Introduction to the KBR Class Action Lawsuit

- KBR Class Action Lawsuit: The KBR Class Action Lawsuit, Norrman v. KBR, Inc., No. 25-cv-04464 (S.D. Tex.), seeks to represent purchasers or acquirers of KBR, Inc. (NYSE: KBR) publicly traded securities between May 6, 2025 and June 19, 2025, inclusive (the “Class Period”)

- Background: KBR provides scientific, technology, and engineering solutions to governments and commercial customers. HomeSafe Alliance is a KBR joint venture in which KBR has a 72% economic interest and, prior to the Class Period, HomeSafe had been awarded the Global Household Goods Contract by the U.S. Department of Defense’s Transportation Command (“TRANSCOM”), which helps U.S. military service members and their families relocate, the complaint alleges.

- Allegations: TheKBR class action lawsuit alleges that despite the knowledge that TRANSCOM had material concerns with HomeSafe’s ability to fulfill the Global Household Goods Contract, defendants claimed that the partnership was without issue and would ramp up in future quarters.

- Complaint: The KBR class action lawsuit also alleges that on June 19, 2025, HomeSafe issued a press release entitled “HomeSafe Alliance Announces TRANSCOM’s Notice to Terminate Global Household Goods Contract,” further disclosing that “HomeSafe has worked in good faith with TRANSCOM for several months to address government delays, obstacles and commercial challenges.” The next day, KBR issued a press release entitled “KBR Announcement on HomeSafe Alliance Global Household Goods Contract,” the complaint alleges.

- Corrective Disclosure: On this news, the price of KBR shares fell, the KBR class action lawsuit alleges.

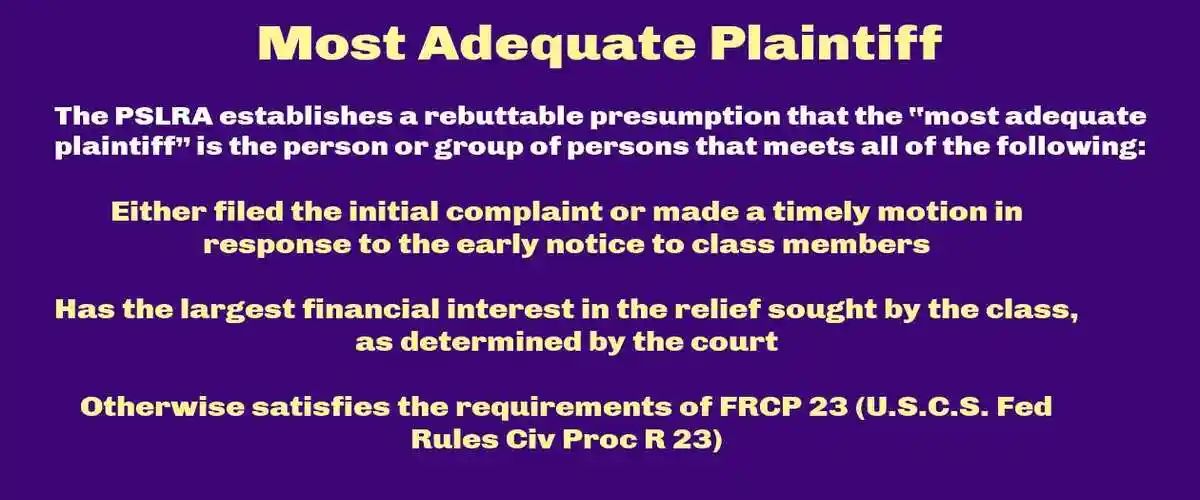

- Lead Plaintiff Motion: Lead plaintiff motions for the KBR class action lawsuit must be filed with the court no later than November 18, 2025. When a securities class action is filed, the Private Securities Litigation Reform Act (PSLRA) requires that within 20 days of the complaint filing, notice must be published informing shareholders of the pending litigation and their right to move the court to serve as lead plaintiff. This process ensures proper representation of shareholder interests in securities litigation cases.

Understanding Securities Fraud Class Action Lawsuits such as the KBR class action lawsuit

Securities fraud class action lawsuits serve as crucial mechanisms for maintaining market integrity and protecting shareholder interests. These legal proceedings fulfill several essential functions:

- Hold companies and their executives accountable for potential violations of securities laws and breaches of corporate governance standards

- Provide meaningful financial compensation to investors who may have suffered losses due to alleged fraudulent activities

- Strengthen internal controls and corporate governance practices across the market through deterrence

- Address systemic issues related to financial disclosure and transparency

Common triggers for securities litigation such as the KBR class action lawsuit include:

- Insider trading violations that undermine market fairness

- False or misleading financial statements that distort company performance

- Material omissions in corporate communications that affect investor decision-making

- Inadequate internal controls leading to misrepresentation of financial position

The power of the class action mechanism

The class action framework provides several distinct advantages in securities litigation:

- Enables individual shareholders to pursue legal remedies collectively, overcoming resource limitations

- Creates economies of scale in litigation, making it economically viable to pursue claims

- Ensures consistent legal outcomes across all affected investors

- Strengthens negotiating position with defendant companies

- Promotes efficient resolution of complex securities disputes

Navigating the legal complexities in the KBR class action lawsuit

Securities litigation involves intricate legal challenges that require careful navigation:

- Meeting stringent pleading requirements under the Private Securities Litigation Reform Act

- Establishing loss causation and damages with precision

- Surviving motions to dismiss through compelling evidence and legal arguments

- Managing complex discovery processes and expert testimony

- Understanding the interplay between securities laws and corporate governance requirements

Misrepresentation of Financial Information

Misrepresentation of Financial Information: Companies may deliberately provide false or misleading financial statements to artificially inflate stock prices, often through:

- Revenue recognition manipulation

- Expense underreporting

- Asset value inflation

- Liability concealment

- Cash flow misrepresentation

Omissions of Material Facts: Securities fraud frequently involves failing to disclose critical information that reasonable investors would consider important in making investment decisions. This includes:

- Known regulatory challenges

- Significant operational problems

- Material weaknesses in internal controls

- Pending litigation or investigations

- Adverse business developments

Insider Trading: Corporate executives may engage in unauthorized trading based on material non-public information, violating fundamental principles of market fairness and corporate governance. This can involve:

- Trading ahead of significant announcements

- Tipping off others about non-public information

- Manipulating disclosure timing for personal gain

- Exploiting knowledge of internal control weaknesses

Consequences of Securities Fraud – KBR Class Action Lawsuit

The repercussions of securities fraud extend far beyond immediate financial losses, impacting:

- Shareholder value through significant stock price declines

- Market confidence in corporate governance systems

- Company reputation and stakeholder trust

- Regulatory compliance costs and penalties

- Exposure to securities litigation

Companies found engaging in fraudulent practices often face:

- Substantial monetary penalties

- Costly regulatory investigations

- Expensive securities litigation

- Mandatory corporate governance reforms

- Enhanced oversight requirements

The Role of Regulatory Bodies

Regulatory authorities, particularly the Securities and Exchange Commission (SEC), play a vital role in:

The SEC maintains broad investigative powers and can impose significant penalties, including:

Importance of Compliance

Maintaining robust compliance programs proves essential for:

Companies must prioritize:

- Accurate financial reporting

- Timely material disclosures

- Effective internal controls

- Strong corporate governance

- Regular compliance training

Protecting Your Investments

Investors must remain vigilant in safeguarding their investments through:

- Regular portfolio monitoring

- Due diligence reviews

- Corporate governance assessment

- Internal control evaluation

- Securities litigation awareness

Effective protection strategies include:

- Analyzing financial statements

- Monitoring corporate disclosures

- Evaluating management credibility

- Assessing governance structures

- Understanding legal remedies

Strategies for Investor Protection

Here are comprehensive strategies investors should consider to protect their interests and navigate potential securities fraud:

Conduct Thorough Due Diligence

Before making any investment decisions, shareholders must conduct extensive research focusing on:

- Comprehensive analysis of the company’s financial statements, paying special attention to revenue recognition practices and internal controls

- Detailed evaluation of management’s track record in maintaining strong corporate governance

- Assessment of the company’s regulatory compliance history and any past securities litigation

- Review of analyst reports and independent research highlighting potential red flags

- Examination of the company’s corporate governance structure, including board independence and audit committee effectiveness

Warning signs that warrant further investigation include:

- Frequent changes in executive leadership or board composition

- History of regulatory violations or securities litigation

- Weak or ineffective internal controls

- Inconsistent financial reporting patterns

- Unusual related-party transactions

Pay particular attention to:

- Changes in accounting policies or practices

- Modifications to internal controls

- Corporate governance updates

- Management’s discussion of operational challenges

- Disclosure of material risks or uncertainties

Implement Portfolio Diversification Strategies

Effective diversification remains crucial for risk management:

- Spread investments across multiple sectors and industries

- Balance holdings between growth and value stocks

- Consider geographic diversification

- Maintain appropriate position sizes

- Regular portfolio rebalancing

Key diversification principles include:

- Avoiding over-concentration in single companies

- Understanding sector-specific risks

- Monitoring correlation between holdings

- Maintaining liquidity reserves

- Regular risk assessment and rebalancing

Monitor Company Communications and Disclosures

Maintaining vigilant oversight of company communications proves essential:

- Carefully review all SEC filings, particularly Forms 10-K, 10-Q, and 8-K

- Analyze earnings calls transcripts and management presentations

- Track company press releases and public statements

- Monitor regulatory investigations or enforcement actions

- Follow securities litigation developments affecting the company

The Lead Plaintiff Process in the KBR Class Action Lawsuit

- Investors who have experienced financial losses due to the alleged fraudulent activities and corporate governance failures have the opportunity to seek appointment as lead plaintiff in this significant securities litigation. This process represents a crucial mechanism for protecting shareholder interests and ensuring proper representation in complex securities cases.

- Under the PSLRA, any investor who purchased Marex Group common stock during the specified class period maintains the right to petition the court for appointment as lead plaintiff. This legislative framework strengthens internal controls and corporate governance by empowering shareholders to take an active role in securities litigation.

- The appointed lead plaintiff assumes the vital responsibility of representing the collective interests of all class members throughout the litigation process, ensuring that proper corporate governance standards are upheld and that internal controls are strengthened to prevent future violations.

Criteria for Lead Plaintiff

- Prospective lead plaintiffs must demonstrate the largest financial interest in the outcome of the securities litigation while also establishing their typicality and adequacy as class representatives. This requirement ensures that the lead plaintiff has sufficient motivation to actively oversee the litigation and protect class interests.

- It’s essential for shareholders to understand that their ability to recover damages through this securities litigation is not contingent upon serving as lead plaintiff. The lead plaintiff process primarily focuses on ensuring effective representation and strong corporate governance oversight.

Filing Deadlines

- Shareholders interested in participating in the KBR class action lawsuit must act decisively, as the deadline for filing lead plaintiff motions is set for November 18, 2025. This timeline reflects the urgency of addressing potential corporate governance failures and strengthening internal controls.

- Affected investors should prioritize gathering comprehensive documentation of their transactions and consulting with experienced securities litigation counsel to ensure their rights are properly protected and preserved throughout the legal process.

The Benefits of Serving as a Lead Plaintiff in the KBR Class Action Lawsuit

- Influencing litigation strategy: Lead plaintiffs play a crucial role in shaping key strategic decisions throughout the securities litigation process, including whether to pursue settlement negotiations or proceed to trial. This position allows shareholders to actively participate in addressing corporate governance concerns and strengthening internal controls.

- Negotiating more competitive fees: Lead plaintiffs can leverage their position to negotiate more favorable attorney fees and reduce overall litigation costs, ultimately maximizing the potential recovery for all class members affected by alleged corporate governance failures.

- Active participation in the case: Lead plaintiffs maintain the right to review critical court filings, monitor case progress, and engage in detailed strategy discussions with legal counsel, ensuring thorough oversight of the securities litigation process.

- Leading settlement discussions: The lead plaintiff’s involvement extends to participation in mediation sessions and settlement negotiations, requiring their approval before any proposed settlement can be presented to the court for consideration. This responsibility helps ensure that any resolution adequately addresses corporate governance reforms and strengthens internal controls to prevent future violations.

- Through this comprehensive lead plaintiff process, the KBR class action lawsuit demonstrates how securities litigation serves as a vital mechanism for enforcing corporate governance standards and maintaining robust internal controls in public companies. The process empowers shareholders to take an active role in protecting their investments while promoting transparency and accountability in corporate management practices.

- No financial risk: Participating in KBR class action lawsuit as a lead plaintiff typically involves minimal financial exposure for shareholders. Lead counsel in these cases operates on a contingency fee basis, advancing all litigation costs and expenses throughout the proceedings. This arrangement means attorneys only receive compensation if they successfully secure a settlement or favorable judgment. Even then, both legal fees and expense reimbursements are paid from the settlement fund rather than the lead plaintiff’s personal assets, ensuring robust protection of shareholder interests while maintaining strong corporate governance standards.

The Lead Plaintiff Deadline in the KBR Class Action Lawsuit

- Lead plaintiff motions for the KBR class action lawsuit must be filed with the court no later than November 14, 2025.

- This securities litigation represents a critical opportunity for investors who suffered losses to seek recovery.

- When a securities class action is filed, it initiates a structured legal process designed to protect shareholder interests and maintain market integrity through robust corporate governance enforcement.

The Eligibility Criteria for Lead Plaintiff Appointment for the KBR Class Action Lawsuit

- The investor must have suffered substantial financial losses directly related to their transactions in Marex Group securities during the specified Class Period

- The investor must have conducted their transactions in full compliance with applicable securities regulations and exchange requirements

- The investor must demonstrate the capability and commitment to actively represent the interests of the entire class throughout the duration of the litigation

- The investor must have no conflicts of interest that could impair their ability to serve as lead plaintiff

- The investor must be willing to participate in discovery and potential testimony if required

- The investor must have maintained detailed records of their transactions and losses

- The investor must be prepared to certify their claims under penalty of perjury

It is crucial to note that both domestic and international investors who meet these criteria are eligible to seek appointment as the lead plaintiff in the class action lawsuit, as courts have consistently recognized the rights of non-U.S. investors in securities class actions. This inclusive approach ensures comprehensive representation of all affected shareholders.

What is the Securities Act of 1934?

- The Securities Act of 1934 represents foundational legislation enacted to regulate securities markets and protect investors from fraudulent practices. This Act established crucial requirements for corporate governance, internal controls, and transparent financial reporting.

- Overall, the Securities Act of 1934 serves as a cornerstone for maintaining market integrity and investor protection through mandatory disclosures, robust internal controls requirements, and enforcement mechanisms that enable securities litigation when violations occur.

- In a securities class action, such as the KBR class action lawsuit, shareholders unite to seek recovery of losses allegedly caused by corporate misconduct, particularly regarding deficient internal controls and misleading disclosures. This litigation mechanism promotes corporate accountability while providing an efficient means for investors to pursue claims that might be impractical to litigate individually.

How Are Damages Calculated in the KBR Class Action Lawsuit

- In securities fraud cases like the KBR class action lawsuit, damages are typically calculated based on out-of-pocket losses that investors sustain due to misleading statements or material omissions regarding internal controls and corporate governance practices.

- These calculations require detailed analysis of stock price movements and trading patterns during the Class Period to determine the financial impact of alleged violations.

Investor Options in the KBR Class Action Lawsuit

- KBR Class Action Lawsuit: Investors affected by the KBR class action lawsuit possess specific legal rights under securities litigation frameworks. Understanding these rights is vital for shareholders considering participation in the lawsuit, as they provide crucial protections and potential avenues for recovery. The strength of internal controls and corporate governance practices often becomes a central focus in such securities litigation.

- KBR Class Action Lawsuit: Investors who experienced losses related to the KBR class action lawsuit have several strategic options available. Each option carries distinct implications regarding potential recovery, involvement in the litigation process, and ability to influence corporate governance reforms. Careful evaluation of these options helps shareholders make informed decisions about protecting their interests.

Frequently Asked Questions About the KBR Class Action Lawsuit

What initiated the KBR class action lawsuit?

The Lantheus lawsuit was initiated by investors alleging that KBR provided misleading information regarding its financial health and operations, resulting in financial losses.

How can I join the KBR class action lawsuit?

If you purchased shares during the class period and suffered a loss, then you are automatically a member of the class and do not need to do anything at this point unless you are considering moving for lead plaintiff.

What are the potential benefits of a KBR class action lawsuit?

Class action lawsuits allow individual investors to collectively seek justice and compensation, which might be challenging to pursue individually. They also promote corporate accountability.

How long will the KBR class action lawsuit take to resolve?

The duration of class action lawsuits can vary significantly, depending on the complexity of the case, legal strategies, and whether settlements are reached. It could take several months to years.

Contact Timothy L. Miles Today About a KBR Class Action Lawsuit

If you suffered substantial losses and wish to serve as lead plaintiff of the KBR class action lawsuit, or just have general questions about you rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors