Introduction to Corporate Governance Reforms in Securities Litigation

Corporate governance reforms play a pivotal role in enhancing investor protection and maintaining market integrity, particularly in the context of securities class actions. As we approach 2025, it is essential for companies, investors, and legal practitioners to stay informed about the latest developments and best practices in this area.

The landscape of internal controls and governance has evolved significantly, driven by the need to address the shortcomings exposed by financial scandals and economic crises. These reforms aim to strengthen the accountability of corporate directors and executives, ensure transparency in financial reporting, and foster a culture of ethical business practices.

In the realm of securities class actions, internal governance reforms serve as a crucial mechanism for safeguarding investors’ interests. These legal actions allow shareholders to collectively seek redress for corporate misconduct, such as fraud or misrepresentation. Effective governance practices can mitigate the risk of such misconduct by promoting rigorous oversight and compliance mechanisms within organizations.

For instance, robust internal controls, independent board oversight, and transparent communication channels can deter fraudulent activities and enhance corporate accountability.

Moreover, internal governance reforms are instrumental in restoring investor confidence, which is vital for the smooth functioning of capital markets. When investors perceive that a company is committed to high standards of governance, they are more likely to invest in its securities. This trust is built on the assurance that their interests are protected and that there are mechanisms in place to address any potential grievances. Consequently, companies that prioritize strong governance frameworks are better positioned to attract and retain investors.

As we look ahead to 2025, it is anticipated that internal governance reforms will continue to evolve, reflecting the dynamic nature of the global business environment. Regulatory bodies are expected to introduce new guidelines and standards aimed at reinforcing investor protection and enhancing the overall integrity of the financial markets. Companies must proactively adapt to these changes by continually assessing and improving their governance practices.

This involves not only complying with regulatory requirements but also embracing a culture of ethical leadership and transparency.

In conclusion, internal governance reforms are integral to ensuring investor protection and fostering trust in the financial markets. As we move towards 2025, stakeholders must remain vigilant and committed to upholding high standards of governance. By doing so, they can contribute to a more resilient and trustworthy financial system, ultimately benefiting both companies and investors alike.

What Are Corporate Governance Reforms?

Reforms to internal policies and procedures

- Revised corporate policies: The company may be forced to rewrite its code of conduct, risk management guidelines, and other internal policies to explicitly address the specific misconduct that led to the lawsuit.

- Prohibition of related-party transactions: To combat potential conflicts of interest, a settlement might prohibit or place strict controls on transactions between the company and its insiders.

- Enhanced disclosure requirements: Beyond standard regulatory disclosures, settlements can mandate more transparent and frequent reporting to investors. This includes providing more detail on executive compensation, board decisions, and internal investigations.

- Strengthened whistleblower protections: To prevent future wrongdoing, companies may be required to establish or enhance confidential reporting mechanisms and guarantee non-retaliation for employees who report misconduct.

Ethics and compliance program overhauls

- Formal compliance programs: Companies are often required to institute or strengthen compliance programs that include employee training, ongoing monitoring, and clear lines of communication regarding potential ethical breaches.

- Mandatory training: Settlement agreements frequently mandate regular and comprehensive ethics and compliance training for all employees, officers, and directors.

- Executive accountability: To ensure accountability, some settlements require the creation of a senior vice-president level compliance committee that reports directly to the CEO, or a Chief Compliance Officer role that reports directly to the board.

Refinements to board composition and oversight

- Improved audit committee oversight: Reforms mandate that the aaudit committee have a high degree of independence and expertise. This includes requiring a financially literate “audit committee financial expert” and restricting the types of consulting work the external auditor can perform for the company.

- Director rotation and evaluation: Some settlements require a rotation of directors or a process for evaluating director performance, pushing for greater engagement and effectiveness.

- Enhancing shareholder rights: Reforms can empower shareholders by requiring majority voting in director elections, mandating a non-binding “say on pay” vote on executive compensation, or limiting anti-takeover provisions.

- Mandatory external audits: Beyond standard audits, a settlement may require a special independent audit of internal controls to identify and fix specific deficiencies.

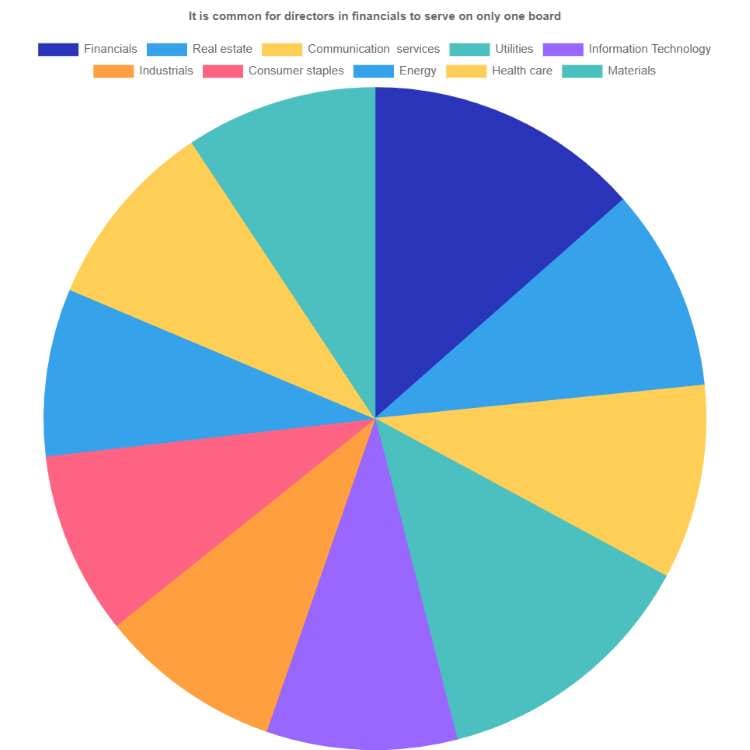

Tellingly, it has become common in the financial section for directors to serve on only one board:

The emphasis on single board service in financials implicitly contrasts with the practice of holding multiple directorships (also known as “overboarding” or “interlocking directorates”) which can be common in other sectors like asset management. director independence, as found in corporate governance studies, often explore the benefits and drawbacks of single versus multiple directorships, touching upon issues like director capacity, potential conflicts of interest, and the impact on firm performance and oversight quality.

This data suggest that the demands, regulations, or nature of governance in the financial industry may lead to a higher focus on singular board commitments compared to other sectors. This promotes better accountability, a far less liklihood of interlocking relationships and conflicts of interest, and the ability to focus on one company rather than serveral.

Key Elements of Corporate Governance:

- Board Structure: The composition, independence, and expertise of the board of directors are critical elements that influence internal governance and promose investor protection and shareholder rights. A well-structured board ensures effective oversight and decision-making with the proper internal controls in place..

- Transparency and Disclosure: Transparency in financial reporting and disclosure of key information to shareholders, robust investor protection, and shareholder rights are fundamental aspects of good governance. This builds trust and confidence among investors and the public and signals strong and robust comporate governance.

- Executive Compensation: Aligning executive compensation with the company’s long-term goals and performance is crucial for ensuring that management’s interests align with those of shareholders, while providing investor protection and retaining strong shareholder rights.

- Shareholder Rights: Protecting shareholder rights and ensuring they have a voice in critical decisions, such as mergers and acquisitions, are essential components of internal governance and demonsrate the company has the proper internal controls in place..

Examples of Enhanced Disclosure Requirements from Settlements

Disclosures related to internal investigations

- Vince McMahon / WWE settlement (2025): The SEC’s settlement with Vince McMahon for undisclosed hush-money payments required disclosure about the previously hidden investigations and agreements. This allowed investors to understand the financial implications and risks that were previously concealed.

Enhanced reporting on internal control risks

- ESG and climate risks: Following actions against companies for misleading ESG statements, settlements can mandate more transparent disclosures of climate-related financial risks and mitigation strategies.

- Cybersecurity risks: A 2024 SEC settlement with four issuers required enhanced disclosures about cybersecurity risks and intrusions after the companies allegedly misled investors.

- Specific business segment performance: Following the NVIDIA case, which alleged the company hid that cryptocurrency mining drove a significant portion of its gaming revenue, a settlement could mandate more detailed revenue reporting by business unit.

Reporting on executive compensation and related-party transactions

- Performance metrics: Reforms can require more detailed disclosure on the specific performance metrics used to determine executive compensation, ensuring shareholders understand how pay is truly linked to performance.

- Related-party transaction oversight: Settlements may mandate the disclosure of all material related-party transactions, including how they were reviewed and approved by the board.

Proactive disclosure on litigation and investigations

- Preemptive disclosure: Beyond just acknowledging ongoing litigation, a settlement can require the company to provide more detail about the nature of the investigation, its potential financial impact, and any material developments.

Comprehensive board oversight disclosures

- Workplace misconduct: The SEC settlement against Activision, prompted by failures related to workplace misconduct, emphasizes the need for companies to have clear processes for escalating internal complaints to the board.

- Board meeting details: While rare, some settlements may even mandate more detailed disclosures about the frequency of board meetings and the topics discussed, particularly if the original lawsuit alleged that the board was disengaged or uninformed.

Disclosures related to product performance and safety

- Bristol-Myers Squibb (BMS): As part of a settlement for misleading investors about a drug trial, BMS agreed to publicly report accurate average sales prices and average manufacturer prices for its drugs covered by Medicare and other federal health care programs.

How Long Does it Take Before Companies See the Benefits of Enhanced Corporate Governance?

Short-term benefits (0-12 months)

- Restored market confidence: Enhanced transparency and a commitment to accountability can quickly rebuild trust with investors and the public. This can help stabilize a company’s stock price, which may have suffered during the lawsuit.

- Increased investor interest: Companies that demonstrate stronger governance become more attractive to investors, who see the firm as a more stable and lower-risk investment. This is especially true for institutional investors, who prioritize good governance.

- Lower cost of capital: Studies show that firms with robust governance are associated with a lower cost of both equity and debt capital. Lenders and investors offer better terms to companies they perceive as less risky due to better oversight and transparency.

- Operational clarity: Reforming internal policies and enhancing disclosure requirements can improve decision-making processes and reduce information asymmetries between management and shareholders.

Medium-term benefits (1-3 years)

- Improved operational efficiency: Better oversight, clearer strategic direction, and more robust risk management can lead to improved financial performance. Research by McKinsey shows that boards with long-term impacts spend nearly twice as much time on strategic, high-level issues.

- Better risk management: By establishing and enforcing robust risk management systems, a company can more effectively identify, assess, and mitigate financial, operational, and reputational risks.

- Stronger board and management: An emphasis on board independence and accountability can lead to more effective leadership. The presence of independent directors with diverse perspectives enhances the quality of decision-making.

- Enhanced employee morale: A corporate culture that prioritizes ethics and accountability can increase employee trust and satisfaction. This can lead to lower turnover and higher productivity.

Long-term benefits (3+ years)

- Enhanced reputation and brand value: A sustained commitment to good corporate governance builds a company’s reputation and brand value, which can provide a significant competitive advantage.

- Increased resilience to crises: Companies with robust governance are better equipped to navigate economic downturns, regulatory changes, and other unforeseen challenges, protecting shareholder value over time.

- Mitigation of future legal risk: Implementing a strong compliance and ethics program, along with transparent disclosure, reduces the potential for future litigation and regulatory actions.

- Sustainable growth: The framework established by strong internal governance practices provides a foundation for sustainable, long-term growth that benefits all stakeholders, not just shareholders.

The Advantages of Securities Class Actions in Securing Robust Corporate Governance and Investor Protection

Cost efficiency and collective action

- Reduced litigation costs: Securities class actionS allows large groups of investors with similar, smaller claims to combine their resources into a single lawsuit. By sharing the costs for attorneys, expert witnesses, and court fees, the process becomes economically feasible for individuals who could not afford to sue alone.

- Contingency fees: Attorneys representing the class often work on a contingency fee basis. This means they are only paid if they successfully obtain a settlement or judgment, which is then taken as a percentage of the recovery. This eliminates upfront financial risk for class members.

- Judicial efficiency: Consolidating many small, similar claims into one class action saves time and resources for the court system. This streamlined process benefits all parties involved by leading to a more efficient resolution.

Deterrence of fraud and corporate accountability

- Large financial liability: The threat of a massive financial penalty, with settlements potentially in the hundreds of millions or billions of dollars, creates a powerful incentive for companies to avoid fraudulent activities and enhance their corporate governance frameworks and provide more investor protectin and shareholder rights.

- Reputational damage: Publicly-filed securities fraud class actions can cause ssignificant reputational damage to a company, leading to a loss of investor and customer confidence. The fear of this negative publicity can also deter misconduct.

- Market integrity: By holding fraudulent actors accountable and forcing companies to pay for their misconduct, class actions help maintain the integrity and transparency of financial markets. This restores investor confidence that the market operates fairly.

Improved corporate governance and internal controls

- Improved oversight: Securities fraud class actions can force a company to restructure its internal governance and implement enhanced oversight, such as appointing more independent directors or creating new compliance roles.

- Stronger internal controls: In the wake of litigation, companies may be required to implement stronger internal controls and compliance programs to prevent future misstatements or fraud. This includes measures like segregating duties and establishing robust approval workflows.

- Enhanced transparency: Settlements can mandate greater disclosure and improved financial reporting. This benefits all investors, not just those in the class, by making the company more transparent and providing more accurate information.

Broader investor protection

- Cost Efficiency: Securities class actions provide aaccess to justice for small-dollar investors who would otherwise have no practical way to seek compensation for losses resulting from corporate fraud.

- Compensation for losses: Securities fraud class action lawsuits aim to recover financial losses suffered by investors who purchased or sold a security at an inflated price due to misleading information. While recoveries are often not 100%, they provide a viable path to compensation.

- Empowerment for small investors: The class action mechanism allows individual investors to pool their collective strength to hold large, well-funded corporations accountable for misconduct. This addresses the “collective action problem” where no single investor has enough at stake to sue individually.

Companies that Improved their Corporate Governance or Compliance After Securities Class Action Lawsuits Were Filed

Case study examples

Enron Corporation (2001)

WorldCom, Inc. (2002)

Alphabet Inc. (Google)

Compass Minerals International Inc. (2025)

Companies that Experienced Improved Financial Performance After Corporate Governance Reforms

- Hitachi: This Japanese conglomerate was on the brink of bankruptcy in 2008. It underwent a massive restructuring that included a sharper focus on core businesses (strategic divestment of underperforming units), cost-cutting, and a more diverse board structure (including foreign and women members, which was uncommon in Japan at the time). While early gains were slow, Hitachi has since achieved higher profitability, strong cash flows, and increased returns on capital, which has led to significant share price appreciation since 2016.

- JSR: This Japanese firm was once known as Japan Synthetic Rubber, a deeply cyclical and low-margin business. However, in 2021, the company exited the synthetic rubber manufacturing business and refocused on its core operations, becoming a global leader in photoresists used for manufacturing cutting-edge semiconductors. This strategic shift, driven by a focus on core competencies and improved governance, resulted in a leaner, faster-growing business. JSR was acquired by a private equity firm in 2024.

- Other Japanese Companies (General Trend): Japanese internal governance reforms, encouraged by the Tokyo Stock Exchange and activist investors, have pushed companies to focus on core business competencies. This has led to a wave of M&A activity, with companies spinning off weak divisions and consolidating fragmented markets, and according to Bain & Company, Japanese-related M&A reached a total of US$123 billion in 2023. This increased activity suggests a positive impact on company value and shareholder returns.

- Activision Blizzard (2025 perspective): While not explicitly tied to improved financial performance, the SEC settlement in 2024 following the company’s failures to properly handle workplace misconduct allegations and related internal complaints serves as a potential catalyst for future financial improvement. By requiring better internal controls and communication to the board, it could lead to better risk management and a more positive work environment, which could indirectly lead to improved financial results down the line.

- Bristol-Myers Squibb (BMS): After facing a securities class action related to misleading disclosures about a drug trial, BMS agreed to publicly disclose the design and results of all clinical trials for its marketed drugs. This enhanced transparency likely helped restore investor trust and could lead to improved stock performance in the long term, as the company operates with a higher degree of accountability.

Companies with Robust Corporate Governance Make More Profits in the Long-Term

- Improved financial performance: Companies with robust corporate governance structures tend to exhibit higher profitability, better stock performance, and lower risk profiles.

- Outperformance during crises: Companies with strong internal governance measures, including board independence and CEO duality, fared better during the COVID-19 pandemic and maintained their financial performance.

- Higher cumulative returns: US companies demonstrating governance leadership consistently outperformed their worst-scoring counterparts between 2018 and 2023, delivering a cumulative return 26.3% higher. Good governance consistently outperformed in the US between January 2015 and December 2023.

- Increased investor confidence and lower cost of capital: Effective corporate governance fosters investor confidence, leading to a lower cost of capital as investors are more willing to invest in companies demonstrating accountability, transparency, and good governance practices.

- Better risk management: Companies with strong governance frameworks are better equipped to manage risks, which positively impacts their financial stability and performance.

- Enhanced stock price stability: Effective board governance and information disclosure are found to be significantly associated with reduced stock price volatility and increased stability.

Examples

- MSCI research found that in the U.S., companies with governance leadership consistently outperformed governance laggards between 2015 and 2023. This suggests a positive correlation over the long term.

- JUST Capital’s Chart of the Week from June 25, 2020, showed that the top quintile of companies in terms of shareholder issues (a proxy for governance quality) significantly outperformed the market during a crisis.

Study

- Improved Risk Management: Good governance helps businesses proactively identify and mitigate financial, operational, legal, and reputational risks.

- Better Decision Making: A structured approach to decision-making, fostered by strong governance, leads to more informed and strategic choices.

- Increased Transparency and Trust: Transparency and accountability build confidence among investors and stakeholders.

- Regulatory Compliance: Strong governance helps ensure adherence to laws and regulations, reducing the risk of penalties.

- Enhanced Long-Term Sustainability: Good governance provides a stable foundation for growth and adaptation.

Securities Class Actions Secure Robust Internal Governance, Investor Protection, and Enhanced Internal Controls

Securing robust internal governance

- Separating CEO and Chairman roles, which reduces the concentration of power and creates a more independent voice on the board.

- Appointing more independent directors, who can provide impartial oversight and challenge management decisions effectively.

- Restructuring the audit committee to improve the integrity of financial reporting.

- Enhancing oversight of senior management to prevent undisclosed conflicts of interest.

Providing investor protections

- Providing a pathway to compensation for financial losses resulting from corporate fraud or misrepresentation.

- Enforcing corporate accountability, sending a message that misconduct has consequences.

- Restoring market integrity by punishing fraudulent activity and promoting transparent financial reporting.

- Amplifying the voice of individual investors, enabling them to take on large, well-funded corporations.

Enhancing internal corporate controls

- Implementing stricter internal financial controls to prevent future accounting misconduct, as seen after the WorldCom scandal.

- Overhauling the company’s compliance system, including its policies and training programs, to ensure ethical standards are understood and enforced at all levels.

- Creating new compliance roles, such as a Chief Compliance Officer who reports directly to the board, to provide additional oversight.

- Implementing clearer approval workflows for significant transactions, creating accountability for large expenditures.

A symbiotic relationship with regulators

Examples of Companies With Strong Governance And Long-Term Financial Success

- Microsoft: Known for strong ESG practices, Microsoft has invested in environmental initiatives and tied executive compensation to diversity targets, reflecting a commitment to broad ESG factors. Their consistent strong financial performance is likely influenced by these efforts.

- PepsiCo: This company consistently practices good internal governance, regularly updating its policies and engaging with investors on key areas like board composition, strategy, and sustainability. These practices have likely contributed to its financial stability and global presence.

- Royal Philips: Royal Philips engages with shareholders and governance groups, particularly during its transformation periods. They emphasize a long-term strategic approach and transparent communication, which has contributed to successful transformations and value creation.

- Tata Group: Based in India, the Tata Group is known for strong ethical values and transparency. Their governance practices include a diverse board structure with independent directors, contributing to balanced decision-making and accountability, leading to sustainable growth.

- HDFC Bank: Another Indian example, HDFC Bank is recognized for sound corporate governance practices within the banking industry. Their framework prioritizes transparency, risk management, and stakeholder engagement, which has helped build a reputation for reliability and strengthened its financial performance.

Emerging Trends in Corporate Governance

The evolution of ESG and stakeholder capitalism

- Balancing stakeholder interests: In this model, companies prioritize the long-term welfare of a broader range of stakeholders—including employees, customers, suppliers, and the community—not just investors.

- ESG backlash and refinement: While political controversy has made the specific acronym “ESG” a target in some regions, the underlying focus on environmental, social, and governance factors remains strong. The trend is evolving to emphasize the link between climate and other ESG risks and long-term financial outcomes.

- Sustainability reporting: New global standards from bodies like the International Sustainability Standards Board (ISSB) are creating a baseline for sustainability disclosures, which helps investors assess a company’s related risks and opportunities.

Enhanced oversight of technology and risk

- AI governance: With the accelerating adoption of AI, boards are developing formal governance structures to manage its risks and opportunities. This includes setting internal policies, ensuring ethical deployment, and continuously upskilling directors on the technology.

- Cybersecurity oversight: Boards recognize cybersecurity as a critical business risk, not just a technical issue. They are re-evaluating risk reporting, ensuring management allocates sufficient resources, and staying educated on emerging cyber threats.

- Geopolitical risk: Increasing global instability, trade conflicts, and national security concerns are requiring boards to re-evaluate geopolitical risk. This includes stress-testing supply chains, assessing market exposure in volatile regions, and developing crisis preparedness plans.

Focus on board composition and effectiveness

- Broadening diversity: While the pace of growth in board diversity has slowed in some regions, stakeholders still value diverse perspectives. The conversation is expanding beyond gender and race to include a wider range of experiences and backgrounds.

- Board refreshment: To ensure directors have the right mix of skills, boards are adopting long-term composition strategies. This involves more intentional succession planning, including targeted term limits and performance evaluations.

- Intra-board collegiality: Boards are focusing on strengthening their internal dynamics to foster constructive discussions and allow all voices to be heard.

Enhanced transparency and activism

- Increased disclosure: Regulators like the SEC now require disclosures on climate-related and cybersecurity risks. Transparency is crucial for building trust, and companies are providing more information on their financial performance, risks, and governance practices.

- Shareholder activism: Both traditional and governance-oriented shareholder activism are on the rise. Investors are holding directors accountable on a growing number of issues, from compensation to board composition

Board’s Responsibility for Artificial Intelligence and Cybersecurity Oversight

Securities litigation is a crucial aspect of the legal landscape that deals with disputes involving financial instruments and the entities that issue them. It encompasses a wide range of activities, including but not limited to, allegations of fraud, breaches of fiduciary duty, and insider trading. As companies continue to leverage advanced technologies, the intersection of artificial intelligence (AI) and corporate governance has become increasingly significant.

- Corporate governance refers to the framework of rules, relationships, systems, and processes within and by which authority is exercised and controlled within corporations. It plays a vital role in ensuring investor protection by promoting transparency, accountability, and fairness in business operations.

- The Rise of AI: The rise of AI presents both opportunities and challenges for corporate governance. On one hand, AI can enhance decision-making processes, improve risk management, and streamline operations. On the other hand, it introduces complexities related to ethical considerations, data privacy, and potential biases in algorithmic decision-making.

- Board AI Oversight: The board of directors has a critical responsibility to oversee AI implementation and integration within the company. This oversight must ensure that AI technologies are aligned with the company’s strategic objectives while also adhering to legal and ethical standards.

- Investor protection: Investor protection is a key concern in the context of AI-driven securities markets. Investors rely on accurate and reliable information to make informed decisions. Any misuse or misrepresentation of AI tools can lead to significant financial losses and erode investor confidence.

- Therefore, it is imperative for boards to establish robust governance mechanisms that monitor AI’s impact on market integrity and investor trust. This includes setting clear policies for AI usage, conducting regular audits, and fostering a culture of accountability among executives and employees.

In conclusion, the convergence of securities litigation, internal governance, and AI oversight underscores the need for a proactive and vigilant approach by corporate boards. As stewards of investor protection, boards must navigate the evolving technological landscape with diligence and foresight. By doing so, they can harness the benefits of AI while mitigating its risks, ultimately contributing to a more transparent and equitable financial system.

Best Practices for Boards in Overseeing AI Incidents?

The most important practices for boards overseeing AI incidents involve establishing a dedicated governance framework, ensuring the board has sufficient expertise, integrating AI into the corporate strategy, and proactively managing related AI incidents and risks. These practices shift AI from a technical or compliance matter to a core part of corporate leadership. The growth of AI continues to rise accross industries:

Establish an AI governance framework

- Create an AI oversight committee: A dedicated subcommittee—or a clear mandate for an existing committee like Audit or Risk—can provide the necessary focus and expertise for AI oversight. This is especially important for companies heavily involved in high-risk AI applications.

- Define and document AI principles: The board should work with management to articulate a set of ethical principles that guide the company’s AI use. These principles should cover fairness, transparency, accountability, and safety.

- Assign clear accountability: Define which executive or team is ultimately responsible for the AI strategy and its outcomes. In many cases, this is a Chief AI Officer or Chief Data Officer.

- Integrate with existing governance: Embed AI governance into existing structures for risk management, ethics, compliance, and cybersecurity rather than treating it as a siloed issue.

Build board knowledge and expertise

- Assess and upgrade board skills: Conduct a skills matrix review to identify gaps in AI knowledge and AI incidents. If needed, appoint new directors with technology or AI expertise to the board.

- Mandate continuous education: Implement a continuous education program for directors. This can include briefings from management, sessions with external AI experts, and online courses.

- Use AI for board functions: Directors can gain hands-on experience by using AI tools for their own governance duties, such as summarizing board meeting transcripts.

Align AI with corporate strategy

- Challenge management on ROI: Boards should ask probing questions about how AI will generate revenue, create a competitive advantage, or improve efficiency.

- Create a strategic roadmap: Help management develop a long-term roadmap for AI that balances smaller, near-term wins with a broader vision for business model transformation.

- Measure performance and success: Require management to define and report on metrics that effectively measure the success of AI initiatives and their financial return.

Manage AI-related Incidents

- Conduct regular risk assessments: Ensure management is regularly assessing and mitigating risks like data privacy, cybersecurity, and the potential for “hallucinations” in generative AI.

- Require human oversight: Mandate that high-risk AI systems include a “human in the loop” to review and validate decisions, especially in critical areas like finance or healthcare.

- Monitor regulatory compliance: Stay informed about the rapidly evolving global AI regulatory landscape (e.g., EU AI Act, NIST AI Risk Management Framework) and ensure compliance is prioritized.

- Vet third-party vendors: As many AI services are outsourced, boards should require management to perform thorough due diligence on vendors’ data security and ethical practices.

Promote an ethical and transparent culture

- Balance innovation with responsibility: The board should support a culture of experimentation but insist that it is balanced with a strong sense of responsibility. This mindset protects the company’s reputation and builds trust with stakeholders.

- Prepare for workforce changes: Boards should oversee management’s plans for adapting the workforce to an AI-integrated environment, including training programs and communicating transparently about AI’s impact on job roles.

- Ensure ethical use aligns with company values: The board is responsible for ensuring that AI aligns with the company’s core values, particularly concerning its social and ethical implications.

Best Practices for Overseeing Cybersecurity Incidents and Risks

Elevate cybersecurity governance and expertise

- Establish a dedicated oversight structure: Rather than delegating cybersecurity solely to the audit committee, boards should consider creating a dedicated technology or cybersecurity incident risk committee to allow for deeper analysis of security and resilience.

- Boost board expertise: Directors don’t need to be technical experts but must have a sufficient level of “cyber literacy” to understand the key risks of cybersecurity incidents. Options for increasing expertise include appointing directors with cybersecurity experience, offering continuous education, and engaging with external experts.

- Foster a “culture of security”: Cybersecurity must be a top-down priority. Boards should work to instill a mindset of security across the organization, reinforced by regular, mandatory employee training and a clearly defined culture of accountability.

Manage risk and strengthen resilience

- Establish an enterprise-wide risk framework: Require management to create a comprehensive framework for assessing, managing, and mitigating cyber risks across all business functions, not just IT.

- Define and categorize risks: Boards should engage with management to identify critical assets and classify cyber risks based on their potential impact to avoid, accept, mitigate, or transfer them.

- Strengthen protections for critical assets: Ensure that resources are allocated to protecting the most valuable data and systems. This includes implementing measures like network segmentation, multi-factor authentication, and robust data loss prevention.

- Manage third-party risks: Require rigorous vendor risk management and due diligence. A significant portion of cyber breaches originate in the supply chain, so contracts should ensure third-party vendors adhere to strong security protocols.

Prepare for and respond to incidents

- Develop and test an incident response plan: The board should ensure a well-defined incident response plan is in place and regularly tested through “tabletop” simulations. These exercises help prepare leadership for their roles during a crisis.

- Prioritize resilience and recovery: Accept that breaches can and will happen. The board’s focus should be on resilience—the ability to maintain and quickly restore business operations—rather than on the unrealistic hope of perfect security.

- Establish a communications strategy: Pre-planned communications protocols are vital for managing the fallout of a cyber incident, including managing stakeholder, media, and regulatory disclosures.

Ensure transparent reporting and compliance

- Demand regular, clear reporting: The board should receive regular updates on the company’s cyber health using non-technical, business-focused metrics that quantify the financial and operational impact of risks.

- Comply with new regulations: The SEC’s 2023 cybersecurity rules require public companies to promptly report material cybersecurity incidents and disclose their risk management strategies annually. Boards must ensure their reporting and oversight practices are integrated to comply with these rules.

- Strengthen communication channels: Foster a strong working relationship with the Chief Information Security Officer (CISO). The CISO should have sufficient access to the board and be empowered to make the necessary decisions to protect the company.

Frequently Asked Questions

1. How Do You Achieve Good Corporate Governance?

Good corporate governance is essential for the long-term success and sustainability of any organization. Achieving good corporate governance requires a combination of effective leadership, transparent decision-making processes, and strong accountability mechanisms.

2. What does corporate governance focus primarily on?

The core of corporate governance is guiding and controlling the operation of the company to bring clarity, accountability, and equality to the stakeholders.

3. What do shareholders reap from internal governance?

Corporate governance promotes transparency and responsibility. Trust-building diminishes investment risk since security, and become attractive to shareholders.

4. Why is internal governance important for risk management?

Corporate governance involves risk identification, risk assessment, and risk management. This helps the companies themselves against financial, operational, as well as legal threats.

5. Is corporate governance affecting the productivity of employees?

Yes, corporate governance creates a good work environment in which the employees feel respected. Hence, they are satisfied at their jobs and more productive.

5. How is internal governance beneficial in attracting investors?

Good internal governance assures the stakeholders that a company is stable and ethically run and hence attracts funding.

7. What serves as a catalyst for companies to adopt stringent internal governance policies?

Conclusion

Contact Timothy L. Miles Today for a Free Case Evaluation About Securities Class Action Lawsuits

If you need reprentation in securities class action lawsuits, an opt out class action, or believe you have additional questions about the opt out process, call us today for a free case evaluation. 855-846-6529 or [email protected] (24/7/365).

Timothy L. Miles, Esq.

Law Offices of Timothy L. Miles

Tapestry at Brentwood Town Center

300 Centerview Dr. #247

Mailbox #1091

Brentwood,TN 37027

Phone: (855) Tim-MLaw (855-846-6529)

Email: [email protected]

Website: www.classactionlawyertn.com

Visit Our Extensive Investor Hub: Learning for Informed Investors