Introduction to Understanding Internal Controls

- Understanding internal controls is vital both in the regulatory landscape and to avoid securities litigation.

- The class action process begins with the identification and filing of a lawsuit and the appointment of a lead plaintiff, who represents the interests of all affected individuals in the class.

- This initial filing outlines the claims against the defendant and the basis for the lawsuit, including evidence of the alleged wrongdoing.

- Once the lawsuit is filed, the court must decide whether to certify the class, a critical step that determines whether the case can proceed as a collective action.

- Certification requires that the claims of the class members are sufficiently similar and that a class action is the most efficient way to resolve the dispute.

- The certification phase involves rigorous scrutiny of several key factors: numerosity (ensuring the class is large enough to make individual lawsuits impractical), commonality (demonstrating shared legal or factual questions), typicality (confirming the representative plaintiff’s claims are typical of the class), and adequacy (verifying the representative can fairly protect class interests).

- Securities class action lawsuits particularly benefit from this framework, as they often involve thousands of investors who suffered similar losses due to corporate misconduct or inadequate disclosure practices.

Discovery and Evidence Gathering in Securities Litigation

- After certification, the discovery phase begins, during which both parties gather and exchange evidence relevant to the case.

- This phase can be lengthy and complex, involving the review of documents, depositions, and expert testimony.

- The goal of discovery is to build a comprehensive factual record that supports the claims of the class.

- It is also an opportunity for the defense to challenge the evidence presented by the plaintiffs. Effective discovery is crucial for the success of a securities class action, as it lays the groundwork for potential settlements or trial outcomes.

Deficient Internal Controls

In securities litigation, discovery often reveals critical gaps in internal controls that contributed to the alleged misconduct.

Corporate emails, board meeting minutes, and internal audit reports frequently become pivotal evidence demonstrating whether companies maintained adequate oversight mechanisms.

Expert witnesses specializing in corporate governance analyze these materials to establish whether reasonable internal controls could have prevented the alleged violations.

Understanding Internal Controls: The Foundation of Corporate Integrity

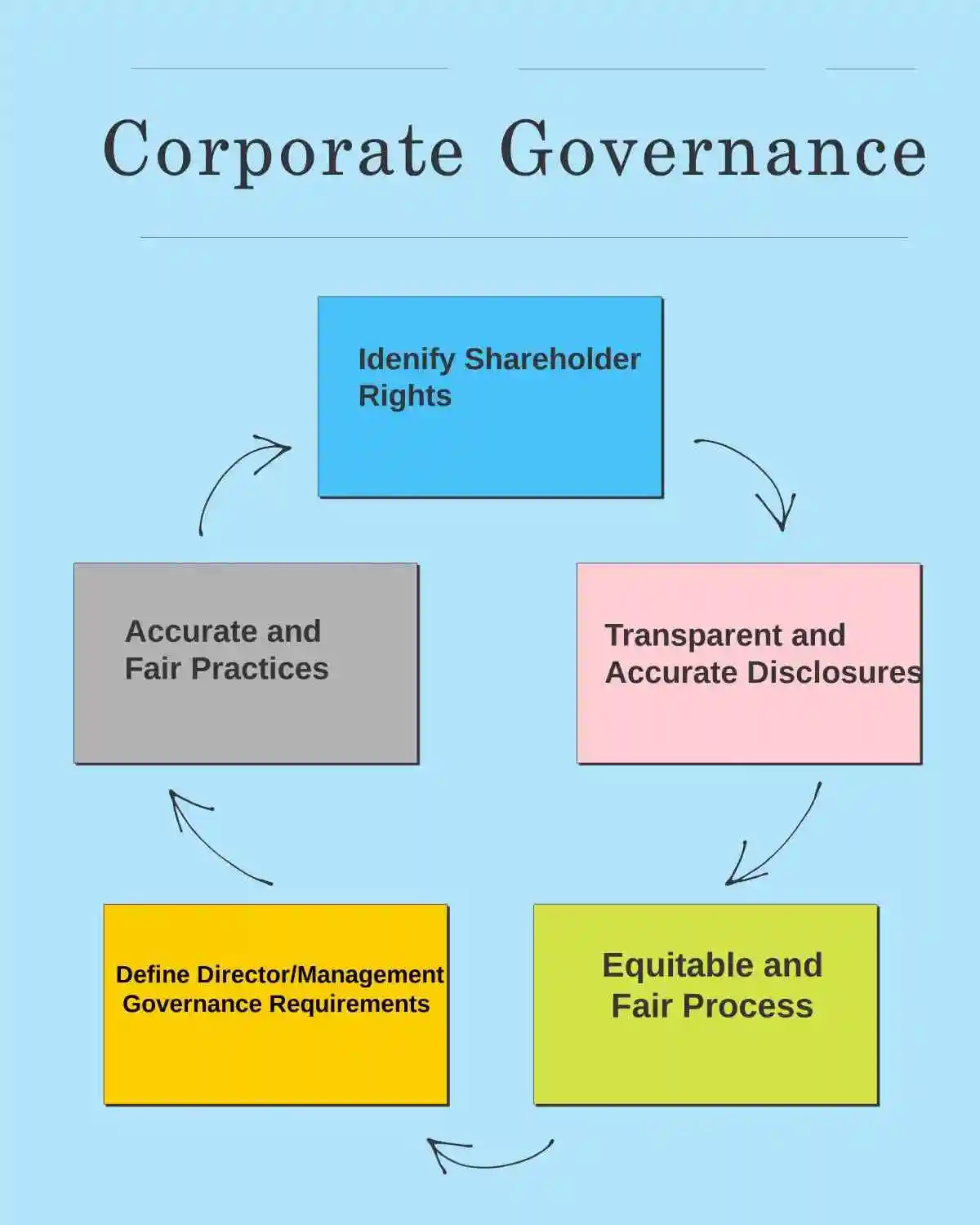

Corporate Governance

Understanding internal controls requires recognizing their multifaceted role in modern corporate governance.

- These controls serve as the essential foundation that supports organizational integrity and efficacy, extending far beyond mere procedural obligations.

- They are crucial for safeguarding assets, ensuring compliance with laws and regulations, and enhancing the accuracy and reliability of financial reporting.

- Without these controls, organizations would operate in a state of vulnerability, exposed to errors, fraud, and inefficiencies that could severely harm their reputation and financial standing.

Internal Control Framework

- Internal controls provide a structured approach to managing risks and facilitating operational efficiency.

- They empower organizations to set clear boundaries and expectations, ensuring that all employees are aligned with the company’s objectives and ethical standards.

- By establishing a clear framework for decision-making and accountability, internal controls help prevent the misuse of resources and ensure that organizational goals are met consistently and effectively.

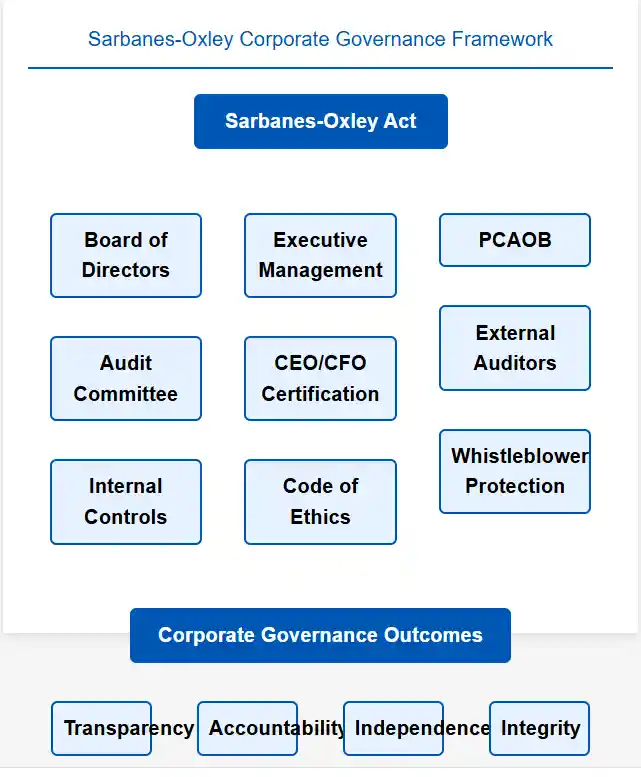

The Sarbanes-Oxley Act

- The Sarbanes-Oxley Act of 2002 fundamentally transformed internal control requirements for public companies, mandating that management assess and report on the effectiveness of internal controls over financial reporting.

- This legislation emerged directly from high-profile corporate failures where inadequate internal controls contributed to massive investor losses, ultimately leading to numerous securities class actions.

- Regulatory Compliance and Corporate Governance Integration

Regulatory Compliance

- Regulatory compliance has evolved into a comprehensive framework that intersects with internal controls at multiple levels.

- Companies must navigate an increasingly complex web of federal and state regulations, industry-specific requirements, and emerging technological considerations.

- The integration of robust internal controls with regulatory compliance programs creates a defensive barrier against potential securities violations.

Best Practices

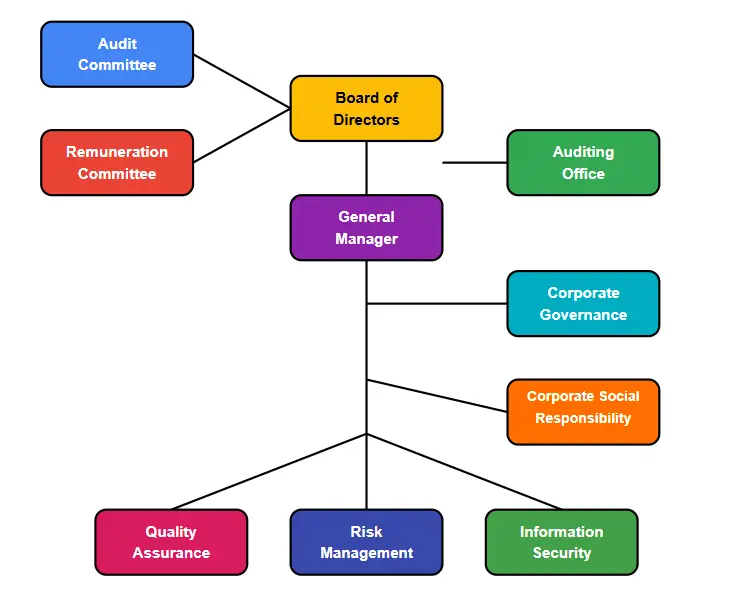

- Corporate governance best practices now emphasize the importance of establishing independent audit committees, implementing whistleblower protection programs, and maintaining regular assessments of control effectiveness.

- These governance mechanisms serve dual purposes: they help prevent violations that could trigger securities litigation while demonstrating good faith efforts to maintain compliance.

- Recent legal precedents have established that companies with demonstrably weak internal controls face heightened scrutiny in securities litigation.

- Courts increasingly examine whether adequate controls could have detected or prevented the alleged misconduct, making internal control adequacy a critical factor in determining liability and damages.

The COSO Framework for Internal Controls

- Control Environment: The “tone at the top” that influences the ethical values and control consciousness of people in the organization.

- Risk Assessment: Identifying and analyzing potential risks to achieving objectives.

- Control Activities: The actual policies and procedures designed to mitigate identified risks.

- Information and Communication: Ensuring that relevant information is identified, captured, and communicated to the right people at the right time.

- Monitoring: Processes for assessing the quality of the internal control system’s performance over time.

The Intersection of Internal Controls and Securities Class Actions

- The relationship between internal controls failures and securities class action lawsuits has become increasingly evident through recent high-profile cases.

- When companies fail to maintain adequate internal controls, they create conditions that can lead to material misstatements, omissions of critical information, or outright fraud—all potential triggers for securities litigation.

- Securities class actions often arise when internal control deficiencies result in:

- Material misrepresentations in financial statements or public disclosures

- Inadequate risk management leading to unexpected losses or regulatory violations

- Failure to detect fraud or other misconduct by management or employees

- Insufficient oversight of complex business operations or emerging risks

- The discovery process in these cases frequently reveals that strengthened internal controls could have prevented or detected the underlying violations.

- This connection has made internal control adequacy a central issue in many securities litigation matters.

Settlement Negotiations and Trial Outcomes

- Once discovery is complete, the parties may engage in settlement negotiations or proceed to trial. Settlements are common in securities class actions, as they allow for a quicker resolution and avoid the uncertainty of a trial.

- The strength of a company’s internal controls often influences settlement discussions, as robust controls may demonstrate good faith efforts to prevent violations, while control deficiencies may increase potential liability exposure.

- If a settlement is reached, the court must approve it, ensuring that it is fair and reasonable for all class members.

- In cases that proceed to trial, the judge or jury will determine the outcome based on the evidence presented, including expert testimony regarding internal control adequacy and its relationship to the alleged violations.

Future Trends and Emerging Considerations

Effectively Monoriting New Technologies

- As we move forward into 2025, the significance of robust internal controls will only continue to grow, becoming an indispensable part of organizational strategy and governance.

- Emerging technologies, evolving regulatory requirements, and increasing investor sophistication are creating new challenges and opportunities for companies seeking to maintain effective control environments.

- The integration of artificial intelligence and automated systems into business operations requires corresponding updates to internal control frameworks. Companies must ensure that their control systems can effectively monitor and govern these new technologies while maintaining regulatory compliance across multiple jurisdictions.

Creating a Culture of Transparency

- Securities litigation trends suggest that courts and regulators will continue to scrutinize internal control adequacy as a factor in determining corporate liability.

- Companies that proactively strengthen their internal controls and governance practices will be better positioned to defend against potential securities claims and demonstrate their commitment to investor protection.

- The evolving landscape of corporate governance demands that organizations view internal controls not as compliance burdens but as strategic assets that protect stakeholder interests while enabling sustainable business growth.

- This perspective recognizes that effective internal controls serve as both defensive mechanisms against litigation risk and foundational elements supporting long-term corporate success.

- By fostering a culture of transparency and trust within an organization, internal controls not only deter fraudulent activities but also promote ethical behavior among employees.

- This cultural shift towards integrity and accountability is essential for building stakeholder confidence and securing a competitive edge in the marketplace, ultimately reducing the risk of becoming subject to securities class action lawsuits while enhancing overall corporate performance.

Key Components of Internal Control Frameworks

The Importance of Robust Internal Controls

- Internal control frameworks are comprehensive systems designed to ensure the effectiveness and efficiency of operations, reliability of financial reporting, and compliance with applicable laws and regulations.

- At the heart of these frameworks are five key components: the control environment, risk assessment, control activities, information and communication, and monitoring activities.

- Each component plays a vital role in reinforcing the organization’s overall control system and preventing securities class action lawsuits.

A Strong Control Environment

- The control environment forms the foundation of the internal control framework, influencing the overall attitude and consciousness of an organization towards controls. It encompasses the integrity, ethical values, and competence of the organization’s people, as well as the management’s philosophy and operating style.

- A strong control environment sets the tone for the organization, ensuring that employees understand the importance of internal controls and are committed to the organization’s objectives.

- This foundation becomes particularly critical when organizations face securities litigation, as a robust control environment demonstrates good faith efforts toward corporate governance and regulatory compliance.

Risk Assesment

Risk assessment is the process of identifying and analyzing risks that may impede the achievement of organizational objectives.

This component involves a thorough evaluation of both internal and external factors that could impact the organization, including risks that might lead to securities class actions.

Modern risk assessment must consider regulatory changes, market volatility, and disclosure requirements that could expose organizations to securities litigation.

By understanding these risks, organizations can develop strategies to mitigate them, ensuring that potential threats are addressed proactively before they manifest as material misstatements or omissions that trigger investor lawsuits.

Control Activities

- Control activities, on the other hand, refer to the policies and procedures put in place to address identified risks.

- These activities include approvals, authorizations, verifications, reconciliations, and performance reviews, all designed to ensure that control objectives are achieved.

- In the context of securities class action prevention, control activities must specifically address financial reporting accuracy, disclosure completeness, and compliance with SEC regulations.

- Information and Communication Systems

Information and Communication

- The fourth component, information and communication, ensures that relevant information is identified, captured, and communicated in a form and timeframe that enables people to carry out their responsibilities effectively.

- This component has become increasingly critical in preventing securities litigation as organizations must maintain accurate, timely, and complete information flows to support proper financial reporting and regulatory disclosures.

- Effective information systems must:

- Capture financial data accurately to prevent misstatements that could trigger securities class actions Facilitate timely disclosure of material information to comply with SEC requirements

- Support internal communication about risks and control deficiencies

- Enable external communication with investors, regulators, and other stakeholders

- Communication channels must operate both vertically and horizontally within the organization, ensuring that control-related information reaches appropriate personnel.

- When information systems fail, organizations often face securities litigation due to inadequate disclosures or material misstatements in financial reports.

Monitoring Activities and Regulatory Compliance

- Monitoring activities represent the fifth and final component of the internal control framework.

- These ongoing evaluations assess the quality of internal control performance over time and ensure that deficiencies are identified and corrected promptly.

- Effective monitoring becomes essential for regulatory compliance and preventing securities class actions.

- Organizations must implement both ongoing monitoring and separate evaluations:

- Ongoing monitoring occurs during regular business operations and includes supervisory activities, reconciliations, and other routine actions

- Separate evaluations involve periodic assessments of internal control effectiveness, often conducted by internal audit functions

- External monitoring through independent auditors provides additional assurance and credibility

- The monitoring component directly supports corporate governance by providing boards and audit committees with regular assessments of control effectiveness.

- When monitoring activities identify deficiencies, organizations must take corrective action promptly to maintain regulatory compliance and prevent conditions that could lead to securities litigation.

Integration with Corporate Governance

- Understanding internal controls within the broader context of corporate governance reveals how these frameworks protect organizations from securities class actions.

- Effective internal controls demonstrate management’s commitment to accurate financial reporting and regulatory compliance, factors that courts and regulators consider when evaluating potential securities violations.

- Organizations with strong internal control frameworks typically experience:

- Reduced exposure to securities litigation through better financial reporting

- Enhanced regulatory compliance through systematic risk management

- Improved corporate governance through transparent oversight mechanisms

- Stronger investor confidence through demonstrated control effectiveness

Practical Implementation for Legal Protection

Minimizing Litigation Exposure

- To maximize protection against securities class actions, organizations should integrate their internal control frameworks with legal and compliance functions.

- This integration ensures that control activities specifically address securities law requirements and that monitoring activities identify potential disclosure issues before they result in securities litigation.

Best Practices

- Best practices include:

- Regular training on securities law requirements for finance and disclosure personnel

- Systematic review of all public disclosures through established control procedures

- Coordination between internal audit, legal, and compliance functions

- Prompt remediation of control deficiencies that could affect financial reporting

Improved Investor Confidence

- By implementing comprehensive internal control frameworks that specifically address securities litigation risks, organizations can significantly reduce their exposure to securities class actions while enhancing overall corporate governance and regulatory compliance.

- These frameworks serve as both operational tools and legal safeguards, protecting stakeholder interests while supporting sustainable business operations.

- The investment in robust internal controls pays dividends through reduced legal exposure, enhanced regulatory relationships, and improved investor confidence

The Foundation of Corporate Governance and Securities Compliance

- Understanding Internal Controls has become increasingly critical in today’s regulatory environment, where inadequate control systems frequently trigger securities class action lawsuits and expose companies to significant legal and financial risks.

- The three fundamental types of internal controls—preventive, detective, and corrective—form the backbone of effective corporate governance and serve as the first line of defense against securities litigation.

Preventive Controls: Building Fortress-Like Protection

- Preventive controls represent the most cost-effective approach to risk management, acting as barriers that stop problems before they materialize.

- These proactive measures include segregation of duties, where no single individual controls an entire transaction process, and access controls that limit system permissions based on job responsibilities.

- Consider the real-world impact: When Enron collapsed, investigators discovered that the company’s preventive controls had been systematically bypassed.

- The lack of proper authorization controls allowed executives to hide debt through special purpose entities, ultimately leading to one of the largest securities class actions in history.

Multi-Layered Authorization Requirements

- Today’s companies implement multi-layered authorization requirements—for instance, requiring board approval for transactions exceeding specific thresholds and implementing dual-signature requirements for significant expenditures.

- Access controls have evolved dramatically in the digital age.

- Modern preventive systems include role-based access management, where employees can only access information necessary for their specific functions.

- This prevents unauthorized modifications to financial records that could mislead investors and trigger securities litigation.

Detective Controls: The Early Warning System

- Detective controls serve as the organization’s radar system, identifying irregularities after they occur but before they cause substantial damage.

- These controls include reconciliations, audits, and variance analysis—each designed to catch discrepancies that preventive measures might have missed.

- Monthly bank reconciliations exemplify effective detective controls.

- When performed independently by someone other than the cash handler, these reconciliations can quickly identify unauthorized transactions or accounting errors.

Weal Controls Leads to Litigation

- Variance analysis compares actual performance against budgets and forecasts, flagging unusual patterns that warrant investigation.

- The importance of robust detective controls cannot be overstated in the context of regulatory compliance.

- The Sarbanes-Oxley Act mandates that public companies maintain effective internal controls over financial reporting, with management required to assess and report on their effectiveness annually.

- Companies with weak detective controls often face securities class action lawsuits when material misstatements go undetected for extended periods.

Corrective Controls: Turning Crisis into Opportunity

- Corrective controls transform identified problems into learning opportunities while minimizing damage.

- These controls include incident response procedures, employee retraining programs, and process improvements designed to prevent recurrence of identified issues.

- Effective corrective controls demonstrate corporate responsibility and can actually strengthen investor confidence.

- When Johnson & Johnson discovered tampering with Tylenol products in 1982, the company’s swift corrective actions—including nationwide recalls and new tamper-resistant packaging—became a textbook example of crisis management that ultimately enhanced the brand’s reputation.

- In the securities context, companies that implement strong corrective controls often receive more favorable treatment from regulators and courts.

- The Department of Justice’s corporate compliance programs explicitly consider a company’s remedial efforts when determining penalties, making effective corrective controls both a legal and business imperative.

The Securities Litigation Connection

- The relationship between internal controls and securities litigation is direct and consequential.

- Plaintiffs in securities class actions frequently allege that defendants failed to maintain adequate internal controls, resulting in material misstatements that artificially inflated stock prices.

- Recent securities class action lawsuits have increasingly focused on companies’ control environments.

- When internal controls fail to prevent or detect financial reporting errors, the resulting restatements often trigger significant stock price declines and subsequent litigation.

- The “fraud-on-the-market” theory, which underlies most securities class actions, relies heavily on the premise that investors relied on the integrity of financial statements that inadequate controls failed to protect.

Regulatory Compliance and Best Practices

- Regulatory compliance requires more than simply checking boxes—it demands a comprehensive approach that integrates all three control types.

- The COSO framework provides the gold standard for internal control design, emphasizing the importance of:

- Control environment that sets the tone at the top

- Risk assessment processes that identify and evaluate threats

- Information and communication systems that support decision-making

- Monitoring activities that ensure controls remain effective over time

- Companies should conduct regular control assessments to identify gaps and implement improvements.

- This proactive approach not only enhances regulatory compliance but also demonstrates to investors and regulators that management takes its fiduciary responsibilities seriously.

- Building an Integrated Control Framework

- The most effective organizations integrate preventive, detective, and corrective controls into a seamless framework that adapts to changing business conditions and regulatory requirements. This integration requires:

- Technology leverage: Modern control systems utilize automated monitoring, exception reporting, and data analytics to enhance both efficiency and effectiveness.

- Cultural commitment: Controls work best when embedded in the organization’s culture, with employees understanding their role in maintaining integrity and compliance.

- Continuous improvement: Regular testing and updating ensure that controls remain relevant and effective as business conditions evolve.

Protecting Stakeholder Interests

- Ultimately, Understanding Internal Controls serves the broader purpose of protecting all stakeholders—investors, employees, customers, and communities.

- When companies maintain robust control environments, they reduce the likelihood of securities litigation, enhance corporate governance, and build sustainable competitive advantages.

- Investors increasingly recognize that companies with strong internal controls represent better long-term investments, as these organizations are less likely to face regulatory sanctions, reputational damage, or the significant costs associated with securities class action lawsuits.

- The three types of internal controls—preventive, detective, and corrective—work together to create a comprehensive risk management system that protects against fraud, ensures regulatory compliance, and maintains the integrity essential for effective corporate governance.

- In an era where corporate accountability has never been more important, these controls serve as the foundation for sustainable business success and stakeholder protection.

The Role of Internal Controls in Risk Management

- In today’s volatile business environment, effective risk management is essential for organizations to achieve their objectives and maintain a competitive advantage.

- Internal controls play a critical role in this process by providing a structured approach to identifying, assessing, and managing risks.

- Through a combination of preventive, detective, and corrective measures, internal controls help organizations mitigate potential threats and capitalize on opportunities for growth.

- Risk management starts with a thorough understanding of the organization’s risk landscape.

Providing a Framework for Identifying Risk

- Internal controls facilitate this process by providing a framework for identifying potential risks and assessing their impact on the organization’s objectives.

- By evaluating both internal and external factors, organizations can prioritize risks and develop strategies to address them effectively.

- This proactive approach ensures that risks are managed in a manner that aligns with the organization’s risk appetite and strategic goals.

- Moreover, internal controls support risk management by promoting a culture of accountability and transparency.

Establishing Clear Expectations and Responsibilities

- By establishing clear expectations and responsibilities, internal controls help ensure that employees are aware of potential risks and are equipped to manage them effectively.

- This cultural shift towards risk awareness and management is essential for fostering an environment of continuous improvement and innovation.

- As organizations navigate the complexities of 2026, the role of internal controls in risk management will be more critical than ever, enabling organizations to adapt to changing conditions and seize new opportunities.

Common Internal Control Weaknesses and How to Address Them

Inadequate Segregation of Duties

- Despite the importance of internal controls, many organizations face challenges in implementing and maintaining effective control systems.

- Common internal control weaknesses include inadequate segregation of duties, lack of proper documentation, insufficient oversight, and failure to adapt to changing risks.

- These weaknesses can expose organizations to significant risks, including fraud, financial misstatements, and regulatory non-compliance.

- One of the most prevalent internal control weaknesses is inadequate segregation of duties.

- This occurs when a single individual is responsible for multiple aspects of a transaction, increasing the risk of errors and fraudulent activities.

- To address this issue, organizations should implement a system of checks and balances, ensuring that responsibilities are distributed among multiple individuals.

- This segregation of duties not only reduces the risk of errors but also promotes accountability and transparency within the organization.

Lack of Proper Documentation

- Another common weakness is the lack of proper documentation and record-keeping.

- Without accurate and timely documentation, organizations may struggle to verify transactions, leading to errors and discrepancies.

- To mitigate this risk, organizations should establish clear documentation procedures and ensure that all transactions are recorded accurately and promptly.

- Additionally, organizations should regularly review and update their internal controls to ensure they remain effective in addressing emerging risks and challenges.

- By addressing these common weaknesses, organizations can strengthen their internal control systems and enhance their overall risk management capabilities.

Regulatory Compliance Framework: Staying Ahead of Evolving Requirements

- Regulatory compliance in today’s environment requires organizations to maintain comprehensive frameworks that address multiple jurisdictions, evolving standards, and increasing enforcement activity.

- Organizations must establish systematic approaches to monitoring regulatory developments, assessing their impact, and implementing necessary changes to maintain compliance.

- The compliance framework should encompass all relevant securities regulations, including disclosure requirements under the Securities Exchange Act of 1934, Sarbanes-Oxley Act provisions, and industry-specific regulations.

- Organizations should maintain detailed compliance calendars that track filing deadlines, disclosure requirements, and regulatory updates that may affect their operations.

- Technology solutions can significantly enhance regulatory compliance efforts by automating monitoring processes, maintaining audit trails, and ensuring consistent application of compliance procedures.

The Importance of Regular Control Testing

- Organizations should invest in systems that can track regulatory changes, flag potential compliance issues, and provide real-time visibility into compliance status across the organization.

- Regular compliance testing and validation procedures help ensure that controls remain effective and responsive to regulatory requirements.

- These procedures should include both management self-assessments and independent testing by internal audit or external parties.

- Documentation of compliance efforts becomes particularly important in demonstrating good faith efforts to maintain regulatory compliance in the event of regulatory inquiries or securities litigation.

Internal Controls and Securities Litigation Prevention

- Effective internal controls serve as the primary defense mechanism against circumstances that commonly lead to securities class action lawsuits.

- Organizations must design and implement controls specifically targeted at preventing material misstatements, ensuring accurate and timely disclosures, and maintaining transparent communication with investors and stakeholders.

Developing a Framework of Disclosure Controls and Procedures

- Disclosure controls and procedures represent a critical subset of internal controls that directly impact securities law compliance.

- These controls must ensure that material information is identified, evaluated, and disclosed in accordance with applicable requirements.

- Organizations should establish clear processes for escalating potential disclosure issues and making materiality determinations in consultation with legal counsel.

- The control framework should address common areas of securities litigation risk, including revenue recognition, asset valuations, related party transactions, and executive compensation.

- Controls should be designed to prevent both intentional misstatements and inadvertent errors that could mislead investors.

Regular Testing and Monoriting of Control Procedures

- Regular testing and validation of these controls help ensure their continued effectiveness.

- Documentation and evidence preservation procedures become particularly important in the context of potential securities litigation.

- Organizations should maintain comprehensive documentation of their control processes, testing results, and remediation efforts.

- This documentation can provide valuable evidence of good faith compliance efforts and help demonstrate the absence of fraudulent intent in the event of litigation.

Fostering Continuous Improvement in Corporate Governance

- Organizations must foster a culture of continuous improvement that encourages employees to identify opportunities for enhancing internal controls, improving corporate governance practices, and strengthening regulatory compliance efforts.

- This culture should promote proactive identification of control deficiencies and rapid implementation of corrective measures.

- Regular control assessments should evaluate not only the design and operating effectiveness of existing controls but also identify opportunities for enhancement and optimization.

- These assessments should consider changes in business operations, regulatory requirements, and industry best practices that may necessitate control updates or improvements.

Employee Feedback and Reporting System

- Employee feedback mechanisms play a crucial role in continuous improvement efforts.

- Organizations should establish channels for employees to report potential control deficiencies, compliance concerns, or suggestions for improvement without fear of retaliation.

- Anonymous reporting systems can be particularly effective in encouraging disclosure of sensitive issues.

- Benchmarking against industry peers and regulatory guidance helps organizations identify areas where their control frameworks may be enhanced.

- Regular review of enforcement actions, litigation trends, and regulatory guidance provides valuable insights into emerging risks and control best practices.

- The continuous improvement process should also incorporate lessons learned from internal control testing, regulatory examinations, and any litigation or enforcement actions.

- Organizations should conduct thorough post-incident reviews to identify control gaps and implement preventive measures to avoid similar issues in the future.

Technology Integration and Control Automation

- Modern internal controls increasingly rely on technology solutions to enhance effectiveness, improve efficiency, and provide real-time monitoring capabilities.

- Organizations should leverage technology to automate routine control procedures, enhance monitoring capabilities, and provide comprehensive audit trails for compliance and litigation defense purposes.

- Automated control systems can significantly reduce the risk of human error while providing consistent application of control procedures across the organization.

- These systems can also generate comprehensive documentation and audit trails that demonstrate control effectiveness and support regulatory compliance efforts.

- Data analytics and artificial intelligence tools can enhance risk identification and monitoring capabilities by analyzing large volumes of transaction data and identifying unusual patterns or potential control failures.

Investment in Technology

- These tools can provide early warning systems for potential issues that might otherwise go undetected until they result in material misstatements or regulatory violations.

- Organizations should also consider the cybersecurity implications of their control systems and ensure that technology solutions include appropriate security measures to protect sensitive information and maintain system integrity.

- By embracing these comprehensive best practices for implementing effective internal controls, organizations can create robust frameworks that not only support operational efficiency but also provide strong protection against securities class actions, ensure regulatory compliance, and enhance overall corporate governance.

- The investment in comprehensive internal control systems pays dividends through reduced litigation risk, improved stakeholder confidence, and enhanced organizational resilience in an increasingly complex regulatory environment.

- Organizations that prioritize the implementation of these best practices position themselves for sustainable growth while minimizing exposure to the significant costs and reputational damage associated with securities litigation and regulatory enforcement actions.

The Impact of Technology on Internal Controls: Navigating Corporate Governance and Securities Litigation Risks

- The rapid advancement of technology has fundamentally transformed how organizations operate, presenting both unprecedented opportunities and complex challenges for internal controls.

- This transformation extends far beyond operational efficiency, directly impacting corporate governance frameworks and significantly influencing an organization’s exposure to securities litigation and securities class actions.

- As companies increasingly rely on digital systems, the intersection between technology and internal controls has become a critical factor in regulatory compliance and the prevention of securities class action lawsuits.

Enhanced Automation: A Double-Edged Sword for Corporate Governance

- One of the most significant impacts of technology on internal controls is the automation of routine tasks and processes.

- Automation reduces the risk of human error, enhances data accuracy, and frees up valuable resources for more strategic activities.

- For example, automated systems can streamline financial reporting, inventory management, and compliance monitoring, allowing organizations to respond more quickly to changes in their risk landscape.

- This enhanced efficiency directly supports robust corporate governance by ensuring that boards and management receive timely, accurate information for decision-making.

- However, organizations must ensure that automated controls are properly designed, implemented, and monitored to prevent errors and fraud.

Failing to Maintain Automated Systems

- The failure of automated systems can create significant vulnerabilities that may expose companies to securities litigation.

- When automated controls malfunction or are improperly configured, they can generate inaccurate financial data or fail to detect material misstatements, potentially leading to securities class actions from investors who rely on this information.

- Understanding internal controls in the context of automation requires organizations to implement comprehensive oversight mechanisms.

- Companies must establish clear protocols for testing automated systems, maintaining audit trails, and ensuring that technological controls align with established corporate governance principles.

- This includes regular assessments of system integrity and the implementation of backup procedures when automated controls fail.

Real-Time Monitoring and Securities Litigation Prevention

- Technology also facilitates real-time monitoring and analysis of internal controls, enabling organizations to detect and respond to irregularities more quickly than ever before.

- Advanced analytics and data visualization tools provide valuable insights into the effectiveness of internal controls, helping organizations identify trends and anomalies that may indicate potential risks.

- This capability is particularly crucial for preventing the types of material misstatements or omissions that often trigger securities class actions.

Invest in Robust Data Governance Frameworks

- Real-time monitoring systems can flag unusual transactions, identify patterns that suggest fraudulent activity, and alert management to potential compliance violations before they escalate into serious problems.

- By implementing these technological solutions, companies can significantly reduce their exposure to securities litigation by addressing issues proactively rather than reactively.

- However, the effectiveness of real-time monitoring depends heavily on the quality of the underlying data and the sophistication of the analytical tools employed.

- Organizations must invest in robust data governance frameworks and ensure that their monitoring systems are calibrated to detect the specific risks most relevant to their industry and business model.

Cybersecurity: The New Frontier of Corporate Risk

- The increased reliance on technology also introduces new cybersecurity risks that organizations must address to protect their data and systems.

- Cybersecurity breaches can compromise the integrity of internal controls, expose sensitive corporate information, and create significant liability exposure.

- In today’s regulatory environment, cybersecurity incidents often trigger disclosure obligations under federal securities laws, and failure to adequately disclose these risks can result in securities class action lawsuits.

- Regulatory compliance in the cybersecurity realm requires organizations to implement comprehensive risk management frameworks that address both preventive measures and incident response protocols.

- Companies must establish clear policies for data protection, system access controls, and breach notification procedures.

- The failure to maintain adequate cybersecurity measures can not only compromise internal controls but also expose organizations to regulatory sanctions and private litigation.

Integration with Corporate Governance Frameworks

- Effective corporate governance requires that boards and management maintain oversight of technological risks and ensure that internal controls evolve with changing technology landscapes.

- This includes establishing clear accountability structures for technology governance, implementing regular assessments of technological risks, and ensuring that internal audit functions have the expertise necessary to evaluate technology-dependent controls.

- Organizations must also consider how technology impacts their disclosure obligations and regulatory compliance requirements.

- As business processes become increasingly automated and data-driven, companies must ensure that their disclosure controls and procedures are adequate to identify and communicate material information to investors and regulators in a timely manner.

Regulatory Compliance in the Digital Age

- The digital transformation of business operations has created new challenges for regulatory compliance.

- Traditional compliance frameworks were designed for manual processes and paper-based documentation, but modern businesses operate in increasingly complex technological environments that require sophisticated compliance monitoring and reporting capabilities.

- Organizations must adapt their compliance programs to address technology-specific risks while maintaining the fundamental principles of effective internal controls.

- This includes implementing controls over data integrity, system access, and automated decision-making processes that could impact financial reporting or regulatory compliance.

- Strategic Implementation for Risk Mitigation

Operational Efficiency and Avoiding Risk Exposure

- By leveraging technology effectively, organizations can enhance their internal controls systems and drive operational efficiency while simultaneously reducing their exposure to securities litigation and securities class actions.

- However, success requires a strategic approach that balances innovation with risk management, ensuring that technological advancement supports rather than undermines corporate governance objectives.

- Companies that proactively address the intersection of technology and internal controls position themselves to capitalize on digital opportunities while maintaining the robust control environments necessary to prevent regulatory violations and protect against securities litigation.

- This strategic approach to technology implementation represents a critical component of modern corporate governance and regulatory compliance strategies.

Understanding Internal Controls in the Modern Regulatory Framework

- Understanding Internal Controls requires recognizing their dual function as both operational safeguards and compliance mechanisms.

- These systems establish comprehensive frameworks for monitoring and enforcing regulatory requirements across all organizational levels.

- Modern internal control systems must address multiple regulatory domains simultaneously, including financial reporting standards under Sarbanes-Oxley, data protection laws such as GDPR and CCPA, and industry-specific regulations that vary dramatically across sectors.

- The sophistication required in today’s internal control environment cannot be overstated.

- Organizations must implement policies and procedures that ensure every transaction, disclosure, and business decision aligns with applicable legal and regulatory standards.

- This includes establishing robust documentation protocols, implementing segregation of duties, and creating comprehensive audit trails that can withstand regulatory scrutiny and potential litigation challenges.

Corporate Governance and Securities Litigation Risks

- Corporate governance failures frequently serve as the foundation for securities litigation, making the integration of compliance considerations into governance structures absolutely critical.

- When organizations fail to maintain adequate internal controls, they create vulnerabilities that can lead to material misstatements, omissions of critical information, or other violations that trigger securities class actions.

- Recent trends in securities class action lawsuits demonstrate how compliance failures can cascade into significant legal exposure.

- Companies that inadequately disclose risks, fail to implement proper internal controls over financial reporting, or neglect emerging regulatory requirements often find themselves defending against investor claims alleging securities fraud.

Ensuring Complete Disclosues to Investors and Regulatory Bodies

- These cases typically focus on whether organizations maintained adequate systems to ensure accurate and complete disclosures to investors and regulatory bodies.

- The financial impact of such litigation extends far beyond settlement amounts.

- Securities class actions can result in years of costly legal proceedings, regulatory investigations, and ongoing compliance monitoring requirements that strain organizational resources and management attention.

- Moreover, the reputational damage associated with securities litigation can affect customer relationships, employee retention, and access to capital markets.

Proactive Compliance Strategies and Risk Mitigation

- Organizations must adopt proactive approaches to regulatory compliance that anticipate rather than merely react to regulatory changes.

- This requires establishing dedicated compliance teams with clear reporting lines to senior management and board oversight committees.

- These teams must maintain current knowledge of regulatory developments, assess their potential impact on organizational operations, and implement necessary changes to internal control systems before violations occur.

- Regular training and development programs represent essential components of effective compliance strategies.

- Employees at all levels must understand their roles in maintaining compliance, recognizing potential violations, and escalating concerns through appropriate channels.

- This training must be ongoing, updated regularly to reflect regulatory changes, and tailored to specific roles and responsibilities within the organization.

- Collaboration with legal and compliance experts provides organizations with knowledge necessary to navigate complex regulatory requirements.

- External advisors can offer objective assessments of compliance programs, identify potential vulnerabilities, and recommend enhancements to internal control systems.

- This collaboration becomes particularly valuable when addressing emerging regulatory areas or industry-specific requirements that require specialized expertise.

Technology Integration and Compliance Monitoring

- Modern compliance programs increasingly rely on technology solutions to enhance monitoring capabilities and ensure consistent application of internal controls.

- Automated systems can flag unusual transactions, monitor compliance with established policies, and generate reports that facilitate regular reviews and audits.

- These technological tools enable organizations to process larger volumes of transactions while maintaining appropriate oversight and control.

- Data analytics and artificial intelligence are revolutionizing compliance monitoring by identifying patterns and anomalies that might indicate potential violations.

- These tools can analyze vast amounts of data to detect trends, assess risks, and prioritize areas requiring additional attention.

- However, organizations must ensure that their use of these technologies complies with applicable privacy and data protection regulations.

Building Sustainable Compliance Culture

- Creating a sustainable compliance culture requires commitment from leadership and integration of compliance considerations into all business processes.

- This culture must emphasize transparency, accountability, and continuous improvement in compliance practices.

- Organizations that successfully build such cultures typically experience fewer compliance violations, reduced litigation risks, and stronger stakeholder confidence.

- Regular audits and reviews serve as critical components of effective internal control systems, providing independent assessments of compliance program effectiveness and identifying areas requiring improvement.

- These reviews must be conducted by qualified personnel with appropriate independence and expertise to ensure objective evaluations.

- By prioritizing regulatory compliance and integrating it comprehensively into their internal control systems, organizations can significantly mitigate legal and financial risks while maintaining stakeholder confidence.

- This integrated approach creates sustainable competitive advantages by reducing operational risks, enhancing decision-making processes, and building trust with investors, customers, and regulatory authorities.

- The evolving regulatory landscape will continue presenting new challenges, but organizations with robust, adaptable compliance frameworks will be better positioned to navigate these changes successfully while avoiding the devastating consequences of securities litigation and regulatory violations.

Conclusion: The Future of Internal Controls in 2026

- As we look to the future, the role of internal controls in organizational success will become even more critical.

- The business landscape is becoming increasingly complex, with evolving risks, regulatory requirements, and technological advancements.

- Organizations must adapt to these changes by strengthening their internal control systems and embracing innovative solutions to manage risks and drive growth.

- The future of internal controls lies in the integration of technology, risk management, and compliance.

- By leveraging technology, organizations can enhance the efficiency and effectiveness of their internal controls, enabling real-time monitoring and data-driven decision-making.

- This requires a strategic approach to technology implementation, ensuring that automated controls are secure, reliable, and aligned with the organization’s objectives.

- Moreover, organizations must continue to prioritize risk management and regulatory compliance, integrating these elements into their internal control systems.

- This requires a proactive approach to identifying and addressing emerging risks, as well as fostering a culture of integrity and accountability.

- By embracing these strategies, organizations can strengthen their internal controls and position themselves for sustainable growth and success in 2025 and beyond.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about securities class action settlements, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at [email protected]. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors