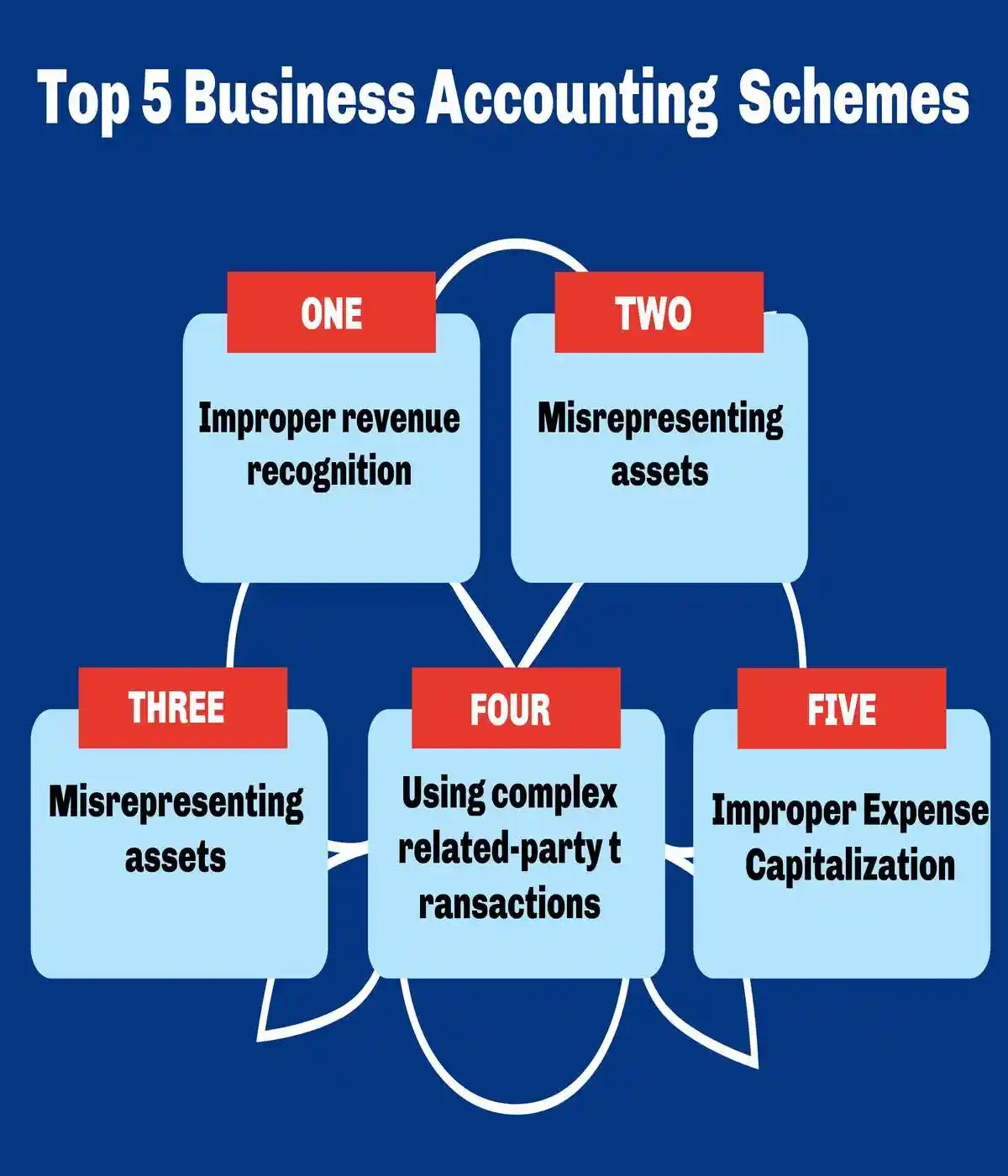

Introduction to Top 5 Business Accounting Fraud Schemes

- Top 5 Business Accounting Fraud Schemes: Improper Revenue Recognition; Misrepresenting Assets; Using Complex Related-Party; Transactions, Improper Expense Capitalization; and Manipulating Reserves.

- Fraudulent Foundation: Improper revenue recognition represents one of the most pervasive and devastating forms of accounting fraud.

- Improper Revenue Recognition: Represents one of the most sophisticated and devastating forms of accounting fraud,

- Related-party transactions (RPTs): Are transactions that occur between two parties who are connected through a pre-existing relationship involving numerous transaction including loans, sales and often lead to conflicts of interests makeing it crucial to aproach them with caution and a commitment to transparence,

- Improper Reveunue Roceognitation: frequently intersects with related-party transactions and is among the most insidious forms of accounting fraud.

- Improper expense capitalization: Emerges when companies deliberately violate accounting principles to manipulate their financial results.

- The Bond: The common thread among the top five busness accounding schemes triggering securities fraud litgitation, are they are intentional and deliberate attents to create ficticous financial health at the expense of shareholders when experiencd portfolio decsimation when the tructh emerges and artifical inflation evaporates.

Improper Revenue Recognition: A Critical Pathway to Securities Fraud and Corporate Devastation

Introduction to Improper Revenue Rec0gnition

- Improper Revenue Recognition: Represents one of the most sophisticated and devastating forms of accounting fraud, creating a dangerous web of deception that fundamentally undermines investor confidence and triggers costly securities fraud class action lawsuits.

- Fraudulent Practice: This ffraudulent practice involves the deliberate manipulation of when and how companies record revenue, violating fundamental accounting principles and regulatory compliance standards established under Generally Accepted Accounting Principles (GAAP) and federal securities laws.

- Accelerated Revenue Recognition: Companies engaging in this scheme typically recognize revenue before it is actually earned, often through techniques such as channel stuffing, bill-and-hold arrangements, or fictitious sales transactions.

- Misleading Investors: These manipulative practices create artificial spikes in reported earnings that mislead investors about the company’s true financial performance and operational health, directly violating the matching principle that requires revenues to be recognized when earned and realizable.

- Complex Related-Party Transactions: Sophisticated revenue recognition fraud often involves intricate arrangements with related entities, subsidiaries, or business partners designed to obscure the true nature of transactions and circumvent traditional internal controls.

- Accounding Fraud Schemes: These schemes may include round-trip transactions, where companies essentially sell products to entities they control and later repurchase them, creating the illusion of legitimate revenue while maintaining actual control over the underlying assets.

Regulatory Enforcement after High Profile Scandals

- Regulatory Enforcement Consequences: The Securities and Exchange Commission aggressively pursues companies and eexecutives involved in improper revenue recognition schemes, often resulting in substantial civil penalties, disgorgement of ill-gotten gains, and permanent bars from serving as officers or directors of public companies.

- Criminal Liability: These regulatory enforcement actions frequently trigger parallel criminal investigations by the Department of Justice, leading to felony charges and significant prison sentences for corporate executives who orchestrate or participate in these fraudulent schemes.

- Enron Scandal Devastation: The collapse of Enron Corporation serves as perhaps the most notorious example of how improper revenue recognition can destroy even the largest corporations, wiping out approximately $74 billion in shareholder value and triggering one of the most significant securities fraud class action settlements in history.

- Sophisticased Accounting Themes: Enron’s executives employed sophisticated mark-to-market accounting for long-term energy contracts, recognizing projected profits immediately rather than over the contract’s duration, while simultaneously hiding massive losses through off-balance-sheet special purpose entities that violated fundamental corporate governance principles.

- WorldCom Fraud Magnitude: WorldCom’s $11 billion accounting fraud, primarily involving the improper capitalization of operating expenses as capital expenditures and the manipulation of reserve accounts to inflate revenue, demonstrates how revenue recognition fraud can persist for years when internal controls fail and corporate governance structures break down.

- Intentional Manipulation: The company’s CFO Scott Sullivan and other executives systematically manipulated quarterly earnings reports to meet Wall Street expectations, ultimately leading to the largest bankruptcy in U.S. history at that time and devastating losses for investors, employees, and creditors.

Triggers Securities Fraud Litigation

- Securities Fraud Class Action Litigation: When improper revenue recognition schemes inevitably unravel, the resulting corrective disclosures typically trigger dramatic stock price declines that create the foundation for extensive securities fraud class action lawsuits under Section 10(b) of the Securities Exchange Act and Rule 10b-5.

- Material Misrepresentations: Plaintiffs in these cases typically allege that companies and their executives made material misrepresentations about financial performance, arguing that investors relied on fraudulent revenue figures when making investment decisions and suffered substantial damages when the truth was revealed.

- Reputational Damage Consequences: The long-term reputational damage from improper revenue recognition extends far beyond immediate financial penalties, creating lasting skepticism among investors, customers, suppliers, and business partners that can persist for decades after resolution.

- Unable to Access Capital: Companies involved in revenue recognition fraud often face difficulty accessing capital markets, securing favorable lending terms, or attracting top-tier talent, while their brands suffer permanent association with corporate malfeasance that undermines competitive positioning and market credibility.

Impact on Investors

- Investor Impact Devastation: Individual and institutional investors bear the brunt of improper revenue recognition fraud, suffering catastrophic losses when artificially inflated stock prices collapse following corrective disclosures.

- Massive Investor Losses: Pension funds, mutual funds, and individual retirement accounts often lose billions of dollars collectively, while employees holding company stock in 401(k) plans face the double devastation of job loss and retirement savings destruction when these schemes unravel.

Lack of Robust Internal Controls

- Internal Controls Failures: Improper revenue recognition typically occurs when companies lack adequate internal controls over financial reporting, particularly segregation of duties in the revenue recognition process, independent verification of sales transactions, and robust review procedures for complex or unusual revenue arrangements.

- Implementing Multi-Layered Controls: Effective prevention requires implementing comprehensive controls that include multiple approval levels for non-standard transactions, regular reconciliation of recorded revenues with underlying documentation, and independent audit procedures that specifically target high-risk revenue recognition areas.

Risk Assessments and Corporate Governance

- Risk Assessments Requirements: Corporate governance best practices mandate regular risk assessments that specifically evaluate revenue recognition processes, identifying potential vulnerabilities where fraud could occur and implementing targeted controls to address these risks.

- Through Examination of Policies: These assessments should examine the company’s revenue streams, contract terms, customer relationships, and accounting policies to ensure compliance with applicable accounting standards and identify areas where additional oversight or controls may be necessary.

Regulatory Compliance Framewords after Sarbanes-Oxley

- Regulatory Compliance Framework: The Sarbanes-Oxley Act of 2002‘s Section 404 requirements mandate that public companies maintain effective internal controls over financial reporting, including specific controls related to revenue recognition that must be tested annually by independent auditors.

- Financial Accounting Standards: Companies must also ensure their revenue recognition policies comply with evolving accounting standards, including the’s Accounting Standards Codification Topic 606, which provides comprehensive guidance on revenue recognition from contracts with customers.

Defection Mechanisms and Governance Structure

- Detection Methodologies: Sophisticated analytical techniques for detecting improper revenue recognition include examining revenue quality metrics such as the relationship between reported earnings and operating cash flows, analyzing accounts receivable aging and collection patterns, and identifying unusual fluctuations in revenue recognition timing or methodology.

- Corporate governance Structures: Should include audit committee oversight of revenue recognition policies, independent testing of revenue transactions, and whistleblower programs that encourage employees to report suspected fraudulent activities.

Prevention Strategies and Robust Control Frameworks

- Prevention Strategies Implementation: Effective prevention of improper revenue recognition requires a comprehensive approach that combines robust internal controls, strong corporate governance oversight, regular training on accounting standards and ethical conduct, and a culture of integrity that prioritizes accurate financial reporting over short-term earnings management.

- Establish Clear Policies: Organizations must establish clear policies regarding revenue recognition, implement multiple levels of review for complex transactions, and maintain detailed documentation that supports all revenue recognition decisions.

Act Decisively and Join Securites Class Action

- Act Decisively: When suspicions arise regarding a company’s revenue recognition practices, investors and stakeholders must act decisively to protect their interests by conducting thorough due diligence, engaging qualified financial analysts to examine the company’s financial statements, and considering legal action if material misrepresentations are discovered.

- Securities Fraud Litigation: If you have suffered substantial losses due to improper revenue recognition fraud and wish to explore your legal options, including potential participation in securities fraud class action litigation, contact experienced securities fraudl itigation attorneys who can evaluate your claims and help you recover damages from corporate wrongdoers who have violated federal securities laws.

Understanding Asset Misrepresentation: A Critical Threat to Market Integrity

- Asset misrepresentation: Stands as one of the most insidious forms of accounting fraud, creating a dangerous web of deception that can devastate investor confidence and trigger costly securities fraud class action lawsuits.

- Deceptive Practice: This deceptive practice occurs when individuals or companies intentionally misstate or falsify asset values to mislead stakeholders, fundamentally undermining the trust that serves as the foundation of financial markets.

The Anatomy of Asset Misrepresentation Schemes

- Inflated Property Values: Companies artificially inflate real estate holdings, equipment valuations, or intellectual property assets to present stronger balance sheets than reality warrants, directly violating fundamental accounting principles and regulatory compliance standards.

- Hidden Liabilities: Organizations systematically underreport debts, contingent liabilities, or pending legal obligations, creating misleading impressions of financial stability that can trigger securities litigation when the truth emerges.

- Fictitious Assets: The most egregious schemes involve creating entirely fabricated assets on financial statements, including non-existent inventory, phantom receivables, or imaginary investments that exist only on paper.

- Complex Valuations: Companies exploit subjective valuation methodologies for intangible assets, goodwill, or derivative instruments to manipulate reported values beyond reasonable market assessments, often circumventing traditional internal controls.

Motivations Behind Asset Misrepresentation

- Meeting Analyst Expectations: The relentless pressure to meet quarterly earnings forecasts and analyst projections drives companies to engage in asset manipulation, particularly when legitimate business performance falls short of market expectations.

- Debt Covenant Compliance: Organizations facing potential loan defaults or covenant violations frequently misrepresent assets to maintain required debt-to-equity ratios or asset coverage requirements, avoiding immediate financial distress.

- Stock Price Manipulation: Corporate executives with significant equity compensation packages may inflate asset values to boost share prices, maximizing personal financial gains while exposing shareholders to substantial risks.

- Acquisition Strategies: Companies seeking to complete mergers or acquisitions often overstate asset values to justify transaction prices or meet regulatory approval requirements, misleading both counterparties and regulators.

The Devastating Consequences of Asset Misrepresentation

- Reputational Damage: Once exposed, asset misrepresentation creates lasting reputational harm that extends far beyond immediate financial penalties, permanently damaging relationships with investors, customers, lenders, and business partners who lose confidence in management integrity.

- Investor Impact: Shareholders suffer substantial losses when corrective disclosures reveal the true extent of asset overstatements, typically triggering dramatic stock price declines that can eliminate decades of accumulated value within days of revelation.

- Financial Losses: The cascading effects include massive securities fraud class actions, regulatory enforcement penalties, audit costs, legal fees, and potential criminal fines that can exceed hundreds of millions of dollars for large-scale schemes.

- Criminal Liability: Individual executives face serious criminal charges including securities fraud, wire fraud, and conspiracy, with potential sentences ranging from substantial fines to decades in federal prison for the most egregious violations.

Detection and Prevention Strategies

- Enhanced Internal Controls: Organizations must implement robust internal controls specifically designed to prevent asset misrepresentation, including segregation of duties in asset valuation processes, independent verification procedures, and regular risk assessments targeting vulnerable areas.

- Independent Auditing: External auditors play a crucial role in detecting asset misrepresentation through detailed substantive testing, analytical procedures, and confirmation processes that verify the existence and valuation of reported assets.

- Whistleblower Programs: Effective corporate governance frameworks include confidential reporting mechanisms that encourage employees to report suspected asset manipulation without fear of retaliation, often serving as the first line of defense against fraud.

- Regular Monitoring: Companies should establish continuous monitoring systems that track key asset ratios, unusual fluctuations in asset values, and discrepancies between reported figures and industry benchmarks or historical trends.

Regulatory Framework and Enforcement

- Securities Laws Violations: Asset misrepresentation typically violates multiple federal securities laws, including Section 10(b) of the Securities Exchange Act and Rule 10b-5, which prohibit material misstatements in connection with securities transactions.

- Sarbanes-Oxley Compliance: The Sarbanes-Oxley Act requires CEO and CFO certifications of financial statement accuracy, making executives personally liable for asset misrepresentations and mandating robust internal controls over financial reporting.

- Regulatory Enforcement: The SEC actively pursues asset misrepresentation cases through civil enforcement actions, seeking monetary penalties, disgorgement of ill-gotten gains, and permanent bars from serving as corporate officers or directors.

- Class Action Litigation: When asset misrepresentation schemes unravel, they typically trigger securities fraud class action lawsuits where investors seek to recover losses caused by reliance on fraudulent financial statements, often resulting in substantial settlements.

Building Resilient Defense Systems

- Tone at the Top: Effective prevention begins with strong leadership commitment to ethical financial reporting, where executives demonstrate through actions and communications that accurate asset reporting takes precedence over short-term financial targets.

- Comprehensive Training: Organizations must provide regular training to finance personnel, asset managers, and executives on proper valuation methodologies, regulatory compliance requirements, and the severe consequences of asset misrepresentation.

- Technology Solutions: Modern enterprise resource planning systems and automated controls can help prevent asset misrepresentation by enforcing approval workflows, maintaining detailed audit trails, and flagging unusual transactions for management review

Instilling a Culture of Ethics and Transparency

- Culture of Integrity: The most effective defense against asset misrepresentation involves fostering an organizational culture where ethical behavior is valued, rewarded, and protected, creating an environment where employees feel empowered to challenge questionable practices.

- Asset misrepresentation: represents a fundamental breach of the trust that underpins efficient capital markets. When companies engage in these deceptive practices, they not only violate legal and ethical standards but also contribute to market inefficiencies that harm the broader economic system.

- Understanding these schemes: their motivations, and their consequences is essential for investors, regulators, and corporate leaders working to maintain market integrity and protect stakeholder interests in an increasingly complex financial landscape.

Hidding Liabilities, Making up Assets and Complex Valuations

- Hidden Liabilities: Organizations systematically underreport debts, contingent liabilities, or pending legal obligations, creating misleading impressions of financial stability that can trigger securities fraud litigation when the truth emerges.

- Fictitious Assets: The most egregious schemes involve creating entirely fabricated assets on financial statements, including non-existent inventory, phantom receivables, or imaginary investments that exist only on paper.

- Complex Valuations: Companies exploit subjective valuation methodologies for intangible assets, goodwill, or derivative instruments to manipulate reported values beyond reasonable market assessments, often circumventing traditional internal controls.

Using Complex Related-Party Transactions: A Sophisticated Fraud Scheme

- Complex Related-Party Transactions: Represent one of the most insidious pathways to accounting fraud, creating a dangerous web of deception that can devastate investor confidence and trigger costly securities class action lawsuits.

- Complex Schemes: This sophisticated fraud scheme exploits the inherent complexity of corporate relationships to obscure financial reality and manipulate reported performance.

Methods of Complex RPT Manipulation

- Circular Transactions: Companies create elaborate circular transaction schemes where funds or assets move between related entities in complex patterns; these arrangements artificially inflate revenue while obscuring the true economic substance of business activities.

- Off-Balance Sheet Entities: Accounting fraud perpetrators establish special purpose vehicles and subsidiary companies to hide debt and inflate assets; these complex structures remove liabilities from consolidated financial statements while maintaining economic control over the entities.

- Transfer Pricing Manipulation: Organizations manipulate transfer pricing between related entities to shift profits to favorable jurisdictions or reporting periods; this accounting fraud technique allows companies to artificially enhance earnings in specific reporting segments while avoiding regulatory scrutiny.

- Asset Shuffling: Complex Related-Party Transactions involve moving Preventing and Detecting Accounting Fraud: An Authoritative and Painstaking Investor Guide [2025]; companies use these schemes to meet earnings targets and avoid covenant violations that could trigger securities litigation.

- Legal and Financial Consequences

- Securities Litigation: When complex RPT schemes unravel, they typically trigger extensive securities class action lawsuits as investors seek toMisleading Financial Statements: An Instructive Investor Guide to a Securities Litigation Trigger [2025]; plaintiffs argue that these transactions constituted material misrepresentations under federal securities laws.

- Regulatory Enforcement: Regulatory compliance failures related to complex RPTs attract intense scrutiny from the SEC and other regulatory bodies; enforcement actions often result in substantial civil penalties, disgorgement of ill-gotten gains, and permanent bars from serving as corporate officers.

- Reputational Damage: The long-term consequences extend far beyond immediate financial penalties, creating lasting skepticism among investors, customers, and business partners; companies involved in complex RPT fraud often struggle to access capital markets and attract quality management talent.

- Criminal Prosecution: Corporate governance failures that enable complex RPT fraud can lead to criminal charges against executives; these prosecutions often result in significant prison sentences and personal financial ruin for those ffound guilty of orchestrating sophisticated fraud schemes.

Detection and Prevention Strategies

- Enhanced Internal Controls: Organizations must implement robust internal controls specifically designed to identify and evaluate complex related-party relationships; these controls should include comprehensive disclosure requirements and independent review processes for all significant RPTs.

- Risk Assessments: Regular risk assessments must specifically address the potential for complex RPT abuse by examining the business rationale for related-party dealings; companies should establish clear policies requiring arm’s length pricing and independent valuation for significant transactions.

- Corporate Governance: abuse by examining the business rationale for related-party dealings of all material related-party transactions; audit committees must have the expertise and authority to challenge management’s explanations for complex RPT structures.

- Regulatory Compliance: Maintaining strict regulatory compliance requires ongoing monitoring of disclosure requirements and prompt reporting of material related-party relationships; companies must ensure that their financial reporting accurately reflects the economic substance of all RPT arrangements.

Warning Signs for Investors

- Red Flags: Investors should exercise heightened scrutiny when companies report significant revenues or profits from related-party transactions; unusual fluctuations in RPT volumes or terms may indicate potential accounting fraud that could lead to securities class action participation opportunities.

- Documentation Gaps: Inadequate documentation or explanation of complex related-party arrangements often signals potential fraud; investors should carefully evaluate whether companies provide sufficient transparency about the business rationale and economic terms of significant RPTs.

Weak Governance and Internal Controls

- Governance Weaknesses: Companies with weak corporate governance structures or inadequate internal controls face elevated risks of complex RPT abuse; these deficiencies create opportunities for management to exploit related-party relationships for fraudulent purposes.

- To effectively navigate the risks associated with complex related-party transactions, businesses must maintain unwavering commitment to transparency and ethical conduct. By implementing comprehensive internal controls, conducting thorough risk assessments, and ensuring robust corporate governance oversight, organizations can protect themselves from the devastating consequences of securities litigation while preserving stakeholder trust and market confidence.

Improper Expense Capitalization: A Sophisticated Fraud Scheme

- Improper expense capitalization: Emerges when companies deliberately violate accounting principles to manipulate their financial results.

- Capitalized Expenses: This accounting fraud involves capitalizing expenses that should be immediately recognized, creating artificial asset inflation while understating current period expenses.

- Calculated Deception: The practice represents a calculated deception that fundamentally distorts a company’s true operational performance and financial health.

Companies Employ Numerous Manipulative Tactics

- Companies engaging in improper expense capitalization typically employ several manipulative tactics. Aggressive capitalization policies allow management to classify routine operational expenses as capital investments, artificially boosting reported earnings.

- Extending useful life estimates beyond reasonable parameters spreads costs over longer periods, reducing annual expense recognition. Capitalizing questionable costs involves recording expenses that provide no future economic benefit as assets, creating phantom value on balance sheets.

- The motivations behind these schemes often stem from intense pressure to meet Wall Street expectations, analyst forecasts, and debt covenant requirements. Management teams facing declining performance may resort to improper expense capitalization to maintain the appearance of financial stability while buying time to address underlying operational challenges.

Red Flags and Detection Strategies

- Warning signs: Improper expense capitalization red flags include unusual increases in capitalized expenses relative to total expenditures, significant changes in capitalization policies without adequate justification, and growing disparities between cash flow from operations and reported earnings.

- Sophisticated analysis: Reveals patterns where companies consistently capitalize expenses that industry peers expense immediately, suggesting potential manipulation.

- Risk assessments: Must examine the reasonableness of useful life estimates, the nature of capitalized costs, and thecontrols should include robust approval processes for capitalization decisions, regular reviews of capitalized balances, and independent verification of asset valuations.

Legal Consequences and Regulatory Enforcement

- The consequences of improper expense capitalization: Extend far beyond accounting corrections. Regulatory enforcement actions typically result in substantial civil penalties, disgorgement of ill-gotten gains, and regulatory compliance mandates that require enhanced oversight and reporting.

- Securities litigation: Frequently follows when ccorrective disclosures reveal the extent of capitalization manipulation, as investors seek recovery for losses incurred due to misleading financial statements.

- Securities class action lawsuits: Often emerge when companies restate earnings due to improper expense capitalization, with plaintiffs alleging material misrepresentations under federal securities laws. The resulting legal ramifications include not only financial settlements but also long-term reputational damage that affects company valuations, customer relationships, and employee morale.

Prevention Through Corporate Governance

- Preventing improper expense capitalization: Requires comprehensive corporate governance frameworks that emphasize transparency and accountability.

- Internal controls: Must include clear capitalization policies, regular training programs, and robust monitoring systems that detect unusual capitalization patterns before they become material misstatements.

- Effective prevention strategies: Integrate multiple control layers: segregation of duties in capitalization decisions, independent review processes, and regular risk assessments that evaluate the appropriateness of capitalization policies. Organizations must foster cultures where ethical financial reporting takes precedence over short-term earnings management pressures.

The Regulatory Landscape and the Importance of Implementing and Mataining Robust Controls

- The regulatory landscape: Continues evolving, with increasing emphasis on proactive risk management and enhanced disclosure requirements.

- Maintaining Robust Controls: Companies must stay current with changing standards while maintaining robust systems that prevent accounting fraud and protect stakeholder interests.

- Improper expense capitalization represents more than technical accounting violations—it constitutes a fundamental breach of trust between companies and their stakeholders. By understanding these risks and implementing comprehensive prevention strategies, organizations can maintain the integrity of their financial reporting while avoiding the devastating consequences of securities litigation and regulatory enforcement actions that inevitably follow fraudulent capitalization schemes.

The Anatomy of Reserve Manipulation: Sophisticated Schemes and Deceptive Practices

- Manipulating reserves: Encompasses several sophisticated schemes that companies employ to distort their financial statements.

- Violating Accouting Princlples; These fraudulent activities directly violate fundamental accounting principles and federal securities laws, creating substantial legal exposure for organizations and their executives.

Cookie Jar Reserves: The Classic Manipulation Scheme

- Excessuve Reserves: One of the most common forms of reserve manipulation involves the creation of excessive reserves during profitable periods, only to reverse these reserves in subsequent quarters when earnings fall short of expectations.

- Cookie Jar: This practice, known as “cookie jar” accounting, allows companies to smooth earnings artificially and create the illusion of consistent financial performance.

- Artifically Boosting Earnings: Companies build these excessive reserves by overestimating future liabilities, warranty costs, or restructuring expenses, then systematically release portions of these reserves to boost earnings in weaker quarters.

- Consequences: The legal ramifications of cookie jar reserve manipulation are severe and far-reaching. When these schemes inevitably unravel, the corrective disclosures typically trigger significant stock price declines, leading to substantial investor losses and creating the foundation for securities class action lawsuits.

- Securities litigation: Plaintiffs typically allege that reserve manipulation constitutes corrective disclosures typically trigger significant stock price declines, arguing that investors relied on false financial statements when making investment decisions.

Inadequate Reserve Recognition: Understating Future Obligations

- Intentionally Understating Reserves: Another prevalent form of manipulating reserves involves the systematic understatement of required reserves to inflate current period earnings.

- Companies engaging in this practice deliberately underestimate future warranty claims, bad debt expenses, environmental liabilities, or litigation costs to present a rosier financial picture to investors and analysts.

- This deceptive practice creates a ticking time bomb, as the inadequate reserves eventually prove insufficient to cover actual losses, forcing companies to record massive charges that devastate reported earnings.

- The regulatory enforcement consequences of inadequate reserve recognition are particularly severe, as this practice directly violates the matching principle and conservative accounting standards. Companies found guilty of systematically understating reserves face substantial civil penalties, regulatory enforcement actions, and extensive securities class action litigation from damaged investors.

Timing Manipulation: Strategic Reserve Reversals

- Sophisticated reserve manipulation schemes often involve the strategic timing of reserve reversals to maximize their impact on reported earnings. Companies may accelerate the reversal of legitimate reserves or delay the recognition of new reserve requirements to meet quarterly earnings targets. This timing manipulation creates artificial volatility in reported results and misleads investors about the company’s underlying operational performance and financial trajectory.

The Devastating Consequences: Legal Penalties and Investor Impact

- The consequences of manipulating reserves extend far beyond simple accounting errors, often resulting in catastrophic financial restatements, regulatory investigations, and extensive securities class action litigation. When reserve manipulation schemes unravel, they typically trigger a cascade of devastating consequences that can threaten the organization’s survival and destroy shareholder value.

Reputational Damage: The Long-Term Cost of Deception

- Companies involved in reserve manipulation face severe reputational damage that extends beyond immediate financial penalties. The revelation of fraudulent reserve practices creates lasting skepticism among investors, customers, and business partners, making it difficult for companies to access capital markets, attract top-tier talent, or maintain customer relationships. This subsequent securities class action settlement exceeded $180 million

Legal Penalties: Criminal and Civil Consequences

- The legal penalties associated with manipulating reserves are severe and multifaceted, encompassing both civil and criminal enforcement actions. Regulatory enforcement agencies actively pursue companies and their executives involved in reserve manipulation, leading to substantial civil penalties, disgorgement of ill-gotten gains, and permanent bans from serving as officers or directors of public companies. These enforcement actions often trigger parallel criminal investigations, resulting in felony charges and significant prison sentences for those found guilty.

- In a notable case involving a major technology company, three C-suite executives faced criminal charges related to systematic reserve manipulation spanning multiple fiscal years. The CFO ultimately received a four-year federal prison sentence, while the company itself entered into a deferred prosecution agreement, paying $275 million in fines and agreeing to enhanced oversight for five years. The subsequent securities class action settlement exceeded $180 million, reflecting the substantial investor losses caused by the fraudulent reserve practices.

Investor Impact: The Ripple Effect of Deception

- When reserve manipulation schemes unravel, the corrective disclosures can trigger dramatic stock price declines, causing substantial financial harm to individual and institutional investors alike.

- The company’s stock price plummeted from $52 per share to $23 per share, representing a devastating 56% decline that wiped out retirement savings and institutional investments.

- The subsequent investigation revealed a pattern of deliberate reserve misstatements spanning three fiscal years, resulting in a substantial legal battle and a multi-million dollar settlement.

- Securities class action plaintiffs typically allege that companies made material misrepresentations about their financial condition, arguing that investors relied on fraudulent reserve figures when making investment decisions. The resulting litigation can drag on for years, creating ongoing uncertainty and additional legal costs that further damage shareholder value and corporate reputation.

Detection and Prevention: Safeguarding Against Reserve Manipulation

- Manipulating reserves requires robust internal controls and comprehensive risk assessments that specifically address reserve-related fraud risks.

- Companies must implement sophisticated control mechanisms that provide independent verification of reserve calculations and prevent unauthorized adjustments to reserve balances.

Implementing Effective Internal Controls

- Approval Policies: Strong authorization and approval policies serve as the backbone of effective reserve control systems, establishing clear hierarchies and approval thresholds for reserve adjustments.

- Sepregation of duties: These policies must specify who has authority to propose, review, and approve reserve changes, ensuring that no single individual can manipulate reserve balances without appropriate oversight and documentation.

- Segregation of duties: Represents perhaps the most fundamental principle in preventing reserve manipulation.

- Critical Contral Mechanism: This critical control mechanism ensures that the individuals responsible for calculating reserves are separate from those who approve reserve adjustments, and both are independent from those who record the final journal entries.

- No Checkpoints: This separation creates natural checkpoints that make fraudulent reserve manipulation significantly more difficult to execute and conceal.

Enhanced Documentation and Audit Trails

- Prevention: Effective prevention of reserve manipulation requires comprehensive documentation of all reserve calculations, assumptions, and adjustments. Companies must maintain detailed audit trails that allow independent verification of reserve methodologies and provide clear evidence of the business rationale supporting each reserve adjustment.

- Documentation: These documentation requirements prove invaluable during regular audits and regulatory enforcement investigations, enabling auditors and regulators to reconstruct decision-making processes and identify potential control weaknesses.

- Regular audits and monitoring activities must specifically focus on reserve balances and related calculations, employing both statistical analysis and detailed transaction testing to identify unusual patterns or unexplained fluctuations. These audit procedures should examine not only the mathematical accuracy of reserve calculations but also the reasonableness of underlying assumptions and the consistency of methodologies across reporting periods.

Building a Culture of Integrity: The Ultimate Defense

- Building a culture of integrity and accountability: Is the cornerstone of effective fraud prevention and serves as the ultimate defense against reserve manipulation.

- Fostering an ethical environment: Where accurate financial reporting is valued over short-term earnings management creates a powerful deterrent against fraudulent activities and protects organizations from the devastating consequences of securities litigation.

- Code of Conduct: Companies must establish clear codes of conduct that explicitly prohibit reserve manipulation and provide specific guidance on appropriate reserve management practices. These policies should be regularly communicated to all employees involved in the financial reporting process, with particular emphasis on the legal and ethical obligations surrounding reserve calculations and adjustments.

- Whistleblower policies: Play a crucial role in detecting and preventing reserve manipulation by providing employees with safe channels to report suspected fraudulent activities. These policies must protect employees from retaliation and provide clear procedures for investigating and addressing reported concerns about reserve practices.

The Regulatory Landscape: Evolving Standards and Enforcement

- Regulatory landscape: Surrounding reserve manipulation continues to evolve, with increasing emphasis on proactive risk management and transparent reporting.

- Regulatory enforcement agencies: Have become increasingly sophisticated in their detection methods, employing advanced data analytics and industry-specific expertise to identify potential reserve manipulation schemes.

- Recent Developments: Recent regulatory developments have strengthened disclosure requirements for reserve methodologies and increased penalties for companies found guilty of reserve manipulation. T

- These enhanced standards: reflect the recognition that reserve manipulation poses significant risks to market integrity and investor confidence, requiring robust preventive measures and swift enforcement action when violations occur.

- Protecting Market Integrity Through Vigilant Oversight

- Manipulating reserves represents one of the most sophisticated yet devastating forms of accounting fraud, with consequences that extend far beyond immediate financial penalties to encompass reputational damage, legal penalties, and substantial investor impact. The lessons learned from past cases of reserve manipulation have underscored the critical importance of transparency and accountability in financial reporting, highlighting the need for robust internal controls, comprehensive risk assessments, and strong corporate governance practices

Protecting Market Integrity Through Vigilant Oversight

- By implementing comprehensive prevention strategies that combine effective internal controls, regular audits, thorough risk assessments, and strong corporate governance practices, companies can protect themselves from the devastating consequences of securities litigation while building stakeholder confidence in their financial reporting integrity. The ultimate goal must be fostering a culture where ethical behavior becomes the norm rather than the exception, creating sustainable value for all stakeholders while maintaining the highest standards of financial reporting accuracy and transparency.

- For investors who have suffered losses due to reserve manipulation schemes, understanding your rights under federal securities laws is crucial. If you have experienced substantial losses and wish to explore your legal options regarding securities class action participation, consulting with experienced securities litigation attorneys can help you understand your rights and potential remedies under applicable securities laws.

Conclusion

- As the financial landscape continues to evolve, the importance of each of the top five business accountng fraus schemes that trigger securities litigations addees in this comprehensive guide remains paramount in maintaining stability, trust, and growth.

- The lessons learned from past instances on the deliberate methods of accounting fraud addresses, demonstrate the need for transparency, accountability, and robust regulatory frameworks to prevent unethical practices.

- Companies, regulators, and stakeholders must work together to promote a culture of integrity and ethical governance, ensuring that reserves are managed responsibly and strategical

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors