation schemes. These technological capabilities enable regulators to analyze vast amounts of financial data and identify statistical anomalies that may indicate premature revenue recognition or other forms of fraud.

- International coordination among regulatory bodies is increasing, creating more consistent global standards for revenue recognition and fraud detection. Companies operating in multiple jurisdictions must navigate complex webs of regulatory requirements, each with its own compliance implications and enforcement mechanisms.

Prevention and Mitigation Strategies

Prevention and Mitigation Strategies

- Preventing premature revenue recognition requires a comprehensive approach that combines robust internal controls, effective corporate governance, regular risk assessments, and a strong ethical culture. Organizations must implement multi-layered defense systems that make fraudulent activities significantly more difficult to execute and conceal.

- Internal controls must be designed specifically to address revenue recognition risks, including detailed policies and procedures that clearly define recognition criteria, mandatory documentation requirements for all revenue transactions, segregation of duties between revenue recognition and cash collection functions, and regular monitoring and testing of control effectiveness.

- Corporate governance improvements should focus on enhancing board independence and expertise, particularly within audit committees responsible for financial reporting oversight. Directors must possess sufficient accounting and industry knowledge to effectively challenge management decisions and identify potential red flags.

- Employee training programs play a crucial role in preventing financial statement fraud by ensuring that all personnel understand their responsibilities and the consequences of unethical behavior. These programs must address specific revenue recognition requirements and provide clear guidance on reporting suspected violations.

Future Outlook and Emerging Challenges

- The landscape of revenue recognition and financial statement fraud continues to evolve as technology transforms business models and creates new opportunities for both legitimate innovation and fraudulent manipulation. Emerging technologies such as artificial intelligence, blockchain, and advanced data analytics offer promising tools for fraud detection and prevention, while simultaneously creating new complexities in revenue recognition that may be exploited by unscrupulous actors.

- Securities litigation related to revenue recognition is likely to increase as investors become more sophisticated in identifying manipulation schemes and pursuing legal remedies. The development of specialized litigation funding and advanced statistical techniques for calculating damages will continue to make securities class actions more attractive to plaintiffs’ attorneys and more costly for defendant companies.

- Regulatory enforcement will continue to evolve as agencies adapt to new business models and technological capabilities. The integration of artificial intelligence and machine learning into regulatory oversight promises to enhance detection capabilities while creating new compliance challenges for companies operating in rapidly changing industries.

- The ultimate defense against premature revenue recognition and related accounting fraud lies in fostering cultures of integrity and accountability throughout organizations. Companies that prioritize ethical conduct, maintain robust internal controls, and embrace transparency in financial reporting will be best positioned to navigate the complex regulatory environment while building sustainable long-term value for all stakeholders.

- By understanding these risks and implementing comprehensive prevention strategies, investors and business leaders can better protect themselves from the devastating consequences of financial statement fraud while contributing to the overall integrity of financial markets. The cost of prevention invariably proves far less than the price of remediation, making proactive compliance not just a legal necessity but a sound business strategy that protects all stakeholders’ interests.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors