Understanding Corporate Governance: From Foundation to Consequences

- The consequences of weak corporate governanc can lead to multiple problems including: regulatory compliance, false financial statements and then securities litigation.

- Corporate governance refers to the intricate framework of rules, practices, and processes by which a company is directed and controlled.

- It is the backbone of any organization, determining the distribution of rights and responsibilities among various participants, such as the board of directors, managers, shareholders, and other stakeholders.

Robust Corporate Governance Builds Trust

- Effective corporate governance ensures accountability, fairness, and transparency in a company’s relationship with all its stakeholders.

- It is essential for maintaining investor confidence and securing capital investment, which are crucial for growth and innovation.

- The principles of corporate governance are rooted in the need to safeguard the interest of stakeholders while ensuring the company achieves its objectives.

- These principles include transparency, accountability, responsibility, and integrity.

- Each of these factors plays a vital role in establishing trust, which is the foundation of any successful business.

- Without trust, companies cannot effectively attract and retain investors, customers, or employees, which undermines their competitiveness and long-term viability.

Globalized Economy and Significance of Robust Corporate Governance

- In today’s globalized economy, the significance of corporate governance has grown exponentially.

- Companies are no longer isolated entities; they operate within a larger ecosystem that includes international markets, multinational regulations, and diverse cultural expectations.

- This complexity necessitates robust corporate governance structures capable of addressing a wide array of challenges, from regulatory compliance to ethical business conduct.

- As such, understanding corporate governance is not merely about adhering to legal requirements but about fostering a culture of ethical business practice that supports sustainable success.

The Importance of Strong Corporate Governance

- Strong corporate governance is crucial for any organization aiming to thrive in the modern business environment.

- It fosters a culture of accountability and transparency, which in turn enhances the trust of investors and other stakeholders.

- When governance structures are robust, they help ensure that management’s actions align with the best interests of shareholders, thereby minimizing risks and promoting long-term profitability.

- Furthermore, sound corporate governance practices are instrumental in mitigating conflicts of interest among stakeholders.

- It provides a framework for resolving disputes and ensures that all parties are treated fairly and equitably.

- This is particularly important in publicly traded companies, where the potential for conflicts between management and shareholders is high.

Robust Corporate Governance Is Vital for Enhancing Your Reputation

- Effective governance mechanisms, such as iindependent board oversight and rigorous audit processes, are essential for resolving these conflicts and maintaining investor confidence.

- Moreover, strong corporate governance can enhance a company’s reputation and brand value.

- In an era where consumers and investors are increasingly concerned about ethical practices, companies that uphold high governance standards are more likely to attract and retain loyal customers and investors.

- This not only contributes to financial stability but also provides a competitive edge in the marketplace.

- In essence, strong corporate governance is not just a regulatory necessity; it is a strategic asset that contributes to a company’s success.

The Consequences of Weak Corporate Governance

- While strong corporate governance serves as a protective shield for organizations, weak corporate governance creates vulnerabilities that can lead to devastating consequences.

- When governance structures fail, companies become susceptible to a cascade of problems that can ultimately destroy shareholder value and undermine market confidence.

- Weak corporate governance manifests in various forms: inadequate board oversight, lack of transparency in decision-making, insufficient risk management, and poor internal controls.

Long-Term Damage to Reputation

- These deficiencies create an environment where misconduct can flourish unchecked, leading to serious financial and reputational damage.

- The ripple effects extend far beyond the company itself, impacting investors, employees, customers, and the broader financial markets.

- The most immediate consequence of governance failures is the erosion of stakeholder trust.

- When investors lose confidence in a company’s leadership and decision-making processes, stock prices typically plummet, making it difficult for the organization to raise capital or maintain its market position.

- This loss of trust can persist for years, creating long-term challenges for recovery and growth.

Financial Misrepresentation and Market Manipulation

- One of the most serious outcomes of weak corporate governance is the increased likelihood of false financial statements and accounting fraud.

- When proper oversight mechanisms are absent or ineffective, management may be tempted to manipulate financial results to meet earnings expectations, secure bonuses, or hide operational problems.

- False financial statements can take many forms, including:

- Revenue recognition manipulation: Recording sales that haven not occurred or accelerating revenue recognition to inflate current period results

- Expense concealment: Hiding or deferring expenses to artificially boost profitability

- Asset overvaluation: Inflating the value of assets on the balance sheet to improve financial ratios

- Liability understatement: Failing to properly record debts or contingent liabilities

- These practices not only violate accounting standards and securities laws but also provide investors with a distorted view of the company’s true financial health.

Far-Reaching Consequences from Poor Governance

- When the truth eventually emerges, the consequences are typically severe and far-reaching.

- Accounting fraud represents the most egregious form of financial misrepresentation.

- Unlike simple errors or aggressive accounting interpretations, fraud involves intentional deception designed to mislead stakeholders.

- The perpetrators of accounting fraud often employ sophisticated schemes to conceal their activities, making detection difficult until significant damage has already occurred.

Internal Controls: The First Line of Defense

- Internal controls serve as the foundation of effective corporate governance, providing systematic safeguards against fraud, errors, and misconduct.

- These controls encompass the policies, procedures, and mechanisms that organizations implement to ensure accurate financial reporting, compliance with laws and regulations, and effective operations.

- When internal controls are weak or poorly implemented, companies become vulnerable to a wide range of problems.

- Compliance failures often begin with inadequate internal control systems that fail to detect or prevent violations of regulatory requirements.

- These failures can cascade through the organization, creating systemic risks that threaten the company’s viability.

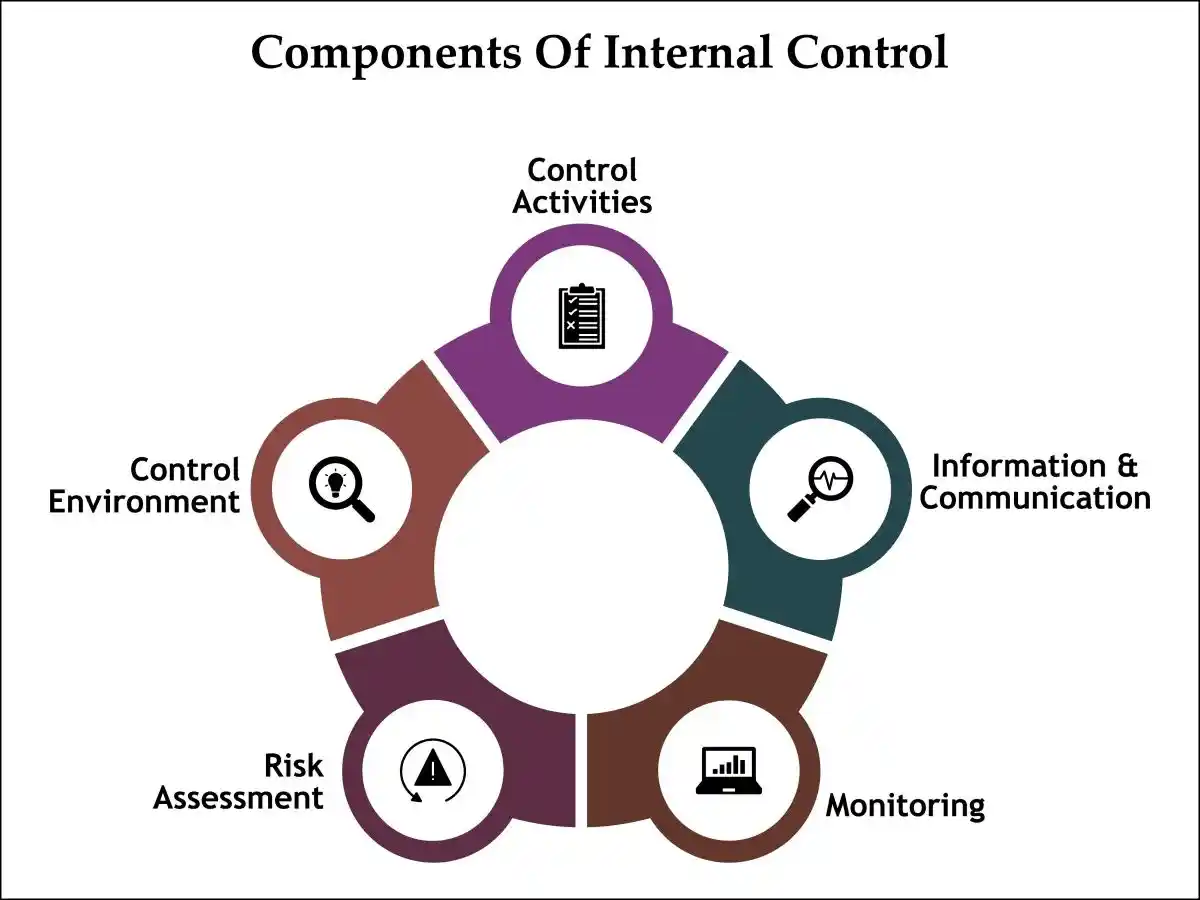

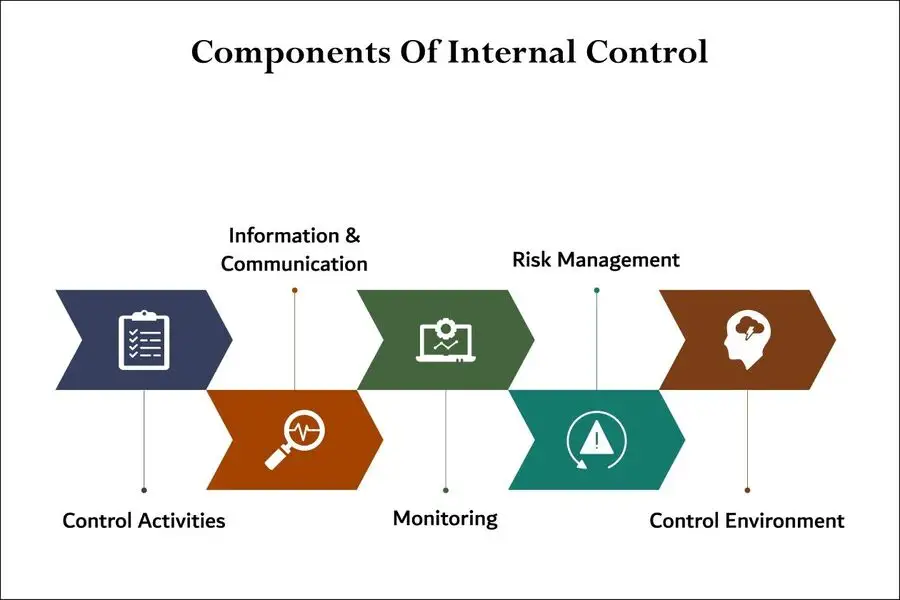

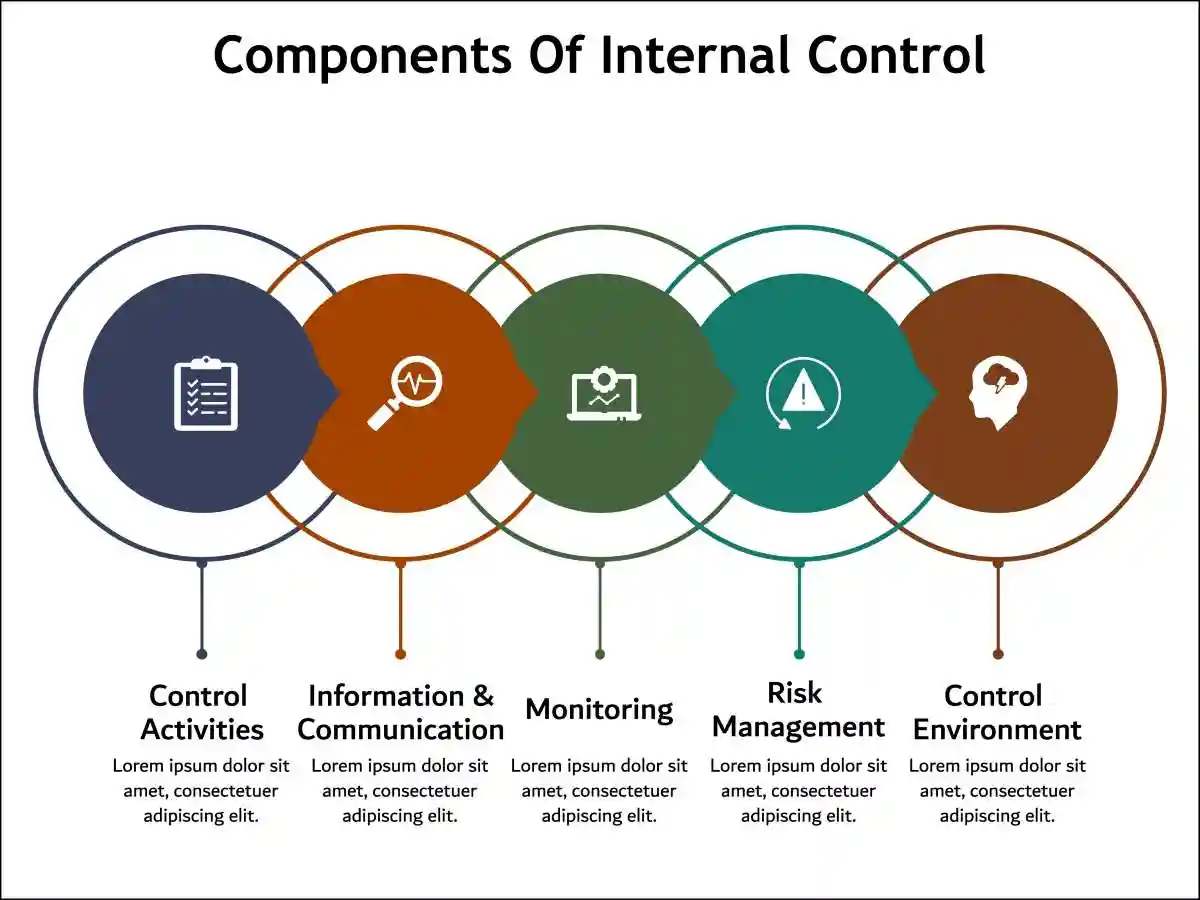

Components of Effective Internal Controls

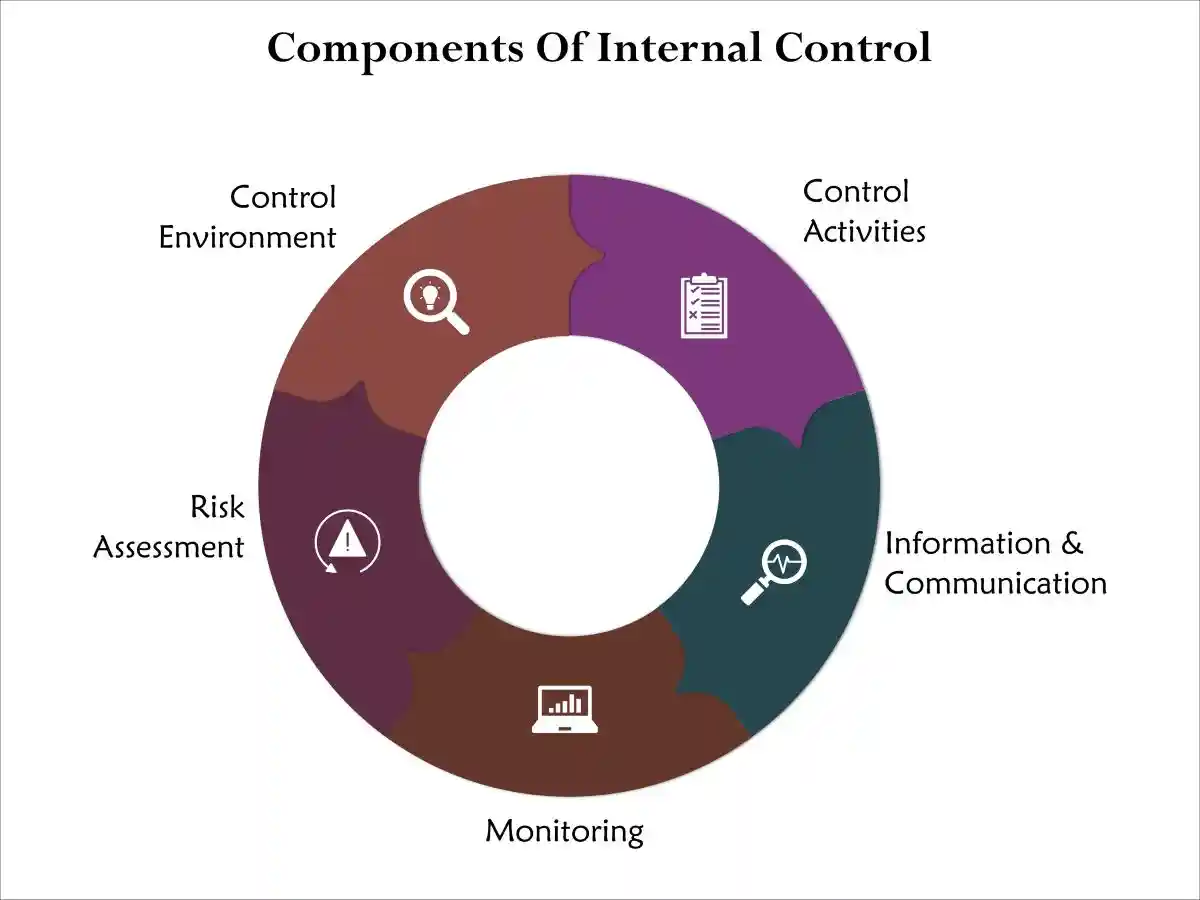

- Robust internal control systems typically include several key components:

- Control environment: The tone set by senior management and the board regarding the importance of integrity and ethical behavior

- Risk assessment: Regular evaluation of potential risks that could affect the achievement of business objectives Control activities: Specific policies and procedures designed to address identified risks

- Information and communication: Systems that ensure relevant information is captured and communicated throughout the organization

- Monitoring activities: Ongoing assessments to ensure controls are operating effectively

- When any of these components is deficient, the entire control system becomes compromised, increasing the likelihood of governance failures and their associated consequences.

The Cost of Control Deficiencies

Organizations with weak internal controls face numerous challenges that can significantly impact their operations and financial performance.

Compliance failures resulting from inadequate controls can lead to regulatory sanctions, fines, and increased scrutiny from oversight bodies.

These consequences not only impose direct costs but also divert management attention from core business activities.

Moreover, weak internal controls increase the risk of operational inefficiencies, as processes may not be properly designed or executed.

]This can result in wasted resources, missed opportunities, and suboptimal decision-making that undermines competitive positioning.

Securities Litigation and Legal Consequences

- When corporate governance failures result in investor losses, affected shareholders often seek recourse through securities litigation.

- This legal mechanism provides investors with a means to recover damages when companies violate securities laws through misrepresentation, fraud, or other misconduct.

- Securities class action lawsuits represent one of the most significant legal risks facing companies with weak governance structures.

- These collective legal actions allow groups of investors who suffered similar losses to pool their resources and pursue claims against the company and its officers.

- The potential financial exposure from such lawsuits can be enormous, often reaching hundreds of millions or even billions of dollars.

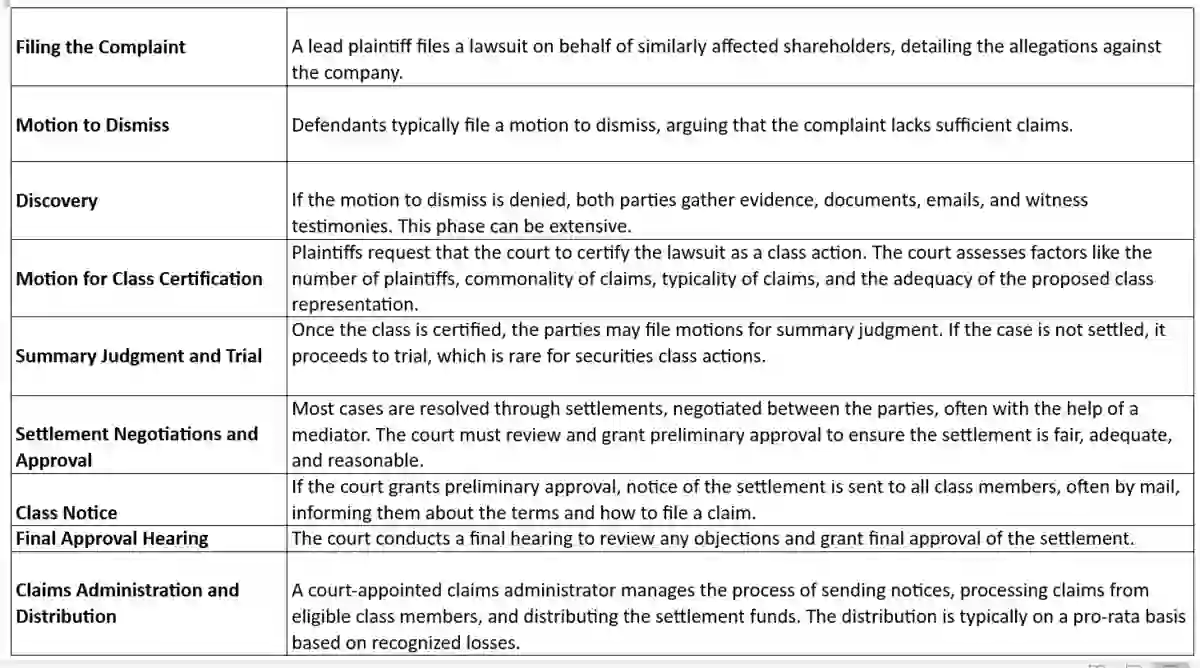

The Litigation Process and Its Impact

- Securities litigation typically follows a predictable pattern that begins when investors discover they have suffered losses due to alleged corporate misconduct.

- The process generally includes:

- Initial investigation: Attorneys and investors examine the circumstances surrounding the alleged misconduct Class certification: Courts determine whether the case meets the requirements for class action treatment Discovery phase: Both parties gather evidence and testimony to support their positions

- Settlement negotiations: Most cases are resolved through negotiated settlements rather than trials

- Final resolution: Either through settlement or court judgment, the matter is concluded

- Throughout this process, companies face significant costs beyond potential damage awards.

- Legal fees, management distraction, reputational damage, and regulatory scrutiny all impose substantial burdens on the organization.

THE SECURITIES LITIGATION PROCESS

Deterrent Effect of Securities Litigation

- Securities class action lawsuits serve an important deterrent function in the financial markets.

- The threat of litigation encourages companies to maintain strong governance practices and accurate financial reporting.

- When executives know they may face personal liability for governance failures, they are more likely to implement robust oversight mechanisms and ensure compliance with securities laws.

- However, the deterrent effect only works when companies have adequate governance structures in place to prevent misconduct from occurring in the first place.

- Organizations with weak governance may find themselves repeatedly facing litigation as problems continue to emerge.

Regulatory Compliance and the Sarbanes-Oxley Framework

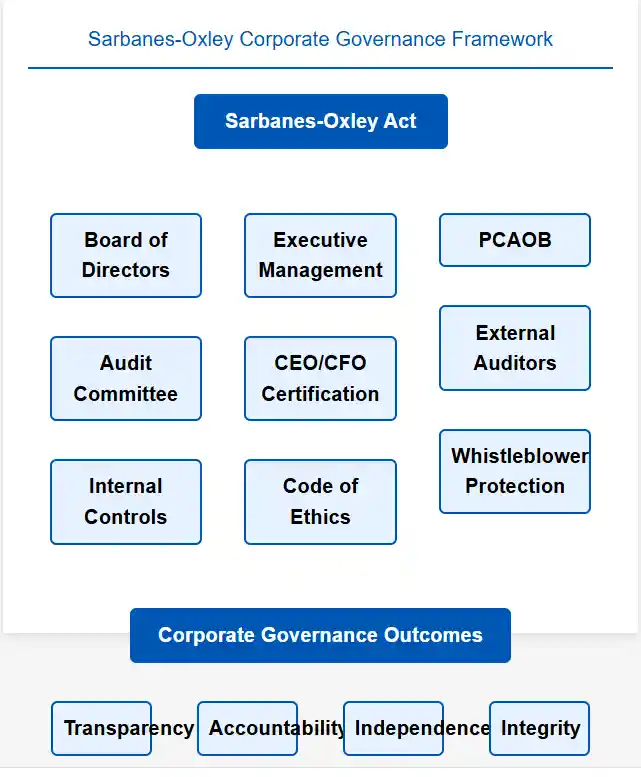

The Sarbanes-Oxley Act of 2002 represents one of the most significant legislative responses to corporate governance failures in U.S. history.

Enacted in the wake of major accounting scandals, this comprehensive law established new standards for corporate accountability and transparency.

Key Provisions of Sarbanes-Oxley

The Sarbanes-Oxley Act addresses many of the governance weaknesses that contributed to corporate scandals through several key provisions:

Section 302: Requires CEOs and CFOs to personally certify the accuracy of financial statements and the effectiveness of internal controls

Section 404: Mandates management assessment and auditor attestation of internal control effectiveness

Section 906: Establishes criminal penalties for executives who knowingly certify false financial statements Whistleblower protections: Provides safeguards for employees who report potential violations

These requirements create a framework that makes it more difficult for governance failures to go undetected and increases accountability for senior executives.

Implementation Challenges and Benefits

- While the Sarbanes-Oxley Act has significantly improved corporate governance practices, implementation has not been without challenges. Companies have invested substantial resources in compliance efforts, including:

- Enhanced documentation: Detailed policies and procedures must be documented and regularly updated

- Testing and monitoring: Internal controls must be regularly tested to ensure they are operating effectively

- Third-party assessments: External auditors must evaluate and report on the effectiveness of internal controls

- Management oversight: Senior executives must take active roles in overseeing compliance efforts

- Despite these costs, the benefits of Sarbanes-Oxley compliance are substantial.

- Companies with strong internal controls are better positioned to prevent fraud, ensure accurate financial reporting, and maintain investor confidence.

The Interconnected Nature of Governance Failures

- Corporate governance failures rarely occur in isolation. Instead, they typically involve a complex web of interconnected problems that reinforce each other and create systemic risks.

- Understanding these relationships is crucial for preventing governance breakdowns and their associated consequences.

The Cascade Effect

- When one aspect of corporate governance fails, it often triggers a cascade of additional problems.

- For example, weak board oversight may lead to inadequate internal controls, which in turn increases the risk of accounting fraud.

- Once fraud occurs, the company becomes vulnerable to securities litigation and regulatory sanctions, further weakening its governance structure.

- This cascade effect explains why governance failures can be so devastating.

- What begins as a relatively minor control deficiency can quickly escalate into crisis that threatens the organization’s survival.

Breaking the Cycle

- Preventing governance failures requires a comprehensive approach that addresses all aspects of the corporate governance framework. Organizations must:

- Establish strong tone at the top: Senior leadership must demonstrate unwavering commitment to ethical behavior and compliance

- Implement robust internal controls: Comprehensive control systems must be designed, implemented, and regularly tested

- Ensure effective board oversight: Independent directors must actively monitor management performance and risk management

- Maintain transparent communication: Stakeholders must receive timely, accurate information about the company’s performance and risks

- Foster a culture of accountability: All employees must understand their responsibilities and the consequences of misconduct

By addressing these fundamental elements, organizations can build resilient governance structures that protect against the various risks and consequences associated with governance failures.

Protecting Stakeholder Interests Through Strong Governance

- The ultimate purpose of corporate governance is to protect the interests of all stakeholders while enabling the organization to achieve its objectives.

- When governance structures are strong and effective, they create value for shareholders, provide security for employees, ensure fair treatment of customers, and contribute to the stability of financial markets.

- Strong corporate governance serves as a foundation for sustainable business success.

- It enables companies to attract capital, retain talent, build customer loyalty, and maintain competitive advantages.

- Moreover, it provides protection against the various risks and consequences that can arise from governance failures.

- The investment in robust governance structures pays dividends through reduced legal and regulatory risks, improved operational efficiency, enhanced reputation, and stronger stakeholder relationships.

The Benefits Str0ngly Outweigh the Costs

- While the costs of implementing and maintaining strong governance may seem significant, they pale in comparison to the potential consequences of governance failures.

- As the business environment continues to evolve, the importance of effective corporate governance will only continue to grow.

- Companies that recognize this reality and invest in building strong governance frameworks will be better positioned to thrive in an increasingly complex and challenging marketplace.

- Those that fail to do so risk facing the severe consequences that inevitably follow from weak corporate governance, including financial losses, legal liability, regulatory sanctions, and ultimately, the destruction of stakeholder value.

- The choice is clear: organizations can either invest proactively in strong governance structures or face the potentially devastating consequences of governance failures.

- The evidence overwhelmingly supports the former approach as the path to sustainable success and stakeholder protection.

A Comprehensive Analysis of Warning Signs and Their Impact

- Weak corporate governance represents one of the most significant threats to organizational integrity, investor confidence, and market stability.

- When companies fail to implement robust governance frameworks, the consequences extend far beyond internal operations, creating ripple effects that can devastate stakeholders, trigger securities litigation, and fundamentally undermine market trust.

Understanding the Critical Indicators of Governance Failure

Lack of Transparency: The Foundation of Governance Breakdown

The absence of transparency in financial reporting and decision-making processes serves as the most fundamental indicator of weak corporate governance.

This deficiency manifests in multiple ways that create dangerous vulnerabilities within organizations.

Companies eexhibiting poor transparency often provide incomplete financial disclosures, delay the release of material information, or present data in ways that obscure rather than illuminate their true financial condition.

When organizations fail to maintain transparent communication channels, they create an environment where false financial statements can flourish undetected.

This lack of transparency becomes particularly dangerous when combined with inadequate oversight mechanisms, as it allows management to manipulate information without appropriate checks and balances.

The resulting information asymmetry between management and stakeholders creates fertile ground for accounting fraud and other forms of financial misconduct.

Internal controls play a crucial role in maintaining transparency, yet companies with weak governance structures often neglect these essential safeguards.

Without proper internal controls, Weak Internal Controls and False Financial Statements: A Double Trigger to Securities Litigation [2025], monitor compliance with regulations, or detect fraudulent activities before they cause significant damage.

This deficiency in internal controls frequently leads to compliance failures that expose companies to regulatory penalties and legal challenges.

Concentration of Power: The Dangers of Unchecked Authority

- The concentration of power within a small group of individuals represents another critical warning sign of governance weakness.

- This concentration typically manifests through dominant CEOs who wield excessive influence over board decisions, boards lacking diversity in expertise and perspectives, or family-controlled companies where personal interests may conflict with shareholder value.

- When power becomes concentrated, the natural checks and balances that characterize effective governance begin to erode.

- Decision-making processes become less collaborative and more autocratic, reducing the likelihood that poor decisions will be challenged or corrected before implementation.

- This concentration creates an environment where unethical behavior can persist unchecked, as there are fewer independent voices willing or able to question management actions.

Board Diversity is Vital for Maintaining Robust Corporate Governance

- The absence of board diversity compounds these problems by limiting the range of perspectives brought to strategic discussions.

- Boards dominated by individuals with similar backgrounds, experiences, or relationships to management are less likely to provide the independent oversight necessary for effective corporoate governance.

- This homogeneity can lead to groupthink, where dissenting opinions are discouraged and critical analysis is sacrificed for consensus.

- Inadequate Risk Management: The Failure to Anticipate and Mitigate Threats

Companies with weak corporate governance frequently demonstrate inadequate risk management frameworks that leave them vulnerable to various threats.

These organizations often lack comprehensive risk assessment processes, fail to implement appropriate risk mitigation strategies, or neglect to monitor emerging risks that could impact their operations.

The absence of robust risk management becomes particularly problematic in today’s rapidly evolving business environment, where companies face increasingly complex challenges ranging from cybersecurity threats to regulatory changes.

Organizations without proper risk management frameworks struggle to identify potential problems before they escalate, respond effectively to crises when they occur, or adapt their strategies to changing market conditions.

Regulatory compliance represents a critical component of effective risk management, yet companies with weak governance often treat compliance as an afterthought rather than a strategic priority.

This approach leads to compliance failures that can result in significant financial penalties, legal challenges, and reputational damage that may take years to repair.

The Devastating Consequences of Governance Failures

Financial Statement Manipulation and Accounting Fraud

The consequences of weak corporate governance become most apparent when companies engage in financial statement manipulation or accounting fraud.

These activities typically emerge from the toxic combination of inadequate oversight, concentrated power, and insufficient internal controls that characterize poorly governed organizations.

False financial statements can take many forms, from revenue recognition manipulation and expense capitalization to off-balance-sheet financing arrangements and related-party transactions designed to obscure the company’s true financial condition.

A Minor Incident Can Escalate into Regulatory Enforcment and Securities Litigation

- These manipulations often begin as minor adjustments intended to smooth earnings or meet analyst expectations but can quickly escalate into systematic fraud that fundamentally misrepresents the company’s performance.

- The impact of accounting fraud extends far beyond the immediate financial misstatements.

- When these manipulations are eventually discovered, they typically trigger a cascade of consequences including regulatory investigations, securities class action lawsuits, criminal prosecutions, and massive financial penalties that can threaten the company’s survival.

Securities Litigation and Legal Consequences

- Companies with weak governance structures face significantly higher risks of securities litigation when their governance failures result in investor losses.

- Securities class action lawsuits have become increasingly common as investors seek compensation for losses resulting from corporate misconduct, misleading financial statements, or inadequate disclosure practices.

- These legal challenges can impose enormous costs on companies, both in terms of direct financial settlements and the indirect costs associated with defending against litigation.

- The legal process itself can consume significant management time and resources, diverting attention from core business operations and strategic initiatives.

- Moreover, the publicity surrounding securities litigation can cause lasting damage to corporate reputation and stakeholder relationships.

- The threat of securities litigation has intensified in recent years as courts have become more willing to hold companies accountable for governance failures and as plaintiff attorneys have developed more sophisticated approaches to identifying and prosecuting corporate misconduct cases.

A Comprehensive Analysis of Warning Signs and Their Impact

Weak corporate governance represents one of the most significant threats to organizational integrity, investor confidence, and market stability.

When companies fail to implement robust governance frameworks, the consequences extend far beyond internal operations, creating ripple effects that can devastate stakeholders, trigger securities litigation, and fundamentally undermine market trust.

Understanding the Critical Indicators of Governance Failure

Lack of Transparency: The Foundation of Governance Breakdown

The absence of transparency in financial reporting and decision-making processes serves as the most fundamental indicator of weak corporate governance. This deficiency manifests in multiple ways that create dangerous vulnerabilities within organizations. Companies exhibiting poor transparency often provide incomplete financial disclosures, delay the release of material information, or present data in ways that obscure rather than illuminate their true financial condition.

When organizations fail to maintain transparent communication channels, they create an environment where false financial statements can flourish undetected. This lack of transparency becomes particularly dangerous when combined with inadequate oversight mechanisms, as it allows management to manipulate information without appropriate checks and balances. The resulting information asymmetry between management and stakeholders creates fertile ground for accounting fraud and other forms of financial misconduct.

Internal controls play a crucial role in maintaining transparency, yet companies with weak governance structures often neglect these essential safeguards. Without proper internal controls, organizations cannot ensure the accuracy of their financial reporting, monitor compliance with regulations, or detect fraudulent activities before they cause significant damage. This deficiency in internal controls frequently leads to compliance failures that expose companies to regulatory penalties and legal challenges.

Concentration of Power: The Dangers of Unchecked Authority

The concentration of power within a small group of individuals represents another critical warning sign of governance weakness. This concentration typically manifests through dominant CEOs who wield excessive influence over board decisions, boards lacking diversity in expertise and perspectives, or family-controlled companies where personal interests may conflict with shareholder value.

When power becomes concentrated, the natural checks and balances that characterize effective governance begin to erode. Decision-making processes become less collaborative and more autocratic, reducing the likelihood that poor decisions will be challenged or corrected before implementation. This concentration creates an environment where unethical behavior can persist unchecked, as there are fewer independent voices willing or able to question management actions.

The absence of board diversity compounds these problems by limiting the range of perspectives brought to strategic discussions. Boards dominated by individuals with similar backgrounds, experiences, or relationships to management are less likely to provide the independent oversight necessary for effective governance. This homogeneity can lead to groupthink, where dissenting opinions are discouraged and critical analysis is sacrificed for consensus.

Inadequate Risk Management: The Failure to Anticipate and Mitigate Threats

Companies with weak corporate governance frequently demonstrate inadequate risk management frameworks that leave them vulnerable to various threats. These organizations often lack comprehensive risk assessment processes, fail to implement appropriate risk mitigation strategies, or neglect to monitor emerging risks that could impact their operations.

The absence of robust risk management becomes particularly problematic in today’s rapidly evolving business environment, where companies face increasingly complex challenges ranging from cybersecurity threats to regulatory changes. Organizations without proper risk management frameworks struggle to identify potential problems before they escalate, respond effectively to crises when they occur, or adapt their strategies to changing market conditions.

Regulatory compliance represents a critical component of effective risk management, yet companies with weak governance often treat compliance as an afterthought rather than a strategic priority. This approach leads to compliance failures that can result in significant financial penalties, legal challenges, and reputational damage that may take years to repair.

The Devastating Consequences of Governance Failures

Financial Statement Manipulation and Accounting Fraud

The consequences of weak corporate governance become most apparent when companies engage in financial statement manipulation or accounting fraud. These activities typically emerge from the toxic combination of inadequate oversight, concentrated power, and insufficient internal controls that characterize poorly governed organizations.

False financial statements can take many forms, from revenue recognition manipulation and expense capitalization to off-balance-sheet financing arrangements and related-party transactions designed to obscure the company’s true financial condition. These manipulations often begin as minor adjustments intended to smooth earnings or meet analyst expectations but can quickly escalate into systematic fraud that fundamentally misrepresents the company’s performance.

The impact of accounting fraud extends far beyond the immediate financial misstatements. When these manipulations are eventually discovered, they typically trigger a cascade of consequences including regulatory investigations, securities class action lawsuits, criminal prosecutions, and massive financial penalties that can threaten the company’s survival.

Securities Litigation and Legal Consequences

Companies with weak governance structures face significantly higher risks of securities litigation when their governance failures result in investor losses. Securities class action lawsuits have become increasingly common as investors seek compensation for losses resulting from corporate misconduct, misleading financial statements, or inadequate disclosure practices.

These legal challenges can impose enormous costs on companies, both in terms of direct financial settlements and the indirect costs associated with defending against litigation. The legal process itself can consume significant management time and resources, diverting attention from core business operations and strategic initiatives. Moreover, the publicity surrounding securities litigation can cause lasting damage to corporate reputation and stakeholder relationships.

The threat of securities litigation has intensified in recent years as courts have become more willing to hold companies accountable for governance failures and as plaintiff attorneys have developed more sophisticated approaches to identifying and prosecuting corporate misconduct cases.

Historical Case Studies: Lessons from Corporate Governance Disasters

The Enron Scandal: A Perfect Storm of Governance Failures

- The Enron scandal remains the quintessential example of how omissions in financial statements can devastate markets and investors.

- The energy company employed sophisticated accounting fraud schemes, including the use of special purpose entities (SPEs) to hide over $1 billion in debt from its balance sheets.

- These corporate scandals involved deliberate omissions of critical financial information that painted a false picture of the company’s financial health.

- Key Legal Precedents Established:

- Enhanced auditor independence requirements under the Sarbanes-Oxley Act

- Stricter CEO and CFO certification of financial statements

- Whistleblower protection provisions that encouraged internal reporting of fraud

- The securities litigation that followed resulted in one of the largest bankruptcy proceedings in U.S. history, with investors losing approximately $74 billion in market value.

- The case established crucial precedents for regulatory compliance, particularly regarding the disclosure of off-balance-sheet transactions and the independence of external auditors.

Timeline: The Rise and Fall of Enron Corporation

1985

Enron Corporation emerges from the merger of Houston Natural Gas Co. and InterNorth Inc., establishing what would become one of America’s most notorious corporate entities.

1995

Fortune magazine recognizes Enron as “America’s Most Innovative Company” – a prestigious title the energy giant would claim for six straight years, cementing its reputation as an industry pioneer.

1998

Andrew Fastow ascends to the position of Chief Financial Officer, where he would later orchestrate an elaborate web of off-balance-sheet entities designed to conceal the company’s mounting financial losses.

2000

Enron’s stock price reaches unprecedented heights, soaring to an all-time peak of $90.56 per share, reflecting investor confidence in the company’s apparent success.

February 12, 2001

Jeffrey Skilling assumes the role of Chief Executive Officer, replacing Kenneth Lay, though Lay continues his involvement as a board member.

August 14, 2001

In a shocking turn of events, Skilling abruptly resigns from his CEO position, with Lay resuming leadership duties. Simultaneously, Enron’s broadband unit reports devastating losses of $137 million, triggering analyst concerns and causing stock prices to plummet to a 52-week low of $39.95.

October 12, 2001

Arthur Andersen’s legal team instructs auditors to destroy Enron documentation, retaining only essential corporate records – a decision that would later prove catastrophic.

October 16, 2001

Enron discloses catastrophic financial results: a $618 million quarterly loss coupled with a staggering $1.2 billion write-down. The stock price continues its downward spiral to $38.84.

October 22, 2001

The company announces it faces investigation by the Securities and Exchange Commission, sending shares tumbling to approximately $20.75 following the revelation.

November 8, 2001

Enron makes a stunning admission: the company has been artificially inflating earnings by roughly $586 million since 1997, revealing the extent of its financial manipulation.

November 29, 2001

Arthur Andersen, Enron’s accounting firm, becomes entangled in the expanding scandal as SEC investigators broaden their probe to include the auditing giant.

December 2, 2001

Enron files for Chapter 11 bankruptcy protection, marking one of the largest corporate failures in U.S. history. Trading closes with shares valued at a mere $0.26.

January 9, 2002

The U.S. Department of Justice initiates criminal proceedings, escalating the matter from civil to criminal investigation.

January 15, 2002

The New York Stock Exchange suspends Enron trading, officially ending the company’s presence on the nation’s premier stock market.

WorldCom: Telecommunications Fraud on an Unprecedented Scale

- Arthur Andersen faces justice as the firm is convicted of obstruction of justice charges, effectively ending its role as one of the “Big Five” accounting firms and serving as a stark reminder of the scandal’s far-reaching consequences.

- The collapse of WorldCom was caused by an $11 billion accounting fraud carried out from 1999 to 2002.

- The scheme involved improperly categorizing billions of dollars in “line costs”—the fees WorldCom paid to other telecommunications companies for network access—as capital expenditures instead of operating expenses.

- This manipulation created the false appearance of a profitable and fast-growing company, which kept its stock price inflated and met Wall Street’s expectations.

- The fraud explained costs, from the income statement to the balance sheet, WorldCom was able to inflate its current profits.

- Instead of deducting these costs immediately, the company treated them as long-term investments that could be depreciated over many years.

- Inflated profits and revenue: The fraudulent accounting turned large quarterly losses into reported profits. The company also inflated its revenue by recording false transactions and improperly booking revenue from capacity swaps with other telecom companies.

- Misuse of reserve accounts: WorldCom’s executives also used reserve accounts to boost reported earnings and smooth out financial performance, further misleading investors.

The key players and discovery

- The fraud was directed by senior management, including CEO Bernard Ebbers and CFO Scott Sullivan, who felt immense pressure to maintain high stock prices and meet aggressive growth targets.

- However, internal auditor Cynthia Cooper and her team uncovered the deception. Despite facing pressure to halt their investigation, they persisted and eventually reported their findings to the company’s audit committee.

The fallout

- Bankruptcy and asset inflation: After the fraud was exposed in 2002, WorldCom filed for Chapter 11 bankruptcy in what was then the largest such filing in U.S. history. Investigations revealed that the company had inflated its assets by more than $11 billion.

- Penalties for executives: Both Ebbers and Sullivan were convicted for their roles in the scandal, receiving prison sentences. Other accounting executives involved also pleaded guilty.

- Legacy and regulation: Coming on the heels of the Enron scandal, the WorldCom collapse led to the passage of the Sarbanes-Oxley Act of 2002. The law was designed to prevent similar corporate fraud by strengthening corporate governance, requiring independent auditors, and increasing penalties for executives who misrepresent financial statements.

- Acquisition by Verizon: After emerging from bankruptcy and rebranding as MCI, the company was ultimately acquired by Verizon Communications in 2005.

The Waste Management Scandal: A Decade of Deception

- Waste Management’s senior executives carried out the scheme through a series of fraudulent accounting manipulations.

- These schemes allowed them to meet earnings targets, secure large bonuses, and sell their inflated stock holdings.

- The specific mechanisms of the fraud included:

- Manipulated depreciation: Executives repeatedly extended the useful life of company assets, such as garbage trucks, and assigned arbitrary, excessive salvage values to them. This dramatically reduced the annual depreciation expense and artificially boosted profits.

- Improper capitalization of expenses: Maintenance and repair costs for landfills were improperly classified as capital expenses rather than as current-period expenses. This illegally deferred recognition of these costs, making short-term profits appear larger.

- Concealment through “netting”: Management secretly used one-time gains from asset sales to erase unrelated operating expenses and accounting misstatements. This practice, known as “netting,” concealed the true financial health of the company from investors and auditors.

- Inflated environmental reserves: Executives would intentionally inflate environmental liability reserves during strong financial quarters. Then, during weaker quarters, they would release the excess reserves into earnings to boost results.

- Failure to write off impaired assets: The company neglected to write off the costs of abandoned or impaired landfill projects, instead keeping the costs on the balance sheet to hide their negative financial impact.

The role of Arthur Andersen

- Waste Management’s longtime auditor, Arthur Andersen, was complicit in the fraud.

- The audit firm was aware of Waste Management’s improper accounting practices and documented numerous issues, but it repeatedly approved the company’s financial statements with an “unqualified” or “clean” opinion.

- The relationship was tainted by a conflict of interest. Many of Waste Management’s top financial officers were former Arthur Andersen employees, and Andersen was highly protective of the lucrative relationship with its “crown jewel” client.

- Andersen also received substantial fees for non-audit consulting services, which compromised its independence.

Unraveling and consequences

- Discovery: The scheme was discovered in 1997 after a new CEO took over and ordered a review of the company’s accounting practices. He resigned months later after calling the accounting “spooky”.

- Financial restatement: In 1998, Waste Management announced it would restate its earnings from 1992 through 1997, revealing over $1.7 billion in overstated profits.

- Regulatory action: The Securities and Exchange Commission (SEC) charged Waste Management’s founder and five other top executives with perpetrating the fraud.

- Executives were fired and faced charges of securities fraud. The SEC also fined Arthur Andersen $7 million for its role.

- Stock price collapse: When the fraud was revealed, the company’s stock price plummeted, causing over $6 billion in losses for shareholders.

- Company restructure: Crippled by the scandal, Waste Management was acquired by a smaller competitor, USA Waste Services. The newly merged company kept the Waste Management name but relocated its headquarters and replaced nearly all top executives.

- Legacy for auditors: The scandal was a major contributing factor to the downfall of Arthur Andersen, which was also implicated in the Enron scandal just a few years later.

- Broader reforms: The Waste Management case, alongside other major financial scandals, helped trigger the push for stricter regulations in corporate governance and financial reporting, ultimately leading to the passage of the Sarbanes-Oxley Act in 2002.

Volkswagen’s Global Deception: Environmental Compliance Meets Securities Law

- The Volkswagen emissions scandal, also known as “Dieselgate,” centered on the company’s installation of illegal “defeat devices” that allowed its diesel vehicles to cheat on emissions tests.

- The scandal, which came to light in 2015, had profound consequences for Volkswagen’s finances, leadership, and public reputation.

- It also highlighted the growing legal and financial risks associated with poor Environmental, Social, and Governance (ESG) practices for corporations across industries.

The scandal and its fallout

- The “defeat device”: Volkswagen engineers programmed software to detect when a vehicle was undergoing an emissions test and activate its full emission controls. During real-world driving, these controls were turned off, causing the cars to emit up to 40 times the legal limit of nitrogen oxides (NOx). This cheating enabled the company to advertise its diesel cars as “clean” while masking their actual pollution levels.

- Massive scale: The software was installed in approximately 11 million vehicles worldwide, including VW, Audi, and Porsche models, affecting hundreds of thousands of cars in the U.S. alone.

- Executive departures: Shortly after the scandal broke, Volkswagen’s CEO, Martin Winterkorn, resigned. Numerous other executives and managers were suspended, indicted, or faced criminal charges in the U.S. and Germany

Legal and financial ramifications

- Multibillion-dollar settlements: The scandal cost Volkswagen over $30 billion in penalties, settlements, and other costs. This included a $14.7 billion settlement in the U.S. to compensate consumers, a $2.7 billion environmental mitigation trust, and a $2 billion investment in zero-emissions vehicle infrastructure.

- Criminal charges: In the U.S., Volkswagen pleaded guilty to three felony charges and paid a $2.8 billion criminal penalty. Several VW employees and executives received prison sentences for their roles in the conspiracy.

- Securities fraud: Volkswagen also faced securities fraud charges from the SEC for misleading investors during bond offerings in 2014 and 2015. This was particularly relevant as executives knew about the emission violations while touting the company’s environmental and regulatory compliance.

- Operational costs: Beyond fines, VW incurred immense costs from vehicle buyback and lease termination programs, recalls, and fixes.

Relevance to ESG disclosure and securities litigation

- Expanded definition of “materiality”: The case demonstrated that non-traditional financial factors, like environmental and regulatory compliance, can be “material” to investors. Lying about environmental performance had a dramatic and direct effect on Volkswagen’s stock price and long-term financial health.

- ESG as a core risk factor: The scandal showed that a company’s public image regarding sustainability and social responsibility directly affects its value. It is no longer enough to “greenwash” an image; deep-seated failures in governance and environmental control pose a material risk to investors.

- Increased scrutiny: In the wake of the scandal, regulators and investors increased their scrutiny of other automakers and industries. This led to more rigorous real-world emissions testing protocols and increased attention to potential cheating.

- Spillover effects on the market: Beyond Volkswagen, the scandal had negative “spillover effects” on the stock and bond values of other automakers and suppliers, particularly in Europe. This suggested a broader reassessment of risk within the automotive sector.

- ESG litigation risk: The Volkswagen case served as a high-profile precedent for securities litigation based on fraudulent ESG representations. It demonstrated that securities fraud law could be effectively used to prosecute cases where false statements about environmental compliance led to investor losses.

Wells Fargo: Incentive-Driven Fraud and Cultural Failures

- The Wells Fargo fake accounts scandal, involving the creation of millions of unauthorized accounts between 2009 and 2016, highlights critic al lessons regarding misaligned incentives and corporate ethics.

- It revealed how a toxic sales culture can compromise risk management and internal controls, causing severe repercussions for customers, investors, and the financial industry as a whole.

Lessons for corporate governance

- Emphasis on ethical leadership: The scandal demonstrated how leadership failures can foster a high-pressure environment that prioritizes profits over integrity. The subsequent leadership overhaul underscored the necessity of senior management championing an ethical culture and taking accountability.

- Need for effective oversight: The board of directors‘ failure to act in time and an insufficient control environment allowed misconduct to persist for years. This highlighted the importance of a board’s active engagement in risk oversight and a governance framework that empowers robust internal controls and audits.

- Integrated risk and compliance: The scandal exposed severe weaknesses in Wells Fargo’s enterprise risk management (ERM). It taught that risk and compliance cannot be treated as isolated functions but must be integrated into all business operations, supported by a system of checks and balances.

- Protections for whistleblowers: Many employees who tried to report the fraudulent activity were ignored or fired. The outcome emphasizes the need for strong whistleblower protections and transparent reporting policies to allow for the early detection of fraud without fear of retaliation.

Lessons for investors

- Scrutinize aggressive sales cultures: The “Eight is Great” sales mantra at Wells Fargo should have been a red flag to investors that the bank’s growth strategy was based on potentially unsustainable and aggressive targets. The scandal taught investors to be wary of companies that prioritize short-term sales metrics at the expense of sustainable business practices.

- Evaluate incentive structures: Compensation plans that over-emphasize sales volume and do not consider the quality of business can encourage misconduct. Investors should analyze incentive structures to ensure they are aligned with ethical behavior and long-term value creation.

- Look beyond financial reports: The scandal revealed that even a company with a strong reputation for financial performance can have deep-seated cultural problems. Investors should pay attention to disclosures regarding cultural and operational risks, as well as indications of low employee morale or high turnover, which can signal underlying issues.

- Consider reputational risk: Wells Fargo’s stock price plummeted and customer loyalty eroded significantly after the scandal broke. This shows investors that reputational damage can result in major financial losses and should be considered a material risk.

Lessons for regulatory oversight

- Proactive enforcement is necessary: The scandal demonstrated that regulatory scrutiny was insufficient to detect widespread misconduct over several years. Regulators now recognize the need for more proactive monitoring and enforcement, moving beyond a “checkbox” approach to compliance.

- Empower consumer protection agencies: The Consumer Financial Protection Bureau (CFPB) played a key role in the investigation and issued significant fines. The case highlighted the critical importance of consumer-focused regulators in identifying and punishing practices that harm the public.

- Implement stronger penalties: Regulators imposed several severe penalties on Wells Fargo, including a multi-billion dollar settlement and an unprecedented cap on the bank’s assets from the Federal Reserve. These actions sent a strong signal that systemic fraud carries serious consequences beyond just financial fines and demonstrated that regulators have expanded their tools for punishing misconduct.

- Increased scrutiny of corporate culture: Post-scandal, regulators became more focused on assessing the corporate culture of financial institutions, viewing it as a core component of risk. This established a precedent for regulators to intervene when they see operational and cultural flaws that could lead to consumer harm.

Theranos: The Intersection of Innovation and Deception

The Theranos fraud case represents a modern example of how omissions in financial statements can intersect with technological claims and investor relations. Founder Elizabeth Holmes was convicted of defrauding investors by making false claims about the company’s blood-testing technology while concealing the true state of its operations.

Key Legal Developments:

- Enhanced scrutiny of private company disclosures to investors

- Stricter due diligence requirements for venture capital investments

- Expanded liability for executives making forward-looking statements

Emerging Patterns in Modern Securities Litigation

Recent securities class action lawsuits demonstrate evolving patterns in corporate governance failures and regulatory compliance challenges:

Technology Sector Vulnerabilities

- Data privacy breaches leading to material omissions in risk disclosures

- Artificial intelligence bias creating new categories of operational risk

- Cybersecurity incidents requiring enhanced disclosure protocols

ESG-Related Litigation Trends

- Climate risk omissions in financial statements and investor communications

- Supply chain compliance failures affecting operational and reputational risk

- Social responsibility claims impacting brand value and market position

Regulatory Response and Compliance Evolution

These landmark cases have driven significant regulatory changes that reshape modern corporate governance:

Enhanced Disclosure Requirements:

- Real-time reporting of material events under Form 8-K

- Expanded risk factor disclosures in annual and quarterly reports

- Executive compensation clawback provisions for financial restatements

Strengthened Internal Controls:

- Section 404 compliance under Sarbanes-Oxley Act

- Whistleblower programs with financial incentives for reporting fraud

- Independent audit committee requirements for all public companies

Regulatory Response: The Sarbanes-Oxley Act

- The corporate scandals of the early 2000s prompted significant regulatory reforms designed to strengthen corporate governance and prevent similar failures in the future.

- The most significant of these reforms was the Sarbanes-Oxley Act of 2002, which established new standards for corporate accountability and transparency.

- The Sarbanes-Oxley Act introduced several key provisions designed to address weak corporate governance that contributed to the major corporate scandals.

Sarbanes-Oxley Requirements

- These provisions include requirements for CEO and CFO certification of financial statements, enhanced independence requirements for audit committees, restrictions on auditor conflicts of interest, and strengthened internal control requirements.

- Section 404 of the Act requires companies to establish and maintain adequate internal controls over financial reporting and to have these controls assessed by external auditors.

- This requirement has significantly improved the quality of internal controls at public companies and has helped prevent many potential accounting irregularities from occurring.

- The Act also established the Public Company Accounting Oversight Board (PCAOB) to oversee the audit profession and ensure that auditors maintain appropriate standards of independence and professional competence.

Building Effective Internal Controls and Compliance Frameworks

Organizations seeking to avoid the consequences of weak corporate governance must prioritize the development of robust internal controls and comprehensive compliance frameworks.

Effective internal controls serve as the first line of defense against fraud and misconduct by establishing clear procedures for financial reporting, authorization of transactions, and monitoring of business activities.

Regulatory compliance requires ongoing attention and resources, as the regulatory environment continues to evolve and become more complex.

Companies must establish compliance programs that not only address current regulatory requirements but also anticipate future changes and emerging risks.

The most effective compliance frameworks integrate governance, risk management, and compliance activities into a comprehensive system that provides management and the board with timely and accurate information about the company’s risk profile and compliance status.

Preventing Securities Litigation Through Proactive Governance

Companies can significantly reduce their exposure to securities litigation by implementing strong governance practices that promote transparency, accountability, and ethical behavior.

Proactive governance measures include establishing Implementing Robust Corporate Governance: A Painstaking and Instructive Guide [2025] maintaining comprehensive disclosure practices, and fostering a corporate culture that prioritizes compliance and ethical behavior.

Securities class action lawsuits often arise when companies fail to disclose material information in a timely manner or when their financial statements contain material misrepresentations.

By maintaining strong governance practices and comprehensive disclosure procedures, companies can reduce the likelihood of these triggering events occurring.

Regular training and education programs can help ensure that all employees understand their responsibilities for maintaining accurate records, complying with applicable regulations, and reporting potential problems to appropriate authorities.

The Path Forward: Strengthening Corporate Governance

The lessons learned from major corporate governance failures provide valuable insights for companies seeking to strengthen their governance practices and avoid similar problems.

Effective governance requires ongoing commitment from leadership, adequate resources, and a corporate culture that values transparency, accountability, and ethical behavior.

Organizations must recognize that strong corporate governance is not merely a compliance requirement but a strategic imperative that can create competitive advantages, reduce risks, and enhance long-term value creation.

By investing in robust corporate governance frameworks, companies can build stakeholder trust, reduce their exposure to legal and regulatory risks, and position themselves for sustainable success.

The consequences of weak corporate governance extend far beyond individual companies to affect entire markets and economies.

By understanding these consequences and taking proactive steps to strengthen governance practices, organizations can contribute to a more stable and trustworthy business environment that benefits all stakeholders.

Through comprehensive governance reforms, enhanced regulatory oversight, and a renewed commitment to corporate accountability, the business community can work to prevent future governance failures and maintain the integrity of our capital markets for generations to come.

Conclusion: Mitigating Risks Through Strong Governance Practices

- In conclusion, the consequences of weak corporate governance can be severe, exposing companies to securities litigation and significant financial and reputational damage.

- By understanding the intricate relationship between governance failures and legal ramifications, businesses can take proactive measures to strengthen their governance frameworks and safeguard their interests.

- Implementing best practices, such as establishing diverse and independent boards, enhancing risk management systems, and fostering a culture of ethical behavior, is essential for maintaining investor trust and securing long-term success.

- Additionally, leveraging technology to improve transparency and accountability can further enhance governance practices and reduce the likelihood of litigation.

- Ultimately, strong corporate governance is not just a regulatory requirement but a strategic imperative.

- By prioritizing governance, companies can mitigate risks, build trust with stakeholders, and ensure their competitiveness in an increasingly cautious market.

- As we move into 2026 and beyond, businesses that embraceb robust governance practices will be better positioned to thrive in the face of evolving challenges and opportunities.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors