Introduction to Creative Accounting

- Creative Accounting: A term often shrouded in mystery and controversy, refers to the manipulation of financial statements within the confines of the law. While it is not inherently illegal, it walks a fine line between ethical practice and deception. As you get deeply into creative accounting, you will discover how companies can present financial results that appear more favorable than they truly are. This practice has become increasingly sophisticated, making it more critical than ever to understand its intricacies.

- Pressure to-Beat-the-Street: In today’s business environment, the pressure to meet financial targets is immense. Companies are tempted to engage in creative accounting to enhance their financial image to investors, regulators, and the public. Understanding creative accounting is essential for anyone involved in financial analysis, reporting, or auditing. It empowers you to identify potential red flags and ensure transparency in financial reporting.

- Short-Term-Profit-Boost: The allure of creative accounting lies in its ability to temporarily boost financial performance. However, this can lead to significant long-term risks. As you navigate through this guide, you will gain insights into the techniques used in creative accounting, their impact on financial statements, and the importance of maintaining ethical standards in accounting practices.

Understanding the Risks of Creative Accounting

- Fraudulent Activities: While creative accounting may offer short-term benefits, it poses significant risks that can undermine the financial health of an organization. One of the primary dangers is the potential for accounting fraud, where creative accounting crosses into illegal territory. When companies prioritize appearance over substance, they may engage in fraudulent activities that can lead to severe legal and financial repercussions.

- Reputational Damages: Another risk associated with creative accounting is the erosion of trust. Investors, regulators, and stakeholders rely on accurate financial reporting to make informed decisions. When creative accounting practices are uncovered, it can damage a company’s reputation and lead to a loss of investor confidence. This loss of trust can have long-lasting effects, making it difficult for the organization to recover.

- Major Risk Assessment: Moreover, creative accounting can create a false sense of financial stability. By manipulating financial statements, companies may hide underlying issues such as excessive debt, poor cash flow, or declining sales. These hidden problems can eventually surface, leading to financial distress or even bankruptcy. Understanding these risks is crucial for maintaining the integrity of financial reporting and safeguarding your organization’s future.

Common Techniques Used in Creative Accounting

Creative Accounting: Involves a variety of techniques designed to enhance financial statements without breaking the law. Understanding these methods is essential for identifying potential issues in financial reports. Some common techniques include:

- Revenue Recognition Manipulation: Companies may accelerate revenue recognition or defer expenses to inflate profits. This can be achieved by recognizing revenue before it is earned or delaying the recognition of expenses.

- Off-Balance-Sheet Financing: By using special purpose entities (SPEs) or similar arrangements, organizations can keep liabilities off their balance sheets, making their financial position appear healthier than it actually is.

- Income Smoothing: To present stable earnings over time, companies may use reserves or accruals to adjust reported income. This technique can mask volatility and create a false sense of consistency.

- Asset Valuation Adjustments: Inflating the value of assets or delaying impairment charges can artificially boost a company’s net worth, misleading stakeholders about its financial strength.

- Concealing liabilities: This involves hiding or failing to disclose certain liabilities, such as outstanding debts or pending lawsuits, in order to make the company appear more financially stable.

Each of these techniques poses unique challenges for financial analysts and auditors. By familiarizing yourself with these methods, you can better assess the accuracy of financial statements and identify potential areas of concern.

The Impact of Creative Accounting on Financial Statements

- Misleading Company Health: Creative accounting can significantly distort the true financial performance and position of a company. When financial statements are manipulated, they provide a misleading view of a company’s health, which can have far-reaching consequences for stakeholders.

- Investor Reliance on Accounting Fraud: For investors, distorted financial statements can lead to poor investment decisions. If a company’s earnings are artificially inflated, investors may believe the company is more profitable than it truly is, leading to overvaluation and potential financial loss. Similarly, creditors may underestimate the risk of lending to a company with manipulated financial statements, leading to increased exposure to default.

- Entire Section Effected: Another impact of creative accounting is its potential to skew industry benchmarks and ratios. When companies engage in creative accounting, it can affect industry averages and distort comparisons between companies. This can make it challenging for analysts and investors to assess a company’s performance relative to its peers accurately.

- The Impact of Accounting Fraud: Ultimately, the integrity of financial statements is crucial for maintaining market confidence. By understanding the impact of creative accounting on financial statements, you can better navigate the financial landscape and make informed decisions that align with your financial goals.

Market Impact After Major Corporate Scandals

Stock Price Impact After Fraud Disclosure

| Time Period | Average Stock Price Decline |

|---|---|

| Immediate Impact (1 Day) | 5-10% |

| Short-Term Impact (20 Days) | 12.3% |

| Companies with Settlements | 14.6-20.6% |

| Companies Later Cleared | 7.2% |

| Extreme Cases (e.g., Luckin Coffee) | 80%+ |

Accounting Fraud: Real-World Examples

Enron

- The Enron scandal remains the quintessential example of howomissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

Valeant Pharmaceuticals (now Bausch Health)

- The scandal: Between 2013 and 2015, Valeant (now Bausch Health) pursued a business model that relied on aggressively hiking drug prices and using a secret network of controlled pharmacies to boost sales. These actions inflated the company’s stock price and created the illusion of robust growth. When this deceptive strategy was exposed, the company’s stock plummeted.

- The litigation: In the aftermath, investors filed a securities class action lawsuit, leading to a $1.2 billion settlement, one of the largest ever against a pharmaceutical company. The SEC also charged Valeant and former executives with accounting violations, resulting in penalties and reimbursement of incentive compensation.

Under Armour

- The scandal: For several years leading up to 2017, the athletic apparel maker Under Armour used a practice known as “pulling forward” sales from future quarters to meet analysts’ revenue targets. After it became impossible to sustain the practice, the company reported a significant drop in revenue growth in 2017. An SEC investigation revealed that company executives were aware of the practices and misled investors and analysts by attributing revenue growth to other factors.

- The litigation: Following the revelations, Under Armour faced both an SEC enforcement action and a securities class action lawsuit from investors. The company agreed to a $9 million penalty in the SEC case and, in 2024, settled the shareholder suit for a record-setting $434 million.

Tyco International

- The scandal: Former CEO L. Dennis Kozlowski and CFO Mark Swartz embezzled hundreds of millions of dollars from the company in the early 2000s, using it to fund lavish personal lifestyles. To conceal the theft and maintain the appearance of strong financial performance, they made false and misleading statements to investors.

- The litigation: Kozlowski and Swartz were convicted of grand larceny, securities fraud, and other crimes. Tyco settled shareholder lawsuits for $3 billion, one of the largest securities class action settlements at the time, and its auditor paid an additional $225 million to settle claims.

Waste Management

- Waste Management’s senior executives carried out the scheme through a series of fraudulent accounting manipulations.

- The specific mechanisms of the fraud included:

- Manipulated depreciation: Executives repeatedly extended the useful life of company assets, such as garbage trucks, and assigned arbitrary, excessive salvage values to them. This dramatically reduced the annual depreciation expense and artificially boosted profits.

- Improper capitalization of expenses: Maintenance and repair costs for landfills were improperly classified as capital expenses rather than as current-period expenses. This illegally deferred recognition of these costs, making short-term profits appear larger.

- Concealment through “netting”: Management secretly used one-time gains from asset sales to erase unrelated operating expenses and accounting misstatements. This practice, known as “netting,” concealed the true financial health of the company from investors and auditors.

- Inflated environmental reserves: Executives would intentionally inflate environmental liability reserves during strong financial quarters. Then, during weaker quarters, they would release the excess reserves into earnings to boost results.

- Failure to write off impaired assets: The company neglected to write off the costs of abandoned or impaired landfill projects, instead keeping the costs on the balance sheet to hide their negative financial impact.

- The role of Arthur Andersen

- Waste Management’s longtime auditor, Arthur Andersen, was complicit in the fraud.

- The audit firm was aware of Waste Management’s improper accounting practices and documented numerous issues, but it repeatedly approved the company’s financial statements with an “unqualified” or “clean” opinion.

- The relationship was tainted by a conflict of interest. Many of Waste Management’s top financial officers were former Arthur Andersen employees, and Andersen was highly protective of the lucrative relationship with its “crown jewel” client.

- Andersen also received substantial fees for non-audit consulting services, which compromised its independence.

- Unraveling and consequences

- Discovery: The scheme was discovered in 1997 after a new CEO took over and ordered a review of the company’s accounting practices. He resigned months later after calling the accounting “spooky”.

- Financial restatement: In 1998, Waste Management announced it would restate its earnings from 1992 through 1997, revealing over $1.7 billion in overstated profits.

- Regulatory action: The Securities and Exchange Commission (SEC) charged Waste Management’s founder and five other top executives with perpetrating the fraud.

- Executives were fired and faced charges of securities fraud. The SEC also fined Arthur Andersen $7 million for its role.

- Stock price collapse: When the fraud was revealed, the company’s stock price plummeted, causing over $6 billion in losses for shareholders.

- Company restructure: Crippled by the scandal, Waste Management was acquired by a smaller competitor, USA Waste Services. The newly merged company kept the Waste Management name but relocated its headquarters and replaced nearly all top executives.

- Legacy for auditors: The scandal was a major contributing factor to the downfall of Arthur Andersen, which was also implicated in the Enron scandal just a few years later.

- Broader reforms: The Waste Management case, alongside other major financial scandals, helped trigger the push for stricter regulations in corporate governance and financial reporting, ultimately leading to the passage of the Sarbanes-Oxley Act in 2002.

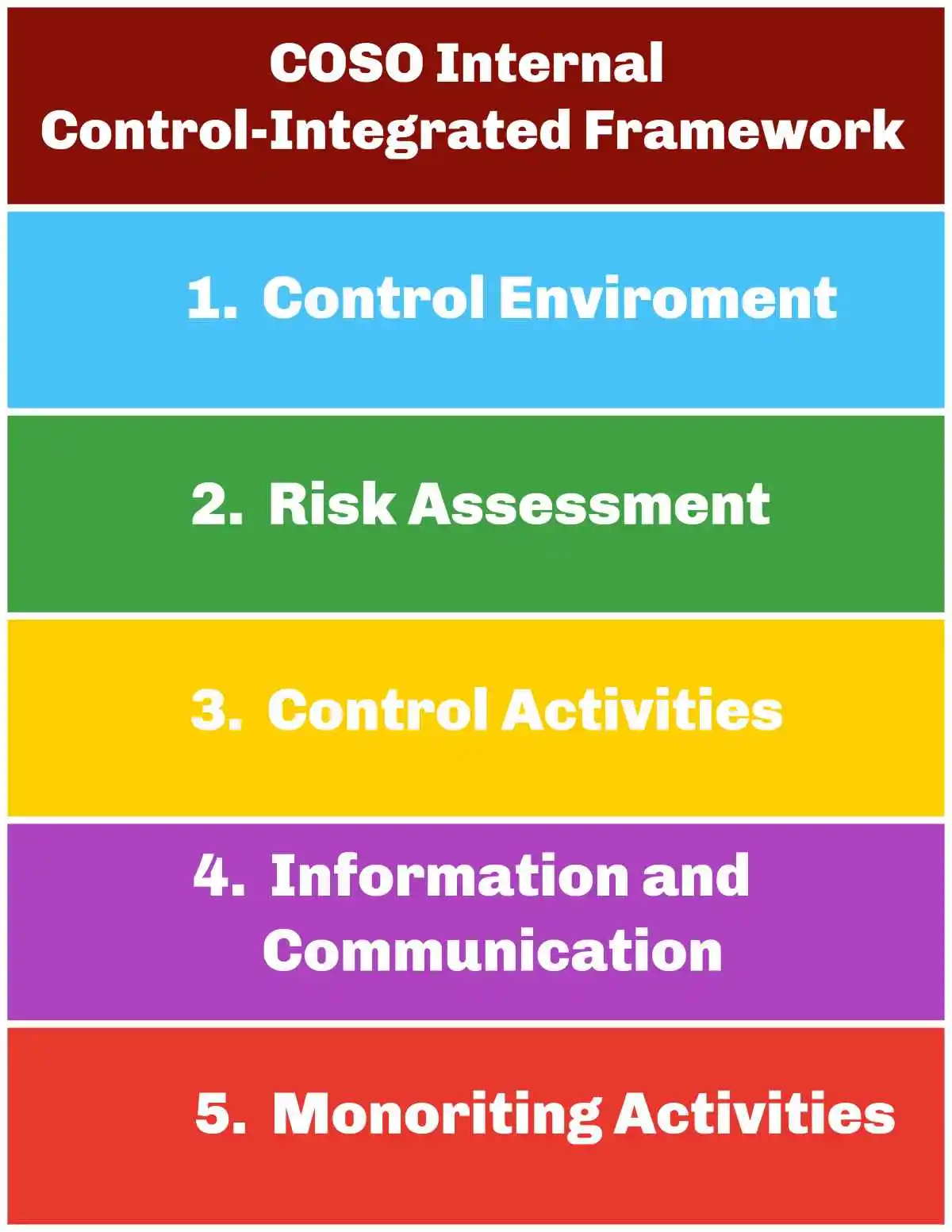

The Role of Internal Controls in Preventing Creative Accounting

Internal Controls: Play a vital role in preventing creative accounting and safeguarding the integrity of financial reporting. By implementing robust internal controls, you can detect and deter fraudulent activities and ensure compliance with accounting standards and regulations.

Key Components of Effective Internal Controls:

- Segregation of Duties: Dividing responsibilities among different employees can reduce the risk of error or fraud. By ensuring that no single individual has control over all aspects of a financial transaction, you can create a system of checks and balances.

- Regular Audits and Reviews: Conducting regular internal and external audits can help identify discrepancies and weaknesses in financial reporting. Audits provide an independent assessment of financial statements and can uncover potential issues before they escalate.

- Comprehensive Documentation: Maintaining thorough documentation of financial transactions and accounting policies is essential for transparency and accountability. Proper documentation provides a clear audit trail and supports accurate financial reporting.

By prioritizing internal controls, you can create a culture of accountability and integrity within your organization. This proactive approach not only prevents creative accounting but also enhances overall financial management and decision-making.

Corporate Governance and Its Importance in Accounting Practices

Corporate governance refers to the systems, processes, and policies that guide a company’s operations and ensure accountability to stakeholders. Strong corporate governance is crucial for maintaining ethical accounting practices and preventing creative accounting.

Principles of Effective Corporate Governance:

- Transparency: Open and honest communication with stakeholders builds trust and ensures that financial information is accurate and reliable. Companies should provide clear and comprehensive disclosures in their financial reports.

- Accountability: Holding management accountable for their actions and decisions promotes ethical behavior and deters creative accounting. This can be achieved through independent oversight by the board of directors and audit committees.

- Fairness: Treating all stakeholders equitably and considering their interests in decision-making promotes ethical conduct and long-term success. Companies should ensure that financial reporting reflects a fair and accurate portrayal of their performance.

By adhering to these principles, you can strengthen your organization’s corporate governance framework and foster a culture of ethical accounting. This commitment to governance not only enhances financial reporting but also contributes to sustainable business growth and success.

Legal Implications: Securities Litigation and Creative Accounting

Creative accounting can lead to significant legal implications, including securities litigation. When companies engage in deceptive accounting practices, they may face lawsuits from investors, regulators, and other stakeholders seeking to recover losses or hold the company accountable.

Potential Legal Consequences:

- Securities and Exchange Commission (SEC) Investigations: The SEC is responsible for enforcing securities laws and can investigate companies suspected of accounting fraud. Violations can result in fines, penalties, and other regulatory actions.

- Class Action Lawsuits: Investors who suffer financial losses due to misleading financial statements may file class action lawsuits against the company. These lawsuits can result in substantial settlements or judgments.

- Criminal Charges: In severe cases, individuals involved in accounting fraud may face criminal charges, leading to fines, imprisonment, and reputational damage.

Understanding the legal implications of creative accounting is essential for protecting your organization from potential legal challenges. By prioritizing ethical accounting practices and compliance with regulatory requirements, you can mitigate the risk of securities litigation and safeguard your company’s reputation.

Best Practices for Ethical Accounting

To prevent creative accounting and ensure the integrity of financial reporting, it is essential to implement best practices for ethical accounting. These practices promote transparency, accountability, and compliance with accounting standards.

Key Best Practices:

- Adhere to Accounting Standards: Ensure that your financial reporting complies with generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS). Consistent application of these standards promotes accuracy and comparability.

- Promote a Culture of Ethics: Foster an organizational culture that values ethical behavior and integrity. Encourage employees to speak up about potential issues and provide training on ethical accounting practices.

- Implement Strong Internal Controls: As previously discussed, robust internal controls are crucial for preventing creative accounting. Regularly assess and update these controls to address emerging risks and maintain compliance.

By incorporating these best practices into your accounting processes, you can create a framework that supports ethical financial reporting and long-term business success.

Future Trends in Accounting: Staying Ahead of Creative Accounting Tactics

As the business landscape evolves, so do the tactics used in creative accounting. Staying ahead of these trends is essential for maintaining the integrity of financial reporting and preventing accounting fraud.

Emerging Trends in Accounting:

- Technological Advancements: The use of artificial intelligence, machine learning, and data analytics is transforming accounting practices. These technologies can enhance financial analysis and improve the detection of unusual transactions or patterns.

- Increased Regulatory Scrutiny: Regulators are continually updating and enforcing accounting standards to address new challenges. Staying informed about regulatory changes is crucial for ensuring compliance and preventing creative accounting.

- Focus on Sustainability Reporting: As environmental, social, and governance (ESG) factors become more important to stakeholders, companies are increasingly incorporating sustainability reporting into their financial statements. This trend requires transparent and accurate reporting to maintain credibility.

By embracing these trends and continuously enhancing your accounting practices, you can stay ahead of creative accounting tactics and ensure the integrity of your financial reporting.

Conclusion: The Importance of Transparency in Financial Reporting

Transparency in Financial Reporting: Is the cornerstone of trust and accountability in the business world. By committing to ethical accounting practices and robust internal controls, you can prevent creative accounting and maintain the confidence of investors, regulators, and stakeholders.

As you navigate the complexities of financial reporting, remember the importance of transparency and accuracy. By prioritizing ethical behavior and continuous improvement, you can safeguard your organization’s reputation and contribute to sustainable business success.

For those seeking to enhance their understanding of creative accounting and improve their accounting practices, we invite you to explore additional resources and training opportunities. By staying informed and proactive, you can master the art of ethical accounting and lead your organization to a prosperous future.

Common Financial Statement Fraud Schemes

| Scheme Type | Description | Example |

|---|---|---|

| Fictitious Revenue | Recording non-existent sales | Counterfeit sales transactions, Bill and hold arrangements |

| Premature Revenue Recognition | Recording revenue before earned | Accelerating revenue before service delivery |

| Channel Stuffing | Forcing excess inventory to distributors | Shipping excessive product to boost quarterly sales |

| Asset Overstatement | Inflating asset values | Phantom inventory, inadequate depreciation |

| Liability Concealment | Hiding financial obligations | Unrecorded debt, understated warranty liabilities |

| Material Omissions | Withholding critical information | Undisclosed related party transactions |

| Journal Entry Manipulation | Falsifying accounting records | Last-minute entries near reporting deadlines |

FREQUENTLY ASKED QUESTIONS

What constitutes effective shareholder engagement practices?

Shareholder engagement has evolved from periodic, reactive communication to systematic, year-round relationship building with institutional and retail investors. Effective engagement practices include:

- Regular communication beyond quarterly earnings calls, including investor days, governance roadshows, and ESG-focused sessions

- Direct board involvement, particularly from lead independent directors, committee chairs, and board chairs

- Transparent disclosure of engagement policies, participation levels, and feedback incorporation

- Systematic processes for soliciting, evaluating, and responding to shareholder proposals

- Off-season engagement focusing on governance practices, board refreshment, and sustainability initiatives

- Multi-channel communication strategies accommodating diverse shareholder preferences

Companies with robust shareholder engagement programs and corporate governance and internal controls demonstrate 14% lower shareholder dissent on “say-on-pay” votes and experience 19% fewer shareholder proposals according to a 2023 analysis by Georgeson.

What are the implications of Delaware corporate law for board governance?

Delaware corporate law establishes the preeminent legal framework governing approximately 65% of Fortune 500 companies and shapes governance practices nationwide. Key principles include:

- The Business Judgment Rule presumption that protects informed, good-faith decisions from judicial second-guessing

- Enhanced scrutiny standards for takeover defenses and change-of-control transactions

- The Caremark doctrine establishing board oversight duties for legal compliance systems

- Section 220 rights enabling shareholders to inspect corporate books and records

- The entire fairness standard requiring both fair dealing and fair price in conflicted transactions

- Multiple statutory protections including exculpation provisions (§102(b)(7)), indemnification rights, and advancement of legal expenses

Recent Delaware decisions have expanded board liability risks in several areas: oversight failures constituting bad faith (Marchand v. Barnhill), director conflicts in controlled transactions (MFW), and information disclosure obligations in shareholder votes (Corwin).

How has SEC regulatory oversight evolved regarding corporate governance and board responsibilities?

SEC regulatory oversight of corporate governance for board functions has intensified substantially, creating new disclosure obligations and compliance requirements. Significant developments include:

- Expanded proxy disclosure requirements detailing board diversity characteristics, skills matrices, and refreshment policies

- Human capital management disclosure mandates covering workforce demographics, compensation practices, and development programs

- Pay-versus-performance disclosure rules requiring detailed analysis of executive compensation relative to financial performance metrics

- Rule 10b5-1 amendments establishing cooling-off periods and certification requirements for executive trading plans

- Regulation S-K modernization requiring principles-based disclosures of material risks and governance practices

- Clawback rules requiring recovery of erroneously awarded incentive compensation following accounting restatements

- Universal proxy card requirements for contested director elections

These evolving requirements necessitate more robust board oversight of disclosure controls and procedures, with particular attention to forward-looking statements and risk factor discussions.

What constitutes board refreshment?

Board refreshment encompasses systematic processes for evaluating, maintaining, and enhancing board composition to ensure continued effectiveness. Best practices include:

- Implementing robust director evaluation frameworks assessing both individual and collective performance

- Establishing clear tenure guidelines balancing institutional knowledge with fresh perspectives

- Developing structured succession planning processes for board leadership positions

- Creating skills matrices mapping current capabilities against strategic needs

- Utilizing independent third-party evaluations to overcome inherent biases

- Implementing diverse candidate slate requirements for director searches

- Establishing onboarding programs ensuring new directors quickly contribute effectively

- Regular assessment of committee composition to match expertise with oversight responsibilities

Progressive boards now disclose refreshment metrics in proxy statements, including average tenure, diversity statistics, and evaluation methodologies. Research indicates boards refreshing at least 25% of directors every five years demonstrate superior financial performance compared to static boards.

How are virtual board meetings transforming governance practices?

Virtual board meetings have evolved from pandemic necessity to strategic governance tool, creating both opportunities and challenges for effective oversight. Research indicates approximately 61% of public companies now employ hybrid meeting models combining in-person and virtual formats. Key considerations include:

- Technology infrastructure requirements ensuring secure, reliable communication

- Modified meeting protocols maximizing engagement in digital environments

- Information security practices protecting confidential board materials

- Revised document retention policies addressing recording practices and transcript creation

- Legal considerations including consent requirements for electronic meetings

- Modified committee structures accommodating digital collaboration

- Impact on corporate governance and board culture and interpersonal dynamics

- Implications for director recruitment given reduced geographic constraints

While virtual formats enhance flexibility and diversity opportunities, evidence suggests certain governance functions—particularly sensitive discussions, CEO evaluations, and strategic planning sessions—benefit from in-person interaction. Leading boards now implement formal policies specifying which matters require physical presence versus those suitable for virtual deliberation.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors