Introduction to Differences In Accounting Periods Fraud

- Misintrepting Fincancial Healgth: In the realm of accounting and financial reporting, discrepancies in accounting periods can often lead to confusion and misinterpretation of a company’s financial health.

- Differences In Accounting Periods Fraud: A manipulative method that can have serious implications for securities litigation.

- Alteing Time Frames: This type of fraud involves altering the time frame of financial reporting to present a misleading picture of a company’s performance.

- Illusion of Growth: By shifting revenues or expenses between periods, companies can create an illusion of stability or growth that is not truly reflective of their operations.

- Undermides Fiancial Statesmens Integrity: Differences In Accounting Periods Fraud is particularly concerning because it undermines the integrity of financial statements, which are vital tools for investors, regulators, and stakeholders to make informed decisions.

- Reclassifying Revenue Timing: The manipulation typically involves extending or shortening accounting periods or reclassifying transactions to alter the timing of revenue recognition or expense recording.

- Skewing Financial Statements: This deceptive practice can inflate earnings in one period while deflating them in another, thereby skewing the true financial position and performance of the company.

- Severe Consequences: The consequences of Differences In Accounting Periods Fraud are significant, leading to potential securities fraud litigation.

- Lack of Transparency: Investors rely on accurate and transparent financial information to assess risks and make investment choices.

- Misleads Shareholders: When companies engage in this form of fraud, they mislead investors, resulting in losses and undermining market confidence.

- Regulatory Bodies: Such as the Securities and Exchange Commission (SEC) are vigilant in identifying and prosecuting such fraudulent activities to maintain the integrity of financial markets.

- Complexity: This stems from differences in accounting periods fraudoften involves complex investigations and legal proceedings. Forensic accountants and auditors play a crucial role in uncovering manipulative practices by meticulously analyzing financial records and transactions.

- Remedies: Legal teams then use this evidence to build cases against fraudulent entities, seeking restitution for affected investors and imposing penalties to deter future misconduct.

- Mitigate Risk: To mitigate the risks associated with differences in accounting periods fraud, companies must adopt robust icorporate governance and internal controls and adhere strictly to accounting standards.

- Transparent and Consistent Reporting Practices: These are essential to ensure that financial statements accurately reflect the company’s performance over time. Regulatory bodies must continue to enhance oversight mechanisms and enact stringent penalties for violations to discourage fraudulent practices.

Accounting Periods Fraud: Key Points

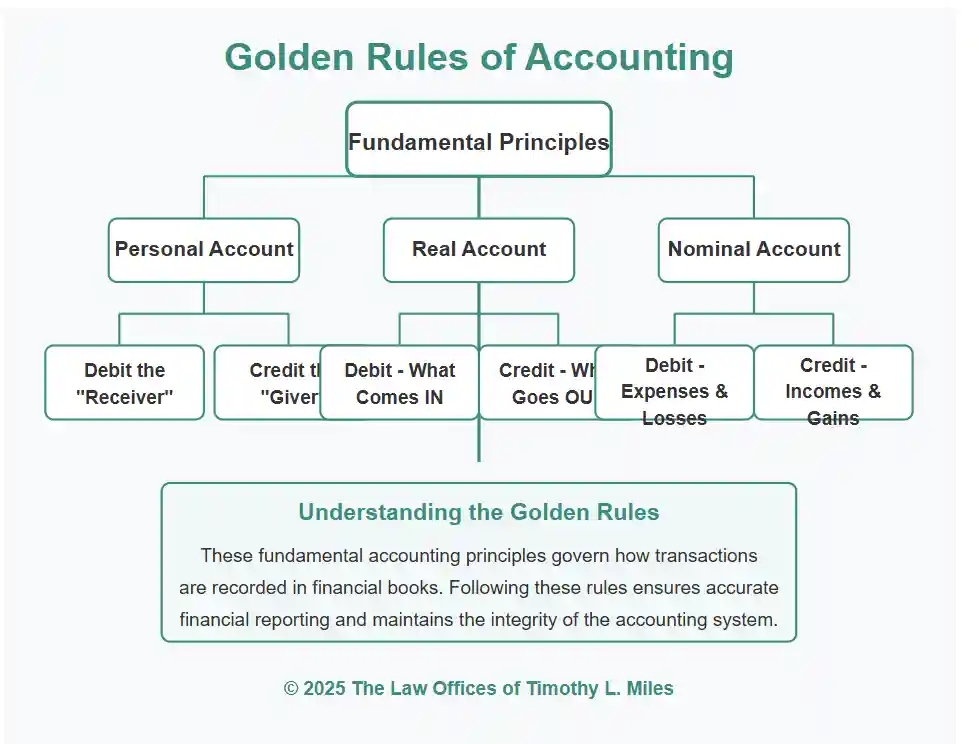

- Foundational Concept: Accounting periods serve as defined intervals for financial reporting, typically covering fiscal quarters or years, allowing stakeholders to track performance systematically.

- Financial Integrity: The accuracy of financial reporting depends on proper representation of transactions within these periods, adhering to accrual accounting principles.

- Manipulation Vulnerability: The structured nature of accounting periods creates opportunities for fraudulent manipulation by unethical entities seeking to misrepresent financial performance.

- Deceptive Intent: Accounting periods fraud involves deliberately misrepresenting financial transactions to deceive stakeholders about a company’s true financial performance.

- Timing Distortion: This fraud typically involves altering revenue recognition timing or expense reporting across different periods to create illusions of stability or growth.

- Detection Challenges: Unlike outright falsification, period manipulation often involves subtle adjustments that appear legitimate, making detection difficult.

- Market Distortion: This form of fraud extends beyond misleading statements to distorting market perceptions and eroding investor trust.

- Premature Revenue Recognition: A common technique where companies record sales before they have actually occurred, artificially inflating current period revenues.

- Expense Delay Tactics: Companies may py reducing reported costs and boosting apparent profits.

- Cookie Jar Reserves: This involves overstating expenses in profitable years to create reserves that can be used during lean periods, creating an illusion of consistent performance.

- Channel Stuffing: Companies artificially inflate sales by pushing excess products to distributors, temporarily boosting revenue but leading to increased returns and reduced future sales.

- Enron Case Study: One of the most infamous examples where complex accounting schemes were used to hide debt and inflate profits, eventually leading to one of history’s largest bankruptcies.

- WorldCom Example: Executives capitalized on accounting rule flexibility to shift expenses from current to future periods, creating false profitability that resulted in massive shareholder losses.

- Legal Complexity: Securities fraud litigation involving accounting periods fraud intersects with complex regulatory frameworks and corporate governance standards.

- Regulatory Enforcement: Agencies like the SEC have authority to impose sanctions, fines, and criminal charges against companies and individuals engaged in financial manipulation.

- Deterrent Effect: Securities fraud itigation serves to discourage accounting fraud by holding companies accountable and exposing fraudulent activities.

- Investigation Requirements: Successfully prosecuting accounting periods fraud cases requires meticulous investigation and evidence gathering by forensic speialists

- Financial Consequences: Companies found guilty face significant financial penalties, legal costs, and devastating reputational damage.

- Investor Protection: The primary aim of enforcement is protecting investors and maintaining financial market integrity through transparency and accountability.

- Corporate Governance Impact: These cases have led to significant reforms in accounting standards, auditing practices, and corporate oversight mechanisms

Accounting Periods Fraud: Legal Implications and Best Practic

- Accounting periods fraud intersects with securities regulation and corporate governance, creating a complex legal landscape.

- Companies engaging in period manipulation may face litigation from shareholders, regulatory bodies, and other stakeholders. Securities litigation often centers on allegations of misleading financial statements, leading to significant financial penalties and legal costs.

- Regulatory agencies like the SEC play a critical role in enforcing accounting standards and pursuing fraud cases.

- Regulators have authority to impose sanctions, fines, and even criminal charges against companies and individuals involved in financial manipulation.

- The reputational damage and financial costs associated with securities fraud litigation can be devastating for companies.

- Securities fraud litigation serves as a deterrent against accounting fraud, helping maintain market integrity and protect investors.

- Successfully prosecuting fraud cases requires meticulous investigation and evidence gathering.

The Role of Auditors in Detecting Accounting Fraud

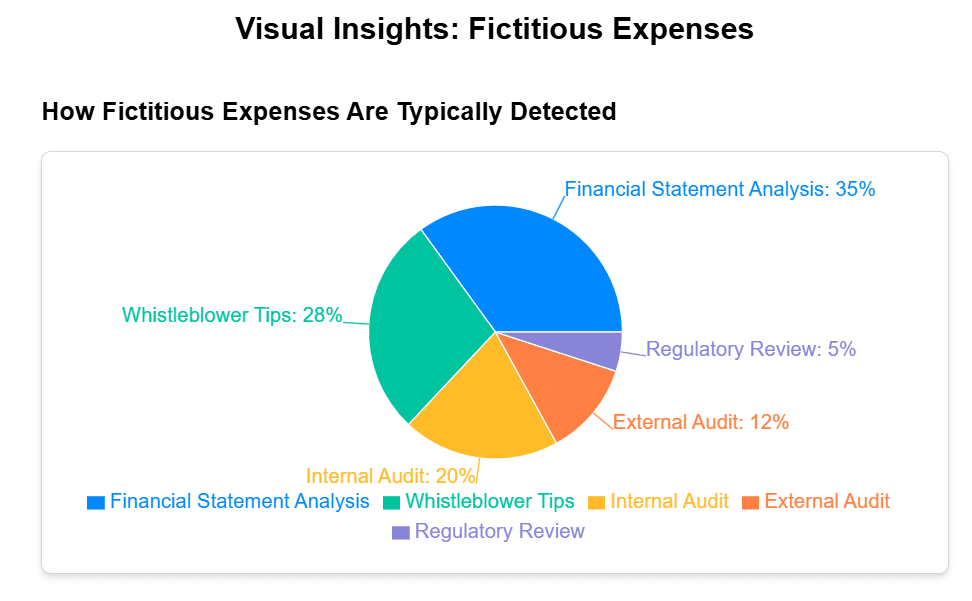

- Auditors serve as an independent check on a company’s financial reporting.

- Through rigorous examination of financial statements and underlying transactions, auditors aim to provide assurance against material misstatements.

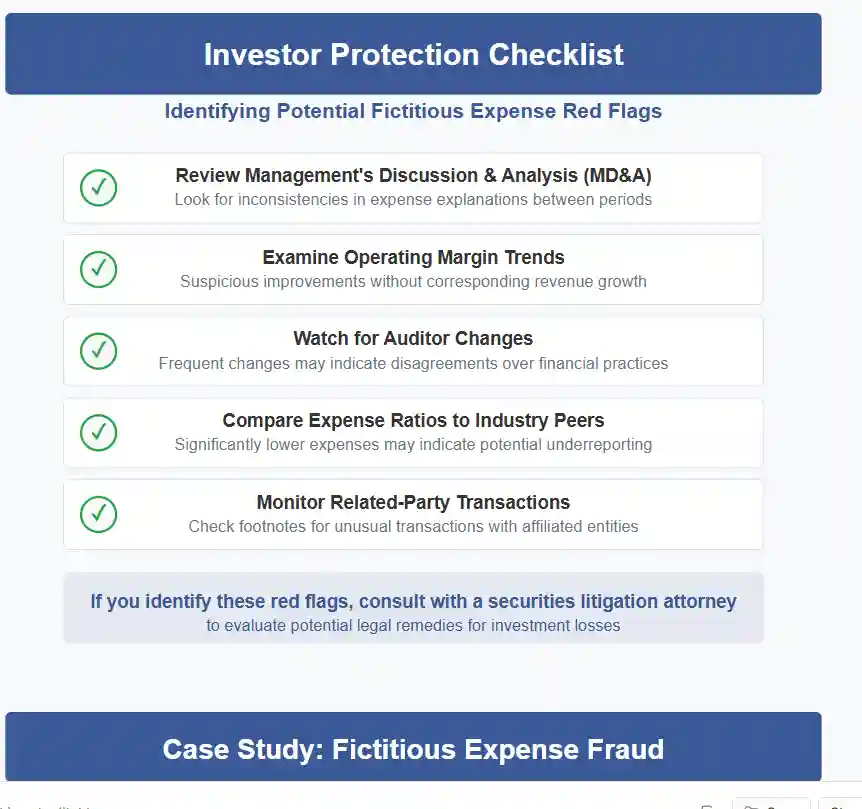

- Auditors must employ technical expertise and professional skepticism to identify manipulation signs like inconsistent revenue recognition or unusual expense patterns.

- Detecting fraud requires auditors to be alert to red flags such as sudden changes in accounting policies or significant adjustments to financial statements.

- Auditors face challenges including the complexity of modern financial transactions and sophisticated fraud concealment techniques.

- Pressure from management to overlook questionable practices highlights the importance of auditor independence and integrity.

- As gatekeepers of financial integrity, auditors must remain vigilant and proactive in combating accounting fraud.

Preventative Measures for Businesses

Preventative Measures for Businesses

- Preventing accounting periods fraud requires a multi-faceted approach combining robust internal controls, ethical corporate culture, and diligent oversigh

- Companies must establish clear policies and procedures for financial reporting to ensure accurate recording in appropriate periods.

- Implementing systems to track revenue recognition and expense allocation reduces the opportunity for manipulation.

- Creating a strong ethical culture promotes transparency and accountability at all levels.

- Companies should encourage employees to report suspicious activities without fear of retribution.

- Regular training programs and a clear code of conduct emphasize the importance of ethical behavior in financial reporting.

- Businesses should conduct regular audits and reviews of financial processes to identify and address potential vulnerabilities.

- Engaging both independent auditors and internal audit teams provides insights into financial reporting practices and helps implement corrective measures.

ework Surrounding Accounting Practices

ework Surrounding Accounting Practices

• International standards like IFRS and GAAP provide guidelines for accurate financial reporting.

• These standards establish principles for revenue recognition, expense allocation, and disclosure requirements.

• Regulatory bodies such as FASB and IASB develop and update accounting standards to address emerging challenges.

• Continuous refinement of accounting standards helps close loopholes that might be exploited for fraudulent purposes.

• Regulatory agencies monitor compliance with accounting standards and investigate suspected fraud cases.

• Agencies have authority to impose penalties on companies and individuals violating accounting regulations.

• Regulatory oversight is essential in deterring fraud and ensuring fair and efficient financial markets.

Best Practices for Ethical Accounting

- Companies should establish a strong ethical framework rooted in transparency and accountability.

- Robust internal controls should be designed to prevent and detect errors and fraud.

- Regular audits and reviews of financial processes help identify weaknesses and provide improvementopportunities.

- Companies should foster a culture of continuous improvement and learning about accounting standards and best practices.

- Innvesting in employee training and development strengthens organizational integrity.

- Promoting a culture of integrity and excellence builds stakeholder trust and contributes to overall financial market stability.

Securities Fraud Class Action Litigation

Fundamentals of Securities fraud Class Actions

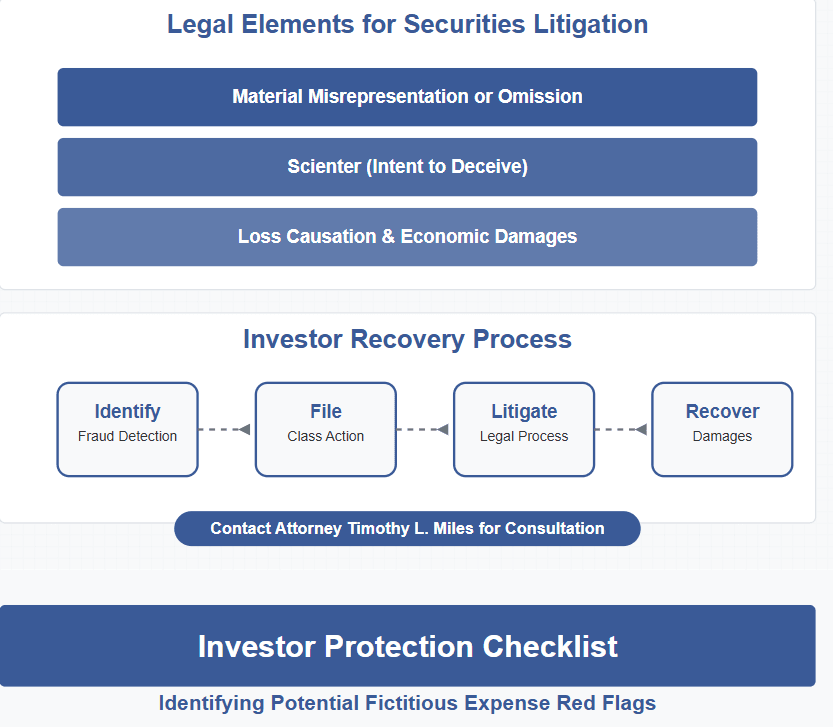

- Securities class action lawsuits serve as a powerful mechanism for investors to seek redress for financial losses caused by corporate misconduct.

- These lawsuits typically arise when a company, its officers, or directors make false or misleading statements, or fail to disclose material information affecting securities value.

- Significant drops in a company’s stock price resulting from misconduct can cause substantial financial losses for investors across the market.

- The class action format allows investors to band together in a single lawsuit rather than pursuing individual claims, streamlining the legal process.

- This collective approach ensures even small investors have a viable means to recover their losses when individually their claims might be too small to litigate.

The Securities Fraud Litigation Process

- Securities fraud litigation begins with identifying potentially fraudulent activities and filing a detailed complaint on behalf of affected investors.

- The complaint must demonstrate that defendants made materially false or misleading statements or omissions that investors relied upon.

- Plaintiffs must establish that these misrepresentations or omissions directly caused their financial losses (loss causation).

- After filing, the complaint undergoes rigorous judicial review, including motions to dismiss and class certification hearings.

- If the court certifies the class, recognizing the group as having legitimate common claims, litigation proceeds to discovery and potentially trial.

Implications for Litigants

- For plaintiffs, these lawsuits offer an opportunity to recover lost investments and hold corporations accountable for misconduct.

- Securities class actions serve as a powerful deterrent against future corporate fraud by establishing legal precedents.

- For defendants, facing securities class actions can result in substantial financial penalties, reputational damage, and increased regulatory scrutiny.

- Companies often must implement more robust compliance programs and improve corporate governance practices following litigation.

- Many cases resolve through settlements before trial, with amounts ranging from millions to billions depending on the misconduct’s scale.

The Connection Between Internal Controls and Securities Litigation

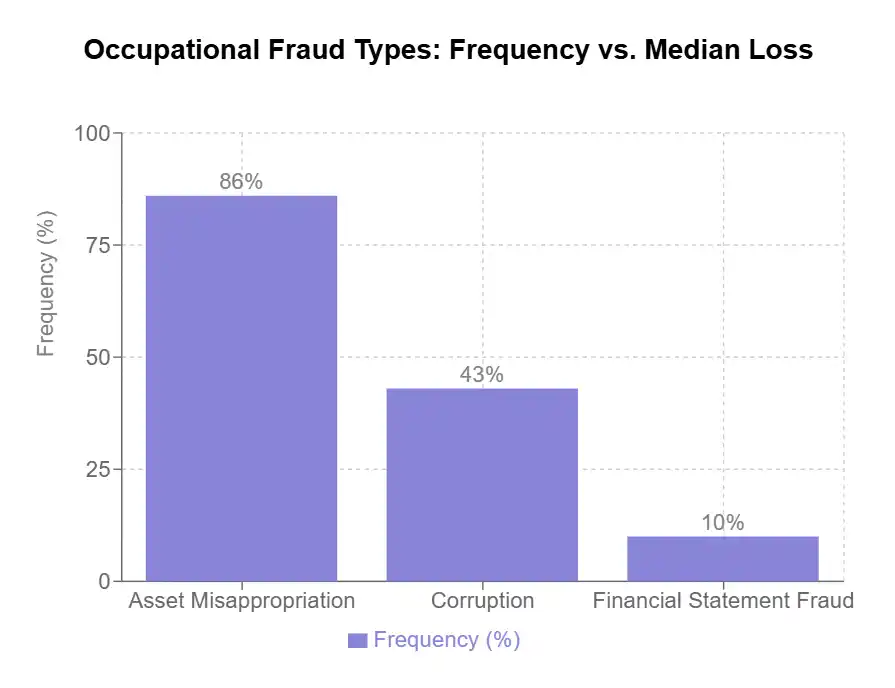

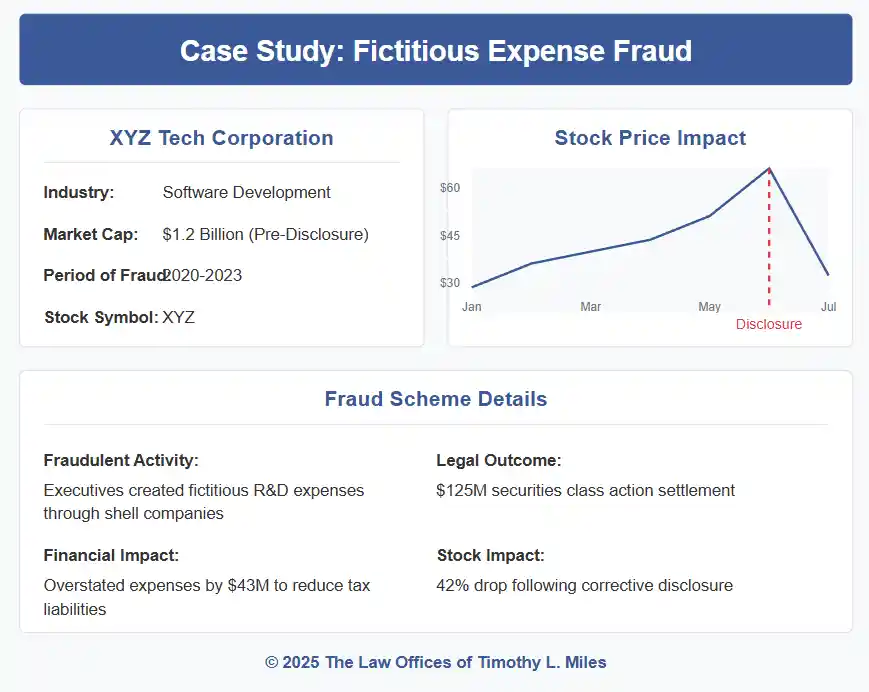

- Weak internal controls over financial reporting are frequently at the center of securities fraud allegations.

- Fictitious expenses and other accounting irregularities often stem directly from inadequate internal control systems.

- The absence of proper oversight mechanisms creates an environment where executives can manipulate financial statements without detection.

- Companies with deficient audit committee oversight face substantially higher risks of securities class action litigation.

- When internal controls fail, financial misstatements often follow, leading to stock drops when the truth emerges.

- Securities litigation frequently targets the representation that a company maintained “effective internal controls” when evidence suggests otherwise.

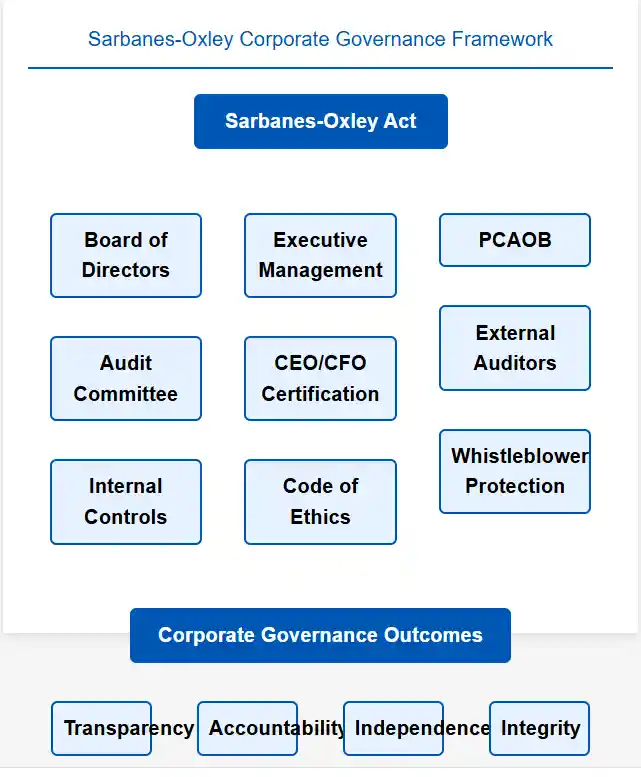

- Sarbanes-Oxley certifications regarding internal controls create personal liability for executives when those controls prove inadequate.

- Material weaknesses in internal controls over financial reporting serve as early warning signs of potential securities fraud.

- Plaintiff attorneys specifically target companies that have disclosed internal control weaknesses and subsequent financial restatements.

- Settlements in cases involving internal control failures tend to be significantly higher than other securities class actions.

Significance of Securities Class Actions

- Securities litigation plays a crucial role in maintaining the integrity of financial markets.

- The threat of class actions helps ensure companies adhere to high standards of transparency and accountability.

- While legally complex and challenging, securities class actions remain an indispensable tool for protecting investor interests.

- By targeting companies with fictitious expenses resulting from poor internal controls, securities litigation promotes better corporate governance across the market.

Corporate Governance and Internal Controls FAQ

What is corporate governance and why is it important?

Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It essentially involves balancing the interests of a company’s many stakeholders, including shareholders, management, customers, suppliers, financiers, government, and the community.

Good corporate governance is crucial because it provides the framework for attaining a company’s objectives while maintaining integrity and compliance with laws and regulations. It helps prevent corporate scandals, fraud, and potential civil and criminal liability.

For investors, it offers increased confidence in the company’s future and its ability to deliver sustainable shareholder value. When governance fails, as seen in cases like Enron and WorldCom, the consequences can be devastating for all stakeholders.

What role does the board of directors play in corporate governance?

The board of directors serves as the primary governing body of a corporation, acting as fiduciaries who represent shareholder interests while ensuring the company’s prosperity. Their responsibilities include:

- Establishing the company’s mission, vision, and values

- Selecting, evaluating, and compensating the CEO

- Approving major financial decisions and strategic initiatives

- Ensuring the integrity of financial reporting systems

- Overseeing risk management and compliance programs

- Monitoring the effectiveness of governance practices

The board’s independence is particularly critical, as directors must make objective decisions free from undue influence. The 2002 Sarbanes-Oxley Act significantly strengthened requirements for board independence, especially for audit committee members. Effective boards maintain a balance of industry expertise, financial acumen, and diverse perspectives to provide comprehensive oversight of management activities.

THE ENRON SCANDAL

Securities Fraud Legal Analysis

┌─────────────────────────────────────────────────────┐

│ SECURITIES LAW VIOLATIONS │

└─────────────────────────────────────────────────────┘

┌───────────────────────────────────────────────────────┐

│ • Rule 10b-5 violations through material │

│ misrepresentations in financial statements │

│ • Failure to disclose related-party transactions │

│ • Creation of deceptive SPEs to hide liabilities │

│ • Falsification of records and accounting fraud │

└───────────────────────────────────────────────────────┘

┌─────────────────────────────────────────────────────┐

│ INVESTOR IMPACT │

└─────────────────────────────────────────────────────┘

┌───────────────────────────────────────────────────────┐

nal investors and │

│ retirement funds nationwide │

Securities Fraud Legal Analysis

┌─────────────────────────────────────────────────────┐

│ SECURITIES LAW VIOLATIONS │

└─────────────────────────────────────────────────────┘

┌───────────────────────────────────────────────────────┐

│ • Rule 10b-5 violations through material │

│ misrepresentations in financial statements │

│ • Failure to disclose related-party transactions │

│ • Creation of deceptive SPEs to hide liabilities │

│ • Falsification of records and accounting fraud │

└───────────────────────────────────────────────────────┘

┌─────────────────────────────────────────────────────┐

│ INVESTOR IMPACT │

└─────────────────────────────────────────────────────┘

┌───────────────────────────────────────────────────────┐

│ • $74 billion in shareholder value destroyed │

│ • Pension funds decimated for thousands of employees │

│ • Out-of-pocket damages for shareholders who │

│ purchased at artificially inflated prices │

│ • Investment losses for institutional investors and │

│ retirement funds nationwide │

└───────────────────────────────────────────────────────┘

┌─────────────────────────────────────────────────────┐

│ LEGAL PRECEDENTS │

└─────────────────────────────────────────────────────┘

┌───────────────────────────────────────────────────────┐

│ • Led to passage of Sarbanes-Oxley Act of 2002 │

│ • Established heightened standards for corporate │

│ governance and financial disclosure │

│ • Enhanced criminal penalties for securities fraud │

│ • Created new requirements for auditor independence │

└───────────────────────────────────────────────────────┘

┌─────────────────────────────────────────────────────┐

│ SHAREHOLDER LITIGATION │

└─────────────────────────────────────────────────────┘

┌───────────────────────────────────────────────────────┐

│ • Class action settlement of $7.2 billion │

│ • Arthur Andersen (auditor) paid $72.5 million │

│ • Citigroup settlement: $2 billion │

│ • JP Morgan Chase settlement: $2.2 billion │

│ • Canadian Imperial Bank settlement: $2.4 billion │

└───────────────────────────────────────────────────────┘

└───────────────────────────────────────────────────────┘

┌─────────────────────────────────────────────────────┐

│ LEGAL PRECEDENTS │

└─────────────────────────────────────────────────────┘

┌───────────────────────────────────────────────────────┐

│ • Led to passage of Sarbanes-Oxley Act of 2002 │

│ • Established heightened standards for corporate │

│ governance and financial disclosure │

│ • Enhanced criminal penalties for securities fraud │

│ • Created new requirements for auditor independence │

└───────────────────────────────────────────────────────┘

┌─────────────────────────────────────────────────────┐

│ SHAREHOLDER LITIGATION │

└─────────────────────────────────────────────────────┘

┌───────────────────────────────────────────────────────┐

│ • Class action settlement of $7.2 billion │

│ • Arthur Andersen (auditor) paid $72.5 million │

│ • Citigroup settlement: $2 billion │

│ • JP Morgan Chase settlement: $2.2 billion │

│ • Canadian Imperial Bank settlement: $2.4 billion │

└───────────────────────────────────────────────────────┘

Internal Controls

What are internal controls and how do they relate to corporate governance?

differences in accounting periods frauddifferences in accounting periods fraud, promote accountability, and prevent fraud. The COSO (Committee of Sponsoring Organizations) framework, widely considered the gold standard, defines five essential components: control environment, risk assessment, control activities, information and communication, and monitoring activities.

- Internal controls form a critical pillar of corporate governance by providing reasonable assurance that:

- Operations are effective and efficient

- Financial reporting is reliable

- The organization complies with applicable laws and regulations

- Company assets are safeguarded against unauthorized acquisition, use, or disposition

- When internal controls are weak or absent, companies become vulnerable to fraud, financial misstatements, and regulatory violations—all of which can trigger securities litigation and destroy shareholder value.

What are the warning signs of inadequate internal controls?

- Several red flags may indicate deficient internal control systems within an organization:

- Lack of segregation of duties, particularly in financial functions

- Frequent financial restatements or unexplained accounting adjustments

- Unusual or complex transactions, especially near reporting periods

- Excessive management override of established controls

- Inadequate documentation for significant transactions

- High employee turnover in accounting or finance departments

- Delayed financial reporting or missed deadlines

- Discrepancies between analytical expectations and reported results

- Audit committee members lacking financial expertise

- Weak or nonexistent whistleblower mechanisms

The presence of these warning signs should prompt immediate action from the board and management. According to recent data, companies with material weaknesses in their internal controls are 38% more likely to experience fraud and face significantly higher litigation risks.

Addressing these deficiencies proactively is essential for maintaining market confidence and regulatory compliance.

What triggers securities class action lawsuits related to financial reporting?

- Securities class action lawsuits are typically triggered by significant stock price drops following revelations of potential misconduct in financial reporting. The most common catalysts include:

- Financial restatements correcting previously reported results

- Disclosure of material weaknesses in internal controls

- Revelation of accounting irregularities or fraud

- Failure to disclose known risks or contingencies

- Misleading statements about business performance or prospects

- Sudden changes in key accounting policies or estimates

- Unexpected write-downs of assets or inventory

- Abrupt departures of senior financial executives or auditors

- Regulatory investigations by the SEC or other authorities

For a securities fraud claim to succeed, plaintiffs must establish that the company or its officers made materially false or misleading statements with scienter (intent to deceive), that investors relied on these statements, and that the revelation of truth caused economic losses.

According to recent data, companies that disclosed material weaknesses in internal controls faced a 29% higher likelihood of securities litigation, with average settlement values 43% higher than other securities class actions.

How does weak corporate governance increase securities litigation risk?

- Weak corporate governance significantly elevates a company’s exposure to securities litigation through several interconnected pathways:

- Inadequate board oversight fails to detect and prevent financial misreporting

- Deficient audit committee expertise reduces effective scrutiny of financial statements

- Weak internal controls create opportunities for fraud and accounting irregularities

- Poor risk management practices leave companies vulnerable to undisclosed threats

- Insufficient disclosure controls lead to incomplete or misleading public statements

- Misaligned executive compensation incentivizes short-term manipulation

- Lack of independence between board and management compromises objective oversight

- Ineffective whistleblower mechanisms prevent early detection of problems

The legal concept of “scienter” (intent to deceive) in securities fraud cases can often be established through evidence of governance failures. Courts increasingly view systematic governance deficiencies as circumstantial evidence of knowledge or reckless disregard for the truth.

Recent studies show that companies with below-average governance ratings face 76% higher litigation rates and typically incur settlement costs 2.5 times greater than their well-governed peers. This underscores why robust governance is not merely a compliance exercise but a critical risk management imperative.

What are internal controls and why are they important for investors?

Internal controls are the policies, procedures, and practices that companies implement to safeguard assets, ensure accurate financial reporting, and promote operational efficiency. For investors, strong internal controls are crucial because they:

- Protect company assets from misappropriation or theft

- Ensure financial statements accurately reflect the company’s true financial position

- Reduce the risk of fraud, including differences in accounting periods fraud,

- Promote compliance with laws and regulations

When internal controls are weak or absent, companies become vulnerable to fraud, which can lead to significant financial losses for investors. The 2002 Sarbanes-Oxley Act specifically requires public companies to assess and report on the effectiveness of their internal controls over financial reporting, making this a legal obligation, not just a best practice.

How does the COSO Framework help prevent financial fraud?

The Committee of Sponsoring Organizations (COSO) Framework is the gold standard for establishing effective internal controls. It consists of five essential components that work together to prevent financial fraud:

- Control Environment: Sets the foundation through leadership commitment to integrity and ethical values

- Risk Assessment: Identifies and analyzes potential risks, including fraud opportunities

- Control Activities: Implements policies and procedures that help ensure management directives are carried out

- Information & Communication: Ensures relevant information is identified, captured, and communicated

- Monitoring Activities: Evaluates the quality of internal control performance over time

Companies that properly implement all five COSO components significantly reduce their risk of financial fraud. For example, a strong control environment with clear accountability structures makes it harder for executives to override controls, while effective monitoring activities help detect unusual transactions before they escalate into major fraud.

How do internal control failures lead to securities class action lawsuits?

- Internal control failures and securities class actions are directly connected through this typical sequence:

- A company maintains inadequate internal controls over financial reporting

- These weaknesses allow fraudulent activities to occur, such as recording fictitious expenses

- The company makes false statements about its financial performance or the effectiveness of its controls

- Investors rely on these misrepresentations when purchasing securities

- When the truth emerges, the stock price drops significantly

- Investors suffer financial losses directly tied to the fraud

Securities class actions provide a mechanism for investors to recover these losses. In 2024, 229 federal securities cases were filed, with a significant portion involving allegations of internal control deficiencies. Courts increasingly recognize that statements about “effective internal controls” can be materially false when evidence shows the company lacked basic financial safeguards.

For example, in the recent Macquarie Infrastructure Corp. case, the Supreme Court clarified standards for omissions in securities fraud actions, making it easier for investors to pursue claims based on control failures.

What compensation can investors receive through securities class action lawsuits?

- Investors who suffer losses due to corporate fraud can potentially recover compensation through securities class action lawsuits in several forms:

- Out-of-pocket damages: The difference between what investors paid for securities and their true value absent the fraud

- Rescissionary damages: In some cases, investors may recover the full purchase price minus the sale price

- Prejudgment interest:Additional compensation for the time value of money lost

- Attorney’s fees and costs: Typically paid from the settlement fund

- The PSLRA (Private Securities Litigation Reform Act) caps damages to avoid disproportionate awards, typically limiting recovery to the difference between the purchase price and the average trading price during the 90-day period following the fraud disclosure. Recent settlements have ranged from millions to billions of dollars, depending on the scale of the fraud and resulting investor losses.

- For investors seeking to participate in these recoveries, it’s important to understand that securities class actions typically proceed automatically on behalf of all affected shareholders, though larger investors may choose to seek appointment as lead plaintiff to have greater control over the litigation.

How can strong corporate governance prevent securities litigation?

- Strong corporate governance serves as the first line of defense against securities litigation by:

- Establishing independent board oversight with qualified audit committee members

- Implementing robust internal controls following the COSO Framework

- Creating clear whistleblower channels for reporting suspicious activities

- Ensuring transparent financial reporting practices

- Maintaining appropriate segregation of duties in financial processes

- Conducting regular, independent audits of financial statements and controls

- Developing compensation structures that don’t incentivize short-term manipulation

Companies with strong governance practices face significantly fewer securities class actions. Recent data shows that companies with independent audit committees experienced 40% fewer securities fraud allegations than those without such oversight.

By prioritizing transparency and accountability, companies not only reduce litigation risk but also build investor trust and protect shareholder value over the long term.

How does board oversight specifically help prevent financial fraud?

Board oversight serves as the first line of defense against financial fraud by ensuring management adheres to established policies and procedures. An effective board, particularly through its audit committee, regularly reviews financial statements, questions unusual transactions, and maintains direct communication with both internal and external auditors.

The board’s responsibility includes establishing a “tone at the top” that emphasizes ethical behavior and transparency. When boards actively engage in financial oversight, they create an environment where fictitious expenses are more likely to be detected and prevented. Studies show that companies where boards review expense reports quarterly experience 35% fewer instances of expense fraud compared to those with annual or less frequent reviews.

What role does corporate governance play in preventing securities litigation?

Corporate governance serves as the foundation for preventing securities litigation by establishing the structures through which companies are directed and controlled. Effective governance creates accountability and transparency, significantly reducing litigation risk.

Strong governance includes:

- Independent board oversight that challenges management assertions and financial reporting

- Robust audit committees with financial expertise to detect accounting irregularities

- Clear reporting lines that prevent information silos and ensure transparency

- Ethical corporate culture that prioritizes compliance over short-term results

Recent data shows that companies with weak governance structures face a substantially higher risk of securities litigation. In fact, 2024 saw 229 federal securities cases filed, with an average settlement value of $43 million—the highest since 2016. Many of these cases stemmed directly from governance failures that allowed financial misreporting to occur.

When governance breaks down, securities litigation often follows. Courts increasingly scrutinize governance practices when evaluating securities fraud claims, making strong corporate governance not just a best practice but a legal necessity.

How do inadequate internal controls lead to securities class actions?

Internal controls over financial reporting are the specific procedures designed to ensure accurate financial statements. When these controls fail, the stage is set for securities litigation through this common sequence:

Control deficiencies allow financial misstatements to occur and go undetected

Misstatements lead to inflated stock prices based on false information

Corrective disclosures reveal the truth, causing stock price drops

Investor losses trigger securities class actions seeking compensation

Thdifferences in accounting periods fraud, COSO Framework identifies five essential components of effective internal controls:

- Control Environment (the foundation)

- Risk Assessment

- Control Activities

- Information & Communication

- Monitoring Activities

Securities class actions frequently target companies that have certified their controls as effective (under Sarbanes-Oxley) when evidence suggests otherwise. These certifications create personal liability for executives when the controls later prove inadequate.

Courts have consistently held that statements about “effective internal controls” can be materially false when significant control weaknesses exist. This makes internal control failures a central focus in securities litigation, with settlements in these cases typically higher than in other securities fraud matters.

By implementing these detection and prevention measures, companies can significantly reduce the risk of fictitious expenses and the resulting securities litigation.

What is a securities class action and how does it differ from other lawsuits?

A securities class action is a specialized type of lawsuit filed by investors who have suffered financial losses due to alleged violations of securities laws. Unlike individual lawsuits, securities class actions allow a large group of investors to pursue claims collectively through representative plaintiffs.

Key distinguishing features:

- Collective representation: One or more “lead plaintiffs” represent all similarly situated investors

- Efficiency: Consolidates hundreds or thousands of claims into a single legal proceeding

- Accessibility: Enables small investors to pursue claims that would be impractical individually

- Specialized procedures: Governed by the Private Securities Litigation Reform Act (PSLRA)

- Heightened pleading standards: Requires specific allegations of fraudulent intent (scienter)

- Securities class actions typically allege that company statements were materially false or misleading, causing artificial inflation in the stock price. When the truth emerges through a “corrective disclosure,” the stock price drops, and investors suffer losses.

- These lawsuits serve both compensatory and deterrent functions. They provide a mechanism for investors to recover damages while also holding companies accountable for misleading statements or omissions. The threat of securities litigation encourages transparency and accurate disclosure in corporate communications.

What damages can investors recover in securities class actions?

Investors in securities class actions primarily recover out-of-pocket damages, which represent the difference between what they paid for the security and what they would have paid had there been no fraud or misrepresentation. These damages are designed to compensate investors for actual losses caused by the alleged misconduct.

Key aspects of securities damages:

- Artificial inflation: Damages are based on the amount by which the stock price was artificially inflated due to misrepresentations

- Loss causation: Investors must demonstrate that their losses were directly caused by the revelation of the truth about the misrepresentation

- 90-day lookback provision: The PSLRA limits damages to the difference between the purchase price and the average trading price during the 90 days following the corrective disclosure

- Proportional recovery: Individual investors typically receive a percentage of their recognized losses based on the total settlement amount

- The calculation of damages in securities litigation is complex and usually requires expert testimony from economists or financial analysts. These experts use event studies and other statistical methods to isolate the impact of the alleged fraud on the stock price.

Settlement amounts in securities class actions vary widely based on factors such as:

- The size of the company and affected investor class

- The magnitude of the stock price drop

- The strength of evidence regarding fraudulent intent

- The company’s financial condition and insurance coverage

- In 2024, the average settlement value reached $43 million, the highest since 2016, reflecting increased scrutiny of corporate disclosures and financial reporting.

Conclusion

Understanding the interplay between corporate governance, internal controls, differences in accounting periods fraud,, and securities litigation is essential for both investors and corporate executives. By recognizing how governance failures and control deficiencies can lead to financial misreporting and subsequent litigation, companies can take proactive steps to mitigate these risks.

If you have questions about securities class actions or believe you may have suffered losses due to corporate misconduct, please contact our securities litigation team for a consultation regarding your rights and potential recovery options.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors