Introduction to Manipulating Timing and Accounting Fraud

- Manipulating Timing and Accounting Fraud represents one of the most insidious threats facing today’s financial markets.

- These sophisticated schemes don’t just damage individual portfolios—they erode the fundamental trust that keeps our entire economic system functioning.

- When corporate executives deliberately distort financial reality, they weaponize information asymmetry against the very investors who fuel their companies’ growth.

The Anatomy of Timing Manipulation

- Timing manipulation operates in the shadows of legitimate business practices, making it particularly dangerous for unsuspecting investors.

- Companies employ various techniques to present their financial performance in misleading ways:

Revenue Recognition

- Revenue Recognition Games: Corporations may accelerate revenue recognition by shipping products earlier than normal or creating artificial sales through related parties.

- This creates an illusion of robust growth that evaporates in subsequent quarters.

- Expense Timing Shifts: Strategic delays in recognizing expenses or moving costs between reporting periods can dramatically alter a company’s apparent profitability.

- These financial misstatements often coincide with critical events like earnings announcements or merger negotiations.

Timing Disclosure Strategically and Deliberately

- Strategic Disclosure Timing: Perhaps most damaging is the calculated timing of material information releases.

- Companies may bury negative news during market holidays or release positive developments just before analyst calls, creating artificial price movements that benefit insiders while harming retail investors.

- The sophistication of these schemes has evolved dramatically.

- Modern timing manipulation often involves complex derivatives, off-balance-sheet entities, and intricate transaction structures designed to exploit regulatory gaps and accounting standards.

Accounting Fraud: Beyond Simple Number Manipulation

- Accounting Fraud extends far beyond basic financial statement manipulation.

- Today’s schemes involve elaborate networks of shell companies, fictitious transactions, and coordinated efforts to deceive auditors, regulators, and investors simultaneously.

- Corporate scandals like Enron and WorldCom revealed how accounting fraud can destroy entire industries and pension funds.

- These cases demonstrated that compliance failures often stem from systematic cultural problems rather than isolated incidents.

- When boards of directors fail to exercise proper oversight, when audit committees lack independence, and when compensation structures reward short-term results over long-term sustainability, the stage is set for massive fraud.

Investor Red Flags

- Red flags that sophisticated investors watch for include:

- Unusual transaction patterns: Look for unexpected revenue or expense fluctuations, especially near the end of a reporting period.

- Discrepancies in financial records: Be wary of inconsistencies between cash flow and reported profits, or frequent and material restatements of earnings.

- Pressure to hit targets: High-pressure sales environments, executive compensation tied directly to short-term targets, or a history of meeting earnings expectations by a small margin can signal risk.

- High-risk industries: Certain industries with complex revenue recognition, such as long-term contracts, are more susceptible to timing manipulation.

Securities Litigation and Regulatory Response

Securitiess Fraud Litigation

- The legal framework surrounding securities litigation has evolved significantly in response to high-profile fraud cases.

- Securities Class Action Lawsuits now serve as a critical deterrent against corporate misconduct, though they often come too late to prevent initial investor losses.

Compliance with Regulatory Bodies

- Regulatory Compliance requirements have intensified, with the Securities and Exchange Commission implementing stricter disclosure requirements and enhanced penalties for violations.

- The Sarbanes-Oxley Act of 2002 introduced criminal liability for executives who certify fraudulent financial statements, fundamentally changing the risk calculus for potential fraudsters.

- However, enforcement remains challenging. Regulatory agencies often lack the resources to conduct comprehensive investigations of complex fraud schemes.

- This reality places additional responsibility on investors, analysts, and institutional stakeholders to maintain vigilance.

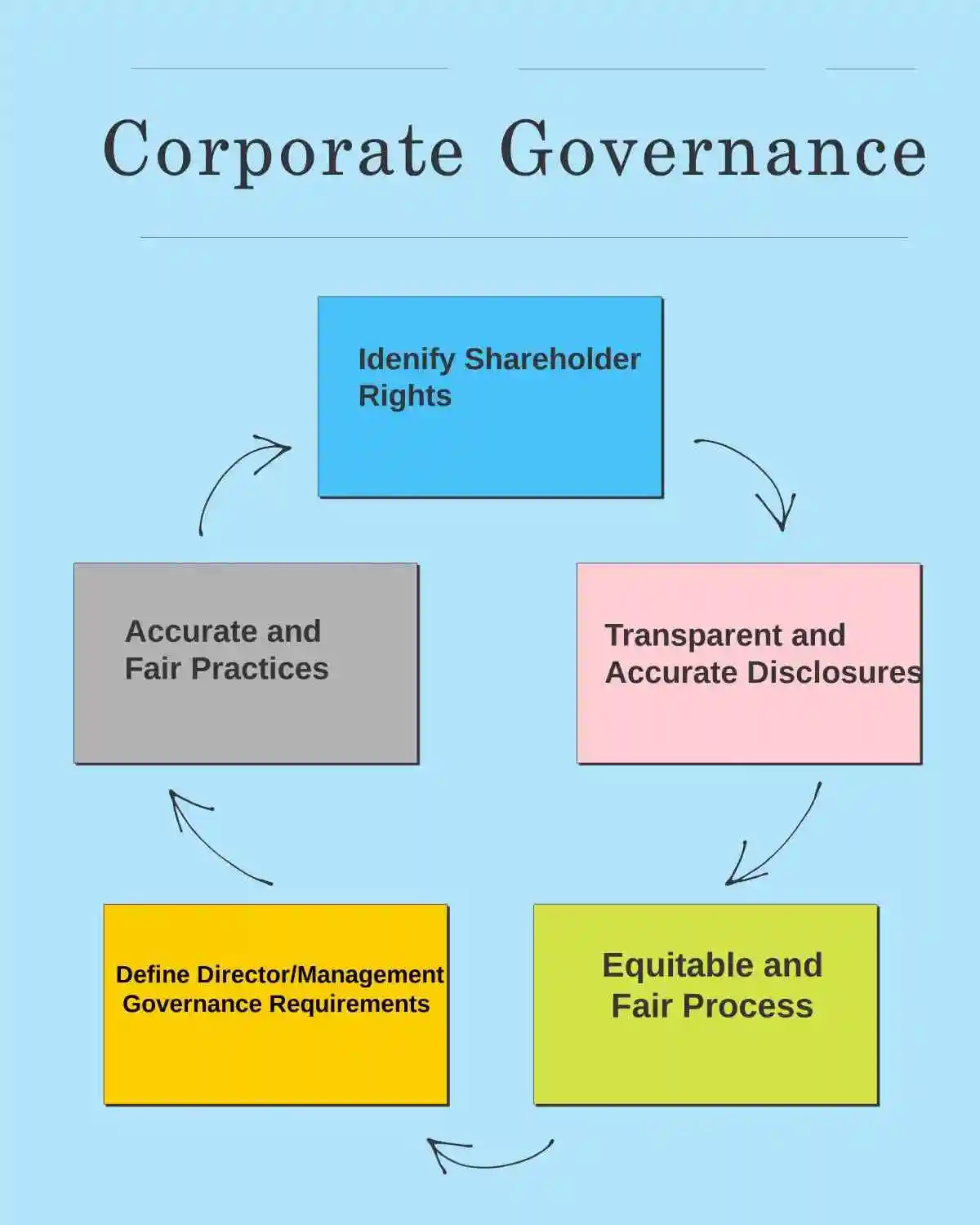

Corporate Governance as the First Line of Defense

- Effective Corporate Governance represents the most powerful tool for preventing timing manipulation and accounting fraud.

- Independent board oversight, robust internal controls, and transparent reporting mechanisms create multiple barriers against fraudulent activities.

Best Practices

- Best practices that investors should demand include:

- Independent audit committees with financial expertise

- Regular rotation of external auditors

- Whistleblower protection programs that encourage internal reporting

- Executive compensation structures that emphasize long-term value creation

Consistent Financial Reporting

- Companies with strong governance frameworks typically demonstrate more consistent financial performance and face fewer regulatory challenges.

- These organizations understand that transparency is not just a legal requirement—it is a competitive advantage that builds investor confidence and reduces capital costs.

Protecting Investors in an Era of Sophisticated Fraud

- For individual and institutional investors, understanding the warning signs of timing manipulation and accounting fraud has become essential for portfolio protection.

- Due diligence must extend beyond traditional financial metrics to include governance assessments, regulatory compliance reviews, and industry-specific risk evaluations.

- Practical strategies for fraud detection include:

- Analyzing cash flow statements more closely than income statements

- Monitoring insider trading patterns and executive compensation changes

- Tracking regulatory filings for subtle changes in accounting policies

- Comparing company performance with industry peers and economic indicators

Rise in Artificial Intelligence

- The rise of artificial intelligence and machine learning tools has created new opportunities for both fraudsters and fraud detection.

- Sophisticated algorithms can now identify unusual patterns in financial data that might escape human analysis, but they can also be used to create more convincing fraudulent schemes.

The Path Forward

- Combating manipulating timing and accounting fraud requires coordinated efforts from regulators, investors, and corporate leaders.

- Enhanced disclosure requirements, stronger penalties for violations, and improved detection technologies all play crucial roles in maintaining market integrity.

- The cost of fraud extends far beyond immediate financial losses.

- When investors lose confidence in financial reporting, capital markets become less efficient, innovation suffers, and economic growth slows.

- Protecting market integrity isn’t just about preventing fraud—it’s about preserving the foundation of our economic system.

PRE- AND POST-PSLRA STANDARDS FOR SECURITIES FRAUD LITIGATION

Feature | Pre-PSLRA Standard | Post-PSLRA Standard |

Motion to dismiss | Based on “notice pleading” (Federal Rule of Civil Procedure 8(a)), making it easier for plaintiffs to survive motions to dismiss. This often led to settlements to avoid costly litigation. | Requires satisfying PSLRA’s heightened pleading standards and the “plausibility” standard from Twombly and Iqbal. Failure to plead with particularity on any element can result in dismissal. |

Pleading | “Notice pleading” was generally sufficient, though fraud claims under Federal Rule of Civil Procedure 9(b) required particularity for the circumstances of fraud, but intent could be alleged generally. | Each misleading statement must be stated with particularity, explaining why it was misleading. Facts supporting beliefs in claims based on “information and belief” must also be stated with particularity. |

Scienter | Pleaded broadly; the “motive and opportunity” test was often sufficient to infer intent. | Requires alleging facts creating a “strong inference” of fraudulent intent, which must be at least as compelling as any opposing inference of non-fraudulent intent, as clarified in Tellabs, Inc. v. Makor Issues & Rights, Ltd.. |

Loss causation | Not a significant pleading hurdle, often assumed if a plaintiff bought at an inflated price. | Requires pleading facts showing the fraud caused the economic loss, often by linking a corrective disclosure to a stock price drop. Dura Pharmaceuticals, Inc. v. Broudo affirmed this. |

Discovery | Could proceed while a motion to dismiss was pending. | Automatically stayed during a motion to dismiss. |

Safe harbor for forward-looking statements | No statutory protection. | Protects certain forward-looking statements if accompanied by “meaningful cautionary statements”. |

Lead plaintiff selection | Often the first investor to file. | Court selects based on a “rebuttable presumption” that the investor with the largest financial interest is the most adequate. |

Liability standard | For non-knowing violations, liability was joint and several. | For non-knowing violations, liability is proportionate; joint and several liability applies only if a jury finds knowing violation. |

Mandatory sanctions | Available under Federal Rule of Civil Procedure 11, but judges were often reluctant to impose them. | Requires judges to review for abusive conduct |

The Devastating Impact of Accounting Fraud: Understanding Investor Losses and Legal Remedies

- Accounting fraud represents one of the most insidious threats to market integrity, systematically destroying investor wealth through deliberate financial deception.

- This sophisticated form of corporate misconduct involves the intentional misstatement or omission of financial information, creating a false narrative about a company’s true financial health.

- When these deceptive practices inevitably surface, the resulting financial misstatements trigger catastrophic investor losses that can devastate portfolios and erode decades of accumulated wealth.

Sophisticated Manipulation Techniques and Timing Fraud

- The complexity of modern accounting fraud extends far beyond simple number manipulation. Manipulating timing and accounting fraud has evolved into an art form, with corporations employing increasingly sophisticated techniques to deceive investors and regulators alike.

- Companies strategically accelerate revenue recognition, defer expenses across reporting periods, and utilize complex off-balance-sheet entities to obscure their true financial position.

- These fraudulent schemes often involve creative revenue recognition practices that exploit accounting standards’ gray areas.

- Corporations may recognize revenue from incomplete transactions, inflate sales through channel stuffing, or create fictitious transactions with related entities.

Timing and Assets

- The manipulation of asset valuations represents another critical component, where companies overstate property values, manipulate depreciation schedules, or fail to recognize impairment losses when assets decline in value.

- The timing element proves particularly devastating because it allows fraud to compound over multiple reporting periods.

- Each fraudulent financial statement builds upon previous deceptions, creating an increasingly unstable foundation that eventually collapses under its own weight.

- When corrective disclosures finally emerge, the accumulated effect of these timing manipulations amplifies investor losses exponentially.

Securities Litigation and Regulatory Compliance Failures

- Securities litigation serves as a critical mechanism for addressing accounting fraud’s devastating effects on investors.

- When companies engage in fraudulent financial reporting, they violate fundamental regulatory compliance requirements established by the SEC.

- These violations trigger securities class action lawsuits that enable defrauded investors to seek collective legal remedies.

- The legal framework surrounding securities fraud litigation has evolved significantly following major corporate scandals like Enron, WorldCom, and more recently, cases involving technology and healthcare companies.

- The Private Securities Litigation Reform Act (PSLRA) established heightened pleading standards that require plaintiffs to demonstrate specific elements including materiality, scienter, and loss causation.

- These requirements ensure that securities class action lawsuits target genuine fraud rather than mere business disappointments.

Regulatory Compliance

- Compliance failures often serve as early warning indicators of more serious accounting irregularities.

- When companies consistently miss regulatory filing deadlines, receive going concern qualifications from auditors, or face repeated SEC comment letters, these red flags suggest underlying problems with financial reporting integrity.

- Sophisticated investors monitor these compliance indicators to identify potential fraud risks before they materialize into significant losses.

Corporate Governance Breakdowns and Systemic Failures

- Corporate governance failures frequently enable and perpetuate accounting fraud within organizations.

- When boards of directors lack independence, audit committees fail to exercise proper oversight, or executive compensation structures incentivize short-term results over long-term sustainability, the conditions become ripe for fraudulent financial reporting.

- The most damaging corporate scandals typically involve systematic breakdowns across multiple governance layers.

- Internal controls prove inadequate to detect or prevent fraudulent activities, external auditors fail to maintain professional skepticism, and regulatory oversight mechanisms miss critical warning signs.

Companies Must Adapt to Technological Advancements

- These multi-layered failures create perfect storms that enable fraud to persist for extended periods, maximizing investor harm.

- Recent corporate scandals have highlighted how modern fraud schemes exploit technological complexity and global business structures.

- Companies may use artificial intelligence systems to manipulate data, employ cryptocurrency transactions to obscure financial flows, or leverage international subsidiaries to circumvent regulatory oversight.

- These evolving techniques require equally sophisticated detection and prevention strategies.

Legal Remedies and Investor Protection Strategies

- Securities class action lawsuits provide essential legal remedies for investors harmed by accounting fraud.

- These collective actions enable individual investors to pool resources and pursue claims against well-funded corporate defendants.

- The class action mechanism proves particularly valuable because individual investor losses may be insufficient to justify standalone litigation, but collective damages can reach hundreds of millions or billions of dollars.

- Successful securities litigation requires demonstrating that financial misstatements were material to investment decisions and directly caused investor losses.

- Economic experts play crucial roles in these cases, analyzing market reactions to corrective disclosures and calculating out-of-pocket damages suffered by class members.

Investors Shold Conduct Through Due Dilligence

- The damage calculation process considers factors including purchase timing, holding periods, and the specific impact of fraudulent statements on stock prices.

- Investors can protect themselves by conducting thorough due diligence that extends beyond reviewing financial statements.

- Contact experienced securities litigation attorneys who can evaluate potential claims and explain legal rights when fraud suspicions arise.

- Understanding the statute of limitations for securities claims proves critical, as delayed action can result in complete loss of legal remedies.

Building Market Confidence Through Accountability

- The enforcement of securities laws through litigation serves broader market integrity purposes beyond compensating individual investors.

- When companies face significant financial penalties and executives encounter personal liability for fraudulent conduct, these consequences create powerful deterrent effects that protect future investors.

- Regulatory compliance requirements continue evolving to address emerging fraud risks. Recent developments include enhanced disclosure requirements for cybersecurity incidents, climate-related risks, and artificial intelligence implementations.

- Companies that proactively embrace transparency and maintain robust internal controls position themselves to avoid the devastating consequences of accounting fraud allegations.

- For investors seeking to protect their portfolios from accounting fraud risks, maintaining diversification, monitoring corporate governance indicators, and staying informed about regulatory developments provides essential protection.

- When fraud does occur, understanding available legal remedies and acting promptly to preserve claims ensures maximum recovery potential.

10 INDICATORS COMPANY LACKS STRONG INTERNAL CONTROLS

1. | Lack of segregation of duties, particularly in financial functions |

2. | Frequent financial restatements or unexplained accounting adjustments |

3. | Unusual or complex transactions, especially near reporting periods |

| 4, | Excessive management override of established controls |

5. | Inadequate documentation for significant transactions |

| 6. | High employee turnover in accounting or finance departments |

7. | Delayed financial reporting or missed deadlines |

| 8. | Discrepancies between analytical expectations and reported results |

9. | Audit committee members lacking financial expertise |

| 10. | Weak or nonexistent whistleblower mechanisms |

Key Indicators of Timing and Accounting Fraud

- Detecting timing manipulation and accounting fraud requires a keen understanding of financial indicators that extend far beyond surface-level anomalies.

- Some of the telltale signs include inconsistencies in financial statements, such as sudden spikes or drops in revenue or profit margins.

- These anomalies can indicate that a company is manipulating its financial data to achieve specific objectives, often to meet analyst expectations or maintain stock price levels during critical periods.

Manipulating Revenue Recognition

- Revenue recognition manipulation stands as one of the most common forms of timing fraud.

- Companies may accelerate revenue recognition by recording sales before they’re actually completed, or defer expenses to future periods to inflate current earnings.

- For instance, channel stuffing—where companies ship excessive inventory to distributors near quarter-end—creates artificial revenue spikes that don’t reflect genuine business performance.

Financial Restatements

- Investors should also be wary of companies that frequently restate earnings or exhibit a pattern of missed earnings forecasts.

- Financial misstatements often emerge through a series of “one-time” adjustments or unusual accounting treatments that become recurring themes.

- When companies consistently blame external factors for performance shortfalls while simultaneously reporting aggressive growth metrics, this disconnect warrants serious scrutiny.

Quality of Earnings: Beyond the Numbers

- Another critical indicator is the quality of a company’s earnings. High-quality earnings are typically characterized by consistency, transparency, and sustainability.

- If a company’s earnings seem too good to be true or are inconsistent with its industry peers, it may be a sign of manipulation.

- Corporate scandals frequently begin with earnings that appear exceptional but lack the underlying business fundamentals to support such performance.

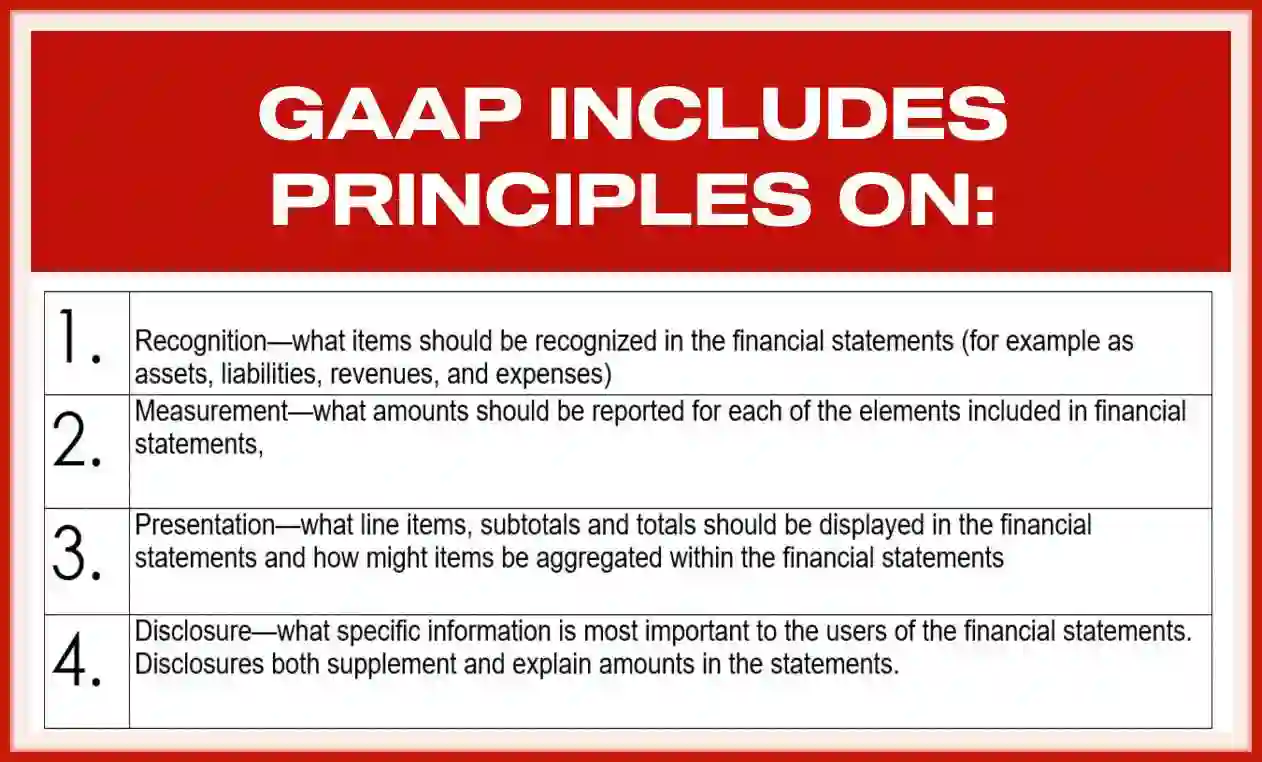

Excessive Use of Non-GAAP Measues

- The excessive use of non-GAAP (Generally Accepted Accounting Principles) measures represents a particularly concerning red flag.

- While these alternative metrics can provide valuable insights when used appropriately, they become problematic when companies use them to obscure the true financial performance.

- Companies that consistently report non-GAAP earnings significantly higher than GAAP earnings, or that change their non-GAAP calculations frequently, may be engaging in manipulating timing and accounting fraud.

Cash Flow Analysis

- Cash flow analysis provides crucial validation of reported earnings.

- When operating cash flows consistently lag reported net income, or when companies show strong earnings growth but declining cash generation, these discrepancies often signal potential fraud.

- Legitimate businesses typically demonstrate correlation between earnings and cash flows over time.

Insider Behavior and Corporate Governance Failures

- Furthermore, the behavior of company insiders can provide valuable clues about potential fraud.

- Significant insider selling or unusual stock transactions may indicate that those with intimate knowledge of the company’s operations are acting on undisclosed information.

- Corporate governance weaknesses often accompany accounting fraud, including boards dominated by management, weak audit committees, or frequent changes in auditing firms.

- Compliance failures frequently manifest through inadequate internal controls, rushed financial reporting processes, or resistance to auditor recommendations.

- Companies experiencing rapid growth or facing intense competitive pressure may be particularly susceptible to cutting corners on financial reporting standards.

Securities Litigation and Regulatory Consequences

- When accounting fraud is discovered, the legal ramifications can be severe and far-reaching.

- Securities litigation often follows the revelation of fraudulent practices, with investors seeking to recover losses through class action lawsuits.

- These legal proceedings can result in substantial financial penalties, management changes, and long-term reputational damage.

- Securities class action lawsuits typically emerge when companies make material misrepresentations or omissions that artificially inflate stock prices.

- The subsequent price corrections, often triggered by corrective disclosures or regulatory investigations, can cause significant investor losses.

Companies Have a Duty of Provide Accurate Financial Statments

- Courts have consistently held that companies have a duty to provide accurate and complete financial information to investors.

- Regulatory compliance requirements under securities laws demand transparency and accuracy in financial reporting.

- The SEC has enhanced its enforcement efforts, utilizing advanced data analytics to identify potential fraud patterns.

- Companies found guilty of securities violations face not only financial penalties but also increased regulatory oversight and potential criminal charges against executives.

Real-World Examples and Legal Precedents

- Historical corporate scandalsprovide instructive examples of how timing manipulation and accounting fraud unfold.

- The Enron scandal demonstrated how complex financial structures could obscure true financial performance, while WorldCom’s capitalization of operating expenses showed how simple accounting manipulations could create billions in fictitious profits.

- More recent cases have involved revenue recognition fraud in technology companies, where software licensing arrangements were manipulated to accelerate revenue recognition.

- These cases resulted in significant securities class action lawsuits and regulatory enforcement actions, highlighting the ongoing relevance of fraud detection principles.

Enhanced Detection Strategies

By monitoring these indicators, investors can better assess the risk of fraud and make more informed investment decisions.

Utilizing analytical tools and staying informed about industry developments can further enhance an investor’s ability to detect potential red flags.

Financial misstatements often follow predictable patterns, and sophisticated investors employ multiple analytical techniques to identify inconsistencies.

Comparative analysis across industry peers can reveal companies whose financial metrics appear outliers.

When companies consistently report margins, growth rates, or returns significantly above industry averages without clear competitive advantages, additional scrutiny is warranted.

Regulatory filings beyond standard financial statements can provide valuable insights.

Management discussion and analysis sections, proxy statements, and insider trading reports often contain information that either supports or contradicts the financial narrative presented in earnings releases.

Protecting Stakeholder Interests

- The detection of manipulating timing and accounting fraud serves broader market integrity purposes.

- When investors, analysts, and regulators maintain vigilance against fraudulent practices, they help preserve confidence in financial markets and protect the interests of all stakeholders.

- Corporate governance reforms following major scandals have strengthened internal controls and audit requirements, but the responsibility for fraud detection extends beyond regulatory compliance.

- Market participants who understand these warning signs contribute to a more transparent and efficient capital allocation process.

- Investment professionals should maintain healthy skepticism when evaluating companies, particularly those in high-growth industries or facing significant competitive pressures.

- The combination of opportunity, pressure, and rationalization—known as the fraud triangle—creates conditions where even previously reputable companies may engage in fraudulent practices.

Actionable Steps for Investors

- Effective fraud detection requires systematic analysis and ongoing monitoring.

- Investors should establish processes for regularly reviewing key financial metrics, tracking management communications for consistency, and comparing company performance against industry benchmarks.

- Professional skepticism, combined with thorough due diligence, remains the most effective defense against accounting fraud.

- When red flags emerge, investors should seek additional information, consult with financial professionals, and consider the potential risks to their investment portfolios.

Evolving Trends in Litigation and Regulatory Compliance

- The evolving landscape of securities litigation and regulatory compliance continues to shape corporate behavior and investor protection mechanisms.

- Understanding these dynamics enables more informed investment decisions and contributes to overall market integrity.

- Through vigilant monitoring of financial indicators, insider behavior, and corporate governance practices, investors can better protect themselves against the damaging effects of timing manipulation and accounting fraud while supporting the broader goal of transparent and efficient capital markets.

Protecting Investors in an Era of Corporate Complexity

- The legal framework surrounding securities litigation serves as the cornerstone of investor protection in today’s increasingly complex financial markets.

- While the SEC continues its pivotal role in enforcing securities laws under the Securities Act of 1933 and the Securities Exchange Act of 1934, the landscape has evolved dramatically to address sophisticated schemes involving manipulating timing and accounting fraud.

The Anatomy of Modern Securities Fraud

- Securities class action lawsuits have become the primary vehicle for addressing large-scale corporate misconduct.

- These collective legal actions allow investors who suffered similar losses to pool resources and seek justice against companies engaged in financial misstatements and compliance failures.

- The power of these lawsuits became evident in landmark cases like the Enron scandal, where investors recovered billions after the company’s accounting fraud was exposed.

- Consider the recent case of a major pharmaceutical company that manipulated clinical trial timelines to inflate stock prices.

- By selectively releasing positive preliminary data while concealing negative results, executives engaged in classic timing manipulation—a practice that cost investors over $2 billion when the truth emerged.

- This case exemplifies how corporate governance failures can cascade into massive investor losses.

The Hidden Costs of Accounting Fraud

- Accounting fraud represents one of the most insidious forms of securities violations. Unlike simple misstatements, these schemes involve systematic manipulation of financial records to present a false picture of corporate health.

- The infamous WorldCom scandal, where executives inflated earnings by $11 billion through fraudulent accounting entries, demonstrates the devastating impact of such corporate scandals.

- Modern accounting fraud often involves:

- Revenue recognition manipulation to meet quarterly targets

- Expense timing shifts to smooth earnings volatility

- Off-balance-sheet arrangements to hide liabilities

- Related-party transactions that lack economic substance

- These practices create artificial stock price inflation, leading to substantial out-of-pocket damages when the truth inevitably surfaces through corrective disclosures.

Regulatory Compliance in the Digital Age

- Today’s regulatory compliance challenges extend far beyond traditional financial reporting. Companies now face scrutiny over cybersecurity disclosures, environmental risks, and artificial intelligence implementations.

- The SEC’s recent emphasis on climate-related disclosures has created new litigation risks for companies that fail to adequately address environmental impacts on their business operations.

- Corporate governance structures must evolve to address these emerging risks.

- Boards of directors now require specialized expertise in technology, cybersecurity, and environmental science to fulfill their oversight responsibilities effectively.

- Failure to maintain adequate governance can result in compliance failures that expose companies to significant litigation risk.

The Financial Impact: Beyond Individual Losses

- The financial consequences of securities litigation extend far beyond individual investor losses.

- Corporate scandals can destroy entire industries’ credibility, as seen in the accounting firm sector following the Arthur Andersen collapse.

- Market confidence erodes, capital costs increase, and economic growth suffers when investors lose faith in corporate disclosures.

- Recent data shows that securities class action lawsuits resulted in over $4.3 billion in settlements during 2024 alone.

- These figures represent not just compensation for harmed investors, but also the enormous costs of compliance failures and inadequate corporate governance.

Protecting Your Investment: Practical Strategies

- For individual investors, understanding warning signs of potential securities fraud is crucial. Red flags include:

- Unusual timing of major announcements relative to insider trading

- Accounting irregularities in financial statements

- Governance changes without adequate explanation

- Regulatory investigations or enforcement actions

- Investors should maintain detailed records of their transactions and stay informed about ongoing litigation affecting their holdings.

- The statute of limitations for securities claims varies by jurisdiction, making prompt action essential when fraud is suspected.

The Path Forward

As financial markets become increasingly complex, the legal framework surrounding securities litigation must continue evolving.

Enhanced regulatory compliance requirements, stronger corporate governance standards, and more sophisticated detection methods for accounting fraud and timing manipulation are essential for maintaining market integrity.

The fight against financial misstatements and corporate scandals requires vigilance from regulators, investors, and corporate leaders alike.

By understanding these legal frameworks and their implications, investors can better protect their interests while contributing to overall market stability.

- Fraud in the financial markets can have a profound impact on investor confidence.

- When instances of timing manipulation or accounting fraud come to light, they can erode trust in the affected companies and the broader market.

- This loss of confidence can lead to increased volatility, as investors become more cautious and risk-averse.

- In severe cases, widespread fraud can trigger market downturns and financial crises.

- The repercussions of diminished investor confidence extend beyond individual companies.

- It can lead to a tightening of capital markets, as investors demand higher returns to compensate for perceived risks.

- This, in turn, can increase the cost of capital for businesses, stifling investment and innovation.

- Moreover, a loss of confidence can result in stricter regulatory scrutiny, as regulators seek to restore trust in the markets through enhanced oversight and enforcement actions.

Rebuilding Investor Confidence

- Rebuilding investor confidence is a challenging task that requires a concerted effort from companies, regulators, and the investing public.

- Companies must prioritize transparency and integrity in their financial reporting, while regulators must enforce stringent standards and hold wrongdoers accountable.

- Investors, on their part, should remain vigilant and informed, using their collective power to demand accountability and drive positive change.

- By working together, stakeholders can help restore trust in the markets and ensure a more stable and resilient financial system.

- How to Identify Potential Triggers for Litigation

- Identifying potential triggers for securities litigation requires a proactive approach and a keen understanding of market dynamics.

- One of the primary indicators is unusual stock price movements that are not supported by fundamental changes in a company’s performance.

- Such anomalies may suggest that insiders are acting on undisclosed information or that there is manipulation at play.

- Another important trigger is the announcement of restated financial statements or significant adjustments to previously reported earnings.

Investors Should Scrutinize a Companies Corporate Governance Practices

- These revisions can indicate underlying issues with a company’s financial reporting, potentially leading to legal action. Investors should also be attentive to whistleblower reports or regulatory investigations, as these can signal the presence of fraudulent activities that may result in litigation.

- Additionally, paying close attention to corporate governance practices and the behavior of company executives can provide valuable clues about potential risks.

- Companies with a history of ethical lapses or questionable leadership decisions are more likely to face litigation.

- By monitoring these factors and staying abreast of industry news, investors can better anticipate potential legal challenges and make informed investment decisions.

The Future of Securities Litigation in 2025 and Beyond

- As we look to the future, the landscape of securities litigation is likely to evolve in response to changing market dynamics and technological advancements.

- In 2025 and beyond, we can expect to see increased reliance on data analytics and artificial intelligence to detect and prevent fraudulent activities.

- These technologies have the potential to enhance regulatory oversight and improve the accuracy and efficiency of investigations.

Globalization of Financial Markets

- Moreover, the globalization of financial markets will necessitate greater collaboration among regulatory bodies across jurisdictions.

- This will require harmonizing standards and sharing information to effectively address cross-border fraud.

- As a result, investors may see more coordinated enforcement actions and a greater emphasis on international cooperation in tackling securities fraud.

- In this rapidly changing environment, investors must remain adaptable and proactive in protecting their interests.

- Staying informed about regulatory developments and leveraging technological tools can provide a competitive edge in identifying and mitigating risks.

- By embracing innovation and maintaining a commitment to ethical practices, the financial industry can build a more resilient and transparent market for the future.

Conclusion

- In conclusion, analyzing the risks of securities fraud requires a comprehensive understanding of timing manipulation and accounting fraud.

- These deceptive practices can have far-reaching consequences for investors and the broader market, underscoring the importance of vigilance and due diligence.

- By recognizing the signs of potential fraud and understanding the legal framework surrounding securities litigation, investors can better protect their portfolios and contribute to a more accountable financial system.

- The journey to safeguarding investments is ongoing, necessitating continuous learning and adaptation to new challenges.

- Investors must remain informed about industry trends and regulatory changes, while also utilizing analytical tools and expert guidance to enhance their decision-making processes.

- By doing so, they can mitigate the impact of fraudulent activities and pursue opportunities with greater confidence.

- Ultimately, the fight against securities fraud is a collective effort that requires the commitment of companies, regulators, and investors alike.

- By fostering a culture of transparency and integrity, the financial industry can build trust and resilience, ensuring a more stable and prosperous future for all participants.

- As we move forward in 2026 and beyond, let us embrace the lessons of the past and work together to create a more equitable and secure financial landscape.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors