Introduction to False and Misleading Financial Statements

False and Misleading Statements: False and misleading financial statements are intentional misrepresentations of a company’s financial information to deceive stakeholders, such as investors, creditors, and regulators.

Severe Consequences: This form of financial fraud can involve manipulating data to inflate a company’s financial health, leading to severe legal, ethical, and financial consequences.

Common methods of falsifying financial statements

- Inflating revenue: Recording sales prematurely, fabricating phantom sales, or recording revenue before it has been earned.

- Understating expenses or liabilities: Delaying the recognition of expenses or concealing debts to artificially boost profits and assets. Using off-balance-sheet entities to hide debt is a common technique.

- Overstating assets: Inflating the value of assets, such as inventory or accounts receivable, to make the balance sheet appear stronger.

- Manipulating disclosures: Intentionally omitting or misrepresenting crucial financial information in the footnotes of financial statements.

- Misappropriating assets: The theft of company assets, which is then covered up with false financial records.

Warning signs of financial fraud

- Inconsistent growth: Unusual or rapid revenue growth that doesn’t align with industry trends.

- Abnormal cash flow: Significant discrepancies between a company’s reported profits and its actual cash flow.

- Frequent restatements: Regular restatements of previously released financial results.

- Abrupt changes in accounting: Sudden, unexplained changes in a company’s auditors or accounting practices.

- Complex transactions: Large, complex, or unusual transactions occurring near the end of a reporting period.

Legal and ethical consequences

- Legal penalties: Companies and individuals can face substantial fines, civil lawsuits, and criminal charges, including imprisonment for executives. The Securities and Exchange Commission (SEC) actively investigates and prosecutes financial fraud.

- Reputational damage: The company’s brand image and credibility can be severely tarnished, leading to a loss of customer loyalty and difficulty attracting talent.

- Loss of investor confidence: Fraudulent practices erode trust, causing stock prices to decline, significant financial losses for investors, and difficulty raising future capital.

- Corporate collapse: Severe cases of financial statement fraud have led to the collapse of major corporations, resulting in widespread economic instability.

Famous examples of financial fraud

- Enron: Famously used off-balance-sheet entities to conceal billions of dollars in debt, which led to the company’s bankruptcy.

- WorldCom: Improperly capitalized expenses, significantly overstating its assets and masking declining performance.

- Lehman Brothers: Allegedly used accounting maneuvers to hide billions in debt, which contributed to its collapse during the 2008 financial crisis.

How to prevent and detect false financial statements

- Implement strong internal controls: Segregate accounting duties and have clear policies and procedures to ensure accurate recording of transactions.

- Conduct regular, independent audits: Regular examination of financial statements by external auditors can help deter and detect fraudulent activity.

- Foster an ethical culture: Leadership should set a strong “tone at the top,” prioritizing integrity and transparency in financial reporting.

- Empower whistleblowers: Establish confidential reporting systems for employees to report unethical behavior without fear of retaliation.

- Use technology: Employing data analytics and artificial intelligence can help identify anomalies in financial data that may indicate fraud.

What to do if you suspect fraud

- Gather evidence: Collect financial statements, press releases, or other documents that support your suspicions.

- Report to authorities: Contact regulatory bodies like the SEC, which offers whistleblower programs with protections and potential rewards.

- Consult a legal professional: Speak with an attorney specializing in securities law to understand your rights and options.

- Leverage whistleblower hotlines: Utilize any internal or external reporting systems that offer confidentiality.

Understanding False and Misleading Financial Statements: Detection, Prevention, and Legal Consequences

- In the realm of corporate finance, the integrity of financial statements is paramount. These documents are the bedrock upon which investors, analysts, and other stakeholders base their decisions. However, the increasing complexity of financial instruments and the pressure on companies to show robust financial health can lead to the temptation to distort these statements.

- False and misleading financial statements are not just errors in accounting but deliberate acts designed to mislead stakeholders. They can take many forms, from overstating revenue and under-reporting liabilities to more sophisticated forms of financial engineering that trigger devastating securities class actions and regulatory enforcement actions.

- Financial statement fraud can be broadly categorized into two types: errors and fraud. Errors are unintentional misstatements or omissions, which can occur due to oversight or a lack of understanding.

- Accounting fraud, on the other hand, is intentional and involves deceit, designed to result in unfair or unlawful gain.

- Understanding these distinctions is crucial because detecting fraud requires a different set of skills and tools compared to identifying errors. The motivations for financial statement fraud are varied, ranging from personal gain, such as bonuses tied to financial performance, to broader corporate strategies aimed at maintaining stock prices or meeting analyst expectations.

- The challenge with false financial statements is that they often go undetected until they lead to severe consequences, such as bankruptcy, securities litigation, or regulatory enforcement actions. Part of the problem lies in the complexity of modern financial reporting, which can obscure fraudulent activities.

- The pressure to “beat-the-street” has emerged as one of the most significant catalysts for securities class actions in modern financial markets. When companies fail to meet earnings expectations, the resulting stock price volatility often triggers investor lawsuits alleging accounting fraud and inadequate corporate governance.

Common Types of Financial Statement Misrepresentation

- The art of financial statement misrepresentation is as varied as it is nefarious. One common type is revenue recognition fraud, where companies record revenue before it is earned or realizable. This can involve recognizing sales that have not yet been finalized or shipping products to distributors without a guaranteed sale. By inflating revenue figures, companies can create a false impression of growth and profitability, misleading investors and analysts who rely on these metrics.

- Expense manipulation represents another sophisticated form of accounting fraud that can devastate investor confidence. Companies may defer legitimate expenses to future periods, capitalize costs that should be exspensed immediately, or create fictitious reserves to smooth earnings over multiple reporting periods. These practices artificially inflate current period profitability while creating future financial obligations that eventually surface in corrective disclosures.

- Asset valuation fraud involves the deliberate overstatement of asset values or the failure to recognize impairments when assets have declined in value. This type of manipulation is particularly common in industries with significant intangible assets or inventory holdings, where valuation requires substantial judgment and estimation.

Notable Corporate Scandals: Lessons from History

Enron

- The Enron scandal remains the quintessential example of how omissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

Waste Management

- Waste Management’s senior executives carried out the scheme through a series of fraudulent accounting manipulations.

- The specific mechanisms of the fraud included:

- Manipulated depreciation: Executives repeatedly extended the useful life of company assets, such as garbage trucks, and assigned arbitrary, excessive salvage values to them. This dramatically reduced the annual depreciation expense and artificially boosted profits.

- Improper capitalization of expenses: Maintenance and repair costs for landfills were improperly classified as capital expenses rather than as current-period expenses. This illegally deferred recognition of these costs, making short-term profits appear larger.

- Concealment through “netting”: Management secretly used one-time gains from asset sales to erase unrelated operating expenses and accounting misstatements. This practice, known as “netting,” concealed the true financial health of the company from investors and auditors.

- Inflated environmental reserves: Executives would intentionally inflate environmental liability reserves during strong financial quarters. Then, during weaker quarters, they would release the excess reserves into earnings to boost results.

- Failure to write off impaired assets: The company neglected to write off the costs of abandoned or impaired landfill projects, instead keeping the costs on the balance sheet to hide their negative financial impact.

The role of Arthur Andersen

- Waste Management’s longtime auditor, Arthur Andersen, was complicit in the fraud.

- The audit firm was aware of Waste Management’s improper accounting practices and documented numerous issues, but it repeatedly approved the company’s financial statements with an “unqualified” or “clean” opinion.

- The relationship was tainted by a conflict of interest. Many of Waste Management’s top financial officers were former Arthur Andersen employees, and Andersen was highly protective of the lucrative relationship with its “crown jewel” client.

- Andersen also received substantial fees for non-audit consulting services, which compromised its independence.

Unraveling and consequences

- Discovery: The scheme was discovered in 1997 after a new CEO took over and ordered a review of the company’s accounting practices. He resigned months later after calling the accounting “spooky”.

- Financial restatement: In 1998, Waste Management announced it would restate its earnings from 1992 through 1997, revealing over $1.7 billion in overstated profits.

- Regulatory action: The Securities and Exchange Commission (SEC) charged Waste Management’s founder and five other top executives with perpetrating the fraud.

- Executives were fired and faced charges of securities fraud. The SEC also fined Arthur Andersen $7 million for its role.

- Stock price collapse: When the fraud was revealed, the company’s stock price plummeted, causing over $6 billion in losses for shareholders.

- Company restructure: Crippled by the scandal, Waste Management was acquired by a smaller competitor, USA Waste Services. The newly merged company kept the Waste Management name but relocated its headquarters and replaced nearly all top executives.

- Legacy for auditors: The scandal was a major contributing factor to the downfall of Arthur Andersen, which was also implicated in the Enron scandal just a few years later.

- Broader reforms: The Waste Management case, alongside other major financial scandals, helped trigger the push for stricter regulations in corporate governance and financial reporting, ultimately leading to the passage of the Sarbanes-Oxley Act in 2002.

Lehman Brothers (2008)

The outcome: The practice was exposed after the bank filed for bankruptcy in September 2008, triggering a global financial meltdown. While an official investigation exposed the fraudulent practice, no senior executives faced criminal charges.

HealthSouth (2003)

Securities Litigation and Class Action Consequences

- When accounting fraud occurs, affected investors often seek recourse through securities class actions and securities litigation. These legal mechanisms provide a pathway for investors to recover losses resulting from materially misleading financial statements and other violations of federal securities laws.

- The securities litigation process typically begins when a company’s stock price declines following the disclosure of previously unknown negative information. If investors can demonstrate that the company made material misstatements or omissions in its financial reports, they may file a class action lawsuit seeking damages for their investment losses.

- Securities class actions related to financial statement fraud often result in substantial settlements. Recent cases have produced recoveries ranging from $50 million to over $500 million, depending on the scope of the fraud and the resulting investor losses. These settlements serve multiple purposes: they compensate injured investors, deter future misconduct, and reinforce the importance of accurate financial reporting.

- The legal consequences extend beyond civil litigation. Regulatory enforcement actions by the SEC can result in substantial monetary penalties, officer and director bars, and requirements for enhanced corporate governance measures. In severe cases, criminal prosecutions may result in prison sentences for executives who participated in fraudulent schemes.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Corporate Governance and Internal Controls Framework

- Effective corporate governance serves as the first line of defense against financial statement fraud. The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of internal control requirements, mandating that public companies establish and maintain adequate internal controls over financial reporting

- Internal controls encompass the policies, procedures, and systems designed to ensure accurate financial reporting and prevent fraud. These controls must address key risk areas including revenue recognition, expense classification, asset valuation, and financial statement disclosure.

- Companies must implement multiple layers of review and approval for significant transactions, maintain proper segregation of duties, and establish clear accountability for financial reporting accuracy.

- The board of directors plays a crucial role in corporate governance by providing oversight of management’s financial reporting responsibilities. Independent directors must possess the financial literacy necessary to understand complex transactions and ask probing questions about unusual or aggressive accounting treatments.

- Audit committees bear particular responsibility for overseeing the external audit process and ensuring that auditors have unfettered access to company records and personnel.

Common Types of Financial Statement Fraud

- Revenue Recognition Fraud: This occurs when a company recognizes revenue before it is earned, often by recording fictitious sales or inflating sales figures. This practice misleads investors about the company’s actual performance and creates artificial growth patterns that cannot be sustained.

- Expense Manipulation: Companies may understate expenses to present a more favorable profit margin. This can involve delaying expense recognition or misclassifying expenses to enhance reported earnings. Such practices artificially inflate profitability metrics that investors rely upon for decision-making.

- Asset Valuation Fraud: Organizations may inflate the value of their assets, such as inventory or property, to enhance their financial position. This misrepresentation can lead to inflated stock prices and misinformed investment decisions, particularly when assets are significantly overvalued compared to market conditions.

- Improper Disclosures: Failing to disclose significant financial obligations or risks can mislead investors. Companies may omit transactions with related parties or fail to disclose contingent liabilities, creating a false sense of security about the company’s true financial position.

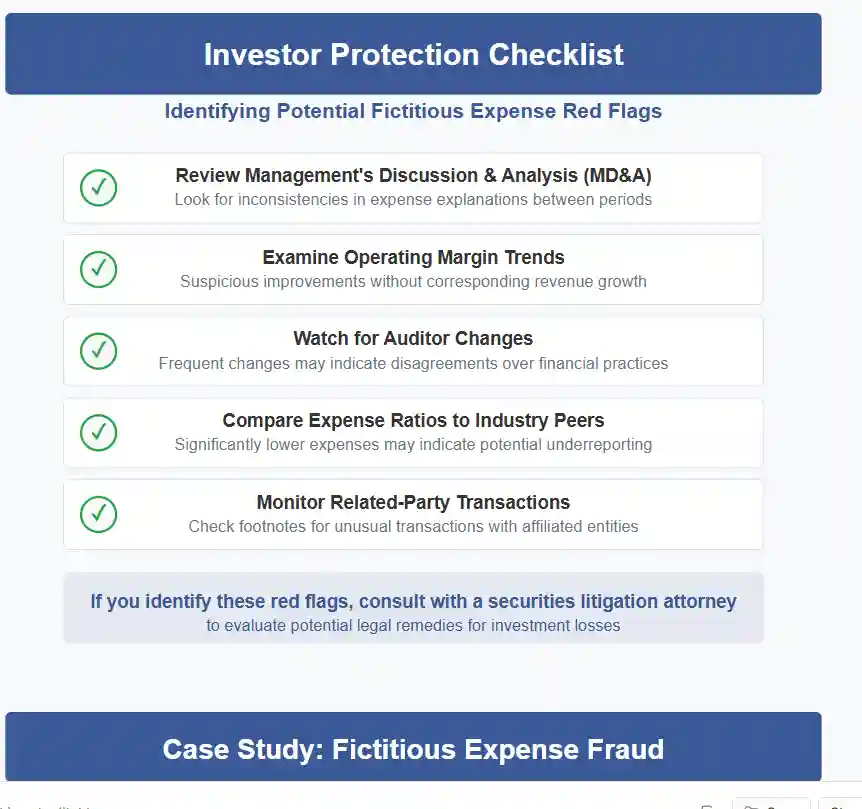

Advanced Red Flags and Warning Signs

- Another red flag to watch for is aggressive accounting practices, such as recognizing revenue prematurely or delaying expense recognition. These tactics can artificially inflate earnings and create a misleading picture of a company’s financial health. Investors should also scrutinize non-recurring or one-time items, as companies may use these as a means to smooth earnings and hide underlying issues.

- Corporate governance deficiencies often correlate with increased fraud risk. Warning signs include:

- Domineering management that discourages questions or dissent from board members

- Lack of independent directors or audit committee members with insufficient financial expertise

- Frequent changes in key personnel, particularly in financial reporting roles

- Poor communication between management and the board of directors

- A pattern of frequent restatements or amendments to financial statements is also cause for concern, as it may indicate a lack of accuracy or transparency in financial reporting. When companies repeatedly revise their previously filed statements, it suggests either incompetence in financial reporting or deliberate manipulation that was later discovered.

Regulatory Compliance and Legal Consequences

- Regulatory compliance in the realm of internal controls has become increasingly stringent following major corporate scandals of the early 2000s.

- The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of internal control requirements, mandating that public companies establish and maintain adequate internal control over financial reporting.

- Section 404 of the Act specifically requires management to assess and report on the effectiveness of these controls, while external auditors must attest to management’s assessment.

- The regulatory framework extends beyond Sarbanes-Oxley to encompass various industry-specific requirements and international standards.

- Companies operating in multiple jurisdictions must navigate complex webs of regulatory requirements, each with its own internal control implications.

Non-Compliance and Litigation

- Failure to maintain compliance with these requirements can result in regulatory sanctions, fines, and increased scrutiny from oversight bodies.

- Securities fraud litigation often follows in the wake of internal control failures and resulting financial misstatements.

- When investors suffer losses due to reliance on false or misleading financial statements, they may pursue legal remedies through securities fraud class action lawsuits.

- These lawsuits typically allege that companies and their executives violated federal securities laws by making material misrepresentations or omissions in their financial disclosures.

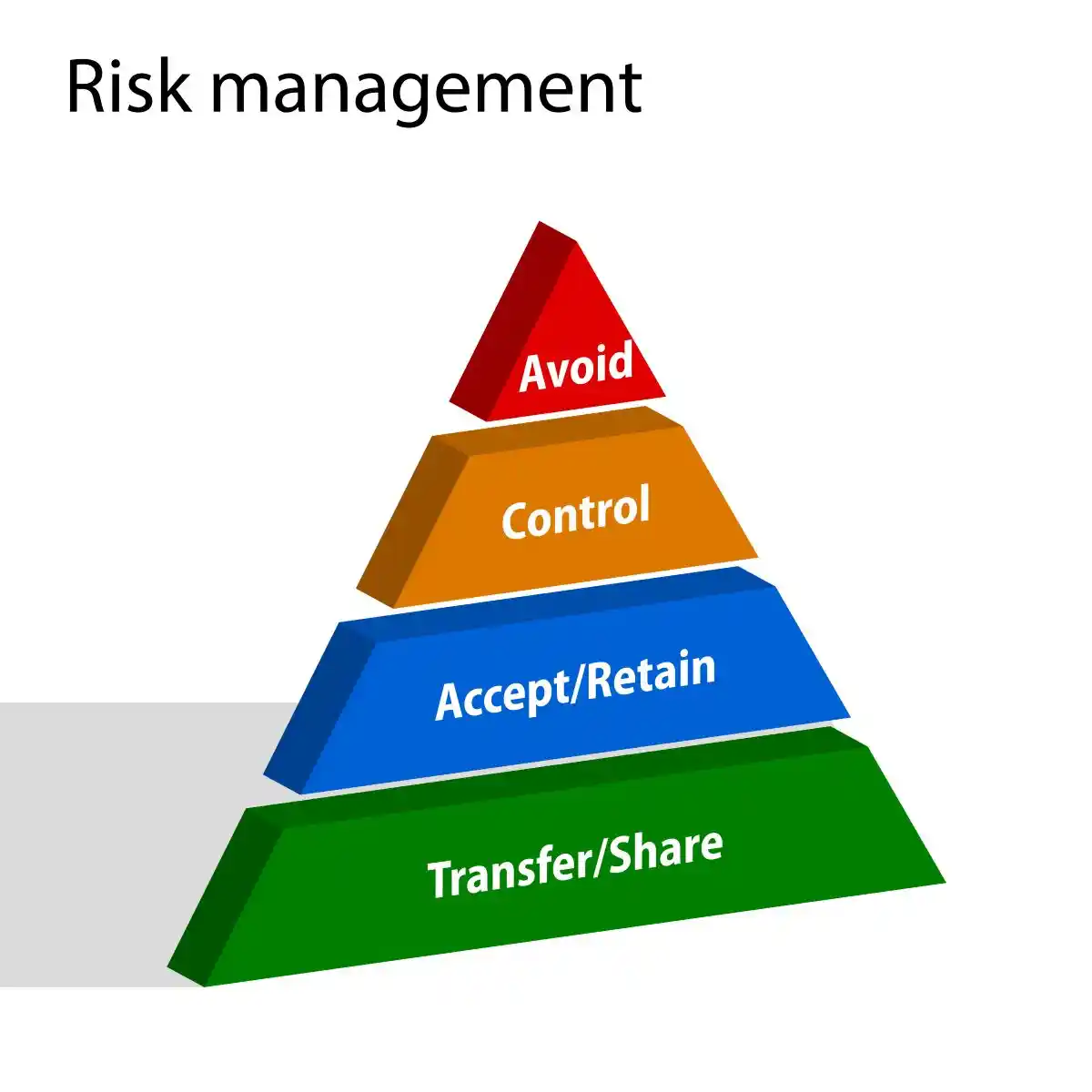

Risk Assessments and Prevention Strategies

- Comprehensive risk assessments form the foundation of effective fraud prevention programs. Companies must systematically evaluate their exposure to financial statement fraud by examining factors such as industry characteristics, competitive pressures, management incentives, and historical patterns of accounting irregularities.

- Risk assessments should identify specific areas where accounting fraud is most likely to occur, such as revenue recognition for companies with complex sales arrangements, inventory valuation for manufacturing businesses, or asset impairment testing for companies with significant intangible assets. These assessments must be updated regularly to reflect changing business conditions and emerging fraud schemes.

- Prevention strategies must address both the opportunity and motivation for fraud. Robust internal controls reduce opportunities by creating multiple checkpoints and approval requirements for significant transactions. Clear policies and procedures provide guidance for employees facing difficult accounting decisions. Regular training programs ensure that personnel understand their responsibilities and the consequences of fraudulent conduct.

- Creating a culture of integrity represents perhaps the most important prevention strategy. When employees understand that ethical conduct is valued and rewarded while misconduct will be detected and punished, they are far less likely to participate in fraudulent schemes. This cultural foundation must be established and reinforced by senior management through consistent words and actions.

Regulatory Compliance and Enforcement Landscape

- The regulatory compliance environment for financial reporting has become increasingly stringent following major corporate scandals of the early 2000s. The SEC has enhanced its enforcement capabilities through specialized units focused on accounting fraud and financial statement fraud. These units employ sophisticated data analytics to identify potential misconduct and have significantly increased the number and size of enforcement actions.

- Regulatory enforcement actions serve multiple purposes beyond punishing wrongdoers. They establish precedents for acceptable accounting practices, deter future misconduct, and provide guidance to companies seeking to maintain compliance. Recent enforcement trends show increased focus on individual accountability, with the SEC pursuing actions against officers and directors who fail to maintain adequate internal controls or oversight.

- The intersection of regulatory compliance and securities litigation creates additional complexity for public companies. Enforcement actions often trigger private securities class actions, as investors use regulatory findings to support their fraud claims. This dual exposure amplifies the potential consequences of accounting fraud and reinforces the importance of proactive compliance measures.

Technological Solutions and Future Outlook

- As we look to the future, technology is transforming both the methods used to commit financial statement fraud and the tools available to detect it. Advanced data analytics enable auditors and regulators to identify unusual patterns that may indicate fraudulent activity. Machine learning algorithms can analyze vast datasets to flag transactions or account balances that deviate from expected norms.

- Blockchain technology offers promising applications for enhancing the integrity of financial reporting. By creating immutable records of transactions, blockchain systems can reduce opportunities for manipulation and provide greater transparency to investors and regulators. Smart contracts can automate compliance checks and ensure that transactions comply with established policies and procedures.

- However, technology also creates new opportunities for sophisticated fraud schemes. As financial reporting systems become more complex and automated, fraudsters may exploit system vulnerabilities or manipulate automated processes to conceal their activities. This technological arms race requires continuous investment in detection capabilities and ongoing vigilance from all stakeholders.

Recent trends and ongoing relevance in 2025

- Increased SEC scrutiny of earnings management: The Securities and Exchange Commission (SEC) ccontinues to focus on combating improper earnings management. Through initiatives like its Earnings Per Share (EPS) Initiative, the SEC uses data analytics to identify companies with suspicious patterns of meeting or narrowly exceeding analyst estimates.

- Focus on non-GAAP disclosures: The SEC is actively scrutinizing companies’ use of non-GAAP financial metrics. Recent enforcement actions and staff comments emphasize that these alternative measures must not be misleading.

- Impact of AI-related fraud: In 2025, the pressure to demonstrate growth and innovation in the AI space is creating a new vulnerability. “AI-washing”—overstating a company’s AI capabilities—is emerging as a significant litigation target, with numerous AI-related securities lawsuits filed in the first half of the year.

- Higher settlement values: While filings can vary year to year, the average settlement value for securities class actions has remained high, reinforcing the potential costs for companies that violate securities laws.

- Importance of crisis management: Companies now face the complex task of managing their public communications during crises without creating new misleading statements that could be used against them in a lawsuit.

Protecting Investments Through Informed Decision-Making

Investors can protect themselves from false and misleading financial statements by developing the knowledge and skills necessary to identify potential red flags. Key warning signs include unusual fluctuations in key financial metrics, frequent restatements of financial results, high management turnover, and aggressive accounting policies that push the boundaries of acceptable practice.

Due diligence processes should include careful analysis of a company’s corporate governance structure, internal controls environment, and history of regulatory compliance. Investors should pay particular attention to companies operating in industries with complex accounting requirements or facing significant competitive or financial pressures.

Understanding the securities litigation landscape can also inform investment decisions. Companies that have previously been subject to securities class actions or regulatory enforcement actions may face higher risks of future misconduct. Conversely, companies with strong corporate governance practices and robust internal controls are better positioned to maintain accurate financial reporting and avoid costly legal disputes.

By staying informed about emerging fraud schemes, regulatory enforcement trends, and best practices in corporate governance, investors can make more informed decisions and better protect their investments from the devastating effects of accounting fraud. This proactive approach represents not merely a defensive strategy but a fundamental component of successful long-term investing in today’s complex financial markets.

The prevention of financial statement fraud ultimately depends on the collective commitment of all stakeholders—management, boards of directors, auditors, regulators, and investors—to maintain the highest standards of integrity and transparency in financial reporting. Through continued vigilance and education, the financial community can work together to preserve market confidence and protect investor interests.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors