Introduction to Misleading Financial Statements

- Signifcant Threat: Misleading financial statements represent one of the most significant threats to market integrity and investor confidence in today’s complex financial landscape.

- Deception: These deceptive documents obscure the true financial health of companies, creating a dangerous environment where investors make critical decisions based on fundamentally flawed information.

- Consequences: The consequences extend far beyond individual portfolio losses, undermining the very foundation of trust that capital markets require to function effectively.

- Sophisticated Fraud: The sophistication of modern accounting fraud has evolved dramatically, with corporate actors employing increasingly complex schemes to manipulate financial data.

- Manipulate Earnings: These fraudulent practices typically manifest through inflated revenue figures that create an illusion of robust growth, understated liabilities that hide financial obligations, and manipulated earnings reports that present artificial profitability.

- Investor Lossses: The intentional distortion of financial data creates a ripple effect throughout the investment ecosystem, affecting not only individual investors but also pension funds, institutional investors, and the broader economic stability.

The Anatomy of False Financial Statements

- False financial statements emerge through various sophisticated mechanisms that exploit weaknesses in financial reporting systems.

- Revenue recognition manipulation stands as one of the most prevalent methods, where companies prematurely record sales or create fictitious transactions to inflate their apparent performance.

- This practice often involves complex arrangements with related parties, channel stuffing techniques, or the inappropriate timing of revenue recognition to meet analyst expectations or debt covenant requirements.

Intentional Concealment of Liabilities

- Expense manipulation represents another critical avenue for financial statement fraud:

- Companies may defer legitimate expenses to future periods, capitalize costs that should be expensed immediately, or create fictitious asset valuations to improve their balance sheet appearance.

- These practices create temporary improvements in financial metrics while building unsustainable distortions that ultimately collapse, causing severe investor losses and untimatley securities litigation.

- The concealment of liabilities through off-balance-sheet financing arrangements has become increasingly sophisticated, with companies creating complex subsidiary structures or special purpose entities to hide debt obligations.

- These arrangements often involve intricate legal structures designed to technically comply with accounting standards while fundamentally misleading investors about the company’s true financial position.

Internal Controls: The First Line of Defense

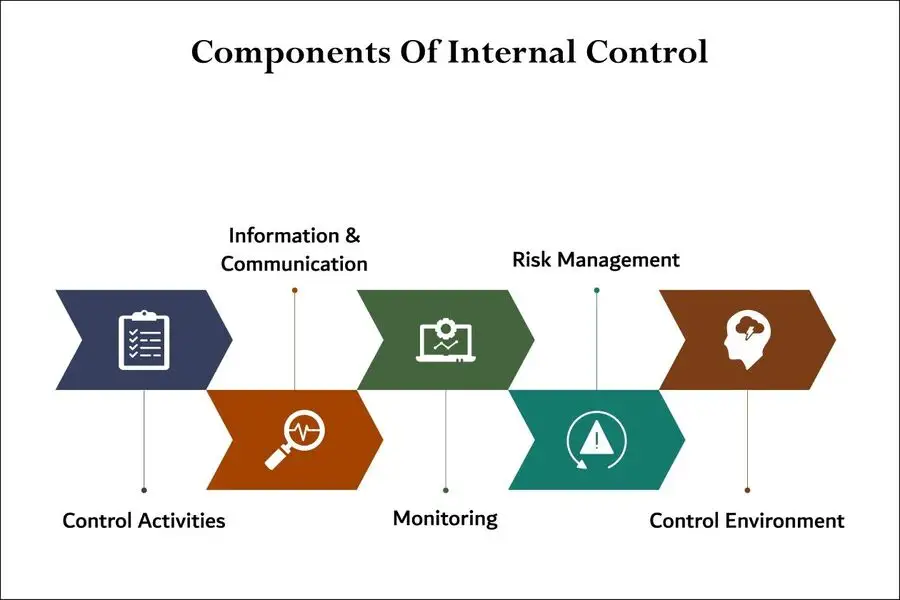

- Robust internal controls serve as the primary defense mechanism against misleading financial statements.

- These systems encompass the policies, procedures, and mechanisms that companies implement to ensure accurate financial reporting, prevent fraud, and maintain compliance with applicable regulations.

- Effective internal control frameworks typically include segregation of duties, where no single individual has complete control over critical financial processes, authorization controls that require appropriate approval for significant transactions, and documentation requirements that create audit trails for all financial activities.

- The Committee of Sponsoring Organizations (COSO) framework provides the foundational structure for internal control systems, emphasizing five key components: control environment, risk assessment, control activities, information and communication, and monitoring activities.

Internal Controls Must Keep Up with Technology

- Companies with strong internal control environments demonstrate a commitment to ethical behavior from senior management, establish clear accountability structures, and maintain comprehensive risk assessment processes that identify potential areas of financial statement manipulation.

- However, internal controls face significant challenges in the modern business environment.

- The increasing complexity of business transactions, the rapid pace of technological change, and the pressure to meet short-term financial targets can create environments where internal controls are bypassed or inadequately designed.

- Management override of controls represents a particularly dangerous scenario where senior executives use their authority to circumvent established safeguards, making detection of fraud extremely difficult.

Corporate Governance and Oversight Mechanisms

- Effective corporate governance structures play a crucial role in preventing misleading financial statements by establishing independent oversight mechanisms and accountability frameworks.

- The board of directors, particularly through its audit committee, bears primary responsibility for overseeing the financial reporting process and ensuring the integrity of financial statements.

- Independent directors with relevant financial expertise provide critical oversight of management’s financial reporting decisions and serve as a check against potential manipulation.

- The audit committee’s responsibilities extend beyond simple review of financial statements to include oversight of internal audit functions, evaluation of external auditor independence, and assessment of the company’s risk management processes.

Auditor Independence

- These committees must maintain regular communication with both internal and external auditors, review significant accounting policies and estimates, and ensure that management maintains appropriate internal controls over financial reporting.

- External auditors provide an additional layer of oversight through their independent examination of financial statements and internal controls.

- However, the effectiveness of external audits depends heavily on auditor independence, the scope of audit procedures, and the auditor’s ability to detect sophisticated fraud schemes.

- The relationship between auditors and management creates inherent tensions that can compromise audit effectiveness, particularly when auditors face pressure to maintain client relationships or when management attempts to limit audit scope.

Regulatory Framework: Sarbanes-Oxley Act and SEC Oversight

- The Sarbanes-Oxley Act of 2002 fundamentally transformed the regulatory landscape surrounding financial reporting, establishing comprehensive requirements designed to prevent misleading financial statements and enhance investor protection.

- Section 302 of the Act requires chief executive officers and chief financial officers to personally certify the accuracy of financial statements and the effectiveness of internal controls, creating direct personal accountability for financial reporting quality.

- Section 404 mandates that companies maintain adequate internal controls over financial reporting and requires management to assess and report on the effectiveness of these controls annually.

- This provision has significantly enhanced the focus on internal control systems and has led to the identification and remediation of numerous control deficiencies that could have resulted in misleading financial statements.

- The Act also established the Public Company Accounting Oversight Board (PCAOB) to oversee the auditing profession and ensure audit quality.

- The PCAOB’s inspection and enforcement activities have revealed significant deficiencies in audit quality and have led to improvements in audit methodologies and auditor accountability.

SEC Regulations and Enforcement

- SEC regulations provide the detailed framework for financial reporting requirements, establishing specific disclosure obligations and enforcement mechanisms.

- The SEC’s Division of Enforcement actively investigates potential securities violations and pursues civil enforcement actions against companies and individuals who engage in financial statement fraud.

- These enforcement actions serve both punitive and deterrent functions, sending clear messages about the consequences of misleading investors.

- The SEC’s emphasis on regulatory compliance extends beyond simple rule-following to encompass the spirit of transparency and investor protection that underlies securities regulations.

- Companies must not only comply with specific disclosure requirements but also ensure that their overall communication with investors provides a fair and accurate picture of their financial condition and business prospects.

Securities Litigation and Investor Remedies

- When misleading financial statements cause investor losses, securities litigation provides a critical mechanism for investor protection and recovery.

- Securities class action lawsuits enable investors who purchased securities during periods of alleged misrepresentation to collectively seek compensation for their losses.

- These lawsuits typically allege violations of Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5, which prohibit fraudulent or deceptive practices in connection with securities transactions.

- Securities class action lawsuits face significant pleading requirements under the Private Securities Litigation Reform Act (PSLRA), which requires plaintiffs to plead fraud with particularity and establish a strong inference of scienter (intent to deceive).

- These heightened standards were designed to prevent frivolous litigation while preserving legitimate claims for investor recovery.

Damages and Regulatory Enforcement

- The calculation of damages in securities fraud cases typically follows the “out-of-pocket” measure, which compensates investors for the difference between the price they paid for securities and the price they would have paid had they known the truth.

- This approach requires complex economic analysis to determine the artificial inflation in stock price caused by the misleading statements and the amount of that inflation that was removed when the truth was revealed.

- Regulatory enforcement actions by the SEC and other regulatory bodies complement private litigation by pursuing civil penalties, disgorgement of ill-gotten gains, and injunctive relief against violators.

- These enforcement actions often result in significant financial penalties and can include bars on individuals serving as officers or directors of public companies.

PRE- AND POST-PSLRA STANDARDS FOR SECURITIES FRAUD LITIGATION

Feature | Pre-PSLRA Standard | Post-PSLRA Standard |

Motion to dismiss | Based on “notice pleading” (Federal Rule of Civil Procedure 8(a)), making it easier for plaintiffs to survive motions to dismiss. This often led to settlements to avoid costly litigation. | Requires satisfying PSLRA’s heightened pleading standards and the “plausibility” standard from Twombly and Iqbal. Failure to plead with particularity on any element can result in dismissal. |

Pleading | “Notice pleading” was generally sufficient, though fraud claims under Federal Rule of Civil Procedure 9(b) required particularity for the circumstances of fraud, but intent could be alleged generally. | Each misleading statement must be stated with particularity, explaining why it was misleading. Facts supporting beliefs in claims based on “information and belief” must also be stated with particularity. |

Scienter | Pleaded broadly; the “motive and opportunity” test was often sufficient to infer intent. | Requires alleging facts creating a “strong inference” of fraudulent intent, which must be at least as compelling as any opposing inference of non-fraudulent intent, as clarified in Tellabs, Inc. v. Makor Issues & Rights, Ltd.. |

Loss causation | Not a significant pleading hurdle, often assumed if a plaintiff bought at an inflated price. | Requires pleading facts showing the fraud caused the economic loss, often by linking a corrective disclosure to a stock price drop. Dura Pharmaceuticals, Inc. v. Broudo affirmed this. |

Discovery | Could proceed while a motion to dismiss was pending. | Automatically stayed during a motion to dismiss. |

Safe harbor for forward-looking statements | No statutory protection. | Protects certain forward-looking statements if accompanied by “meaningful cautionary statements”. |

Lead plaintiff selection | Often the first investor to file. | Court selects based on a “rebuttable presumption” that the investor with the largest financial interest is the most adequate. |

| Liability standard | For non-knowing violations, liability was joint and several. | For non-knowing violations, liability is proportionate; joint and several liability applies only if a jury finds knowing violation. |

Mandatory sanctions | Available under Federal Rule of Civil Procedure 11, but judges were often reluctant to impose them. | Requires judges to review for abusive conduct |

Practical Guidance for Investor Protection

- Investors can take several proactive steps to protect themselves from the risks associated with misleading financial statements.

- Due diligence processes should include careful analysis of financial statement footnotes, which often contain critical information about accounting policies, contingent liabilities, and other factors that could affect the company’s financial position.

- Investors should pay particular attention to changes in accounting methods, unusual transactions with related parties, and significant estimates or judgments that could be subject to manipulation.

- Red flags that may indicate potential financial statement manipulation include consistent earnings that exactly meet analyst expectations, significant growth in accounts receivable or inventory relative to sales growth, frequent changes in auditors or key financial personnel, and complex corporate structures that make financial analysis difficult.

The Importance of Diversification

- Investors should also be wary of companies that provide limited access to management or that are reluctant to answer detailed questions about their financial reporting.

- Professional investors and institutional fund managers often employ forensic accounting techniques to identify potential financial statement fraud.

- These techniques include ratio analysis to identify unusual trends, cash flow analysis to verify the quality of reported earnings, and detailed review of segment reporting to identify inconsistencies or unusual patterns.

- The importance of diversification cannot be overstated in protecting against losses from individual company fraud.

- While diversification cannot eliminate the risk of misleading financial statements, it can limit the impact of any single company’s fraud on an overall investment portfolio.

The Path Forward: Strengthening Market Integrity

- The fight against misleading financial statements requires ongoing vigilance from all market participants.

- Companies must continue to strengthen their internal control systems and corporate governance practices, recognizing that the cost of maintaining robust controls is far less than the potential consequences of financial statement fraud.

- Regulators must adapt their oversight mechanisms to address evolving fraud schemes and maintain effective enforcement programs that deter misconduct.

- Investors bear responsibility for conducting appropriate due diligence and remaining skeptical of investment opportunities that seem too good to be true.

The investment community benefits when investors ask tough questions, demand transparency, and hold companies accountable for their financial reporting quality.

Robust Internal Control Frameworks

- The legal system provides essential protections through securities litigation and regulatory enforcement, but these mechanisms work most effectively when supported by strong internal controls, effective corporate governance, and informed investor participation.

- By working together, all market participants can help ensure that financial statements provide the accurate, transparent information that investors need to make informed decisions and that markets require to function efficiently.

- Understanding these legal matters empowers investors to better position themselves to seek justice and potentially recover losses incurred due to misleading statements or omissions by corporations through securities litigation.

- The complexity of modern financial reporting requires sophisticated approaches to fraud detection and prevention, but the fundamental principles of ttransparency, accountability, and investor protection remain constant guideposts for maintaining market integrity.

Understanding Financial Misrepresentation

- The relationship between corporate governance and financial reporting accuracy has never been more critical. When companies fail to maintain robust

- Internal Controls and ethical leadership, they create environments where financial misrepresentation can flourish unchecked.

- This section examination explores the various forms of financial fraud, their devastating impacts on investors, and the regulatory frameworks designed to combat these practices.

Common Types of Financial Misrepresentation

- Financial misrepresentation manifests in numerous sophisticated forms, each designed to create false impressions about a company’s financial performance and prospects.

- Revenue recognition fraud stands as one of the most prevalent and damaging forms of Accounting Fraud.

- This practice involves recording revenue before it is actually earned, inflating sales figures through fictitious transactions, or manipulating the timing of revenue recognition to meet analyst expectations and maintain stock prices.

- Consider the cautionary tale of a technology company that recorded software licenses as immediate revenue despite the fact that implementation services were still pending and customer payments remained uncertain.

Creating the Illusion of False Earnings

- This practice created an illusion of robust growth that attracted investors and inflated the company’s market valuation, only to collapse when the true nature of these transactions became apparent during a Regulatory Enforcement investigation.

- Expense manipulation represents another sophisticated form of financial misrepresentation where companies systematically understate their operational costs or shift expenses between reporting periods.

- This practice can involve capitalizing expenses that should be recorded immediately, creating fictitious vendor credits, or simply failing to record known liabilities.

The Impact on Investors of Misleading Financial Statements

- The impact of such practices extends beyond mere accounting irregularities—they fundamentally distort investors’ understanding of a company’s operational efficiency and profitability.

- The WorldCom fraud provides a stark illustration of expense manipulation on a massive scale.

- The scheme involved improperly categorizing billions of dollars in “line costs”—the fees WorldCom paid to other telecommunications companies for network access—as capital expenditures instead of operating expenses.

- This manipulation created the false appearance of a profitable and fast-growing company, which kept its stock price inflated and met Wall Street’s expectations.

- The fraud explained costs, from the income statement to the balance sheet, WorldCom was able to inflate its current profits.

- Instead of deducting these costs immediately, the company treated them as long-term investments that could be depreciated over many years.

- Inflated profits and revenue: The fraudulent accounting turned large quarterly losses into reported profits. The company also inflated its revenue by recording false transactions and improperly booking revenue from capacity swaps with other telecom companies.

- Misuse of reserve accounts: WorldCom’s executives also used reserve accounts to boost reported earnings and smooth out financial performance, further misleading investors.

Creating Fictitious Vendors and Manipulating Payroll Systems

- Companies might also engage in “cookie jar” accounting, where they create excessive reserves during profitable periods and release them during challenging times to maintain the appearance of consistent performance.

- Asset misappropriation, though less common in public companies due to enhanced Internal Controls, remains a significant concern for investors.

- This form of fraud involves the theft or misuse of company resources, often accompanied by sophisticated schemes to conceal the unauthorized activities.

- These schemes can include creating fictitious vendors, manipulating payroll systems, or diverting customer payments to personal accounts.

The Critical Role of Internal Controls and Corporate Governance

- Internal Controls serve as the first line of defense against financial misrepresentation, yet their effectiveness depends entirely on the commitment of corporate leadership to maintain ethical standards and transparent reporting practices.

- The Sarbanes-Oxley Act revolutionized corporate accountability by requiring CEOs and CFOs to personally certify the accuracy of their companies’ financial statements and the effectiveness of internal control systems.

- Effective Corporate Governance structures must include independent board oversight, robust audit committees, and clear segregation of duties within financial reporting processes.

The Result of Weak Governance Frameworks

- Companies with weak governance structures often exhibit warning signs such as concentrated decision-making authority, inadequate board independence, or compensation structures that create perverse incentives for financial manipulation.

- The Enron scandal exemplifies the catastrophic consequences of governance failures. The energy giant’s complex web of special purpose entities, aggressive accounting practices, and board oversight failures created an environment where massive financial misrepresentation could flourish undetected.

- The company’s collapse not only devastated shareholders but also highlighted fundamental weaknesses in corporate governance practices across American businesses.

The Devastating Impact of Misleading Financial Statements on Investors

- The consequences of relying on Misleading Financial Statements extend far beyond simple financial losses, creating a cascade of economic and social damage that can persist for years.

- When investors make decisions based on False Financial Statements, they fundamentally misallocate capital, directing resources toward companies that appear profitable but are actually struggling or fraudulent.

- Individual investors often suffer the most severe consequences from financial misrepresentation.

- Retirement accounts, college savings plans, and other long-term investment strategies can be decimated when companies reveal the true extent of their financial problems.

- The emotional toll on investors who trusted corporate management and lost significant portions of their life savings cannot be quantified in purely financial terms.

The Broader Implications of Accounting Fraud

- Investors face unique challenges when confronting financial misrepresentation.

- Pension funds, insurance companies, and mutual funds managing assets on behalf of millions of beneficiaries must navigate complex legal landscapes to recover losses and fulfill their fiduciary duties.

- These institutions often become lead plaintiffs in Securities Class Action Lawsuits, seeking to recover damages for all affected investors.

- The broader market implications of financial misrepresentation create systemic risks that extend far beyond individual companies or sectors.

- When major corporations are revealed to have engaged in extensive fraud, investor confidence in financial reporting standards can erode rapidly, leading to market volatility and reduced investment activity.

- This phenomenon creates a vicious cycle where legitimate companies struggle to access capital markets due to increased investor skepticism.

Securities Class Action Lawsuits: Seeking Justice for Defrauded Investors

- Securities Class Action Lawsuits provide crucial mechanisms for investors to seek compensation when they suffer losses due to financial misrepresentation.

- These complex legal proceedings allow similarly situated investors to pool their resources and pursue claims against companies that have violated federal securities laws through misleading financial statements or omissions of material facts.

- The legal standards for Securities litigation require plaintiffs to demonstrate that companies made material misstatements or omissions, that these statements influenced their investment decisions, and that they suffered quantifiable losses as a result.

- Proving these elements often requires extensive financial analysis, expert testimony, and detailed examination of corporate communications and internal documents.

The Complexity of Securities Fraud Litigation

- Securities Class Action Lawsuits have resulted in significant recoveries for defrauded investors, with some settlements reaching billions of dollars.

- The WorldCom securities litigation resulted in a $6.1 billion settlement, one of the largest in history, providing partial compensation to investors who suffered losses due to the company’s massive accounting fraud.

- The complexity of modern Securities litigation requires extensive experience in financial analysis, securities law, and corporate governance.

- Successful cases often depend on the ability to demonstrate clear causal relationships between corporate misstatements and investor losses, requiring sophisticated economic modeling and expert testimony.

Building Stronger Defenses Against Financial Misrepresentation

- Investors can protect themselves by developing sophisticated analytical skills and maintaining healthy skepticism about corporate financial statements.

- Red flags that may indicate potential financial misrepresentation include unexplained changes in accounting methods, unusual related-party transactions, aggressive revenue recognition practices, or management teams that consistently meet earnings expectations despite challenging business conditions.

- Corporate Governance reforms continue to evolve in response to emerging threats and changing business environments.

- Companies that prioritize transparency, maintain robust Internal Controls, and foster cultures of ethical behavior are more likely to avoid the devastating consequences of financial misrepresentation.

- The ongoing evolution of Regulatory Compliance requirements reflects the dynamic nature of financial markets and the persistent creativity of those who would manipulate them.

Empowering Investoers to Make Informed Decisions

- Investors, regulators, and corporate leaders must remain vigilant and adaptive to protect market integrity and maintain public confidence in financial reporting standards.

- Securities Class Action Lawsuits will continue to play essential roles in deterring financial fraud and providing remedies for injured investors.

- These legal mechanisms, combined with enhanced regulatory oversight and improved corporate governance practices, create multiple layers of protection against financial misrepresentation.

- While the threat of financial misrepresentation will never be completely eliminated, the combination of stronger legal frameworks, enhanced enforcement mechanisms, and more sophisticated investor awareness creates a more robust defense against corporate fraud.

- Understanding the various forms of financial misrepresentation, their potential impacts, and the available legal remedies empowers investors to make more informed decisions and seek appropriate recourse when they become victims of corporate fraud.

- The ongoing commitment to transparency, accountability, and investor protection remains essential for maintaining healthy and efficient capital markets.

Steps to Take When You Suspect Misleading Financial Statements

- If you suspect a company has issued false financial statements, swift action can protect your investments and contribute to broader market integrity.

Conducting Deep Financial Analysis

- Begin with a thorough forensic examination of the company’s financial reports.

- Compare key metrics against industry benchmarks, focusing on revenue recognition patterns, expense timing, and cash flow consistency. Red flags include:

- Sudden spikes in accounts receivable without corresponding sales growth

- Declining cash flows despite reported profit increases

- Unusual related-party transactions

- Frequent auditor changes or qualified opinions

- Pro tip: Use financial ratio analysis to identify discrepancies. A company reporting strong earnings while burning cash often signals potential accounting fraud.

Engaging Expert Consultation

- Do not navigate this alone.

- Financial analysts and forensic accountants possess specialized skills to validate your suspicions.

- Consider consulting:

- Independent research firms specializing in fraud detection

- Certified fraud examiners with securities litigation experience

- Investment advisors familiar with regulatory compliance requirements

Strategic Reporting to Regulatory Authorities

- Once you have gathered compelling evidence, report your concerns to appropriate regulatory enforcement agencies:

- United States:

- Securities and Exchange Commission (SEC) via their online complaint center

- Financial Industry Regulatory Authority (FINRA) for broker-dealer misconduct

- United Kingdom:

- Financial Conduct Authority (FCA) through their whistleblowing program

- Companies House for filing irregularities

- Document everything meticulously.

- Regulatory authorities require detailed evidence to initiate investigations, and your thorough preparation strengthens their case.

Adjusting Your Investment Strategy

- Evaluate the potential misrepresentation’s impact on your portfolio immediately:

- Risk Assessment: Quantify your exposure to the questionable company

- Diversification Review: Reduce concentration risk by reallocating assets

- Due Diligence Enhancement: Strengthen screening processes for future investments

- Legal Consultation: Consider joining securities class action lawsuits if applicable

- Stay informed about ongoing developments through SEC filings, court documents, and financial news sources.

Preventive Measures for Companies

- Organizations can prevent misleading financial statements through:

- Robust Internal Controls:

- Segregation of duties in financial reporting

- Regular internal audits and compliance reviews

- Whistleblower protection programs

- Technology-enabled monitoring systems

- Strong Corporate Governance:

- Independent audit committees with financial expertise

- Regular board oversight of financial reporting processes

- Executive certification requirements for financial statements

- Transparent communication with stakeholders

- Robust Internal Controls:

- Companies implementing these measures demonstrate commitment to regulatory compliance and reduce fraud risk significantly.

Building Market Integrity

- Your vigilance contributes to broader market health. When investors actively monitor for false financial statements and report suspicious activity, they create accountability that protects everyone’s interests.

- Take Action Today:

- Review your current holdings for red flags

- Bookmark regulatory reporting websites

- Connect with qualified financial professionals

- Join investor protection organizations

Conclusion: Navigating the Risks of Financial Misrepresentation

- As we look toward 2025 and beyond, the ability to identify and address misleading financial statements is more critical than ever for investors.

- In an increasingly complex and interconnected financial landscape, understanding the intricacies of financial reporting and the potential for misrepresentation can make the difference between success and failure.

- By recognizing red flags, understanding the legal framework, and learning from past cases, investors can better protect their portfolios from the risks of financial misrepresentation.

- While regulatory bodies and auditors play a vital role in maintaining market integrity, investors must also take responsibility for their own financial security.

- Through diligent research, diversification, and a long-term investment strategy, investors can minimize their exposure to misleading financial statements and make informed decisions.

- By staying vigilant and proactive, they can navigate the challenges of the modern financial environment and achieve sustainable growth.

- Ultimately, the key to safeguarding investments lies in education and awareness.

- By equipping themselves with the knowledge and tools necessary to recognize and respond to financial misrepresentation, investors can turn potential pitfalls into opportunities for growth.

- As the financial landscape continues to evolve, staying informed and adaptable will remain essential to navigating the risks and seizing the opportunities that lie ahead.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors