Introduction to Misstating Asset Values in Financial Reporting

- Misstating Asset Values in Financial Reporting: Is the intentional overstating or understating of an asset’s value in financial statements, creating a false impression of a company’s financial health and potentially leading to financial statement fraud.

- Mechanisms of Action: This can involve improperly valuing assets like inventory, real estate, or investments, and is often done to manipulate stock prices, secure loans, or influence investor perception. Such actions are illegal, can result in severe consequences for companies and executives, including fines and imprisonment, and erode trust in financial markets.

How Misstatements Occur

- Overstating Assets: A company might inflate the value of assets to appear more financially sound than it is, often to attract investors or secure funding.

- Understating Assets: This is less common but can occur to manipulate profits or hide assets.

- Improper Valuation Methods: Techniques like changing inventory valuation methods or incorrectly accounting for depreciation can be used to alter reported asset values.

- Misappropriation: In some cases, misstating asset values can be a cover for misappropriating assets, such as embezzling cash or stealing inventory.

Examples of Asset Misstatements

- Inventory Valuation: Overstating inventory value to boost reported profits.

- Investment Valuation: Misrepresenting the value of securities or other investments, especially those with limited marketability.

- Accounts Receivable: Inflating the value of accounts receivable to show better liquidity.

- Fixed Assets: Improperly valuing fixed assets like property or equipment.

Consequences of Misstating Asset Values

- Financial Statement Fraud: Intentional misrepresentation of financial data to deceive stakeholders.

- Legal and Regulatory Penalties: Companies and executives can face civil and criminal charges, leading to significant fines and potential imprisonment.

- Loss of Investor Trust: Misleading financial reports erode trust in a company and the broader financial markets.

- Difficulty Obtaining Capital: A company’s reputation for financial integrity can be destroyed, making it harder to secure loans or investments.

- Stock Price Manipulation:The goal is often to iinflate a company’s stock price, but uncovering the fraud can lead to stock value collapse.

Understanding Asset Valuation in Financial Reporting

- Valuating Assets: Asset valuation is a cornerstone of financial reporting, crucial for assessing a company’s financial health and making informed economic decisions.

- Mechanism: It involves estimating the worth of a company’s assets, which can range from physical items like machinery and buildings to intangible assets such as patents and goodwill.

- Impacts Financial Staatments: The accuracy of asset valuation directly impacts the financial statements, influencing key metrics such as net income and shareholder equity

Complex Valuation Methodologies

- Complexity: The complexity of asset valuation extends far beyond simple mathematical calculations. Market conditions, asset depreciation, and economic forecasts all contribute to the intricate nature of this process.

- Distinct Valuation: Different asset types require distinct valuation methodologies, creating layers of complexity that demand both quantitative analysis and professional judgment.

- Example: For instance, while a building’s value might be assessed based on its purchase price adjusted for depreciation, a patent’s worth could depend on projected future revenue streams.

- Subjective Nature of Valuation: However, the subjective nature of valuation creates opportunities for manipulation, potentially leading to misstating asset values in financial reporting.

- Inflating Asset Values: Companies facing financial pressure might inflate asset values to present a healthier financial position than reality warrants.

- Triggers Securities Litigation: Such practices can mislead stakeholders, trigger poor investment decisions, and ultimately result in devastating securities class action lawsuits.

Enhanced Asset Valuation Methods and Their Vulnerabilities

- The Historical Cost Approach: Remains one of the most straightforward valuation methods, where assets are valued based on their original purchase price, adjusted for depreciation or amortization.

- Method: This method provides clear, objective foundations for valuation but may fail to reflect current market conditions, particularly for appreciating assets like real estate.

- Mistates Assets Values: The gap between historical cost and current market value creates opportunities for misstating asset values, especially when companies resist writing down impaired assets.

The Use of Fair value accounting

- Curent Market Prices: Fair value accounting estimates an asset’s worth based on current market prices, particularly useful for assets traded in active markets such as stocks or bonds.

- Signicant Volatility: While this method provides dynamic, realistic asset valuations aligned with current economic conditions, it can introduce significant volatility into financial statements.

- Manipulate Earnings: Companies may exploit this volatility to manipulate earnings through selective asset sales or impairment timing.

Alternative Approach of Income Approach

- Intangible Assets: The income approach proves particularly relevant for intangible assets, estimating value based on present value of expected future cash flows.

- Detailed Modeling: This method requires detailed financial modeling and forecasting, creating substantial opportunities for manipulation.

- Inflating Assets: Companies can inflate asset values by using overly optimistic projections or inappropriate discount rates, leading to financial statement fraud that triggers regulatory enforcement actions.

The Critical Problem of Misstating Asset Values

- Misstating Asset Aalues: Represents one of the most sophisticated forms of financial statement fraud, creating a dangerous web of deception that devastates investor confidence and triggers costly securities class actions.

- Deliberate Misstatement: This deceptive practice involves deliberate misstatement of asset values, quantities, or classifications to artificially inflate financial performance and present misleading pictures of economic health.

- Employing Various Schemes: Companies engaging in misstating asset values typically employ various schemes, including phantom asset creation where non-existent assets are recorded, deliberate overvaluation of existing assets through inflated cost calculations, or failure to write down impaired or obsolete assets.

- Violates Disclosure Requirements: These manipulations directly violate fundamental disclosure requirements under federal securities laws, creating substantial liability for securities litigation.

- Pressure: The pressure to “beat-the-street” has emerged as one of the most significant catalysts for asset valuation fraud in modern financial markets.

- Fraudulent Practice: When companies face declining performance, increased competition, or economic downturns, management may resort to these fraudulent practices to avoid reporting losses that could trigger securities class action lawsuits or damage market reputation.

Securities Litigation and Class Actions: Legal Consequences

- Misleading Financial Statements: When misstating asset values occurs, affected investors often seek recourse through securities class action lawsuits and securities litigation. These legal mechanisms provide pathways for investors to recover losses resulting from materially misleading financial statements and other violations of federal securities laws.

- Securities class actions: Typically follow a predictable pattern: initial allegations of fraud, stock price decline following corrective disclosure, class certification, discovery process, and eventual settlement or trial. The legal consequences prove severe and far-reaching, often resulting in massive settlements ranging from $50 million to $500 million, depending on the scope of fraud and investor losses.

- Misleading Investors: The intersection of asset valuation fraud and securities litigation becomes particularly evident when examining how these practices violate fundamental disclosure requirements. Companies must provide accurate, complete information about their financial condition, and misstating asset values directly breaches this obligation, creating substantial legal liability.

THE SECURITIES LITGATION PROCESS

Filing the Complaint | A lead plaintiff files a lawsuit on behalf of similarly affected shareholders, detailing the allegations against the company. |

Motion to Dismiss | Defendants typically file a motion to dismiss, arguing that the complaint lacks sufficient claims. |

| Discovery | If the motion to dismiss is denied, both parties gather evidence, documents, emails, and witness testimonies. This phase can be extensive. |

Motion for Class Certification | Plaintiffs request that the court to certify the lawsuit as a class action. The court assesses factors like the number of plaintiffs, commonality of claims, typicality of claims, and the adequacy of the proposed class representation. |

Summary Judgment and Trial | Once the class is certified, the parties may file motions for summary judgment. If the case is not settled, it proceeds to trial, which is rare for securities class actions. |

| Settlement Negotiations and Approval | Most cases are resolved through settlements, negotiated between the parties, often with the help of a mediator. The court must review and grant preliminary approval to ensure the settlement is fair, adequate, and reasonable. |

Class Notice | If the court grants preliminary approval, notice of the settlement is sent to all class members, often by mail, informing them about the terms and how to file a claim. |

| Final Approval Hearing | The court conducts a final hearing to review any objections and grant final approval of the settlement. |

Claims Administration and Distribution | A court-appointed claims administrator manages the process of sending notices, processing claims from eligible class members, and distributing the settlement funds. The distribution is typically on a pro-rata basis based on recognized losses. |

Regulatory Compliance and Legal Consequences

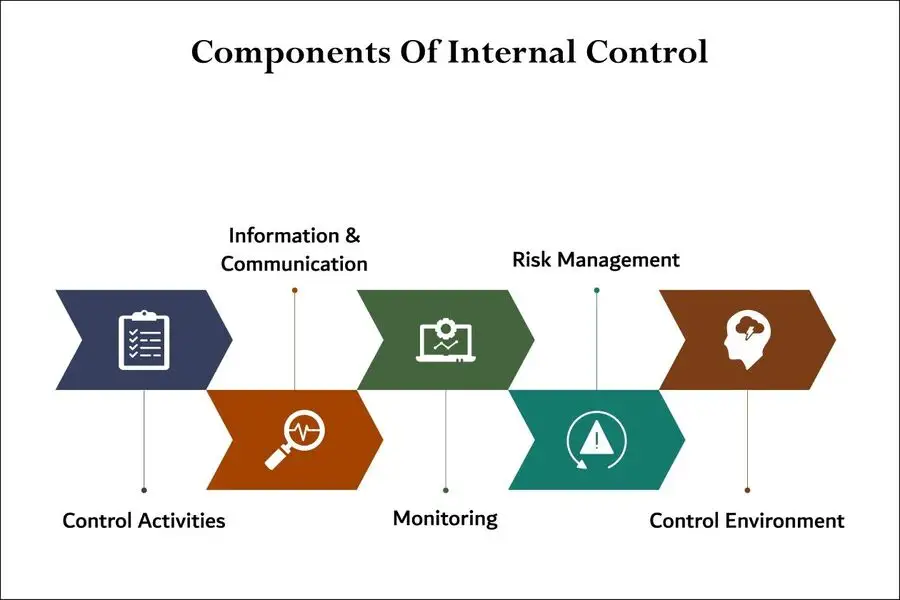

- Regulatory compliance in the realm of internal controls has become increasingly stringent following major corporate scandals of the early 2000s.

- The Sarbanes-Oxley Act of 2002 fundamentally transformed the landscape of internal control requirements, mandating that public companies establish and maintain adequate internal control over financial reporting.

- Section 404 of the Act specifically requires management to assess and report on the effectiveness of these controls, while external auditors must attest to management’s assessment.

- The regulatory framework extends beyond Sarbanes-Oxley to encompass various industry-specific requirements and international standards.

- Companies operating in multiple jurisdictions must navigate complex webs of regulatory requirements, each with its own internal control implications.

Non-Compliance and Litigation

- Failure to maintain compliance with these requirements can result in regulatory sanctions, fines, and increased scrutiny from oversight bodies.

- Securities fraud litigation often follows in the wake of internal control failures and resulting financial misstatements.

- When investors suffer losses due to reliance on false or misleading financial statements, they may pursue legal remedies through securities fraud class action lawsuits.

- These lawsuits typically allege that companies and their executives violated federal securities laws by making material misrepresentations or omissions in their financial disclosures.

Corporate Governance and Internal Controls Framework

Effective Corporate Governance: Serves as the primary defense against asset valuation fraud. Strong governance frameworks establish clear accountability structures, robust oversight mechanisms, and ethical cultures that discourage fraudulent behavior.

Internal controls: Specifically designed to address asset valuation risks include segregation of duties, independent verification procedures, and regular management review processes.

Risk assessments: Play crucial roles in identifying vulnerabilities in asset valuation processes. Companies must regularly evaluate risks associated with different asset types, market conditions, and operational changes that might affect valuation accuracy. These assessments inform the design and implementation of appropriate internal controls to mitigate identified risks.

Regulatory Enforcement and Compliance Requirements

- Regulatory Bodies: Regulatory enforcement actions by the Securities and Exchange Commission (SEC) demonstrate the serious consequences of misstating asset values. SEC penalties for asset valuation fraud often exceed tens of millions of dollars, accompanied by additional sanctions including officer and director bars, disgorgement of ill-gotten gains, and enhanced compliance requirements.

- Stringent Reporting Requirments: The Sarbanes-Oxley Act established stringent regulatory reporting requirements that directly address asset valuation integrity. Companies must maintain detailed documentation supporting asset valuations, implement robust review procedures, and ensure appropriate management oversight. Violations of these requirements trigger both civil and criminal penalties.

- Regulatory compliance: In asset valuation requires comprehensive understanding of applicable accounting standards, SEC reporting requirements, and industry-specific guidance. Companies operating in multiple jurisdictions must navigate complex webs of regulatory requirements, each with its own implications for asset valuation and internal control design.

- Other fraud penalties above $25 million: The SEC frequently announces penalties over $25 million for violations that may be related to but are not exclusively asset valuation fraud. Recent examples include:

- $35 million against Wells Fargo for improper cash sweep practices.

- $25 million against Merrill Lynch for similar cash sweep violations.

- $25 million against UBS Financial Services over a complex options trading strategy.

- Variable penalties based on cooperation: The final penalty amount often depends on the cooperation level of the firm under investigation. For instance, in the cash sweep case, Merrill Lynch was noted for its cooperation and remedial action, which likely influenced its specific settlement amount compared to Wells Fargo’s.

- Signifcant SEC Penalties: Large-scale asset valuation fraud cases pursued by the SEC often involve penalties well above $25 million. Penalties can vary significantly depending on the scale of the fraud, the number of harmed investors, and whether the case is settled or goes to trial

- Macquarie Investment Management paid a $80 million civil penalty (in addition to disgorgement and interest) for overvaluing illiquid assets in client accounts. The total amount exceeded $79 million.

- A financial services company CFO pleaded guilty to a fraud scheme that caused more than $25 million in losses for shareholders and was ordered to pay restitution.

- UBS paid $25 million to settle SEC fraud charges involving the overvaluation of complex financial instruments.

- Wells Fargo paid penalties of $28 million and $7 million, respectively, from its Clearing Services and Advisors Financial Network units for failing to disclose financial incentives.

- Vanguard and Empower paid more than $25 million combined in penalties for disclosure failures related to financial incentives and compensation.

- Severity of the misconduct: The most significant penalties are reserved for cases that involve intentional deceit or widespread harm to investors.

- Cooperation: While not a factor in penalties for egregious cases, a firm’s cooperation with an investigation can lead to a lower fine in less severe cases. For instance, PJT Partners received a $600,000 penalty for recordkeeping failures after it self-reported the issue.

- Disgorgement: In addition to penalties, the SEC can force fraudsters to give up any illicit gains (disgorgement) and pay prejudgment interest.

- Multiple violations: Penalties can be issued on a per-violation basis, significantly increasing the total fine for large-scale misconduct.

- Other penalties: In cases of criminal prosecution, individuals can face prison time and higher fines. For example, the Sarbanes-Oxley Act allows for penalties of up to 20 years in prison for certain types of securities fraud.

Valuation pressure

- Pressure Motives Fraud: A 2022 article from the Harvard Law School Forum on Corporate Governance noted that “valuation pressure affects most public companies” and can motivate fraudulent actions, even by managers not explicitly seeking to enrich themselves. This can lead to misleading valuations and fraudulent portrayals of a company’s financial health, often resulting in significant penalties when discovered

Case Studies: Learning from Corporate Scandals

Enron

- The Enron scandal remains the quintessential example of how omissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

Under Armour

- The scandal: For several years leading up to 2017, the athletic apparel maker Under Armour used a practice known as “pulling forward” sales from future quarters to meet analysts’ revenue targets. After it became impossible to sustain the practice, the company reported a significant drop in revenue growth in 2017. An SEC investigation revealed that company executives were aware of the practices and misled investors and analysts by attributing revenue growth to other factors.

- The litigation: Following the revelations, Under Armour faced both an SEC enforcement action and a securities class action lawsuit from investors. The company agreed to a $9 million penalty in the SEC case and, in 2024, settled the shareholder suit for a record-setting $434 million.

Tyco International

- The scandal: Former CEO L. Dennis Kozlowski and CFO Mark Swartz embezzled hundreds of millions of dollars from the company in the early 2000s, using it to fund lavish personal lifestyles. To conceal the theft and maintain the appearance of strong financial performance, they made false and misleading statements to investors.

- The litigation: Kozlowski and Swartz were convicted of grand larceny, securities fraud, and other crimes. Tyco settled shareholder lawsuits for $3 billion, one of the largest securities class action settlements at the time, and its auditor paid an additional $225 million to settle claims.

HealthSouth (2003)

- The fraud: The healthcare company HealthSouth, led by CEO Richard Scrushy, was caught in an accounting scandal involving the fraudulent inflation of its earnings. Between 1996 and 2002, the company systematically overstated its profits by billions of dollars to meet analyst expectations.

- The cover-up: The fraud was carried out by executives who would meet to “fill the gap” between actual and reported earnings. The scheme involved falsifying financial records to inflate revenue and hide expenses.

The outcome: When the fraud was uncovered, it led to massive financial restatements, the resignation and eventual conviction of several executives, and a steep drop in the company’s stock price. Although Scrushy was initially acquitted of accounting fraud, he was later convicted of bribery in a separate case.

Livent

- The scandal: The Canadian theatrical company Livent, founded by Garth Drabinsky and Myron Gottlieb, manipulated its books throughout the 1990s to paint a picture of financial success. The accounting scheme involved capitalizing pre-production costs as long-term fixed assets, erasing expenses from the general ledger, and improperly recognizing revenue. The fraud was designed to secure financing and mislead investors about the company’s true performance.

- The litigation: After the fraud was uncovered, Livent collapsed, and Drabinsky and Gottlieb were criminally convicted of fraud. A lawsuit against the company’s auditor, Deloitte & Touche, found them negligent for failing to catch the extensive fraud.

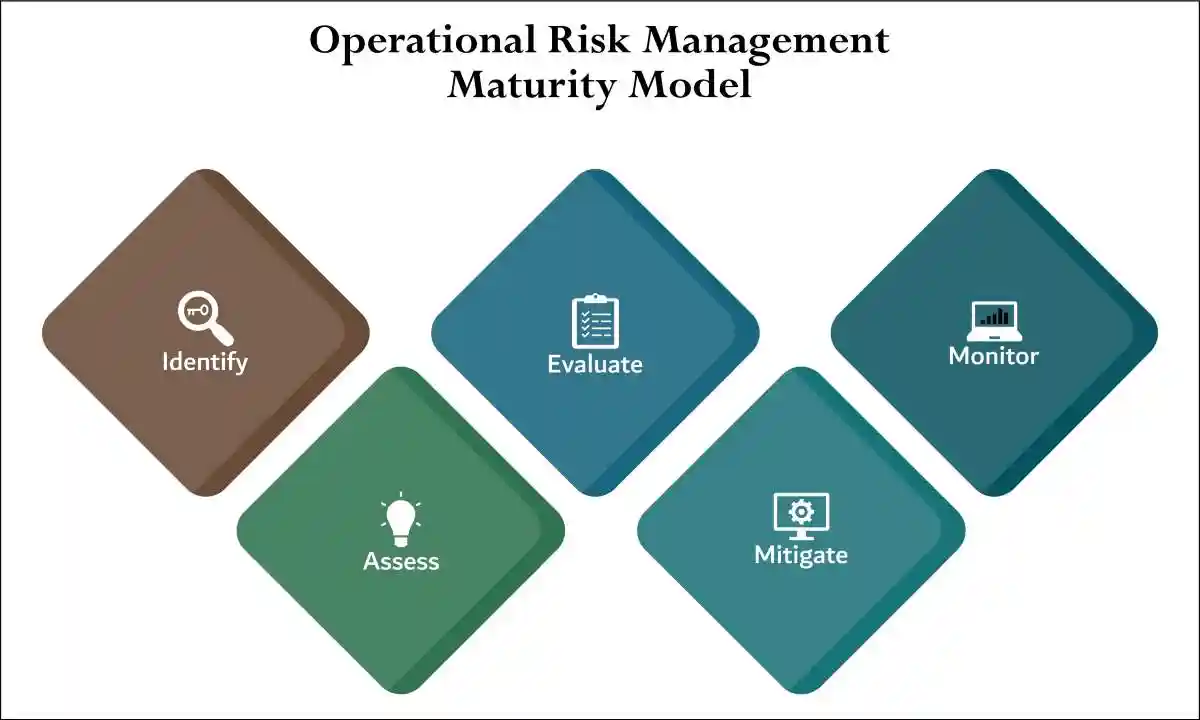

Risk Assessment Methodologies and Prevention Strategies

- Identificaton of Scheme: Effective risk assessments for asset valuation begin with comprehensive identification of potential fraud schemes and vulnerabilities. Companies must evaluate risks associated with different asset types, including tangible assets subject to impairment, intangible assets requiring subjective valuations, and financial instruments subject to market volatility.

- Internal controls: Designed to prevent asset valuation fraud must address specific risk factors including management override capabilities, inadequate segregation of duties, and insufficient independent verification procedures. Robust control frameworks incorporate multiple layers of protection, including automated controls, management review procedures, and independent audit functions.

- Corporate governance structures: Play essential roles in preventing asset valuation fraud by establishing appropriate tone at the top, ensuring board oversight of financial reporting processes, and maintaining ethical cultures that discourage fraudulent behavior. Effective governance requires active board participation in risk assessment processes and regular evaluation of internal control effectiveness.

Future Outlook and Best Practices

- Evolving Landscape: The evolving landscape of asset valuation and regulatory compliance demands continuous adaptation of prevention strategies and control frameworks. Emerging technologies offer new opportunities for fraud detection and prevention, including artificial intelligence systems that can identify unusual patterns in asset valuation data and blockchain technologies that provide immutable records of asset transactions.

- Litgation and Regulation: Securities class actions and regulatory enforcement actions continue evolving in response to new fraud schemes and market developments. Companies must stay informed about emerging litigation trends, regulatory guidance updates, and industry best practices to maintain effective compliance programs.

- Comprensive Control Environment: By implementing comprehensive prevention strategies that combine robust internal controls, regular risk assessments, strong corporate governance practices, and ongoing regulatory compliance efforts, companies can protect themselves from the devastating consequences of asset valuation fraud. The investment in effective controls represents not merely a compliance obligation but a fundamental business imperative that supports long-term success and market confidence.

- Empowering Investors: Understanding these complex relationships between asset valuation, fraud risk, and legal consequences empowers iinvestors to make more informed decisions and helps companies build sustainable, ethical business practices that protect all stakeholders’ interests.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses through finanial statment fraud or mistating values, or have questions about securities class action lawsuits, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors