Introduction to Embezzling Receipts and Securities Litigation

Methods of embezzling with receipts

- Fictitious expenses: An employee submits fake receipts for reimbursement for expenses that never occurred. A former executive in Nashville, for example, embezzled over $760,000 by submitting falsified receipts for travel and supplies he never purchased.

- Altered receipts: A legitimate receipt is modified to inflate the total amount. For example, an employee might submit a receipt for a $30 business lunch that has been digitally altered to appear as $130, and then pocket the difference.

- Mischaracterized expenses: Personal expenses are disguised as business-related costs. An employee might submit a receipt for a personal dinner as a client meeting or claim a tank of gas for their private vehicle as a business expense.

- Duplicate submissions: The same receipt is submitted multiple times for reimbursement over a period of time. This is designed to exploit gaps in an expense tracking system that lacks proper checks for duplicate entries.

- Skimming cash receipts: For businesses that handle a lot of cash, an employee may pocket cash payments and then use a receipt book to document a portion of the transactions or fail to record them entirely.

- Inflated invoices: Employees may use their access to accounting software like QuickBooks to manipulate invoices, inflating the amount a customer owes. They then take a kickback from the excess funds before the customer is notified of the true amount owed.

Red flags and prevention

Red flags and prevention

- Businesses can protect themselves by implementing internal controls and monitoring for suspicious activity. Watch for these signs:

- Rounded total amounts on reimbursement requests.

- Customers claiming they already paid a bill when company records show an overdue balance.

- Vendors complaining of non-payment or underpayment.

- An employee’s reluctance to take vacation, as they fear their fraud will be uncovered by a substitute.

- An employee insisting on working alone on certain financial tasks.

- Using AI-generated fake receipts, which can be identified by inconsistent fonts, illogical math, or outdated logos.

Understanding Embezzlement: Definitions and Types

- Embezzlement: Is a form of financial fraud that involves the unauthorized taking or misappropriation of funds or property entrusted to one’s care but owned by another. It typically occurs in corporate settings where employees handle large sums of money or valuable assets.

- Deceipt and Breach: The act of embezzling is often characterized by deceit and breach of trust, where individuals manipulate records, falsify documents, or exploit their positions for personal gain.

- Violation of Trust: Unlike theft, embezzlement involves a violation of trust since the perpetrator is usually in a position of responsibility or authority within the organization.

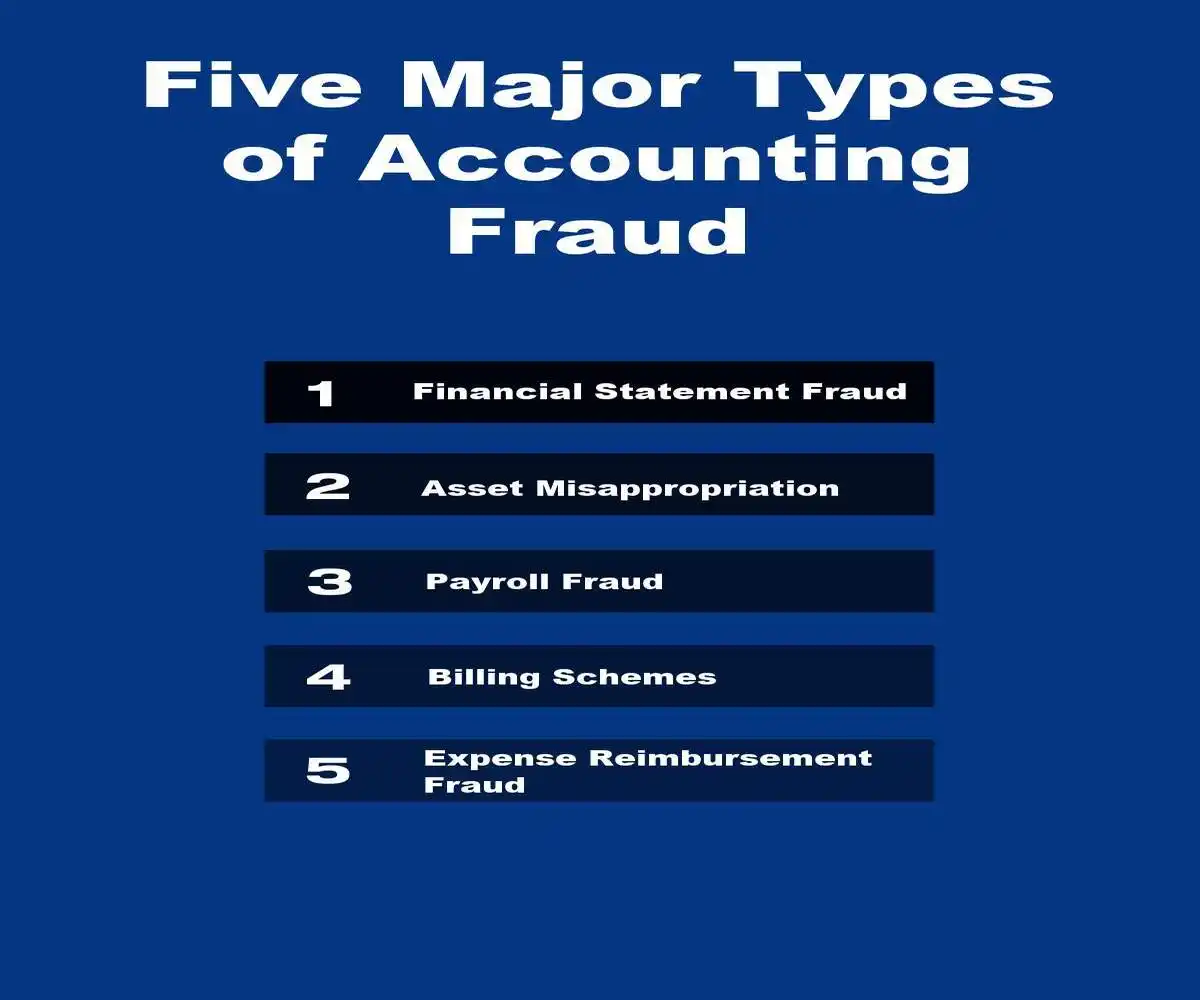

Types of Embezzlement

- There are several types of embezzlement, each with varying degrees of complexity and method.

- Diverting Cash Receipts: Cash skimming is a common form where an individual diverts cash receipts before they are rrecorded in the company’s accounting system.

- Payroll Fraud: Another prevalent type is payroll fraud, where an employee manipulates payroll systems to increase their salary, create fictitious employees, or claim unauthorized overtime.

- Inventory Theft: Involves removing physical goods from a company’s inventory without authorization, often disguised through manipulated inventory records or falsified documentation.

- Ponzi Schemes: Sophisticated forms of embezzlement can involve complex schemes like Ponzi schemes, where funds from new investors are used to pay returns to earlier investors, creating the illusion of a profitable venture.

- Understanding these various types is crucial for businesses and individuals to identify potential vulnerabilities in their financial systems and implement effective preventive measures.

The Legal Framework Surrounding Embezzlement

- The legal landscape surrounding embezzlement is multifaceted, with laws varying significantly across jurisdictions. Generally, embezzlement is prosecuted under criminal law, and its definition and penalties are outlined in statutes specific to each jurisdiction.

- These laws typically categorize embezzlement as a felony or misdemeanor depending on the amount embezzled and the perpetrator’s intent. Penalties can range from fines and restitution to imprisonment, and the severity is often proportional to the amount embezzled and the breach of trust involved.

Embezzling Receipts and Securities Litigation Implications

- Embezzling Receipts: Represents one of the most sophisticated yet devastating forms of accounting fraud that continues to plague modern financial markets, serving as a catalyst for numerous securities class actions and regulatory enforcement actions.

- Deceptive Practice: This deceptive practice involves the systematic manipulation of cash receipts, revenue recognition, and financial reporting to present a misleading picture of a company’s true financial health.

- Inflative Revenue: When companies engage in embezzling receipts, they typically employ various schemes designed to inflate reported revenues while concealing the actual diversion of funds.

- Fictitious Transactions: These schemes often involve creating fictitious sales transactions, manipulating the timing of revenue recognition, or establishing complex networks of shell companies to disguise the flow of embezzled funds.

- Pressure to Beath-the-Street: The pressure to meet earnings expectations and maintain stock prices creates powerful incentives for management to engage in these fraudulent practices.

Connection to Securities Litigation

High Profile Case: The connection between embezzling receipts and securities litigation becomes particularly evident when examining recent high-profile cases.

High-Profile Cases

- FTE Networks, Inc.: The former CEO, Michael Palleschi, was sentenced to 12 years in prison for leading a scheme that inflated revenue, concealed liabilities, and embezzled company funds.

- ArciTerra Companies LLC: The SEC charged the company and its CEO, Jonathan M. Larmore, for allegedly misappropriating over $35 million from real estate investment funds since 2017.

- Genesys: A CFO was sentenced for embezzling at least $3.1 million by writing company checks for personal expenses over eight years.

- Resort Homes: A former bookkeeper pleaded guilty to embezzling at least $1.79 million over eight years through fraudulently authorized checks and false entries in accounting records.

- ABS Seafood: A former CFO was convicted of embezzling over $9 million through misuse of company credit cards and funds.

- Americanas SA.: In 2023, a major retail corporation faced devastating consequences when investigators discovered that senior executives had systematically diverted customer payments while simultaneously inflating reported sales figures.

- The fraud: An accounting scandal involving the misuse of “supplier finance,” a common but complex financial practice, led to the discovery of a $4 billion imbalance in the company’s books. Management had manipulated records for years to inflate the company’s financial health.

- The outcome: The fraud was revealed in January 2023, and the company filed for bankruptcy shortly after.

- FTX collapse (2022–2023): Though a cryptocurrency exchange rather than a traditional retail corporation, the scandal led to the 2023 conviction of founder Sam Bankman-Fried. He was found guilty of diverting nearly $10 billion in customer funds for personal gain and other ventures.

- Macy’s accounting error (2024): The company announced in November 2024 that a single employee intentionally concealed $132 million to $154 million in delivery expenses since late 2021. This caused the company to delay its earnings report and restate its 2023 net income down by 57%

- Newell Brands (2023): The Securities and Exchange Commission (SEC) fined the consumer products company in 2023. It charged the company and its former CEO with misleading investors by using fraudulent practices to misrepresent its “core sales growth,” a non-GAAP financial metric.

- The Kraft Heinz Company: In September 2021, the SEC charged Kraft Heinz Company with engaging in an expense management scheme that resulted in the restatement of several years’ worth of financial reporting. The firm’s former Chief Operating Officer and Chief Procurement Officer were both charged with misconduct related to this long-running scheme. Kraft Heinz Company neither admitted to nor denied the SEC’s findings and agreed to pay a penalty of $62m.

- Granite Construction: In August 2022, civil engineering and infrastructure firm Granite Construction reported misconduct carried out by their former senior vice president and group manager, Dale Swanberg. The misconduct involved Swanberg’s manipulation of a particular project’s profit margins and not recording the costs. The SEC fined the company $12m for this financial misconduct.

- Saytam: In 2009, Indian IT services and back-office accounting firm Saytam admitted to falsifying revenues, margins and cash balances to the tune of 50 billion rupees. Although founder and Chairman Ramalinga Raju and his brother were charged with breach of trust, conspiracy, cheating and falsification of records, they were released after the Central Bureau of Investigation failed to file charges on time.

- Treaty of Utrecht: In the UK, we can go back to the 18th century to find one of the earliest known accounting fraud cases. In 1720, the UK signed the Treaty of Utrecht 1713 with Spain, allowing it to trade in the seas near South America.

- In actual fact, barely any trade occurred as Spain renounced the Treaty, but this was concealed on the UK stock market. A Parliamentary inquiry rrevealed fraud among government members, including the Tory Chancellor of the Exchequer, John Aislabie, who was sent to prison.

- Wirecard: Wirecard: Once seen as a promising German fintech company, was exposed in 2020 for engaging in extensive accounting fraud over several years. The company had falsely inflated its revenue and profits, leading to a significant scandal that ultimately forced it to file for insolvency.

- Despite journalist investigations and growing scrutiny, Germany’s financial regulator, BaFin, largely backed Wirecard, even barring investors from short-selling as questions mounted. However, in 2020, Wirecard admitted that €1.9 billion it claimed in accounts likely never existed.

- Patisserie Valerie

- Auditors came under the spotlight after the Serious Fraud Office (SFO) and the FRC opened up investigations into accounting fraud by Patisserie Valerie. Finance director Chris Marsh was arrested after suspension, and former auditor Grant Thornton was also under investigation.

- The scandal became bigger than originally thought, with the popular bakery chain admitting to “thousands of false entries into the company’s ledgers”. The fraud has pushed the bakery chain into administration, with a statement revealing that the company “has been unable to review its bank facilities, and therefore regrettably the business does not have sufficient funding to meet its liabilities as they fall due.”

Corporate Governance Failures and Internal Control Deficiencies

- Corporate Governance Failures: Often create the perfect environment for embezzlement schemes to flourish undetected. When boards of directors fail to exercise proper oversight, when internal controls are inadequate or poorly implemented, and when management prioritizes short-term results over ethical conduct, organizations become vulnerable to sophisticated fraud schemes.

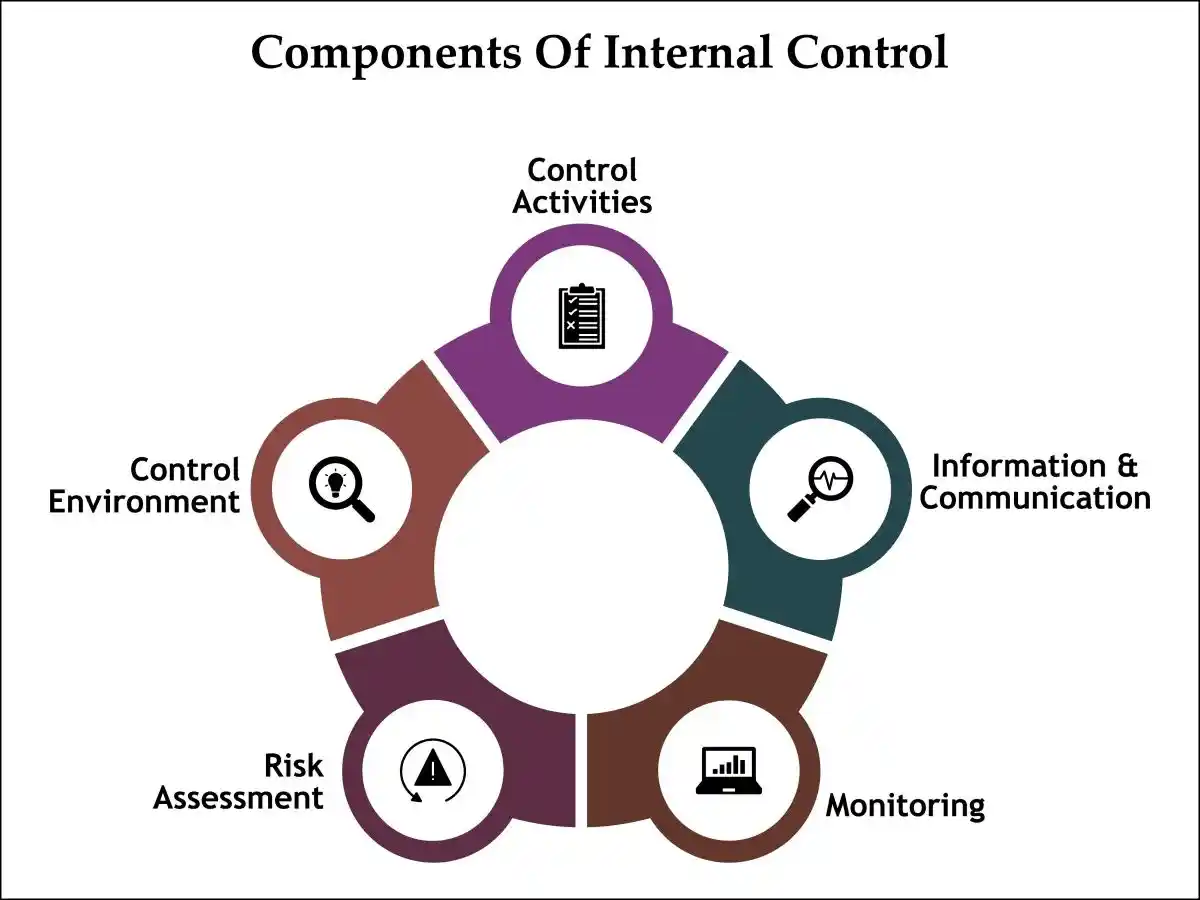

- Internal controls: Represent the first line of defense against embezzlement and financial statement fraud. These controls must encompass multiple layers of protection, including:

- Authorization Controls: Requiring multiple approvals for significant transactions and establishing clear spending limits for different organizational levels. When properly implemented, these controls create checkpoints that make fraudulent activities significantly more difficult to execute and conceal.

- Segregation of Duties: Ensuring that no single individual has complete control over critical financial processes. This fundamental principle prevents employees from both initiating and concealing fraudulent transactions.

- Documentation Requirements: Maintaining comprehensive records of all financial transactions and requiring supporting documentation for all expenditures and revenue recognition.

- Regular Reconciliation Procedures: Implementing systematic processes to compare recorded transactions with bank statements, customer accounts, and other external sources of verification.

- Securities Litigation Trigger: The failure of these internal controls has been documented in numerous securities class actions where investors suffered massive losses due to management’s ability to manipulate financial results without detection. In one notable case from 2024, a technology company’s inadequate controls allowed executives to embezzle over $150 million in customer receipts while simultaneously inflating reported revenues by nearly $400 million.

Regulatory Enforcement and Compliance Requirements

- Regulatory enforcement Agencies: Have significantly intensified their focus on embezzlement cases, particularly those involving financial statement fraud and securities violations. The Securities and Exchange Commission (SEC) has imposed increasingly severe penalties on companies that fail to maintain adequate internal controls or that engage in fraudulent financial reporting.

- Recent Regulatory Enforcement Actions: Demonstrate the severe consequences of embezzlement schemes.

SEC Penalties from 2024

- Morgan Stanley: The SEC brought settled charges against Morgan Stanley for a multi-year fraud involving block trades. The penalty included an $83 million civil penalty and approximately $166 million in disgorgement and prejudgment interest.

- Multiple firms for record-keeping failures: The SEC also issued more than $600 million in combined civil penalties against over 70 firms for “off-channel” communications violations.

- Terraform Labs: While not a traditional financial services company, the largest single financial remedy obtained by the SEC in 2024 was a $4.5 billion judgment against crypto company Terraform Labs and its founder for securities fraud.

- FAT Brands: In May 2024, the SEC filed a complaint alleging securities fraud against FAT Brands and its former CEO for making illegal loans to the CEO, who then used the company’s money for personal expenses.

Other Notable 2024 Enforcement Actions Include:

- Whistleblower protection violations: JPMorgan Chase was issued a record $18 million civil penalty for a standalone violation of the whistleblower protection rule, which prohibits impeding potential whistleblowers from contacting the SEC.

- Macquarie cross-trading: The SEC charged investment advisory firm Macquarie with overvaluing illiquid securities and impermissibly favoring certain advisory clients. The company agreed to pay $9.8 million in disgorgement and a $70 million civil penalty.

- Bitcoin Beautee: The SEC charged Xue Lee (aka Sam Lee) and Brenda Chunga Bitcoin Beautee) for their involvement in an allegedly fraudulent crypto asset pyramid scheme that raised more than $1.7 billion from investors worldwide

- NovaTech Ltd.: The SEC charged Cynthia and Eddy Petion and their company, NovaTech Ltd., for allegedly operating a fraudulent scheme that raised more than $650 million in crypto assets from more than 200,000 investors worldwide.

- Pre-IPO Fraud: The SEC charged five unregistered brokers and their companies in connection with an alleged pre-IPO fraud scheme that raised at least $528 million from more than 4,000 investors around the world

Artificial Intelligence

- QZ Asset Management: The SEC charged QZ Asset Management for allegedly falsely claiming that it would use its proprietary AI-based technology to help generate extraordinary weekly returns while promising “100%” protection for client funds.

- Delphia and Global Predictions: The SEC settled charges against investment advisers Delphia and Global Predictions with making false and misleading statements about their purported use of AI in their investment process.

Cybersecurity

- Intercontinental Exchange, Inc.: The SEC settled charges against The Intercontinental Exchange, Inc. and nine wholly owned subsidiaries, including the New York Stock Exchange, for failure to inform the SEC of a cyber intrusion in a timely manner as required by Regulation Systems Compliance and Integrity.

- Equiniti Trust Company LLC: The SEC settled charges against transfer agent Equiniti Trust Company LLC for their failure to make sure client securities and funds were being protected for against theft or other misuse, which caused losses in millions for their clients.

- R.R. Donnelley & Sons: The SEC settled brought and settled charges against R.R. Donnelley & Sons for disclosure and internal control failures relating to cybersecurity incidents.

Crypto

- Silvergate Capital: The SEC settled brought and settled charges against Silvergate Capital for making false and misleading disclosures to investors about the robustness of the Bank Secrecy Act/Anti-Money Laundering (BSA/AML) compliance program and the monitoring of crypto customers, including FTX, by its wholly owned subsidiary, Silvergate Bank.

- Barnbridge DAO: The SEC settled charges against Barnbridge DAO, a entitled that is know as a purportedly decentralized autonomous organization, for their failure to register its structured crypto assets offered for offer an sell, yet their sold them as securities.

Prosecution Trends

- Continued decline in prosecutions: The Transactional Records Access Clearinghouse (TRAC) at Syracuse University has found that federal white-collar prosecutions, including those that would cover embezzlement, have been decreasing for years.

- As of May 2025, TRAC reported that federal efforts to prosecute white-collar crimes had declined by more than 10% from the previous fiscal year, even with an earlier promise from the Biden administration to focus on corporate crime.

- This continues a longer-term trend. The number of annual white-collar prosecutions fell from over 10,000 in 2011 to a projected 3,862 for fiscal year 2025.

- Focus on individual vs. corporate prosecution: When white-collar crimes are pursued, prosecutors overwhelmingly target individuals rather than the corporations themselves. Since the DOJ began tracking business entities separately in 2004, prosecutions of organizations have only accounted for about 1% of white-collar cases.

- Pandemic fraud prosecutions: While the DOJ has pursued numerous fraud cases related to pandemic relief funds, most involve organized groups and relatively lower-level offenders, not the high-profile executive embezzlement schemes mentioned in the prompt. The Government Accountability Office (GAO) reported in July 2025 that 46% of convicted pandemic fraud defendants had conspiracy charges, suggesting large-scale, coordinated schemes.

Securities Class Actions and Investor Remedies

- Securities class Actions: Have become the primary mechanism through which investors seek recovery for losses resulting from embezzlement-related financial statement fraud. These lawsuits typically allege that companies and their executives violated federal securities laws by making materially false or misleading statements about their financial condition.

- The legal framework for securities litigation in embezzlement cases typically focuses on several key elements:

- Material Misstatements: Demonstrating that the company’s financial statements contained significant errors or omissions that would influence reasonable investors’ decisions.

- Scienter: Proving that management acted with intent to deceive or with severe recklessness regarding the truth or falsity of their statements.

- Loss Causation: Establishing that investors’ losses were directly caused by the revelation of the fraud rather than other market factors.

THE SECURITIES LITIGATION PROCESS

| Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

| Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

| Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

| Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

| Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

| Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Some of the Largest Settlements and Fraud Cases Reported In 2024

- $2 billion: Cummins Inc. The engine manufacturer agreed to pay $2 billion to resolve claims of emission control violations. The settlement, which did not involve an admission of wrongdoing, included a $1.675 billion civil penalty—the largest-ever under the Clean Air Act.

- $425 million: Teva Pharmaceuticals USA Inc. The drug manufacturer paid $425 million to settle allegations that it violated the False Claims Act by illegally raising prices and making copayment donations for the multiple sclerosis drug Copaxone. Teva also paid $25 million to resolve claims of conspiring to fix generic drug prices.

- $235.7 million: SAP SE. The software company paid over $235 million in a bribery case to resolve violations of the Foreign Corrupt Practices Act. The bribes were used to secure business in Indonesia and South Africa.

- $109 million: Janet Yamanka Mello. A civilian financial program manager for the U.S. Army was sentenced to 15 years in prison for stealing nearly $109 million from youth programs.

- $22 million: Amit Patel. A former employee of the Jacksonville Jaguars was sentenced to over six years in prison for embezzling $22.2 million from the team.

Risk Assessments and Prevention Strategies

Risk Assessments and Prevention Strategies

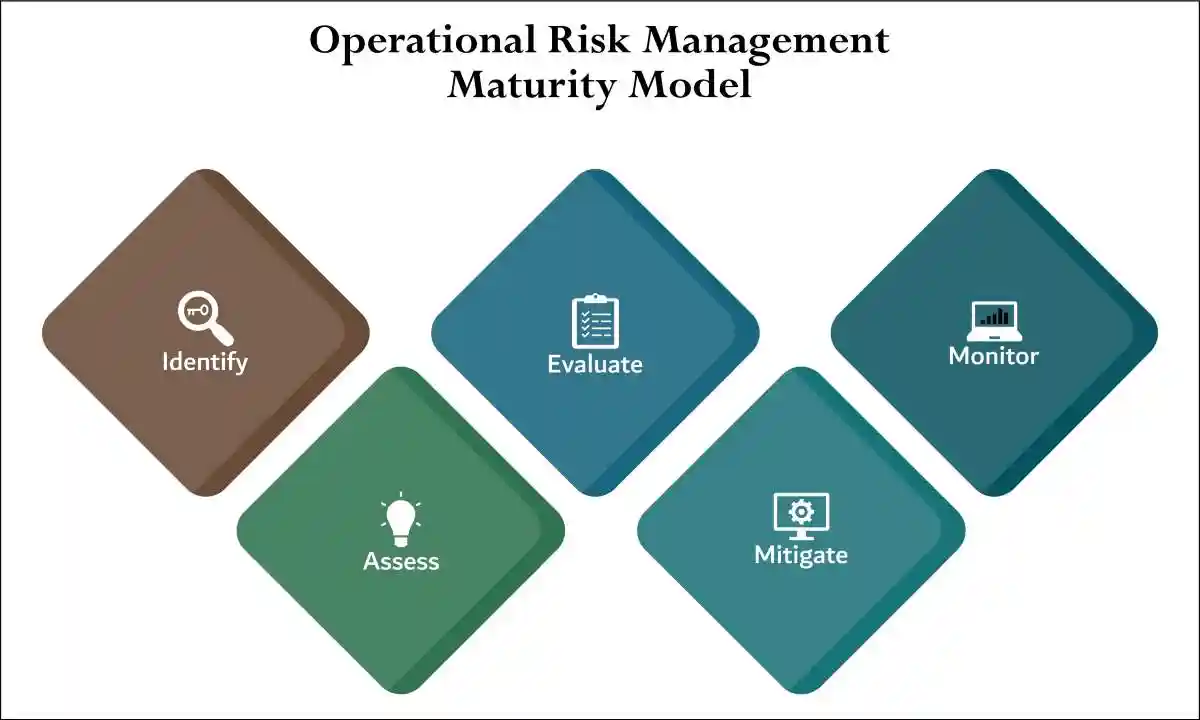

- Risk assessments: Must address the unique challenges posed by embezzlement schemes, particularly those involving receipt manipulation and revenue fraud. Organizations must implement comprehensive frameworks that evaluate both the likelihood and potential impact of various fraud scenarios.

- Key Risk Assessment Components include:

- Personnel Risk Evaluation: Assessing the backgrounds, financial pressures, and behavioral patterns of employees in positions of trust. This evaluation must consider factors such as personal financial difficulties, lifestyle changes, and unusual work patterns that may indicate fraudulent activity.

- Process Vulnerability Analysis: Identifying weaknesses in financial processes that could be exploited for embezzlement purposes. This analysis must examine cash handling procedures, revenue recognition practices, and account reconciliation processes.

- Technology Risk Assessment: Evaluating the adequacy of information systems controls and the potential for electronic manipulation of financial records.

- Vendor and Third-Party Risk: Assessing the controls over relationships with external parties who may facilitate or conceal embezzlement schemes.

- Organizations that implement comprehensive risk assessments and maintain robust internal controls significantly reduce their exposure to both embezzlement losses and securities litigation risks. The investment in effective controls represents not merely a regulatory compliance obligation but a fundamental business imperative that supports long-term success and market confidence.

Future Implications and Technological Solutions

- Embezzlement Landscrape: The landscape of embezzlement detection and prevention continues to evolve rapidly, driven by advances in data analytics, artificial intelligence, and blockchain technology. These technological solutions offer unprecedented capabilities for identifying suspicious patterns and preventing fraudulent activities before they can cause significant damage.

- Advanced Analytics: Machine learning algorithms can now analyze vast amounts of transaction data to identify anomalous patterns that may indicate embezzlement activities. These systems can detect subtle changes in cash flow patterns, unusual vendor relationships, and irregular timing of transactions that might escape traditional audit procedures.

- Blockchain Technology: The iimplementation of blockchain-based systems for financial transactions creates immutable records that make embezzlement significantly more difficult to conceal. These systems provide real-time transparency and eliminate many opportunities for manipulation.

- Regulatory Enforcement: Continues to intensify and securities litigation becomes increasingly sophisticated, organizations must embrace proactive approaches to fraud prevention. The cost of prevention invariably proves far less than the price of remediation, making comprehensive internal controls and risk assessments essential components of sound business strategy.

- By understanding the complex relationships between embezzlement, accounting fraud, and securities litigation, stakeholders can better protect themselves against these devastating schemes while contributing to the overall integrity of financial markets.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors