Introduction to Accounting Misstatements

What Is an Accounting Misstatement?: Is any inaccuracy or omission in a company’s financial statements, differing from what the relevant accounting standards require, and can stem from innocent errors or intentional fraud.

- Discrepancy with Standards: A misstatement represents a deviation from the applicable financial reporting framework (like Generally Accepted Accounting Principles or IFRS), which dictates how financial information should be recorded, presented, and disclosed.

- Error vs. Fraud:

- Error: Unintentional mistakes, such as miscalculations, incorrect interpretations of accounting rules, or inaccurate processing of data.

- Fraud: Intentional manipulation or distortion of financial records to mislead stakeholders.

- Error: Unintentional mistakes, such as miscalculations, incorrect interpretations of accounting rules, or inaccurate processing of data.

- Types of Misstatements:

- Incorrect Amount: Valuing an asset or liability incorrectly, such as an asset having an extra zero in its net profit figure.

- Incorrect Classification: Placing an item on the wrong line of a financial statement, like treating a finance cost as part of the cost of sales.

- Inadequate Presentation: Presenting financial information in a way that does not conform to standards, such as not separately presenting discontinued operations.

- Insufficient or Misleading Disclosure: Failing to include necessary information or providing inadequate explanations in the notes to the financial statements, potentially due to management bias.

- Incorrect Amount: Valuing an asset or liability incorrectly, such as an asset having an extra zero in its net profit figure.

- Impact on Stakeholders: Misstatements can mislead users of financial statements—like investors and creditors—by distorting a company’s financial health, profitability, or liquidity.

- Auditor’s Role: Auditors are responsible for identifying and evaluating misstatements, accumulating them, and determining their overall impact to ensure the financial statements present a fair view. Uncorrected misstatements, those identified but not fixed by management, are particularly important for the auditor to assess.

Understanding Accounting Misstatements: Detection, Prevention, and Investor Protection

- What Is an Accounting Misstatement: It is a concept that fundamentally represents one of the most significant threats to market integrity and investor confidence in today’s complex financial landscape.

- Misstatement: In the realm of financial accounting, a misstatement occurs when the reported figures of a company’s financial statements deviate from the actual numbers. This deviation might arise from errors or fraudulent activities, leading to the distortion of a company’s financial position and performance.

- Accounting Misstatements: Can be minor or material, with the latter significantly affecting the decisions of stakeholders such as investors, creditors, and regulators. The essence of understanding accounting misstatements lies in recognizing their potential to mislead and the subsequent impact on the transparency and reliability of financial reports.

- Accounting Misstatements: Can be likened to a fog that clouds the true financial landscape of a company, creating dangerous blind spots for investors navigating the markets. While minor errors might be rectified swiftly without much consequence, material misstatements can lead to catastrophic investor decisions, regulatory enforcement actions, and devastating loss of stakeholder trust.

When the Scheme Unravels

- Deceptive Practices Unravel: When these deceptive practices unravel, they often trigger securities class actions that can result in settlements ranging from $50 million to over $500 million, fundamentally altering the trajectory of both companies and their investors.

- Complex Accounting: The complexity of accounting misstatements lies not only in their detection but also in their interpretation and the cascading legal consequences that follow. They can manifest in various forms, from revenue recognition errors to misclassifications of expenses, each presenting unique challenges for detection and correction.

- Financial Statement Fraud: Represents the most severe form of these misstatements, involving deliberate manipulation designed to deceive investors and regulatory bodies. As we explore further, the goal is to equip investors with comprehensive knowledge to identify potential misstatements and implement proactive measures to safeguard their investments.Comprehensive Types of Accounting Misstatements

Types of Accounting Misstatements

- Accounting Misstatements: Can be broadly categorized into two primary types: errors and accounting fraud. Errors are unintentional misstatements or omissions in financial statements that can result from mathematical mistakes, misinterpretation of accounting standards, or oversight in data entry.

- Unintentional Errors: These unintentional errors, while lacking fraudulent intent, can still trigger securities litigation if they materially impact investor decisions. They may arise from flawed internal controls, inadequate staff training, or systemic weaknesses in corporate governance, emphasizing the critical need for robust accounting systems and continuous professional development.

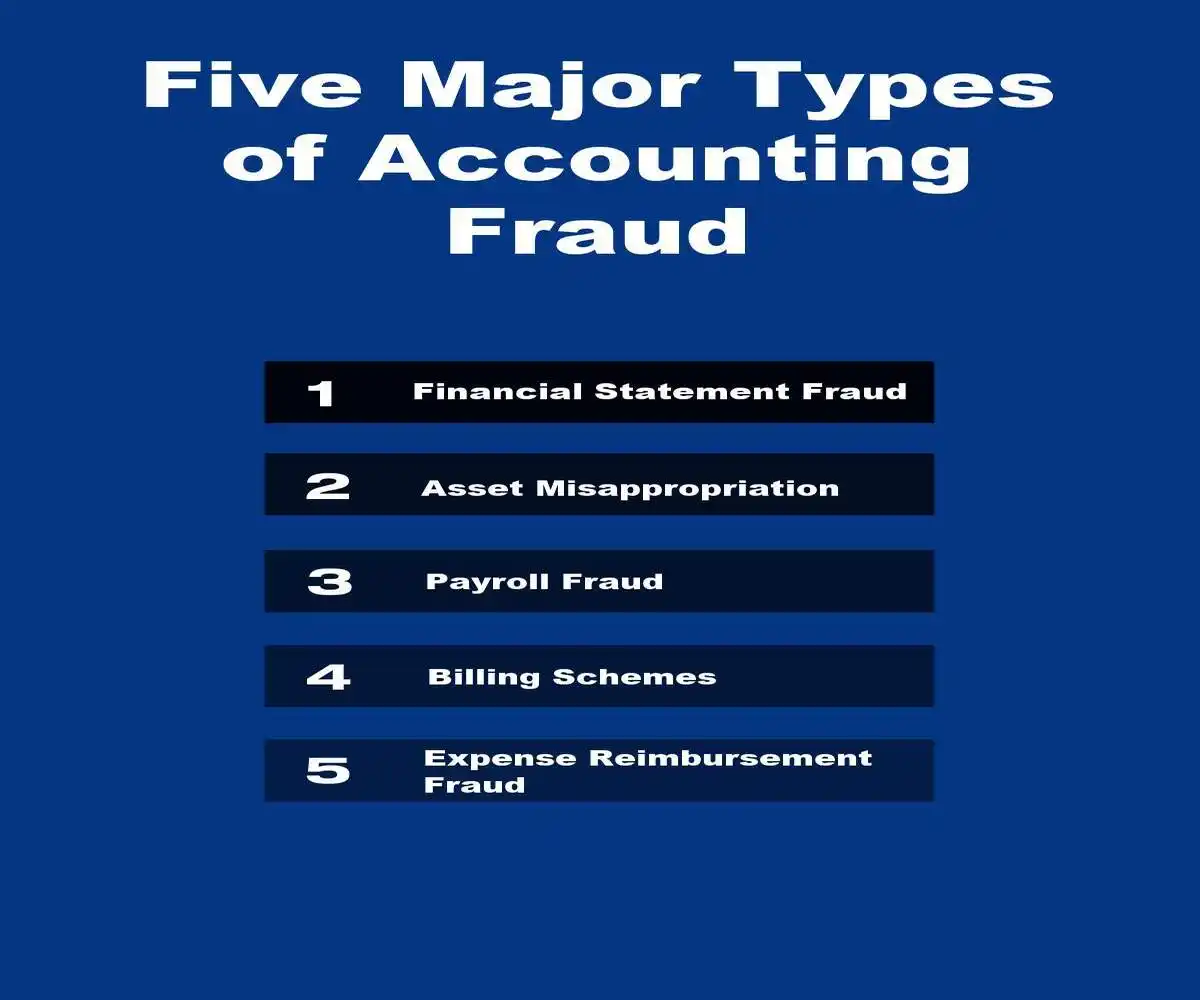

- Accounting Fraud, conversely, represents deliberate manipulation of financial information with the intent to deceive stakeholders. This category encompasses several sophisticated schemes:

- Revenue Recognition Fraud: involves the premature recognition of revenue, fictitious sales transactions, or the manipulation of revenue timing to meet earnings targets. Companies under pressure to “beat-the-street” often resort to these tactics, creating artificial revenue spikes that inevitably collapse when the truth emerges.

- Expense Manipulation: Includes the improper capitalization of operating expenses, understating liabilities, or shifting expenses between reporting periods. This practice artificially inflates profitability and can persist for extended periods before detection.

- Asset Valuation Fraud encompasses the overstatement of asset values, failure to recognize impairments, or the creation of fictitious assets. Inventory manipulation represents a particularly common form of this fraud, where companies overstate inventory values or create phantom inventory to boost apparent financial health.

- Disclosure Violations involve the omission of material information that investors require to make informed decisions. These violations often accompany other forms of fraud, creating a comprehensive web of deception that can devastate market confidence when revealed.

Landmark Cases: Learning from Corporate Failures

Enron

- The Enron scandal remains the quintessential example of how omissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

Waste Management

- Waste Management’s senior executives carried out the scheme through a series of fraudulent accounting manipulations.

- The specific mechanisms of the fraud included:

- Manipulated depreciation: Executives repeatedly extended the useful life of company assets, such as garbage trucks, and assigned arbitrary, excessive salvage values to them. This dramatically reduced the annual depreciation expense and artificially boosted profits.

- Improper capitalization of expenses: Maintenance and repair costs for landfills were improperly classified as capital expenses rather than as current-period expenses. This illegally deferred recognition of these costs, making short-term profits appear larger.

- Concealment through “netting”: Management secretly used one-time gains from asset sales to erase unrelated operating expenses and accounting misstatements. This practice, known as “netting,” concealed the true financial health of the company from investors and auditors.

- Inflated environmental reserves: Executives would intentionally inflate environmental liability reserves during strong financial quarters. Then, during weaker quarters, they would release the excess reserves into earnings to boost results.

- Failure to write off impaired assets: The company neglected to write off the costs of abandoned or impaired landfill projects, instead keeping the costs on the balance sheet to hide their negative financial impact.

The role of Arthur Andersen

- Waste Management’s longtime auditor, Arthur Andersen, was complicit in the fraud.

- The audit firm was aware of Waste Management’s improper accounting practices and documented numerous issues, but it repeatedly approved the company’s financial statements with an “unqualified” or “clean” opinion.

- The relationship was tainted by a conflict of interest. Many of Waste Management’s top financial officers were former Arthur Andersen employees, and Andersen was highly protective of the lucrative relationship with its “crown jewel” client.

- Andersen also received substantial fees for non-audit consulting services, which compromised its independence.

Unraveling and consequences

- Discovery: The scheme was discovered in 1997 after a new CEO took over and ordered a review of the company’s accounting practices. He resigned months later after calling the accounting “spooky”.

- Financial restatement: In 1998, Waste Management announced it would restate its earnings from 1992 through 1997, revealing over $1.7 billion in overstated profits.

- Regulatory action: The Securities and Exchange Commission (SEC) charged Waste Management’s founder and five other top executives with perpetrating the fraud.

- Executives were fired and faced charges of securities fraud. The SEC also fined Arthur Andersen $7 million for its role.

- Stock price collapse: When the fraud was revealed, the company’s stock price plummeted, causing over $6 billion in losses for shareholders.

- Company restructure: Crippled by the scandal, Waste Management was acquired by a smaller competitor, USA Waste Services. The newly merged company kept the Waste Management name but relocated its headquarters and replaced nearly all top executives.

- Legacy for auditors: The scandal was a major contributing factor to the downfall of Arthur Andersen, which was also implicated in the Enron scandal just a few years later.

- Broader reforms: The Waste Management case, alongside other major financial scandals, helped trigger the push for stricter regulations in corporate governance and financial reporting, ultimately leading to the passage of the Sarbanes-Oxley Act in 2002.

HealthSouth (2003)

Recent High-Profile Cases

- FTE Networks, Inc.: The former CEO, Michael Palleschi, was sentenced to 12 years in prison for leading a scheme that inflated revenue, concealed liabilities, and embezzled company funds.

- ArciTerra Companies LLC: The SEC charged the company and its CEO, Jonathan M. Larmore, for allegedly misappropriating over $35 million from real estate investment funds since 2017.

- Genesys: A CFO was sentenced for embezzling at least $3.1 million by writing company checks for personal expenses over eight years.

- Resort Homes: A former bookkeeper pleaded guilty to embezzling at least $1.79 million over eight years through fraudulently authorized checks and false entries in accounting records.

- ABS Seafood: A former CFO was convicted of embezzling over $9 million through misuse of company credit cards and funds.

- FTX collapse (2022–2023): Though a cryptocurrency exchange rather than a traditional retail corporation, the scandal led to the 2023 conviction of founder Sam Bankman-Fried. He was found guilty of diverting nearly $10 billion in customer funds for personal gain and other ventures.

- Macy’s accounting error (2024): The company announced in November 2024 that a single employee intentionally concealed $132 million to $154 million in delivery expenses since late 2021. This caused the company to delay its earnings report and restate its 2023 net income down by 57%

- Newell Brands (2023): The Securities and Exchange Commission (SEC) fined the consumer products company in 2023. It charged the company and its former CEO with misleading investors by using fraudulent practices to misrepresent its “core sales growth,” a non-GAAP financial metric.

- The Kraft Heinz Company: In September 2021, the SEC charged Kraft Heinz Company with engaging in an expense management scheme that resulted in the restatement of several years’ worth of financial reporting. The firm’s former Chief Operating Officer and Chief Procurement Officer were both charged with misconduct related to this long-running scheme. Kraft Heinz Company neither admitted to nor denied the SEC’s findings and agreed to pay a penalty of $62m.

- Granite Construction: In August 2022, civil engineering and infrastructure firm Granite Construction reported misconduct carried out by their former senior vice president and group manager, Dale Swanberg. The misconduct involved Swanberg’s manipulation of a particular project’s profit margins and not recording the costs. The SEC fined the company $12m for this financial misconduct.

- Saytam: In 2009, Indian IT services and back-office accounting firm Saytam admitted to falsifying revenues, margins and cash balances to the tune of 50 billion rupees. Although founder and Chairman Ramalinga Raju and his brother were charged with breach of trust, conspiracy, cheating and falsification of records, they were released after the Central Bureau of Investigation failed to file charges on time.

- Treaty of Utrecht: In the UK, we can go back to the 18th century to find one of the earliest known accounting fraud cases. In 1720, the UK signed the Treaty of Utrecht 1713 with Spain, allowing it to trade in the seas near South America.

- In actual fact, barely any trade occurred as Spain renounced the Treaty, but this was concealed on the UK stock market. A Parliamentary inquiry revealed fraud among government members, including the Tory Chancellor of the Exchequer, John Aislabie, who was sent to prison.

Critical Risk Factors and Detection Strategies

Critical Risk Factors and Detection Strategies

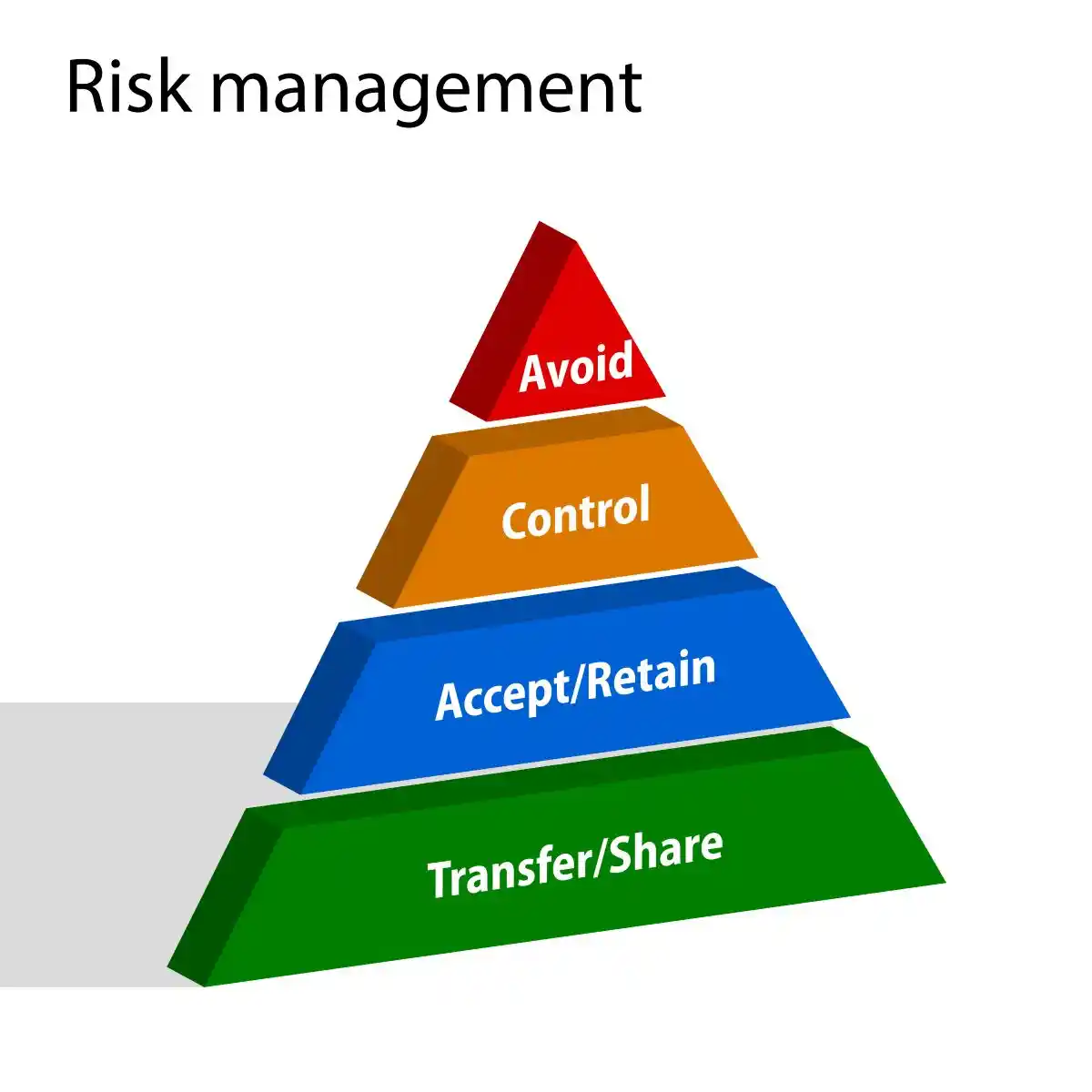

- Financial Statement Fraud: Typically emerges from a combination of pressure, opportunity, and rationalization.

- Financial pressure represents one of the most significant financial statement fraud risk factors, particularly when companies face declining performance, covenant violations, or intense market expectations. According to recent studies, over 60% of fraud cases involve companies experiencing significant financial stress or facing critical financing deadlines.

- Weak Internal Controls: Opportunity manifests through weak internal controls, inadequate board oversight, or complex business structures that obscure fraudulent activities. Companies with decentralized operations, significant related-party transactions, or rapid growth often present elevated fraud risks due to stretched control systems and insufficient oversight mechanisms.

- Corporate Governance Deficiencies: Create environments where fraud can flourish undetected. Warning signs include boards dominated by management, audit committees lacking financial expertise, frequent turnover in key financial positions, and compensation structures that create excessive incentives for short-term performance.

- Heightened Scrutiny: Investors should maintain heightened scrutiny when encountering these red flags: unexplained changes in accounting policies, significant increases in days sales outstanding, unusual fluctuations in gross margins, frequent restatements of financial results, and management teams that consistently deflect detailed questions about financial performance.

- Risk Assessments: Conducted by independent auditors often identify these patterns, making audit reports valuable sources of insight for vigilant investors.

Comprehensive Prevention Strategies

- Corporate Governance Failures: Often create the perfect environment for embezzlement schemes to flourish undetected. When boards of directors fail to exercise proper oversight, when internal controls are inadequate or poorly implemented, and when management prioritizes short-term results over ethical conduct, organizations become vulnerable to sophisticated fraud schemes.

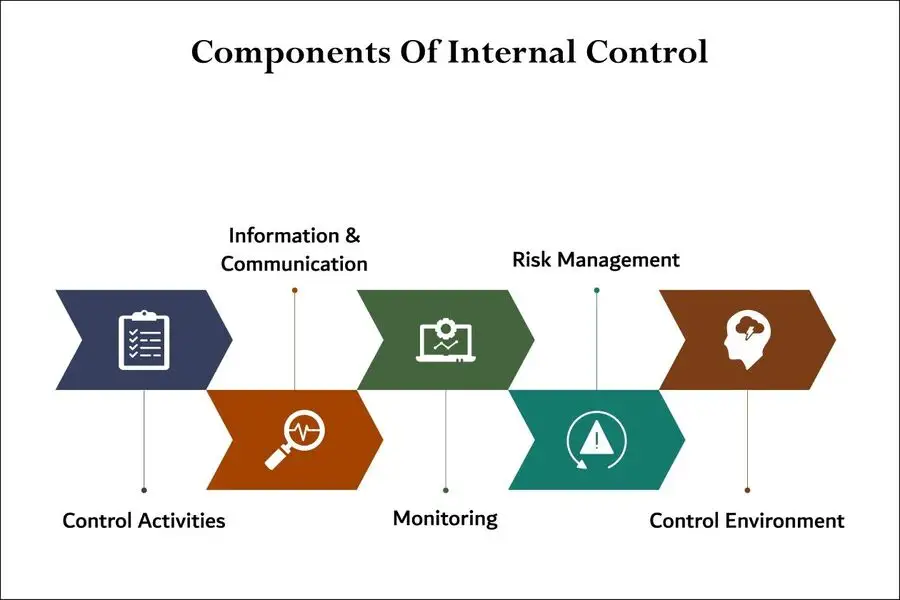

- Internal controls: Represent the first line of defense against embezzlement and financial statement fraud. These controls must encompass multiple layers of protection, including:

- Authorization Controls: Requiring multiple approvals for significant transactions and establishing clear spending limits for different organizational levels. When properly implemented, these controls create checkpoints that make fraudulent activities significantly more difficult to execute and conceal.

- Segregation of Duties: Ensuring that no single individual has complete control over critical financial processes. This fundamental principle prevents employees from both initiating and concealing fraudulent transactions.

- Documentation Requirements: Maintaining comprehensive records of all financial transactions and requiring supporting documentation for all expenditures and revenue recognition.

- Regular Reconciliation Procedures: Implementing systematic processes to compare recorded transactions with bank statements, customer accounts, and other external sources of verification.

- Securities Litigation Trigger: The failure of these internal controls has been documented in numerous securities class actions where investors suffered massive losses due to management’s ability to manipulate financial results without detection. In one notable case from 2024, a technology company’s inadequate controls allowed executives to embezzle over $150 million in customer receipts while simultaneously inflating reported revenues by nearly $400 million.

- Whistleblower Programs: Create essential reporting channels for employees who observe potential misconduct. Effective programs guarantee anonymity, prohibit retaliation, and provide clear escalation procedures. The SEC’s whistleblower program has resulted in over $1 billion in awards to individuals who report securities violations, demonstrating the critical role these programs play in fraud detection and prevention.

Regulatory Framework and Legal Consequences

Securities Class Actions: Represent the primary legal mechanism through which investors seek recovery for losses resulting from accounting fraud.

Violations of Federal Law: These lawsuits typically allege violations of federal securities laws, including material misstatements in financial reports, inadequate disclosure of material information, and failures in internal controls. Successful class actions can result in settlements exceeding $100 million, with the largest cases reaching settlements of $500 million or more.

Corporate Governance Requirements: Have strengthened substantially following major corporate scandals. Public companies must maintain independent audit committees, implement executive certification requirements, and establish comprehensive internal controls systems. These requirements create multiple layers of accountability and significantly increase the likelihood of detecting fraudulent activities before they cause substantial investor harm.

Regulatory Enforcement Actions: By the SEC complement private litigation, imposing civil penalties, cease-and-desist orders, and officer and director bars. The SEC’s enforcement program has intensified significantly, with accounting fraud cases representing approximately 30% of all enforcement actions. Penalties have escalated dramatically, with individual cases resulting in civil penalties exceeding $25 million for severe violations.

SEC Penalties from 2024

- Morgan Stanley: The SEC brought settled charges against Morgan Stanley for a multi-year fraud involving block trades. The penalty included an $83 million civil penalty and approximately $166 million in disgorgement and prejudgment interest.

- Multiple firms for record-keeping failures: The SEC also issued more than $600 million in combined civil penalties against over 70 firms for “off-channel” communications violations.

- Terraform Labs: While not a traditional financial services company, the largest single financial remedy obtained by the SEC in 2024 was a $4.5 billion judgment against crypto company Terraform Labs and its founder for securities fraud.

- FAT Brands: In May 2024, the SEC filed a complaint alleging securities fraud against FAT Brands and its former CEO for making illegal loans to the CEO, who then used the company’s money for personal expenses.

Other Notable 2024 Enforcement Actions Include:

- Whistleblower protection violations: JPMorgan Chase was issued a record $18 million civil penalty for a standalone violation of the whistleblower protection rule, which prohibits impeding potential whistleblowers from contacting the SEC.

- Macquarie cross-trading: The SEC charged investment advisory firm Macquarie with overvaluing illiquid securities and impermissibly favoring certain advisory clients. The company agreed to pay $9.8 million in disgorgement and a $70 million civil penalty.

- Bitcoin Beautee: The SEC charged Xue Lee (aka Sam Lee) and Brenda Chunga Bitcoin Beautee) for their involvement in an allegedly fraudulent crypto asset pyramid scheme that raised more than $1.7 billion from investors worldwide

- NovaTech Ltd.: The SEC charged Cynthia and Eddy Petion and their company, NovaTech Ltd., for allegedly operating a fraudulent scheme that raised more than $650 million in crypto assets from more than 200,000 investors worldwide.

- Pre-IPO Fraud: The SEC charged five unregistered brokers and their companies in connection with an alleged pre-IPO fraud scheme that raised at least $528 million from more than 4,000 investors around the world

Artificial Intelligence

- QZ Asset Management: The SEC charged QZ Asset Management for allegedly falsely claiming that it would use its proprietary AI-based technology to help generate extraordinary weekly returns while promising “100%” protection for client funds.

- Delphia and Global Predictions: The SEC settled charges against investment advisers Delphia and Global Predictions with making false and misleading statements about their purported use of AI in their investment process.

Cybersecurity

- Intercontinental Exchange, Inc.: The SEC settled charges against The Intercontinental Exchange, Inc. and nine wholly owned subsidiaries, including the New York Stock Exchange, for failure to inform the SEC of a cyber intrusion in a timely manner as required by Regulation Systems Compliance and Integrity.

- Equiniti Trust Company LLC: The SEC settled charges against transfer agent Equiniti Trust Company LLC for their failure to make sure client securities and funds were being protected for against theft or other misuse, which caused losses in millions for their clients.

- R.R. Donnelley & Sons: The SEC settled brought and settled charges against R.R. Donnelley & Sons for disclosure and internal control failures relating to cybersecurity incidents.

Crypto

- Silvergate Capital: The SEC settled brought and settled charges against Silvergate Capital for making false and misleading disclosures to investors about the robustness of the Bank Secrecy Act/Anti-Money Laundering (BSA/AML) compliance program and the monitoring of crypto customers, including FTX, by its wholly owned subsidiary, Silvergate Bank.

- Barnbridge DAO: The SEC settled charges against Barnbridge DAO, a entitled that is know as a purportedly decentralized autonomous organization, for their failure to register its structured crypto assets offered for offer an sell, yet their sold them as securities.

Advanced Risk Assessment and Technology Integration

- Modern Risk Assessments: Incorporate sophisticated analytical techniques that identify unusual patterns and potential fraud indicators. Data analytics tools can detect anomalies in revenue recognition, expense patterns, and balance sheet relationships that might escape traditional audit procedures. Companies implementing advanced analytics report significant improvements in fraud detection capabilities and regulatory compliance effectiveness.

- Artificial Intelligence: Along with machine learning technologies are revolutionizing fraud detection by analyzing vast datasets to identify subtle patterns indicative of manipulative activities. These systems can monitor transactions in real-time, flag unusual journal entries, and alert management to potential control violations before they result in material misstatements.

- Blockchain Technology: Offers promising applications for enhancing the integrity of financial reporting systems. By creating immutable transaction records and automated verification procedures, blockchain implementations can significantly reduce opportunities for financial statement fraud while improving the reliability of internal controls.

Investor Protection and Market Integrity

- Securities Litigation: Serves as a crucial mechanism for maintaining market integrity and deterring fraudulent conduct. The threat of substantial legal consequences creates powerful incentives for companies to maintain accurate financial reporting and robust control systems. Investors who suffer losses due to accounting fraud can recover damages through class action settlements, though recovery typically represents only a fraction of actual losses.

- Effective Investor Protection: Requires a multi-layered approach combining strong regulatory compliance, vigorous enforcement, and educated market participants. Investors must develop sophisticated analytical skills to identify potential fraud indicators and maintain appropriate diversification to limit exposure to individual company risks.

- The future of fraud prevention depends on continued technological advancement, strengthened corporate governance standards, and sustained commitment to ethical conduct throughout the business community. As detection capabilities improve and legal consequences intensify, the cost-benefit analysis increasingly favors honest financial reporting over fraudulent manipulation.

- Regulatory Compliance: Will continue evolving to address emerging fraud schemes and technological developments. Companies that proactively invest in comprehensive control systems, ethical training programs, and advanced detection technologies position themselves for long-term success while protecting stakeholders from the devastating consequences of financial statement fraud.

- By understanding these complex dynamics and implementing comprehensive prevention strategies, investors and companies can work together to maintain the market integrity essential for continued economic growth and prosperity.

Legal Implications of Accounting Misstatements

- What Is an Accounting Misstatement: Fundamentally involves the deliberate or negligent misrepresentation of financial information that materially affects a company’s reported performance. The legal implications of these accounting misstatements can be severe, encompassing both civil and criminal consequences that extend far beyond immediate financial penalties.

- False Financial Information: When a company knowingly or recklessly reports false financial information, it may face lawsuits from investors who suffered losses as a result of relying on those inaccurate statements. Such securities class actions can be costly and time-consuming, diverting resources from core business activities and damaging the company’s reputation in the process.

Corporate Governance and Internal Controls

- The Sarbanes-Oxley Act of 2002: Strengthened the legal framework for prosecuting corporate fraud, emphasizing the critical importance of corporate governance and robust internal controls. Companies must now demonstrate regulatory compliance through comprehensive risk assessments and systematic monitoring of financial reporting processes.

- Effective Internal Controls: Serve as the first line of defense against financial statement fraud. Organizations that fail to implement adequate control systems face increased scrutiny from regulators and higher exposure to securities litigation.

Long-Term Impact

- Loss of Investor Confidence: Beyond immediate legal ramifications, accounting misstatements lead to long-term reputational damage. Companies found guilty of financial misreporting struggle to regain investor trust, affecting their market position and future business opportunities. This loss of credibility can hinder access to capital markets and impact the company’s long-term viability.

- Breach of Trust: The intersection of accounting fraud and securities class actions ultimately represents a fundamental breach of trust that reverberates throughout financial markets. Regulatory compliance and strong corporate governance practices remain essential safeguards against these devastating consequences, protecting both companies and investors from the severe legal implications of accounting misstatements.

Conclusion: The Importance of Vigilance in Financial Statements

Conclusion: The Importance of Vigilance in Financial Statements

- Vigilance in Financial Reporting: In an ever-evolving financial landscape, vigilance in financial statements is paramount. Accounting misstatements, whether caused by errors or fraud, can have far-reaching consequences for investors, companies, and the broader market. As we have explored in this comprehensive guide, understanding the types, causes, and impacts of misstatements is essential for making informed investment decisions and safeguarding one’s financial interests.

- Due Diligence: For investors, staying informed, conducting thorough due diligence, and diversifying investments are key strategies for mitigating the risks associated with accounting misstatements. Companies, on the other hand, must prioritize accurate financial reporting through robust internal controls, staff training, and ethical corporate governance.

- Culture of Ethics: By fostering a culture of transparency and accountability, companies can build trust with stakeholders and maintain their competitive edge.

- Vigilance in the Market: Ultimately, the vigilance of all market participants—investors, auditors, regulators, and companies—is crucial in ensuring the integrity of financial statements. By working together and remaining alert to potential misstatements, we can uphold the transparency and reliability of the financial markets, paving the way for informed decision-making and sustainable growth.

- As we move forward into 2025 and beyond, let us remain committed to the principles of accuracy and integrity in financial reporting, safeguarding the investments and interests of all stakeholders.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors