Introduction to the Corporate Greed and its Financial Toll on Invesors

Corporate Greed shows up as white-collar crime when businesses try to hide their real financial figures. Financial trickery and white-collar crime poses one of the most damaging forms of corporate wrongdoing. This deception severely harms shareholders and the companies. Such financial trickery stands as one of the most damaging forms of corporate wrongdoing in today’s markets. The greed of top corporate leaders often drives these actions seeking to maintain their power and status.

“Some people feel a greater need to parade material objects to indicate their social position, power and status. These public displays of wealth give them a high that quickly wears off. Before long, their income is no longer sufficient, so they start looking for short-cuts to more money.”

- Fraud costs the federal government up to $521 billion a year.

- According to the Federal Bureau of Investigation (FBI), white collar crime costs the American taxpayers and estimated $400 Billion every year. But the cost to the true victims is much greater.

- According to an Eastern Michigan Universitiy thesis, white collar crime is responsible for an estimated $250 billion to $1 trillion in economic damages each year.

- It is estimated that the federal government loses between 0.5% and 5% “of their spending to fraud and related loss based on international estimates.“

- According to the Yale Law Journal, “the government permits managers to buy their way out of trouble, using shareholder assets to avoid individual criminal penalties by agreeing to criminal settlements.”

- It has been estimated that high-level corporate fraud cost the global economy over $5 trillion every year.

But the impact of corporate greed goes beyond financial loss, its impacts people, industries, reputations, the environment and more. Corporate wrongdoing causes more damage than most people think and affects everyone with a stake in these companies.

The S&P 500 has hit remarkable new heights, yet investor confidence continues to drop. As noted in the article,”Looking at Corporate Governance from the Investor’s Perspective,” on Harvard Law School Forum on Corporate Governance, this contradiction highlights how market performance and trust in corporate governance do not always align.

The effects of corporate misconduct go far beyond direct market losses. Investors now turn to securities class action lawsuits to get their money back when corporate greed hurts them financially. Securities class action lawsuits seek to make companies answer for their misleading statements, fraud, and other securities law violations that cost investors money.

This piece explains how corporate greed plays out in financial markets and breaks down securities litigation mechanics. You will see the huge financial toll these problems take on investors. On top of that, you will find out about major corporate wrongdoing cases and learn practical ways to shield your investments from corporate misconduct in 2025 and beyond.

What is corporate greed and how does it show up in finance?

Wall Street has an old saying that just two emotions drive markets: fear and greed. This might oversimplify how markets work, but greed’s role in financial markets is huge, especially when it comes to hurting investors and causing corporate wrongdoing.

Defining corporate greed in modern markets

Corporate greed boils down to an endless hunger for excessive profits and resources that ignores ethics, social responsibility, and fair business practices. Companies show this behavior when they chase quick money instead of lasting success, and they often hurt their workers, communities, and the environment along the way.

The 2020-2022 inflation period really showed corporate greed at its worst. American families struggled to keep up with rising prices faster than ever. Company profits made up a shocking 54% of overall price increases from April 2020 to December 2021. This was a big change from the usual 13% that company profits add to price increases.

The push to make more and more money often guides executives to make choices that help themselves but hurt shareholders. Gordon Gekko’s famous line in Wall Street, “greed is good,” still shapes how companies act today. But this get-rich-quick thinking makes it very hard to stick to careful, long-term investment plans.

Common corporate greed examples in America

American business history is full of cases where greed pushed companies into bad behavior and eventual failure. Here are some key examples:

- Accounting Fraud

Enron Corporation’s quick downfall in 2001 stands out as the best-known case of cooking the books. Executives used special purpose entities and offshore accounts to hide what was really going on with the company’s money. - Price Gouging

Recent inflation gave many companies a chance to raise prices way more than needed to cover costs. Some CEOs even bragged about it to investors. AutoZone’s CFO said inflation was “a little bit our friend…in terms of retail pricing,” while Kroger’s CEO pointed out that “a little bit of inflation is always good in our business“. - Financial Manipulation

Wells Fargo paid $3 billion to settle criminal charges after opening millions of fake accounts between 2002-2016. - Environmental Exploitation

Profit-hungry companies often drain resources and pollute without thinking about environmental damage. They put quick cash ahead of protecting nature for the future.

CEO pay compared to worker pay shows just how bad things have gotten. By 2021, CEOs earned 324 times more than their average workers. Back in the 1960s, it was just 20 times more.

How greed leads to corporate misconduct

Corporate greed starts a chain reaction that ends up causing misconduct in several ways. Big paychecks for executives encourage short-term thinking. Banks, private equity funds, and other companies offer huge rewards to their top people, pushing them to chase quick wins without caring about workers or communities.

Fewer companies control U.S. industries now than in the 1970s because of mergers and buyouts. This market power lets big companies boldly charge more while keeping their profits high.

Company culture and market forces work together to create perfect conditions for corruption and fraud. Most corporate misconduct comes from greed-driven actions like:

- Financial Statement Manipulation

Executives fudge numbers to please analysts, attract investors, get loans, meet debt rules, earn bonuses, or pump up stock prices. - Fraudulent Communications

Companies lie about how well they are doing, what their future looks like, and how good their products are. - Insider Trading

People break their duty to the company by trading stocks based on secret information.

The 2008 financial crisis showed everyone what happens when corporate greed runs wild. Financial companies took bigger and bigger risks to make quick profits, and the whole world’s economy paid the price.

Knowing how corporate greed works in financial markets helps spot warning signs before they turn into big legal cases that damage investor portfolios.

Understanding securities litigation and class actions

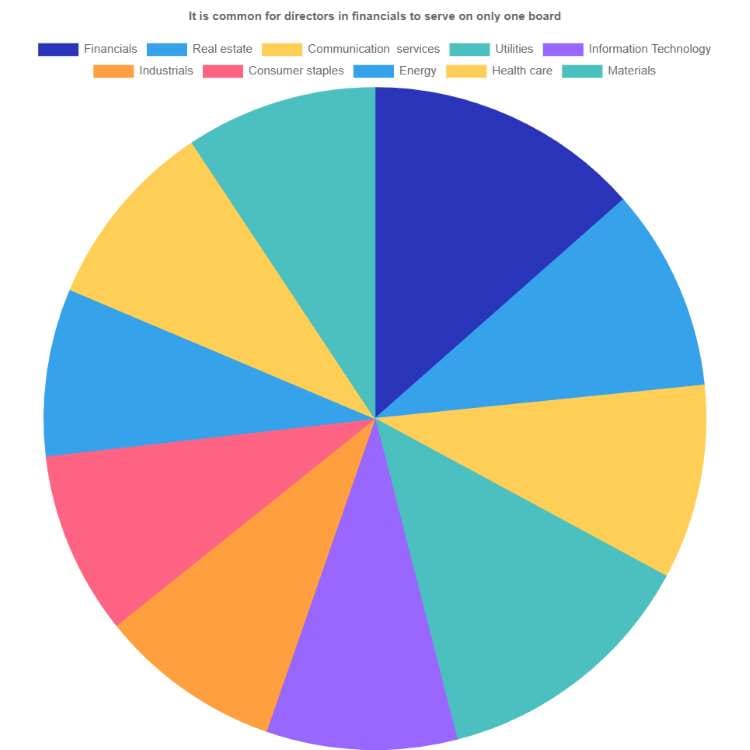

Securities litigation stands as the main legal tool to fight corporate misconduct in financial markets. Corporate executives who put profits ahead of ethics often face investors in court. The legal landscape shows how these cases shield investor interests from corporate wrongdoing. Before taking a deep-dive into securities litigation, see the chart below which hopefully will help explain the economical, operational and legal frameworks for securities class actions.

Detailed Summary Table Outlining the Economic, Operational,and Legal Frameworks for Securities Class Actions |

Category | Key Elements | Practical Implications | Recent Developments |

| Economic | |||

| Corporate Financial Impact | • Legal fees and defense costs • Settlement payments • Penalties and fines • Remediation expenses | • Direct reduction in profitability • Potential stock price decline • Impact on shareholder value • Financial statement disclosures | • Average settlement amounts increased 15% in 2023 • Defense costs typically range from $2-8M per case |

| Operational Disruption | • Management distraction • Document production burden • Internal investigation requirements • Testimony preparation | • Reduced focus on core business • Resource reallocation • Strategic initiative delays • Compliance program overhauls | • Companies now spend average of 1,200+ hours on litigation response • 68% of executives report significant operational impact |

| Investor Recovery Mechanism | • Class action procedures • Out-of-pocket damages • Lead plaintiff selection • Claims administration | • Financial loss compensation • Transaction-based calculations • Pro-rata distribution • Claims filing requirements | • Recovery rates average 2-3% of investor losses • Institutional investors recover higher percentages |

| Market Confidence Effects | • Transparency enhancement • Accountability mechanisms • Governance improvements • Disclosure quality | • Investor trust restoration • Market participation incentives • Capital formation support • Information reliability | • Post-litigation governance reforms implemented in 72% of settled cases • Measurable improvements in disclosure quality |

| Current Trends | |||

| Individual Accountability Focus | • Officer and director liability • Personal financial consequences • Clawback provisions • D&O insurance implications | • Executive behavior modification • Personal risk assessment • Compliance prioritization • Leadership accountability | • 64% increase in named individual defendants • Personal contributions to settlements up 28% |

| Technology-Enhanced Detection | • AI-powered surveillance • Advanced analytics • Pattern recognition • Anomaly detection | • Increased violation detection • Stronger evidence collection • More sophisticated cases • Higher success rates | • SEC using machine learning to identify disclosure anomalies • 42% of new cases involve technology-detected violations |

| Litigation Process Modernization | • E-discovery platforms • Digital evidence management • Virtual proceedings • Automated document review | • Faster case processing • Cost efficiency improvements • Enhanced evidence organization • Remote participation | • 87% reduction in document review time • 35% decrease in litigation costs through technology |

| Cross-Border Complexity | • Jurisdictional challenges • Regulatory differences • Enforcement coordination • International evidence gathering | • Multi-jurisdiction compliance • Global risk assessment • Harmonized defense strategies • International settlement considerations | • 38% of securities cases now involve cross-border elements • International regulatory cooperation agreements expanded |

| Legal Frameworks | |||

| Pleading Standards | • PSLRA requirements • Scienter (intent) showing • Particularity in allegations • Strong inference threshold | • Higher dismissal rates • Front-loaded case investment • Detailed complaint preparation • Expert involvement earlier | • Macquarie Infrastructure Corp. v. Moab Partners (2024) reshaped omission standards • Motion to dismiss success rate at 47% |

| Loss Causation Elements | • Corrective disclosure • Price impact evidence • Economic analysis • Event studies | • Causal chain demonstration • Market efficiency proof • Expert testimony requirements • Damages limitation | • Dura Pharmaceuticals v. Broudo remains controlling precedent • Increasing sophistication in economic analyses |

| Damages Calculation | • Out-of-pocket methodology • Inflation per share • 90-day lookback period • Transaction-based approach | • Expert-driven calculations • Trading pattern importance • Holding period considerations • Proportional recovery | • Forensic accounting techniques increasingly sophisticated • Competing damages models in 92% of cases |

| Class Certification | • Commonality requirements • Typicality standards • Adequacy of representation • Predominance of common issues | • Class definition strategies • Lead plaintiff selection • Institutional investor preference • Certification challenges | • Institutional investors serve as lead plaintiffs in 58% of cases • Class certification contested in 94% of cases |

| Investor Considerations | |||

| Participation Decision Factors | • Loss threshold assessment • Lead plaintiff potential • Litigation timeline • Cost-benefit analysis | • Active vs. passive participation • Resource commitment evaluation • Recovery expectations • Reputational considerations | • Minimum loss threshold for lead plaintiff typically $100K+ • Average case duration now 3.2 years |

| Recovery Optimization | • Claims filing procedures • Documentation requirements • Deadline adherence • Distribution mechanics | • Proof of transaction needs • Claims administrator interaction • Recovery maximization strategies • Tax implications | • Only 35% of eligible investors file claims • Electronic claim filing now standard |

| Governance Implications | • Board oversight duties • Disclosure controls • Risk management systems • Compliance programs | • Director liability concerns • Committee responsibilities • Reporting procedures • Documentation practices | • Board-level disclosure committees now present in 78% of public companies • Director education programs expanded |

| Future Participation Rights | • Opt-out considerations • Individual action potential • Settlement objection rights • Appeal possibilities | • Strategic participation choices • Large loss alternative approaches • Settlement evaluation • Ongoing case monitoring | • Opt-out actions by large investors increased 47% • Settlement objections successful in only 3% of cases |

What is securities litigation?

Securities litigation includes all legal cases related to federal and state regulation and enforcement of securities laws. This complex area deals with complex legal frameworks that ban fraudulent activities in offering, purchasing, or selling securities. The Securities and Exchange Commission (SEC) acts as the main federal body that regulates securities and can take legal action to protect investors.

Securities litigation covers several violations:

- Securities class action lawsuits

- Breach of fiduciary duty claims

- Market manipulation cases

- Accounting irregularities disputes

- Corporate control litigation

Most securities cases fall under major laws like the Securities Act of 1933, the Securities Exchange Act of 1934, and newer reforms like the Sarbanes-Oxley Act of 2002. These laws create the foundation to hold companies responsible for misrepresenting their financial health, operations, and future outlook.

How securities class action lawsuits work

Securities class actions let groups of investors sue companies that knowingly make false and misleading statements about publicly traded securities. Companies often inflate security prices artificially through misrepresentations. Stock prices usually drop once the truth comes out, and investors lose money.

The legal process follows these steps:

STEPS TO SECURITIES CLASS ACTION LAWSUITS

Filing the Complaint A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. Motion to Dismiss Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. Discovery If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. Motion for Class Certification Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. Summary Judgment and Trial Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. Settlement Negotiations and Approval Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. Class Notice If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. Final Approval Hearing The court conducts a final hearing to review any objections and grant final approval of the settlement. Claims Administration and Distribution A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses.

A company’s stock price drops sharply before most securities class actions begin. One or more shareholders speak for the entire group of affected investors instead of each person filing separately. This group approach offers an affordable way to take legal action against big corporations.

The investor.gov website explains that federal securities class actions represent shareholders who bought or sold company securities during a specific “class period”. You might be part of the class automatically, but you can “opt out” to pursue your own case.

Why these lawsuits are increasing in 2025

Securities class action filings stayed steady in early 2025 compared to late 2024, with 114 new cases. All the same, the financial impact of these cases has grown. The Disclosure Dollar Loss Index hit $403 billion in early 2025, showing a 56% jump from the previous six months. The Maximum Dollar Loss Index grew even more to $1.85 trillion, a huge 154% increase.

Several reasons explain this move toward “mega litigation” in 2025:

AI-related filings lead the pack with 12 cases in early 2025, set to pass the 15 AI-related filings from all of 2024. Many cases involve “AI washing” where companies oversell their AI capabilities to investors.

Settlement values reached $56 million on average through early 2025, the highest since 2016 after adjusting for inflation. Companies now prefer to settle rather than face long court battles.

The consumer non-cyclical sector saw 31% more filings in early 2025. We filed more cases against biotech and pharmaceutical companies.

U.S. exchange-listed companies face a slightly lower chance of securities litigation at 3.8% per year, but each lawsuit’s potential financial impact has grown much larger.

The financial toll on investors

Stock prices crash the moment corporate misconduct becomes public. Investors face financial consequences that go way beyond the reach and influence of the original price drops. Corporate greed creates layers of financial burden that hits both individual and institutional investors hard.

Direct losses from falling stock prices

Stock prices nosedive when corporate misconduct news breaks. This creates immediate damage to investors’ portfolios:

- Stock price collapse risk points to high reductions that cause extreme negative returns and big financial losses for investors

- Markets react harshly to corporate misconduct announcements. The three-day mean cumulative abnormal returns (CAR) show -2.22% drops during times of high social awareness

- Environmental violations trigger even stronger market reactions. Prices drop by -9.2% on average within five days of the announcement

These first losses mark just the beginning. A full picture reveals more damage. The cumulative abnormal returns reach -9.2% during the -5 to +5 day period around misconduct revelations. Stocks take extra hits when systemic corporate problems, not individual wrongdoing, get the blame.

Legal fees and settlement costs

Securities litigation adds another financial burden for shareholders:

- Securities class action lawsuits cost investors $39 billion yearly, yet settlements return only $5 billion

- Shareholders lost $701 billion in investment value from securities fraud class actions since December 1995. Settlement recoveries totaled just $90 billion – a seven-to-one cost-benefit ratio

- Lawyers – both plaintiff and defense – took half of the nearly $23 billion in securities claims costs over five years

Legal recovery brings more challenges for investors. The SEC warns that not all harmed investors will get their money back. Those who do might receive nowhere near their actual losses. Defense costs run between $22 billion and $30 billion because each defendant needs separate counsel. Shareholders end up paying these expenses.

Loss of trust and long-term value erosion

Corporate wrongdoing creates lasting damage by breaking trust:

- The market, consumers, suppliers, and the public see these firms differently after misconduct

- Lower sales and revenue follow this negative image, which hurts financial performance and stock prices

- Research shows greed hurts shareholder returns. Leaders who chase only profits damage long-term performance

Investors take this triple financial hit while many corporate executives walk away. Shareholders lost $245 billion to corporate misconduct in 2020 alone. This happens because executives often chase quick wins instead of building lasting value.

Merger-objection lawsuits paint a clear picture of this economic toll. Between 2012-2017, each suit cost $3.8 million to defend and settle. Lawyers took 61% of these expenses. The worst part? Shareholders got nothing in 85% of settled merger-objection claims.

Real-world cases of corporate malfeasance

The destructive effects of corporate wrongdoing become crystal clear through real-life cases where investors lost billions of dollars. These examples show how corporate greed turns from an abstract idea into a financial disaster.

Case 1: Enron and the collapse of investor confidence

Enron stands as a perfect example of corporate fraud’s destructive power, despite once being called “America’s Most Innovative Company”:

- Enron shares reached $90.75 at their peak but crashed to just $0.26 after declaring bankruptcy on December 2, 2001

- Shareholders ended up losing about $74 billion in the four years before Enron’s bankruptcy

- The whole ordeal left 4,000 employees jobless, while thousands more lost their retirement savings tied to Enron stock

A survey after the collapse revealed that 43% of active investors lost faith in the stock market, and 88% believed Enron’s executives, board, auditors or attorneys had “intentionally” deceived the public. The Enron disaster led to major regulatory changes through the Sarbanes-Oxley Act of 2002 to prevent similar corporate frauds.

Case 2: Wells Fargo’s fake accounts scandal

Wells Fargo employees created millions of fake accounts between 2002-2016 while struggling under extreme pressure to meet unrealistic sales targets:

- The bank created about 1.5 million unauthorized checking and savings accounts, plus over 500,000 credit cards without customer permission

- Later estimates showed the total fake accounts were closer to 3.5 million

- The bank ended up paying $3 billion to settle criminal and civil investigations

The scandal grew from a “cross-sell strategy” that pushed employees to sell huge amounts of products whatever the customer needed. Many employees described workplace stress so bad they often cried, vomited, and had panic attacks. The bank fired 5,300 employees, but the Department of Justice found that top managers knew about these practices since 2002.

Case 3: Recent 2025 securities class actions

Securities litigation has seen much activity in early 2025:

- Federal courts received 108 new securities class action suits, with Q1 seeing 65 cases – a five-year high

- AI-related claims jumped to 13 suits in six months, nearly matching 2024’s total of 16

- Cryptocurrency cases reached 8 filings in half a year, equaling the entire 2024 count

The financial toll has been heavy. Average settlements rose to $56 million—27% higher than 2024’s inflation-adjusted $44 million. The median settlement dropped slightly to $12.5 million from $14.3 million in 2024. Case resolutions picked up speed in early 2025, with 121 cases completed (87 dismissed, 34 settled). This pace could lead to 242 total resolutions for the year—12% more than 2024.

How corporate misconduct affects the broader market

Corporate misconduct does more than just hurt individual investors. It sends shockwaves through financial markets and creates weaknesses that put everyone’s investments at risk. The damage spreads way beyond the reach and influence of the companies involved, which threatens stability across economies.

Market volatility and investor panic

Corporate fraud wipes out about 1.6% of equity value each year. This added up to $830 billion in 2021 alone. This systemic destruction leads to several problems:

- Stock prices suddenly crash when bad news that built up over time comes out all at once

- Trading spikes around lawsuit announcements, showing widespread panic selling

- Major market indices can crash during big fraud revelations. The 2008 crisis saw major indices lose over 50% of their value

Companies facing fraud allegations typically see their stock price drop by 12.3% with no recovery for up to three years after their first court date. The volatility spreads beyond just one company. Lawsuits affect competitor companies through both competitive and ripple effects, disrupting entire industries.

Effect on retirement funds and pensions

Pension trustees must protect their plan participants’ interests, which makes them easy targets for corporate wrongdoing. This means:

- Pension funds have to recover losses through securities class actions

- These funds must treat lawsuit claims as real assets, just like their other investments

- Public pension funds have gotten back tens of billions of dollars since the Private Securities Litigation Reform Act of 1995 passed

Millions of people’s retirement security depends on avoiding bad investments and fighting to get money back when fraud happens. Things got harder after 2010 when the Supreme Court ruled that U.S. laws don’t cover securities traded outside the country.

Reputational damage to entire sectors

Beyond money losses, corporate misconduct destroys trust in whole industries:

- Companies with good reputations attract better talent, charge more, and keep loyal customers

- When corporate scandals break, they instantly damage reputations. This affects not just the guilty company but the industry’s image too

- Investors start doubting similar businesses, wondering if these problems exist everywhere

Stock prices fall nowhere near the actual penalties because reputation damage runs deep. The lasting drop shows a darker future for both the company and possibly its entire sector. Starting with financial services and moving to technology, scandals have broken public trust in whole industries. This leads to tougher oversight for everyone in the market.

What investors can do to protect themselves

Corporate greed remains a serious threat to financial markets. You need to take action now to protect your investment portfolio. A preventive approach works better than reacting after problems surface and helps you spot potential misconduct before it affects your finances.

Looking into company background and who’s in charge

Good research into a company’s history gives you crucial information:

- Use business directories and library resources to check the company’s track record

- Get into leadership backgrounds to find previous misconduct allegations or ethical issues

- Look at how often auditors change – frequent changes might point to transparency problems

Spotting warning signs in financial reports

Financial statements can show early signs of trouble:

- Keep an eye on falling profit margins that point to operational problems

- Watch out for strange accounting practices or aggressive ways of recording revenue

- Pay attention to high debt-to-equity ratios that could lead to money troubles

Make sure profits match actual cash flow—big differences often mean deeper problems

Getting help from outside tools and experts

Outside resources are a great way to improve your analysis:

- Put financial statement analysis tools to work finding inconsistencies

- Compare independent audit results with what management says

- Look for earnings manipulation by tracking volatility patterns quarter by quarter

Taking part in class actions if you qualify

If you find fraud, class actions can help you recover losses:

- Keep track of securities class action clearinghouse websites for relevant cases

- Remember you’re automatically included if you bought shares during the specified time

- Think about whether staying in the class suits you better than filing your own claim

When your only concern is the love of profit, you lose sight of the basic corporate fundamentals such as internal controls and corporate governance.

INTERNAL CONTROL MECHANISMS LEADING TO SECURTIIES CLASS ACTION LAWSUITS

Internal Corporate Mechanisms | Reasons Leading to Securities Fraud |

| Ineffective governance mechanisms | including lack of board committees, non-independent board members, and underqualified directors |

| Poor risk management | Insufficient attention to potential threats that could destabilize the company |

| Ethical leadership failures | Including integrity issues, fraud, and corruption |

| Concentration of power | decision-making controlled by small groups without proper checks and balances |

| Lack of transparency | failure to disclose accurate financial information |

Conclusion

Corporate greed poses one of the biggest threats to investors today. This piece shows how unbridled profit-seeking behavior guides companies toward devastating financial outcomes in markets of all sizes. Market highs keep breaking records, yet the troubling truth remains – corporate misconduct drains billions from investor portfolios each year.

In spite of that, knowing these patterns enables you to protect your investments better. Corporate malfeasance follows clear signs:

- Financial statement manipulation to inflate stock prices artificially

- Misleading communications to hide operational problems

- Insider trading that benefits executives at shareholder expense

- Accounting fraud that conceals actual financial performance

Securities litigation has become crucial for accountability, though recoveries are nowhere near actual losses. Investors lose $39 billion when lawsuits are announced, yet only $5 billion typically comes back through settlements. These numbers paint a harsh picture.

Prevention remains your best defense. Deep research into a company’s history, its leadership’s background, and financial reporting helps spot red flags before they harm your portfolio. Critical warning signs in financial statements can protect you from potential fraud.

Corporate governance makes all the difference. Companies that focus on long-term sustainability rather than short-term profits ended up giving better returns to shareholders. Ethical leadership should play a key role in your investment choices.

Enron, Wells Fargo, and recent AI-related litigation prove that corporate greed can strike any sector. These cases show why constant watchfulness must guide your investment strategy.

Markets may reach new peaks, but the lesson stays clear – corporate misconduct remains a risk that needs your attention. Securities litigation helps after fraud occurs, but taking action early works better to protect your finances. Fighting corporate greed takes both system-wide changes and aware investors. This combination creates markets where trust and accountability can grow stronger.

Key Takeaways

Corporate greed continues to devastate investor portfolios, with shareholders losing $39 billion annually from securities fraud while recovering only $5 billion through settlements—a stark reminder that prevention beats litigation.

• Corporate misconduct destroys 1.6% of equity value annually ($830 billion in 2021), with stock prices typically dropping 12.3% and failing to recover for up to three years after fraud revelations.

• Securities class action filings in 2025 show alarming trends: AI-related cases surged to 13 suits in six months, while average settlement values reached $56 million—the highest since 2016.

• Investors can protect themselves by researching company leadership backgrounds, monitoring financial statement red flags like profit margin reductions, and watching for aggressive accounting practices.

• Major scandals like Enron ($74 billion in shareholder losses) and Wells Fargo’s fake accounts demonstrate how corporate greed creates systemic market damage beyond individual companies.

• Prevention remains the most effective defense—thorough due diligence and ethical leadership evaluation prove far more valuable than relying on post-fraud litigation recovery.

The harsh reality is that while executives often escape consequences, shareholders bear the financial burden through direct losses, legal fees, and long-term trust erosion that affects entire market sectors.

FAQs

Q1. What is the average settlement amount for securities class action lawsuits? The average settlement value for securities class action lawsuits reached $56 million in the first half of 2025, representing a 27% increase from 2024’s inflation-adjusted average of $44 million. However, the median settlement amount decreased slightly to $12.5 million from $14.3 million in 2024.

Q2. How do securities class action settlements typically work? Securities class action settlements usually involve a payment of cash, stock, or a combination of both to a common fund. This fund is then distributed to eligible class members in proportion to their determined losses. Not all harmed investors may recover money, and those who do may receive substantially less than their total losses.

Q3. What are some red flags investors should look for in financial reports that alert to possible securities class actions? Investors should be alert to consistent reductions in profit margins, unusual accounting treatments, aggressive revenue recognition methods, high debt-to-equity ratios, and large discrepancies between profitability and actual cash flow. These can be indicators of potential financial issues or misconduct.

Q4. How does corporate misconduct affect the broader market? Corporate misconduct can lead to increased market volatility, investor panic, and significant drops in stock prices across entire sectors. It also erodes trust in financial markets, impacts retirement funds and pensions, and can cause reputational damage to entire industries beyond just the offending company.

Q5. What steps can investors take to protect themselves from corporate fraud besise securities litigation? Investors can protect themselves by thoroughly researching company history and leadership, understanding red flags in financial reports, utilizing third-party analysis tools, and staying informed about ongoing securities litigation. Additionally, participating in relevant class actions when eligible can help recover some losses in cases of fraud.

Contact Timothy L. Miles Today for a Free Case Evaluation About Securities Class Action Lawsuits

If you need reprentation in securities class action lawsuits, an opt out class action, or believe you have additional questions about corporate greed or securiteis, call us today for a free case evaluation. 855-846-6529 or tmiles@timmileslaw.com (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: tmiles@timmileslaw.com

Website: www.classactionlawyertn.com

Visit Our Extensive Investor Hub: Learning for Informed Investors