Introduction to Understating Expenses and Securities Class Actions

Understanding the nuances of understating expenses and securities class actions is crucial for professionals in finance and corporate governance.

- Inflated Profits: Understating expenses refers to the deliberate action of recording lower expenses than those actually incurred, which can artificially inflate a company’s reported profits and mislead stakeholders.

- Unethical: This unethical practice can lead to severe legal consequences, including securities litigation.

- Securities Class Actions: Lawsuits filed by investors who have suffered financial losses due to the fraudulent activities or misrepresentations by a company.

- Accountability: These actions are designed to hold companies accountable for their misconduct and provide restitution to affected investors.

- Legal Action: In the context of securities litigation, understating expenses can be a significant factor that triggers legal action.

- Investor Reliance: When a company understates its expenses, it provides false information that investors rely on when making investment decisions.

- Corrective Disclosure: If the truth comes to light, and the company’s financial statements are found to be inaccurate, the stock price can plummet, leading to substantial losses for shareholders.

- Remedy: Consequently, affected investors may band together to file a class action lawsuit against the company, seeking compensation for their losses and justice for the wrongdoing.

- Transparency: Professionals must be vigilant in ensuring that all expenses are accurately recorded and reported. Transparency in financial reporting is not only a legal requirement but also a pillar of ethical business practices.

- Build Investor Trust: By maintaining integrity in their financial disclosures, companies can build trust with their investors and avoid the pitfalls of securities litigation.

Understanding the gravity of these issues helps professionals navigate the complex landscape of corporate finance and protects the interests of all stakeholders involved.

Methods for Understating Expenses

- Improper capitalization of costs: A company might improperly classify operating costs, which should be immediately expensed, as capital expenditures. This defers the expense over a longer period through depreciation, thereby increasing net income in the current period. For example, Worldcom was found to have capitalized billions of dollars in line access fees.

- Delaying expense recognition: Management might hold invoices and intentionally not record expenses until a future accounting period. This practice shifts costs and artificially inflates profits for the current period.

- Inadequate provisions: Failing to properly estimate and record provisions for future expenses or liabilities, such as bad debts, returns, or legal expenses, keeps current expenses artificially low.

- Failure to write down impaired assets: Companies may fail to write down the value of assets that have been impaired (e.g., obsolete inventory or uncollectible accounts receivable). This keeps the recorded expense from the write-down off the income statement.

- Concealing liabilities: When liabilities are hidden, related expenses are also understated, which inflates net earnings.

- Falsified timing of expenses. Shifting expenses between accounting periods directly affects bottom-line earnings; an entity’s management or accounting personnel might have incentives tied to certain targets that the manipulated earnings enable them to meet. Typically, these schemes postpone the booking of current-period expenses to a later period.

- Inventory overstatement and understatement: Overstate inventory directly affects the cost of goods sold, understating it, and thus reducing expenses. If management has the motive to decrease profits in a given period, they might understate inventory, which would overstate the cost of goods sold (increasing expenses) and reduce bottom-line earnings.

Impact on Financial Statements

1. Income statement

- Overstated Net Income: Understating expenses directly leads to an inflated net income (profit) because expenses are subtracted from revenues to calculate net income.

- Misleading Profitability Ratios: Profitability ratios, such as net profit margin, will appear higher than they actually are, giving a false impression of the company’s efficiency and profitability.

2. Balance sheet

- Overstated Assets: If the understated expense is related to an asset (e.g., failing to record depreciation expense, which reduces the value of assets), the asset’s value on the balance sheet will be overstated.

- Overstated Equity: Since understated expenses lead to overstated net income, and net income is closed to retained earnings (part of stockholders’ equity), the equity section of the balance sheet will be overstated.

- Understated Liabilities (Potentially): In some cases, understating expenses can be linked to understating liabilities. For example, failing to accrue for expenses incurred but not yet paid (like wages payable) would understate both expenses and liabilities.

3. Statement of cash flows

- Potentially Misleading Operating Cash Flows: While understating expenses does not directly affect cash outflows in the current period, a decrease in prepaid expenses has the opposite effect on cash flow. As you use the prepaid goods or services, their value shifts from your balance sheet (as an asset) to your income statement (as an expense). If understated expenses resulted in inflated net income, and the indirect method is used to prepare the statement of cash flows, adjustments might be required to accurately reconcile net income to cash from operations.

4. Retained earnings statement

- Overstated Retained Earnings: As net income is overstated due to understated expenses, the retained earnings balance will also be overstated. Retained earnings are directly impacted by net income, so any manipulation of expenses will cascade to this statement.

In essence, understating expenses distorts the true financial picture of a company, making it appear more profitable and financially sound than it actually is subjecting the company to securities litigation. This can have significant consequences for investors, creditors, and other stakeholders who rely on accurate financial information for decision-making and is a red flag the company lacks robust corporate governance framewords and has week internal controls over financial reporting.

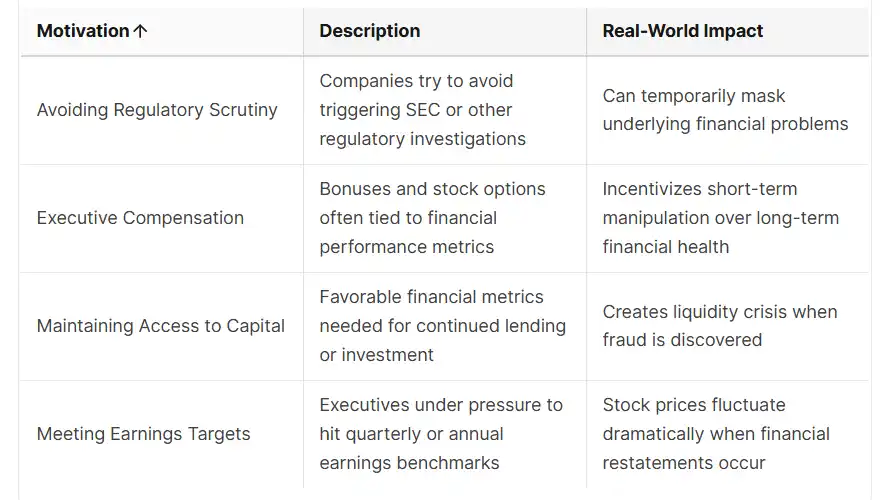

Motivations for Understating Expenses

Meeting or exceeding financial targets

- Analyst and investor expectations: Companies often understate expenses to ensure they meet or exceed earnings forecasts made by market analysts. Meeting these targets can boost investor confidence and support a higher stock price.

- Performance-based bonuses: Many executives and managers have their compensation tied to financial metrics like net income or revenue growth. Understating expenses is a direct way to inflate these numbers and trigger large personal bonuses or stock options.

- Debt covenant compliance: Lenders may include debt covenants in loan agreements that require a company to maintain certain financial ratios, such as a minimum profit margin. By understating expenses, a company can avoid breaching these covenants and facing penalties or loan defaults.

Influencing stock price and market perception

- Boosting stock price: Presenting a more profitable company can attract new investors and drive up the stock price, benefiting existing shareholders and those with stock-based compensation.

- Weathering poor performance: During periods of economic downturn or poor business performance, management may understate expenses to hide the company’s financial struggles and project an image of stability.

- Smoothing earnings: Companies may manage earnings to present a consistent, predictable growth pattern, rather than volatile fluctuations. For instance, they might intentionally understate expenses in a weak period to meet targets, even if it means overstating them later.

Securing financing

- Attracting investors: A strong income statement with high profitability can make a company more attractive to potential investors or during an initial public offering (IPO).

- Obtaining favorable loan terms: By exaggerating profitability and cash flow, a company can improve its chances of securing bank loans or credit lines and may negotiate better interest rates.

Tax reduction (in some cases)

- Decreasing taxable income: While understating expenses generally increases reported income, some forms of manipulation might aim to lower income for tax purposes. For instance, in some instances, a company might use “aggressive but permissible accounting practices” to reduce its tax bill, though this is a different motivation from projecting a favorable public image.

Enabling fraudulent activity

- Covering up embezzlement: An employee who has misappropriated funds may understate expenses to hide the fact that cash was stolen. This is typically uncovered during an audit.

- Taking advantage of lax internal controls: A lack of robust corporate governance and internal controls creates an opportunity for unethical or fraudulent behavior, allowing individuals or management to understate expenses with a lower risk of detection.

INTERNAL MECHANISMS LEADING THE SECURITIES CLASS ACTIONS

| Internal Corporate Mechanisms | Reasons Leading to Securities Fraud |

Ineffective corporate governance mechanisms | including lack of board committees, non-independent board members, and underqualified directors |

Poor risk management | Insufficient attention to potential threats that could destabilize the company |

Ethical leadership failures | Including integrity issues, fraud, and corruption |

Concentration of power | decision-making controlled by small groups without proper checks and balances |

| Lack of transparency | failure to disclose accurate financial information |

Detection and Prevention

- Analytical procedures: Auditors compare current expense balances and trends to previous periods and to industry benchmarks. Unexplained variations can signal potential issues.

- Trend analysis: Observing unusual or inconsistent trends, such as increasing profits without a corresponding increase in revenue, is a red flag.

- Reviewing internal controls: Companies with weak internal controls are more vulnerable to this type of fraud. A strong control environment, including a separation of duties and a robust audit committee, is key to prevention.

- Reviewing footnote disclosures: Reading the footnotes of financial statements carefully can reveal information about contingent liabilities, legal actions, and off-balance-sheet financing arrangements that may not be reflected in the main financial statements.

Preventive Measures | Response Mechanisms | |

Corporate | Prevention Mechanisms: • Clear reporting guidelines • Independent board oversight • Robust internal controls • Ethics training & culture | Detection Systems: |

Securities | Red Flags: Falsified Expenses: • Unusual expense fluctuations • Narrative vs. financial discrepancies • Frequent financial restatements • Vague disclosure explanations | Impact on Companies: |

Stakeholder | Securities Litigation Process: 1. Class action formation 2. Motion to dismiss stage 3. Discovery process 4. Settlement or trial | Investor Protection Steps: |

Preventing financial statement fraud

- Implementation of whistleblower programs with a hotline encourging and traning employes and providing them strong protections from retaliation

- Foster an environment that encourages all employess to comply with legal and regulatory requirements

High Profile Cases of Companies Understating Expenses

- Method: The telecom giant fraudulently classified billions of dollars in operating expenses as capital expenditures. Normal expenses, such as the fees WorldCom paid to lease network lines from other companies, were treated as long-term assets instead of being immediately recognized on the income statement.

- Impact: This deceptive reclassification artificially boosted WorldCom’s reported profits and masked its deteriorating financial health, which eventually led to its collapse and a historic bankruptcy filing.

- Method: The energy company would transfer poorly performing assets to off-balance-sheet SPEs, which were not properly consolidated into Enron’s financial statements. By doing so, Enron was able to avoid recognizing the losses and debts associated with these assets on its books.

- Impact: These accounting tricks misled investors about the company’s true financial condition and ultimately led to its bankruptcy. The scandal also led to the downfall of its auditing firm, Arthur Andersen.

- Method: Top executives would hold “family meetings” to “fix” quarterly earnings shortfalls. They made false accounting entries that would reduce a “contractual adjustment” contra-revenue account and/or decrease reported expenses. They also improperly used reserves, including their bad-debt reserves, to manipulate earnings.

- Impact: This scheme systematically overstated earnings by at least $1.4 billion and artificially inflated HealthSouth’s financial performance over several years, leading to convictions for several executives.

- Method: Xerox used a number of accounting manipulations to close a $3 billion gap between its actual and reported performance between 1997 and 2000. This included prematurely recognizing revenue from long-term equipment leases, which effectively understated the company’s future expenses and overstated its current earnings.

- Impact: The SEC investigation and subsequent settlement forced Xerox to restate its financial results and pay a $10 million civil penalty.

- Method: Lucent executives made undisclosed “extra-contractual commitments” to induce customers to buy their products, such as offering credits and other incentives. This allowed Lucent to prematurely or improperly recognize revenue on sales that should not have been booked under Generally Accepted Accounting Principles (GAAP).

- Impact: In addition to facing legal action from the SEC and having to restate earnings, Lucent was fined $25 million for its lack of cooperation during the investigation

Robust Corporate Governanee and Strong Internal Controls that Can Prvent Understating Expenses

Segregation of duties

- Split transaction functions. For expense management, no single person should have control over all phases of a transaction.

- Authorization: Approving expenses or purchase orders.

- Record-keeping: Entering invoices or transactions into the accounting system.

- Custody of assets: Processing and issuing payments, such as running checks.

- Prevent self-approval. A robust system must prohibit managers or executives from approving their own expenses.

Authorization and approval controls

- Spending limits: Set clear dollar limits for different categories of expenses. Transactions exceeding a specific threshold must be escalated for higher-level approval.

- Pre-authorization: Require pre-authorization for significant or unusual expenses before they are incurred, ensuring they are planned and aligned with company goals.

- Required documentation: Mandate that all expense claims include itemized receipts, invoices, and a description of the business purpose. This documentation can be verified against an expense policy.

- Expense management software: Use automated systems that enforce policy rules, requiring documentation and flagging non-compliant submissions for review.

Reconciliation and monitoring controls

- Independent reconciliation: A person independent of the expense-incurring or recording process should reconcile bank and credit card statements with the company’s accounting records. This helps detect missing or altered transactions.

- Budget-to-actual analysis: Compare actual expenses to budgeted amounts on a regular basis. Unusual variances or consistently low reported expenses may indicate that expenses are being understated.

- Analytical reviews: Conduct trend analysis by comparing expenses from the current period to previous periods. Automated systems can flag deviations from normal spending patterns.

- Fixed asset vs. expense scrutiny: Carefully review transactions that have been classified as capital expenditures to ensure they were not inappropriately capitalized to avoid reporting them as expenses.

Auditing and oversight

- Regular internal audits: A company’s internal audit department should periodically review expense reports, looking for red flags like round numbers, missing receipts, or duplicate claims.

- Independent external audits: An annual external audit by an independent accounting firm is a cornerstone of financial reporting integrity. These auditors provide an objective assessment of financial records and controls, helping to prevent and detect material misstatements.

- Audit committee oversight: An active and independent audit committee on the board of directors is essential for overseeing the financial reporting process and maintaining auditor independence.

Corporate culture and ethics

- “Tone at the top”: A strong corporate culture starts with management. Leaders must clearly communicate a zero-tolerance policy for financial manipulation and unethical behavior, setting the ethical “tone at the top”.

- Employee training: Regularly train employees on expense policies, accounting standards, and the importance of ethical financial reporting.

- Whistleblower policy: Establish a confidential and protected channel for employees to report suspicious activity without fear of retaliation.

Conclusion

Understanding the intricacies of understating expenses and securities class actions is essential for anyone involved in financial management or corporate governance.

Understating expenses refers to the practice of reporting lower expenses than actually incurred, often to inflate profits and present a more favorable financial position.

This malpractice can lead to severe legal ramifications, including securities litigation. Securities litigation encompasses lawsuits filed by investors who have suffered losses due to fraudulent activities, such as misstated financial records. Companies found guilty of understating expenses can face hefty fines, reputational damage, and loss of investor trust.

Therefore, maintaining accurate financial reporting is not only a regulatory requirement but also a critical factor in sustaining long-term business success and investor confidence and avoiding securities litigation.

It is imperative for companies to implement stringent auditing processes and ensure transparency in their financial disclosures to mitigate the risks associated with securities class actions.

In the end, the key is maintaing strong and robust corporate governance and strong internal controls over financial reporting which will be you strongest defense against securities class action lawsuits.

Contact Timothy L. Miles Today for a Free Case Evaluation

If you suffered substantial losses and wish to serve as lead plaintiff in a securities class action, or have questions about understating expenses, or just general questions about your rights as a shareholder, please contact attorney Timothy L. Miles of the Law Offices of Timothy L. Miles, at no cost, by calling 855/846-6529 or via e-mail at tmiles@timmileslaw.com. (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: tmiles@timmileslaw.com

Website: www.classactionlawyertn.com

Facebook Linkedin Pinterest youtube

Visit Our Extensive Investor Hub: Learning for Informed Investors