Understanding Securities Litigation and Discrepancies In Financial Records

- Discrepancies in financial records is a trigger to securities ligation as well as enforcement actions from regulatory bodies.

- Securities litigation is a complex area of law that involves disputes over investments, primarily focusing on claims of fraud or misrepresentation in the purchase or sale of securities.

- These lawsuits can be initiated by investors, regulatory bodies, or corporations, and they often revolve around allegations that a company has provided false or misleading information about its financial health.

- At the heart of securities litigation is the protection of investors and the integrity of financial markets throug regulatory bodies and securities litigation.

- When discrepancies in financial records come to light, they can serve as a catalyst for these legal proceedings, bringing intense scrutiny and potential penalties.

- The foundation of securities litigation is built on the Securities Act of 1933 and the Securities Exchange Act of 1934, which aim to ensure transparency and fairness in the securities markets through enforcement by regulatory bodies.

- These laws require companies to provide accurate and timely information so that investors can make informed decisions or be subjected to regulatory bodies enforcment or securities class action lawsuits.

- When discrepancies are detected, they can undermine investor confidence and lead to financial losses, prompting legal action.

- Securities litigation serves as a mechanism to hold companies accountable, deterring fraudulent activities and promoting market stability.

- In recent years, the landscape of securities litigation has evolved significantly, with increased regulatory oversight and heightened investor awareness.

- The rise of sophisticated technology and data analytics has enabled stakeholders to detect discrepancies more easily, leading to a surge in litigation cases.

- As we move into 2025, the stakes are higher than ever, with companies facing intensified pressure to maintain the accuracy and transparency of their financial reporting.

- Understanding the complex world of securities litigation is crucial for anyone involved in the financial sector, as it provides insights into the legal ramifications of financial discrepancies and the importance of compliance with regulatory standards and enforcement by regulatory bodies.

Recent Developments Reshaping Securities Litigation

Enhanced Detection Capabilities Through Technology

- The integration of artificial intelligence and machine learning algorithms has revolutionized how financial discrepancies are identified.

- Advanced data analytics platforms now scan thousands of financial documents in real-time, flagging inconsistencies that might have gone unnoticed for years.

- This technological advancement has led to a significsant increase in early detection of accounting irregularities compared to traditional audit methods.

Regulatory Evolution and Enforcement Trends

- The Securities and Exchange Commission has implemented stricter enforcement protocols in 2024, resulting in $$8.2 billion in penalties – a significant increase from the previous year.

- The SEC received approximately 24,980 whistleblower tips, a significant increase over the 18,354 tips from 2023.

Key regulatory changes include:

- Enhanced disclosure requirements for quarterly earnings reports

- Stricter penalties for late or inaccurate filings

- Expanded liability for corporate officers and directors

Economic Implications: The Ripple Effect

Market-Wide Impact Assessment

- When financial discrepancies trigger securities litigation, the economic consequences extend far beyond the implicated company.

- Market confidence erosion typically results in sector-wide stock price volatility, affecting even companies with pristine financial records.

- Recent analysis shows that major securities litigation announcements cause an average of approvimately 8.3% decline in sector indices within 48 hours.

Corporate Financial Burden

The direct costs of securities litigation have escalated dramatically.

Companies now face:

- Defense costs for securities class actions are estimated to range between $22 billion and $30 billion total for cases filed since 1996

- The median settlement amount in 2022 was $13.0 million, representing a 46% increase from 2021.

- Regulatory fines that can exceed annual profits

- Reputational damage leading to long-term revenue loss

Investor Recovery Patterns

- Despite these challenges, investor recovery rates have improved

- Class action settlements in 2024 returned an average of 67 cents per dollar of claimed losses, compared to 52 cents in 2020.

- This improvement reflects more sophisticated damage calculation methodologies and stronger legal precedents.

Case Study: Technology Sector Vulnerabilities

- The technology sector has become particularly susceptible to securities litigation triggered by financial discrepancies.

- Revenue recognition irregularities in software companies have led to high-profile cases where companies overstated subscription revenues or improperly classified one-time payments as recurring revenue.

- The case highlighted how modern business models create new opportunities for financial misrepresentation.

Financial Discrepancies in Securities Litigation: A Comprehensive Analysis

- Financial discrepancies represent the cornerstone of most securities fraud cases, ccreating the foundation for investor losses and subsequent litigation.

- These irregularities not only distort market perceptions but also trigger complex legal proceedings that can reshape entire industries.

- Understanding these discrepancies and their evolving legal implications has become increasingly critical as regulatory frameworks adapt to modern market realities.

Revenue Recognition Errors: The Foundation of Market Deception

- Revenue recognition errors remain among the most devastating forms of financial manipulation, particularly as they directly impact a company’s perceived growth trajectory and market valuation.

- These discrepancies typically manifest when companies prematurely recognize revenue or artificially inflate sales figures through channel stuffing, bill-and-hold arrangements, or fictitious transactions.

- Recent developments in this area have been shaped by the implementation of ASC 606 Revenue Recognition which fundamentally altered how companies must recognize revenue.

- This new standard has created both opportunities for legitimate revenue optimization and new avenues for potential manipulation.

- Companies struggling with the transition have sometimes used the complexity of the new rules to obscure questionable practices.

- The fraud on the market plays a particularly crucial role in revenue recognition cases. This theory presumes that investors rely on market prices that reflect all publicly available information, including fraudulent revenue statements.

- When companies manipulate revenue figures, they effectively poison the market’s pricing mechanism, creating artificial inflation that affects all investors who purchase shares during the fraud period.

- Case Example: The recent Luckin Coffee scandal demonstrated how systematic revenue inflation could create market-wide distortions. The company fabricated approximately $310 million in sales, leading to a dramatic stock price collapse when the fraud was revealed.

- Investors who purchased shares during the fraud period could claim damages based on the artificial price inflation caused by the false revenue reports.

Financial Statement Misstatements: Beyond Simple Accounting Errors

- Financial statement misstatements encompass a broader category of discrepancies that extend far beyond basic accounting mistakes.

- These intentional or reckless misrepresentations can include improper asset valuations, hidden liabilities, inadequate reserves, or failure to disclose material contingencies.

- The legal landscape surrounding financial statement misstatements has evolved significantly following recent Supreme Court decisions.

- The 2021 ruling in Goldman Sachs Group, Inc. v. Arkansas Teacher Retirement System refined how courts assess the materiality of alleged misstatements, particularly regarding generic corporate statements about business ethics and regulatory compliance.

- Modern misstatement cases increasingly involve complex financial instruments and off-balance-sheet arrangements. Companies may use special purpose entities, derivative contracts, or other sophisticated structures to obscure their true financial condition.

- These arrangements often require expert testimony to unravel, making litigation more expensive and time-consuming.

- Detection Methods have become increasingly sophisticated, with forensic accountants employing advanced data analytics to identify patterns suggesting manipulation.

- Red flags include unusual fluctuations in key ratios, inconsistent cash flow patterns relative to reported earnings, and discrepancies between reported results and industry benchmarks.

- The Private Securities Litigation Reform Act (PSLRA) requires plaintiffs to plead misstatements with particularity, meaning they must identify specific false statements and explain why they were misleading.

- This heightened pleading standard has made it more challenging to pursue cases based solely on general allegations of financial irregularities.

Expense Manipulation: The Subtle Art of Earnings Management

- Expense manipulation represents perhaps the most nuanced form of financial discrepancy, as it often involves timing differences rather than outright fabrication.

- Companies may defer maintenance expenses, capitalize costs that should be expensed, or manipulate reserves to smooth earnings across reporting periods.

- Recent regulatory focus has intensified on cookie jar reserves and other forms of earnings management.The SEC has increased scrutiny of companies that consistently meet or barely exceed analyst expectations, viewing such patterns as potential indicators of manipulation.

- Restructuring charges have become a particular area of concern, as companies may use these one-time expenses to hide ongoing operational problems or create reserves for future use.

- The timing and classification of these charges can significantly impact investor perceptions and stock valuations.

- The materiality threshold for expense manipulation cases has been refined through recent court decisions.

- Courts now consider not just the absolute dollar amount of the manipulation but also its impact on key financial metrics that investors rely upon, such as earnings per share, profit margins, and growth rates.

Recent Legal Developments and Investor Protection

The legal framework governing financial discrepancies continues to evolve, with several 2024 developments reshaping the landscape:

- Enhanced Disclosure Requirements: New SEC rules require more detailed explanations of significant accounting estimates and judgments, making it harder for companies to hide questionable practices in footnotes.

- Artificial Intelligence and Detection: Regulatory bodies are increasingly using AI-powered tools to identify unusual patterns in financial reporting, leading to more targeted investigations and enforcement actions.

- ESG-Related Discrepancies: Environmental, social, and governance reporting has become a new frontier for potential misstatements, as companies face pressure to present favorable sustainability metrics.

Protecting Investor Interests

- For investors seeking to protect themselves from financial discrepancy-related losses, several best practices have emerged:

- Due Diligence Enhancement: Investors should pay particular attention to companies with complex business models, frequent accounting changes, or unusual related-party transactions.

- Professional Guidance: Given the complexity of modern financial discrepancy cases, investors who suspect fraud should consult with experienced securities litigation attorneys who can assess the strength of potential claims.

- Documentation Preservation: Maintaining detailed records of investment decisions and the information relied upon can be crucial for establishing damages in subsequent litigation.

- The intersection of technological advancement and regulatory evolution continues to create new challenges and opportunities in financial discrepancy detection and litigation.

- As markets become more complex and interconnected, the potential impact of financial discrepancies on investor welfare only increases, making robust legal remedies and enforcement mechanisms more critical than ever.

- Understanding these evolving dynamics empowers investors to make more informed decisions and seek appropriate remedies when corporate misconduct damages their financial interests.

The Impact of Financial Irregularities on Investors

- Financial irregularities can have profound effects on investors, often resulting in financial losses and a loss of trust in the market.

- When discrepancies are discovered, they can lead to a sharp decline in a company’s stock price, eroding the value of investors’ portfolios.

- For institutional investors managing large funds, the impact can be even more severe, with substantial financial repercussions that can affect their ability to meet fiduciary obligations.

- The ripple effect of financial irregularities can extend beyond individual investors, affecting market stability and investor sentiment as a whole.

- Investors rely heavily on the accuracy and transparency of financial records to make informed decisions.

- When these records are found to be inaccurate, it undermines the credibility of the financial information and calls into question the reliability of the company’s management.

- This can lead to a loss of confidence not only in the affected company but also in the broader financial markets.

- As trust is a fundamental component of investing, discrepancies in financial records can have a long-lasting impact on investor behavior, prompting increased scrutiny and a more cautious approach to investment decisions.

- Moreover, financial irregularities can trigger a chain reaction of legal and regulatory actions, further impacting investors.

- Securities fraud class actions may be filed by shareholders seeking compensation for their losses, while regulatory bodies may impose fines and sanctions on the company.

- These actions can create additional financial burdens for the company, potentially leading to bankruptcy or restructuring.

- For investors, the prospect of prolonged litigation and the uncertainty surrounding the outcome can add to the financial and emotional toll of dealing with financial discrepancies.

Recent Developments in Fraud on the Market Theory

- The fraud on the market theory has undergone significant evolution in recent years, fundamentally reshaping how investors can seek remedies for securities fraud.

- This legal doctrine, which presumes that investors rely on the integrity of market prices when making investment decisions, has been refined through landmark court decisions and regulatory developments that directly impact investor protection strategies.

- Recent Supreme Court precedents have strengthened the theoretical foundation while imposing more rigorous pleading standards.

- The 2024 developments in securities litigation have particularly emphasized the need for plaintiffs to demonstrate specific causal connections between alleged misrepresentations and market price distortions.

- Courts now require more sophisticated economic analysis to establish that fraudulent statements actually influenced trading prices, moving beyond the traditional presumption of market efficiency.

Enhanced Pleading Requirements and Market Impact Analysis

- Modern applications of the fraud on the market theory now incorporate advanced econometric modeling to demonstrate price impact.

- Economic experts must present detailed event studies showing how specific disclosures affected stock prices, accounting for market-wide factors and industry-specific trends.

- This evolution has made securities litigation more complex but potentially more effective for investors who can meet these heightened standards.

- Courts now examine whether alleged misstatements would have significantly altered the “total mix” of information available to reasonable investors.

- This analysis considers not just the magnitude of financial misstatements but also their timing, the company’s disclosure practices, and the broader market context in which the information was released.

Institutional vs. Retail Investor Considerations

- Institutional investors face unique challenges under the evolving fraud on the market theory framework.

- Their sophisticated investment processes and access to independent research can complicate claims of reliance on public statements.

- However, recent developments have recognized that even sophisticated investors may rely on market prices that incorporate fraudulent information, particularly in efficient markets where information is rapidly absorbed into stock prices.

- Retail investors, conversely, benefit from stronger presumptions of market reliance but must navigate increasingly complex damage calculations.

- The evolution toward more precise economic modeling means that individual investor recoveries may vary significantly based on their specific trading patterns and the timing of their transactions relative to corrective disclosures.

Regulatory Response and Market Integrity Measures

- The SEC has responded to these developments by enhancing disclosure requirements and implementing more robust oversight mechanisms.

- New regulations require companies to provide more detailed risk assessments and to update investors more frequently about material changes in their business operations or financial condition.

- Near real-time disclosure requirements have fundamentally altered the landscape in which financial irregularities occur and are detected.

- Companies now face pressure to disclose material information immediately, reducing the window during which fraudulent schemes can operate undetected.

- This has led to faster market corrections but also increased volatility when irregularities are discovered.

Practical Implications for Investor Protection

- Investors seeking to protect themselves in this evolving landscape should focus on diversification strategies that account for the increased detection and correction speed of financial irregularities.

- The enhanced legal framework means that while fraudulent schemes may be detected more quickly, the resulting market corrections can be more severe and immediate.

- Due diligence practices must now incorporate awareness of the sophisticated economic analysis required to prove securities fraud claims.

- Investors should maintain detailed records of their investment decisions and the information sources they relied upon, as these may become crucial evidence in potential litigation.

- The modern securities litigation environment offers both nhanced protections and increased complexity for investors.

- While the legal framework provides stronger theoretical foundations for recovery, the practical requirements for proving fraud claims have become more demanding.

- Investors who understand these developments and adapt their strategies accordingly are better positioned to protect their interests and seek appropriate remedies when financial irregularities occur.

- By staying informed about these evolving legal standards and maintaining robust investment practices, investors can better navigate the complex intersection of market dynamics, regulatory oversight, and legal remedies that characterize today’s financial markets.

The Comprehensive Impact of Financial Irregularities on Investors: Understanding Market Disruption and Legal Remedies

- Financial irregularities represent one of the most significant threats t marketo integrity and investor confidence, creating cascading effects that extend far beyond immediate financial losses.

- When corporations engage in fraudulent activities, material misrepresentations, or omissions of critical information, the resulting damage permeates multiple layers of the financial ecosystem, affecting individual investors, institutional stakeholders, and market stability as a whole.

Systemic Market Disruption and Investor Categories

- The immediate impact of financial irregularities manifests most visibly through dramatic stock price volatility.

- When discrepancies surface, markets often experience what economists term “corrective disclosure events” – sudden, sharp price movements that reflect the market’s attempt to incorporate previously hidden information.

- These events disproportionately affect different investor categories in distinct ways.

- Retail investors typically bear the heaviest burden, lacking the sophisticated risk management tools and diversification strategies available to institutional players.

- Their portfolios often concentrate holdings in fewer securities, making them particularly vulnerable to single-company fraud events.

- Institutional investors, while better positioned to absorb losses through diversification, face their own challenges. Pension funds, mutual funds, and insurance companies managing billions in assets can experience substantial portfolio damage that ultimately affects millions of beneficiaries and policyholders.

- High-frequency traders and algorithmic systems create additional complexity during irregularity disclosures. These automated systems can amplify price movements, creating artificial volatility that compounds the damage from the underlying fraud.

- This technological amplification represents a modern dimension of financial irregularity impact that wasn’t present in earlier market eras.

Recent Developments in Fraud on the Market Theory

- The legal landscape surrounding financial irregularities has evolved significantly, particularly regarding fraud on the market theory applications.

- Recent Supreme Court decisions, including the landmark 2024 ruling in Macquarie Infrastructure Corp. v. Moab Partners, L.P., have fundamentally reshaped how courts assess materiality and market impact in securities fraud cases.

- Fraud on the market theory operates on the premise that in efficient markets, material misrepresentations become incorporated into stock prices, allowing investors to rely on market prices as accurate reflections of available information.

- Recent developments have strengthened this theory’s application by establishing clearer standards for demonstrating market efficiency and price impact.

- Modern courts increasingly recognize that artificial intelligence and algorithmic trading have enhanced market efficiency, making the fraud-on-the-market presumption more robust.

- This evolution means that investors can more effectively demonstrate that they relied on market prices that incorporated fraudulent information, even without reading specific company disclosures.

Psychological and Behavioral Impact on Investment Decisions

- Beyond quantifiable financial losses, irregularities create profound psychological effects that alter investor behavior patterns.

- Research in behavioral finance demonstrates that fraud events trigger what psychologists term “betrayal trauma” – a specific form of psychological damage that occurs when trusted institutions violate that trust.

- This trauma manifests in several ways: heightened risk aversion, where investors become overly cautious and miss legitimate opportunities; analysis paralysis, where the fear of future fraud leads to excessive due diligence that prevents timely investment decisions; and market timing attempts, where investors try to predict and avoid future irregularities, often resulting in poor market timing and reduced returns.

- Institutional investors experience additional pressures through fiduciary responsibility concerns.

- Fund managers may adopt overly conservative strategies to aavoid potential fraud exposure, potentially underperforming their benchmarks and failing to meet their obligations to beneficiaries.

Regulatory Evolution and Enhanced Enforcement

- The rregulatory response to financial irregularities has intensified significantly, with enforcement agencies developing more sophisticated detection methods and imposing more severe penalties.

- The SEC has enhanced its data analytics capabilities, using artificial intelligence to identify suspicious patterns in financial reporting and trading activity.

- Whistleblower programs have become increasingly effective, with the SEC’s Office of the Whistleblower awarding over $1 billion in payments since 2012.

- These programs create additional deterrent effects while providing early warning systems for potential irregularities.

- Recent regulatory developments include enhanced disclosure requirements for cybersecurity incidents, expanded executive compensation clawback provisions, and stricter audit committee independence standards.

- These measures aim to prevent irregularities before they occur while ensuring more rapid detection and disclosure when problems arise.

Long-term Market Efficiency and Participation Effects

- Financial irregularities create lasting damage to market efficiency by introducing persistent uncertainty about information quality.

- Even after specific fraud cases resolve, investors may continue to discount corporate disclosures, leading to higher risk premiums and increased cost of capital for all public companies.

- Retail investor participation often declines following major fraud events, as individual investors lose confidence in market fairness.

- This reduced participation can Accounting Fraud and Securities Litigation: A Comprehensive and Painstaking Investor Guide [2025] that makes markets less efficient and more susceptible to future disruptions.

Legal Remedies and Investor Protection Mechanisms

- Investors affected by financial irregularities have several legal remedies available, primarily through securities class action lawsuits.

- These actions allow investors to recover out-of-pocket damages – the difference between what they paid for securities and their true value without the fraudulent information.

- The PSLRA provides important protections while establishing rigorous pleading standards.

- Recent court decisions have clarified that plaintiffs must demonstrate not only that misrepresentations occurred, but also that these misrepresentations caused their economic losses through market price impact.

- Expert testimony plays a crucial role in these cases, with forensic accountants and financial analysts providing critical insights into how fraud affected market prices and quantifying resulting damages.

- Modern event studies and econometric analyses have become increasingly sophisticated, providing more accurate damage calculations.

- Understanding these comprehensive impacts empowers investors to better protect themselves and seek appropriate remedies when financial irregularities occur.

- The evolving legal landscape continues to strengthen investor protections while maintaining market efficiency and corporate accountability.

- For investors who have suffered losses due to financial irregularities, consulting with experienced securities litigation attorneys can help determine available remedies and ensure proper protection of legal rights in this complex regulatory environment to prevent enforcemt by regulatory bodies.

Case Studies: Notable Securities Litigation Cases

- Examining notable securities litigation cases provides valuable insights into the consequences of financial discrepancies and the legal mechanisms used to address them.

- One significant case is the Enron scandal, where the energy company engaged in accounting fraud to conceal its debt and inflate profits.

- The discrepancies in Enron’s financial records led to one of the largest bankruptcies in U.S. history and a slew of lawsuits against the company and its executives.

- The case highlighted the need for stricter regulatory oversight and led to the enactment of the Sarbanes-Oxley Act, which introduced enhanced financial reporting requirements for public companies.

- The Enron litigation demonstrated the critical role of loss causation in securities fraud cases.

- Investors who purchased Enron stock during the fraud period ultimately recovered approximately $7.2 billion through class action settlements.

- The case established important precedents regarding artificial inflation of stock prices and how corrective disclosures trigger market corrections.

- Economic experts utilized sophisticated event studies to demonstrate how Enron’s fraudulent statements inflated the stock price by as much as $40 per share during peak periods.

- Another prominent case is the Lehman Brothers collapse, which was precipitated by financial irregularities and risky investment practices.

- Lehman Brothers’ failure to accurately disclose its financial position and the use of off-balance-sheet transactions to hide liabilities contributed to the 2008 financial crisis.

- The fallout from Lehman’s discrepancies resulted in extensive litigation, with investors, creditors, and regulators seeking accountability and compensation.

- This case underscored the systemic risks posed by financial discrepancies and the importance of transparency in financial reporting.

- The Lehman Brothers litigation involved complex fraud on the market theory applications, particularly regarding the efficient market hypothesis and how material misrepresentations affected market prices.

- Recent developments in this theory have strengthened plaintiff positions by establishing clearer standards for proving market efficiency and reliance.

- Courts now recognize that even sophisticated institutional investors can rely on market integrity when making investment decisions, expanding the scope of potential recoveries.

- More recently, the case of Wirecard AG in Germany has garnered attention for its financial discrepancies involving fraudulent accounting practices.

- The company’s collapse in 2020, following the revelation of a €1.9 billion accounting hole, led to criminal investigations and numerous lawsuits.

- The Wirecard case highlighted the vulnerabilities in regulatory oversight and the challenges of detecting financial fraud in complex corporate structures.]

- It also served as a wake-up call for regulators and investors to enhance due diligence and risk management practices to prevent similar occurrences in the future.

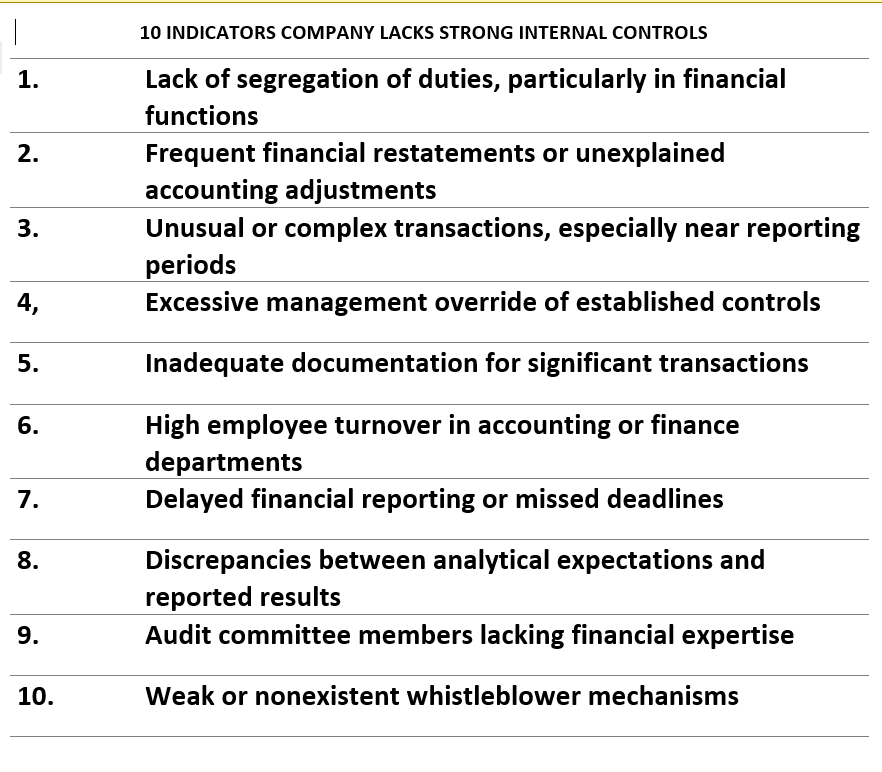

How to Identify Red Flags in Financial Records

- Identifying red flags in financial records is essential for investors, analysts, and regulators to prevent financial discrepancies and mitigate the risk of securities litigation.

- One key indicator of potential discrepancies is inconsistencies in financial statements. Discrepancies between reported revenues, expenses, and profits can suggest manipulation or errors in financial reporting.

- By comparing financial statements over time and against industry benchmarks, stakeholders can identify unusual trends or anomalies that warrant further investigation.

- Advanced analytical techniques have become increasingly sophisticated in detecting these inconsistencies. Modern fraud detection employs data analytics to identify patterns that human reviewers might miss, including unusual journal entries, revenue recognition timing irregularities, and expense categorization anomalies.

- These technological advances have proven particularly effective in uncovering complex accounting manipulations that traditional auditing methods often overlook.

- Another red flag is the presence of complex financial instruments or off-balance-sheet transactions that lack transparency. Such arrangements can be used to obscure a company’s true financial position and hide liabilities.]

- Recent developments in regulatory oversight have heightened scrutiny of these structures, particularly following high-profile cases where companies used sophisticated financial engineering to mislead investors. Stakeholders should scrutinize these transactions and seek to understand the underlying risks and implications.

- Frequent restatements of financial results or changes in accounting policies represent another critical warning sign. Companies that regularly revise their financial statements may be attempting to correct prior inaccuracies or mislead stakeholders or action by regulatory bodies.

- The Fraud on the Market Theory becomes particularly relevant here, as material misstatements can artificially inflate stock prices, creating market-wide reliance on false information that ultimately harms investors when the truth emerges.

- The behavior of company insiders serves as an equally important red flag. Unusual insider trading activity, significant changes in executive compensation structures, or unexplained departures of key financial personnel can indicate potential discrepancies.

- Recent regulatory bodies have developments that have strengthened disclosure requirements for insider transactions, making it easier for analysts to detect suspicious patterns.

- Corporate governance deterioration represents an emerging area of concern. Warning signs include board composition changes that reduce independence, audit committee turnover, or resistance to external auditor recommendations. These governance red flags often precede more obvious financial irregularities.

- Modern stakeholders must also consider digital footprints and social media sentiment as supplementary indicators. Unusual patterns in company communications, social media activity, or employee reviews can provide early warning signals that complement traditional financial analysis.

- By remaining vigilant and proactive in identifying these red flags, stakeholders can protect their investments and hold companies accountable for financial discrepancies.

- The integration of traditional analytical methods with emerging technological tools and regulatory frameworks creates a comprehensive approach to fraud detection that serves the broader goal of market integrity and investor protection.

Steps to Take if You Suspect Financial Discrepancies

- If you suspect financial discrepancies in a company, it is important to take a systematic approach to address your concerns.

- The first step is to conduct a thorough analysis of the company’s financial statements and disclosures. Look for inconsistencies, unusual trends, or discrepancies that deviate from industry norms.

- Pay attention to changes in accounting policies, restatements of financial results, and any complex financial transactions that lack transparency. This analysis will help you gather evidence and identify specific areas of concern.

- Once you have identified potential discrepancies, consider engaging with the company’s management or investor relations team to seek clarification.

- Ask questions about the discrepancies and request additional information or explanations.

- Open communication with the company can provide valuable insights and help determine whether the discrepancies are the result of errors, miscommunication, or intentional manipulation.

- If the company’s responses are unsatisfactory or raise further concerns, it may be necessary to escalate the issue to regulatory authorities or seek legal advice.

- If the discrepancies are significant and could affect the company’s financial health or stock performance, you may need to reassess your investment strategy.

- This could involve reducing your exposure to the company, diversifying your portfolio, or seeking alternative investment opportunities.

- By taking proactive steps to address suspected financial discrepancies, you can protect your investments and contribute to greater accountability and transparency in the financial markets.

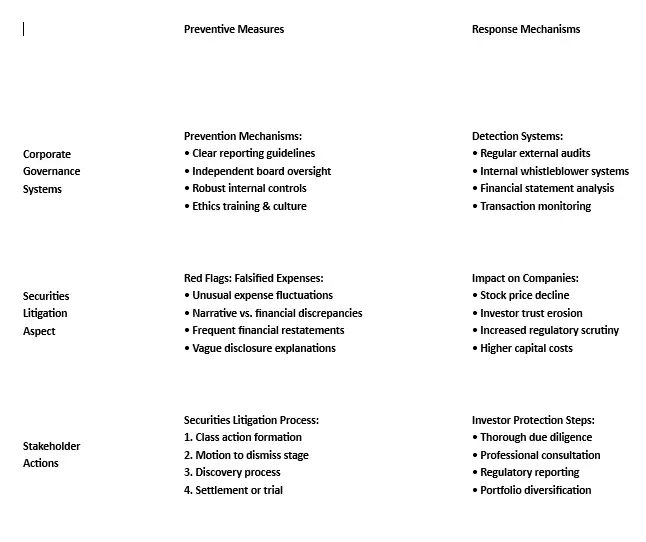

Comprehensive Preventative Measures for Companies: Safeguarding Against Securities Litigation in the Modern Era

- In today’s increasingly complex regulatory landscape, companies face unprecedented scrutiny regarding their financial reporting and disclosure practices.

- The cost of securities litigation extends far beyond monetary settlements – it encompasses reputational damage, operational disruption, and erosion of stakeholder confidence that can persist for years.

- As regulatory enforcement intensifies and investor sophistication grows, implementing robust preventative measures has evolved from a best practice to an absolute necessity for corporate survival.

- The foundation of effective securities litigation prevention rests on three interconnected pillars: comprehensive corporate governance frameworks, cutting-edge technological solutions, and continuous employee education.

- However, recent developments in regulatory enforcement and emerging technologies have fundamentally reshaped how companies must approach these traditional safeguards.

Advanced Corporate Governance Frameworks: Beyond Basic Compliance

- Establishing a strong corporate governance framework requires more than appointing independent directors and forming audit committees.

- Modern governance frameworks must be dynamic, responsive, and deeply integrated into every aspect of business operations.

Strategic Board Composition and Independence

- Companies should prioritize directors with diverse professional backgrounds, including financial reporting expertise, regulatory experience, and industry-specific knowledge.

- Recent trends show that boards with at least 40% independent directors demonstrate significantly lower rates of securities violations.

Key implementation strategies include:

- Rotating committee assignments every three years to prevent complacency and ensure fresh perspectives

- Mandatory continuing education programs for directors on evolving securities regulations and industry-specific risks

- Comprehensive background checks and conflict-of-interest assessments conducted annually rather than only at appointment

Enhanced Audit Committee Functionality

- The audit committee serves as the primary guardian against financial discrepancies, but its effectiveness depends on proactive engagement rather than passive oversight.

- Successful audit committees implement quarterly deep-dive sessions focusing on specific risk areas, maintain direct communication channels with internal audit teams, and establish whistleblower protocols that bypass traditional management hierarchies.

- They also engage in pre-emptive risk assessment, identifying potential problem areas before they manifest in financial statements.

Comprehensive Policy Implementation and Monitoring

- Policies and procedures form the operational backbone of governance frameworks, but their effectiveness depends on consistent implementation and regular updates.

- Companies must establish living documents that evolve with regulatory changes and business developments.

Critical policy areas include:

- Related-party transaction approval processes with mandatory independent valuations

- Disclosure committee procedures ensuring timely identification and reporting of material information

- Document retention policies that anticipate securities litigation discovery requirements

PREMENTAIVE MEASURES AND RESPONSE MECHANISMS

Technology and Data Analytics: The New Frontier of Compliance

- The integration of advanced technology and data analytics has revolutionized how companies monitor and detect potential discrepancies.

- Artificial intelligence and machine learning algorithms can now identify patterns and anomalies that would be impossible for human reviewers to detect.

Employee Training and Awareness: Building a Culture of Compliance

- While technology and governance structures provide the framework for compliance, human behavior ultimately determines their effectiveness.

- Comprehensive employee training programs must address not only technical requirements but also the cultural and behavioral aspects of ethical conduct.

Comprehensive Training Program Design

- Effective training programs go beyond annual compliance sessions to create ongoing educational experiences that reinforce ethical behavior and regulatory awareness.

Advanced training components include:

- Scenario-based learning using real-world examples and case studies from recent securities violations

- Interactive simulations that allow employees to practice identifying and responding to potential compliance issue

- Cross-functional workshops that help employees understand how their activities impact other departments and overall compliance

Creating Accountability Mechanisms

- Training effectiveness depends on creating clear accountability structures that reinforce the importance of compliance.

- This includes establishing performance metrics that incorporate compliance behavior, implementing recognition programs for employees who demonstrate exceptional ethical conduct, and ensuring that consequences for violations are consistently applied regardless of seniority or performance in other areas.

Communication and Reporting Channels

- Employees must have multiple avenues for reporting potential compliance concerns without fear of retaliation.

- Anonymous reporting systems, regular town halls with senior management, and ombudsman programs all contribute to creating an environment where compliance concerns are addressed proactively rather than reactively.

Recent Developments in Securities Regulation and Fraud Prevention

- The regulatory landscape continues to evolve rapidly, with significant developments in 2025 reshaping how companies must approach compliance from regulatory bodies and shareholder litigation prevention.

Phased Implementation Approach

- Phase One should focus on establishing foundational governance structures and identifying critical risk areas.

- Phase Two involves implementing technology solutions and enhancing existing controls.

- Phase Three emphasizes cultural transformation through comprehensive training and accountability mechanisms.

Measuring Effectiveness

- Companies must establish quantitative and qualitative metrics to assess the effectiveness of their preventative measures to prevent securities litigation.

- This includes tracking control deficiencies, employee training completion rates, whistleblower reports, and external audit findings.

- Regular benchmarking against industry peers and best practices ensures continuous improvement.

Continuous Evolution and Adaptation

- Preventative measures must evolve continuously to address emerging risks, regulatory changes, and business developments.

- By implementing these comprehensive preventative measures, companies can significantly reduce their exposure to securities litigation while building sustainable competitive advantages through enhanced operational efficiency, stakeholder confidence, and regulatory compliance.

- The investment in robust preventative frameworks ultimately pays dividends through reduced legal costs, improved market valuation, and enhanced reputation with investors, regulators, and other stakeholders.

Conclusion:

- As we look towards the future of securities litigation in 2026, it is clear that the landscape will continue to evolve in response to changing regulatory requirements, technological advancements, and investor expectations.

- Financial discrepancies will remain a significant trigger for litigation, as stakeholders demand greater accountability and transparency from companies.

- The role of regulatory bodies will be increasingly important, as they work to enforce compliance and protect investors in an increasingly complex financial environment.

- Ultimately, the future of securities litigation will be shaped by the collective efforts of companies, regulators, investors, and other stakeholders to uphold the principles of integrity, transparency, and accountability.

- By fostering a culture of trust and ethical conduct, companies can reduce the likelihood of financial discrepancies and securities litigation, while enhancing their reputation and long-term success.

- As we move forward, the lessons learned from past securities litigation cases will continue to inform best practices and guide the development of more effective regulatory frameworks, ensuring a fair and resilient financial market for all participants.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors